UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ANNUAL REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2023

Commission File Number 0-18350

GRANITE CONSTRUCTION PROFIT

SHARING AND 401(K) PLAN

GRANITE CONSTRUCTION INCORPORATED

585 West Beach Street

Watsonville, California 95076

Telephone: (831) 724-1011

| | | | | |

| Item 4. | FINANCIAL STATEMENTS AND SCHEDULES PREPARED IN ACCORDANCE WITH THE FINANCIAL REPORTING REQUIREMENTS OF THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF 1974 |

The following documents are filed as part of this report:

1. Financial Statements

The following financial statements are filed as part of this report:

2. Financial Statement Schedule

The following financial statement schedule of the Granite Construction Profit Sharing and 401(k) Plan as of December 31, 2023 is filed as part of this report and shall be read in conjunction with the financial statements of the Plan.

EXHIBIT

The following exhibit is attached hereto and filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | GRANITE CONSTRUCTION PROFIT SHARING AND 401(K) PLAN |

| | |

Date: June 14, 2024 | By: | /s/ Abigail E. Glines |

| | | Abigail E. Glines |

| | | Committee Secretary |

| | | Granite Construction Profit Sharing and 401(k) Plan Administrative Committee |

INDEX TO EXHIBIT

| | | | | | | | |

Exhibit Number | Document | |

| | | |

| 23.1 | | |

Granite Construction Profit Sharing and 401(k) Plan

Financial Statements

as of December 31, 2022 and 2021 and

for the year ended December 31, 2022

Index of Financial Statements, Schedule and Exhibit

| | | | | |

| | |

| | Pages |

| |

| | |

| Financial Statements: | |

| |

| |

| |

| | |

| Supplemental Information: | |

| | |

| |

| |

| Exhibit: | |

| |

Supplemental Information other than the above are omitted because they are not applicable.

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and

Plan Administrative Committee of

Granite Construction Profit Sharing and 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Granite Construction Profit Sharing and 401(k) Plan (the “Plan”) as of December 31, 2023, and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023, and 2022, and the changes in net assets available for benefits for the year that ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Opinion on the Supplemental Information

The supplemental information included in Schedule H, line 4(i) – Schedule of Assets (Held at End of Year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

| | | | | |

| /s/ Moss Adams LLP | |

| Moss Adams LLP | |

Campbell, California

June 14, 2024

We have served as the Plan’s auditor since 2013.

F-2

| | |

| Granite Construction Profit Sharing and 401(k) Plan |

| Statements of Net Assets Available for Benefits |

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Investments, at fair value: | | | |

| Mutual funds | $ | 153,853,199 | | | $ | 119,968,523 | |

| Common stock | 48,430,884 | | | 35,694,919 | |

| Common/collective trusts | 528,487,525 | | | 469,387,332 | |

| Total investments | 730,771,608 | | | 625,050,774 | |

| Uninvested cash | 97 | | | 28 | |

| Employer contributions receivable | 703,326 | | | 734,820 | |

| Notes receivable from participants | 5,609,619 | | | 5,309,009 | |

| Net assets available for benefits | $ | 737,084,650 | | | $ | 631,094,631 | |

The accompanying notes are an integral part of these financial statements.

F-3

| | |

| Granite Construction Profit Sharing and 401(k) Plan |

| Statement of Changes in Net Assets Available for Benefits |

| | | | | |

| Year ended |

| December 31, |

| 2023 |

| Change in net assets available for benefits attributed to: | |

| Investment activities: | |

| Net appreciation in fair value of investments | $ | 111,487,752 | |

| Interest and dividends | 6,413,789 | |

| Net gain from investment activities | 117,901,541 | |

| |

| Additions: | |

| Employee contributions, including rollovers | 30,055,981 | |

| Employer contributions | 18,594,419 | |

| Fee credits | 30,905 | |

| Interest income on notes receivable from participants | 294,248 | |

| Total additions | 48,975,553 | |

| |

| Deductions: | |

| Distributions to participants or beneficiaries | (60,089,972) | |

| Loan distribution/Deemed distribution of participant loans | (586,175) | |

| Fees and expenses | (210,928) | |

| Total deductions | (60,887,075) | |

| |

| Change in net assets available for benefits during the year | 105,990,019 | |

| Net assets available for benefits, beginning of year | 631,094,631 | |

| |

| Net assets available for benefits, end of year | $ | 737,084,650 | |

The accompanying notes are an integral part of these financial statements.

