UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2025

Commission File Number: 001-38027

CANADA GOOSE HOLDINGS INC.

(Translation of registrant’s name into English)

100 Queen’s Quay East, 22nd Floor

Toronto, Ontario, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

EXHIBIT INDEX

Exhibits 99.1 and 99.2 to this report of a Foreign Private Issuer on Form 6-K are deemed filed for all purposes under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended.

| | | | | | | | |

| | |

Exhibit No. | | Description |

| |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

| 99.5 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Canada Goose Holdings Inc.

| | | | | | | | | | | | | | | | | |

| | | |

| | By: | /s/ Neil Bowden | |

| | Name: | Neil Bowden | |

| | Title: | Chief Financial Officer | |

| Date: February 6, 2025 | | | |

Canada Goose Holdings Inc.

Condensed Consolidated Interim Financial Statements

As at and for the third and three quarters ended

December 29, 2024 and December 31, 2023

(Unaudited)

Condensed Consolidated Interim Statements of Income

(unaudited)

(in millions of Canadian dollars, except per share amounts)

| | | | | | | | | | | | | | | | | | | | |

| | Third quarter ended | | Three quarters ended |

| Notes | December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| | $ | $ | | $ | $ |

| Revenue | 3 | 607.9 | | 609.9 | | | 963.8 | | 975.8 | |

| Cost of sales | 6 | 155.9 | | 160.2 | | | 295.1 | | 291.4 | |

| Gross profit | | 452.0 | | 449.7 | | | 668.7 | | 684.4 | |

| Selling, general & administrative expenses | | 247.7 | | 250.9 | | | 559.7 | | 583.0 | |

| Operating income | | 204.3 | | 198.8 | | | 109.0 | | 101.4 | |

| Net interest, finance and other costs | 10 | 14.3 | | 14.8 | | | 26.0 | | 42.9 | |

| Income before income taxes | | 190.0 | | 184.0 | | | 83.0 | | 58.5 | |

| Income tax expense | | 46.4 | | 52.6 | | | 7.1 | | 8.0 | |

| Net income | | 143.6 | | 131.4 | | | 75.9 | | 50.5 | |

| | | | | | |

| Attributable to: | | | | | | |

| Shareholders of the Company | | 139.7 | | 130.6 | | | 67.7 | | 53.4 | |

| Non-controlling interest | | 3.9 | | 0.8 | | | 8.2 | | (2.9) | |

| Net income | | 143.6 | | 131.4 | | | 75.9 | | 50.5 | |

| | | | | | |

| Earnings per share attributable to shareholders of the Company | | | | | | |

| Basic | 4 | $ | 1.44 | | $ | 1.30 | | | $ | 0.70 | | $ | 0.52 | |

| Diluted | 4 | $ | 1.42 | | $ | 1.29 | | | $ | 0.69 | | $ | 0.52 | |

The accompanying notes to the condensed consolidated interim financial statements are an integral part of these financial statements.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 1 of 36 |

Condensed Consolidated Interim Statements of Comprehensive Income

(unaudited)

(in millions of Canadian dollars, except per share amounts)

| | | | | | | | | | | | | | | | | | | | |

| | Third quarter ended | | Three quarters ended |

| Notes | December 29, 2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| | $ | $ | | $ | $ |

| Net income | | 143.6 | | 131.4 | | | 75.9 | | 50.5 | |

| | | | | | |

| Other comprehensive income | | | | | | |

| Items that will not be reclassified to earnings, net of tax: | | | | | | |

| Actuarial loss on post-employment obligation | | — | | (0.1) | | | (0.7) | | (0.3) | |

| Items that may be reclassified to earnings, net of tax: | | | | | | |

| Cumulative translation adjustment (loss) gain | | (7.5) | | 6.7 | | | 10.0 | | 0.2 | |

| Net loss on derivatives designated as cash flow hedges | 15 | (1.2) | | (7.5) | | | (10.2) | | (1.5) | |

| Reclassification of net loss (gain) on cash flow hedges to income | 15 | 1.4 | | 0.1 | | | 1.3 | | (0.9) | |

| Other comprehensive (loss) income | | (7.3) | | (0.8) | | | 0.4 | | (2.5) | |

| Comprehensive income | | 136.3 | | 130.6 | | | 76.3 | | 48.0 | |

| | | | | | |

| Attributable to: | | | | | | |

| Shareholders of the Company | | 132.6 | | 129.7 | | | 68.1 | | 51.6 | |

| Non-controlling interest | | 3.7 | | 0.9 | | | 8.2 | | (3.6) | |

| Comprehensive income | | 136.3 | | 130.6 | | | 76.3 | | 48.0 | |

The accompanying notes to the condensed consolidated interim financial statements are an integral part of these financial statements.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 2 of 36 |

Condensed Consolidated Interim Statements of Financial Position

(unaudited)

(in millions of Canadian dollars)

| | | | | | | | | | | | | | |

| Notes | December 29,

2024 | December 31,

2023 | March 31,

2024 |

| | $ | $ | $ |

| Assets | | | Reclassified | Reclassified |

| Current assets | | | | |

| Cash | | 285.2 | | 154.3 | | 144.9 | |

| Trade receivables | 5 | 174.9 | | 144.5 | | 70.4 | |

| Inventories | 6 | 407.4 | | 478.4 | | 445.2 | |

| Income taxes receivable | | 15.9 | | 8.1 | | 28.0 | |

| Other current assets | 14 | 55.0 | | 61.0 | | 52.3 | |

| Total current assets | | 938.4 | | 846.3 | | 740.8 | |

| | | | |

| Deferred income taxes | | 102.4 | | 90.3 | | 76.3 | |

| Property, plant and equipment | | 164.9 | | 177.2 | | 171.8 | |

| Intangible assets | | 132.2 | | 132.1 | | 135.1 | |

| Right-of-use assets | 7 | 299.4 | | 272.7 | | 279.8 | |

| Goodwill | | 71.3 | | 76.5 | | 70.8 | |

| Other long-term assets | 14 | 15.6 | | 6.8 | | 7.0 | |

| Total assets | | 1,724.2 | | 1,601.9 | | 1,481.6 | |

| | | | |

| Liabilities | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | 8, 14 | 215.6 | | 268.8 | | 177.7 | |

| Provisions | 2, 9 | 69.7 | | 78.3 | | 49.1 | |

| Income taxes payable | | 25.9 | | 14.5 | | 16.8 | |

| Short-term borrowings | 10 | 70.6 | | 38.7 | | 9.4 | |

| Current portion of lease liabilities | 7 | 84.7 | | 76.4 | | 79.9 | |

| Total current liabilities | | 466.5 | | 476.7 | | 332.9 | |

| | | | |

| Provisions | 2, 9 | 16.0 | | 13.9 | | 14.3 | |

| Deferred income taxes | | 13.4 | | 13.6 | | 17.2 | |

| | | | |

| Term Loan | 10 | 410.5 | | 381.0 | | 388.5 | |

| Lease liabilities | 7 | 265.3 | | 244.9 | | 250.6 | |

| Other long-term liabilities | 14 | 43.1 | | 70.9 | | 54.6 | |

| Total liabilities | | 1,214.8 | | 1,201.0 | | 1,058.1 | |

| | | | |

| Equity | 11 | | | |

| Equity attributable to shareholders of the Company | | 494.7 | | 396.5 | | 417.0 | |

| Non-controlling interests | | 14.7 | | 4.4 | | 6.5 | |

| Total equity | | 509.4 | | 400.9 | | 423.5 | |

| Total liabilities and equity | | 1,724.2 | | 1,601.9 | | 1,481.6 | |

The accompanying notes to the condensed consolidated interim financial statements are an integral part of these financial statements.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 3 of 36 |

Condensed Consolidated Interim Statements of Changes in Equity

(unaudited)

