0001674168FALSE00016741682024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________

FORM 8-K

_________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 8, 2024

_________________________________________________

Hilton Grand Vacations Inc.

(Exact Name of Registrant as Specified in its Charter)

_________________________________________________

| | | | | | | | |

| Delaware | 001-37794 | 81-2545345 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

6355 MetroWest Boulevard, Suite 180 Orlando, Florida | 32835 |

(Address of principal executive offices) | (Zip Code) |

(407) 613-3100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | HGV | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Hilton Grand Vacations Inc. (the “Company”) issued a press release announcing the results of the Company’s operations for the quarter ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information under this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| Exhibit 99.1 | | |

| Exhibit 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| HILTON GRAND VACATIONS INC. |

| | |

| By: | /s/ Daniel J. Mathewes |

| | Daniel J. Mathewes |

| | President and Chief Financial Officer |

Date: August 8, 2024

Exhibit 99.1

| | | | | | | | |

| Investor Contact: Mark Melnyk 407-613-3327 mark.melnyk@hgv.com | Media Contact: Lauren George 407-613-8431 lauren.george@hgv.com |

FOR IMMEDIATE RELEASE

Hilton Grand Vacations Reports Second Quarter 2024 Results

ORLANDO, Fla. (Aug. 8, 2024) – Hilton Grand Vacations Inc. (NYSE: HGV) (“HGV” or “the Company”) today reports its second quarter 2024 results.

Second quarter of 2024 highlights1

•Total contract sales were $757 million.

•Member count was 720,000. Net Owner Growth (NOG) for the legacy HGV-DRI business for the 12 months ended June 30, 2024, was 1.7%.

•Total revenues for the second quarter of 2024 were $1.235 billion compared to $1.007 billion for the same period in 2023.

◦Total revenues were affected by a net deferral of $13 million in the current period compared to a net deferral of $6 million in the same period in 2023.

•Net income attributable to stockholders for the second quarter was $2 million compared to $80 million net income attributable to stockholders for the same period in 2023.

◦Adjusted net income attributable to stockholders for the second quarter was $65 million compared to $95 million for the same period in 2023.

◦Net income attributable to stockholders and adjusted net income attributable to stockholders were affected by a net deferral of $8 million in the current period compared to a net deferral of $4 million in the same period in 2023.

•Diluted EPS for the second quarter was $0.02 compared to $0.71 for the same period in 2023.

◦Adjusted diluted EPS for the second quarter was $0.62 compared to $0.85 for the same period in 2023.

◦Diluted EPS and adjusted diluted EPS were affected by a net deferral of $8 million in the current period compared to a net deferral of $4 million in the same period in 2023, or $(0.08) and $(0.04) per share in the current period and the same period in 2023, respectively.

•Adjusted EBITDA attributable to stockholders for the second quarter was $262 million compared to $248 million for the same period in 2023.

◦Adjusted EBITDA attributable to stockholders was affected by a net deferral of $8 million in the current period compared to a net deferral of $4 million in the same period in 2023.

•During the second quarter, the Company repurchased 2.3 million shares of common stock for $100 million.

◦Through July 31, 2024, the Company has repurchased approximately 1.1 million shares for $46 million and currently has $114 million of remaining availability under the 2023 Share Repurchase Plan.

◦On Aug. 7, 2024, HGV’s Board of Directors approved a new share repurchase program authorizing the Company to repurchase up to an aggregate of $500 million of its outstanding shares of common stock over a two-year period (the “2024 Repurchase Plan”), which is in addition to the amount remaining under the 2023 Share Repurchase Plan.

•The Company is updating its guidance for the full year 2024 Adjusted EBITDA, excluding deferrals and recognitions, to a range of $1.075 billion to $1.135 billion, or a reduction of $125 million from its prior guidance range.

“Our results were below expectations this quarter, as we experienced some sales challenges along with a pullback in consumer spending behavior late in the quarter,” said Mark Wang, CEO of Hilton Grand Vacations. “While we aren’t satisfied with our performance, we’ve identified and are addressing those challenges, and I remain confident in our business and our long-term path. Our integration remains on track, and our underlying business fundamentals are solid – with more members, more geographic diversity, and more free cash flow than we’ve ever had.”

1.The Company’s current period results and prior year results include impacts related to deferrals of revenues and direct expenses related to the Sales of VOIs under construction that are recognized when construction is complete. These impacts are reflected in the sub-bullets.

Overview

On Jan. 17, 2024, HGV completed the acquisition of Bluegreen Vacations Holding Corporation (“Bluegreen” or “Bluegreen Vacations”).

For the quarter ended June 30, 2024, diluted EPS was $0.02 compared to $0.71 for the quarter ended June 30, 2023. Net income attributable to stockholders and Adjusted EBITDA attributable to stockholders were $2 million and $262 million, respectively, for the quarter ended June 30, 2024, compared to net income attributable to stockholders and Adjusted EBITDA attributable to stockholders of $80 million and $248 million, respectively, for the quarter ended June 30, 2023. Total revenues for the quarter ended June 30, 2024, were $1,235 million compared to $1,007 million for the quarter ended June 30, 2023.

Net income attributable to stockholders and Adjusted EBITDA attributable to stockholders for the quarter ended June 30, 2024, included a net deferral of $8 million relating to the sales of intervals of a project under construction in Hawaii during the period. The Company anticipates recognizing revenues and related expenses for projects in Hawaii in 2024 when it expects to complete these projects and recognize the net deferral impacts.

Consolidated Segment Highlights – Second quarter of 2024

Real Estate Sales and Financing

For the quarter ended June 30, 2024, Real Estate Sales and Financing segment revenues were $740 million, an increase of $136 million compared to the quarter ended June 30, 2023. Real Estate Sales and Financing segment Adjusted EBITDA and Adjusted EBITDA profit margin were $193 million and 26.1%, respectively, for the quarter ended June 30, 2024, compared to $189 million and 31.3%, respectively, for the quarter ended June 30, 2023. Real Estate Sales and Financing segment revenues results in the second quarter of 2024 increased primarily due to a $93 million increase in sales revenue and a $26 million increase in financing revenue.

Real Estate Sales and Financing segment Adjusted EBITDA reflects a net construction deferral of $8 million for the quarter ended June 30, 2024, compared to $4 million net construction deferrals for the quarter ended June 30, 2023, both of which decreased reported Adjusted EBITDA attributable to stockholders.

Contract sales for the quarter ended June 30, 2024, increased $145 million to $757 million compared to the quarter ended June 30, 2023. For the quarter ended June 30, 2024, tours increased by 39.4% and VPG decreased by 10.9% compared to the quarter ended June 30, 2023. For the quarter ended June 30, 2024, fee-for-service contract sales represented 19.5% of contract sales compared to 29.5% for the quarter ended June 30, 2023.

Financing revenues for the quarter ended June 30, 2024, increased by $26 million compared to the quarter ended June 30, 2023. This was driven primarily by an increase in the weighted average interest rate of 50 basis points for the originated portfolio and an increase in the carrying balance of the timeshare financing receivables portfolio as of June 30, 2024, compared to June 30, 2023.

