UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-41411

Haleon plc

(Translation

of registrant’s name into English)

Building 5, First Floor, The Heights,

Weybridge, Surrey, KT13 0NY

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

EXHIBIT INDEX

|

Exhibit

Number

|

Description

|

|

99.1

|

2

November 2023 - Haleon 2023 Q3 Trading Statement

|

99.1

2 November 2023

2023 Q3 Trading Statement1

Three months ended 30 September 2023

|

5% organic revenue growth demonstrating strength and diversity of

portfolio

|

|

●

|

Q3 revenue +5.0% organic growth with price +6.6% and volume/mix

(1.6)%; reported (3.3)%

|

|

●

|

9m revenue +8.5% organic growth with price +7.2% and volume/ mix

+1.3%; reported +5.6%

|

|

●

|

Strong performance from Power Brands with Q3 organic revenue +9.3%;

9m +9.8%

|

|

●

|

Volume / mix decline in Q3 reflected lower volume in North America

in Digestive Health and Other driven by one-off retailer inventory adjustments and the expected

decline in Emergen-C; Excluding both factors, volume/mix would have

been flat

|

|

●

|

Oral Health delivered high single digit growth, Respiratory

reflected a normal seasonal sell in, and VMS was up slightly driven

by strong Centrum growth

|

|

●

|

Organic revenue in EMEA and LatAm grew 10.8%, APAC increased 5.9%

and North America declined 1.5%

|

8.8% adjusted

operating profit3

growth; continued strong

momentum

|

|

●

|

Q3 operating profit of £584m (+2.6%)

|

|

●

|

Q3 adjusted operating profit growth +8.8% constant currency;

reported down 5.0% at £689m

|

|

●

|

Strong Q3 adjusted operating profit margin 24.6% and up +90bps

constant currency reflecting positive operational leverage; down

50bps on a reported basis

|

|

FY 2023 guidance reiterated, completion of Lamisil

sale

|

|

●

|

All FY 2023 guidance unchanged

|

|

●

|

Lamisil sale completed on 31 October 2023

|

Brian McNamara, Chief Executive Officer, Haleon said:

“I am pleased with our Q3 results, which demonstrate

continued strong momentum across the business.

Despite challenging markets, we have delivered another quarter of

strong organic growth, reflecting the strength of our category

positions and the ongoing ability of our brands to grow or maintain

share.

Our Power Brands grew ahead of the overall portfolio in the period,

with all three Oral Health brands, Panadol and Centrum the standout

performers. In Oral Health, innovation underpinned brand success

alongside excellent execution in market.

The productivity program continues to progress well and remains on

track, as we ensure that Haleon’s structure and operations as

a standalone business are optimised to deliver effectively for our

customers and consumers.

Our FY guidance remains unchanged and we expect to deliver strong

growth in both organic revenue and adjusted operating profit

constant currency. Whilst we are mindful of what remains an

uncertain economic and geopolitical environment, we remain

confident in our medium term guidance, and remain committed to

drive long term sustainable growth.”

| Adjusted

results |

Reported

results

|

|

Period

ended 30 September (unaudited)

|

vs 2022

|

|

2023

|

vs 2022

|

|

Three

months organic revenue growth2

Nine

months organic revenue growth2

|

5.0%

8.5%

|

Three

months revenue

Nine

months revenue

|

£2,798m

£8,536m

|

(3.3)%

+5.6%

|

1. All

numbers within the release are unaudited and are organic unless

referenced otherwise. The commentary in this announcement contains

forward looking statements and should be read in conjunction with

the cautionary note in the Appendix

2.

Reported revenue is calculated at the average rate for the period.

Organic revenue is calculated at constant currency. The difference

between Reported and Organic revenue growth is predominantly due to

adjustment to recalculate the reported results as if they had been

generated at prior year exchange rates. Organic revenue growth,

Adjusted operating profit, Adjusted operating profit margin are

non-IFRS measures; definitions and calculations of non-IFRS

measures can be found in the Appendix

3. At

constant currency

Outlook

|

For FY 2023 the Company continues to expect:

|

|

|

●

|

Organic

revenue growth to be 7-8%

|

|

|

|

●

|

Adjusted

operating profit growth to be 9-11% constant currency

|

|

|

|

●

|

Net

interest expense of c.£350m

|

|

|

|

●

|

Adjusted

effective tax rate of 23-24%

|

|

Foreign exchange

As

shared in the Aide Memoire dated 9 October 2023, whilst we do not

guide specifically on foreign exchange, translational foreign

exchange based on spot rates as at 30 September 2023 and using

FY2022 results as a base for FY 2023, would have a negative impact

of c.3.5% on revenue and negative impact of c.6-6.5% on Adjusted

operating profit.