(in millions of Canadian dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Share capital | Contributed surplus | Retained earnings | Accumulated other comprehensive income (loss) | Total attributable to shareholders | Non-controlling interest | Total |

| Notes | Multiple voting shares | Subordinate voting shares | Total | | | | | | |

| | $ | $ | $ | $ | $ | $ | $ | $ | $ |

| Balance at March 31, 2024 | | 1.4 | | 103.5 | | 104.9 | | 54.4 | | 252.5 | | 5.2 | | 417.0 | | 6.5 | | 423.5 | |

| Tax on normal course issuer bid purchase of subordinate voting shares in fiscal 2024 | 2 | — | | — | | — | | — | | (0.6) | | — | | (0.6) | | — | | (0.6) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Issuance of shares | 11 | — | | 4.6 | | 4.6 | | (4.0) | | — | | — | | 0.6 | | — | | 0.6 | |

| Net income | | — | | — | | — | | — | | 67.7 | | — | | 67.7 | | 8.2 | | 75.9 | |

| Other comprehensive income | | — | | — | | — | | — | | — | | 0.4 | | 0.4 | | — | | 0.4 | |

| Share-based payment | 12 | — | | — | | — | | 9.6 | | — | | — | | 9.6 | | — | | 9.6 | |

| Balance at December 29, 2024 | | 1.4 | | 108.1 | | 109.5 | | 60.0 | | 319.6 | | 5.6 | | 494.7 | | 14.7 | | 509.4 | |

| | | | | | | | | | |

| Balance at April 2, 2023 | | 1.4 | | 117.3 | | 118.7 | | 28.5 | | 316.5 | | 5.8 | | 469.5 | | 8.0 | | 477.5 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Normal course issuer bid purchase of subordinate voting shares | 11 | — | | (13.6) | | (13.6) | | — | | (96.9) | | — | | (110.5) | | — | | (110.5) | |

| Normal course issuer bid purchase of subordinate voting shares held for cancellation | 11 | — | | (0.3) | | (0.3) | | — | | (2.0) | | — | | (2.3) | | — | | (2.3) | |

| Liability to broker under automatic share purchase plan | 11 | — | | — | | — | | (23.1) | | — | | — | | (23.1) | | — | | (23.1) | |

| Issuance of shares | 11 | — | | 4.0 | | 4.0 | | (3.9) | | — | | — | | 0.1 | | — | | 0.1 | |

| Net income (loss) | | — | | — | | — | | — | | 53.4 | | — | | 53.4 | | (2.9) | | 50.5 | |

| Other comprehensive loss | | — | | — | | — | | — | | — | | (1.8) | | (1.8) | | (0.7) | | (2.5) | |

| Share-based payment | 12 | — | | — | | — | | 11.2 | | — | | — | | 11.2 | | — | | 11.2 | |

| Balance at December 31, 2023 | | 1.4 | | 107.4 | | 108.8 | | 12.7 | | 271.0 | | 4.0 | | 396.5 | | 4.4 | | 400.9 | |

The accompanying notes to the condensed consolidated interim financial statements are an integral part of these financial statements.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 4 of 36 |

Condensed Consolidated Interim Statements of Cash Flows

(unaudited)

(in millions of Canadian dollars) | | | | | | | | | | | | | | | | | | | | |

| | Third quarter ended | | Three quarters ended |

| Notes | December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| | $ | $ | | $ | $ |

| Operating activities | | | | | | |

| Net income | | 143.6 | | 131.4 | | | 75.9 | | 50.5 | |

| Items not affecting cash: | | | | | | |

| Depreciation and amortization | | 32.6 | | 32.2 | | | 97.5 | | 92.0 | |

| Income tax expense | | 46.4 | | 52.6 | | | 7.1 | | 8.0 | |

| Interest expense | 10 | 14.9 | | 11.8 | | | 37.5 | | 32.1 | |

| Foreign exchange loss (gain) | | 0.7 | | (1.4) | | | (1.2) | | (1.9) | |

| | | | | | |

| | | | | | |

| Loss on disposal of assets | | 0.5 | | 0.1 | | | 0.9 | | 0.1 | |

| Share-based payment | 12 | 3.6 | | 4.3 | | | 9.8 | | 11.5 | |

| Remeasurement of put option | 10 | 0.7 | | 4.9 | | | 1.6 | | 15.7 | |

| Remeasurement of contingent consideration | 10 | (1.3) | | (1.9) | | | (13.1) | | (4.9) | |

| | 241.7 | | 234.0 | | | 216.0 | | 203.1 | |

| Changes in non-cash operating items | 17 | 118.4 | | 134.0 | | | (20.2) | | (32.2) | |

| Income taxes paid | | (3.9) | | (7.6) | | | (11.2) | | (56.6) | |

| Interest paid | | (8.2) | | (12.1) | | | (29.9) | | (32.5) | |

| Net cash from operating activities | | 348.0 | | 348.3 | | | 154.7 | | 81.8 | |

| Investing activities | | | | | | |

| Purchase of property, plant and equipment | | (9.5) | | (15.1) | | | (14.9) | | (46.3) | |

| Investment in intangible assets | | (0.1) | | (0.2) | | | (0.1) | | (0.7) | |

| Initial direct costs of right-of-use assets | 7 | (0.3) | | — | | | (0.4) | | (0.4) | |

| Net cash outflow from business combination | | — | | (12.3) | | | — | | (12.3) | |

| Net cash used in investing activities | | (9.9) | | (27.6) | | | (15.4) | | (59.7) | |

| Financing activities | | | | | | |

| Mainland China Facilities (repayments) borrowings | 10 | (44.3) | | (38.2) | | | 30.1 | | (0.5) | |

| Japan Facility borrowings (repayments) | 10 | 3.8 | | (3.7) | | | 29.8 | | 11.7 | |

| Term Loan repayments | 10 | — | | (1.0) | | | (2.0) | | (3.0) | |

| Revolving Facility repayments | 10 | (60.9) | | (86.3) | | | — | | — | |

| Transaction costs on financing activities | 10 | — | | 0.1 | | | — | | (0.2) | |

| Normal course issuer bid purchase of subordinate voting shares | 11 | — | | (54.3) | | | — | | (111.7) | |

| | | | | | |

| Principal payments on lease liabilities | 7 | (23.2) | | (21.0) | | | (64.1) | | (49.7) | |

| | | | | | |

| Issuance of shares | 12 | 0.6 | | — | | | 0.6 | | 0.1 | |

| Net cash used in financing activities | | (124.0) | | (204.4) | | | (5.6) | | (153.3) | |

| Effects of foreign currency exchange rate changes on cash | | 2.3 | | 0.5 | | | 6.6 | | (1.0) | |

| Increase (decrease) in cash | | 216.4 | | 116.8 | | | 140.3 | | (132.2) | |

| Cash, beginning of period | | 68.8 | | 37.5 | | | 144.9 | | 286.5 | |

| Cash, end of period | | 285.2 | | 154.3 | | | 285.2 | | 154.3 | |

The accompanying notes to the condensed consolidated interim financial statements are an integral part of these financial statements.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 5 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Note 1. The Company

Organization

Canada Goose Holdings Inc. and its subsidiaries (the “Company”) design, manufacture, and sell performance luxury apparel for men, women, youth, children, and babies. The Company’s product offerings include various styles of down-filled outerwear, rain and everyday jackets, fleece, vests, apparel, footwear, and accessories for the fall, winter, and spring seasons. The Company’s head office is located at 100 Queens Quay East, Toronto, Canada, M5E 1V3. The use of the terms “Canada Goose”, “we”, and “our” throughout these notes to the condensed consolidated interim financial statements ("Interim Financial Statements") refer to the Company.

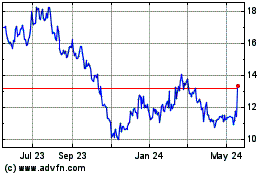

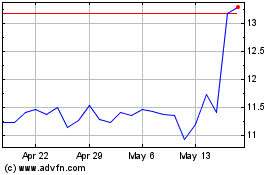

Canada Goose is a public company listed on the Toronto Stock Exchange and the New York Stock Exchange under the trading symbol “GOOS”. The principal shareholders of the Company are investment funds advised by Bain Capital LP and its affiliates (“Bain Capital”), and DTR LLC ("DTR"), an entity indirectly controlled by the Chairman and Chief Executive Officer of the Company. The principal shareholders hold multiple voting shares representing 52.7% of the total shares outstanding as at December 29, 2024, or 91.8% of the combined voting power of the total voting shares outstanding. Subordinate voting shares that trade on public markets represent 47.3% of the total shares outstanding as at December 29, 2024, or 8.2% of the combined voting power of the total voting shares outstanding.

Statement of compliance

The Interim Financial Statements are prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”), specifically IAS 34, Interim Financial Reporting. Certain information, which is considered material to the understanding of the Interim Financial Statements and is normally included in the audited annual consolidated financial statements prepared in accordance with IFRS Accounting Standards, is not provided in these notes. These Interim Financial Statements should be read in conjunction with the Company's audited annual consolidated financial statements for the year ended March 31, 2024.

The Interim Financial Statements were authorized for issuance in accordance with a resolution of the Company’s Board of Directors on February 5, 2025.

Fiscal year

The Company's fiscal year is a 52 or 53-week reporting cycle with the fiscal year ending on the Sunday closest to March 31. Each fiscal quarter is 13 weeks for a 52-week fiscal year. Fiscal 2025 is a 52-week fiscal year.

Operating segments

The Company classifies its business in three operating and reportable segments: Direct-to-Consumer ("DTC"), Wholesale, and Other. The DTC segment comprises sales through country-specific e-Commerce platforms available across numerous markets, which includes the recommerce platform Canada Goose Generations, currently available in the United States and Canada, and our Company-owned retail stores located in luxury shopping locations.

The Wholesale segment comprises sales made to a mix of retailers and international distributors, who are partners that have exclusive rights to an entire market, and travel retail locations.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 6 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

The Other segment comprises revenue and costs that are not related to the Company’s DTC or Wholesale segments, such as sales to employees, friends and family sales, and results from the Paola Confectii business.

