Global Partners LP (NYSE: GLP) today reported financial results

for the fourth quarter and full year ended December 31, 2018.

“We capped 2018 with a record fourth quarter in our Gasoline

Distribution and Station Operations (GDSO) segment,” said Eric

Slifka, the Partnership’s President and Chief Executive Officer.

“GDSO product margin increased more than $46 million in the

quarter, primarily driven by significantly stronger than expected

fuel margins in November and December and a full quarter’s

performance of Champlain Oil and Cheshire Oil, which were acquired

in July 2018.

“Our full-year results reflect the continued focus on optimizing

our assets and expanding the footprint of our business,” Slifka

said. “In GDSO, the Champlain and Cheshire acquisitions added 136

sites, including 62 owned properties, to our retail portfolio.

These transactions further leverage our terminal assets and drive

economies of scale.”

For the fourth quarter of 2018 net income attributable to the

Partnership was $52.5 million, or $1.47 per diluted common limited

partner unit, compared with net income attributable to the

Partnership of $18.6 million, or $0.55 per diluted common limited

partner unit, for the same period of 2017.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) was $109.7 million in the fourth quarter of 2018 compared

with $41.0 million in the year-earlier period.

Distributable cash flow (DCF) was $67.6 million in the fourth

quarter of 2018 compared with $10.0 million in the same period of

2017. Results for the fourth quarter of 2017 included a net loss on

sale and disposition of assets of $5.6 million. Excluding this

charge, distributable cash flow would have been $15.6 million for

the three months ended December 31, 2017.

Adjusted EBITDA was $109.8 million in the fourth quarter of 2018

compared with $46.7 million in the fourth quarter of 2017.

Gross profit in the fourth quarter of 2018 was $221.8 million

compared with $157.6 million in the fourth quarter of 2017,

primarily due to the strong GDSO fuel margins in the last two

months of 2018. Combined product margin, which is gross profit

adjusted for depreciation allocated to cost of sales, was $244.1

million in the fourth quarter of 2018 compared with $179.1 million

in the fourth quarter of 2017.

Combined product margin, EBITDA, Adjusted EBITDA, and DCF are

non-GAAP (Generally Accepted Accounting Principles) financial

measures, which are explained in greater detail below under “Use of

Non-GAAP Financial Measures.” Please refer to Financial

Reconciliations included in this news release for reconciliations

of these non-GAAP financial measures to their most directly

comparable GAAP financial measures for the three and 12 months

ended December 31, 2018 and 2017.

GDSO segment product margin was $188.5 million in the fourth

quarter of 2018, an increase of $46.2 million from $142.3 million

in the fourth quarter of 2017. This performance primarily reflected

the strong fuel margins in November and December and, to a lesser

extent, the acquisitions of Champlain Oil and Cheshire Oil.

Wholesale segment product margin was $48.5 million in the fourth

quarter of 2018 compared with $32.2 million in the fourth quarter

of 2017, primarily due to more favorable market conditions in

distillates and gasoline blendstocks.

Commercial segment product margin was $7.1 million in the fourth

quarter of 2018 compared with $4.5 million in the same period of

2017.

Sales in the fourth quarter of 2018 were $3.3 billion compared

with $2.4 billion in the fourth quarter of 2017. Wholesale segment

sales were $1.8 billion in the fourth quarter of 2018 compared with

$1.2 billion in the fourth quarter of 2017. GDSO segment sales were

$1.1 billion in the fourth quarter of 2018 compared with $1.0

billion in the fourth quarter of 2017. Commercial segment sales

were $0.4 billion in the fourth quarter of 2018 compared with $0.2

billion in the fourth quarter of 2017.

Volume in the fourth quarter of 2018 was 1.6 billion gallons

compared with 1.2 billion gallons in the same period of 2017.

Wholesale segment volume was 1.0 billion gallons in the fourth

quarter of 2018 compared with 656.8 million gallons in the fourth

quarter of 2017. GDSO volume was 415.2 million gallons in the

fourth quarter of 2018 compared with 400.5 million gallons in the

same period of 2017. Commercial segment volume was 179.2 million

gallons in the fourth quarter of 2018 compared with 138.8 million

gallons in the same period of 2017.

