HEICO Corporation Announces Its Largest Acquisition

August 18 2017 - 7:00AM

Business Wire

Signs Agreement to Buy AeroAntenna

Technology, Inc.

HEICO Corporation (NYSE:HEI.A) (NYSE:HEI) announced today that

its Electronic Technologies Group entered into a stock purchase

agreement to acquire 100% of the stock of AeroAntenna Technology

Inc. (“AAT”).

Chatsworth, CA-based AAT is a leader in the design and

production of high performance active antenna systems for critical

defense applications, precision guided munitions, commercial

aircraft and other commercial uses. AAT is a known leader in

numerous antenna types, including GPS, aircraft navigation and

satellite communications antennas.

HEICO stated the purchase price is $316.5 million in cash to be

paid at closing, subject to typical post-closing adjustments, and a

$20 million cash earnout payment if AAT meets its earnings targets.

This transaction is the largest purchase in HEICO’s history. The

purchase price includes approximately $37 million to compensate the

sellers for certain tax elections which will result in a net cash

tax benefit to HEICO worth at least that amount.

HEICO expects the acquisition to be accretive to its earnings

within the first year following closing and stated that the

purchase price falls within the typical earnings multiple the

Company targets for acquisitions. HEICO will finance the purchase

through its cash balances and existing revolving credit facility.

Additional financial details were not disclosed.

Founded in 1991 by Yosef (“Joe”) Klein, AAT has developed a

recognized brand name in its industry through its unique product

offering and continuously innovative research and development

platform.

AAT employs approximately 140 people at its 30,000 square foot

facility in Chatsworth, CA. HEICO stated that AAT would continue to

operate in the same location with current management in place. No

material staff turnover is expected post-acquisition.

Laurans A. Mendelson, Chairman and Chief Executive Officer of

HEICO Corporation, along with Victor H. Mendelson, HEICO’s

Co-President and Chief Executive Officer of the Electronics

Technologies Group, jointly commented, “AAT is a great fit for

HEICO. Their commitment to the highest quality antennas and focus

on customer needs have been the key ingredients to their long-term

success. These principles are an important part of HEICO’s DNA and

we are excited to partner with a like-minded organization. We are

also fortunate that AAT has an outstanding management team lead by

its founder and President, Joe Klein. We welcome Joe and his entire

AAT team to the HEICO family.”

Joe Klein, AAT’s President, remarked, “We are thrilled to

partner with HEICO. From the moment we met, there was an immediate

chemistry between our two teams. I could not be more excited to

join the HEICO team and look forward to the future.”

The transaction is subject to clearance under the

Hart-Scott-Rodino Antitrust Improvements Act and other customary

closing conditions. Closing is expected promptly after receipt of

antitrust clearance and satisfaction of the closing conditions.

HEICO Corporation is engaged primarily in the design,

production, servicing and distribution of products and services to

certain niche segments of the aviation, defense, space, medical,

telecommunications and electronics industries through its

Hollywood, Florida-based Flight Support Group and its Miami,

Florida-based Electronic Technologies Group. HEICO’s customers

include a majority of the world’s airlines and overhaul shops, as

well as numerous defense and space contractors and military

agencies worldwide, in addition to medical, telecommunications and

electronics equipment manufacturers. For more information about

HEICO, please visit our website at http://www.heico.com.

Certain statements in this press release constitute

forward-looking statements, which are subject to risks,

uncertainties and contingencies. HEICO's actual results may differ

materially from those expressed in or implied by those

forward-looking statements as a result of factors including: lower

demand for commercial air travel or airline fleet changes or

airline purchasing decisions, which could cause lower demand for

our goods and services; product specification costs and

requirements, which could cause an increase to our costs to

complete contracts; governmental and regulatory demands, export

policies and restrictions, reductions in defense, space or homeland

security spending by U.S. and/or foreign customers or competition

from existing and new competitors, which could reduce our sales;

our ability to introduce new products and services at profitable

pricing levels, which could reduce our sales or sales growth;

product development or manufacturing difficulties, which could

increase our product development costs and delay sales; our ability

to make acquisitions and achieve operating synergies from acquired

businesses; customer credit risk; interest, foreign currency

exchange and income tax rates; economic conditions within and

outside of the aviation, defense, space, medical,

telecommunications and electronics industries, which could

negatively impact our costs and revenues; and defense budget cuts,

which could reduce our defense-related revenue. Parties receiving

this material are encouraged to review all of HEICO's filings with

the Securities and Exchange Commission, including, but not limited

to filings on Form 10-K, Form 10-Q and Form 8-K. We undertake no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except to the extent required by applicable law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170818005097/en/

HEICO CorporationVictor H. Mendelson, 305-374-1745orCarlos L.

Macau, Jr., 954-987-4000

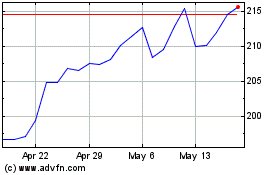

HEICO (NYSE:HEI)

Historical Stock Chart

From Oct 2024 to Nov 2024

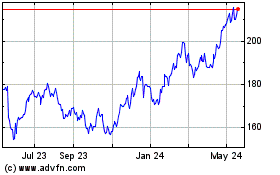

HEICO (NYSE:HEI)

Historical Stock Chart

From Nov 2023 to Nov 2024