Resort Operations and Club Management

For the quarter ended June 30, 2024, Resort Operations and Club Management segment revenue was $386 million, an increase of $66 million compared to the quarter ended June 30, 2023. Resort Operations and Club Management segment Adjusted EBITDA and Adjusted EBITDA profit margin were $152 million and 39.4%, respectively, for the quarter ended June 30, 2024, compared to $123 million and 38.4%, respectively, for the quarter ended June 30, 2023, primarily due to an increase in management fees and higher average daily rates, partially offset by an increase in development and maintenance fees compared to the same period in 2023.

Inventory

The estimated value of the Company’s total contract sales pipeline is $12.8 billion at current pricing.

The total pipeline includes $8.7 billion of sales relating to inventory that is currently available for sale at open or soon-to-open projects. The remaining $4.1 billion of sales is related to inventory at new or existing projects that will become available for sale in the future upon registration, delivery or construction.

Owned inventory represents 90.0% of the Company’s total pipeline. Approximately 68.7% of the owned inventory pipeline is currently available for sale.

Fee-for-service inventory represents 10.0% of the Company’s total pipeline. Approximately 61.5% of the fee-for-service inventory pipeline is currently available for sale.

Balance Sheet and Liquidity

Total cash and cash equivalents were $328 million and total restricted cash was $273 million as of June 30, 2024.

As of June 30, 2024, the Company had $4,885 million of corporate debt, net outstanding with a weighted average interest rate of 6.850% and $1,725 million of non-recourse debt, net outstanding with a weighted average interest rate of 5.075%.

As of June 30, 2024, the Company’s liquidity position consisted of $328 million of unrestricted cash and $446 million remaining borrowing capacity under the revolver facility.

As of June 30, 2024, HGV has $750 million remaining borrowing capacity in total under the Timeshare Facility. Of this amount, HGV has $647 million of mortgage notes that are available to be securitized and another $324 million of mortgage notes that the Company expects will become eligible as soon as it meets typical milestones, including receipt of first payment, deeding or recording.

Free cash flow was $95 million for the quarter ended June 30, 2024, compared to $180 million for the same period in the prior year. Adjusted free cash flow was $370 million for the quarter ended June 30, 2024, compared to $(13) million for the same period in the prior year. Adjusted free cash flow for the quarter ended June 30, 2024, and 2023 includes add-backs of $62 million and $22 million, respectively for acquisition and integration related costs and $13 million related to litigation settlement payment for the quarter ended June 30, 2024.

As of June 30, 2024, the Company’s total net leverage on a trailing 12-month basis, inclusive of all anticipated cost synergies, was approximately 3.67x.

Total Construction Deferrals and/or Recognitions Included in Results Reported Under Accounting Standards Codification Topic 606 (“ASC 606”)

The Company’s Adjusted EBITDA as reported under ASC 606 includes construction-related recognitions and deferrals of revenues and related expenses as detailed in Table T-1 below. Under ASC 606, the Company defers revenues and related expenses pertaining to sales at projects that occur during periods when that project is under construction until the period when construction is completed.

T-1

NET CONSTRUCTION DEFERRAL ACTIVITY

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 |

| NET CONSTRUCTION DEFERRAL ACTIVITY | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Full

Year |

Sales of VOIs recognitions (deferrals) | | $ | 2 | | | $ | (13) | | | $ | — | | | $ | — | | | $ | (11) | |

Cost of VOI sales (deferrals)(1) | | (1) | | | (4) | | | — | | | — | | | (5) | |

Sales and marketing expense (deferrals) | | — | | | (1) | | | — | | | — | | | (1) | |

Net construction recognitions (deferrals)(2) | | $ | 3 | | | $ | (8) | | | $ | — | | | $ | — | | | $ | (5) | |

| | | | | | | | | | |

Net (loss) income attributable to stockholders | | $ | (4) | | | $ | 2 | | | $ | — | | | $ | — | | | $ | (2) | |

Net income attributable to noncontrolling interest | | 2 | | | 2 | | | — | | | — | | | 4 | |

Net (loss) income | | (2) | | | 4 | | | — | | | — | | | 2 | |

| Interest expense | | 79 | | | 87 | | | — | | | — | | | 166 | |

Income tax (benefit) expense | | (11) | | | 3 | | | — | | | — | | | (8) | |

| Depreciation and amortization | | 62 | | | 68 | | | — | | | — | | | 130 | |

| Interest expense and depreciation and amortization included in equity in earnings from unconsolidated affiliates | | 1 | | | 2 | | | — | | | — | | | 3 | |

| EBITDA | | 129 | | | 164 | | | — | | | — | | | 293 | |

Other loss, net | | 5 | | | 3 | | | — | | | — | | | 8 | |

| Share-based compensation expense | | 9 | | | 18 | | | — | | | — | | | 27 | |

| Acquisition and integration-related expense | | 109 | | | 48 | | | — | | | — | | | 157 | |

| Impairment expense | | 2 | | | — | | | — | | | — | | | 2 | |

Other adjustment items(3) | | 22 | | | 33 | | | — | | | — | | | 55 | |

| Adjusted EBITDA | | 276 | | | 266 | | | — | | | — | | | 542 | |

| Adjusted EBITDA attributable to noncontrolling interest | | 3 | | | 4 | | | — | | | — | | | 7 | |

| Adjusted EBITDA attributable to stockholders | | $ | 273 | | | $ | 262 | | | $ | — | | | $ | — | | | $ | 535 | |

T-1

NET CONSTRUCTION DEFERRAL ACTIVITY

(CONTINUED, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 |

| NET CONSTRUCTION DEFERRAL ACTIVITY | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Full

Year |

Sales of VOIs recognitions (deferrals) | | $ | 4 | | | $ | (6) | | | $ | (12) | | | $ | (21) | | | $ | (35) | |

Cost of VOI sales recognitions (deferrals)(1) | | 1 | | | (1) | | | (3) | | | (6) | | | (9) | |

Sales and marketing expense recognitions (deferrals) | | 1 | | | (1) | | | (2) | | | (3) | | | (5) | |

Net construction recognitions (deferrals)(2) | | $ | 2 | | | $ | (4) | | | $ | (7) | | | $ | (12) | | | $ | (21) | |

| | | | | | | | | | |

Net income attributable to stockholders | | $ | 73 | | | $ | 80 | | | $ | 92 | | | $ | 68 | | | $ | 313 | |

Net income attributable to noncontrolling interest | | — | | | — | | | — | | | — | | | — | |

Net income | | 73 | | | 80 | | | 92 | | | 68 | | | 313 | |

| Interest expense | | 44 | | | 44 | | | 45 | | | 45 | | | 178 | |

| Income tax expense | | 17 | | | 35 | | | 44 | | | 40 | | | 136 | |

| Depreciation and amortization | | 51 | | | 52 | | | 53 | | | 57 | | | 213 | |

| Interest expense and depreciation and amortization included in equity in earnings from unconsolidated affiliates | | — | | | 1 | | | — | | | 1 | | | 2 | |

| EBITDA | | 185 | | | 212 | | | 234 | | | 211 | | | 842 | |

| Other (gain) loss, net | | (1) | | | (3) | | | 1 | | | 1 | | | (2) | |

| Share-based compensation expense | | 10 | | | 16 | | | 12 | | | 2 | | | 40 | |

| Acquisition and integration-related expense | | 17 | | | 13 | | | 12 | | | 26 | | | 68 | |

Impairment expense | | — | | | 3 | | | — | | | — | | | 3 | |

Other adjustment items(3) | | 7 | | | 7 | | | 10 | | | 30 | | | 54 | |

| Adjusted EBITDA | | 218 | | | 248 | | | 269 | | | 270 | | | 1,005 | |

Adjusted EBITDA attributable to noncontrolling interest | | — | | | — | | | — | | | — | | | — | |

Adjusted EBITDA attributable to stockholders | | $ | 218 | | | $ | 248 | | | $ | 269 | | | $ | 270 | | | $ | 1,005 | |

(1)Includes anticipated Costs of VOI sales related to inventory associated with Sales of VOIs under construction that will be acquired once construction is complete.

