false

0001260729

N-CSRS

0001260729

2024-01-01

2024-06-30

0001260729

gdv:CommonStocksMember

2024-01-01

2024-06-30

0001260729

gdv:CumulativePreferredStocksMember

2024-01-01

2024-06-30

0001260729

gdv:SeriesHCumulativePreferredStockMember

2024-01-01

2024-06-30

0001260729

gdv:SeriesJCumulativePreferredStockMember

2024-01-01

2024-06-30

0001260729

gdv:SeriesKCumulativePreferredStockMember

2024-01-01

2024-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment

Company Act file number 811-21423

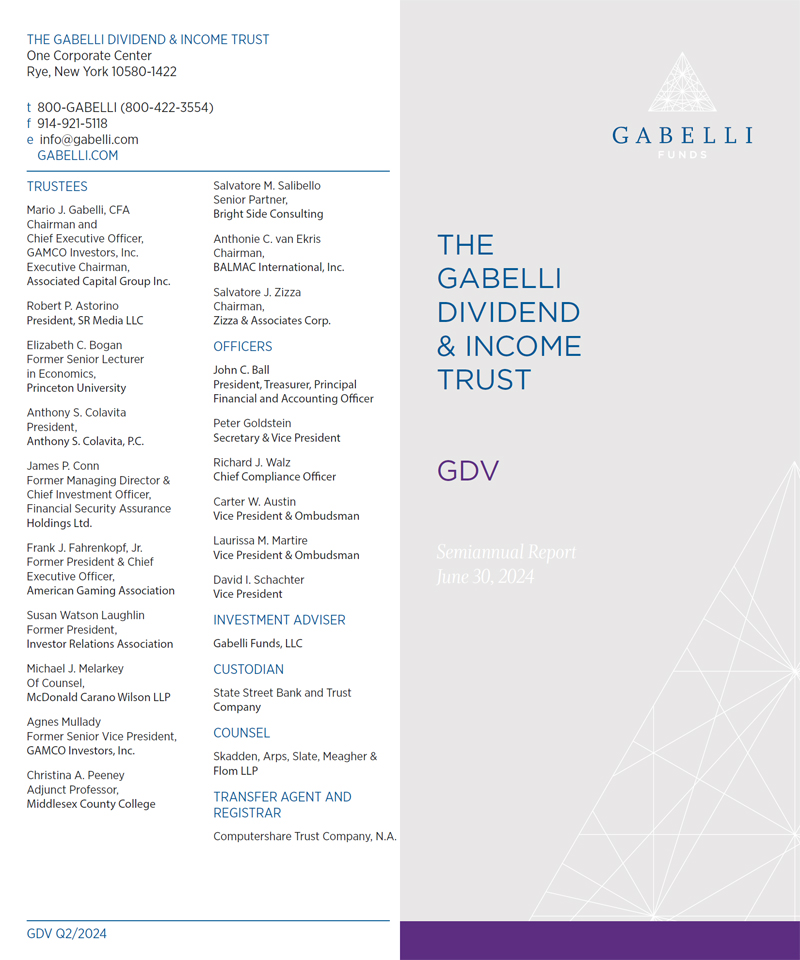

The

Gabelli Dividend & Income Trust

(Exact name of registrant as specified in charter)

One

Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John

C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address

of agent for service)

Registrant’s

telephone number, including area code: 1-800-422-3554

Date

of fiscal year end: December 31

Date

of reporting period: June 30, 2024

Form

N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission

to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company

Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A

registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public.

A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently

valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission,

100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements

of 44 U.S.C. § 3507.

Item

1. Reports to Stockholders.

| (a) | Include

a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act

(17 CFR 270.30e-1). |

The

Report to Shareholders is attached herewith.

The

Gabelli Dividend & Income Trust

Semiannual

Report — June 30, 2024

To

Our Shareholders,

For

the six months ended June 30, 2024, the net asset value (NAV) total return of The Gabelli Dividend & Income Trust (the Fund)

was 7.1%, compared with a total return of 15.3% for the Standard & Poor’s (S&P) 500 Index. The total return for

the Fund’s publicly traded shares was 8.1%. The Fund’s NAV per share was $26.73, while the price of the publicly traded

shares closed at $22.71 on the New York Stock Exchange (NYSE). See page 3 for additional performance information.

Enclosed

are the financial statements, including the schedule of investments, as of June 30, 2024.

Investment

Objective (Unaudited)

The

Gabelli Dividend & Income Trust is a diversified, closed-end management investment company. The Fund’s investment objective

is to seek a high level of total return with an emphasis on dividends and income. In making stock selections, the Fund’s

investment adviser looks for securities that have a superior yield and capital gains potential.

Performance

Discussion (Unaudited)

The

U.S. stock market had another very impressive first quarter of 2024, up about 10% on a total return basis; this was after

a double-digit gain in the fourth quarter of last year. Short term interest rates have held steady for the last few

quarters, but the 10-year and 30-year U.S. Treasuries have both moved up by about 30 basis points over the last quarter. The

Fed has repeatedly stated its intention to bring inflation down to 2%, but we are still not there yet. For the last few

quarters, the Fed has kept the Fed Funds target rate at 5.5%. Of the eleven sectors that make up the S&P 500 Index, all

were up in the first quarter, with only one exception, the Real Estate sector. The best performing sector was communication

Services, up almost 16%, followed by Energy, which was up about 14%, and Technology, up by over 12%. One of the best

performing stocks in (y)our portfolio during the first quarter was NVIDIA, the computer chip company that has been a star

performer on Wall Street for the last year. Two other top contributors to performance during the quarter were American

Express and Bank of New York, both global financial companies based in New York City. There were, of course, several stock

holdings in (y)our portfolio that declined during the first quarter. One top detractor to performance was Boeing, which has

been experiencing several recent production issues with its airplanes. In addition, Sony, the Japanese conglomerate with

interests in media and electronics, was another detraction.

| As

permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual

shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead,

the reports will be made available on the Fund’s website (www.gabelli.com), and you will be notified by mail each time

a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports

electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports

on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call

800-422-3554 or send an email request to info@gabelli.com. |

As

we approach another presidential election in a few months, the U.S. economy continues to expand. Some of this expansion is

due to productivity growth (thanks to AI), and some is due to a greater number of workers in the labor force (thanks to the

return of workers who left the workforce during COVID, as well as to more immigrants). Also helping the economy is a huge

amount of fiscal stimulus, which unfortunately means we are running a deficit to GDP ratio of about 7%, unheard of in an

economy near full employment. The Federal Reserve kept short-term interest rates steady during the second quarter of 2024.

Long-term interest rates did not move materially in the second quarter, but the stock market was up again, approximately 4%

on a total return basis. Growth stocks once again easily outperformed value stocks, a phenomenon that has been in place for

well over a decade now. In the second quarter, value stocks, as measured by the S&P/Citigroup Value Index, were down

about 2%. Of the eleven sectors that make up the S&P 500 Index, five were up in the second quarter, while six of the

sectors were down. The best performing sector was Technology, up a stellar 13.8% on a total return basis. The Communications

sector was up over 9%, and the Utility sector was up over 4%. The worst performing sector was Materials, down just over 4%.

One of the best performing stocks in (y)our portfolio was Alphabet (1.7% of total investments as of June 30, 2024), one of

the so-called Magnificent Seven which has been driving performance in the U.S. stock market. NVIDIA (1.6%) was another top

performer, as was the credit card company American Express (2.4%). Many consumer staples companies, including snack food

company Mondelēz (1.1%) and global spirits company Diageo (0.7%), were hurt in the second quarter as consumers started to

pull back on spending due to inflationary pressures, and both were top detractors to Fund performance. Another poor

performing stock in the quarter was Zoetis (0.4%), which focuses on animal health care.

Thank

you for your investment in The Gabelli Dividend & Income Trust.

We

appreciate your confidence and trust.

| The

views expressed reflect the opinions of the Fund’s portfolio managers and Gabelli Funds, LLC, the Adviser, as of the date

of this report and are subject to change without notice based on changes in market, economic, or other conditions. These views

are not intended to be a forecast of future events and are no guarantee of future results. |

Comparative

Results

Average

Annual Returns through June 30, 2024 (a) (Unaudited)

| | |

| |

| |

| |

| |

| |

| |

Since |

| | |

Six | |

| |

| |

| |

| |

| |

Inception |

| | |

Months | |

1

Year | |

5

Year | |

10

Year | |

15

Year | |

20

Year | |

(11/28/03) |

| The Gabelli Dividend & Income

Trust (GDV) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NAV Total Return (b) | |

| 7.10 | % | |

| 12.21 | % | |

| 8.74 | % | |

| 6.83 | % | |

| 11.61 | % | |

| 8.16 | % | |

| 8.04 | % |

| Investment Total Return

(c) | |

| 8.07 | | |

| 14.30 | | |

| 7.59 | | |

| 6.88 | | |

| 12.58 | | |

| 8.57 | | |

| 7.74 | |

| S&P 500 Index | |

| 15.29 | | |

| 24.56 | | |

| 15.05 | | |

| 12.86 | | |

| 14.82 | | |

| 10.29 | | |

| 10.44 | |

| Dow Jones Industrial Average | |

| 4.79 | | |

| 16.07 | | |

| 10.31 | | |

| 11.29 | | |

| 13.43 | | |

| 9.45 | | |

| 9.57 | |

| (a) | Performance

returns for periods of less than one year are not annualized. Returns represent past

performance and do not guarantee future results. Investment returns and the principal

value of an investment will fluctuate. The Fund’s use of leverage may magnify the volatility

of net asset value changes versus funds that do not employ leverage. When shares are

sold, they may be worth more or less than their original cost. Current performance may

be lower or higher than the performance data presented. Visit www.gabelli.com for performance

information as of the most recent month end. The S&P 500 Index is an unmanaged indicator

of stock market performance. The Dow Jones Industrial Average is an unmanaged index of

30 large capitalization stocks. Dividends are considered reinvested. You cannot invest

directly in an index. |

| (b) | Total

returns and average annual returns reflect changes in the NAV per share and reinvestment

of distributions at NAV on the ex-dividend date and adjustment for the spin-off and are

net of expenses. Since inception return is based on an initial NAV of $19.06. |

| (c) | Total

returns and average annual returns reflect changes in closing market values on the NYSE,

reinvestment of distributions, and adjustment for the spin-off. Since inception return

is based on an initial offering price of $20.00. |

Investors

should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing.