Seasonality

Our business is seasonal, and we have historically realized a significant portion of our Wholesale revenue and operating income in the second and third quarters of the fiscal year and DTC revenue and operating income in the third and fourth quarters of the fiscal year. Thus, lower-than-expected revenue in these periods could have an adverse impact on our annual operating results.

Cash flows from operating activities are typically highest in the third and fourth quarters of the fiscal year due to revenue from the DTC segment and the collection of trade receivables from Wholesale revenue earlier in the year. Working capital requirements typically increase as inventory builds. Borrowings have historically increased in the first and second quarters and been repaid in the balance of the year.

Note 2. Material accounting policy information

Basis of presentation

The accounting policies and critical accounting estimates and judgments as disclosed in the Company's audited annual financial statements for the year ended March 31, 2024 have been applied consistently in the preparation of these Interim Financial Statements except as noted below. The Interim Financial Statements are presented in Canadian dollars, the Company’s functional and presentation currency.

As at March 31, 2024, the Company amended the allocation basis for certain selling, general and administrative ("SG&A") expenses between the operating segments to provide more relevant information on financial performance of each operating segment. The reclassification did not impact net income, earnings per share, or the consolidated statements of financial position in the comparative year. Comparative figures have been reclassified to conform with the current year presentation.

Principles of consolidation

The Interim Financial Statements include the accounts of the Company and its subsidiaries and those investments over which the Company has control. All intercompany transactions and balances have been eliminated.

Standards issued and not yet adopted

Certain new standards, amendments, and interpretations to existing IFRS Accounting Standards have been published but are not yet effective and have not been adopted early by the Company. Management anticipates that pronouncements will be adopted in the Company’s accounting policy for the first period beginning after the effective date of the pronouncement.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 7 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Standards issued and adopted

In January 2020, the IASB issued an amendment to IAS 1, Presentation of Financial Statements to clarify its requirements for the presentation of liabilities in the statement of financial position. The limited scope amendment affected only the presentation of liabilities in the statement of financial position and not the amount or timing of its recognition. The amendment clarified that the classification of liabilities as current or non-current is based on rights that are in existence at the end of the reporting period and specified that classification is unaffected by expectations about whether an entity will exercise its right to defer settlement of a liability. It also introduced a definition of ‘settlement’ to make clear that settlement refers to the transfer to the counterparty of cash, equity instruments, other assets or services. On October 31, 2022, the IASB issued Non-Current Liabilities with Covenants (Amendments to IAS 1). These amendments specify that covenants to be complied with after the reporting date do not affect the classification of debt as current or non-current at the reporting date. These amendments are effective for annual reporting periods beginning on or after January 1, 2024.

The adoption of the amendments was recognized as a change in accounting policy in accordance with IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors ("IAS 8"). The Company amended the existing accounting policies related to its presentation of liabilities in the statement of financial position as at April 1, 2024. The Company assessed the impact of the amendments and identified $23.0m of liabilities at the date of adoption, recognized as non-current liabilities on the provisions line related to warranty that can no longer be classified as such in accordance with the amendments. As a result, this balance was reclassified to current liabilities on the provisions line in the statement of financial position.

In accordance with IAS 8, retrospective application is required for accounting policy changes and comparative financial information was restated in the statement of financial position. As a result, $23.3m and $23.0m were reclassified from non-current provisions to current provisions for December 31, 2023 and March 31, 2024, respectively.

In May 2023, the IASB issued International Tax Reform, Pillar Two Model Rules, Amendments to IAS 12, Income Taxes (the “Amendments”). The Amendments provide the Company with an exception from recognition and disclosure requirements for deferred tax assets and liabilities arising from the Organization for Economic Co-operation and Development ("OECD") Pillar Two international tax reform.

The Company is within the scope of the OECD Pillar Two rules. Pursuant to these rules, the parent entity of the Company will be required to pay a tax on the profit of any subsidiary whose effective tax rate (determined in accordance with Canadian Pillar Two rules) is less than 15%, unless the jurisdiction of the subsidiary’s incorporation has implemented similar Pillar Two rules. On June 20, 2024, Pillar Two rules became law in Canada and apply to the Company from April 1, 2024.

The Company has completed an assessment of the application of the Pillar Two rules and does not currently estimate a material impact on its tax position, however it continues to monitor developments.

On June 20, 2024, the tax on normal course issuer bid purchases of subordinate voting shares was enacted in Canada. The rules pertain to transactions that occur on or after January 1, 2024. During the third and three quarters ended December 29, 2024, there were no repurchases made. However, due to repurchases made during fiscal 2024, $0.6m in taxes on normal course issuer bid purchases of subordinate voting shares was recorded in the third and three quarters ended December 29, 2024 and charged to retained earnings.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 8 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Note 3. Segment information

The Company has three reportable operating segments: DTC, Wholesale, and Other. The Company measures each reportable operating segment’s performance based on revenue and segment operating income, which is the profit metric utilized by the Company's chief operating decision maker, the Chairman and Chief Executive Officer, for assessing the performance of operating segments. No single customer contributed 10 per cent or more to the Company’s revenue for the third and three quarters ended December 29, 2024 and December 31, 2023.

As at March 31, 2024, the performance measure for our Other segment was revised to exclude corporate general and administrative expenses; these expenses were presented as a reconciling item to the Company’s consolidated operating income. This change in segment reporting was made to improve the understanding of financial performance in the Other segment.

Corporate expenses comprises costs that do not occur through the DTC, Wholesale, or Other segments, including the cost of marketing expenditures to build brand awareness across all segments, management overhead costs in support of manufacturing operations, other corporate costs, and foreign exchange gains and losses not specifically associated with segment operations. Comparative figures have been reclassified to conform with the current year presentation.

The following table presents key performance information of the Company’s reportable operating segments:

| | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| $ | $ | | $ | $ |

| Revenue | | | | | |

| DTC | 517.8 | | 514.0 | | | 684.8 | | 679.2 | |

| Wholesale | 75.7 | | 81.8 | | | 229.0 | | 270.9 | |

| Other | 14.4 | | 14.1 | | | 50.0 | | 25.7 | |

| Total segment revenue | 607.9 | | 609.9 | | | 963.8 | | 975.8 | |

| | | | | |

| Operating income | | Reclassified | | | Reclassified |

| DTC | 287.9 | | 283.4 | | | 270.4 | | 282.3 | |

| Wholesale | 25.4 | | 29.5 | | | 83.7 | | 110.2 | |

| Other | 1.2 | | 1.6 | | | 8.1 | | 4.1 | |

| Total segment operating income | 314.5 | | 314.5 | | | 362.2 | | 396.6 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 9 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

The following table reconciles the Company’s reportable total segment operating income to income before income taxes:

| | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| $ | $ | | $ | $ |

| Total segment operating income | 314.5 | | 314.5 | | | 362.2 | | 396.6 | |

| Corporate expenses | (110.2) | | (115.7) | | | (253.2) | | (295.2) | |

| Total operating income | 204.3 | | 198.8 | | | 109.0 | | 101.4 | |

| Net interest, finance and other costs | 14.3 | | 14.8 | | | 26.0 | | 42.9 | |

| Income before income taxes | 190.0 | | 184.0 | | | 83.0 | | 58.5 | |

The following table summarizes depreciation and amortization in SG&A expenses of each reportable operating segment and depreciation and amortization included in corporate expenses: | | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| $ | $ | | $ | $ |

| Depreciation and amortization expense | | | | | |

| DTC | 24.4 | | 24.3 | | | 73.2 | | 69.2 | |

| Wholesale | 0.8 | | 1.0 | | | 2.7 | | 3.0 | |

| Other | — | | — | | | 0.6 | | — | |

| Total segment depreciation and amortization expense | 25.2 | | 25.3 | | | 76.5 | | 72.2 | |

| Corporate expenses | 4.4 | | 3.9 | | | 12.5 | | 11.1 | |

Total depreciation and amortization expense | 29.6 | | 29.2 | | | 89.0 | | 83.3 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 10 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Geographic information

The Company determines the geographic location of revenue based on the location of its customers.

| | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| $ | $ | | $ | $ |

| Canada | 91.1 | | 94.9 | | | 170.7 | | 176.3 | |

| United States | 161.5 | | 157.5 | | | 243.4 | | 241.8 | |

| North America | 252.6 | | 252.4 | | | 414.1 | | 418.1 | |

Greater China1 | 219.6 | | 230.5 | | | 287.9 | | 293.9 | |

Asia Pacific (excluding Greater China1) | 50.9 | | 40.2 | | | 79.5 | | 65.1 | |

| Asia Pacific | 270.5 | | 270.7 | | | 367.4 | | 359.0 | |

EMEA2 | 84.8 | | 86.8 | | | 182.3 | | 198.7 | |

| Total revenue | 607.9 | | 609.9 | | | 963.8 | | 975.8 | |

1Greater China comprises Mainland China, Hong Kong, Macau, and Taiwan.

2EMEA comprises Europe, the Middle East, Africa, and Latin America.

