- Strong YoY growth in Group H1 Revenue of 20% to €250m with a

36% increase in Adjusted EBITDA(1) to €102m

- Strong improvement in H1 Adjusted EBITDA margin of 4.6pts to

40.7% and a 64% drop-through(2)

- Solid acceleration in LTM Adjusted EBITDA to €175m vs €164m

in the previous quarter

- Financial guidance(3) for FY24/25 Adjusted EBITDA between

€185m and €205m

- Share buy-back increased from $10m to $15m and extension of

the program until November 2025

Global Blue Group Holding AG (NYSE:GB and GB.WS) today announces

its financial results for the second quarter and six month period

ended September 30, 2024.

Global Blue’s CEO, Jacques Stern, commented:

“We are pleased to report a strong H1 performance with 20%

revenue growth, significantly outperforming the luxury market,

driven by our unique exposure to affluent and high-net-worth

international shoppers. This growth, combined with our high

operating leverage, led to a 36% increase in Adjusted EBITDA and a

4.6pt increase in margin to 40.7%, resulting in LTM Adjusted EBITDA

rising to €175 million from €164 million in the last quarter.

“The macro and microeconomic environment in which Global Blue

operates remains highly favourable. The travel industry is

experiencing positive trends, particularly in the high-end segment,

and we have made strong progress in implementing our management

technology initiatives. In that context, and even if we continue to

meaningfully outperform the luxury market, considering the broader

luxury market slowdown and our decision to accelerate €5 million of

investments in future growth initiatives, we have adapted our

FY24/25 Adjusted EBITDA guidance to €185 million - €205

million.

“In addition, and in light of the solid improvement in free cash

flow generation, we have increased our share buy-back program from

$10 million to $15 million and extended the program to November 30,

2025.”

EXECUTIVE SUMMARY

Strong financial performance In Q2 FY24/25, the Group

delivered a 17% year-over-year increase in revenue to €132 million

and a 25% year-over-year increase in Adjusted EBITDA to €59

million, resulting, for H1 FY24/25, in a 20% year-over-year

increase in revenue to €250 million and a 36% year-over-year

increase in Adjusted EBITDA to €102 million, with an Adjusted

EBITDA margin of 40.7% and drop-through of 64%.

Furthermore, continued strong cash conversion brought the net

leverage ratio(4) down to 2.9x at the end of September 2024, from

4.5x at the end of September 2023, and on-track to reach the

long-term target of <2.5x.

Share buy-back update Global Blue announced today an

increase and extension of its previously announced share repurchase

program. The repurchase program is being increased to $15 million

and extended for an additional 9 months to November 30, 2025. No

shares will be purchased from Silver Lake or its affiliates. Global

Blue plans to continue using its existing cash to fund repurchases

made under the extended share repurchase program. As of November

20, 2024, Global Blue has repurchased approximately $2.8 million of

common shares under the share repurchase program.

Financial guidance and long-term targets The macro and

microeconomic environment in which Global Blue operates remains

highly favorable. The travel industry is experiencing positive

trends, particularly in the high-end segment, and Global Blue has

made significant progress in implementing strategic initiatives to

further penetrate the market. In parallel, Global Blue has

continued to outperform in the luxury market, driven by its unique

exposure to affluent and high-net-worth international shoppers.

That said, considering the recent luxury market slowdown and taking

into account the Group’s decision to accelerate €5 million of

investments (fixed costs) in future growth initiatives (expansion

into new countries, adaptation of Japan’s business model and

Hospitality Gateway), we have adapted our FY24/25 Adjusted EBITDA

guidance to €185 million - $205 million.

Long-term targets include 8-12% revenue growth, >50%

drop-through, and a net leverage ratio of <2.5x.

FINANCIAL PERFORMANCE

Q2 FY24/25 Financial Performance

€M

Q2

FY22/23

Q2

FY23/24

Q2

FY24/25

Q2 FY24/25

vs.