Summary

of Portfolio Holdings (Unaudited)

The

following table presents portfolio holdings as a percent of total investments as of June 30, 2024:

The

Gabelli Dividend & Income Trust

| Financial Services | |

| 16.4 | % |

| Health Care | |

| 10.7 | % |

| Food and Beverage | |

| 8.6 | % |

| Computer Software and Services | |

| 7.8 | % |

| Diversified Industrial | |

| 4.6 | % |

| Energy and Utilities: Oil | |

| 4.3 | % |

| U.S. Government Obligations | |

| 4.3 | % |

| Business Services | |

| 3.0 | % |

| Retail | |

| 2.9 | % |

| Environmental Services | |

| 2.7 | % |

| Automotive: Parts and Accessories | |

| 2.6 | % |

| Entertainment | |

| 2.5 | % |

| Electronics | |

| 2.4 | % |

| Semiconductors | |

| 2.4 | % |

| Machinery | |

| 2.4 | % |

| Telecommunications | |

| 2.2 | % |

| Consumer Products | |

| 2.1 | % |

| Equipment and Supplies | |

| 1.8 | % |

| Building and Construction | |

| 1.7 | % |

| Aerospace | |

| 1.6 | % |

| Energy and Utilities: Services | |

| 1.3 | % |

| Energy and Utilities: Integrated | |

| 1.3 | % |

| Energy and Utilities: Natural Gas | |

| 1.2 | % |

| Specialty Chemicals | |

| 1.2 | % |

| Metals and Mining | |

| 1.1 | % |

| Computer Hardware | |

| 1.0 | % |

| Transportation | |

| 0.9 | % |

| Cable and Satellite | |

| 0.8 | % |

| Automotive | |

| 0.7 | % |

| Communications Equipment | |

| 0.5 | % |

| Real Estate Investment Trust | |

| 0.5 | % |

| Energy and Utilities | |

| 0.5 | % |

| Consumer Services | |

| 0.5 | % |

| Hotels and Gaming | |

| 0.4 | % |

| Energy and Utilities: Electric | |

| 0.3 | % |

| Energy and Utilities: Water | |

| 0.3 | % |

| Broadcasting | |

| 0.3 | % |

| Wireless Communications | |

| 0.2 | % |

| Publishing | |

| 0.0 | %* |

| Agriculture | |

| 0.0 | %* |

| Closed-End Funds | |

| 0.0 | %* |

| Paper and Forest Products | |

| 0.0 | %* |

| | |

| 100.0 | % |

| * | Amount

represents less than 0.05%. |

The

Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and

third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.gabelli.com or

by calling the Fund at 800-GABELLI (800-422-3554). The Fund’s Form N-PORT is available on the SEC’s website

at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information

on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy

Voting

The

Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each

year. A description of the Fund’s proxy voting policies, procedures, and how each Fund voted proxies relating to portfolio

securities is available without charge, upon request, by (i) calling 800-GABELLI (800-422-3554); (ii) writing to The Gabelli Funds

at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

The

Gabelli Dividend & Income Trust

Schedule of Investments — June 30, 2024 (Unaudited)