(2)The table represents deferrals and recognitions of Sales of VOIs revenue and direct costs for properties under construction.

(3)Includes costs associated with restructuring, one-time charges and other non-cash items. This amount also includes the amortization of premiums and discounts resulting from purchase accounting.

Conference Call

Hilton Grand Vacations will host a conference call on Aug. 8, 2024, at 11 a.m. (ET) to discuss second quarter results.

To access the live teleconference, please dial 1-877-407-0784 in the U.S./Canada (or +1-201-689-8560 internationally) approximately 15 minutes prior to the teleconference’s start time. A live webcast will also be available by logging onto the HGV Investor Relations website at https://investors.hgv.com.

In the event of audio difficulties during the call on the toll-free number, participants are advised that accessing the call using the +1-201-689-8560 dial-in number may bypass the source of audio difficulties.

A replay will be available within 24 hours after the teleconference’s completion through Aug. 15, 2024. To access the replay, please dial 1-844-512-2921 in the U.S. (+1-412-317-6671 internationally) using ID#13743187. A webcast replay and transcript will also be available within 24 hours after the live event at https://investors.hgv.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements convey management’s expectations as to the future of HGV, and are based on management’s beliefs, expectations, assumptions and such plans, estimates, projections and other information available to management at the time HGV makes such statements. Forward-looking statements include all statements that are not historical facts, and may be identified by terminology such as the words “outlook,” “believe,” “expect,” “potential,” “goal,” “continues,” “may,” “will,” “should,” “could,” “would,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” “future,” “guidance,” “target,” or the negative version of these words or other comparable words, although not all forward-looking statements may contain such words. The forward-looking statements contained in this press release include statements related to HGV’s revenues, earnings, taxes, cash flow and related financial and operating measures, and expectations with respect to future operating, financial and business performance and other anticipated future events and expectations that are not historical facts, including, related to the acquisition and integration of Bluegreen Vacations Holding Corporation (“Bluegreen”).

HGV cautions you that our forward-looking statements involve known and unknown risks, uncertainties and other factors, including those that are beyond HGV’s control, which may cause the actual results, performance or achievements to be materially different from the future results. Any one or more of these risks or uncertainties, including those related to HGV's acquisition and integration of Bluegreen, could adversely impact HGV’s operations, revenue, operating profits and margins, key business operational metrics, financial condition or credit rating.

For a more detailed discussion of these factors, see the information under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HGV’s most recent Annual Report on Form 10-K, which may be supplemented and updated by the risk factors in HGV’s quarterly reports, current reports and other filings HGV makes with the SEC.

HGV’s forward-looking statements speak only as of the date of this communication or as of the date they are made. HGV disclaims any intent or obligation to update any “forward-looking statement” made in this communication to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time.

Non-GAAP Financial Measures

The Company refers to certain non-GAAP financial measures in this press release, including Adjusted Net Income or Loss, Adjusted Diluted EPS, EBITDA, Adjusted EBITDA, Adjusted EBITDA Attributable to Stockholders, EBITDA profit margin, Adjusted EBITDA profit margin, Free Cash Flow and Adjusted Free Cash Flow, profits and profit margins for HGV’s key activities - real estate, financing, resort and club management, and rental and ancillary services. Please see the tables in this press release and “Definitions” for additional information and reconciliations of such non-GAAP financial measures.

The Company believes these additional measures are also important in helping investors understand the performance and efficiency with which we are able to convert revenues for each of these key activities into operating profit, both in dollars and as margins, and are frequently used by securities analysts, investors and other interested parties as one of common performance measures to compare results or estimate valuations across companies in our industry.

The Company refers to Adjusted EBITDA guidance excluding deferrals and recognitions, which does not take into account any future deferrals of revenues and direct expenses related to the sales of VOIs under construction that are recognized, only on a non-GAAP basis, as the quantification of reconciling items to the most directly comparable U.S. GAAP financial measure is not readily available without unreasonable effort due to uncertainties associated with the timing and amount of such items. These items may create a material difference between the non-GAAP and comparable U.S. GAAP results. We

define Adjusted EBITDA Attributable to Stockholders as Adjusted EBITDA excluding amounts attributable to the noncontrolling interest in HGV/Big Cedar Vacations in which HGV owns a 51% interest (“Big Cedar”).

About Hilton Grand Vacations Inc.

Hilton Grand Vacations Inc. (NYSE:HGV) is recognized as a leading global timeshare company and is the exclusive vacation ownership partner of Hilton. With headquarters in Orlando, Florida, Hilton Grand Vacations develops, markets, and operates a system of brand-name, high-quality vacation ownership resorts in select vacation destinations. Hilton Grand Vacations has a reputation for delivering a consistently exceptional standard of service, and unforgettable vacation experiences for guests and approximately 720,000 Club Members. Membership with the Company provides best-in-class programs, exclusive services and maximum flexibility for our Members around the world.

For more information, visit www.corporate.hgv.com. Follow us on Instagram, Facebook, LinkedIn, X (formerly Twitter), Pinterest and YouTube.

HILTON GRAND VACATIONS INC.

DEFINITIONS

EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders

EBITDA, presented herein, is a financial measure that is not recognized under U.S. GAAP that reflects net income, before interest expense (excluding non-recourse debt), a provision for income taxes and depreciation and amortization.

Adjusted EBITDA, presented herein, is calculated as EBITDA, as previously defined, further adjusted to exclude certain items, including, but not limited to, gains, losses and expenses in connection with: (i) other gains, including asset dispositions and foreign currency transactions; (ii) debt restructurings/retirements; (iii) non-cash impairment losses; (iv) share-based and other compensation expenses; and (v) other items, including but not limited to costs associated with acquisitions, restructuring, amortization of premiums and discounts resulting from purchase accounting, and other non-cash and one-time charges.

Adjusted EBITDA Attributable to Stockholders is calculated as Adjusted EBITDA, as previously defined, excluding amounts attributable to the noncontrolling interest in Big Cedar.

EBITDA profit margin, presented herein, represents EBITDA, as previously defined, divided by total revenues. Adjusted EBITDA profit margin, presented herein, represents Adjusted EBITDA, as previously defined, divided by total revenues.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders are not recognized terms under U.S. GAAP and should not be considered as alternatives to net income or other measures of financial performance or liquidity derived in accordance with U.S. GAAP. In addition, our definitions of EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders may not be comparable to similarly titled measures of other companies.