F-4

General

The following description of the Granite Construction Profit Sharing and 401(k) Plan (“Plan”) provides only general information. For a more complete description of the Plan’s provisions, refer to the Plan document.

The Plan is a defined contribution plan covering all eligible non-union employees of Granite Construction Incorporated and its participating subsidiaries (“Company”). An employee generally becomes eligible to elect to make contributions to the Plan as of his or her date of hire. For all other purposes under the Plan, an employee generally becomes a participant in the Plan as of the first day of the month coinciding with or following the date on which he or she is credited with six months of service (or as soon as administratively practicable thereafter). The Company does not guarantee the benefits provided by the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended.

The Company has appointed an Administrative Committee (“Committee”) as the Plan administrator (“Administrator”). Other than with respect to the Granite Construction Incorporated Common Stock in the Granite Common Stock Fund or the Granite Construction Employee Stock Ownership Plan (“Granite ESOP Stock Fund”), the Committee has exclusive authority and responsibility for all matters in connection with the operation and administration of the Plan. An independent fiduciary selected by the Company has authority and responsibility related to investments in the Granite Common Stock Fund and Granite ESOP Stock Fund, the assets of which consist of Company common stock and non-interest bearing cash. All necessary and proper expenses incurred in the administration of the Plan are paid either by the Company or from Plan assets pursuant to the Plan document.

Contributions

The Company may make profit sharing and/or matching contributions to the Plan. Profit sharing contributions from the Company may be contributed to the Plan in an amount (or under such formula) as determined by the Company’s Board of Directors. Once employees have reached six months of service and remain employed, they are eligible for profit sharing.

Profit sharing contributions are payable solely out of the Company’s current or accumulated earnings and profits. The profit sharing contribution shall not exceed the maximum amount deductible under the provisions of the Internal Revenue Code (“IRC”). The Company must pay the total profit sharing contribution to the Plan trustee before the date the Company is required to file its Federal income tax return (including extensions). There were no profit sharing contributions made to the Plan for the year ended December 31, 2023.

The Company’s Board of Directors determines Company matching contributions to the Plan. Once employees have reached six months of service they are eligible for employer match. For the year ended December 31, 2023, the rate of matching contributions equaled 100% of participant contributions up to a maximum of 6% of compensation. The Company’s matching contribution is paid into the Plan at the same time as the participant contributions are paid into the Plan and are vested as described below.

All eligible Plan participants can make employee pre-tax contributions to the Plan of up to 50% of gross pay, and/or after-tax Roth contributions to the Plan of up to 50% of gross pay, not to exceed a combined total of pre-tax and after-tax Roth contribution of $22,500 in 2023. Effective January 1, 2023, the Plan also permits the automatic enrollment of eligible employees in the Plan 30 days after their hire date, with a contribution of 3% of eligible compensation, unless the employee affirmatively elects otherwise. Plan participants who reached age 50 during the Plan year have the option to make an additional “Catch Up” contribution on a pre-tax basis and/or after-tax Roth basis, not to exceed a combined total of pre-tax and after-tax Roth contributions of $7,500 in 2023

Beginning with dividends paid in 2013, participants and beneficiaries who hold Company common stock in either Granite ESOP Stock Fund or Granite Common Stock Fund have the option for quarterly dividends to automatically reinvest in Company common stock or to be paid as a cash dividend.

Eligible participants who are performing services under a public contract subject to provisions or regulations under the Davis-Bacon Act or any state or municipal “prevailing wage” law or ordinance are eligible to receive a portion of the Fringe Benefit Credit as an Employer Prevailing Wage contribution.

Forfeitures

Company profit sharing contributions to participants leaving employment prior to the vesting of such contributions are forfeited by the participant. Profit sharing forfeitures for each year not used to pay Plan expenses are contributed to participants on a per capita basis for each year in which the participant is employed by the Company as of the year end. The forfeiture account held funds of $5,124 as of December 31, 2023. The forfeiture account held no funds as of December 31, 2022.

