By Jon Sindreu, Art Patnaude and Jasmine Horsey

At a construction site in central London, several cranes rear

above a concrete structure that is being built into the new

European headquarters of Goldman Sachs.

Three years ago, the co-chief executives of the bank's

international operations said that if Britain left the European

Union the U.S. bank would scale back its London operations. Last

Thursday, Britain voted to leave the EU.

The Goldman Sachs headquarters is one of at least 20 new

buildings being built by foreign financial services companies that

were expanding in London ahead of the vote. While most say that

they haven't changed their mind on construction yet, their

crane-filed sites now stand as a potent symbol of post-Brexit risks

and tensions for the finance industry and for Britain.

"I think a number of them will be put on hold," said Michael

Ball, professor of property economics at the University of

Reading.

Before the referendum, several international banks threatened to

move jobs from London to other European capitals, such as Paris,

Dublin and Frankfurt, if the vote was to leave. Foreign

institutions can sell their services across the EU from London and

had expressed fears that with Britain outside the bloc they would

lose this "financial passport."

In 2013, Goldman Sachs executives Michael Sherwood and Richard

Gnodde told the Evening Standard newspaper that if Britain left the

EU, the bank may end up spreading its sales teams across the

continent. Currently, all but 500 of the bank's 6,500 European

staff are based in London. A spokesman for Goldman Sachs said the

issue hadn't yet been discussed following the vote.

The stakes are high for both Britain and the banks. Financial

services contribute 18% to London's economy, and construction and

real estate make up about another 17%. For the finance industry,

London offers a cluster of mutually dependent services, from

lawyers to fund managers and bankers. London also allows a base in

an English-speaking country with lower taxation than many European

peers and amenities that bankers like, despite the city's high

costs.

When French bank Société Générale SA announced in 2014 it would

build a 26-story building in London's Canary Wharf financial

district, their prospective neighbors at Morgan Stanley were riled

at the thought of getting their office views obscured by a

rival.

On Monday, Morgan Stanley employees were openly gloating,

according to several people at the U.S. bank.

Société Générale has said that it remains committed to London.

Morgan Stanley declined to comment.

But Britain's exit from the EU could potentially hit all banks,

depending on the sort of deal that Britain and Brussels can come to

on U.K.-based firms' continued access to the rest of the bloc.

London could lose 100,000 jobs to continental Europe, According

to an estimate from Jefferies International Ltd.

On Thursday, the chairman of HSBC PLC, Douglas Flint, said that

the British bank may have to move 1,000 of its 6,000 London-based

investment banks to Paris if the U.K. lost its passporting rights

into the single market.

Among other banks building new headquarters, Royal Bank of

Canada, Canada's largest lender by assets, has signed a pre-let

deal to move staff from its current two London locations into to a

more central 37-story tower. This week, workers in high visibility

clothing continued to work among the three cranes that towered over

a site surrounded by some of London's most iconic modern

buildings.

A representative for the bank said no discussions had taken

place to change relocation plans.

Bloomberg LP, the financial services and media company owned by

U.S. magnate Michael Bloomberg, is set to move its European

headquarters into new, larger offices next year. Designed by

renowned architect Norman Foster, the building had to include a

double basement to protect the remains of a Roman temple found

under it. A representative for the company, which competes with Dow

Jones, the publisher of The Wall Street Journal, said plans hadn't

changed.

But Britain's exit from the EU could potentially hit even those

companies staying in London. If enough firms vacate office space in

the city, commercial property prices could tumble, hitting

businesses that already have built or agreed to let new offices at

current high prices.

London is in the midst of a massive office-construction boom

after years of supply constraint. According to a survey by

accounting firm Deloitte LLP, 51 new office buildings have been

started in central London since the start of the year, the highest

volume since records began in 2002.

As of March, companies had already signed leases on 42% of

office space being built, according to Deloitte. Of those

companies, 25% are international banks.

Real-estate analysts at Swiss bank UBS said the city will see a

large volume of new supply coming into the market at a time when

demand from businesses is "likely to remain very weak."

UBS has plans of its own. Later this year, the bank is expected

to move into a new 700,000-square-foot office in London.

--

Margot Patrick contributed to this article.

Write to Jon Sindreu at jon.sindreu@wsj.com and Art Patnaude at

art.patnaude@wsj.com

(END) Dow Jones Newswires

June 30, 2016 13:03 ET (17:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

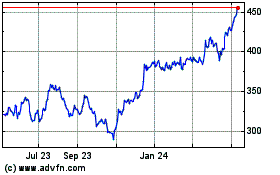

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Nov 2024 to Dec 2024

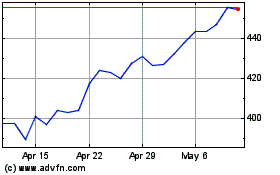

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Dec 2023 to Dec 2024