HGV believes that EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders provide useful information to investors about us and our financial condition and results of operations for the following reasons: (i) EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions; and (ii) EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in our industry.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders have limitations as analytical tools and should not be considered either in isolation or as a substitute for net income, cash flow or other methods of analyzing our results as reported under U.S. GAAP. Some of these limitations are:

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders do not reflect changes in, or cash requirements for, our working capital needs;

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders do not reflect our interest expense (excluding interest expense on non-recourse debt), or the cash requirements necessary to service interest or principal payments on our indebtedness;

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders do not reflect our tax expense or the cash requirements to pay our taxes;

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments;

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders do not reflect the effect on earnings or changes resulting from matters that we consider not to be indicative of our future operations;

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders do not reflect any cash requirements for future replacements of assets that are being depreciated and amortized; and

•EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders may be calculated differently from other companies in our industry limiting their usefulness as comparative measures.

Because of these limitations, EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to Stockholders should not be considered as discretionary cash available to us to reinvest in the growth of our business or as measures of cash that will be available to us to meet our obligations.

Adjusted Net Income, Adjusted Net Income Attributable to Stockholders and Adjusted Diluted EPS Attributable to Stockholders

Adjusted Net Income, presented herein, is calculated as net income further adjusted to exclude certain items, including, but not limited to, gains, losses and expenses in connection with costs associated with acquisitions, restructuring, amortization of premiums and discounts resulting from purchase accounting, and other non-cash and one-time charges. Adjusted Net Income Attributable to Stockholders, presented herein, is calculated as Adjusted Net Income, as defined above, excluding amounts attributable to the noncontrolling interest in Big Cedar. Adjusted Diluted EPS, presented herein, is calculated as Adjusted Net Income Attributable to Stockholders, as defined above, divided by diluted weighted average shares outstanding.

Adjusted Net Income, Adjusted Net Income Attributable to Stockholders and Adjusted Diluted EPS are not recognized terms under U.S. GAAP and should not be considered as alternatives to net income (loss) or other measures of financial performance or liquidity derived in accordance with U.S. GAAP. In addition, our definition may not be comparable to similarly titled measures of other companies.

Adjusted Net Income, Adjusted Net Income Attributable to Stockholders and Adjusted Diluted EPS are useful to assist our investors in evaluating our ongoing operating performance for the current reporting period and, where provided, over different reporting periods.

Free Cash Flow and Adjusted Free Cash Flow

Free Cash Flow represents cash from operating activities less non-inventory capital spending.

Adjusted Free Cash Flow represents free cash flow further adjusted to exclude net non-recourse debt activities and other one-time adjustment items including, but not limited to, costs associated with acquisitions.

We consider Free Cash Flow and Adjusted Free Cash Flow to be liquidity measures not recognized under U.S. GAAP that provides useful information to both management and investors about the amount of cash generated by operating activities that can be used for investing and financing activities, including strategic opportunities and debt service. We do not believe these non-GAAP measures to be a representation of how we will use excess cash.

Non-GAAP Measures within Our Segments

Sales revenue represents sales of VOIs, net, and Fee-for-service commissions and brand fees earned from the sale of fee-for-service VOIs. Fee-for-service commissions and brand fees represents sales, marketing, brand and other fees, which corresponds to the applicable line item from our condensed consolidated statements of operations, adjusted by marketing revenue and other fees earned primarily from discounted marketing related packages which encompass a sales tour to prospective owners. Real estate expense represents costs of VOI sales and Sales and marketing expense, net. Sales and marketing expense, net represents sales and marketing expense, which corresponds to the applicable line item from our condensed consolidated statements of operations, adjusted by marketing revenue and other fees earned primarily from discounted marketing related packages which encompass a sales tour to prospective owners. Both fee-for-service commissions and brand fees and sales and marketing expense, net, represent non-GAAP measures. We present these items net because it provides a meaningful measure of our underlying real estate profit related to our primary real estate activities which focus on the sales and costs associated with our VOIs.

Real estate profit represents sales revenue less real estate expense. Real estate margin is calculated as a percentage by dividing real estate profit by sales revenue. We consider real estate profit margin to be an important non-GAAP operating measure because it measures the efficiency of our sales and marketing spending, management of inventory costs, and initiatives intended to improve profitability.

Financing profit represents financing revenue, net of financing expense, both of which correspond to the applicable line items from our condensed consolidated statements of operations. Financing profit margin is calculated as a percentage by dividing financing profit by financing revenue. We consider this to be an important non-GAAP operating measure because it measures the efficiency and profitability of our financing business in connection with our VOI sales.

Resort and club management profit represents resort and club management revenue, net of resort and club management expense, both of which correspond to the applicable line items from our condensed consolidated statements of operations. Resort and club management profit margin is calculated as a percentage by dividing resort and club management profit by resort and club management revenue. We consider this to be an important non-GAAP operating measure because it measures the efficiency and profitability of our resort and club management business that support our VOI sales business.

Rental and ancillary services profit represents rental and ancillary services revenues, net of rental and ancillary services expenses, both of which correspond to the applicable line items from our condensed consolidated statements of operations. Rental and ancillary services profit margin is calculated as a percentage by dividing rental and ancillary services profit by rental and ancillary services revenue. We consider this to be an important non-GAAP operating measure because it measures our ability to convert available inventory and unoccupied rooms into revenue and profit by transient rentals, as well as profitability of other services, such as food and beverage, retail, spa offerings and other guest services.

Real Estate Metrics

Contract sales represents the total amount of VOI products (fee-for-service, just-in-time, developed, and points-based) under purchase agreements signed during the period where we have received a down payment of at least 10% of the contract price. Contract sales differ from revenues from the Sales of VOIs, net that we report in our condensed consolidated statements of operations due to the requirements for revenue recognition, as well as adjustments for incentives. While we do not record the purchase price of sales of VOI products developed by fee-for-service partners as revenue in our condensed consolidated financial statements, rather recording the commission earned as revenue in accordance with U.S. GAAP, we believe contract sales to be an important operational metric, reflective of the overall volume and pace of sales in our business and believe it provides meaningful comparability of HGV’s results the results of our competitors which may source their VOI products differently. HGV believes that the presentation of contract sales on a combined basis (fee-for-service, just-in-time, developed, and points-based) is most appropriate for the purpose of the operating metric; additional information regarding the split of contract sales, is included in Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations in our most recent Quarterly Report on form 10-Q for the period ended June 30, 2024.

Developed Inventory refers to VOI inventory that is sourced from projects developed by HGV.

Fee-for-Service Inventory refers to VOI inventory HGV sells and manages on behalf of third-party developers.

Just-in-Time Inventory refers to VOI inventory primarily sourced in transactions that are designed to closely correlate the timing of the acquisition with HGV’s sale of that inventory to purchasers.

Points-Based Inventory refers to VOI sales that are backed by physical real estate that is or will be contributed to a trust.

NOG or Net Owner Growth represents the year-over-year change in membership.

Tour flow represents the number of sales presentations given at HGV’s sales centers during the period.

Volume per guest (“VPG”) represents the sales attributable to tours at HGV’s sales locations and is calculated by dividing contract sales, excluding telesales, by tour flow. HGV considers VPG to be an important operating measure because it measures the effectiveness of HGV’s sales process, combining the average transaction price with closing rate.