F-5

Administrative Expenses

The Company incurs accounting and certain administrative services for the Plan. Fees incurred by the Plan for the investment management services or record keeping services are paid by the Plan participants. Fee credits are generated from the investments in the Plan. These fee credits are allocated from the Plan to eligible participant’s accounts on a quarterly basis.

Participant Accounts

Contributions received by the Plan are deposited with the Plan trustee and custodian, T. Rowe Price Trust Company (“T. Rowe Price”). Each eligible participant’s account balance is credited with an allocation of (a) the Company’s 401(k) match, Prevailing Wage Employer contribution, if eligible, and discretionary profit sharing contributions, if any, (b) Plan earnings or losses, (c) profit sharing forfeitures of terminated participant non-vested accounts, (d) participant contributions, and (e) fee credits. The discretionary profit sharing contributions are allocated based on eligible compensation as defined in the Plan document. Profit sharing forfeitures are allocated to eligible participant accounts in equal amounts as defined in the Plan document.

Notes Receivable from Participants

The Plan allows participants to borrow not less than $1,000 and up to the lesser of $50,000 or 50% of their vested Plan account balance. Notes Receivable from Participants (“Notes Receivable”) bear interest at prime rate plus 1% and must be repaid to the Plan within a five-year period, unless the Note Receivable is used for the purchase of a principal residence in which case the maximum repayment period may be extended not to exceed 15 years. Outstanding Notes Receivable at December 31, 2023 carried interest rates ranging from 3.25% to 9.5%, maturing through October 2037.

Vesting of Benefits

The full amount of the participant’s profit sharing account balance becomes vested on his or her normal retirement date, as defined in the Plan document, or when his or her employment with the Company terminates by reason of death or total disability, or after three years of vesting service is completed as defined in the Plan document.

The value of the participant's elective contribution, Company matching contribution and Prevailing Wage Employer Contributions are fully vested immediately upon contribution to the Plan.

Distributions

On termination of service for any reason, including death or disability, participant’s with a vested benefit of less than $5,000 who fail to provide instructions regarding the payment of their benefit, the benefit will be distributed in the form of a direct rollover to an Individual Retirement Account (“IRA”) maintained by T. Rowe Price (“T. Rowe Price IRA”). Once the benefit has been transferred to the T. Rowe Price IRA, it will be invested in an investment product designed to preserve principal and provide a reasonable rate of return and liquidity. All reasonable fees associated with the T. Rowe Price IRA will be paid from the participant’s account as prescribed in the Plan document.

Participants or beneficiaries, eligible to take distribution may elect to leave their account balance in the Plan or receive their total benefits in a lump-sum, partial distribution, or equal installment payments.

Hardship Withdrawals

The Plan provides for withdrawals in the event of financial hardship, as defined in the Plan document.

Plan Investments

Participants may direct their Plan contributions into any of the designated investment options approved by the Committee. Included in the designated investment options are various mutual funds, common/collective trusts and Company common stock.

Effective January 1, 2016, there was a freeze of new investments in Company common stock, other than the reinvestment of dividends, into the Granite Common Stock Fund.

F-6

| | | | | |

| 2. | Summary of Significant Accounting Policies |

Basis of accounting

The financial statements have been prepared on an accrual basis in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Use of estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and changes therein, and related disclosure of contingent assets and liabilities. The estimates, judgments and assumptions are continually evaluated based on available information and experiences; however, actual results could differ from those estimates.

Investment valuation and income recognition

Investments are stated at fair value. Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurement, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability in the most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC Topic 820 also establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and to minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

• Level 1: Quoted prices in active markets for identical assets or liabilities.

• Level 2: Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

• Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The Plan holds no assets valued using Level 2 and Level 3 inputs.

Units held in the Common/Collective Trust (“CCT”) are valued using the net asset value (“NAV”) practical expedient (“NAV practical expedient”) of the CCT as reported by the CCT managers. The NAV practical expedient is based on the fair value of the underlying assets owned by the CCT, minus its liabilities, and then divided by the number of units outstanding. The NAV practical expedient of a CCT is calculated based on a compilation of primarily observable market information. CCT’s are redeemable daily and have no restrictions, other than the Stable Value Fund (“SVF”) which imposes a 90-day “equity wash” provision on exchanges to competing funds.