Lamisil

The

Lamisil disposal to Karo Healthcare AB announced with HY 2023

results on 2 August completed 31 October 2023. As a reminder at

that time we commented that whilst the disposal is expected to be

dilutive to Adjusted operating margin in 2024, this should be

offset by the productivity program. The impact for FY 2023 is

expected be slightly dilutive to constant currency adjusted

operating profit growth, which is already reflected in the FY 2023

guidance in the Outlook section above.

Presentation for analysts and shareholders:

A short

presentation followed by Q&A will be hosted by Tobias Hestler,

Chief Financial Officer and Sonya Ghobrial, Head of Investor

Relations at 9:00am GMT (10:00am CET) on 2 November 2023, which can

be accessed at http://www.haleon.com/investors/.

For

analysts and shareholders wishing to ask questions on the Q&A

call, please use the dial-in details below which will have a

Q&A facility:

|

UK:

|

+44 800

279 3956

|

|

US:

|

+1 631

570 5613

|

|

All

other:

|

+44 20

7107 0613

|

|

Passcode:

|

42874219

|

An

archived webcast of the Q&A call will be available later on the

day of the results and can be accessed at www.haleon.com/investors/.

Financial calendar

|

|

|

|

Haleon

Highlights: Oral Health

|

7

December 2023

|

|

FY 2023

Results

|

29

February 2024

|

|

Q1 2024

Trading Statement

|

1

May 2024

|

Enquiries

|

Investors

|

Media

|

|

Sonya

Ghobrial

|

+44

7392 784784

|

Zoe

Bird

|

+44

7736 746167

|

|

Rakesh

Patel

|

+44

7552 484646

|

Nidaa

Lone

|

+44

7841 400607

|

|

Emma

White

|

+44

7792 750133

|

|

|

|

Email:

investor-relations@haleon.com

|

Email:

corporate.media@haleon.com

|

About Haleon plc

Haleon

(LSE / NYSE: HLN) is a global leader in consumer health, with a

purpose to deliver better everyday health with humanity.

Haleon’s product portfolio spans five major categories - Oral

Health, Pain Relief, Respiratory Health, Digestive Health and

Other, and Vitamins, Minerals and Supplements (VMS). Its

long-standing brands - such as Advil, Sensodyne, Panadol, Voltaren,

Theraflu, Otrivin, Polident, parodontax and Centrum - are built on

trusted science, innovation and deep human

understanding.

For

more information please visit www.haleon.com

Operational review

Revenue by product category for the three months ended 30 September

2022 and 2023:

|

|

Revenue (£m)

|

|

Revenue change (%)

|

|

2023

|

2022

|

|

Reported

|

Organic1

|

|

Oral

Health

|

790

|

787

|

|

0.4%

|

9.4%

|

|

VMS

|

410

|

437

|

|

(6.2)%

|

1.4%

|

|

Pain

Relief

|

636

|

648

|

|

(1.9)%

|

6.2%

|

|

Respiratory

Health

|

439

|

457

|

|

(3.9)%

|

4.2%

|

|

Digestive

Health and Other

|

523

|

563

|

|

(7.1)%

|

0.9%

|

|

Group revenue

|

2,798

|

2,892

|

|

(3.3)%

|

5.0%

|

1. Reported revenue is calculated at the average rate for the

period. Organic revenue is calculated at constant currency. The

difference between Reported and Organic revenue growth is

predominantly due to adjustment to recalculate the reported results

as if they had been generated at prior year exchange rates.

Definitions and calculations of non-IFRS measures can be found in

the Appendix

All

commentary below refers to organic revenue growth unless otherwise

stated. Key category performance was as follows:

Oral Health

Organic

revenue growth of 9.4%, with all three Power Brands delivering

double digit growth. Sensodyne continued to see strong

growth in the US, LatAm and India. parodontax benefited from particularly

strong growth in Middle East & Africa and some European

markets. Denture Care was strong in LatAm.