HILTON GRAND VACATIONS INC.

FINANCIAL TABLES

| | | | | |

| T-2 |

| T-3 |

| T-4 |

| T-5 |

| T-6 |

| T-7 |

| T-8 |

| T-9 |

| T-10 |

| T-11 |

| T-12 |

| T-13 |

| T-14 |

| T-15 |

| T-16 |

T-2

HILTON GRAND VACATIONS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share data) | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (unaudited) | | |

| ASSETS | | | |

| Cash and cash equivalents | $ | 328 | | | $ | 589 | |

| Restricted cash | 273 | | | 296 | |

Accounts receivable, net | 524 | | | 507 | |

| Timeshare financing receivables, net | 2,976 | | | 2,113 | |

| Inventory | 1,929 | | | 1,400 | |

| Property and equipment, net | 902 | | | 758 | |

| Operating lease right-of-use assets, net | 84 | | | 61 | |

| Investments in unconsolidated affiliates | 78 | | | 71 | |

| Goodwill | 1,933 | | | 1,418 | |

| Intangible assets, net | 1,887 | | | 1,158 | |

| | | |

| Other assets | 553 | | | 314 | |

| TOTAL ASSETS | $ | 11,467 | | | $ | 8,685 | |

LIABILITIES AND EQUITY | | | |

| Accounts payable, accrued expenses and other | $ | 1,159 | | | $ | 952 | |

| Advanced deposits | 224 | | | 179 | |

| Debt, net | 4,885 | | | 3,049 | |

| Non-recourse debt, net | 1,725 | | | 1,466 | |

| Operating lease liabilities | 101 | | | 78 | |

Deferred revenue | 321 | | | 215 | |

Deferred income tax liabilities | 972 | | | 631 | |

Total liabilities | 9,387 | | | 6,570 | |

| | | |

Equity: | | | |

| Preferred stock, $0.01 par value; 300,000,000 authorized shares, none issued or outstanding as of June 30, 2024 and December 31, 2023 | — | | | — | |

| Common stock, $0.01 par value; 3,000,000,000 authorized shares, 102,485,583 shares issued and outstanding as of June 30, 2024 and 105,961,160 shares issued and outstanding as of December 31, 2023 | 1 | | | 1 | |

| Additional paid-in capital | 1,456 | | | 1,504 | |

| Accumulated retained earnings | 456 | | | 593 | |

| Accumulated other comprehensive income | 5 | | | 17 | |

Total stockholders' equity | 1,918 | | | 2,115 | |

Noncontrolling interest | 162 | | | — | |

Total equity | 2,080 | | | 2,115 | |

TOTAL LIABILITIES AND EQUITY | $ | 11,467 | | | $ | 8,685 | |

T-3

HILTON GRAND VACATIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Sales of VOIs, net | $ | 471 | | | $ | 355 | | | $ | 909 | | | $ | 673 | |

| Sales, marketing, brand and other fees | 167 | | | 173 | | | 312 | | | 331 | |

| Financing | 102 | | | 76 | | | 206 | | | 150 | |

| Resort and club management | 171 | | | 133 | | | 337 | | | 264 | |

| Rental and ancillary services | 195 | | | 173 | | | 376 | | | 331 | |

| Cost reimbursements | 129 | | | 97 | | | 251 | | | 192 | |

| Total revenues | 1,235 | | | 1,007 | | | 2,391 | | | 1,941 | |

| Expenses | | | | | | | |

| Cost of VOI sales | 65 | | | 48 | | | 113 | | | 98 | |

| Sales and marketing | 453 | | | 336 | | | 854 | | | 637 | |

| Financing | 44 | | | 24 | | | 83 | | | 48 | |

| Resort and club management | 48 | | | 44 | | | 102 | | | 86 | |

| Rental and ancillary services | 188 | | | 154 | | | 361 | | | 306 | |

| General and administrative | 58 | | | 48 | | | 103 | | | 90 | |

| Acquisition and integration-related expense | 48 | | | 13 | | | 157 | | | 30 | |

| Depreciation and amortization | 68 | | | 52 | | | 130 | | | 103 | |

| License fee expense | 40 | | | 34 | | | 75 | | | 64 | |

| Impairment expense | — | | | 3 | | | 2 | | | 3 | |

| Cost reimbursements | 129 | | | 97 | | | 251 | | | 192 | |

| Total operating expenses | 1,141 | | | 853 | | | 2,231 | | | 1,657 | |

| Interest expense | (87) | | | (44) | | | (166) | | | (88) | |

| Equity in earnings from unconsolidated affiliates | 3 | | | 2 | | | 8 | | | 5 | |

Other (loss) gain, net | (3) | | | 3 | | | (8) | | | 4 | |

Income (loss) before income taxes | 7 | | | 115 | | | (6) | | | 205 | |

Income tax (expense) benefit | (3) | | | (35) | | | 8 | | | (52) | |

Net income | 4 | | | 80 | | | 2 | | | 153 | |

Net income attributable to noncontrolling interest | 2 | | | — | | | 4 | | | — | |

Net income (loss) attributable to stockholders | $ | 2 | | | $ | 80 | | | $ | (2) | | | $ | 153 | |

Earnings per share attributable to stockholders(1): | | | | | | | |

| Basic | $ | 0.02 | | | $ | 0.72 | | | $ | (0.02) | | | $ | 1.37 | |

| Diluted | $ | 0.02 | | | $ | 0.71 | | | $ | (0.02) | | | $ | 1.35 | |

(1)Earnings per share is calculated using whole numbers.

T-4

HILTON GRAND VACATIONS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in millions) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating Activities | | | | | | | |

Net income | $ | 4 | | | $ | 80 | | | $ | 2 | | | $ | 153 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 68 | | | 52 | | | 130 | | | 103 | |

| Amortization of deferred financing costs, acquisition premiums and other | 38 | | | 7 | | | 63 | | | 14 | |

| Provision for financing receivables losses | 95 | | | 41 | | | 159 | | | 71 | |

| Impairment expense | — | | | 3 | | | 2 | | | 3 | |

Other loss (gain), net | 3 | | | (3) | | | 8 | | | (4) | |

| Share-based compensation | 18 | | | 16 | | | 27 | | | 26 | |

| | | | | | | |

| Equity in earnings from unconsolidated affiliates | (3) | | | (2) | | | (8) | | | (5) | |

| Return on investment in unconsolidated affiliates | — | | | 6 | | | — | | | 6 | |

| Net changes in assets and liabilities, net of effects of acquisitions: | | | | | | | |

| Accounts receivable, net | (9) | | | 18 | | | 15 | | | 26 | |

| Timeshare financing receivables, net | (118) | | | (72) | | | (196) | | | (96) | |

| Inventory | (6) | | | 34 | | | (31) | | | (67) | |

| Purchases and development of real estate for future conversion to inventory | (17) | | | (4) | | | (50) | | | (6) | |

| Other assets | 91 | | | 110 | | | (154) | | | (134) | |

| Accounts payable, accrued expenses and other | (33) | | | (52) | | | 55 | | | 32 | |

| Advanced deposits | 5 | | | 11 | | | 5 | | | 35 | |

| Deferred revenue | (23) | | | (51) | | | 86 | | | 63 | |

| | | | | | | |

| Net cash provided by operating activities | 113 | | | 194 | | | 113 | | | 220 | |

| Investing Activities | | | | | | | |

| Acquisitions, net of cash, cash equivalents and restricted cash acquired | 10 | | | — | | | (1,444) | | | — | |

| Capital expenditures for property and equipment (excluding inventory) | (7) | | | (4) | | | (17) | | | (9) | |

| Software capitalization costs | (11) | | | (10) | | | (20) | | | (16) | |

| | | | | | | |

| Other | (1) | | | — | | | (1) | | | — | |

| Net cash used in investing activities | (9) | | | (14) | | | (1,482) | | | (25) | |

| Financing Activities | | | | | | | |

| Proceeds from debt | 25 | | | — | | | 2,085 | | | 438 | |

| Proceeds from non-recourse debt | 615 | | | — | | | 905 | | | 175 | |

| Repayment of debt | (289) | | | (4) | | | (397) | | | (157) | |

| Repayment of non-recourse debt | (415) | | | (215) | | | (1,231) | | | (397) | |