All other assets held by the Plan are measured using Level 1 inputs. Common stock is valued at the closing price on the active market on which the individual securities are traded. Mutual funds are valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the U.S. Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

In the Statement of Changes in Net Assets Available for Benefits, the Plan presents the net appreciation or depreciation in the fair value of its investments which consists of the realized gains or losses and unrealized appreciation or depreciation on those investments. Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

F-7

Distributions to participants or beneficiaries

Distributions to participants or beneficiaries are recorded when paid.

Notes Receivable from Participants

Notes Receivable are measured as unpaid principal balance plus any accrued but unpaid interest. Such notes are considered delinquent if any scheduled repayment remains unpaid for a predetermined amount of time based upon the terms of the Plan document. Delinquent notes receivable from participants meeting such terms are reclassified as Deemed Distributions. No allowance for credit losses has been recorded as of December 31, 2023 or 2022.

Risks and uncertainties

The Plan provides for various investment options in any combination of common/collective trusts, mutual funds, Company common stock, or other investment securities which the Administrator may from time to time make available. Investment securities are exposed to various risks, such as interest rate, market fluctuations, and credit risks among others. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in risks in the near term could materially affect participants’ account balances and the amounts reported in the Statement of Net Assets Available for Benefits.

The Plan’s exposure to a concentration of credit risk is limited by the diversification of investments across participant directed fund elections. Additionally, the investments within each investment fund option are further diversified into varied financial instruments, with the exception of the Granite Common Stock Fund, which primarily invests in the securities of a single issuer.

F-8

| | | | | |

| 3. | Fair Value Measurements |

The Plan measures and discloses certain financial assets and liabilities at fair value. As of December 31, 2023 and 2022, the Plan’s valuation methodologies used to measure the fair values of common stock and mutual funds was derived from quoted market prices as substantially all of these instruments have active markets or contain underlying assets that may be so valued. As more fully described in Note 2, CCTs are valued using NAV practical expedient measuring the net asset value of the underlying investments at year end.

The methods described above for measuring fair values as of December 31, 2023 and 2022 may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Administrator believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There have been no changes in the techniques used at December 31, 2023 and 2022.

The following tables summarize each class of the Plan’s investments:

| | | | | | | | | | | | | | |

| Fair Value Measurement at Reporting Date |

| December 31, 2023 | Level 1 | Level 2 | Level 3 | Total |

| Mutual Funds | $ | 153,853,199 | | $ | — | | $ | — | | $ | 153,853,199 | |

| Common Stock | 48,430,884 | | — | | — | | 48,430,884 | |

| Total Assets in the fair value hierarchy | $ | 202,284,083 | | $ | — | | $ | — | | $ | 202,284,083 | |

| | | | |

| Investments measured at NAV practical expedient | | | | 528,487,525 | |

| | | | |

| Investments at fair value | | | | $ | 730,771,608 | |

| | | | | | | | | | | | | | |

| December 31, 2022 | Level 1 | Level 2 | Level 3 | Total |

| Mutual Funds | $ | 119,968,523 | | $ | — | | $ | — | | $ | 119,968,523 | |

| Common Stock | 35,694,919 | | — | | — | | 35,694,919 | |

| Total Assets in the fair value hierarchy | $ | 155,663,442 | | $ | — | | $ | — | | $ | 155,663,442 | |

| | | | |

| Investments measured at NAV practical expedient | | | | 469,387,332 | |

| | | | |

| Investments at fair value | | | | $ | 625,050,774 | |

The Internal Revenue Service (“IRS”) has determined and informed the Company by letter dated July 29, 2014 that the Plan and related trust are designed in accordance with applicable sections of the IRC regarding tax exempt status. The Plan has been amended since receiving this favorable determination letter. The Administrator believes the Plan and the trust which forms a part of the Plan are designed and are currently operated in compliance with the applicable requirements of the IRC, and are thereby exempt from Federal income and State franchise taxes.