Recent Highlights

- Global’s Board of Directors announced a

quarterly cash distribution of $0.50 per unit, or $2.00 per unit on

an annualized basis, on all of its outstanding common units for the

period from October 1 to December 31, 2018. The distribution was

paid on February 14, 2019 to unitholders of record as of the close

of business on February 8, 2019.

- Global’s Board of Directors announced a

quarterly cash distribution of $0.609375 per unit, or $2.4375 per

unit on an annualized basis, on the Partnership’s Series A

preferred units for the period from November 15, 2018 through

February 14, 2019. This distribution was paid on February 15, 2019

to holders of record as of the opening of business on February 1,

2019.

Business Outlook

“We continue to demonstrate our expertise in acquiring,

integrating, operating and leveraging high-quality assets,” Slifka

said. “Looking ahead, we are well positioned to capitalize on

opportunities across our businesses.”

For full-year 2019, Global expects to generate EBITDA of $200

million to $225 million. This EBITDA guidance excludes gains or

losses on the sale and disposition of assets and goodwill and

long-lived asset impairment charges.

The Partnership’s guidance and future performance are based on

assumptions regarding market conditions such as the crude oil

market, business cycles, demand for petroleum products and

renewable fuels, utilization of assets and facilities, weather,

credit markets, the regulatory and permitting environment and the

forward product pricing curve, which could influence quarterly

financial results. The Partnership believes these assumptions are

reasonable given currently available information and its assessment

of historical trends. Because Global’s assumptions and future

performance are subject to a wide range of business risks and

uncertainties, the Partnership can provide no assurance that actual

performance will fall within guidance ranges.

With respect to 2019 net income and net cash from operating

activities, the most comparable financial measures to EBITDA

calculated in accordance with GAAP, the Partnership is unable to

project either metric without unreasonable effort and for the

following reasons: 1) The Partnership is unable to project net

income because this metric includes the impact of certain non-cash

items, most notably those resulting from the sale of non-strategic

sites, which the Partnership is unable to project with any

reasonable degree of accuracy; and 2) The Partnership is unable to

project net cash from operating activities because this metric

includes the impact of changes in commodity prices, including their

impact on inventory volume and value, receivables, payables and

derivatives, which the Partnership is unable to project with any

reasonable degree of accuracy. Please see the "Use of Non-GAAP

Financial Measures" section of this news release.

Financial Results Conference Call

Management will review the Partnership’s fourth-quarter and

full-year 2018 financial results in a teleconference call for

analysts and investors today.

Time: 10:00 a.m. ET Dial-in numbers:

(877) 709-8155 (U.S. and Canada) (201) 689-8881 (International)

The call also will be webcast live and archived on Global’s

website.

Use of Non-GAAP Financial Measures

Product Margin

Global Partners views product margin as an important performance

measure of the core profitability of its operations. The

Partnership reviews product margin monthly for consistency and

trend analysis. Global Partners defines product margin as product

sales minus product costs. Product sales primarily include sales of

unbranded and branded gasoline, distillates, residual oil,

renewable fuels, crude oil and propane, as well as convenience

store sales, gasoline station rental income and revenue generated

from logistics activities when the Partnership engages in the

storage, transloading and shipment of products owned by others.

Product costs include the cost of acquiring the refined petroleum

products, renewable fuels, crude oil and propane, and all

associated costs including shipping and handling costs to bring

such products to the point of sale as well as product costs related

to convenience store items and costs associated with logistics

activities. The Partnership also looks at product margin on a per

unit basis (product margin divided by volume). Product margin is a

non-GAAP financial measure used by management and external users of

the Partnership’s consolidated financial statements to assess its

business. Product margin should not be considered an alternative to

net income, operating income, cash flow from operations, or any

other measure of financial performance presented in accordance with

GAAP. In addition, product margin may not be comparable to product

margin or a similarly titled measure of other companies.