Payment of debt issuance costs | (12) | | | — | | | (51) | | | — | |

| Repurchase and retirement of common stock | (100) | | | (121) | | | (199) | | | (206) | |

| Payment of withholding taxes on vesting of restricted stock units | — | | | — | | | (21) | | | (14) | |

| Proceeds from employee stock plan purchases | 5 | | | 4 | | | 5 | | | 4 | |

| Proceeds from stock option exercises | 1 | | | 2 | | | 7 | | | 7 | |

| | | | | | | |

| Other | (1) | | | (1) | | | (2) | | | (2) | |

Net cash (used in) provided by financing activities | (171) | | | (335) | | | 1,101 | | | (152) | |

| Effect of changes in exchange rates on cash, cash equivalents & restricted cash | (10) | | | (9) | | | (16) | | | (10) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (77) | | | (164) | | | (284) | | | 33 | |

| Cash, cash equivalents and restricted cash, beginning of period | 678 | | | 752 | | | 885 | | | 555 | |

| Cash, cash equivalents and restricted cash, end of period | 601 | | | 588 | | | 601 | | | 588 | |

| Less: Restricted cash | 273 | | | 336 | | | 273 | | | 336 | |

| Cash and cash equivalents | $ | 328 | | | $ | 252 | | | $ | 328 | | | $ | 252 | |

T-5

HILTON GRAND VACATIONS INC.

FREE CASH FLOW RECONCILIATION

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 113 | | | $ | 194 | | | $ | 113 | | | $ | 220 | |

| Capital expenditures for property and equipment | | (7) | | | (4) | | | (17) | | | (9) | |

| Software capitalization costs | | (11) | | | (10) | | | (20) | | | (16) | |

| Free Cash Flow | | $ | 95 | | | $ | 180 | | | $ | 76 | | | $ | 195 | |

| Non-recourse debt activity, net | | 200 | | | (215) | | | (326) | | | (222) | |

| Acquisition and integration-related expense | | 48 | | | 13 | | | 157 | | | 30 | |

Litigation settlement payment | | 13 | | | — | | | 63 | | | — | |

Other adjustment items(1) | | 14 | | | 9 | | | 26 | | | 17 | |

| Adjusted Free Cash Flow | | $ | 370 | | | $ | (13) | | | $ | (4) | | | $ | 20 | |

(1)Includes capitalized acquisition and integration-related costs.

T-6

HILTON GRAND VACATIONS INC.

SEGMENT REVENUE RECONCILIATION

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Real estate sales and financing | | $ | 740 | | | $ | 604 | | | $ | 1,427 | | | $ | 1,154 | |

| Resort operations and club management | | 386 | | | 320 | | | 746 | | | 622 | |

| Total segment revenues | | 1,126 | | | 924 | | | 2,173 | | | 1,776 | |

| Cost reimbursements | | 129 | | | 97 | | | 251 | | | 192 | |

| Intersegment eliminations | | (20) | | | (14) | | | (33) | | | (27) | |

| Total revenues | | $ | 1,235 | | | $ | 1,007 | | | $ | 2,391 | | | $ | 1,941 | |

T-7

HILTON GRAND VACATIONS INC.

SEGMENT EBITDA, ADJUSTED EBITDA TO NET INCOME AND

ADJUSTED EBITDA ATTRIBUTABLE TO STOCKHOLDERS

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) attributable to stockholders | $ | 2 | | $ | 80 | | $ | (2) | | $ | 153 |

Net income attributable to noncontrolling interest | 2 | | — | | 4 | | — |

Net income | 4 | | 80 | | 2 | | 153 |

| Interest expense | 87 | | 44 | | 166 | | 88 |

| Income tax expense (benefit) | 3 | | 35 | | (8) | | 52 |

| Depreciation and amortization | 68 | | 52 | | 130 | | 103 |

| Interest expense, depreciation and amortization included in equity in earnings from unconsolidated affiliates | 2 | | 1 | | 3 | | 1 |

| EBITDA | 164 | | 212 | | 293 | | 397 |

Other loss (gain), net | 3 | | (3) | | 8 | | (4) |

| Share-based compensation expense | 18 | | 16 | | 27 | | 26 |

| Acquisition and integration-related expense | 48 | | 13 | | 157 | | 30 |

| Impairment expense | — | | 3 | | 2 | | 3 |

Other adjustment items(1) | 33 | | 7 | | 55 | | 14 |

| Adjusted EBITDA | 266 | | 248 | | 542 | | 466 |

Adjusted EBITDA attributable to noncontrolling interest | 4 | | — | | 7 | | — |

Adjusted EBITDA attributable to stockholders | $ | 262 | | $ | 248 | | $ | 535 | | $ | 466 |

| | | | | | | |

| | | | | | | |

| Segment Adjusted EBITDA: | | | | | | | |

Real estate sales and financing(2) | $ | 193 | | $ | 189 | | $ | 399 | | $ | 358 |

Resort operations and club management(2) | 152 | | 123 | | 286 | | 232 |

| Adjustments: | | | | | | | |

| Adjusted EBITDA from unconsolidated affiliates | 5 | | 3 | | 11 | | 6 |

| License fee expense | (40) | | (34) | | (75) | | (64) |

General and administrative(3) | (44) | | (33) | | (79) | | (66) |

| Adjusted EBITDA | 266 | | 248 | | 542 | | 466 |

Adjusted EBITDA attributable to noncontrolling interest | 4 | | — | | 7 | | — |

Adjusted EBITDA attributable to stockholders | $ | 262 | | $ | 248 | | $ | 535 | | $ | 466 |

| Adjusted EBITDA profit margin | 21.5 | % | | 24.6 | % | | 22.7 | % | | 24.0 | % |

| EBITDA profit margin | 13.3 | % | | 21.1 | % | | 12.3 | % | | 20.5 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1)Includes costs associated with restructuring, one-time charges and other non-cash items. This amount also includes the amortization of premiums and discounts resulting from purchase accounting.

(2)Includes intersegment transactions, share-based compensation, depreciation and other adjustments attributable to the segments.

(3)Excludes segment related share-based compensation, depreciation and other adjustment items.

T-8

HILTON GRAND VACATIONS INC.