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. No uncertain positions have been identified that would require such recognition or disclosure in the financial statements as of December 31, 2023 and 2022. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no such audits.

F-9

| | | | | |

| 5. | Related Party and Party in Interest Transactions |

The Plan provides for investment in Company common stock in the Granite Common Stock Fund and Granite ESOP Stock Fund. Any purchase or sale of Company common stock by administrators is performed in the open market and at fair value. These transactions qualify as party-in-interest transactions but are exempt from prohibited transaction rules. Certain Plan investments are managed by an affiliate of T. Rowe Price, the trustee and custodian of the Plan. Any purchases and sales of these funds are performed in the open market at fair value. Such transactions, while considered party-in-interest transactions under ERISA regulations, are permitted under the provisions of the Plan and are specifically exempt from the prohibition of party-in-interest transactions under ERISA.

Aggregate investment in Company common stock at December 31, 2023 and 2022 for each asset category is as follows:

| | | | | | | | |

| December 31, |

| 2023 | 2022 |

| Granite Common Stock Fund | | |

| Fair Value | $ | 10,898,688 | | $ | 8,159,983 | |

| Number of Shares | 214,288 | 232,677 |

| | |

| Granite ESOP Stock Fund | | |

| Fair Value | $ | 37,532,196 | | $ | 27,534,936 | |

| Number of Shares | 737,951 | 785,142 |

| | |

| Total Company common stock held | | |

| Fair Value | $ | 48,430,884 | | $ | 35,694,919 | |

| Number of Shares | 952,239 | 1,017,819 |

During the year ended December 31, 2023, Granite Common Stock Fund purchased $373,755 and sold $942,182 of Company common stock, and Granite ESOP Stock Fund purchased $2,048,741 and sold $2,310,566 of Company common stock.

Although it has not expressed any intent to do so, the Company may terminate the Plan at any time. In the event of termination of the Plan, all participants who are employed by the Company at the date of termination will become 100% vested in their account balances.

F-10

| | | | | |

| 7. | Reconciliation of Financial Statements to Form 5500 |

The following is a reconciliation of net assets available for benefits per the financial statements at December 31, 2023 and 2022 to the Form 5500:

| | | | | | | | |

| December 31, |

| 2023 | 2022 |

| Net assets available for benefits per the financial statements | $ | 737,084,650 | | $ | 631,094,631 | |

| Amounts allocated to withdrawing participants | (234,729,601) | | (220,944,804) | |

| Net assets available for benefits per the Form 5500 | $ | 502,355,049 | | $ | 410,149,827 | |

The following is a reconciliation of distributions to participants per the financial statements for the year ended December 31, 2023 to the Form 5500:

| | | | | |

| Distributions to participants per the financial statements | $ | 60,089,972 | |

| Amounts allocated to withdrawing participants at December 31, 2023 | 234,729,601 | |

| Amounts allocated to withdrawing participants at December 31, 2022 | (220,944,804) | |

| Distributions to participants per Form 5500 | $ | 73,874,769 | |

The participant vested balances of employees who terminated or retired prior to December 31, 2023, and have not taken a distribution prior to December 31, 2023, are included in benefit claims payable on Schedule H of the Form 5500.

Deemed Distributions directly offset the affected participant’s account balance and are otherwise treated and reported as a Plan distribution to the participant in the current reporting period.

F-11

Granite Construction Profit Sharing and 401(k) Plan

EIN 77-0239383, Plan 001

Schedule H, Line 4(i) - Schedule of Assets (Held At End of Year)