The Company’s non-current, non-financial assets (comprising property, plant and equipment, intangible assets and right-of-use assets) are geographically located as follows:

| | | | | | | | | | | |

| December 29,

2024 | December 31,

2023 | March 31,

2024 |

| $ | $ | $ |

| Canada | 208.0 | | 223.7 | | 222.1 | |

| United States | 127.1 | | 122.3 | | 140.7 | |

| North America | 335.1 | | 346.0 | | 362.8 | |

Greater China1 | 67.2 | | 71.7 | | 63.6 | |

Asia Pacific (excluding Greater China1) | 48.0 | | 37.3 | | 34.1 | |

| Asia Pacific | 115.2 | | 109.0 | | 97.7 | |

EMEA2 | 146.2 | | 127.0 | | 126.2 | |

| Non-current, non-financial assets | 596.5 | | 582.0 | | 586.7 | |

1Greater China comprises Mainland China, Hong Kong, Macau, and Taiwan.

2EMEA comprises Europe, the Middle East, Africa, and Latin America.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 11 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Note 4. Earnings per share

The following table presents details for the calculation of basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| (in millions of Canadian dollars, except share and per share amounts) | December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| Net income attributable to shareholders of the Company | $ | 139.7 | | $ | 130.6 | | | $ | 67.7 | | $ | 53.4 | |

| Weighted average number of multiple and subordinate voting shares outstanding | 96,798,985 | | 100,253,473 | | | 96,714,942 | | 102,144,232 | |

| Weighted average number of shares on exercise of stock options, RSUs and PSUs | 1,373,227 | | 1,055,363 | | | 1,319,037 | | 981,133 | |

| Diluted weighted average number of multiple and subordinate voting shares outstanding | 98,172,212 | | 101,308,836 | | | 98,033,979 | | 103,125,365 | |

| Earnings per share attributable to shareholders of the Company | | | | | |

| Basic | $ | 1.44 | | $ | 1.30 | | | $ | 0.70 | | $ | 0.52 | |

| Diluted | $ | 1.42 | | $ | 1.29 | | | $ | 0.69 | | $ | 0.52 | |

Note 5. Trade receivables

| | | | | | | | | | | |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | March 31,

2024 |

| $ | $ | $ |

| Trade accounts receivable | 147.1 | | 129.4 | | 57.1 | |

| Credit card receivables | 16.3 | | 7.5 | | 3.7 | |

| Other receivables | 14.0 | | 9.3 | | 12.3 | |

| 177.4 | | 146.2 | | 73.1 | |

| Less: expected credit loss and sales allowances | (2.5) | | (1.7) | | (2.7) | |

| Trade receivables | 174.9 | | 144.5 | | 70.4 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 12 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Note 6. Inventories

| | | | | | | | | | | |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | March 31,

2024 |

| $ | $ | $ |

| Raw materials | 36.8 | | 48.9 | | 48.4 | |

| Work in progress | 14.9 | | 23.0 | | 25.8 | |

| Finished goods | 355.7 | | 406.5 | | 371.0 | |

| Total inventories at the lower of cost and net realizable value | 407.4 | | 478.4 | | 445.2 | |

Inventories are written down to net realizable value when the cost of inventories is estimated to be unrecoverable due to obsolescence, damage, or declining rate of sale.

The breakdown of the provision for inventory obsolescence is presented as follows:

| | | | | | | | | | | |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | March 31,

2024 |

| $ | $ | $ |

| Raw material reserves | 23.5 | | 21.6 | | 22.2 | |

| Finished goods reserves | 37.2 | | 29.4 | | 38.6 | |

| Provision for inventory obsolescence | 60.7 | | 51.0 | | 60.8 | |

Amounts charged to cost of sales comprise the following:

| | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| $ | $ | | $ | $ |

| Cost of goods manufactured | 152.9 | | 157.2 | | | 286.6 | | 282.9 | |

| Depreciation and amortization included in costs of sales | 3.0 | | 3.0 | | | 8.5 | | 8.5 | |

| 155.9 | | 160.2 | | | 295.1 | | 291.4 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 13 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Note 7. Leases

Right-of-use assets

The following table presents changes in the cost and the accumulated depreciation of the Company’s right-of-use assets:

| | | | | | | | | | | | | | |

| (in millions of Canadian dollars) | Retail stores | Manufacturing facilities | Other | Total |

| Cost | $ | $ | $ | $ |

| March 31, 2024 | 450.3 | | 44.2 | | 60.9 | | 555.4 | |

| Additions | 52.5 | | — | | 2.2 | | 54.7 | |

| | | | |

| Lease modifications | 11.7 | | 4.5 | | 1.0 | | 17.2 | |

| Derecognition on termination | (6.4) | | — | | (1.5) | | (7.9) | |

| Impact of foreign currency translation | 22.9 | | — | | 1.1 | | 24.0 | |

| December 29, 2024 | 531.0 | | 48.7 | | 63.7 | | 643.4 | |

| | | | |

| April 2, 2023 | 396.7 | | 44.9 | | 58.4 | | 500.0 | |

| Additions | 25.6 | | — | | 2.6 | | 28.2 | |

| Additions from business combinations | — | | 1.2 | | — | | 1.2 | |

| Lease modifications | 9.8 | | 0.1 | | 1.5 | | 11.4 | |

| Derecognition on termination | (4.0) | | — | | (1.8) | | (5.8) | |

| Impact of foreign currency translation | (6.4) | | — | | (0.4) | | (6.8) | |

| December 31, 2023 | 421.7 | | 46.2 | | 60.3 | | 528.2 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 14 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

| | | | | | | | | | | | | | |

| (in millions of Canadian dollars) | Retail stores | Manufacturing facilities | Other | Total |

| Accumulated depreciation | $ | $ | $ | $ |

| March 31, 2024 | 229.7 | | 24.0 | | 21.9 | | 275.6 | |

| Depreciation | 52.2 | | 3.9 | | 6.3 | | 62.4 | |

| Derecognition on termination | (6.4) | | — | | (0.5) | | (6.9) | |

| | | | |

| Impact of foreign currency translation | 12.2 | | — | | 0.7 | | 12.9 | |

| December 29, 2024 | 287.7 | | 27.9 | | 28.4 | | 344.0 | |

| | | | |

| April 2, 2023 | 171.1 | | 20.6 | | 16.5 | | 208.2 | |

| Depreciation | 46.7 | | 4.2 | | 5.2 | | 56.1 | |

| Derecognition on termination | (4.0) | | — | | (1.8) | | (5.8) | |

| Impact of foreign currency translation | (2.8) | | — | | (0.2) | | (3.0) | |

| December 31, 2023 | 211.0 | | 24.8 | | 19.7 | | 255.5 | |

| | | | |

| Net book value | | | | |

| December 29, 2024 | 243.3 | | 20.8 | | 35.3 | | 299.4 | |

| December 31, 2023 | 210.7 | | 21.4 | | 40.6 | | 272.7 | |

| March 31, 2024 | 220.6 | | 20.2 | | 39.0 | | 279.8 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 15 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Lease liabilities

The following table presents the changes in the Company's lease liabilities:

| | | | | | | | | | | | | | |

| (in millions of Canadian dollars) | Retail stores | Manufacturing facilities | Other | Total |

| $ | $ | $ | $ |

| March 31, 2024 | 255.7 | | 23.8 | | 51.0 | | 330.5 | |

| Additions | 52.1 | | — | | 2.2 | | 54.3 | |

| | | | |

| Lease modifications | 11.6 | | 4.5 | | 1.0 | | 17.1 | |

| Derecognition on termination | — | | — | | (1.0) | | (1.0) | |

| Principal payments | (53.3) | | (4.3) | | (6.5) | | (64.1) | |

| Impact of foreign currency translation | 12.7 | | 0.1 | | 0.4 | | 13.2 | |

| December 29, 2024 | 278.8 | | 24.1 | | 47.1 | | 350.0 | |

| | | | |

| April 2, 2023 | 259.2 | | 27.7 | | 47.9 | | 334.8 | |

| Additions | 25.5 | | — | | 2.3 | | 27.8 | |

| Additions from business combinations | — | | 1.2 | | — | | 1.2 | |

| Lease modifications | 9.8 | | 0.1 | | 1.5 | | 11.4 | |

| | | | |

| Principal payments | (46.0) | | (4.0) | | 0.3 | | (49.7) | |

| Impact of foreign currency translation | (4.1) | | — | | (0.1) | | (4.2) | |

| December 31, 2023 | 244.4 | | 25.0 | | 51.9 | | 321.3 | |

Lease liabilities are classified as current and non-current liabilities as follows:

| | | | | | | | | | | | | | |

| (in millions of Canadian dollars) | Retail stores | Manufacturing facilities | Other | Total |

| $ | $ | $ | $ |

| Current lease liabilities | 71.6 | | 5.9 | | 7.2 | | 84.7 | |

| Non-current lease liabilities | 207.2 | | 18.2 | | 39.9 | | 265.3 | |

| December 29, 2024 | 278.8 | | 24.1 | | 47.1 | | 350.0 | |

| | | | |

| Current lease liabilities | 62.8 | | 6.3 | | 7.3 | | 76.4 | |

| Non-current lease liabilities | 181.6 | | 18.7 | | 44.6 | | 244.9 | |

| December 31, 2023 | 244.4 | | 25.0 | | 51.9 | | 321.3 | |

| | | | |

| Current lease liabilities | 65.8 | | 6.3 | | 7.8 | | 79.9 | |

| Non-current lease liabilities | 189.9 | | 17.5 | | 43.2 | | 250.6 | |

| March 31, 2024 | 255.7 | | 23.8 | | 51.0 | | 330.5 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 16 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

For the third and three quarters ended December 29, 2024, $20.1m and $26.6m, respectively, of lease payments were not included in the measurement of lease liabilities (third and three quarters ended December 31, 2023 - $22.7m and $28.8m, respectively). The majority of these balances related to short-term leases and variable rent payments, which are expensed as incurred.