Q2 FY23/24 (%)

Revenue

Tax Free Shopping Solutions

Payments

Post-Purchase Solutions

62.5

15.3

4.1

86.2

20.2

6.7

101.9

23.4

6.7

Revenue

81.9

113.2

132.0

17%

Variable costs

(19.7)

(25.0)

(27.1)

Contribution(5)

62.2

88.2

104.9

19%

Fixed costs

(36.3)

(41.1)

(46.1)

Adjusted EBITDA

Adjusted EBITDA Margin(%)

25.8

31.5%

47.2

41.7%

58.7

44.5%

25%

+2.8pts

Adjusted Depreciation &

Amortization

(9.1)

(8.9)

(12.5)

Net Finance Costs

(13.8)

(13.9)

(14.2)

Adjusted Profit before Tax

2.9

24.4

32.0

Adjusted Income Tax Expense

(4.4)

(8.1)

(9.3)

Non-Controlling Interests

(0.6)

2.3

(2.0)

Adjusted Net Income Group Share

(2.1)

14.0

20.7

Revenue The Group delivered revenue of €132.0 million, a

17% year-over-year increase, driven by a solid performance in both

Tax Free Shopping Solutions and Payments.

Tax Free Shopping Solutions revenue grew 18% year-over-year

reaching €101.9 million. Continental Europe reached €87.6 million,

a 17% increase, while Asia Pacific reached €14.3 million, a 28%

increase, benefiting from strong progression of

Sales-in-Store(6).

Payments revenue is up 16% year-over-year to €23.4 million,

ahead of the 9% growth in Sales-in-Store, driven predominantly by

increased margins on treasury gains.

Post-Purchase Solutions saw a slight decline of 1%

year-over-year, with revenue at €6.7 million driven by management’s

focus on contribution margin.

Contribution Given the strong focus on variable cost

optimization, the Group delivered €104.9 million contribution, a

19% year-over-year increase, and maintained a high level of

Contribution margin with Tax-Free Shopping Solutions at 86%, FX

Solutions at 96%, and Post-Purchase Solutions at 59%.

Adjusted EBITDA Strong revenue growth and the high

operating leverage profile brought Adjusted EBITDA to €58.7

million, a 25% year-over-year increase. Adjusted EBITDA margins

expanded by 2.8pts to 44.5%, with a 62% drop-through.

H1 FY24/25 Financial Performance

€M

H1

FY22/23

H1

FY23/24

H1

FY24/25

H1 FY24/25

vs.

H1 FY23/24 (%)

Revenue

Tax Free Shopping Solutions

Payments

Post-Purchase Solutions

102.1

27.9

8.0

154.8

39.0

13.8

193.0

43.7

13.0

Revenue

138.0

207.7

249.7

20%

Variable costs

(34.7)

(48.1)

(53.2)

Contribution

103.3

159.6

196.5

23%

Fixed costs

(70.7)

(84.5)

(94.8)

Adjusted EBITDA

Adjusted EBITDA Margin(%)

32.6

23.6%

75.0

36.1%

101.7

40.7%

36%

5pts

Adjusted Depreciation &

Amortization

(17.8)

(17.9)

(23.5)

Net Finance Costs

(23.8)

(24.6)

(29.4)

Adjusted Profit before Tax

(9.0)

32.5

48.9

Adjusted Income Tax Expense

(3.8)

(12.6)

(16.9)

Non-Controlling Interests

(0.9)

(3.7)

(5.3)

Adjusted Net Income Group Share

(13.7)

16.1

26.7

Revenue The Group delivered revenue of €249.7 million, a

20% year-over-year increase, driven by a particularly strong

performance in Tax Free Shopping Solutions.

Tax Free Shopping Solutions delivered revenue of €193.0 million,

a 25% year-over-year increase. Revenue in Continental Europe

reached €162.0 million, a 21% year-over-year increase, while

revenue in Asia Pacific reached €31.0 million, a 49% year-over-year

increase, benefiting from strong progression in Sales-in-Store.

Payments delivered revenue of €43.7 million, a 12%

year-over-year increase, ahead of the 7% growth in Sales-in-Store,

mainly due to the increased margin on treasury gains. Revenue in FX

Solutions reached €22.3 million, a 10% year-over-year increase,

while revenue in Acquiring reached €20.5 million, a 14%

year-over-year increase, and revenue in the Hospitality Gateway

business reached €0.9 million, a 32% year-over-year increase.

Post-Purchase Solutions delivered revenue of €13.0 million, a 6%

year-over-year decline impacted by management’s decision to move

away from certain low-contribution ZigZag carrier contracts

(contribution grew 7% after carrier costs).