EBITDA and Adjusted

EBITDA

EBITDA and Adjusted EBITDA are non-GAAP financial measures used

as supplemental financial measures by management and may be used by

external users of Global Partners’ consolidated financial

statements, such as investors, commercial banks and research

analysts, to assess the Partnership’s:

- compliance with certain financial

covenants included in its debt agreements;

- financial performance without regard to

financing methods, capital structure, income taxes or historical

cost basis;

- ability to generate cash sufficient to

pay interest on its indebtedness and to make distributions to its

partners;

- operating performance and return on

invested capital as compared to those of other companies in the

wholesale, marketing, storing and distribution of refined petroleum

products, gasoline blendstocks, renewable fuels, crude oil and

propane, and in the gasoline stations and convenience stores

business, without regard to financing methods and capital

structure; and

- viability of acquisitions and capital

expenditure projects and the overall rates of return of alternative

investment opportunities.

Adjusted EBITDA is EBITDA further adjusted for gains or losses

on the sale and disposition of assets and goodwill and long-lived

asset impairment charges. EBITDA and Adjusted EBITDA should not be

considered as alternatives to net income, operating income, cash

flow from operating activities or any other measure of financial

performance or liquidity presented in accordance with GAAP. EBITDA

and Adjusted EBITDA exclude some, but not all, items that affect

net income, and these measures may vary among other companies.

Therefore, EBITDA and Adjusted EBITDA may not be comparable to

similarly titled measures of other companies.

Distributable Cash Flow

Distributable cash flow is an important non-GAAP financial

measure for the Partnership’s limited partners since it serves as

an indicator of success in providing a cash return on their

investment. Distributable cash flow as defined by the Partnership’s

partnership agreement is net income plus depreciation and

amortization minus maintenance capital expenditures, as well as

adjustments to eliminate items approved by the audit committee of

the board of directors of the Partnership’s general partner that

are extraordinary or non-recurring in nature and that would

otherwise increase distributable cash flow.

Distributable cash flow as used in our partnership agreement

also determines our ability to make cash distributions on our

incentive distribution rights. The investment community also uses a

distributable cash flow metric similar to the metric used in our

partnership agreement with respect to publicly traded partnerships

to indicate whether or not such partnerships have generated

sufficient earnings on a current or historic level that can sustain

distributions on preferred or common units or support an increase

in quarterly cash distributions on common units. Our partnership

agreement does not permit adjustments for certain non-cash items,

such as net losses on the sale and disposition of assets and

goodwill and long-lived asset impairment charges.

Distributable cash flow should not be considered as an

alternative to net income, operating income, cash flow from

operations, or any other measure of financial performance presented

in accordance with GAAP. In addition, distributable cash flow may

not be comparable to distributable cash flow or similarly titled

measures of other companies.

About Global Partners LP

With approximately 1,600 locations primarily in the Northeast,

Global Partners is one of the region’s largest independent owners,

suppliers and operators of gasoline stations and convenience

stores. Global also owns, controls or has access to one of the

largest terminal networks in New England and New York, through

which it distributes gasoline, distillates, residual oil and

renewable fuels to wholesalers, retailers and commercial customers.

In addition, Global engages in the transportation of petroleum

products and renewable fuels by rail from the mid-continental U.S.

and Canada. Global, a master limited partnership, trades on the New

York Stock Exchange under the ticker symbol “GLP.” For additional

information, visit www.globalp.com.

Forward-looking Statements

Certain statements and information in this press release may

constitute “forward-looking statements.” The words “believe,”

“expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,”

“would,” “could” or other similar expressions are intended to

identify forward-looking statements, which are generally not

historical in nature. These forward-looking statements are based on

Global Partners’ current expectations and beliefs concerning future

developments and their potential effect on the Partnership. While

management believes that these forward-looking statements are

reasonable as and when made, there can be no assurance that future

developments affecting the Partnership will be those that it

anticipates. All comments concerning the Partnership’s expectations

for future revenues and operating results are based on forecasts

for its existing operations and do not include the potential impact

of any future acquisitions. Forward-looking statements involve

significant risks and uncertainties (some of which are beyond the

Partnership’s control) and assumptions that could cause actual

results to differ materially from the Partnership’s historical

experience and present expectations or projections.