Note 8. Accounts payable and accrued liabilities

Accounts payable and accrued liabilities consist of the following:

| | | | | | | | | | | |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | March 31,

2024 |

| $ | $ | $ |

| Trade payables | 42.1 | | 60.0 | | 57.6 | |

| Accrued liabilities | 105.4 | | 107.9 | | 73.5 | |

| Employee benefits | 33.2 | | 34.4 | | 38.6 | |

| Derivative financial instruments | 7.3 | | 3.8 | | 1.9 | |

| ASPP liability (note 11) | — | | 43.1 | | — | |

| Other payables | 27.6 | | 19.6 | | 6.1 | |

| Accounts payable and accrued liabilities | 215.6 | | 268.8 | | 177.7 | |

Note 9. Provisions

The Company amended the existing accounting policies related to its presentation of liabilities in the statement of financial position as at April 1, 2024 and identified warranty provisions within non-current liabilities can no longer be classified as such. As a result, $23.3m and $23.0m for December 31, 2023 and March 31, 2024, respectively, was reclassified to current liabilities on the provisions line in the statement of financial position. See "Note 2. Material accounting policy information" for more details on the reclassification.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 17 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Provisions are classified as current and non-current liabilities based on legal rights which exist as at the reporting date as follows:

| | | | | | | | | | | | | | |

| (in millions of Canadian dollars) | Warranty | Sales returns | Asset retirement obligations | Total |

| $ | $ | $ | $ |

| Current provisions | 29.7 | | 40.0 | | — | | 69.7 | |

| Non-current provisions | — | | — | | 16.0 | | 16.0 | |

| December 29, 2024 | 29.7 | | 40.0 | | 16.0 | | 85.7 | |

| | | | |

| Reclassified | | | |

| Current provisions | 30.6 | | 47.7 | | — | | 78.3 | |

| Non-current provisions | — | | — | | 13.9 | | 13.9 | |

| December 31, 2023 | 30.6 | | 47.7 | | 13.9 | | 92.2 | |

| | | | |

| Reclassified | | | |

| Current provisions | 30.3 | | 18.8 | | — | | 49.1 | |

| Non-current provisions | — | | — | | 14.3 | | 14.3 | |

| March 31, 2024 | 30.3 | | 18.8 | | 14.3 | | 63.4 | |

Note 10. Borrowings

Amendments to borrowings

Post June 28, 2024, Canadian Dollar Offered Rate rates were no longer being published. As a result, in the first quarter ended June 30, 2024, the Company entered into amendments for its Revolving Facility (as defined below) to transition from the Canadian Dollar Offered interest benchmarks to the Canadian Overnight Repo Rate Average ("CORRA”). There were no further amendments to borrowings in the three quarters ended December 29, 2024.

Revolving Facility

The Company has an agreement with a syndicate of lenders for a senior secured asset-based revolving credit facility ("Revolving Facility") in the amount of $467.5m, with an increase in commitments to $517.5m during the peak season (June 1 - November 30). The Revolving Facility matures on May 15, 2028. Amounts owing under the Revolving Facility may be borrowed, repaid and re-borrowed for general corporate purposes. The Company has pledged substantially all of its assets as collateral for the Revolving Facility. The Revolving Facility contains financial and non-financial covenants which could impact the Company’s ability to draw funds.

The Revolving Facility has multiple interest rate charge options that are based on the Canadian prime rate, the lenders' Alternate Base Rate, European Base Rate, SOFR rate, or EURIBOR rate plus an applicable margin, with interest payable the earlier of quarterly or at the end of the then current interest period (whichever is earlier).

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 18 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

As at December 29, 2024, the Company had repaid all amounts owing on the Revolving Facility (December 31, 2023 - $nil, March 31, 2024 - $nil). As at December 29, 2024, no interest and administrative fees remain outstanding (December 31, 2023 - $nil, March 31, 2024 - $nil). There were deferred financing charges in the amounts of $0.8m as at December 29, 2024 and were included in other long-term liabilities (December 31, 2023 - $1.0m, March 31, 2024 - $1.0m). As at and during the three quarters ended December 29, 2024, the Company was in compliance with all covenants.

The Company had unused borrowing capacity available under the Revolving Facility of $309.5m as at December 29, 2024 (December 31, 2023 - $359.4m, March 31, 2024 - $203.7m).

The revolving credit commitment also includes a letter of credit commitment in the amount of $25.0m, with a $5.0m sub-commitment for letters of credit issued in a currency other than Canadian dollars, U.S. dollars, euros or British pounds sterling, and a swingline commitment for $25.0m. As at December 29, 2024, the Company had letters of credit outstanding under the Revolving Facility of $1.6m (December 31, 2023 - $1.5m, March 31, 2024 - $1.5m).

Term Loan

The Company has a senior secured loan agreement with a syndicate of lenders that is secured on a split collateral basis ("Term Loan") alongside the Revolving Facility. The Term Loan has an aggregate principal amount of USD300.0m, with quarterly repayments of USD0.75m on the principal amount and a maturity date of October 7, 2027. Moreover, the Term Loan has an interest rate of SOFR plus a term SOFR adjustment of 0.11448% with an applicable margin of 3.50% payable monthly in arrears. SOFR plus the term SOFR adjustment may not be less than 0.75%.

Voluntary prepayments of amounts owing under the Term Loan may be made at any time without premium or penalty, once repaid may not be reborrowed. As at December 29, 2024, the Company had USD288.8m (December 31, 2023 - USD291.0m, March 31, 2024 - USD290.3m) aggregate principal amount outstanding under the Term Loan. The Company has pledged substantially all of its assets as collateral for the Term Loan. The Term Loan contains financial and non-financial covenants which could impact the Company’s ability to draw funds. As at and during the three quarters ended December 29, 2024, the Company was in compliance with all covenants.

As the Term Loan is denominated in U.S. dollars, the Company remeasures the outstanding balance plus accrued interest at each balance sheet date.

The amount outstanding with respect to the Term Loan is as follows:

| | | | | | | | | | | |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | March 31,

2024 |

| $ | $ | $ |

| Term Loan | 416.3 | | 385.7 | | 393.1 | |

| Unamortized portion of deferred transaction costs | (0.5) | | (0.7) | | (0.6) | |

| Term Loan, net of unamortized deferred transaction costs | 415.8 | | 385.0 | | 392.5 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 19 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Mainland China Facilities

A subsidiary of the Company in Mainland China has uncommitted loan facilities in the aggregate amount of RMB510.0m ($100.7m) ("Mainland China Facilities"). The term of each draw on the loans is one, three or six months or such other period as agreed upon and shall not exceed 12 months (including any extension or rollover). The interest rate on each facility is equal to 3.1% or the loan prime rate of 1 year, minus a marginal rate of 0.5%, and payable quarterly. Proceeds drawn on the Mainland China Facilities are being used to support working capital requirements and build up of inventory for peak season sales. As at December 29, 2024, the Company had $30.1m (RMB152.3m) owing on the Mainland China Facilities (December 31, 2023 - $9.3m (RMB50.0m), March 31, 2024 - no amounts owing).

Japan Facility

A subsidiary of the Company in Japan has a loan facility in the aggregate amount of JPY4,000.0m ($36.5m) ("Japan Facility") with a floating interest rate of Japanese Bankers Association Tokyo Interbank Offered Rate plus an applicable margin of 0.30%. The term of the facility is 12 months and each draw on the facility is payable within the term. Proceeds drawn on the Japan Facility are being used to support build up of inventory for peak season sales. As at December 29, 2024, the Company had $35.2m (JPY3,850.0m) owing on the Japan Facility (December 31, 2023 - $25.4m (JPY2,700.0m), March 31, 2024 - $5.4m (JPY600.0m)).