REAL ESTATE SALES PROFIT DETAIL SCHEDULE

(in millions, except Tour Flow and VPG)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Tour flow | 226,388 | | 162,444 | | 400,526 | | 292,712 |

| VPG | $ | 3,320 | | $ | 3,728 | | $ | 3,441 | | $ | 3,835 |

| Owned contract sales mix | 80.5 | % | | 70.5 | % | | 82.1 | % | | 68.8 | % |

| Fee-for-service contract sales mix | 19.5 | % | | 29.5 | % | | 17.9 | % | | 31.2 | % |

| | | | | | | |

| Contract sales | $ | 757 | | $ | 612 | | $ | 1,388 | | $ | 1,135 |

| Adjustments: | | | | | | | |

Fee-for-service sales(1) | (148) | | (180) | | (248) | | (354) |

| Provision for financing receivables losses | (94) | | (41) | | (158) | | (71) |

| Reportability and other: | | | | | | | |

Net (deferral) of sales of VOIs under construction(2) | (13) | | (6) | | (11) | | (2) |

| Fee-for-service sale upgrades, net | — | | 7 | | — | | 12 |

Other(3) | (31) | | (37) | | (62) | | (47) |

| Sales of VOIs, net | $ | 471 | | $ | 355 | | $ | 909 | | $ | 673 |

| Plus: | | | | | | | |

| Fee-for-service commissions and brand fees | 88 | | 111 | | 152 | | 218 |

| Sales revenue | 559 | | 466 | | 1,061 | | 891 |

| | | | | | | |

| Cost of VOI sales | 65 | | 48 | | 113 | | 98 |

| Sales and marketing expense, net | 374 | | 274 | | 694 | | 524 |

| Real estate expense | 439 | | 322 | | 807 | | 622 |

| Real estate profit | $ | 120 | | $ | 144 | | $ | 254 | | $ | 269 |

Real estate profit margin(4) | 21.5 | % | | 30.9 | % | | 23.9 | % | | 30.2 | % |

| | | | | | | |

| Reconciliation of fee-for-service commissions: | | | | | | | |

| Sales, marketing, brand and other fees | $ | 167 | | $ | 173 | | $ | 312 | | $ | 331 |

Less: Marketing revenue and other fees(5) | (79) | | (62) | | (160) | | (113) |

| Fee-for-service commissions and brand fees | $ | 88 | | $ | 111 | | $ | 152 | | $ | 218 |

| | | | | | | |

| Reconciliation of sales and marketing expense: | | | | | | | |

| Sales and marketing expense | $ | 453 | | $ | 336 | | $ | 854 | | $ | 637 |

Less: Marketing revenue and other fees(5) | (79) | | (62) | | (160) | | (113) |

| Sales and marketing expense, net | $ | 374 | | $ | 274 | | $ | 694 | | $ | 524 |

(1)Represents contract sales from fee-for-service properties on which we earn commissions and brand fees.

(2)Represents the net impact related to deferrals of revenues and direct expenses related to the Sales of VOIs under construction that are recognized when construction is complete.

(3)Includes adjustments for revenue recognition, including amounts in rescission and sales incentives.

(4)Excluding the marketing revenue and other fees adjustment, Real Estate profit margin was 18.8% and 27.3% for the three months ended June 30, 2024 and 2023, respectively. and 20.8% and 26.8%. for the six months ended June 30, 2024, and 2023, respectively.

(5)Includes revenue recognized through our marketing programs for existing owners and prospective first-time buyers and revenue associated with sales incentives, title service and document compliance.

T-9

HILTON GRAND VACATIONS INC.

CONTRACT SALES MIX BY TYPE SCHEDULE

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Just-In-Time Contract Sales Mix | 20.9 | % | | 13.6 | % | | 22.6 | % | | 15.1 | % |

| Fee-For-Service Contract Sales Mix | 19.5 | % | | 29.5 | % | | 17.9 | % | | 31.2 | % |

| Total Capital-Efficient Contract Sales Mix | 40.4 | % | | 43.1 | % | | 40.5 | % | | 46.3 | % |

T-10

HILTON GRAND VACATIONS INC.

FINANCING PROFIT DETAIL SCHEDULE

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Interest income | $ | 116 | | $ | 68 | | $ | 228 | | $ | 138 |

| Other financing revenue | 14 | | 11 | | 22 | | 19 |

Premium amortization of acquired timeshare financing receivables | (28) | | (3) | | (44) | | (7) |

| Financing revenue | 102 | | 76 | | 206 | | 150 |

Consumer financing interest expense | 22 | | 11 | | 45 | | 23 |

| Other financing expense | 20 | | 13 | | 34 | | 26 |

Amortization of acquired non-recourse debt discounts and premiums, net | 2 | | — | | 4 | | (1) |

| Financing expense | 44 | | 24 | | 83 | | 48 |

| Financing profit | $ | 58 | | $ | 52 | | $ | 123 | | $ | 102 |

| Financing profit margin | 56.9 | % | | 68.4 | % | | 59.7 | % | | 68.0 | % |

T-11

HILTON GRAND VACATIONS INC.

RESORT AND CLUB PROFIT DETAIL SCHEDULE

(in millions, except for Members and Net Owner Growth)

| | | | | | | | | | | |

| Twelve Months Ended June 30, |

| 2024 | | 2023 |

| Total members | 720,069 | | 522,156 |

Net Owner Growth (NOG)(1) | 8,776 | | 14,204 |

Net Owner Growth % (NOG)(1) | 1.7 | % | | 2.8 | % |

(1)NOG is a trailing-twelve-month concept for which the twelve months ended June 30, 2024 and ended June 30, 2023 includes member count for HGV Max and Legacy HGV-DRI members only on a consolidated basis.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Club management revenue | $ | 67 | | $ | 53 | | $ | 130 | | $ | 104 |

| Resort management revenue | 104 | | 80 | | 207 | | 160 |

| Resort and club management revenues | 171 | | 133 | | 337 | | 264 |

| Club management expense | 21 | | 15 | | 41 | | 30 |

| Resort management expense | 27 | | 29 | | 61 | | 56 |

| Resort and club management expenses | 48 | | 44 | | 102 | | 86 |

| Resort and club management profit | $ | 123 | | $ | 89 | | $ | 235 | | $ | 178 |

| Resort and club management profit margin | 71.9 | % | | 66.9 | % | | 69.7 | % | | 67.4 | % |

T-12

HILTON GRAND VACATIONS INC.

RENTAL AND ANCILLARY PROFIT DETAIL SCHEDULE

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Rental revenues | $ | 181 | | $ | 162 | | $ | 350 | | $ | 309 |

| Ancillary services revenues | 14 | | 11 | | 26 | | 22 |

| Rental and ancillary services revenues | 195 | | 173 | | 376 | | 331 |

| Rental expenses | 177 | | 144 | | 340 | | 287 |

| Ancillary services expense | 11 | | 10 | | 21 | | 19 |

| Rental and ancillary services expenses | 188 | | 154 | | 361 | | 306 |

| Rental and ancillary services profit | $ | 7 | | $ | 19 | | $ | 15 | | $ | 25 |

| Rental and ancillary services profit margin | 3.6 | % | | 11.0 | % | | 4.0 | % | | 7.6 | % |

T-13

HILTON GRAND VACATIONS INC.

