UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number 001-35297

Fortuna Mining Corp.

(Translation of registrant’s name into English)

200 Burrard Street, Suite 650, Vancouver, British

Columbia, Canada V6C 3L6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

FORM 20-F ¨ FORM

40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fortuna Mining Corp. |

| |

(Registrant) |

| |

|

| Date: December 3, 2024 |

By: |

/s/ "Jorge Ganoza Durant" |

| |

|

Jorge Ganoza Durant |

| |

|

President and CEO |

Exhibits:

99.1 News release dated December 3, 2024

Exhibit 99.1

NEWS

RELEASE

Fortuna reports progress on its share buyback

program

Vancouver, December 3, 2024: Fortuna Mining

Corp. (NYSE: FSM | TSX: FVI) is pleased to report that during the fourth quarter as of Friday, November

29, 2024, it has repurchased under the Company’s normal course issuer bid (NCIB) an aggregate of 6,402,640 common shares on the

open market of the New York Stock Exchange. Shares were repurchased at a weighted-average price of $4.77 per common share for a total

gross amount of $30,529,066, excluding brokerage fees; these shares will be cancelled. To date, the Company has repurchased 41.88 percent

of the 15,287,201 shares it is authorized to repurchase under the NCIB (refer to Fortuna news release dated April 30, 2024).

Jorge A. Ganoza, Chief Executive Officer of Fortuna

commented, “With record earnings in the third quarter, and strong free cash flow generation supported by historically high gold

prices, Fortuna is positioned to return capital to its shareholders.” Mr. Ganoza continued, “Our capital priorities moving

forward will be to continue to balance returns to shareholders with advancing high value opportunities in our portfolio.”

About Fortuna Mining Corp.

Fortuna Mining Corp. is a Canadian precious metals

mining company with five operating mines in Argentina, Burkina Faso, Côte d'Ivoire, Mexico, and Peru, as well as the preliminary

economic assessment stage Diamba Sud Gold Project located in Senegal. Sustainability is integral to all our operations and relationships.

We produce gold and silver and generate shared value over the long-term for our stakeholders through efficient production, environmental

protection, and social responsibility. For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO, and Director

Fortuna Mining Corp.

Investor Relations:

Carlos Baca | info@fmcmail.com

| fortunamining.com | X | LinkedIn

| YouTube

Forward-looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation

and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements

of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could

cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements

in this news release include, without limitation, statements relating to Fortuna’s intentions with respect to the NCIB and the effects

of repurchases of common shares thereunder, including any enhancement to shareholder value; and Fortuna’s capital priorities and

its business strategy, plans and outlook. Often, but not always, these Forward-looking Statements can be identified by the use of words

such as “expected”, “estimated”, “potential”, “open”, “future”, “assumed”,

“projected”, “used”, “detailed”, “has been”, “gain”, “planned”,

“reflecting”, “will”, “anticipated”, “estimated” “containing”, “remaining”,

“to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions,

including negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially

different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and

factors include, among others, legislative or regulatory developments; any significant changes to common share price or trading volume;

continued availability of capital and financing; changes to general economic, market or business conditions; business opportunities that

become available to, or are pursued by, Fortuna; operational risks associated with mining and mineral processing; risks associated with

war, hostilities or other conflicts, such as the Ukrainian – Russian conflict and the Israel – Hamas war, and the impacts

such conflicts may have on global economic activity; risks related to the Company’s ability to obtain adequate financing for planned

exploration and development activities; as well as those factors discussed under “Risk Factors” in the Company’s Annual

Information Form. Although the Company has attempted to identify important factors that could cause actual actions, events or results

to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results

to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein

are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to prevailing and further market

prices for Fortuna’s common shares; that Fortuna’s future results of operations will be consistent with past performance and

management expectations in relation thereto; the continued availability of capital; future cash flow and debt levels; that there will

be no material adverse change affecting the Company, its properties or its production estimates (which assume accuracy of projected head

grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labor and contractor

availability and other operating or technical difficulties); that there will be no significant disruptions affecting the Company’s

operations; and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims

any obligation to update any Forward-looking Statements, whether as a result of new information, future events or results or otherwise,

except as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance

on Forward-looking Statements.

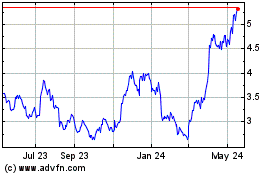

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Nov 2024 to Dec 2024

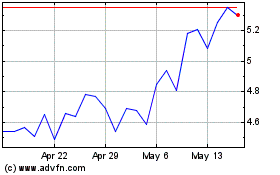

Fortuna Mining (NYSE:FSM)

Historical Stock Chart

From Dec 2023 to Dec 2024