| Shares | |

| |

Cost | |

Market

Value |

| | | | |

COMMON STOCKS — 95.4% | |

| | | |

| | |

| | | | |

Aerospace — 1.6% | |

| | | |

| | |

| | 7,370 | | |

Allient Inc. | |

$ | 262,074 | | |

$ | 186,240 | |

| | 1,950 | | |

BAE Systems plc, ADR | |

| 100,367 | | |

| 130,357 | |

| | 700 | | |

Ducommun Inc.† | |

| 41,333 | | |

| 40,642 | |

| | 1,000 | | |

Embraer SA, ADR† | |

| 26,040 | | |

| 25,800 | |

| | 200 | | |

General Dynamics Corp. | |

| 43,051 | | |

| 58,028 | |

| | 12,000 | | |

HEICO Corp. | |

| 1,075,570 | | |

| 2,683,320 | |

| | 15,000 | | |

Hexcel Corp. | |

| 957,832 | | |

| 936,750 | |

| | 75,000 | | |

Howmet Aerospace Inc. | |

| 1,535,205 | | |

| 5,822,250 | |

| | 65,300 | | |

L3Harris Technologies Inc. | |

| 8,108,283 | | |

| 14,665,074 | |

| | 2,325 | | |

Mercury Systems Inc.† | |

| 98,064 | | |

| 62,752 | |

| | 213 | | |

Northrop Grumman Corp. | |

| 100,331 | | |

| 92,857 | |

| | 1,200,000 | | |

Rolls-Royce Holdings plc† | |

| 2,490,768 | | |

| 6,929,291 | |

| | 27,440 | | |

RTX Corp. | |

| 2,421,948 | | |

| 2,754,702 | |

| | 6,000 | | |

Spirit AeroSystems Holdings Inc., Cl. A† | |

| 200,162 | | |

| 197,220 | |

| | 300 | | |

Thales SA | |

| 38,173 | | |

| 48,032 | |

| | 53,700 | | |

The Boeing Co.† | |

| 8,354,515 | | |

| 9,773,937 | |

| | | | |

| |

| 25,853,716 | | |

| 44,407,252 | |

| | | | |

| |

| | | |

| | |

| | | | |

Agriculture — 0.0% | |

| | | |

| | |

| | 5,000 | | |

Corteva Inc. | |

| 156,047 | | |

| 269,700 | |

| | | | |

| |

| | | |

| | |

| | | | |

Automotive — 0.7% | |

| | | |

| | |

| | 15,000 | | |

Daimler Truck Holding AG | |

| 440,481 | | |

| 597,108 | |

| | 50,000 | | |

Ford Motor Co. | |

| 639,713 | | |

| 627,000 | |

| | 77,500 | | |

General Motors Co. | |

| 3,075,978 | | |

| 3,600,650 | |

| | 322,500 | | |

Iveco Group NV | |

| 1,809,522 | | |

| 3,616,143 | |

| | 100,000 | | |

PACCAR Inc. | |

| 3,051,903 | | |

| 10,294,000 | |

| | 25,000 | | |

Piaggio & C SpA | |

| 74,648 | | |

| 74,324 | |

| | 49,500 | | |

Traton SE | |

| 974,515 | | |

| 1,619,517 | |

| | | | |

| |

| 10,066,760 | | |

| 20,428,742 | |

| | | | |

| |

| | | |

| | |

| | | | |

Automotive: Parts and Accessories — 2.6% | | |

| | |

| | 62,676 | | |

Aptiv plc† | |

| 4,122,187 | | |

| 4,413,644 | |

| | 9,000 | | |

Atmus Filtration Technologies Inc.† | |

| 257,839 | | |

| 259,020 | |

| | 165,932 | | |

Dana Inc. | |

| 3,192,545 | | |

| 2,011,096 | |

| | 430,000 | | |

Dowlais Group plc | |

| 535,719 | | |

| 397,344 | |

| | 308,915 | | |

Garrett Motion Inc.† | |

| 1,885,352 | | |

| 2,653,580 | |

| | 264,400 | | |

Genuine Parts Co. | |

| 19,071,629 | | |

| 36,571,808 | |

| | 6,000 | | |

Lear Corp. | |

| 713,500 | | |

| 685,260 | |

| | 12,000 | | |

Modine Manufacturing Co.† | |

| 380,000 | | |

| 1,202,280 | |

| | 42,000 | | |

Monro Inc. | |

| 1,270,958 | | |

| 1,002,120 | |

| | 18,900 | | |

O’Reilly Automotive Inc.† | |

| 8,081,374 | | |

| 19,959,534 | |

| | 13,000 | | |

Phinia Inc. | |

| 529,799 | | |

| 511,680 | |

| | 10,000 | | |

Visteon Corp.† | |

| 1,162,274 | | |

| 1,067,000 | |

| | | | |

| |

| 41,203,176 | | |

| 70,734,366 | |

| | | | |

| |

| | | |

| | |

| | | | |

Broadcasting — 0.3% | |

| | | |

| | |

| | 455,000 | | |

Grupo Televisa SAB, ADR | |

| 1,323,421 | | |

| 1,260,350 | |

| Shares | |

| |

Cost | |

Market

Value |

| | 42,121 | | |

Liberty Broadband Corp., Cl. C† | |

$ | 3,220,437 | | |

$ | 2,309,073 | |

| | 55,000 | | |

Liberty Media Corp.-Liberty SiriusXM† | |

| 1,566,554 | | |

| 1,218,800 | |

| | 140,000 | | |

Sinclair Inc. | |

| 3,314,774 | | |

| 1,866,200 | |

| | 35,000 | | |

TEGNA Inc. | |

| 529,986 | | |

| 487,900 | |

| | | | |

| |

| 9,955,172 | | |

| 7,142,323 | |

| | | | |

| |

| | | |

| | |

| | | | |

Building and Construction — 1.7% | |

| | | |

| | |

| | 102,000 | | |

Carrier Global Corp. | |

| 5,065,665 | | |

| 6,434,160 | |

| | 34,700 | | |

Centuri Holdings Inc.† | |

| 728,700 | | |

| 675,956 | |

| | 1,500 | | |

Cie de Saint-Gobain SA | |

| 115,560 | | |

| 116,659 | |

| | 78,200 | | |

Fortune Brands Innovations Inc. | |

| 1,261,127 | | |

| 5,078,308 | |

| | 4,500 | | |

H&E Equipment Services Inc. | |

| 168,430 | | |

| 198,765 | |

| | 125,193 | | |

Herc Holdings Inc. | |

| 6,012,023 | | |

| 16,686,975 | |

| | 161,100 | | |

Johnson Controls International plc | |

| 7,389,543 | | |

| 10,708,317 | |

| | 17,500 | | |

Masterbrand Inc.† | |

| 102,927 | | |

| 256,900 | |

| | 11,000 | | |

Sika AG | |

| 1,412,765 | | |

| 3,148,979 | |

| | 5,625 | | |

United Rentals Inc. | |

| 1,420,384 | | |

| 3,637,856 | |

| | | | |

| |

| 23,677,124 | | |

| 46,942,875 | |

| | | | |

| |

| | | |

| | |

| | | | |

Business Services — 3.0% | |

| | | |

| | |

| | 4,500 | | |

ITOCHU Corp. | |

| 194,595 | | |

| 219,672 | |

| | 15,000 | | |

Jardine Matheson Holdings Ltd. | |

| 873,589 | | |

| 530,700 | |

| | 70,000 | | |

JCDecaux SE† | |

| 1,547,429 | | |

| 1,377,135 | |

| | 8,000 | | |

Loomis AB | |

| 213,081 | | |

| 208,322 | |

| | 11,000 | | |

Marubeni Corp. | |

| 192,816 | | |

| 203,434 | |

| | 141,620 | | |

Mastercard Inc., Cl. A | |

| 11,545,423 | | |

| 62,477,079 | |

| | 8,500 | | |

Mitsubishi Corp. | |

| 198,033 | | |

| 166,312 | |

| | 8,000 | | |

Mitsui & Co. Ltd. | |

| 187,720 | | |

| 181,540 | |

| | 55,000 | | |

Rentokil Initial plc, ADR | |

| 1,716,381 | | |

| 1,630,750 | |

| | 30,503 | | |

Steel Partners Holdings LP† | |

| 318,362 | | |

| 1,135,587 | |

| | 25,000 | | |

Stericycle Inc.† | |

| 1,395,096 | | |

| 1,453,250 | |

| | 8,000 | | |

Sumitomo Corp. | |

| 195,490 | | |

| 199,739 | |

| | 36,000 | | |

UL Solutions Inc., Cl. A | |

| 1,245,404 | | |

| 1,518,840 | |

| | 55,000 | | |

Vestis Corp. | |

| 899,550 | | |

| 672,650 | |

| | 41,600 | | |

Visa Inc., Cl. A | |

| 6,337,410 | | |

| 10,918,752 | |

| | | | |

| |

| 27,060,379 | | |

| 82,893,762 | |

| | | | |

| |

| | | |

| | |

| | | | |

Cable and Satellite — 0.8% | |

| | | |

| | |

| | 18,000 | | |

AMC Networks Inc., Cl. A† | |

| 359,061 | | |

| 173,880 | |

| | 15,000 | | |

Cogeco Inc. | |

| 296,908 | | |

| 528,490 | |

| | 383,000 | | |

Comcast Corp., Cl. A | |

| 15,713,524 | | |

| 14,998,280 | |

| | 23,000 | | |

EchoStar Corp., Cl. A† | |

| 441,274 | | |

| 409,630 | |

| | 10,000 | | |

Liberty Latin America Ltd., Cl. A† | |

| 86,772 | | |

| 96,100 | |

| | 130,000 | | |

Liberty Latin America Ltd., Cl. C† | |

| 1,340,387 | | |

| 1,250,600 | |

See

accompanying notes to financial statements.

The

Gabelli Dividend & Income Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | |

| |

Cost | |

Market

Value |

| | | | |

COMMON STOCKS (Continued) | |

| | | |

| | |

| | | | |

Cable and Satellite (Continued) | |

| | | |

| | |

| | 95,000 | | |

Rogers Communications Inc., Cl.