VMS

Organic

revenue grew 1.4%. Centrum

experienced double-digit growth largely in China, the US and Middle

East & Africa, partly offset by a double digit decline in

Emergen-C in North America

as the immunity category continued to revert to pre-COVID-19

levels. Caltrate declined

low single digit following a strong comparative in the prior year

in South East Asia and Taiwan.

Pain Relief

Organic

revenue growth of 6.2% driven by very strong growth in Panadol in Middle East & Africa,

and in APAC, the latter helped by restocking following improved

capacity. Voltaren grew

mid-single digit with strength in Central and Eastern Europe and

some other European markets. Advil declined mid-single digit due to

more competitive market conditions. Fenbid declined double digit following

significant growth in H1 2023 due to the cessation of COVID-19

lockdown restrictions, with inventory levels normalising in

Q3.

Respiratory Health

Organic

revenue increased 4.2% reflecting the normal seasonal sell in in

EMEA and LatAm, and North America, as well as weakness in allergy.

Theraflu increased double

digit with strong growth in Central and Eastern Europe.

Robitussin saw strong

growth from improved capacity in North America in contrast to

constraints last year. Flonase declined high single digit

given normalisation of inventory following a weak

season.

Digestive Health and Other

Organic

revenue growth of 0.9% was adversely impacted by one-off retailer

inventory adjustments in North America and to a lesser extent by

phasing of contract manufacturing sales. Digestive Health declined

mid-single digit with mid-single digit growth in Eno offset by a double digit decline in

Preparation H and

Benefiber. Skin Health

brands increased mid-single digit driven by growth in Bactroban in APAC and Abreva/Zovirax in North America and

EMEA and LatAm, which more than offset a decline in Fenistil. Smokers Health revenue

declined mid-single digit.

Geographical segment performance

Revenue by geographical segment for the three months ended 30

September:

|

|

Revenue (£m)

|

|

Revenue change (%)

|

|

|

2023

|

2022

|

|

Reported

|

Organic1

|

|

Price1

|

Vol/Mix1

|

|

North America

|

1,018

|

1,101

|

|

(7.5)%

|

(1.5)%

|

|

2.6%

|

(4.1)%

|

|

EMEA and LatAm

|

1,155

|

1,136

|

|

1.7%

|

10.8%

|

|

12.7%

|

(1.9)%

|

|

APAC

|

625

|

655

|

|

(4.6)%

|

5.9%

|

|

2.9%

|

3.0%

|

|

Group

|

2,798

|

2,892

|

|

(3.3)%

|

5.0%

|

|

6.6%

|

(1.6)%

|

1. Reported revenue is calculated at the average rate for the

period. Organic revenue is calculated at constant currency. The

difference between Reported and Organic revenue growth is

predominantly due to adjustment to recalculate the reported results

as if they had been generated at prior year exchange rates.

Definitions and calculations of non-IFRS measures can be found in

the Appendix.

All

commentary refers to organic growth unless otherwise

stated.

|

North America

|

|

●

|

Organic revenue growth in North America was (1.5)%, with 2.6% price

and (4.1)% volume/mix.

|

|

●

|

Volume/mix decline largely reflected reduced volume in Digestive

Health and Other largely driven by a one-off retailer inventory

adjustment and the expected double digit decline in

Emergen-C. Removing the impact of both of these factors

volume/mix would have been slightly positive.

|

|

●

|

Oral Health saw mid-single digit growth with high-single digit

growth in Sensodyne reflecting continued strong performance of

Sensodyne Pronamel

Active Shield. VMS increased

low-single digit with Centrum up double digit reflecting outperformance

of Centrum

Silver which continued to

benefit from activation of cognitive function claims. VMS category

growth was reduced by Emergen-C. Respiratory Health declined low-single digit

reflecting limited out of season use and a normal seasonal sell in;

as well as weaker allergy performance. Pain Relief declined

mid-single digit largely driven by Advil. Digestive Health and Other revenue fell

mid-single digit largely reflecting Digestive Health which declined

double digit due to retailer inventory adjustments, mainly

on Benefiber and Preparation

H, as well as weakness in

Smokers Health.

|

|

Europe, Middle East & Africa (EMEA) and Latin America

(LatAm)

|

|

●

|

Organic revenue growth in EMEA and LatAm was 10.8%, with 12.7%

price and (1.9)% volume/mix.

|

|

●

|

There was a c.3% impact to Q3 2023 revenue from pricing in Turkey

and Argentina, which impacted the overall Group by

c.1%.

|

|

●

|

Negative volume/mix largely reflected a decline in LatAm,

predominantly from weakness in Mexico and Columbia.

|

|

●

|

Oral Health, Pain Relief and Digestive Health and Other all grew

double digit. In Oral Health, revenue increased double digit due to

double digit growth in Sensodyne and Denture Care

and high single digit growth in

parodontax.

