0001819438False00018194382024-08-142024-08-140001819438wk:CommonStock0.0001ParValuePerShareMember2024-08-142024-08-140001819438wk:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member2024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 14, 2024

ESS TECH, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39525 | | 98-1550150 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

26440 SW Parkway Ave., Bldg. 83 Wilsonville, Oregon | | 97070 |

| (Address of principal executive offices) | | (Zip code) |

(855) 423-9920

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | GWH | | The New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 | | GWH.W | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2024, ESS Tech, Inc. (the “Company”) issued a press release announcing financial results for the quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Item 2.02 and Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit No. | | |

| 99.1 | | |

| 104 | | Cover page interactive data file |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: August 14, 2024

| | | | | |

| ESS TECH, INC. |

| |

| By: | /s/ Anthony Rabb |

| Name: | Anthony Rabb |

| Title: | Chief Financial Officer |

Exhibit 99.1

ESS Tech, Inc. Announces Second Quarter 2024 Financial Results

Finalizing Funding Agreement for up to $50 Million with Export-Import Bank of the United States

Began Production of Second Energy Center for Portland General Electric

Energy Warehouse Becomes First Operational Long-Duration Energy Storage at an Airport

Exited Q2 with Cash and Short-Term Investments over $74 Million; Expected to Carry ESS Well Into 2025

WILSONVILLE, Ore. – August 14, 2024 – ESS Tech, Inc. (“ESS,” “ESS, Inc.” or the “Company”) (NYSE: GWH), a leading manufacturer of long-duration energy storage systems (LDES) for commercial and utility-scale applications, today announced financial results for its second quarter ended June 30, 2024.

“ESS made significant headway in the business in the second quarter and we continue to be encouraged by the growing imperative for Long Duration Energy Storage to be coupled to renewables. Importantly, outside funding is expected to play an important role for not only our operational expansion, but also our partnership with Sacramento Municipal Utility District, or SMUD. First, we are close to finalizing an agreement for up to $50 million in funding from the Export-Import Bank of the United States to expand our manufacturing capacity and expect to add about $10 million to our balance sheet in the second half alone for previously installed capacity. Additionally, our long duration storage project with SMUD has been granted $10 million by the California Energy Commission to further our collaboration. Our progress with our projects across numerous customers in the second quarter also reflects the continued importance of our relationships. In Q2, our Energy Warehouses started charging ground power units at Schiphol airport in Amsterdam, were integrated into Burbank Water and Power’s EcoCampus and connected to a 265 kW solar array, and was selected by Indian Energy, the California Energy Commission and the Department of Defense for testing to deliver energy security to remote communities like tribal nations and military bases,” said Eric Dresselhuys, CEO of ESS. “Although revenue in the second quarter was lower than expected due to the timing of EW shipments due to delays at a key partner, we expect this to resolve itself in the coming weeks, allowing us to ship our products and recover revenue in the third quarter.”

“On the Energy Center front, we remain on schedule with Portland General Electric and continue to expect to ramp EC shipments in the back half of the year. With the first EC currently cycling, we began production of our second unit in July and expect these to be connected to the grid by late 2024. In parallel, we have positioned our operations to begin building the first ECs for commercial deliveries to Tampa Electric and SMUD later this month. Our plan to transition to volume manufacturing and shipments remains solidly on track and we continue to expect to achieve our goal of growing our revenue by three to four times in 2024.”

Recent Business Highlights

•An Energy Warehouse™ (EW) system at Schiphol Airport in Amsterdam, the second largest airport in mainland Europe, became the first iron flow battery to be operational at an airport. This EW will be used to help advance Schiphol Airport’s sustainability strategy and has now been tested on Schiphol’s AB platform. The EW system has begun to be used to recharge Electric Ground Power Units (E-GPU), which are intended to replace the diesel ground power units currently used to supply electrical power to aircraft when parked at airport gates.

•The California Energy Commission, or CEC, awarded a $10 million grant to a long-duration battery storage project in partnership with ESS and Sacramento Municipal Utility District, or SMUD. The CEC funding will be used to demonstrate a 3.6 MW, 8-hour iron flow battery project, with SMUD committing an additional $19.5 million to cover additional other costs for the LDES project.