B | |

$ | 2,781,806 | | |

$ | 3,513,100 | |

| | | | |

| |

| 21,019,732 | | |

| 20,970,080 | |

| | | | |

| |

| | | |

| | |

| | | | |

Communications Equipment — 0.5% | |

| | | |

| | |

| | 24,000 | | |

Arista Networks Inc.† | |

| 3,647,813 | | |

| 8,411,520 | |

| | 106,000 | | |

Corning Inc. | |

| 2,259,210 | | |

| 4,118,100 | |

| | 7,500 | | |

QUALCOMM Inc. | |

| 982,475 | | |

| 1,493,850 | |

| | 95,000 | | |

Telesat Corp.† | |

| 3,052,824 | | |

| 864,500 | |

| | | | |

| |

| 9,942,322 | | |

| 14,887,970 | |

| | | | |

| |

| | | |

| | |

| | | | |

Computer Hardware — 1.0% | |

| | | |

| | |

| | 110,550 | | |

Apple Inc. | |

| 6,552,138 | | |

| 23,284,041 | |

| | 10,000 | | |

Dell Technologies Inc., Cl. C | |

| 395,440 | | |

| 1,379,100 | |

| | 5,000 | | |

HP Inc. | |

| 138,100 | | |

| 175,100 | |

| | 17,500 | | |

Micron Technology Inc. | |

| 972,900 | | |

| 2,301,775 | |

| | | | |

| |

| 8,058,578 | | |

| 27,140,016 | |

| | | | |

| |

| | | |

| | |

| | | | |

Computer Software and Services — 7.8% | | |

| | |

| | 30,000 | | |

3D Systems Corp.† | |

| 152,485 | | |

| 92,100 | |

| | 1,000 | | |

Akamai Technologies Inc.† | |

| 78,920 | | |

| 90,080 | |

| | 1,000 | | |

Alibaba Group Holding Ltd., ADR | |

| 216,505 | | |

| 72,000 | |

| | 32,000 | | |

Alphabet Inc., Cl. A | |

| 1,800,227 | | |

| 5,828,800 | |

| | 224,900 | | |

Alphabet Inc., Cl. C | |

| 15,071,689 | | |

| 41,251,158 | |

| | 163,900 | | |

Amazon.com Inc.† | |

| 16,387,816 | | |

| 31,673,675 | |

| | 8,520 | | |

Backblaze Inc., Cl. A† | |

| 89,773 | | |

| 52,483 | |

| | 4,000 | | |

Check Point Software Technologies Ltd.† | |

| 454,950 | | |

| 660,000 | |

| | 23,000 | | |

Cisco Systems Inc. | |

| 963,885 | | |

| 1,092,730 | |

| | 17,800 | | |

CrowdStrike Holdings Inc., Cl. A† | |

| 2,515,791 | | |

| 6,820,782 | |

| | 7,530 | | |

Edgio Inc.† | |

| 345,466 | | |

| 82,227 | |

| | 5,000 | | |

Fastly Inc., Cl. A† | |

| 42,275 | | |

| 36,850 | |

| | 6,200 | | |

Fiserv Inc.† | |

| 667,836 | | |

| 924,048 | |

| | 1,000 | | |

Fortinet Inc.† | |

| 52,570 | | |

| 60,270 | |

| | 2,500 | | |

Gen Digital Inc. | |

| 57,350 | | |

| 62,450 | |

| | 502,000 | | |

Hewlett Packard Enterprise Co. | |

| 6,863,266 | | |

| 10,627,340 | |

| | 4,790 | | |

Intuit Inc. | |

| 2,008,721 | | |

| 3,148,036 | |

| | 55,000 | | |

Kyndryl Holdings Inc.† | |

| 935,669 | | |

| 1,447,050 | |

| | 38,750 | | |

Meta Platforms Inc., Cl. A | |

| 10,153,068 | | |

| 19,538,525 | |

| | 137,950 | | |

Microsoft Corp. | |

| 13,583,140 | | |

| 61,656,752 | |

| | 9,086 | | |

MKS Instruments Inc. | |

| 802,294 | | |

| 1,186,450 | |

| | 81,000 | | |

N-able Inc.† | |

| 1,070,826 | | |

| 1,233,630 | |

| | 2,500 | | |

Oracle Corp. | |

| 186,535 | | |

| 353,000 | |

| | 50,000 | | |

Oxford Metrics plc | |

| 62,961 | | |

| 63,205 | |

| | 64,000 | | |

Rockwell Automation Inc. | |

| 2,373,359 | | |

| 17,617,920 | |

| | 1,000 | | |

Rubrik Inc., Cl. A† | |

| 32,000 | | |

| 30,660 | |

| | 4,500 | | |

SAP SE, ADR | |

| 580,385 | | |

| 907,695 | |

| | 7,400 | | |

ServiceNow Inc.† | |

| 2,317,303 | | |

| 5,821,358 | |

| Shares | |

| |

Cost | |

Market

Value |

| | 42,973 | | |

SolarWinds Corp. | |

$ | 581,065 | | |

$ | 517,825 | |

| | 12,000 | | |

Stratasys Ltd.† | |

| 192,659 | | |

| 100,680 | |

| | 19,757 | | |

Vimeo Inc.† | |

| 77,744 | | |

| 73,694 | |

| | | | |

| |

| 80,718,533 | | |

| 213,123,473 | |

| | | | |

| |

| | | |

| | |

| | | | |

Consumer Products — 2.1% | |

| | | |

| | |

| | 30,000 | | |

Church & Dwight Co. Inc. | |

| 1,199,580 | | |

| 3,110,400 | |

| | 298,000 | | |

Edgewell Personal Care Co. | |

| 11,308,223 | | |

| 11,976,620 | |

| | 43,000 | | |

Energizer Holdings Inc. | |

| 1,564,155 | | |

| 1,270,220 | |

| | 95,000 | | |

Hanesbrands Inc.† | |

| 452,141 | | |

| 468,350 | |

| | 700 | | |

Johnson Outdoors Inc., Cl. A | |

| 48,584 | | |

| 24,486 | |

| | 150 | | |

Kering SA | |

| 76,281 | | |

| 54,377 | |

| | 3,995 | | |

Nintendo Co. Ltd., ADR | |

| 40,182 | | |

| 53,134 | |

| | 219,000 | | |

Philip Morris International Inc. | |

| 20,533,427 | | |

| 22,191,270 | |

| | 62,870 | | |

Spectrum Brands Holdings Inc. | |

| 5,170,783 | | |

| 5,402,419 | |

| | 250 | | |

The Estee Lauder Companies Inc., Cl. A | |

| 47,689 | | |

| 26,600 | |

| | 72,000 | | |

The Procter & Gamble Co. | |

| 4,198,273 | | |

| 11,874,240 | |

| | 12,000 | | |

The Scotts Miracle-Gro Co. | |

| 688,480 | | |

| 780,720 | |

| | | | |

| |

| 45,327,798 | | |

| 57,232,836 | |

| | | | |

| |

| | | |

| | |

| | | | |

Consumer Services — 0.4% | |

| | | |

| | |

| | 86,530 | | |

Arlo Technologies Inc.† | |

| 418,163 | | |

| 1,128,351 | |

| | 13,100 | | |

Ashtead Group plc | |

| 310,315 | | |

| 874,684 | |

| | 25,000 | | |

Avis Budget Group Inc. | |

| 2,755,732 | | |

| 2,613,000 | |

| | 750 | | |

Booking Holdings Inc. | |

| 2,335,604 | | |

| 2,971,125 | |

| | 7,000 | | |

Travel + Leisure Co. | |

| 238,201 | | |

| 314,860 | |

| | 54,000 | | |

Uber Technologies Inc.† | |

| 4,299,039 | | |

| 3,924,720 | |

| | | | |

| |

| 10,357,054 | | |

| 11,826,740 | |

| | | | |

| |

| | | |

| | |

| | | | |

Diversified

Industrial — 4.6% | |

| | | |

| | |

| | 500 | | |

Agilent Technologies Inc. | |

| 57,296 | | |

| 64,815 | |

| | 10,555 | | |

American Outdoor Brands Inc.† | |

| 115,635 | | |

| 94,995 | |

| | 237,000 | | |

Ampco-Pittsburgh Corp.† | |

| 600,996 | | |

| 182,490 | |

| | 36,000 | | |

Ardagh Group SA† | |

| 146,340 | | |

| 140,040 | |

| | 10,845 | | |

AZZ Inc. | |

| 415,635 | | |

| 837,776 | |

| | 10,000 | | |

Barnes Group Inc. | |

| 385,326 | | |

| 414,100 | |

| | 95,000 | | |

Bouygues SA | |

| 3,295,487 | | |

| 3,049,155 | |

| | 4,800 | | |

Crane Co. | |

| 304,553 | | |

| 695,904 | |

| | 3,000 | | |

Crane NXT Co. | |

| 99,774 | | |

| 184,260 | |

| | 52,200 | | |

Eaton Corp. plc | |

| 8,338,197 | | |

| 16,367,310 | |

| | 119,100 | | |

General Electric Co. | |

| 15,766,505 | | |

| 18,933,327 | |

| | 3,500 | | |

Graham Corp.† | |

| 49,878 | | |

| 98,560 | |

| | 110,000 | | |

Griffon Corp. | |

| 1,980,905 | | |

| 7,024,600 | |

| | 172,000 | | |

Honeywell International Inc. | |

| 21,823,415 | | |

| 36,728,880 | |

| | 11,000 | | |

Hyster-Yale Inc. | |

| 369,630 | | |

| 767,030 | |

| | 43,199 | | |

Intevac Inc.† | |

| 182,940 | | |

| 166,748 | |

| | 37,500 | | |

ITT Inc. | |

| 954,003 | | |

| 4,844,250 | |

| | 10,000 | | |

nVent Electric plc | |

| 140,660 | | |

| 766,100 | |

See

accompanying notes to financial statements.

The

Gabelli Dividend & Income Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | |

| |

Cost | |

Market

Value |

| | |

COMMON STOCKS (Continued) | |

| |

|

| | | | |

Diversified Industrial (Continued) | |

| | | |

| | |

| | 15,000 | | |

Pentair plc | |

$ | 425,273 | | |

$ | 1,150,050 | |

| | 10,678 | | |

Proto Labs Inc.† | |

| 694,953 | | |

| 329,843 | |

| | 1,250 | | |

Siemens AG | |

| 218,904 | | |

| 232,557 | |

| | 6,500 | | |

Sulzer AG | |

| 415,548 | | |

| 898,548 | |

| | 287,000 | | |

Textron Inc. | |

| 12,250,779 | | |

| 24,641,820 | |

| | 15,225 | | |

The Sherwin-Williams Co. | |

| 2,689,844 | | |

| 4,543,597 | |

| | 300,000 | | |

Toray Industries Inc. | |

| 2,270,748 | | |

| 1,419,914 | |

| | 36,000 | | |

Trinity Industries Inc. | |

| 739,138 | | |

| 1,077,120 | |

| | | | |

| |

| 74,732,362 | | |

| 125,653,789 | |

| | | | |

| |

| | | |

| | |

| | | | |

Electronics — 2.4% | |

| | | |

| | |

| | 5,000 | | |

Flex Ltd.† | |

| 65,845 | | |

| 147,450 | |

| | 58,000 | | |

Intel Corp. | |

| 3,059,830 | | |

| 1,796,260 | |

| | 10,025 | | |

Kimball Electronics Inc.† | |

| 206,302 | | |

| 220,349 | |

| | 148,000 | | |

Resideo Technologies Inc.† | |

| 1,253,917 | | |

| 2,894,880 | |

| | 1,650 | | |

Signify NV | |

| 57,604 | | |

| 41,173 | |

| | 360,000 | | |

Sony Group Corp., ADR | |

| 12,443,702 | | |

| 30,582,000 | |

| | 38,000 | | |

TE Connectivity Ltd. | |

| 1,106,583 | | |

| 5,716,340 | |

| | 84,200 | | |

Texas Instruments Inc. | |

| 3,705,255 | | |

| 16,379,426 | |

| | 13,000 | | |

Thermo Fisher Scientific Inc. | |

| 4,991,810 | | |

| 7,189,000 | |

| | 3,500 | | |

Universal Display Corp. | |

| 557,137 | | |

| 735,875 | |

| | | | |

| |

| 27,447,985 | | |

| 65,702,753 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities — 0.3% | |

| | | |

| | |

| | 43,000 | | |

Alliant Energy Corp. | |

| 2,177,679 | | |

| 2,188,700 | |

| | 26,850 | | |

GE Vernova Inc.† | |

| 3,767,467 | | |

| 4,605,044 | |

| | 16,000 | | |

Northwest Natural Holding Co. | |

| 609,971 | | |

| 577,760 | |

| | 23,000 | | |

NOV Inc. | |

| 409,024 | | |

| 437,230 | |

| | | | |

| |

| 6,964,141 | | |

| 7,808,734 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities: Electric — 0.3% | |

| | | |

| | |

| | 2,000 | | |

ALLETE Inc. | |

| 65,474 | | |

| 124,700 | |

| | 5,000 | | |

American Electric Power Co. Inc. | |

| 184,350 | | |

| 438,700 | |

| | 29,000 | | |

Electric Power Development Co. Ltd. | |

| 607,454 | | |

| 452,511 | |

| | 74,000 | | |

Evergy Inc. | |

| 4,107,578 | | |

| 3,919,780 | |

| | 12,000 | | |

Pinnacle West Capital Corp. | |

| 468,584 | | |

| 916,560 | |

| | 10,000 | | |

Portland General Electric Co. | |

| 455,250 | | |

| 432,400 | |

| | 3,000 | | |

PPL Corp. | |

| 80,959 | | |

| 82,950 | |

| | 61,600 | | |

The AES Corp. | |

| 661,652 | | |

| 1,082,312 | |

| | 6,500 | | |

WEC Energy Group Inc. | |

| 438,633 | | |

| 509,990 | |

| | | | |

| |

| 7,069,934 | | |

| 7,959,903 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities: Integrated — 1.3% | | |

| | |

| | 20,000 | | |

Chubu Electric Power Co. Inc. | |

| 307,625 | | |

| 236,311 | |

| | 20,000 | | |

Endesa SA | |

| 506,664 | | |

| 375,582 | |

| | 228,000 | | |

Enel SpA | |

| 1,036,727 | | |

| 1,585,683 | |

| Shares | |

| |

Cost | |

Market

Value |

| | 12,500 | | |

Eversource Energy | |

$ | 681,111 | | |

$ | 708,875 | |

| | 23,000 | | |

Hawaiian Electric Industries Inc. | |

| 594,426 | | |

| 207,460 | |

| | 410,000 | | |

Hera SpA | |

| 822,663 | | |

| 1,402,452 | |

| | 16,000 | | |

Hokkaido Electric Power Co. Inc. | |

| 102,051 | | |

| 118,740 | |

| | 45,000 | | |

Iberdrola SA, ADR | |

| 952,490 | | |

| 2,354,400 | |

| | 115,000 | | |

Korea Electric Power Corp., ADR† | |

| 1,568,135 | | |

| 815,350 | |

| | 23,000 | | |

Kyushu Electric Power Co. Inc. | |

| 228,450 | | |

| 236,876 | |

| | 23,000 | | |

MGE Energy Inc. | |

| 492,211 | | |

| 1,718,560 | |

| | 160,000 | | |

NextEra Energy Inc. | |

| 11,419,769 | | |

| 11,329,600 | |

| | 5,650 | | |

NextEra Energy Partners LP | |

| 281,304 | | |

| 156,166 | |

| | 49,000 | | |

NiSource Inc. | |

| 397,054 | | |

| 1,411,690 | |

| | 10,000 | | |

Northwestern Energy Group Inc. | |

| 522,880 | | |

| 500,800 | |

| | 57,500 | | |

OGE Energy Corp. | |

| 685,360 | | |

| 2,052,750 | |

| | 11,000 | | |

Ormat Technologies Inc. | |

| 165,000 | | |

| 788,700 | |

| | 140,000 | | |

PG&E Corp. | |

| 1,515,735 | | |

| 2,444,400 | |

| | 68,000 | | |

PNM Resources Inc. | |

| 2,708,372 | | |

| 2,513,280 | |

| | 30,000 | | |

Public Service Enterprise Group Inc. | |

| 906,079 | | |

| 2,211,000 | |

| | 50,000 | | |

Shikoku Electric Power Co. Inc. | |

| 878,676 | | |

| 428,864 | |

| | 40,000 | | |

The Chugoku Electric Power Co. Inc. | |

| 558,192 | | |

| 262,664 | |

| | 18,000 | | |

The Kansai Electric Power Co. Inc. | |

| 217,251 | | |

| 302,293 | |

| | 50,000 | | |

Tohoku Electric Power Co. Inc. | |

| 645,500 | | |

| 451,085 | |

| | | | |

| |

| 28,193,725 | | |

| 34,613,581 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities: Natural Gas — 1.2% | | |