In Pain Relief double digit growth was

largely due to strength in Panadol where revenue grew double digit driven by price

and strong demand in Middle East & Africa. Voltaren grew high-single digit. Respiratory Health saw

mid-single digit growth with particular strength in

Theraflu. In Digestive Health and Other, there was double

digit growth in Digestive Health with Eno particularly strong. Smokers Health and Skin

Health both increased mid-single digit. VMS revenue declined

low-single digit, with double digit growth in Centrum more than offset by a decline in some Local

Brands.

|

|

●

|

Geographically, Middle East & Africa, and LatAm saw strong

double digit revenue growth which was price driven. Central and

Eastern Europe was up high-single digit. Northern Europe, Southern

Europe and Germany increased mid-single digit.

|

|

Asia-Pacific

|

|

●

|

Organic revenue growth in APAC was 5.9%, with 2.9% price and 3.0%

volume/mix.

|

|

●

|

Respiratory Health delivered double digit growth with strong demand

arising from Cold and Flu season and improved supply, as well as

strong Flonase growth in China. High-single digit growth in Oral

Health resulted from mainly strength in Sensodyne and parodontax which both increased double digit. VMS grew

low-single digit with double digit growth in Centrum partly offset by a low-single digit decline

in Caltrate. Pain Relief grew mid-single digit with growth

in Voltaren and Panadol, up mid-single and double digit respectively,

partly offset by a move to more normal inventory levels in

Fenbid

following the exceptional growth in

H1. Digestive Health and Other increased low-single digit with

Digestive Health and Smokers Health up low-single digit and

high-single digit respectively. Skin Health grew high-single digit

mainly due to strong growth in Bactroban in China.

|

|

●

|

Geographically, India grew double digit helped by continued

strength in Sensodyne. Greater China grew mid-single digit with strong

results in Sensodyne and Centrum partly offset by a decline in Fenbid and Contac following strong sales during H1 2023 and the

subsequent normalisation of stock levels in H2. Australia/New

Zealand was up low-single digit.

|

Operating profit and margin

Operating

profit increased by 2.6% to £584m (Q3 2022: £569m), and

operating profit margin increased by 120bps to 20.9% (Q3 2022:

19.7%).

Adjusted

operating profit declined 5.0% at actual exchange rates to

£689m (Q3 2022: £725m). Adjusted operating profit at

constant currency increased 8.8% driven by good operating leverage,

particularly through price as well as efficiencies, which were

partially offset by volume/mix decline. Adjusted operating profit

margin of 24.6% declined by 50bps at actual exchange rates and was

up 90bps at constant currency.

Nine months ended 30 September 2023

The

information included here is being made public this quarter in

connection with the Registration Rights Agreement entered into on 1

June 2022 among Haleon, Pfizer, GSK and certain Scottish limited

partnerships controlled by GSK.

Operational review

Revenue

by product category for the nine months ended 30

September:

|

Revenue (£m)

|

|

Revenue change (%)

|

|

2023

|

2022

|

|

Reported

|

Organic1

|

|

Oral Health

|

2,379

|

2,225

|

|

6.9%

|

10.3%

|

|

VMS

|

1,226

|

1,253

|

|

(2.2)%

|

0.2%

|

|

Pain Relief

|

2,041

|

1,896

|

|

7.6%

|

10.6%

|

|

Respiratory Health

|

1,278

|

1,140

|

|

12.1%

|

14.8%

|

|

Digestive Health and Other

|

1,612

|

1,566

|

|

2.9%

|

5.3%

|

|

Group revenue

|

8,536

|

8,080

|

|

5.6%

|

8.5%

|

1. Reported revenue is calculated at the average rate for the

period. Organic revenue is calculated at constant currency. The

difference between Reported and Organic revenue growth is

predominantly due to adjustment to recalculate the reported results

as if they had been generated at prior year exchange rates.