Short-term Borrowings

As at December 29, 2024, the Company has short-term borrowings in the amount of $70.6m (December 31, 2023 - $38.7m, March 31, 2024 - $9.4m). Short-term borrowings include $30.1m (December 31, 2023 - $9.3m, March 31, 2024 - $nil) owing on the Mainland China Facilities, $35.2m (December 31, 2023 - $25.4m, March 31, 2024 - $5.4m) owing on the Japan Facility, and $5.3m (December 31, 2023 - $4.0m, March 31, 2024 - $4.0m) for the current portion of the quarterly principal repayments on the Term Loan. Short-term borrowings are all due within the next 12 months.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 20 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Net interest, finance and other costs consist of the following:

| | | | | | | | | | | | | | | | | |

| Third quarter ended | | Three quarters ended |

| (in millions of Canadian dollars) | December 29,

2024 | December 31,

2023 | | December 29,

2024 | December 31,

2023 |

| $ | $ | | $ | $ |

| Interest expense | | | | | |

| Mainland China Facilities | 0.6 | | 0.4 | | | 0.8 | | 0.8 | |

| Japan Facility | 0.1 | | 0.1 | | | 0.1 | | 0.1 | |

| Revolving Facility | 0.4 | | 1.3 | | | 2.5 | | 2.8 | |

| Term Loan | 4.7 | | 4.8 | | | 15.2 | | 14.8 | |

| Lease liabilities | 4.2 | | 4.2 | | | 12.9 | | 12.8 | |

| Standby fees | 0.3 | | 0.3 | | | 0.9 | | 0.9 | |

| | | | | |

| Foreign exchange losses on Term Loan net of hedges | 4.9 | | 0.5 | | | 5.7 | | — | |

| Fair value remeasurement on the put option liability (note 14) | 0.7 | | 4.9 | | | 1.6 | | 15.7 | |

| Fair value remeasurement on the contingent consideration (note 14) | (1.3) | | (1.9) | | | (13.1) | | (4.9) | |

| Interest income | (0.3) | | (0.1) | | | (0.9) | | (0.9) | |

| Other costs | — | | 0.3 | | | 0.3 | | 0.8 | |

| Net interest, finance and other costs | 14.3 | | 14.8 | | | 26.0 | | 42.9 | |

Note 11. Shareholders' equity

Share capital transactions for the three quarters ended December 29, 2024

Normal course issuer bid for Fiscal 2025

The Board of Directors authorized the Company to initiate a normal course issuer bid, in accordance with the requirements of the Toronto Stock Exchange, to purchase up to 4,556,841 subordinate voting shares over the 12-month period from November 22, 2024 and ending no later than November 21, 2025 (the "Fiscal 2025 NCIB"). Purchased subordinate voting shares will be cancelled.

In connection with the Fiscal 2025 NCIB, the Company also entered into an automatic share purchase plan (the “Fiscal 2025 ASPP”) under which a designated broker may purchase subordinate voting shares under the Fiscal 2025 NCIB during the regularly scheduled quarterly trading blackout periods of the Company. The repurchases made under the Fiscal 2025 ASPP will be made in accordance with certain purchasing parameters and will continue until the earlier of the date in which the Company has acquired the maximum limit of subordinate voting shares pursuant to the Fiscal 2025 ASPP or upon the date of expiry of the Fiscal 2025 NCIB.

Since the commencement of the plan on November 22, 2024, the Company made no repurchases under the Fiscal 2025 NCIB.

During the three quarters ended December 29, 2024, the Company made no repurchases under the Fiscal 2024 NCIB, as defined below.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 21 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

The transactions affecting the issued and outstanding share capital of the Company are described below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions of Canadian dollars, except share amounts) | Multiple voting shares | | Subordinate voting shares | | Total |

| Number | $ | | Number | $ | | Number | $ |

| March 31, 2024 | 51,004,076 | | 1.4 | | | 45,528,438 | | 103.5 | | | 96,532,514 | | 104.9 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Exercise of stock options | — | | — | | | 99,039 | | 0.6 | | | 99,039 | | 0.6 | |

| Settlement of RSUs | — | | — | | | 174,203 | | 4.0 | | | 174,203 | | 4.0 | |

| Total share issuances | — | | — | | | 273,242 | | 4.6 | | | 273,242 | | 4.6 | |

| December 29, 2024 | 51,004,076 | | 1.4 | | | 45,801,680 | | 108.1 | | | 96,805,756 | | 109.5 | |

Share capital transactions for the three quarters ended December 31, 2023

Normal course issuer bid for Fiscal 2024

The Board of Directors authorized the Company to initiate a normal course issuer bid, in accordance with the requirements of the Toronto Stock Exchange, to purchase up to 4,980,505 subordinate voting shares over the 12-month period which started on November 22, 2023 and concluded on November 21, 2024 (the "Fiscal 2024 NCIB").

In connection with the Fiscal 2024 NCIB, the Company also entered an automatic share purchase plan (the “Fiscal 2024 ASPP”) under which a designated broker may purchase subordinate voting shares under the Fiscal 2024 NCIB during the regularly scheduled quarterly trading blackout periods of the Company. The repurchases made under the Fiscal 2024 ASPP will be made in accordance with certain purchasing parameters and will continue until the earlier of the date in which the Company has acquired the maximum limit of subordinate voting shares pursuant to the Fiscal 2024 ASPP or upon the date of expiry of the Fiscal 2024 NCIB.

During the three quarters ended December 31, 2023, under the Fiscal 2024 NCIB, the Company purchased 1,862,550 subordinate voting shares for cancellation for total cash consideration of $29.5m, of which $2.3m was payable to the designated broker as at the period end. The amount to purchase the subordinate voting shares was charged to share capital, with the remaining $25.3m charged to retained earnings. Of the 1,862,550 subordinate voting shares purchased, 1,365,074 were purchased under the Fiscal 2024 ASPP for total cash consideration of $22.2m.

A liability representing the maximum amount that the Company could be required to pay the designated broker under the Fiscal 2024 ASPP was $43.1m as at December 31, 2023. The amount was charged to contributed surplus.

Since the commencement of the Fiscal 2024 NCIB, the Company purchased 3,586,124 subordinate voting shares for total cash consideration of $56.9m. Of the 3,586,124 subordinate voting shares purchased, 3,088,648 were purchased under the Fiscal 2024 ASPP for total cash consideration of $49.6m.

Normal course issuer bid for Fiscal 2023

The Board of Directors authorized the Company to initiate a normal course issuer bid, in accordance with the requirements of the Toronto Stock Exchange, to purchase up to 5,421,685 subordinate voting shares over the 12-month period which started on November 22, 2022 and concluded on November 21, 2023 (the "Fiscal 2023 NCIB").

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 22 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

In connection with the Fiscal 2023 NCIB, the Company had also entered an automatic share purchase plan (the “Fiscal 2023 ASPP”) under which a designated broker may purchase subordinate voting shares under the Fiscal 2023 NCIB during the regularly scheduled quarterly trading blackout periods of the Company. This Fiscal 2023 ASPP terminated on November 21, 2023, along with the Fiscal 2023 NCIB, and the liability to the broker was fully settled at the end of the plan.

During the three quarters ended December 31, 2023, the Company purchased 4,268,883 subordinate voting shares for cancellation for total cash consideration of $83.3m. The amount to purchase the subordinate voting shares was charged to share capital, with the remaining $73.6m charged to retained earnings. Of the 4,268,883 subordinate voting shares purchased, 1,184,152 were purchased under the Fiscal 2023 ASPP for total cash consideration of $25.3m.

Since the commencement of the Fiscal 2023 NCIB, the Company purchased 5,421,685, which represents the total authorized subordinate voting shares for cancellation for total cash consideration of $111.2m.

The transactions affecting the issued and outstanding share capital of the Company are described below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions of Canadian dollars, except share amounts) | Multiple voting shares | | Subordinate voting shares | | Total |

| Number | $ | | Number | $ | | Number | $ |

| April 2, 2023 | 51,004,076 | | 1.4 | | | 53,184,912 | | 117.3 | | | 104,188,988 | | 118.7 | |

| Purchase of subordinate voting shares | — | | — | | | (5,987,741) | | (13.6) | | | (5,987,741) | | (13.6) | |

| Purchase of subordinate voting shares held for cancellation | — | | — | | | (143,692) | | (0.3) | | | (143,692) | | (0.3) | |

| Total share purchases | — | | — | | | (6,131,433) | | (13.9) | | | (6,131,433) | | (13.9) | |

| Exercise of stock options | — | | — | | | 36,350 | | 0.2 | | | 36,350 | | 0.2 | |

| Settlement of RSUs | — | | — | | | 134,475 | | 3.8 | | | 134,475 | | 3.8 | |

| Total share issuances | — | | — | | | 170,825 | | 4.0 | | | 170,825 | | 4.0 | |

| December 31, 2023 | 51,004,076 | | 1.4 | | | 47,224,304 | | 107.4 | | | 98,228,380 | | 108.8 | |

Note 12. Share-based payments

Stock options

The Company issued stock options to purchase subordinate voting shares under its incentive plans, prior to the public share offering on March 21, 2017, the Legacy Plan, and subsequently, the Omnibus Plan. All options are issued at an exercise price that is not less than market value at the time of grant and expire ten years after the grant date.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 23 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Stock option transactions are as follows:

| | | | | | | | | | | | | | | | | |

| Three quarters ended |

| December 29,

2024 | | December 31,

2023 |

| (in millions of Canadian dollars, except share and per share amounts) | Weighted average exercise price | Number of shares | | Weighted average exercise price | Number of shares |

| Options outstanding, beginning of period | $ | 33.51 | | 4,608,777 | | $ | 36.58 | | 4,055,199 | |

| Granted | $ | 17.92 | | 1,000,924 | | $ | 22.21 | | 758,327 | |

| Exercised | $ | 5.53 | | (99,039) | | $ | 2.83 | | (36,350) | |

| Cancelled | $ | 35.20 | | (678,281) | | $ | 29.54 | | (303,217) | |

| Options outstanding, end of period | $ | 30.62 | | 4,832,381 | | $ | 34.89 | | 4,473,959 |

Restricted share units

The Company grants shares as part of the Restricted Share Unit ("RSU") program under the Omnibus Plan to employees of the Company. The RSUs are treated as equity instruments for accounting purposes. We expect that vested RSUs will be paid at settlement through the issuance of one subordinate voting share per RSU. The RSUs vest over a period of three years, a third on each anniversary of the date of grant.