| | |

| | 16,000 | | |

APA Corp. | |

| 185,550 | | |

| 471,040 | |

| | 200,000 | | |

Enterprise Products Partners LP | |

| 2,913,916 | | |

| 5,796,000 | |

| | 47,000 | | |

Kinder Morgan Inc. | |

| 978,429 | | |

| 933,890 | |

| | 239,500 | | |

National Fuel Gas Co. | |

| 11,939,330 | | |

| 12,978,505 | |

| | 89,790 | | |

National Grid plc | |

| 1,019,220 | | |

| 1,001,786 | |

| | 22,000 | | |

National Grid plc, ADR | |

| 1,086,983 | | |

| 1,249,600 | |

| | 14,300 | | |

ONEOK Inc. | |

| 524,693 | | |

| 1,166,165 | |

| | 75,000 | | |

Sempra | |

| 1,199,553 | | |

| 5,704,500 | |

| | 47,000 | | |

Southwest Gas Holdings Inc. | |

| 1,744,397 | | |

| 3,307,860 | |

| | 74,000 | | |

UGI Corp. | |

| 2,910,536 | | |

| 1,694,600 | |

| | | | |

| |

| 24,502,607 | | |

| 34,303,946 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities: Oil — 4.3% | |

| | | |

| | |

| | 78,900 | | |

Chevron Corp. | |

| 7,734,576 | | |

| 12,341,538 | |

| | 207,300 | | |

ConocoPhillips | |

| 12,469,370 | | |

| 23,710,974 | |

| | 65,000 | | |

Devon Energy Corp. | |

| 856,057 | | |

| 3,081,000 | |

| | 123,000 | | |

Eni SpA, ADR | |

| 4,396,603 | | |

| 3,787,170 | |

See

accompanying notes to financial statements

The

Gabelli Dividend & Income Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | |

| |

Cost | |

Market

Value |

| | |

COMMON STOCKS (Continued) | |

| |

|

| | | | |

Energy and Utilities: Oil (Continued) | |

| | | |

| | |

| | 375,000 | | |

Equinor ASA, ADR | |

$ | 6,897,752 | | |

$ | 10,710,000 | |

| | 109,000 | | |

Exxon Mobil Corp. | |

| 6,273,866 | | |

| 12,548,080 | |

| | 15,400 | | |

Hess Corp. | |

| 957,640 | | |

| 2,271,808 | |

| | 129,000 | | |

Marathon Petroleum Corp. | |

| 4,189,817 | | |

| 22,378,920 | |

| | 73,000 | | |

Occidental Petroleum Corp. | |

| 4,223,548 | | |

| 4,601,190 | |

| | 100,000 | | |

PetroChina Co. Ltd., Cl. H | |

| 40,300 | | |

| 101,164 | |

| | 25,000 | | |

Petroleo Brasileiro SA, ADR | |

| 276,028 | | |

| 362,250 | |

| | 52,000 | | |

Phillips 66 | |

| 4,107,965 | | |

| 7,340,840 | |

| | 75,000 | | |

Repsol SA, ADR | |

| 1,487,593 | | |

| 1,179,000 | |

| | 92,800 | | |

Shell plc, ADR | |

| 5,015,873 | | |

| 6,698,304 | |

| | 3,000 | | |

Texas Pacific Land Corp. | |

| 1,205,174 | | |

| 2,202,810 | |

| | 70,000 | | |

TotalEnergies SE, ADR | |

| 3,318,049 | | |

| 4,667,600 | |

| | 2,891 | | |

Woodside Energy Group Ltd., ADR | |

| 66,493 | | |

| 54,380 | |

| | | | |

| |

| 63,516,704 | | |

| 118,037,028 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities: Services — 1.3% | | | |

| | |

| | 2,000 | | |

Baker Hughes Co. | |

| 61,706 | | |

| 70,340 | |

| | 79,000 | | |

Dril-Quip Inc.† | |

| 1,892,040 | | |

| 1,469,400 | |

| | 556,325 | | |

Halliburton Co. | |

| 17,984,331 | | |

| 18,792,658 | |

| | 117,975 | | |

Oceaneering International Inc.† | |

| 1,634,267 | | |

| 2,791,289 | |

| | 277,000 | | |

Schlumberger NV | |

| 11,719,127 | | |

| 13,068,860 | |

| | | | |

| |

| 33,291,471 | | |

| 36,192,547 | |

| | | | |

| |

| | | |

| | |

| | | | |

Energy and Utilities: Water — 0.3% | |

| | | |

| | |

| | 11,000 | | |

American States Water Co. | |

| 138,388 | | |

| 798,270 | |

| | 6,000 | | |

American Water Works Co. Inc. | |

| 715,889 | | |

| 774,960 | |

| | 53,000 | | |

Essential Utilities Inc. | |

| 1,985,426 | | |

| 1,978,490 | |

| | 70,000 | | |

Mueller Water Products Inc., Cl. A | |

| 845,455 | | |

| 1,254,400 | |

| | 34,000 | | |

Severn Trent plc | |

| 876,357 | | |

| 1,022,910 | |

| | 22,000 | | |

SJW Group | |

| 383,583 | | |

| 1,192,840 | |

| | 7,500 | | |

The York Water Co. | |

| 97,903 | | |

| 278,175 | |

| | 8,000 | | |

United Utilities Group plc, ADR | |

| 212,760 | | |

| 201,040 | |

| | | | |

| |

| 5,255,761 | | |

| 7,501,085 | |

| | | | |

| |

| | | |

| | |

| | | | |

Entertainment — 2.5% | |

| | | |

| | |

| | 222,000 | | |

Atlanta Braves Holdings Inc., Cl. A† | |

| 6,307,448 | | |

| 9,175,260 | |

| | 65,000 | | |

Atlanta Braves Holdings Inc., Cl. C† | |

| 2,452,933 | | |

| 2,563,600 | |

| | 25,300 | | |

Caesars Entertainment Inc.† | |

| 1,079,074 | | |

| 1,005,422 | |

| | 61,333 | | |

Fox Corp., Cl. A | |

| 1,949,372 | | |

| 2,108,015 | |

| | 71,000 | | |

Fox Corp., Cl. B | |

| 2,242,420 | | |

| 2,273,420 | |

| | 3,000 | | |

International Game Technology plc | |

| 74,263 | | |

| 61,380 | |

| | 59,880 | | |

Madison Square Garden Entertainment Corp.† | |

| 1,629,258 | | |

| 2,049,693 | |

| Shares | |

| |

Cost | |

Market

Value |

| | 50,000 | | |

Madison Square Garden Sports Corp.† | |

$ | 4,495,586 | | |

$ | 9,406,500 | |

| | 22,800 | | |

Netflix Inc.† | |

| 8,254,657 | | |

| 15,387,264 | |

| | 170,000 | | |

Ollamani SAB† | |

| 411,674 | | |

| 387,390 | |

| | 91,000 | | |

Paramount Global, Cl. A | |

| 2,817,272 | | |

| 1,672,580 | |

| | 255,000 | | |

Paramount Global, Cl. B | |

| 6,092,582 | | |

| 2,649,450 | |

| | 3,000 | | |

Penn Entertainment Inc.† | |

| 102,748 | | |

| 58,065 | |

| | 59,880 | | |

Sphere Entertainment Co.† | |

| 1,423,927 | | |

| 2,099,393 | |

| | 16,000 | | |

Take-Two Interactive Software Inc.† | |

| 2,525,044 | | |

| 2,487,840 | |

| | 17,000 | | |

The Walt Disney Co. | |

| 1,535,057 | | |

| 1,687,930 | |

| | 105,000 | | |

Universal Music Group NV | |

| 1,972,606 | | |

| 3,123,854 | |

| | 650,000 | | |

Vivendi SE | |

| 7,254,944 | | |

| 6,791,322 | |

| | 650,000 | | |

Warner Bros Discovery Inc.† | |

| 7,447,307 | | |

| 4,836,000 | |

| | | | |

| |

| 60,068,172 | | |

| 69,824,378 | |

| | | | |

| |

| | | |

| | |

| | | | |

Environmental Services — 2.7% | |

| | | |

| | |

| | 179,000 | | |

Republic Services Inc. | |

| 7,417,439 | | |

| 34,786,860 | |

| | 29,180 | | |

Veolia Environnement SA | |

| 443,012 | | |

| 872,509 | |

| | 97,222 | | |

Waste Connections Inc. | |

| 4,631,690 | | |

| 17,048,850 | |

| | 104,500 | | |

Waste Management Inc. | |

| 4,408,953 | | |

| 22,294,030 | |

| | | | |

| |

| 16,901,094 | | |

| 75,002,249 | |

| | | | |

| |

| | | |

| | |

| | | | |

Equipment and Supplies — 1.8% | |

| | | |

| | |

| | 3,000 | | |

CTS Corp. | |

| 108,270 | | |

| 151,890 | |

| | 106,000 | | |

Flowserve Corp. | |

| 3,972,727 | | |

| 5,098,600 | |

| | 113,500 | | |

Graco Inc. | |

| 2,326,211 | | |

| 8,998,280 | |

| | 267,500 | | |

Mueller Industries Inc. | |

| 2,902,664 | | |

| 15,231,450 | |

| | 456,825 | | |

RPC Inc. | |

| 1,093,504 | | |

| 2,855,156 | |

| | 70,000 | | |

Sealed Air Corp. | |

| 1,816,046 | | |

| 2,435,300 | |

| | 96,000 | | |

The Timken Co. | |

| 3,641,176 | | |

| 7,692,480 | |

| | 29,000 | | |

Valmont Industries Inc. | |

| 7,040,732 | | |

| 7,959,050 | |

| | | | |

| |

| 22,901,330 | | |

| 50,422,206 | |

| | | | |

| |

| | | |

| | |

| | | | |

Financial Services — 16.4% | |

| | | |

| | |

| | 7,000 | | |

AJ Bell plc | |

| 27,179 | | |

| 33,581 | |

| | 277,250 | | |

American Express Co. | |

| 26,808,184 | | |

| 64,197,237 | |

| | 60,000 | | |

American International Group Inc. | |

| 3,564,060 | | |

| 4,454,400 | |

| | 274,600 | | |

Bank of America Corp. | |

| 7,604,618 | | |

| 10,920,842 | |

| | 60,000 | | |

Berkshire Hathaway Inc., Cl. B† | |

| 12,010,374 | | |

| 24,408,000 | |

| | 15,600 | | |

BlackRock Inc. | |

| 2,983,138 | | |

| 12,282,192 | |

| | 74,000 | | |

Blackstone Inc. | |

| 3,583,266 | | |

| 9,161,200 | |

| | 7,174 | | |

Brookfield Asset Management Ltd., Cl. A | |

| 25,030 | | |

| 272,971 | |

| | 28,500 | | |

Brookfield Corp. | |

| 105,526 | | |

| 1,183,890 | |

| | 196 | | |

Brookfield Reinsurance Ltd. | |

| 10,388 | | |

| 8,152 | |

| | 2,300 | | |

Brooks Macdonald Group plc | |

| 60,387 | | |

| 56,695 | |

| | 14,000 | | |

Cannae Holdings Inc. | |

| 225,924 | | |

| 253,960 | |

| | 152,000 | | |

Citigroup Inc. | |

| 7,253,057 | | |

| 9,645,920 | |

See

accompanying notes to financial statements.