Definitions and calculations of non-IFRS measures can be found on

pages 13-18.

All

commentary below refers to organic revenue growth unless otherwise

stated.

Oral Health

Organic

revenue growth of 10.3%, with all three Power Brands delivering

double digit growth. Sensodyne performance was largely due

to double digit growth in US, Middle East & Africa, LatAm and

India. parodontax growth

was broad based and particularly strong in Middle East &

Africa. Denture Care benefited from particularly strong growth in

LatAm.

VMS

Organic

revenue grew 0.2%, with mid-single digit growth in Centrum and mid-single digit growth in

Caltrate largely offset by

the expected normalisation of Emergen-C to pre-pandemic levels in

North America, and weakness in some Local Brands such as

Calsource and Scotts.

Pain Relief

Organic

revenue growth of 10.6% driven by very strong growth in

Panadol,

particularly in EMEA

and LatAm, and also in APAC due to Fenbid growth in China in H1 2023 with

9m revenue more than double last year. Voltaren grew mid-single digit helped

by strength in Central and Eastern Europe, as well as Middle East

& Africa. Advil grew

low-single digit.

Respiratory Health

Organic

revenue increased 14.8% given a strong cold and flu season at the

start of 2023, and some re-stocking in EMEA and LatAm, and North

America given particularly low inventory levels at the end of last

year. Theraflu, Otrivin and

Robitussin all saw revenue

up double digit.

Digestive Health and Other

Organic

revenue was up 5.3%, with Digestive Health up low-single digit

driven by good growth in Tums and Eno partly offset by a decline in

Nexium. Smokers Health

revenue increased low-single digit and Skin Health brands increased

mid-single digit driven by growth of Bactroban in Asia Pacific and

Fenistil in EMEA and

LatAm.

Geographical segment performance

Revenue by geographical segment for the nine months ended 30

September:

|

|

Revenue (£m)

|

|

Revenue change (%)

|

|

|

2023

|

2022

|

|

Reported

|

Organic1

|

|

Price1

|

Vol/Mix1

|

|

North America

|

3,064

|

2,974

|

|

3.0%

|

2.4%

|

|

3.9%

|

(1.5)%

|

|

EMEA and LatAm

|

3,478

|

3,205

|

|

8.5%

|

13.4%

|

|

13.0%

|

0.4%

|

|

APAC

|

1,994

|

1,901

|

|

4.9%

|

9.6%

|

|

2.5%

|

7.1%

|

|

Group

|

8,536

|

8,080

|

|

5.6%

|

8.5%

|

|

7.2%

|

1.3%

|

1. Reported revenue is calculated at the average rate for the

period. Organic revenue is calculated at constant currency. The

difference between Reported and Organic revenue growth is

predominantly due to adjustment to recalculate the reported results

as if they had been generated at prior year exchange rates.

Definitions and calculations of non-IFRS measures can be found on

pages 13-18.

All

commentary below refers to organic revenue growth unless otherwise

stated.

|

North America

|

|

●

|

Organic revenue growth in North America was 2.4%, with 3.9% price

and (1.5)% volume/mix.

|

|

●

|

Volume/Mix declined 1.5% driven by a decline in Q3 from retailer

inventory adjustments and the expected normalisation in

Emergen-C. Removing the impact of both of these factors

volume/mix would have been positive.

|

|

●

|

Oral Health increased mid-single digit, with Sensodyne and parodontax both up double digit offsetting a low-single digit

decline in Denture Care. Respiratory Health revenue increased

high-single digit given sustained incidence of cold and flu at the

start of 2023 with particular strength in Robitussin. Flonase declined mid-single digit given a weak allergy

season. Pain Relief increased low-single digit, mainly driven by

good growth in Excedrin and Voltaren, and with low single digit growth in

Advil. Digestive Health and Other declined low single

digit driven by softer consumption in Nexium partly offset by good growth in

Tums.