RSU transactions are as follows:

| | | | | | | | | | | |

| Three quarters ended |

| December 29,

2024 | | December 31,

2023 |

| Number of shares | | Number of shares |

| RSUs outstanding, beginning of period | 480,518 | | | 318,082 | |

| Granted | 420,634 | | | 376,543 | |

| Settled | (174,203) | | | (134,475) | |

| Cancelled | (85,956) | | | (38,599) | |

| RSUs outstanding, end of period | 640,993 | | 521,551 |

Performance share units

In May 2023, the Company implemented a Performance Share Unit (“PSU”) program under the Omnibus Plan. A PSU represents the right to receive a subordinate voting share settled by the issuance of shares at the vesting date. PSUs vest on the third anniversary of the award date and are earned only if certain performance targets are achieved. Shares issued per PSU at the vesting date can decrease or increase if minimum or maximum performance targets are achieved ranging from 0% to 200% of the PSU award granted. If performance targets are achieved, the Company expects that those vested PSUs will be paid at settlement through the issuance of one subordinate voting share per PSU. PSUs are treated as equity instruments for accounting purposes.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 24 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

PSU transactions are as follows:

| | | | | | | | | | | |

| Three quarters ended |

| December 29,

2024 | | December 31,

2023 |

| Number of shares | | Number of shares |

| PSUs outstanding, beginning of period | 342,925 | | | — | |

| Granted | 428,121 | | | 399,349 | |

| | | |

| Cancelled | (86,646) | | | (9,491) | |

| PSUs outstanding, end of period | 684,400 | | 389,858 |

Shares reserved for issuance

As at December 29, 2024, subordinate voting shares, to a maximum of 4,212,552 shares, have been reserved for issuance under equity incentive plans to select employees of the Company, with vesting contingent upon meeting the service, performance goals and other conditions of the Omnibus Plan.

Accounting for share-based awards

For the third and three quarters ended December 29, 2024, the Company recorded $3.6m and $9.8m, respectively, as compensation expense for the vesting of stock options, RSUs and PSUs (third and three quarters ended December 31, 2023 - $4.3m and $11.5m, respectively). Share-based compensation expense is included in SG&A expenses.

The assumptions used to measure the fair value of options granted under the Black-Scholes option pricing model at the grant date were as follows:

| | | | | | | | | | | |

| Three quarters ended |

| (in millions of Canadian dollars, except share and per share amounts) | December 29,

2024 | | December 31,

2023 |

| Weighted average stock price valuation | $ | 17.92 | | | $ | 22.21 | |

| Weighted average exercise price | $ | 17.92 | | | $ | 22.21 | |

| Risk-free interest rate | 3.98 | % | | 4.12 | % |

| Expected life in years | 5 | | | 5 | |

| Expected dividend yield | — | % | | — | % |

| Volatility | 40 | % | | 40 | % |

| Weighted average fair value of options issued | $ | 6.03 | | | $ | 7.50 | |

RSU and PSU fair values are determined based on the market value of the subordinate voting shares at the time of grant. As at December 29, 2024, the weighted average fair value of RSUs was $18.38 (December 31, 2023 - $22.22). As at December 29, 2024, the weighted average fair value of PSUs was $18.85 (December 31, 2023 - $22.21).

Note 13. Related party transactions

The Company enters into transactions from time to time with its principal shareholders, as well as organizations affiliated with members of the Board of Directors and key management personnel by incurring expenses for business services. During the third and three quarters ended December 29, 2024, the Company incurred expenses with related parties of $0.2m and

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 25 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

$1.3m, respectively, (third and three quarters ended December 31, 2023 - $0.4m and $0.8m, respectively) from companies related to certain shareholders. Balances owing to related parties as at December 29, 2024 were $0.5m (December 31, 2023 - $0.4m, March 31, 2024 - $0.2m).

A lease liability due to the former controlling shareholder of the acquired Baffin Inc. business (the "Baffin Vendor") for leased premises was $2.0m as at December 29, 2024 (December 31, 2023 - $2.8m, March 31, 2024 - $2.5m). During the third and three quarters ended December 29, 2024, the Company paid principal and interest on the lease liability, net of rent concessions, and other operating costs to entities affiliated with the Baffin Vendor totalling $0.4m and $1.3m, respectively (third and three quarters ended December 31, 2023 - $0.3m and $1.0m, respectively). No amounts were owing to Baffin entities as at December 29, 2024, December 31, 2023, and March 31, 2024.

The joint venture between the Company and Sazaby League ("Japan Joint Venture"), has lease liabilities due to the non-controlling shareholder, Sazaby League for leased premises. Lease liabilities were $1.5m as at December 29, 2024 (December 31, 2023 - $2.2m, March 31, 2024 - $1.9m). During the third and three quarters ended December 29, 2024, the Company incurred principal and interest on lease liabilities, royalty fees, and other operating costs to Sazaby League totalling $0.8m and $2.6m, respectively (third and three quarters ended December 31, 2023 - $1.3m and $3.2m, respectively). Balances owing to Sazaby League as at December 29, 2024 were $0.3m (December 31, 2023 - $0.1m, March 31, 2024 - $0.3m).

During the third and three quarters ended December 29, 2024, the Japan Joint Venture sold inventory of $0.7m and $0.9m, respectively to companies wholly owned by Sazaby League (third and three quarters ended December 31, 2023 - $1.1m and $1.2m, respectively). As at December 29, 2024, the Japan Joint Venture recognized a trade receivable of $0.6m from these companies (December 31, 2023 - $0.9m, March 31, 2024 - $0.1m).

In connection with the Paola Confectii business combination that occurred on November 1, 2023, subject to the controlling shareholders of Paola Confectii SRL ("PCML Vendors") remaining employees through November 1, 2025, a further amount is payable to the PCML Vendors if certain performance conditions are met based on financial results (“Earn-Out”). For the third and three quarters ended December 29, 2024, the Company recognized $1.2m and $2.7m, respectively, of remuneration costs related to the Earn-Out based on the estimated value of $7.7m for the payout (third and three quarters ended December 31, 2023 - $0.5m and $0.5m, respectively). These costs have been included in other long-term liabilities on the statement of financial position, and reflects the amount owing to the PCML Vendors as at December 29, 2024.

A lease liability due to one of the PCML Vendors for leased premises was $1.2m as at December 29, 2024 (December 31, 2023 - $1.2m, March 31, 2024 - $1.2m). During the third and three quarters ended December 29, 2024, the Company paid principal and interest on the lease liability, to one of the PCML Vendors totalling less than $0.1m and $0.1m, respectively (third and three quarters ended December 31, 2023 - less than $0.1m and less than $0.1m, respectively). No amounts were owing to one of the PCML Vendors as at December 29, 2024, December 31, 2023, and March 31, 2024.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 26 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