•We are finalizing the details to close agreement with the Export-Import Bank of the United States, or EXIM, for up to $50 million in funding provided by the Make More in America Initiative. This funding is long-term, low interest, and non-dilutive capital to finance expanding manufacturing capacity, enabling ESS to immediately add to our cash position, borrowing about $10 million on a lookback basis for previously installed capacity. Later this year, the funding is planned to be used for the addition of our second manufacturing line, which is expected to triple our production capacity.

•Indian Energy, a Native American-owned microgrid developer and integrator, the CEC, and the Department of Defense together selected ESS’ iron flow batteries to demonstrate the diverse capabilities of LDES technologies for utility-scale, resilient microgrids and their ability to deliver energy security to remote communities like tribal nations and military bases. Over the coming months, our project partners are expecting to demonstrate optimal use cases in the California energy market, including solar peak shifting and grid ancillary services, after which we expect our EW to be placed into commercial operation.

•We began building our second EC in July, which we plan to deploy beside the first EC, both for Portland General Electric. We expect to start building and shipping our first commercial ECs in the second half of 2024 for delivery to Tampa Electric and the Sacramento Municipal Utility District, or SMUD.

•We filed our definitive proxy statement with the SEC on August 8, 2024 to execute a reverse split, following a listing notice from the NYSE received in March. We will hold our special shareholders meetings on August 23rd and, once having effected the split in late August, we expect to be in compliance with the listing requirements and will continue our operations as a publicly-listed company.

Conference Call Details

ESS will hold a conference call on Wednesday, August 14, 2024 at 5:00 p.m. EDT to discuss financial results for its second quarter 2024 ended June 30, 2024. Interested parties may join the conference call beginning at 5:00 p.m. EDT on Wednesday, August 14, 2024 via telephone by calling (833) 470-1428 in the U.S., or for international callers, by calling +1 (404) 975-4839 and entering conference ID 366142. A telephone replay will be available until August 21, 2024, by dialing (866) 813-9403 in the U.S., or for international callers, +1 (929) 458-6194 with conference ID 167636. A live webcast of the conference call will be available on ESS’ Investor Relations website at http://investors.essinc.com/.

A replay of the call will be available via the web at http://investors.essinc.com/.

About ESS, Inc.

At ESS (NYSE: GWH), our mission is to accelerate global decarbonization by providing safe, sustainable, long-duration energy storage that powers people, communities and businesses with clean, renewable energy anytime and anywhere it’s needed. As more renewable energy is added to the grid, long-duration energy storage is essential to providing the reliability and resiliency we need when the sun is not shining and the wind is not blowing.

Our technology uses earth-abundant iron, salt and water to deliver environmentally safe solutions capable of providing up to 12 hours of flexible energy capacity for commercial and utility-scale energy storage applications. Established in 2011, ESS, Inc. enables project developers, independent power producers, utilities and other large energy users to deploy reliable, sustainable long-duration energy storage solutions. For more information visit www.essinc.com.

Use of Non-GAAP Financial Measures

In this press release and the accompanying earnings call, the Company includes Non-GAAP Operating Expenses and Adjusted EBITDA, which are non-GAAP performance measures that the Company uses to supplement its results presented in accordance with U.S. GAAP. As required by the rules of the Securities and Exchange Commission (“SEC”), the Company has provided herein a reconciliation of the non-GAAP financial measures contained in this press release and the accompanying earnings call to the most directly comparable measures under GAAP. The Company’s management believes Non-GAAP Operating Expenses and Adjusted EBITDA are useful in evaluating its operating performance and are similar measures reported by publicly-listed U.S. companies, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. By providing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s profitability for the periods presented. Adjusted EBITDA is not intended to be a substitute for net income/loss or any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. Further, Non-GAAP Operating Expenses are not intended to be a substitute for GAAP Operating Expenses or any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

The Company defines and calculates Non-GAAP Operating Expenses as GAAP Operating Expenses adjusted for stock-based compensation and other special items determined by management as they are not indicative of business operations. The Company defines and calculates Adjusted EBITDA as net loss before interest, other non-operating expense or income, (benefit) provision for income taxes, and depreciation and amortization, and further adjusted for stock-based compensation and other special items determined by management, including, but not limited to, fair value adjustments for certain financial liabilities associated with debt and equity transactions as they are not indicative of business operations.