The

Gabelli Dividend & Income Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | |

| |

Cost | |

Market

Value |

| | | | |

COMMON

STOCKS (Continued) | |

| | | |

| | |

| | | | |

Financial

Services (Continued) | |

| | | |

| | |

| | 18,500 | | |

Cullen/Frost

Bankers Inc. | |

$ | 1,345,682 | | |

$ | 1,880,155 | |

| | 11,000 | | |

EXOR NV | |

| 671,170 | | |

| 1,150,950 | |

| | 140 | | |

Farmers & Merchants

Bank of Long Beach | |

| 1,055,771 | | |

| 658,000 | |

| | 37,000 | | |

Fidelity National

Financial Inc. | |

| 375,359 | | |

| 1,828,540 | |

| | 80,000 | | |

FTAI Aviation Ltd. | |

| 1,323,086 | | |

| 8,258,400 | |

| | 23,000 | | |

HSBC Holdings plc,

ADR | |

| 788,345 | | |

| 1,000,500 | |

| | 23,249 | | |

Interactive Brokers

Group Inc., Cl. A | |

| 916,968 | | |

| 2,850,327 | |

| | 20,450 | | |

Intercontinental Exchange

Inc. | |

| 2,310,228 | | |

| 2,799,400 | |

| | 155,000 | | |

Invesco Ltd. | |

| 3,318,821 | | |

| 2,318,800 | |

| | 14,000 | | |

Janus Henderson Group

plc | |

| 450,404 | | |

| 471,940 | |

| | 316,947 | | |

JPMorgan Chase &

Co., CDI | |

| 23,310,852 | | |

| 64,105,700 | |

| | 63,000 | | |

KeyCorp. | |

| 822,234 | | |

| 895,230 | |

| | 112,400 | | |

KKR & Co. Inc. | |

| 7,715,312 | | |

| 11,828,976 | |

| | 85,000 | | |

Loews Corp. | |

| 5,280,348 | | |

| 6,352,900 | |

| | 42,000 | | |

M&T Bank Corp. | |

| 3,349,636 | | |

| 6,357,120 | |

| | 7,400 | | |

Moody’s Corp. | |

| 2,990,747 | | |

| 3,114,882 | |

| | 188,726 | | |

Morgan Stanley | |

| 5,251,646 | | |

| 18,342,280 | |

| | 70,000 | | |

National Australia

Bank Ltd., ADR | |

| 810,381 | | |

| 840,000 | |

| | 124,000 | | |

Navient Corp. | |

| 904,132 | | |

| 1,805,440 | |

| | 65,500 | | |

Northern Trust Corp. | |

| 2,786,330 | | |

| 5,500,690 | |

| | 173,213 | | |

Oaktree Specialty

Lending Corp. | |

| 3,263,145 | | |

| 3,258,137 | |

| | 5,000 | | |

PayPal Holdings Inc.† | |

| 335,979 | | |

| 290,150 | |

| | 80,000 | | |

Resona Holdings Inc. | |

| 381,969 | | |

| 529,306 | |

| | 14,000 | | |

S&P Global Inc. | |

| 4,942,492 | | |

| 6,244,000 | |

| | 90,000 | | |

SLM Corp. | |

| 453,093 | | |

| 1,871,100 | |

| | 146,000 | | |

State Street Corp. | |

| 9,089,455 | | |

| 10,804,000 | |

| | 123,000 | | |

T. Rowe Price Group

Inc. | |

| 8,849,749 | | |

| 14,183,130 | |

| | 621,000 | | |

The Bank of New York

Mellon Corp. | |

| 20,522,540 | | |

| 37,191,690 | |

| | 35,000 | | |

The Charles Schwab

Corp. | |

| 2,428,002 | | |

| 2,579,150 | |

| | 33,000 | | |

The Goldman Sachs

Group Inc. | |

| 7,587,869 | | |

| 14,926,560 | |

| | 83,500 | | |

The Hartford Financial

Services Group Inc. | |

| 2,788,895 | | |

| 8,395,090 | |

| | 112,000 | | |

The PNC Financial

Services Group Inc. | |

| 8,737,059 | | |

| 17,413,760 | |

| | 68,200 | | |

The Travelers Companies

Inc. | |

| 5,285,155 | | |

| 13,867,788 | |

| | 60,000 | | |

W. R. Berkley Corp. | |

| 2,762,453 | | |

| 4,714,800 | |

| | 534,000 | | |

Wells Fargo &

Co. | |

| 18,561,549 | | |

| 31,714,260 | |

| | 2,300 | | |

Willis

Towers Watson plc | |

| 175,957 | | |

| 602,922 | |

| | | | |

| |

| 226,203,944 | | |

| 447,825,113 | |

| Shares | |

| |

Cost | |

Market

Value |

| | | | |

Food

and Beverage — 8.6% | |

| | | |

| | |

| | 12,000 | | |

Ajinomoto

Co. Inc. | |

$ | 205,201 | | |

$ | 420,735 | |

| | 100,117 | | |

BellRing Brands Inc.† | |

| 2,491,216 | | |

| 5,720,685 | |

| | 12,500 | | |

Brown-Forman Corp.,

Cl. B | |

| 439,792 | | |

| 539,875 | |

| | 374,000 | | |

Campbell Soup Co. | |

| 15,538,023 | | |

| 16,901,060 | |

| | 900,000 | | |

China Mengniu Dairy

Co. Ltd. | |

| 1,077,834 | | |

| 1,613,512 | |

| | 46,000 | | |

Conagra Brands Inc. | |

| 1,348,907 | | |

| 1,307,320 | |

| | 156,000 | | |

Danone SA | |

| 7,558,438 | | |

| 9,536,253 | |

| | 1,920,000 | | |

Davide Campari-Milano

NV | |

| 5,918,650 | | |

| 18,144,121 | |

| | 1,500 | | |

Diageo plc | |

| 66,184 | | |

| 47,205 | |

| | 141,500 | | |

Diageo plc, ADR | |

| 20,208,642 | | |

| 17,840,320 | |

| | 70,954 | | |

Flowers Foods Inc. | |

| 1,053,433 | | |

| 1,575,179 | |

| | 164,200 | | |

General Mills Inc. | |

| 9,361,776 | | |

| 10,387,292 | |

| | 18,000 | | |

Heineken Holding NV | |

| 747,987 | | |

| 1,419,758 | |

| | 260,000 | | |

ITO EN Ltd. | |

| 5,640,538 | | |

| 5,626,950 | |

| | 110,000 | | |

Keurig Dr Pepper Inc. | |

| 1,412,776 | | |

| 3,674,000 | |

| | 1,650,000 | | |

Kikkoman Corp. | |

| 3,967,130 | | |

| 19,111,039 | |

| | 10,000 | | |

Lamb Weston Holdings

Inc. | |

| 898,435 | | |

| 840,800 | |

| | 11,000 | | |

Lifecore Biomedical

Inc.† | |

| 109,552 | | |

| 56,430 | |

| | 108,000 | | |

Maple Leaf Foods Inc. | |

| 2,081,739 | | |

| 1,809,408 | |

| | 6,000 | | |

McCormick & Co.

Inc. | |

| 290,905 | | |

| 414,000 | |

| | 85,000 | | |

Molson Coors Beverage

Co., Cl. B | |

| 4,476,446 | | |

| 4,320,550 | |

| | 465,000 | | |

Mondelēz International

Inc., Cl. A | |

| 18,163,911 | | |

| 30,429,600 | |

| | 60,000 | | |

Morinaga Milk Industry

Co. Ltd. | |

| 588,860 | | |

| 1,257,132 | |

| | 10,000 | | |

Nathan’s Famous Inc. | |

| 591,370 | | |

| 677,800 | |

| | 4,400 | | |

National Beverage

Corp. | |

| 202,873 | | |

| 225,456 | |

| | 24,000 | | |

Nestlé SA | |

| 1,876,188 | | |

| 2,450,086 | |

| | 35,000 | | |

Nestlé SA,

ADR | |

| 2,563,158 | | |

| 3,585,750 | |

| | 384,000 | | |

Nissin Foods Holdings

Co. Ltd. | |

| 4,370,561 | | |

| 9,742,607 | |

| | 65,082 | | |

Nomad Foods Ltd. | |

| 1,685,780 | | |

| 1,072,551 | |

| | 69,250 | | |

PepsiCo Inc. | |

| 8,764,166 | | |

| 11,421,402 | |

| | 39,000 | | |

Pernod Ricard SA | |

| 2,792,532 | | |

| 5,291,885 | |

| | 42,000 | | |

Post Holdings Inc.† | |

| 2,669,095 | | |

| 4,374,720 | |

| | 24,500 | | |

Remy Cointreau SA | |

| 1,360,469 | | |

| 2,043,962 | |

| | 18,000 | | |

Suntory Beverage &

Food Ltd. | |

| 573,702 | | |

| 638,486 | |

| | 2,500 | | |

The Boston Beer Co.

Inc., Cl. A† | |

| 831,230 | | |

| 762,625 | |

| | 235,000 | | |

The Coca-Cola Co. | |

| 9,397,145 | | |

| 14,957,750 | |

| | 41,000 | | |

The Hain Celestial

Group Inc.† | |

| 624,377 | | |

| 283,310 | |

| | 5,150 | | |

The J.M. Smucker Co. | |

| 763,564 | | |

| 561,556 | |

| | 414,000 | | |

The Kraft Heinz Co. | |

| 15,238,148 | | |

| 13,339,080 | |

| | 5,000 | | |

The Simply Good Foods

Co.† | |

| 172,310 | | |

| 180,650 | |

| | 14,000 | | |

TreeHouse Foods Inc.† | |

| 569,609 | | |

| 512,960 | |

| | 19,000 | | |

Unilever plc, ADR | |

| 675,997 | | |

| 1,044,810 | |

See

accompanying notes to financial statements.