Note 14. Financial instruments and fair value

The following table presents the fair values and fair value hierarchy of the Company’s financial instruments and excludes financial instruments carried at amortized cost that are short-term in nature:

| | | | | | | | | | | | | | | | | |

| December 29,

2024 |

| (in millions of Canadian dollars) | Level 1 | Level 2 | Level 3 | Carrying value | Fair value |

| $ | $ | $ | $ | $ |

| Financial assets | | | | | |

| Derivatives included in other current assets | — | | 11.1 | | — | | 11.1 | | 11.1 | |

| Derivatives included in other long-term assets | — | | 15.6 | | — | | 15.6 | | 15.6 | |

| Financial liabilities | | | | | |

| Derivatives included in accounts payable and accrued liabilities | — | | 7.3 | | — | | 7.3 | | 7.3 | |

| Mainland China Facilities | — | | 30.1 | | — | | 30.1 | | 30.1 | |

| Japan Facility | — | | 35.2 | | — | | 35.2 | | 35.2 | |

| | | | | |

| Term Loan | — | | 415.8 | | — | | 415.8 | | 418.1 | |

| | | | | |

| Put option liability included in other long-term liabilities | — | | — | | 31.7 | | 31.7 | | 31.7 | |

| Contingent consideration included in other long-term liabilities | — | | — | | 4.3 | | 4.3 | | 4.3 | |

| Earn-Out included in other long-term liabilities (note 13) | — | | — | | 4.2 | | 4.2 | | 4.2 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 27 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

| | | | | | | | | | | | | | | | | |

| December 31,

2023 |

| (in millions of Canadian dollars) | Level 1 | Level 2 | Level 3 | Carrying value | Fair value |

| $ | $ | $ | $ | $ |

| Financial assets | | | | | |

| Derivatives included in other current assets | — | | 18.2 | | — | | 18.2 | | 18.2 | |

| Derivatives included in other long-term assets | — | | 6.7 | | — | | 6.7 | | 6.7 | |

| Financial liabilities | | | | | |

| Derivatives included in accounts payable and accrued liabilities | — | | 3.8 | | — | | 3.8 | | 3.8 | |

| Mainland China Facilities | — | | 9.3 | | — | | 9.3 | | 9.3 | |

| Japan Facility | — | | 25.4 | | — | | 25.4 | | 25.4 | |

| | | | | |

| Term Loan | — | | 385.0 | | — | | 385.0 | | 421.7 | |

| Derivatives included in other long-term liabilities | — | | 12.2 | | — | | 12.2 | | 12.2 | |

| Put option liability included in other long-term liabilities | — | | — | | 45.7 | | 45.7 | | 45.7 | |

| Contingent consideration included in other long-term liabilities | — | | — | | 10.6 | | 10.6 | | 10.6 | |

| Earn-Out included in other long-term liabilities (note 13) | — | | — | | 0.5 | | 0.5 | | 0.5 | |

| | | | | | | | | | | | | | | | | |

| March 31,

2024 |

| (in millions of Canadian dollars) | Level 1 | Level 2 | Level 3 | Carrying value | Fair value |

| $ | $ | $ | $ | $ |

| Financial assets | | | | | |

| Derivatives included in other current assets | — | | 15.1 | | — | | 15.1 | | 15.1 | |

| Derivatives included in other long-term assets | — | | 6.9 | | — | | 6.9 | | 6.9 | |

| Financial liabilities | | | | | |

| Derivatives included in accounts payable and accrued liabilities | — | | 1.9 | | — | | 1.9 | | 1.9 | |

| | | | | |

| Japan Facility | — | | 5.4 | | — | | 5.4 | | 5.4 | |

| | | | | |

| Term Loan | — | | 392.5 | | — | | 392.5 | | 389.2 | |

| Derivatives included in other long-term liabilities | — | | 5.3 | | — | | 5.3 | | 5.3 | |

| Put option liability included in other long-term liabilities | — | | — | | 29.4 | | 29.4 | | 29.4 | |

| Contingent consideration included in other long-term liabilities | — | | — | | 17.7 | | 17.7 | | 17.7 | |

| Earn-Out included in other long-term liabilities (note 13) | — | | — | | 1.5 | | 1.5 | | 1.5 | |

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 28 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

In connection with the Japan Joint Venture, for the third and three quarters ended December 29, 2024, the Company recorded a decrease of JPY141.2m ($1.5m, excluding translation losses of $0.2m) and a decrease of JPY1,514.0m ($13.4m, excluding translation losses of $0.3m), respectively, on the remeasurement of the contingent consideration. The Company recorded an increase of JPY71.3m (a decrease of $0.6m, excluding translation losses of $1.3m) and an increase of JPY185.6m ($2.3m, excluding translation gains of $0.7m) on the remeasurement of the put option liability during the third and three quarters ended December 29, 2024, respectively. The change in fair value of the put option liability was driven by progression through the 10-year term, whereas the change in fair value of the contingent consideration was driven by the extension in term. During the first quarter ended June 30, 2024, the Company and Sazaby League amended the Joint Venture Agreement to extend the period by which the deferred contingent consideration is payable if an agreed cumulative adjusted EBIT target is not reached through the period ended June 30, 2026 to April 2, 2028.

For the third and three quarters ended December 31, 2023, the Company recorded a decrease of JPY196.9m ($1.5m, excluding translation gains of $0.4m) and a decrease of JPY529.7m ($6.3m, excluding translation losses of $1.4m) on the remeasurement of the contingent consideration. The Company recorded an increase of JPY518.3m ($6.2m, excluding translation gains of $1.3m) and an increase of JPY1,707.4m ($13.6m, excluding translation losses of $2.1m) on the remeasurement of the put option liability during the third and three quarters ended December 31, 2023.

Note 15. Financial risk management objectives and policies

The Company’s primary risk management objective is to protect the Company’s assets and cash flow, in order to increase the Company’s enterprise value.

The Company is exposed to capital management risk, liquidity risk, credit risk, market risk, foreign exchange risk, and interest rate risk. The Company’s senior management and Board of Directors oversee the management of these risks. The Board of Directors reviews and agrees upon policies for managing each of these risks which are summarized below.

Capital management

The Company manages its capital and capital structure with the objectives of safeguarding sufficient working capital over the annual operating cycle and providing sufficient financial resources to grow operations to meet long-term consumer demand. The Board of Directors of the Company monitors the Company’s capital management on a regular basis. The Company will continually assess the adequacy of the Company’s capital structure and capacity and make adjustments within the context of the Company’s strategy, economic conditions, and risk characteristics of the business.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to satisfy the requirements for business operations, capital expenditures, debt service and general corporate purposes, under normal and stressed conditions. The primary source of liquidity is funds generated by operating activities; the Company also relies on the Mainland China Facilities, the Japan Facility, and the Revolving Facility as sources of funds for short-term working capital needs. The Company continuously reviews both actual and forecasted cash flows to ensure that the Company has appropriate capital capacity.

| | | | | | | | |

| Canada Goose Holdings Inc. | Page 29 of 36 |

Notes to the Condensed Consolidated Interim Financial Statements

(unaudited)

The following table summarizes the amount of contractual undiscounted future cash flow requirements as at December 29, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contractual obligations by fiscal year | Q4 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Thereafter | Total |

| (in millions of Canadian dollars) | $ | $ | $ | $ | $ | $ | $ | $ |

| Accounts payable and accrued liabilities | 215.6 | | — | | — | | — | | — | | — | | — | | 215.6 | |

| Mainland China Facilities | 30.1 | | — | | — | | — | | — | | — | | — | | 30.1 | |

| Japan Facility | 35.2 | | — | | — | | — | | — | | — | | — | | 35.2 | |

| | | | | | | | |

| Term Loan | 2.2 | | 4.3 | | 4.3 | | 405.5 | | — | | — | | — | | 416.3 | |

Interest commitments relating to borrowings1 | 9.6 | | 34.1 | | 34.1 | | 17.0 | | — | | — | | — | | 94.8 | |

| | | | | | | | |

| Lease obligations | 27.1 | | 98.3 | | 85.8 | | 56.8 | | 47.1 | | 35.8 | | 74.0 | | 424.9 | |

| Pension obligation | — | | — | | — | | — | | — | | — | | 2.7 | | 2.7 | |

| Total contractual obligations | 319.8 | | 136.7 | | 124.2 | | 479.3 | | 47.1 | | 35.8 | | 76.7 | | 1,219.6 | |

| | | | | | | | |

1Interest commitments are calculated based on the loan balance and the interest rate payable on the Mainland China Facilities, the Japan Facility, and the Term Loan of 2.89%, 0.68%, and 8.19% respectively, as at December 29, 2024.

As at December 29, 2024, we had additional liabilities which included provisions for warranty, sales returns, asset retirement obligations, deferred income tax liabilities, the Earn-Out to the PCML Vendors, the put option liability and the contingent consideration on the Japan Joint Venture. These liabilities have not been included in the table above as the timing and amount of future payments are uncertain.

Letter of guarantee facility

On April 14, 2020, Canada Goose Inc. entered into a letter of guarantee facility in the amount of $10.0m. Letters of guarantee are available for terms of up to 12 months and will be charged a fee equal to 1.0% per annum calculated against the face amount and over the term of the guarantee. Amounts issued on the facility will be used to finance working capital requirements of Canada Goose Inc. through letters of guarantee, standby letters of credit, performance bonds, counter guarantees, counter standby letters of credit, or similar credits. The Company immediately reimburses the issuing bank for amounts drawn on issued letters of guarantees. At December 29, 2024, the Company had $9.2m outstanding.

In addition, a subsidiary of the Company in Mainland China entered into letters of guarantee and as at December 29, 2024 the amount outstanding was $9.6m. Amounts will be used to support retail operations of such subsidiaries through letters of guarantee, standby letters of credit, performance bonds, counter guarantees, counter standby letters of credit, or similar credits.

Credit risk