VMS declined high-single digit largely due to Emergen-C.

|

|

Europe, Middle East & Africa (EMEA) and Latin America

(LatAm)

|

|

●

|

Organic revenue growth in EMEA and LatAm was 13.4%, with 13.0%

price and 0.4% volume/mix.

|

|

●

|

There was a c.3% impact to 9m 2023 revenue from pricing Turkey and

Argentina, which impacted the overall group by c.1%.

|

|

●

|

Oral Health, Pain Relief, Respiratory Health, and Digestive Health

and Other, all grew double digit. In Oral Health,

Sensodyne, parodontax and Denture Care were up double-digit. Pain Relief

grew double digit with particular strength in Panadol during the third quarter driven by price and

strong demand in Middle East & Africa as well as mid-single

digit growth in Voltaren. In Digestive Health and Other, there was double

digit growth in all categories. Respiratory Health benefited from a

strong cold and flu season at the start of the year. VMS revenues

grew low-single digit underpinned by double digit growth in

Centrum

partly offset by weakness in some

Local Brands.

|

|

●

|

Geographically, LatAm, Middle East & Africa, Central and

Eastern Europe, and Southern Europe saw double digit growth.

Northern Europe was up high single digit, and Germany grew

mid-single digit.

|

|

Asia-Pacific

|

|

●

|

Organic revenue growth in APAC was 9.6%, with 2.5% price and 7.1%

volume/mix.

|

|

●

|

Double digit growth in Pain Relief and Respiratory Health was

driven mainly by Fenbid and Contac, which saw significant growth due to the easing

of COVID-19 related lockdown restrictions in China in H1. Oral

Health was up high-single digit with mid-single digit growth

in Sensodyne and double-digit in parodontax and Denture Care. Mid-single digit growth in VMS

was underpinned by mid-single digit growth in Centrum and mid-single digit growth in Caltrate. Digestive Health and Other grew low-single digit

with mid-single digit growth in Skin Health and low single digit

growth in Smokers Health which was partly offset by a low single

digit decline in Digestive Health.

|

|

●

|

Geographically, China was up double digit percent, with results

benefitting from sales of Fenbid and Contac following the easing of COVID-19 related

restrictions. India grew high-single digit with continued strength

in Sensodyne. Australia/New Zealand grew mid-single

digit.

|

Operating profit and margin

Operating

profit increased by 17.4% to £1,725m (9m 2022: £1,469m),

and operating profit margin increased by 200bps to 20.2% (9m 2022:

18.2%).

Adjusted

operating profit increased by 2.3% at actual exchange rates to

£1,960m (9m 2022: £1,916m) and increased by 8.9% at

constant currency. Good operational leverage, particularly through

price, as well as efficiencies was partly offset by adverse

transactional FX earlier in the year and higher standalone

costs.

As a

result of the above, adjusted operating profit margin was 23.0%, a

decline of 70bps at actual exchange rates and an increase of 10bps

at constant currency.

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE THREE MONTHS ENDED 30

SEPTEMBER (unaudited)

|

|

|

|

|

|

2023

|

2022

|

|

|

£m

|

£m

|

|

|

|

|

|

Revenue

|

2,798

|

2,892

|

|

Cost of sales

|

(1,082)

|

(1,073)

|

|

Gross profit

|

1,716

|

1,819

|

|

|

|

|

|

Selling, general and administration

|

(1,058)

|

(1,196)

|

|

Research and development

|

(75)

|

(82)

|

|

Other operating (expense)/income

|

1

|

28

|

|

Operating profit

|

584

|

569

|

|

|

|

|

|

Net finance costs

|

(88)

|

(74)

|

|

|

|

|

|

Profit before tax

|

496

|

495

|

|

|

|

|

|

Income tax

|

(122)

|

(130)

|

|

|

|

|

|

Profit after tax for the period

|

374

|

365

|

|

|

|

|

|

Profit attributable to shareholders of the Group

|

365

|

345

|

|

Profit attributable to non-controlling interests

|

9

|

20

|

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE NINE MONTHS ENDED 30 SEPTEMBER (unaudited)

|

|

|

|

|

|

2023

|

2022

|

|

|

£m

|

£m

|

|

|

|

|

|

Revenue

|

8,536

|

8,080

|

|

Cost of sales

|

(3,270)

|

(3,050)

|

|

Gross profit

|

5,266

|

5,030

|

|

|

|

|

|

Selling, general and administration

|

(3,320)

|

(3,375)

|

|

Research and development

|

(217)

|

(218)