For additional information regarding known material factors that

could cause actual results to differ from the Partnership’s

projected results, please see Global Partners’ filings with the

SEC, including its Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K.

Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

The Partnership undertakes no obligation to publicly update or

revise any forward-looking statements after the date they are made,

whether as a result of new information, future events or

otherwise.

GLOBAL PARTNERS LPCONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per unit

data)(Unaudited)

Three Months EndedDecember

31, Twelve Months EndedDecember 31, 2018

2017 2018 2017 Sales $ 3,274,301 $ 2,400,492 $

12,672,602 $ 8,920,552 Cost of sales 3,052,457

2,242,923 12,022,193 8,337,500

Gross profit 221,844 157,569 650,409 583,052 Costs and

operating expenses: Selling, general and administrative expenses

49,555 43,433 171,002 155,033 Operating expenses 87,072 74,930

321,115 283,650 Loss (gain) on trustee taxes - 16,194 (52,627 )

16,194 Lease exit and termination gain - - (3,506 ) - Amortization

expense 2,976 2,425 10,960 9,206 Net loss (gain) on sale and

disposition of assets 40 5,667 5,880 (1,624 ) Goodwill and

long-lived asset impairment - -

414 809 Total costs and operating expenses

139,643 142,649 453,238

463,268 Operating income 82,201 14,920 197,171

119,784 Interest expense (23,508 ) (20,394 )

(89,145 ) (86,230 ) Income (loss) before income tax

(expense) benefit 58,693 (5,474 ) 108,026 33,554 Income tax

(expense) benefit (6,523 ) 23,635

(5,623 ) 23,563 Net income 52,170 18,161

102,403 57,117 Net loss attributable to noncontrolling

interest 360 393 1,502

1,635 Net income attributable to Global

Partners LP 52,530 18,554 103,905 58,752

Less: General partner's interest in net

income, including incentive distribution rights

554 124 1,033 394 Less: Series A preferred limited partner interest

in net income

1,682 - 2,691 -

Net income attributable common limited partners $ 50,294

$ 18,430 $ 100,181 $ 58,358

Basic net income per common limited partner unit (1) $ 1.49

$ 0.55 $ 2.97 $ 1.74 Diluted net income

per common limited partner unit (1) $ 1.47 $ 0.55 $

2.95

$ 1.74 Basic weighted average common limited

partner units outstanding 33,750 33,645

33,701 33,589 Diluted weighted

average limited partner units outstanding

34,066

33,751

33,972

33,634

(1)

Under the Partnership's partnership

agreement, for any quarterly period, the incentive distribution

rights ("IDRs") participate in net income only to the extent of the

amount of cash distributions actually declared, thereby excluding

the IDRs from participating in the Partnership's undistributed net

income or losses. Accordingly, the Partnership's undistributed net

income or losses is assumed to be allocated to the common

unitholders and to the General Partner's general partner interest.

Net income attributable to common limited partners is divided by

the weighted average common units outstanding in computing the net

income per limited partner unit.

GLOBAL PARTNERS LPCONSOLIDATED BALANCE

SHEETS(In thousands)(Unaudited)

December 31, 2018

2017 Assets Current assets: Cash and cash equivalents

$ 8,121 $ 14,858 Accounts receivable, net 334,777 417,263 Accounts

receivable - affiliates 5,435 3,773 Inventories 386,442 350,743

Brokerage margin deposits 14,766 9,681 Derivative assets 26,390

3,840 Prepaid expenses and other current assets 98,977

77,977 Total current assets 874,908 878,135 Property

and equipment, net 1,132,632 1,036,667 Intangible assets, net

58,532 56,545 Goodwill 327,406 312,401 Other assets 30,813

36,421 Total assets $ 2,424,291 $ 2,320,169

Liabilities and partners' equity Current liabilities:

Accounts payable $ 308,979 $ 313,412 Working capital revolving

credit facility - current portion 103,300 126,700 Environmental

liabilities - current portion 6,092 5,009 Trustee taxes payable

42,613 110,321 Accrued expenses and other current liabilities

117,274 99,507 Derivative liabilities 4,494 13,708

Total current liabilities 582,752 668,657 Working capital

revolving credit facility - less current portion 150,000 100,000

Revolving credit facility 220,000 196,000 Senior notes 664,455

661,774 Environmental liabilities - less current portion 57,132

52,968 Financing obligations 149,997 150,334 Deferred tax

liabilities 42,856 40,105 Other long-term liabilities 57,905

56,013 Total liabilities 1,925,097 1,925,851

Partners' equity Global Partners LP equity 497,331 390,953

Noncontrolling interest 1,863 3,365 Total partners'

equity 499,194 394,318 Total liabilities and

partners' equity $ 2,424,291 $ 2,320,169

GLOBAL

PARTNERS LPFINANCIAL RECONCILIATIONS(In

thousands)(Unaudited)

Three Months EndedDecember 31,

Twelve Months EndedDecember 31, 2018

2017 2018 2017

Reconciliation of gross profit to product margin Wholesale

segment: Gasoline and gasoline blendstocks $ 22,318 $ 17,709 $

76,741 $ 82,124 Crude oil 4,274 4,031 7,159 7,279 Other oils and

related products 21,912 10,509

53,389 62,799 Total 48,504 32,249 137,289

152,202 Gasoline Distribution and Station Operations segment:

Gasoline distribution 134,869 95,928 373,303 326,536 Station

operations 53,619 46,357 203,098

174,986 Total 188,488 142,285 576,401 501,522

Commercial segment 7,087 4,523

23,611 17,858 Combined product margin 244,079

179,057 737,301 671,582 Depreciation allocated to cost of sales

(22,235 ) (21,488 ) (86,892 ) (88,530 )

Gross profit $ 221,844 $ 157,569 $ 650,409 $

583,052

Reconciliation of net income to EBITDA and

Adjusted EBITDA Net income $ 52,170 $ 18,161 $ 102,403 $ 57,117

Net loss attributable to noncontrolling interest 360

393 1,502 1,635 Net

income attributable to Global Partners LP 52,530 18,554 103,905

58,752 Depreciation and amortization, excluding the impact of

noncontrolling interest 27,156 25,716 105,639 103,601 Interest

expense, excluding the impact of noncontrolling interest 23,508

20,394 89,145 86,230 Income tax expense (benefit) 6,523

(23,635 ) 5,623 (23,563 ) EBITDA

109,717 41,029 304,312 225,020 Net loss (gain) on sale and

disposition of assets 40 5,667 5,880 (1,624 ) Goodwill and

long-lived asset impairment - -

414 809 Adjusted EBITDA (1) $ 109,757 $

46,696 $ 310,606 $ 224,205

Reconciliation of net cash provided by (used in) operating

activities to EBITDA and Adjusted EBITDA Net cash provided by

(used in) operating activities $ 214,758 $ (13,999 ) $ 168,856 $

348,442 Net changes in operating assets and liabilities and certain

non-cash items (135,160 ) 58,389 40,385 (185,673 )

Net cash from operating activities and

changes in operating assets and liabilities attributable to

noncontrolling interest

88 (120 ) 303 (416 ) Interest expense, excluding the impact of

noncontrolling interest 23,508 20,394 89,145 86,230 Income tax

expense (benefit) 6,523 (23,635 ) 5,623

(23,563 ) EBITDA 109,717 41,029 304,312 225,020 Net

loss (gain) on sale and disposition of assets 40 5,667 5,880 (1,624

) Goodwill and long-lived asset impairment - -

414 809 Adjusted EBITDA (1) $

109,757 $ 46,696 $ 310,606 $ 224,205

Reconciliation of net income to distributable cash

flow Net income $ 52,170 $ 18,161 $ 102,403 $ 57,117 Net loss

attributable to noncontrolling interest 360

393 1,502 1,635 Net income

attributable to Global Partners LP 52,530 18,554 103,905 58,752

Depreciation and amortization, excluding the impact of

noncontrolling interest 27,156 25,716 105,639 103,601 Amortization

of deferred financing fees and senior notes discount 1,723 1,715

6,873 7,089 Amortization of routine bank refinancing fees (1,022 )