Forward-Looking Statements

This communication contains certain forward-looking statements, including statements regarding ESS and its management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. The words “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intends”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “will” and “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Examples of forward-looking statements include, among others, statements regarding the Company’s manufacturing plans, the Company’s order and sales pipeline, the Company’s ability to execute on orders, the Company’s ability to effectively manage costs, the Company’s partnerships with third parties such as Amsterdam Airport Schiphol, Burbank Water and Power, and the Sacramento Municipal Utility District and the finalization of the EXIM loan. These forward-looking statements are based on ESS’ current expectations and beliefs concerning future developments and their potential effects on ESS. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication. There can be no assurance that the future developments affecting ESS will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond ESS control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, which include, but are not limited to, continuing supply chain issues; delays, disruptions, or quality control problems in the Company’s manufacturing operations; the Company’s ability to hire, train and retain an adequate number of manufacturing employees; issues related to the shipment and installation of the Company’s products; issues related to customer acceptance of the Company’s products; issues related to the Company’s partnerships with third parties; inflationary pressures; risk of loss of government funding for customer projects; and the Company’s need to achieve significant business growth to achieve sustained, long-term profitability. Except as required by law, ESS is not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Contacts

Investors:

Erik Bylin

investors@essinc.com

Media:

Morgan Pitts

503.568.0755

Morgan.Pitts@essinc.com

Source: ESS Tech, Inc.

ESS Tech, Inc.

Condensed Statements of Operations and Comprehensive Loss

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | | |

| Revenue | | $ | 342 | | | $ | 2,826 | | | $ | 2,556 | | | $ | 3,197 | |

| Revenue - related parties | | 6 | | | 1 | | | 530 | | | $ | 2 | |

| Total revenue | | 348 | | | 2,827 | | | 3,086 | | | $ | 3,199 | |

| Cost of revenue | | 11,748 | | | — | | | 22,874 | | | — | |

| Gross profit (loss) | | (11,400) | | | 2,827 | | | (19,788) | | | 3,199 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 2,836 | | | 19,450 | | | 6,382 | | | 37,181 | |

| Sales and marketing | | 2,711 | | | 1,739 | | | 4,745 | | | 3,592 | |

| General and administrative | | 6,178 | | | 5,845 | | | 11,704 | | | 11,132 | |

| Total operating expenses | | 11,725 | | | 27,034 | | | 22,831 | | | 51,905 | |

| Loss from operations | | (23,125) | | | (24,207) | | | (42,619) | | | (48,706) | |

| Other income (expenses), net: | | | | | | | | |

| Interest income, net | | 1,052 | | | 1,330 | | | 2,291 | | | 2,582 | |

| Gain (loss) on revaluation of common stock warrant liabilities | | 115 | | | (115) | | | 115 | | | 573 | |

| Other income (expense), net | | 18 | | | 63 | | | (37) | | | 721 | |

| Total other income, net | | 1,185 | | | 1,278 | | | 2,369 | | | 3,876 | |

| Net loss and comprehensive loss to common stockholders | | $ | (21,940) | | | $ | (22,929) | | | $ | (40,250) | | | $ | (44,830) | |

| | | | | | | | |

| Net loss per share - basic and diluted | | $ | (0.12) | | | $ | (0.15) | | | $ | (0.23) | | | $ | (0.29) | |

| | | | | | | | |

| Weighted-average shares used in per share calculation - basic and diluted | | 175,758,584 | | | 154,900,330 | | | 175,136,561 | | | 154,514,265 | |

ESS Tech, Inc.