Contribution Given the strong focus on variable cost

optimization, the Group delivered a contribution of €196.5 million,

a 23% year-over-year increase, and maintained a high level of

contribution margin with Tax Free Shopping Solutions at 85%, FX

Solutions at 96% and Post-Purchase Solutions at 60%.

Adjusted EBITDA The Group delivered Adjusted EBITDA of

€101.7 million in H1 FY24/25, a 36% year-over-year increase,

reflecting strong revenue growth and the high operating leverage

profile of the business. This resulted in a margin improvement of

4.6pts to 40.7% and a 64% drop-through. Consequently, there has

been a solid acceleration in the LTM Adjusted EBITDA to €175

million, up from €164 million in the previous quarter.

Adjusted Profit before Tax The Group delivered Adjusted

Profit Before Tax of €48.9 million in H1 FY24/25, a 50%

year-over-year increase. High growth reflects the increase in

Adjusted EBITDA, partially offset by a €4.8 million increase in net

finance costs due to higher interest expenses during the period,

and a €5.6 million increase in depreciation and amortization,

largely attributed to increased capital expenditure in improving

technology base over the last two years.

Cash Flow, Balance Sheet and Net Debt Adjusted EBITDA

less capital expenditure rose €19.0 million year-over-year to €76.1

million. In parallel, reflecting the normalization of Working

Capital, Pre-tax unlevered Free Cash Flow reached €57.1 million vs.

€11.7 million in the same period last year.

As at September 30, 2024, Group Net Debt came down to €515.6

million, consisting of Gross Financial Debt of €610.0 million and

Cash & Cash Equivalents of €94.4 million, resulting in a net

leverage ratio of 2.9x, a significant improvement from 4.5x at

September 30, 2023.

LATEST TAX FREE SHOPPING TRENDS IN OCTOBER 2024

In October 2024, following on from the strong performance in Q2

FY24/25, Tax Free Shopping like-for-like Worldwide Issued

Sales-in-Store experienced a year-over-year growth rate of 17%.

In Continental Europe, October 2024 Sales-in-Store increased by

12% compared to the same period last year, driven by a 14% increase

in the number of shoppers and a 2% decrease in the average spend

per shopper.

In Asia Pacific, October 2024 Sales-in-Store increased by 29%

compared to the same period last year. This was driven by a 32%

increase in the number of shoppers and a 2% decrease in the average

spend per shopper.

FINANCIAL GUIDANCE AND LONG-TERM TARGETS

The macro and microeconomic environment in which Global Blue

operates remains highly favorable. The travel industry is

experiencing positive trends, particularly in the high-end segment,

and Global Blue has made significant progress in implementing

strategic technology initiatives to further penetrate the market.

In parallel, Global Blue has continued to outperform in the luxury

market, driven by its unique exposure to affluent and

high-net-worth international shoppers. That said, considering the

recent luxury market slowdown and taking into account the Group’s

decision to accelerate €5 million of investments (fixed costs) in

future growth initiatives (expansion into new countries, adaptation

of Japan’s business model and Hospitality Gateway), we have

adjusted our FY24/25 Adjusted EBITDA guidance to €185 million -

€200 million.

Long-term targets include 8-12% revenue growth, >50%

drop-through, and a net leverage ratio of <2.5x.

1The table below provides a reconciliation between Profit and

Adjusted EBITDA.

For the three months

ended September 30

For the six months

ended September 30

€M

2024

2023

2024

2023

Profit for the period

16.6

1.8

43.7

11.4

Profit margin (%)

12.6%

1.6%

17.5%

5.5%

Income Tax Expense

10.9

8.8

22.6

12.8

Net Finance Costs

14.2

13.9

29.4

24.6

Exceptional Items*

3.4

12.7

(19.6)

6.0

Depreciation & Amortization

13.6

10.0

25.7

20.1

Adjusted EBITDA

58.7

47.2

101.7

75.0

Adjusted EBITDA Margin (%)

44.5%

41.7%

40.7%

36.1%

*Exceptional Items consist of items which

Global Blue does not consider indicative of its ongoing operating

and financial performance, not directly related to ordinary

business operations and which are not included in the assessment of

management performance.