December 31, 2023

| | | | | | | | | | | | | | |

| (a) | (b) | (c) | (d) | (e) |

| Identity of issuer, borrower, lessor or similar party | Description of

investments | Cost(1) | Current Value |

| * | T. Rowe Price Retirement 2025 Tr Fund | Common/Collective Trust | | $ | 66,302,827 | |

| * | T. Rowe Price Retirement 2035 Tr Fund | Common/Collective Trust | | 76,673,157 | |

| * | T. Rowe Price Retirement 2030 Tr Fund | Common/Collective Trust | | 64,380,928 | |

| * | T. Rowe Price Retirement 2040 Tr Fund | Common/Collective Trust | | 69,077,580 | |

| * | T. Rowe Price Stable Value Common Fund N | Common/Collective Trust | | 53,559,501 | |

| * | T. Rowe Price Retirement 2045 Tr Fund | Common/Collective Trust | | 69,475,323 | |

| Vanguard US Growth Admiral Fund | Mutual Fund | | 36,436,392 | |

| * | T. Rowe Price Retirement 2020 Tr Fund | Common/Collective Trust | | 24,526,501 | |

| * | T. Rowe Price Retirement 2050 Tr Fund | Common/Collective Trust | | 47,368,947 | |

| Vanguard Institutional Index Fund | Mutual Fund | | 42,846,582 | |

| * | Granite ESOP Stock Fund | Common Stock | | 37,532,196 | |

| * | T. Rowe Price Retirement 2055 Tr Fund | Common/Collective Trust | | 24,803,347 | |

| Dodge & Cox Income Fund | Mutual Fund | | 9,578,716 | |

| * | T. Rowe Price Retirement 2015 Tr Fund | Common/Collective Trust | | 6,627,898 | |

| J.P. Morgan Mid Cap Value Fund L | Mutual Fund | | 10,990,935 | |

| Vanguard Total Bond Market Index Admiral Fund | Mutual Fund | | 6,401,769 | |

| * | Granite Construction Incorporated Common Stock Fund | Common Stock | | 10,898,688 | |

| * | T. Rowe Price Retirement 2060 Tr Fund | Common/Collective Trust | | 14,593,731 | |

| * | T. Rowe Price Retirement 2065 Tr Fund | Common/Collective Trust | | 4,055,619 | |

| American Funds Europacific Growth Fund R6 | Mutual Fund | | 6,115,307 | |

| Vanguard Total International Stock Index Admiral Fund | Mutual Fund | | 8,332,125 | |

| Vanguard Equity Income Admiral Fund | Mutual Fund | | 12,485,840 | |

| Fidelity Inflation-Protected Bond Index Fund | Mutual Fund | | 2,642,932 | |

| Northern Small Cap Value Fund | Mutual Fund | | 5,951,772 | |

| * | T. Rowe Price Retirement 2010 Tr Fund | Common/Collective Trust | | 4,234,905 | |

| * | T. Rowe Price Retirement Balanced Tr Fund | Common/Collective Trust | | 1,811,264 | |

| Vanguard Extended MKT Index Fund | Mutual Fund | | 5,754,936 | |

| * | T. Rowe Price Retirement 2005 Tr Fund | Common/Collective Trust | | 995,997 | |

| Vanguard FED Money MKT Fund | Mutual Fund | | 5,692,978 | |

| Vanguard Explorer, ADM | Mutual Fund | | 622,915 | |

| Total Investments at Fair Market Value | | | 730,771,608 | |

| * | Participant Loans | 3.25% - 9.5% maturing through October 2037 | | 5,609,619 | |

| Total Investments | | | $ | 736,381,227 | |

| | | | |

| * Known party-in-interest (exempt transactions) | | | |

| (1) Cost information has been omitted with respect to participant directed investments | | | |

S-1

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333-170488, No. 333-181642 and No. 333-256719) of Granite Construction Incorporated of our report dated June 14, 2024, relating to the financial statements and supplementary information of the Plan Granite Construction Profit Sharing and 401(k) Plan (the “Plan”) appearing in this Annual Report on Form 11-K of the Plan for the year ended December 31, 2023.

| | |

| /s/ Moss Adams LLP |

| Moss Adams LLP |

Campbell, California

June 14, 2024

S-2

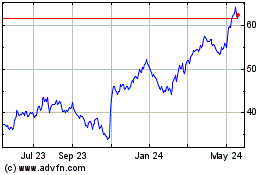

Granite Construction (NYSE:GVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

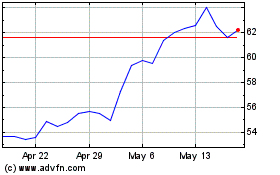

Granite Construction (NYSE:GVA)

Historical Stock Chart

From Nov 2023 to Nov 2024