Condensed Balance Sheets

(unaudited)

(in thousands, except share data)

| | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 36,744 | | | $ | 20,165 | |

| Restricted cash, current | 906 | | | 1,373 | |

| Accounts receivable, net | 981 | | | 1,990 | |

| Short-term investments | 37,695 | | | 87,899 | |

| Inventory | 4,425 | | | 3,366 | |

| Prepaid expenses and other current assets | 3,908 | | | 3,305 | |

| Total current assets | 84,659 | | | 118,098 | |

| Property and equipment, net | 17,758 | | | 16,266 | |

| Intangible assets, net | 4,790 | | | 4,923 | |

| Operating lease right-of-use assets | 2,195 | | | 2,167 | |

| Restricted cash, non-current | 946 | | | 945 | |

| Other non-current assets | 785 | | | 833 | |

| Total assets | $ | 111,133 | | | $ | 143,232 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 5,833 | | | $ | 2,755 | |

| Accrued and other current liabilities | 9,669 | | | 10,755 | |

| Accrued product warranties | 3,240 | | | 2,129 | |

| Operating lease liabilities, current | 1,572 | | | 1,581 | |

| Deferred revenue, current | 5,689 | | | 2,546 | |

| Total current liabilities | 26,003 | | | 19,766 | |

| Operating lease liabilities, non-current | 884 | | | 957 | |

| Deferred revenue, non-current | — | | | 3,835 | |

| Deferred revenue, non-current - related parties | 14,400 | | | 14,400 | |

| Common stock warrant liabilities | 802 | | | 917 | |

| Other non-current liabilities | — | | | — | |

| Total liabilities | 42,089 | | | 39,875 | |

| Stockholders' equity: | | | |

Preferred stock ($0.0001 par value; 200,000,000 shares authorized, none issued and outstanding as of June 30, 2024 and December 31, 2023) | — | | | — | |

Common stock ($0.0001 par value; 2,000,000,000 shares authorized, 176,822,039 and 174,211,911 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively) | 18 | | | 18 | |

| Additional paid-in capital | 805,433 | | | 799,496 | |

| Accumulated deficit | (736,407) | | | (696,157) | |

| Total stockholders' equity | 69,044 | | | 103,357 | |

| Total liabilities and stockholders' equity | $ | 111,133 | | | $ | 143,232 | |

ESS Tech, Inc.

Condensed Statements of Cash Flows

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (40,250) | | | $ | (44,830) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 2,521 | | | 2,105 | |

| Non-cash interest income | (1,573) | | (1,487) | |

| Non-cash lease expense | 658 | | 604 | |

| Stock-based compensation expense | 5,880 | | | 4,784 | |

| Inventory write-down and losses on noncancellable purchase commitments | 1,530 | | | — | |

| Change in fair value of common stock warrant liabilities | (115) | | | (573) | |

| Other non-cash (income) expenses, net | 25 | | | (33) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 1,526 | | | 4,653 | |

| Inventory | (2,875) | | | — | |

| Prepaid expenses and other current assets | (555) | | | 2,561 | |

| Accounts payable | 1,925 | | | (664) | |

| Accrued and other current liabilities | (1,962) | | | (4,234) | |

| Accrued product warranties | 1,111 | | | 3,460 | |

| Deferred revenue | (1,209) | | | (3,189) | |

| Operating lease liabilities | (768) | | | (689) | |

| Net cash used in operating activities | (34,131) | | | (37,532) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (1,565) | | | (3,440) | |

| Maturities and purchases of short-term investments, net | 51,752 | | | 37,363 | |

| Net cash provided by investing activities | 50,187 | | | 33,923 | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| Payments on notes payable | — | | | (800) | |

| Proceeds from stock options exercised | 21 | | | 122 | |

| Repurchase of shares from employees for income tax withholding purposes | (178) | | | (82) | |

| Proceeds from contributions to Employee Stock Purchase Plan | 214 | | | 332 | |

| Other, net | — | | | (14) | |

| Net cash provided by (used in) financing activities | 57 | | | (442) | |

| | | |

| Net change in cash, cash equivalents and restricted cash | 16,113 | | | (4,051) | |

| Cash, cash equivalents and restricted cash, beginning of period | 22,483 | | | 36,655 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 38,596 | | | $ | 32,604 | |

ESS Tech, Inc.