The

Gabelli Dividend & Income Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | |

| |

Cost | |

Market

Value |

| | | | |

COMMON

STOCKS (Continued) | |

| | | |

| | |

| | | | |

Food

and Beverage (Continued) | |

| | | |

| | |

| | 10,000 | | |

WK Kellogg

Co. | |

$ | 121,562 | | |

$ | 164,600 | |

| | 470,000 | | |

Yakult

Honsha Co. Ltd. | |

| 5,651,870 | | |

| 8,402,977 | |

| | | | |

| |

| 165,142,081 | | |

| 234,728,247 | |

| | | | |

| |

| | | |

| | |

| | | | |

Health

Care — 10.7% | |

| | | |

| | |

| | 30,500 | | |

Abbott Laboratories | |

| 1,791,668 | | |

| 3,169,255 | |

| | 58,600 | | |

AbbVie Inc. | |

| 6,037,073 | | |

| 10,051,072 | |

| | 30,000 | | |

AstraZeneca plc, ADR | |

| 1,643,903 | | |

| 2,339,700 | |

| | 185,987 | | |

Avantor Inc.† | |

| 5,102,432 | | |

| 3,942,924 | |

| | 188,000 | | |

Bausch + Lomb Corp.† | |

| 2,940,982 | | |

| 2,729,760 | |

| | 100,000 | | |

Baxter International

Inc. | |

| 5,348,466 | | |

| 3,345,000 | |

| | 1,000 | | |

Bayer AG | |

| 61,178 | | |

| 28,252 | |

| | 17,500 | | |

Becton Dickinson &

Co. | |

| 4,106,780 | | |

| 4,089,925 | |

| | 2,500 | | |

BioMarin Pharmaceutical

Inc.† | |

| 195,120 | | |

| 205,825 | |

| | 12,500 | | |

Bio-Rad Laboratories

Inc., Cl. A† | |

| 4,672,253 | | |

| 3,413,875 | |

| | 28,000 | | |

Boston Scientific

Corp.† | |

| 2,138,507 | | |

| 2,156,280 | |

| | 41,000 | | |

Bristol-Myers Squibb

Co. | |

| 2,526,558 | | |

| 1,702,730 | |

| | 75,000 | | |

Catalent Inc.† | |

| 6,312,159 | | |

| 4,217,250 | |

| | 25,000 | | |

Cencora Inc. | |

| 2,058,535 | | |

| 5,632,500 | |

| | 9,000 | | |

Charles River Laboratories

International Inc.† | |

| 2,010,958 | | |

| 1,859,220 | |

| | 12,500 | | |

Chemed Corp. | |

| 4,372,072 | | |

| 6,782,250 | |

| | 23,000 | | |

DaVita Inc.† | |

| 1,452,151 | | |

| 3,187,110 | |

| | 1,000 | | |

Demant A/S† | |

| 38,808 | | |

| 43,280 | |

| | 100,000 | | |

DENTSPLY SIRONA Inc. | |

| 5,007,874 | | |

| 2,491,000 | |

| | 55,000 | | |

Elanco Animal Health

Inc.† | |

| 694,558 | | |

| 793,650 | |

| | 15,000 | | |

Elevance Health Inc. | |

| 3,500,477 | | |

| 8,127,900 | |

| | 50,900 | | |

Eli Lilly & Co. | |

| 7,053,482 | | |

| 46,083,842 | |

| | 330,000 | | |

Evolent Health Inc.,

Cl. A† | |

| 5,853,000 | | |

| 6,309,600 | |

| | 24,500 | | |

Fortrea Holdings Inc.† | |

| 436,270 | | |

| 571,830 | |

| | 467 | | |

GE HealthCare Technologies

Inc. | |

| 22,282 | | |

| 36,389 | |

| | 12,510 | | |

Gerresheimer AG | |

| 811,484 | | |

| 1,343,778 | |

| | 45,000 | | |

Halozyme Therapeutics

Inc.† | |

| 1,902,539 | | |

| 2,356,200 | |

| | 25,000 | | |

HCA Healthcare Inc. | |

| 2,456,791 | | |

| 8,032,000 | |

| | 45,500 | | |

Henry Schein Inc.† | |

| 3,144,612 | | |

| 2,916,550 | |

| | 30,000 | | |

ICU Medical Inc.† | |

| 6,460,525 | | |

| 3,562,500 | |

| | 8,600 | | |

Incyte Corp.† | |

| 600,366 | | |

| 521,332 | |

| | 42,371 | | |

Integer Holdings Corp.† | |

| 2,096,234 | | |

| 4,906,138 | |

| | 15,900 | | |

Intuitive Surgical

Inc.† | |

| 3,862,682 | | |

| 7,073,115 | |

| | 101,535 | | |

Johnson & Johnson | |

| 11,861,697 | | |

| 14,840,356 | |

| | 3,735 | | |

Kenvue Inc. | |

| 47,900 | | |

| 67,902 | |

| | 24,500 | | |

Labcorp Holdings Inc. | |

| 2,660,858 | | |

| 4,985,995 | |

| | 10,000 | | |

Lantheus Holdings

Inc.† | |

| 577,651 | | |

| 802,900 | |

| | 8,000 | | |

McKesson Corp. | |

| 1,335,744 | | |

| 4,672,320 | |

| | 40,000 | | |

Medtronic plc | |

| 4,203,444 | | |

| 3,148,400 | |

| | 132,000 | | |

Merck & Co. Inc. | |

| 8,562,755 | | |

| 16,341,600 | |

| Shares | |

| |

Cost | |

Market

Value |

| | 191,042 | | |

Option

Care Health Inc.† | |

$ | 2,182,081 | | |

$ | 5,291,863 | |

| | 1,000 | | |

Organon & Co. | |

| 34,571 | | |

| 20,700 | |

| | 75,000 | | |

Owens & Minor

Inc.† | |

| 1,380,948 | | |

| 1,012,500 | |

| | 100,000 | | |

Pacific Biosciences

of California Inc.† | |

| 2,600,360 | | |

| 137,000 | |

| | 63,000 | | |

Patterson Cos. Inc. | |

| 1,447,314 | | |

| 1,519,560 | |

| | 78,000 | | |

Perrigo Co. plc | |

| 2,507,430 | | |

| 2,003,040 | |

| | 65,000 | | |

PetIQ Inc.† | |

| 1,642,643 | | |

| 1,433,900 | |

| | 487,088 | | |

Pfizer Inc. | |

| 11,733,413 | | |

| 13,628,722 | |

| | 27,430 | | |

QuidelOrtho Corp.† | |

| 1,852,867 | | |

| 911,225 | |

| | 250 | | |

Roche Holding AG | |

| 76,242 | | |

| 69,425 | |

| | 25,000 | | |

Silk Road Medical

Inc.† | |

| 865,354 | | |

| 676,000 | |

| | 24,400 | | |

Stryker Corp. | |

| 4,880,147 | | |

| 8,302,100 | |

| | 3,000 | | |

Teladoc Health Inc.† | |

| 58,986 | | |

| 29,340 | |

| | 110,000 | | |

Tenet Healthcare Corp.† | |

| 5,169,718 | | |

| 14,633,300 | |

| | 30,000 | | |

Teva Pharmaceutical

Industries Ltd., ADR† | |

| 492,273 | | |

| 487,500 | |

| | 56,000 | | |

The Cigna Group | |

| 10,786,969 | | |

| 18,511,920 | |

| | 48,000 | | |

The Cooper Companies

Inc. | |

| 2,234,608 | | |

| 4,190,400 | |

| | 15,000 | | |

Treace Medical Concepts

Inc.† | |

| 238,186 | | |

| 99,750 | |

| | 4,050 | | |

UnitedHealth Group

Inc. | |

| 2,078,425 | | |

| 2,062,503 | |

| | 10,000 | | |

Vertex Pharmaceuticals

Inc.† | |

| 1,942,839 | | |

| 4,687,200 | |

| | 25,000 | | |

Viatris Inc. | |

| 370,628 | | |

| 265,750 | |

| | 25,000 | | |

Zimmer Biomet Holdings

Inc. | |

| 2,705,607 | | |

| 2,713,250 | |

| | 58,238 | | |

Zoetis

Inc. | |

| 2,746,332 | | |

| 10,096,140 | |

| | | | |

| |

| 185,990,769 | | |

| 291,664,593 | |

| | | | |

| |

| | | |

| | |

| | | | |

Hotels

and Gaming — 0.4% | |

| | | |

| | |

| | 19,000 | | |

Accor SA | |

| 654,124 | | |

| 779,330 | |

| | 79,800 | | |

Boyd Gaming Corp. | |

| 444,899 | | |

| 4,396,980 | |

| | 43,000 | | |

Entain plc | |

| 592,178 | | |

| 342,445 | |

| | 400 | | |

Flutter Entertainment

plc† | |

| 63,793 | | |

| 73,141 | |

| | 6,000 | | |

Gambling.com Group

Ltd.† | |

| 56,159 | | |

| 49,320 | |

| | 15,000 | | |

Golden Entertainment

Inc. | |

| 469,950 | | |

| 466,650 | |

| | 15,500 | | |

Las Vegas Sands Corp. | |

| 915,115 | | |

| 685,875 | |

| | 400,000 | | |

Mandarin Oriental

International Ltd. | |

| 680,880 | | |

| 692,000 | |

| | 20,400 | | |

MGM Resorts International† | |

| 731,383 | | |

| 906,576 | |

| | 15,000 | | |

Ryman Hospitality

Properties Inc., REIT | |

| 683,117 | | |

| 1,497,900 | |

| | 12,000 | | |

Super Group SGHC Ltd.† | |

| 46,379 | | |

| 38,760 | |

| | 5,000 | | |

Wyndham Hotels &

Resorts Inc. | |

| 191,090 | | |

| 370,000 | |

| | 500 | | |

Wynn

Resorts Ltd. | |

| 49,068 | | |

| 44,750 | |

| | | | |

| |

| 5,578,135 | | |

| 10,343,727 | |

| | | | |

| |

| | | |

| | |

| | | | |

Machinery —

2.4% | |

| | | |

| | |

| | 63,000 | | |

Astec Industries Inc. | |

| 2,435,678 | | |

| 1,868,580 | |

| | 1,801,700 | | |

CNH Industrial NV | |

| 14,734,333 | | |

| 18,251,221 | |

See

accompanying notes to financial statements.