2Drop-through refers to the portion of Revenue growth that drops

through to the Adjusted EBITDA line. 3A reconciliation of the

foregoing guidance for the non-IFRS metric of Adjusted EBITDA to

net income (loss) cannot be provided without unreasonable effort

because of the inherent difficulty of accurately forecasting the

occurrence and financial impact of the various adjusting items

necessary for such reconciliation that have not yet occurred, are

out of our control, or cannot be reasonably predicted. For the same

reasons, the Company is unable to assess the probable significance

of the unavailable information, which could have a material impact

on its future IFRS financial results. 4Net Leverage refers to Net

Debt divided by the last 12 months Adjusted EBITDA excluding

Post-Purchase Solutions Adjusted EBITDA losses. 5Contribution

refers to revenue less variable costs. 6Sales-in-Store refers to

the Issued Sales-In-Store (Spend), like-for-like (at constant

merchant scope and exchange rates).

WEBCAST INFORMATION An audio recording of commentary on

the results, along with supplemental financial information, can be

accessed via the Investor Relations section of the company’s

website at Global Blue Group Holding AG - Investor Relations.

NON-IFRS FINANCIAL MEASURES This press release contains

certain Non-IFRS Financial Measures. These non-IFRS measures may

not be indicative of Global Blue’s historical operating results nor

are such measures meant to be predictive of Global Blue’s future

results. Not all companies calculate non-IFRS measures in the same

manner or on a consistent basis. As a result, these measures and

ratios may not be comparable to measures used by other companies

under the same or similar names. Accordingly, undue reliance should

not be placed on the non-IFRS measures presented in this press

release.

FORWARD-LOOKING STATEMENTS This press release contains

certain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act

of 1934, as amended, including statements regarding Global Blue or

its management’s expectations, hopes, beliefs, intentions, or

strategies regarding the future. The words “anticipate,” “believe”,

“continue”, “could”, “estimate”, “expect”, “intends”, “may”,

“might”, “plan”, “possible”, “potential”, “predict”, “project”,

“should”, “would” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. These forward-looking

statements are based on Global Blue’s current expectations and

beliefs concerning future developments and their potential effects

on Global Blue. There can be no assurance that the future

developments affecting Global Blue will be those that we have

anticipated. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond Global Blue’s

control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements. These include

commercial expectations and other external factors, including

political, legal, fiscal, market and economic conditions and

factors affecting travel and traveller shopping, including the

global COVID-19 pandemic and applicable legislation, regulations

and rules (including, but not limited to, accounting policies and

accounting treatments), movements in foreign exchange rates,

inflation and other factors described under “Risk Factors” in

Global Blue’s Annual Report on Form 20-F/A for the fiscal year

ended March 31, 2024 filed with the Securities and Exchange

Commission (the “SEC”), and in other reports we file from time to

time with the SEC, all of which are difficult to predict and are

beyond Global Blue’s control. Except as required by law, Global

Blue is not undertaking any obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise.

ABOUT GLOBAL BLUE Global Blue is the business partner for

the shopping journey, providing technology and services to enhance

the experience and drive performance.

With over 40 years of expertise, today we connect thousands of

retailers, acquirers, and hotels with nearly 80 million consumers

across more than 50 countries, in three industries: Tax Free

Shopping, Payments and Post-Purchase solutions.

With c2,000 employees, Global Blue generated €28bn

Sales-in-Store and €422M revenue in FY 2023/24. Global Blue is

listed on the New York Stock Exchange.

For more information, please visit www.globalblue.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241122117779/en/

FOR FURTHER INFORMATION Frances Gibbons, Head of Investor

Relations +44 (0) 7815 034 212 fgibbons@globalblue.com

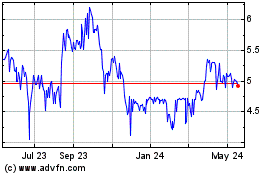

Global Blue (NYSE:GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

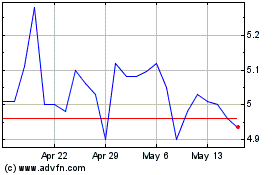

Global Blue (NYSE:GB)

Historical Stock Chart

From Dec 2023 to Dec 2024