REAL ESTATE SALES AND FINANCING SEGMENT ADJUSTED EBITDA

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Sales of VOIs, net | $ | 471 | | $ | 355 | | $ | 909 | | $ | 673 |

| Sales, marketing, brand and other fees | 167 | | 173 | | 312 | | 331 |

| Financing revenue | 102 | | 76 | | 206 | | 150 |

| Real estate sales and financing segment revenues | 740 | | 604 | | 1,427 | | 1,154 |

| Cost of VOI sales | (65) | | (48) | | (113) | | (98) |

| Sales and marketing expense | (453) | | (336) | | (854) | | (637) |

| Financing expense | (44) | | (24) | | (83) | | (48) |

| Marketing package stays | (20) | | (14) | | (33) | | (27) |

| Share-based compensation | 3 | | 3 | | 6 | | 6 |

| Other adjustment items | 32 | | 4 | | 49 | | 8 |

| Real estate sales and financing segment adjusted EBITDA | $ | 193 | | $ | 189 | | $ | 399 | | $ | 358 |

| Real estate sales and financing segment adjusted EBITDA profit margin | 26.1 | % | | 31.3 | % | | 28.0 | % | | 31.0 | % |

T-14

HILTON GRAND VACATIONS INC.

RESORT AND CLUB MANAGEMENT SEGMENT ADJUSTED EBITDA

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Resort and club management revenues | $ | 171 | | $ | 133 | | $ | 337 | | $ | 264 |

| Rental and ancillary services | 195 | | 173 | | 376 | | 331 |

| Marketing package stays | 20 | | 14 | | 33 | | 27 |

| Resort and club management segment revenue | 386 | | 320 | | 746 | | 622 |

| Resort and club management expenses | (48) | | (44) | | (102) | | (86) |

| Rental and ancillary services expenses | (188) | | (154) | | (361) | | (306) |

| Share-based compensation | 2 | | 1 | | 3 | | 2 |

| | | | | | | |

| Resort and club segment adjusted EBITDA | $ | 152 | | $ | 123 | | $ | 286 | | $ | 232 |

| Resort and club management segment adjusted EBITDA profit margin | 39.4 | % | | 38.4 | % | | 38.3 | % | | 37.3 | % |

T-15

HILTON GRAND VACATIONS INC.

ADJUSTED NET INCOME ATTRIBUTABLE TO STOCKHOLDERS AND

ADJUSTED DILUTED EARNINGS PER SHARE ATTRIBUTABLE TO STOCKHOLDERS (Non-GAAP)

(in millions except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) attributable to stockholders | $ | 2 | | | $ | 80 | | | $ | (2) | | | $ | 153 | |

| Net income attributable to noncontrolling interest | 2 | | | — | | | 4 | | | — | |

| Net income | 4 | | | 80 | | | 2 | | | 153 | |

Income tax expense (benefit) | 3 | | | 35 | | | (8) | | | 52 | |

| Income (loss) before income taxes | 7 | | | 115 | | | (6) | | | 205 | |

| Certain items: | | | | | | | |

Other loss (gain), net | 3 | | | (3) | | | 8 | | | (4) | |

| Impairment expense | — | | | 3 | | | 2 | | | 3 | |

| Acquisition and integration-related expense | 48 | | | 13 | | | 157 | | | 30 | |

Other adjustment items(1) | 33 | | | 7 | | | 55 | | | 14 | |

| Adjusted income before income taxes | 91 | | | 135 | | | 216 | | | 248 | |

Income tax (expense) | (24) | | | (40) | | | (48) | | | (63) | |

| Adjusted net income | 67 | | | 95 | | | 168 | | | 185 | |

| Net income attributable to noncontrolling interest | 2 | | | — | | | 4 | | | — | |

| Adjusted net income attributable to stockholders | $ | 65 | | | $ | 95 | | | $ | 164 | | | $ | 185 | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Diluted | 104.3 | | | 112.2 | | | 104.3 | | | 113.3 | |

Earnings per share attributable to stockholders(2): | | | | | | | |

| Diluted | $0.02 | | $0.71 | | $(0.02) | | $1.35 |

| Adjusted diluted | $0.62 | | $0.85 | | $1.57 | | $1.63 |

(1)Includes costs associated with restructuring, one-time charges, the amortization of premiums and discounts resulting from purchase accounting and other non-cash items.

(2)Earnings per share amounts are calculated using whole numbers.

T-16

HILTON GRAND VACATIONS INC.

RECONCILIATION OF NON-GAAP PROFIT MEASURES TO GAAP MEASURE

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| ($ in millions) | 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) attributable to stockholders | $ | 2 | | | $ | 80 | | | $ | (2) | | | $ | 153 | |

Net income attributable to noncontrolling interest | 2 | | | — | | | 4 | | | — | |

Net income | 4 | | | 80 | | | 2 | | | 153 | |

| Interest expense | 87 | | | 44 | | | 166 | | | 88 | |

Income tax (benefit) expense | 3 | | | 35 | | | (8) | | | 52 | |

| Depreciation and amortization | 68 | | | 52 | | | 130 | | | 103 | |

| Interest expense, depreciation and amortization included in equity in earnings from unconsolidated affiliates | 2 | | | 1 | | | 3 | | | 1 | |

| EBITDA | 164 | | | 212 | | | 293 | | | 397 | |

Other loss (gain), net | 3 | | | (3) | | | 8 | | | (4) | |

Equity in earnings from unconsolidated affiliates(1) | (5) | | | (3) | | | (11) | | | (6) | |

Impairment expense | — | | | 3 | | | 2 | | | 3 | |

| License fee expense | 40 | | | 34 | | | 75 | | | 64 | |

| Acquisition and integration-related expense | 48 | | | 13 | | | 157 | | | 30 | |

| General and administrative | 58 | | | 48 | | | 103 | | | 90 | |

| Profit | $ | 308 | | | $ | 304 | | | $ | 627 | | | $ | 574 | |

| | | | | | | |

| Real estate profit | $ | 120 | | | $ | 144 | | | $ | 254 | | | $ | 269 | |

| Financing profit | 58 | | | 52 | | | 123 | | | 102 | |

| Resort and club management profit | 123 | | | 89 | | | 235 | | | 178 | |

| Rental and ancillary services profit | 7 | | | 19 | | | 15 | | | 25 | |

| Profit | $ | 308 | | | $ | 304 | | | $ | 627 | | | $ | 574 | |

(1) Excludes impact of interest expense, depreciation and amortization included in equity in earnings from unconsolidated affiliates of $2 million and $3 million, respectively, for the three and six months ended June 30, 2024 and $1 million for both the three and six months ended June 30, 2023.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

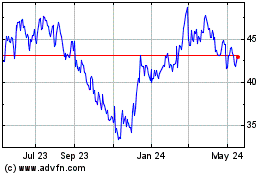

Hilton Grand Vacations (NYSE:HGV)

Historical Stock Chart

From Jan 2025 to Feb 2025

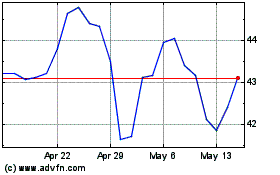

Hilton Grand Vacations (NYSE:HGV)

Historical Stock Chart

From Feb 2024 to Feb 2025