The Gabelli Dividend & Income

Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON STOCKS (Continued) | |

| | | |

| | |

| | | | |

Machinery (Continued) | |

| | | |

| | |

| | 53,800 | | |

Deere & Co. | |

$ | 5,790,984 | | |

$ | 20,101,294 | |

| | 12,000 | | |

Oshkosh Corp. | |

| 1,364,367 | | |

| 1,298,400 | |

| | 3,500 | | |

Otis Worldwide Corp. | |

| 176,951 | | |

| 336,910 | |

| | 1,500 | | |

Tennant Co. | |

| 97,500 | | |

| 147,660 | |

| | 40,000 | | |

Twin Disc Inc. | |

| 355,151 | | |

| 471,200 | |

| | 163,980 | | |

Xylem Inc. | |

| 8,444,982 | | |

| 22,240,607 | |

| | | | |

| |

| 33,399,946 | | |

| 64,715,872 | |

| | | | |

| |

| | | |

| | |

| | | | |

Metals and Mining — 1.1% | |

| | | |

| | |

| | 59,585 | | |

Agnico Eagle Mines Ltd. | |

| 1,918,960 | | |

| 3,896,859 | |

| | 18,000 | | |

Alliance Resource Partners LP | |

| 4,541 | | |

| 440,280 | |

| | 124,190 | | |

Barrick Gold Corp. | |

| 2,395,613 | | |

| 2,071,489 | |

| | 8,000 | | |

BHP Group Ltd., ADR | |

| 217,549 | | |

| 456,720 | |

| | 10,000 | | |

Endeavour Mining plc | |

| 198,681 | | |

| 211,250 | |

| | 10,000 | | |

Franco-Nevada Corp. | |

| 494,836 | | |

| 1,185,629 | |

| | 860 | | |

Franco-Nevada Corp., New York | |

| 124,722 | | |

| 101,927 | |

| | 200,000 | | |

Freeport-McMoRan Inc. | |

| 3,752,940 | | |

| 9,720,000 | |

| | 270,620 | | |

Newmont Corp. | |

| 10,625,089 | | |

| 11,330,859 | |

| | 9,615 | | |

Osisko Gold Royalties Ltd. | |

| 150,247 | | |

| 149,802 | |

| | | | |

| |

| 19,883,178 | | |

| 29,564,815 | |

| | | | |

| |

| | | |

| | |

| | | | |

Paper and Forest Products — 0.0% | |

| | | |

| | |

| | 2,200 | | |

Keweenaw Land Association Ltd.† | |

| 56,254 | | |

| 66,440 | |

| | | | |

| |

| | | |

| | |

| | | | |

Publishing — 0.0% | |

| | | |

| | |

| | 1,200 | | |

Graham Holdings Co., Cl. B | |

| 632,929 | | |

| 839,460 | |

| | | | |

| |

| | | |

| | |

| | | | |

Real Estate Investment Trust — 0.5% | |

| | |

| | 46,000 | | |

American Tower Corp. | |

| 8,553,947 | | |

| 8,941,480 | |

| | 16,000 | | |

Crown Castle Inc. | |

| 1,942,162 | | |

| 1,563,200 | |

| | 1,400 | | |

Equinix Inc. | |

| 513,747 | | |

| 1,059,240 | |

| | 1,800 | | |

VICI Properties Inc. | |

| 58,196 | | |

| 51,552 | |

| | 85,000 | | |

Weyerhaeuser Co. | |

| 2,638,024 | | |

| 2,413,150 | |

| | | | |

| |

| 13,706,076 | | |

| 14,028,622 | |

| | | | |

| |

| | | |

| | |

| | | | |

Retail — 2.9% | |

| | | |

| | |

| | 95,500 | | |

AutoNation Inc.† | |

| 5,226,675 | | |

| 15,220,790 | |

| | 1,000 | | |

AutoZone Inc.† | |

| 1,462,827 | | |

| 2,964,100 | |

| | 19,000 | | |

Bassett Furniture Industries Inc. | |

| 96,034 | | |

| 269,990 | |

| | 42,000 | | |

CarMax Inc.† | |

| 3,589,010 | | |

| 3,080,280 | |

| | 64,500 | | |

Chipotle Mexican Grill Inc.† | |

| 2,009,667 | | |

| 4,040,925 | |

| | 200,000 | | |

Conn's Inc.† | |

| 4,850,850 | | |

| 221,000 | |

| | 6,900 | | |

Costco Wholesale Corp. | |

| 3,633,101 | | |

| 5,864,931 | |

| | 175,000 | | |

CVS Health Corp. | |

| 14,043,316 | | |

| 10,335,500 | |

| | 75,000 | | |

Hertz Global Holdings Inc.† | |

| 629,721 | | |

| 264,750 | |

| | 98,500 | | |

Ingles Markets Inc., Cl. A | |

| 1,382,832 | | |

| 6,758,085 | |

| | 29,530 | | |

Lowe's Companies Inc. | |

| 1,348,137 | | |

| 6,510,184 | |

| Shares | | |

| |

Cost | | |

Market

Value | |

| | 7,000 | | |

Macy's Inc. | |

$ | 166,705 | | |

$ | 134,400 | |

| | 7,500 | | |

MSC Industrial Direct Co. Inc., Cl. A | |

| 532,090 | | |

| 594,825 | |

| | 15,000 | | |

Penske Automotive Group Inc. | |

| 2,299,704 | | |

| 2,235,300 | |

| | 56,250 | | |

Rush Enterprises Inc., Cl. B | |

| 599,173 | | |

| 2,207,250 | |

| | 234,000 | | |

Sally Beauty Holdings Inc.† | |

| 3,328,179 | | |

| 2,510,820 | |

| | 348,000 | | |

Seven & i Holdings Co. Ltd. | |

| 3,718,011 | | |

| 4,239,418 | |

| | 25,000 | | |

Starbucks Corp. | |

| 2,485,574 | | |

| 1,946,250 | |

| | 12,000 | | |

The Home Depot Inc. | |

| 2,899,029 | | |

| 4,130,880 | |

| | 70,000 | | |

Walgreens Boots Alliance Inc. | |

| 2,221,977 | | |

| 846,650 | |

| | 60,000 | | |

Walmart Inc. | |

| 970,066 | | |

| 4,062,600 | |

| | | | |

| |

| 57,492,678 | | |

| 78,438,928 | |

| | | | |

| |

| | | |

| | |

| | | | |

Semiconductors — 2.4% | |

| | | |

| | |

| | 31,000 | | |

Advanced Micro Devices Inc.† | |

| 3,036,460 | | |

| 5,028,510 | |

| | 28,000 | | |

Applied Materials Inc. | |

| 5,803,781 | | |

| 6,607,720 | |

| | 6,100 | | |

ASML Holding NV | |

| 2,358,220 | | |

| 6,238,653 | |

| | 1,050 | | |

Broadcom Inc. | |

| 941,209 | | |

| 1,685,806 | |

| | 3,000 | | |

Entegris Inc. | |

| 246,781 | | |

| 406,200 | |

| | 345,000 | | |

NVIDIA Corp. | |

| 3,457,311 | | |

| 42,621,300 | |

| | 1,500 | | |

NXP Semiconductors NV | |

| 274,055 | | |

| 403,635 | |

| | 34,804 | | |

SkyWater Technology Inc.† | |

| 256,863 | | |

| 266,251 | |

| | 11,000 | | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | |

| 868,070 | | |

| 1,911,910 | |

| | | | |

| |

| 17,242,750 | | |

| 65,169,985 | |

| | | | |

| |

| | | |

| | |

| | | | |

Specialty Chemicals — 1.2% | |

| | | |

| | |

| | 11,000 | | |

Air Products and Chemicals Inc. | |

| 2,562,352 | | |

| 2,838,550 | |

| | 30,000 | | |

Ashland Inc. | |

| 1,880,763 | | |

| 2,834,700 | |

| | 8,000 | | |

Axalta Coating Systems Ltd.† | |

| 204,330 | | |

| 273,360 | |

| | 500 | | |

DSM-Firmenich AG | |

| 64,583 | | |

| 56,546 | |

| | 203,000 | | |

DuPont de Nemours Inc. | |

| 11,737,432 | | |

| 16,339,470 | |

| | 17,000 | | |

FMC Corp. | |

| 1,536,045 | | |

| 978,350 | |

| | 13,000 | | |

International Flavors & Fragrances Inc. | |

| 989,195 | | |

| 1,237,730 | |

| | 16,760 | | |

Novonesis (Novozymes) B | |

| 418,737 | | |

| 1,025,494 | |

| | 83,000 | | |

Olin Corp. | |

| 1,490,430 | | |

| 3,913,450 | |

| | 5,400 | | |

Rogers Corp.† | |

| 669,534 | | |

| 651,294 | |

| | 5,000 | | |

Sensient Technologies Corp. | |

| 315,608 | | |

| 370,950 | |

| | 65,000 | | |

Valvoline Inc.† | |

| 1,432,687 | | |

| 2,808,000 | |

| | | | |

| |

| 23,301,696 | | |

| 33,327,894 | |

| | | | |

| |

| | | |

| | |

| | | | |

Telecommunications — 2.2% | |

| | | |

| | |

| | 29,000 | | |

AT&T Inc. | |

| 520,576 | | |

| 554,190 | |

| | 148,000 | | |

BCE Inc. | |

| 4,123,357 | | |

| 4,790,760 | |

| | 395,000 | | |

Deutsche Telekom AG, ADR | |

| 6,618,069 | | |

| 9,950,050 | |

See

accompanying notes to financial statements.

The Gabelli Dividend & Income

Trust

Schedule of Investments (Continued) — June 30, 2024 (Unaudited)

| Shares | | |

| |

Cost | | |

Market

Value | |

| | | | |

COMMON STOCKS (Continued) | |

| | | |

| | |

| | | | |

Telecommunications (Continued) | |

| | | |

| | |

| | 73,750 | | |

Eurotelesites AG† | |

$ | 273,067 | | |

$ | 289,076 | |

| | 62,279 | | |

GCI Liberty Inc., Escrow† | |

| 0 | | |

| 1 | |

| | 195,000 | | |

Hellenic Telecommunications Organization SA, ADR | |

| 1,323,723 | | |

| 1,386,450 | |