(1,028 ) (4,088 ) (4,277 ) Non-cash tax reform benefit - (22,183 )

- (22,183 ) Maintenance capital expenditures, excluding the impact

of noncontrolling interest (12,781 ) (12,775 )

(38,641 ) (34,718 ) Distributable cash flow (2)(3) 67,606

9,999 173,688 108,264 Distributions to Series A preferred

unitholders (4) (1,682 ) - (2,691 )

- Distributable cash flow after distributions to

Series A preferred unitholders

$

65,924

$

9,999

$

170,997

$

108,264

Reconciliation of net cash provided by

(used in) operating activities to distributable cash flow Net

cash provided by (used in) operating activities $ 214,758 $ (13,999

) $ 168,856 $ 348,442 Net changes in operating assets and

liabilities and certain non-cash items (135,160 ) 58,389 40,385

(185,673 )

Net cash from operating activities and

changes in operating assets and liabilities attributable to

noncontrolling interest

88 (120 ) 303 (416 ) Amortization of deferred financing fees and

senior notes discount 1,723 1,715 6,873 7,089 Amortization of

routine bank refinancing fees (1,022 ) (1,028 ) (4,088 ) (4,277 )

Non-cash tax reform benefit - (22,183 ) - (22,183 ) Maintenance

capital expenditures, excluding the impact of noncontrolling

interest (12,781 ) (12,775 ) (38,641 )

(34,718 ) Distributable cash flow (2)(3) 67,606 9,999 173,688

108,264 Distributions to Series A preferred unitholders (4)

(1,682 ) - (2,691 ) -

Distributable cash flow after distributions to Series A preferred

unitholders $ 65,924 $ 9,999 $ 170,997 $

108,264 (1) Adjusted EBITDA for the twelve

months ended December 31, 2018 includes a one-time gain of

approximately $52.6 million as a result of the extinguishment of a

contingent liability related to a Volumetric Ethanol Excise Tax

Credit. (2) As defined by the Partnership's partnership

agreement, distributable cash flow is not adjusted for certain

non-cash items, such as net losses on the sale and disposition of

assets and goodwill and long-lived asset impairment charges.

(3)

Distributable cash flow includes a net

loss on sale and disposition of assets of $0.1 million and $5.6

million for the three months ended December 31, 2018 and 2017,

respectively, and a net loss on sale and disposition of assets and

a net goodwill and long-lived asset impairment of $6.3 million and

$13.3 million for the twelve months ended December 31, 2018 and

2017, respectively. Excluding these charges,

distributable cash flow would have been $67.7 million and $15.6

million for the three months ended December 31, 2018 and 2017,

respectively, and $180.0 million and $121.6 million for the twelve

months ended December 31, 2018 and 2017,

respectively. For the twelve months ended December 31,

2018, distributable cash flow includes a one-time gain of

approximately $52.6 million as a result of the extinguishment of a

contingent liability related to a Volumetric Ethanol Excise Tax

Credit. For the twelve months ended December 31, 2017,

distributable cash flow includes a $14.2 million gain on the sale

of the Partnership's natural gas marketing and electricity

brokerage businesses in February 2017.

(4) Distributions to Series A preferred unitholders

represent the distributions earned by the preferred unitholders

during the period. Distributions on the Series A Preferred Units

are cumulative and payable quarterly in arrears on February 15, May

15, August 15 and November 15 of each year.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190307005351/en/

Daphne H. FosterChief Financial OfficerGlobal Partners

LP(781) 894-8800Edward J. FaneuilExecutive Vice President,

General Counsel and SecretaryGlobal Partners LP(781) 894-8800

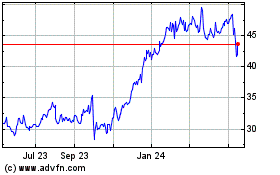

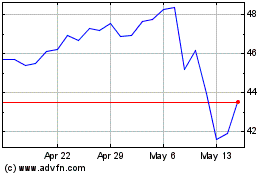

Global Partners (NYSE:GLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Global Partners (NYSE:GLP)

Historical Stock Chart

From Jul 2023 to Jul 2024