Condensed Statements of Cash Flows (continued)

(unaudited)

(in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for operating leases included in cash used in operating activities | $ | 874 | | | $ | 827 | |

| Non-cash investing and financing transactions: | | | |

| Purchase of property and equipment included in accounts payable and accrued and other current liabilities | 1,970 | | | 931 | |

| | | |

| | | |

| Transfers between inventory and property and equipment, net | 1,051 | | | — | |

| | | |

| Cash and cash equivalents | $ | 36,744 | | | $ | 30,287 | |

| Restricted cash, current | 906 | | | 1,373 | |

| Restricted cash, non-current | 946 | | | 944 | |

| Total cash, cash equivalents and restricted cash shown in the condensed statements of cash flows | $ | 38,596 | | | $ | 32,604 | |

ESS Tech, Inc.

Reconciliation of GAAP to Non-GAAP Operating Expenses

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Research and development | | $ | 2,836 | | | $ | 19,450 | | | $ | 6,382 | | | $ | 37,181 | |

| Less: stock-based compensation | | (908) | | | (1,130) | | | (1,309) | | | (2,123) | |

| Non-GAAP research and development | | $ | 1,928 | | | $ | 18,320 | | | $ | 5,073 | | | $ | 35,058 | |

| | | | | | | | |

| Sales and marketing | | $ | 2,711 | | | 1,739 | | | $ | 4,745 | | | $ | 3,592 | |

| Less: stock-based compensation | | (163) | | | (165) | | | (258) | | | (315) | |

| Non-GAAP sales and marketing | | $ | 2,548 | | | $ | 1,574 | | | $ | 4,487 | | | $ | 3,277 | |

| | | | | | | | |

| General and administrative | | $ | 6,178 | | | $ | 5,845 | | | $ | 11,704 | | | $ | 11,132 | |

| Less: stock-based compensation | | (1,540) | | | (1,430) | | | (2,974) | | | (2,346) | |

| Non-GAAP general and administrative | | $ | 4,638 | | | $ | 4,415 | | | $ | 8,730 | | | $ | 8,786 | |

| | | | | | | | |

| Total operating expenses | | $ | 11,725 | | | $ | 27,034 | | | $ | 22,831 | | | $ | 51,905 | |

| Less: stock-based compensation | | (2,611) | | | (2,725) | | | (4,541) | | | (4,784) | |

| Non-GAAP total operating expenses | | $ | 9,114 | | | $ | 24,309 | | | $ | 18,290 | | | $ | 47,121 | |

ESS Tech, Inc.

Reconciliation of GAAP Net Loss to Adjusted EBITDA

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | | | | $ | (21,940) | | | $ | (22,929) | | | $ | (40,250) | | | $ | (44,830) | |

| Interest income, net | | | | (1,052) | | | (1,330) | | | (2,291) | | | (2,582) | |

| Stock-based compensation | | | | 3,026 | | | 2,725 | | | 5,880 | | | 4,784 | |

| Depreciation and amortization | | | | 1,302 | | | 1,028 | | | 2,521 | | | 2,105 | |

| Gain (loss) on revaluation of common stock warrant liabilities | | | | (115) | | | 115 | | | (115) | | | (573) | |

| Other income (expense), net | | | | (18) | | | (63) | | | 37 | | | (721) | |

| Adjusted EBITDA | | | | $ | (18,797) | | | $ | (20,454) | | | $ | (34,218) | | | $ | (41,817) | |

v3.24.2.u1

Cover

|

Aug. 14, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity Registrant Name |

ESS TECH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39525

|

| Entity Tax Identification Number |

98-1550150

|

| Entity Address, Address Line One |

26440 SW Parkway Ave.

|

| Entity Address, Address Line Two |

Bldg. 83

|

| Entity Address, City or Town |

Wilsonville

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97070

|

| City Area Code |

855

|

| Local Phone Number |

423-9920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819438

|

| Amendment Flag |

false

|

| Common Stock 0.0001 Par Value Per Share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GWH

|

| Security Exchange Name |

NYSE

|

| Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

GWH.W

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wk_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

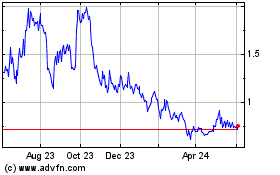

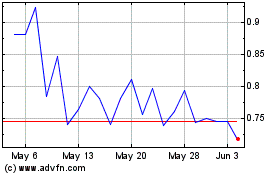

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Feb 2025 to Mar 2025

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Mar 2024 to Mar 2025