|

|

Other operating (expense)/income

|

(4)

|

32

|

|

Operating profit

|

1,725

|

1,469

|

|

|

|

|

|

Net finance costs

|

(269)

|

(110)

|

|

|

|

|

|

Profit before tax

|

1,456

|

1,359

|

|

|

|

|

|

Income tax

|

(352)

|

(450)

|

|

|

|

|

|

Profit after tax for the period

|

1,104

|

909

|

|

|

|

|

|

Profit attributable to shareholders of the Group

|

1,052

|

862

|

|

Profit attributable to non-controlling interests

|

52

|

47

|

|

|

|

|

|

Basic earnings per share (pence)

|

11.4

|

9.3

|

|

Diluted earnings per share (pence)

|

11.3

|

9.3

|

Appendix

Cautionary note regarding forward-looking statements

This document contains certain statements that are, or may be

deemed to be, "forward-looking statements“ (including for

purposes of the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934).

Forward-looking statements give Haleon’s current expectations

and projections about future events, including strategic

initiatives and future financial condition and performance, and so

Haleon’s actual results may differ materially from what is

expressed or implied by such forward-looking statements.

Forward-looking statements sometimes use words such as

"expects“, "anticipates“, "believes“,

"targets“, "plans", "intends“, “aims”,

"projects“, "indicates", "may", “might”, "will",

"should“, “potential”, “could” and

words of similar meaning (or the negative thereof). All statements,

other than statements of historical facts, included in this

presentation are forward-looking statements. Such forward-looking

statements include, but are not limited to, statements relating to

future actions, prospective products or product approvals, future

performance or results of current and anticipated products, sales

efforts, expenses, the outcome of contingencies such as legal

proceedings, dividend payments and financial results.

Any forward-looking statements made by or on behalf of Haleon speak

only as of the date they are made and are based upon the knowledge

and information available to Haleon on the date of this document.

These forward-looking statements and views may be based on a number

of assumptions and, by their nature, involve known and unknown

risks, uncertainties and other factors because they relate to

events and depend on circumstances that may or may not occur in the

future and/or are beyond Haleon’s control or precise

estimate. Such risks, uncertainties and other factors that could

cause Haleon’s actual results, performance or achievements to

differ materially from those in the forward-looking statements

include, but are not limited to, those discussed under “Risk

Factors” on pages 202 to 210 in Haleon’s Annual Report

and Form 20-F 2022. Forward-looking statements should, therefore,

be construed in light of such risk factors and undue reliance

should not be placed on forward-looking statements.

Subject to our obligations under English and U.S. law in relation

to disclosure and ongoing information (including under the Market

Abuse Regulations, the UK Listing Rules and the Disclosure and

Transparency Rules of the Financial Conduct Authority ("FCA")), we

undertake no obligation to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. You should, however, consult any

additional disclosures that Haleon may make in any documents which

it publishes and/or files with the SEC and take note of these

disclosures, wherever you are located.

No statement in this document is or is intended to be a profit

forecast or profit estimate.

Use of non-IFRS measures (unaudited)

We use certain alternative performance measures to make financial,

operating, and planning decisions and to evaluate and report

performance. We believe these measures provide useful information

to investors and as such, where clearly identified, we have

included certain alternative performance measures in this document

to allow investors to better analyse our business performance and

allow greater comparability. To do so, we have excluded items

affecting the comparability of period-over-period financial

performance. Adjusted Results and other non-IFRS measures may be

considered in addition to, but not as a substitute for or superior

to, information presented in accordance with IFRS.

Constant currency

The Group’s reporting currency is Pounds Sterling, but the

Group’s significant international operations give rise to

fluctuations in foreign exchange rates. To neutralise foreign

exchange impact and to better illustrate the change in results from

one period to the next, the Group discusses its results both

on an “as reported basis” or using actual exchange

rates (AER) (local currency results translated into Pounds Sterling

at the prevailing foreign exchange rate) and using constant

currency exchange rates (CER). To calculate results on a constant

currency basis, prior year exchange rates are used to restate

current year comparatives. The principal currencies and relevant

exchange rates in the key markets where the Group operates are

shown below.

|

|

|

|

|

|

|

|

|

Nine months to 30 September

|

|

|

|

2023

|

|

2022

|

|

Average rates:

|

|

|

|

|

|

USD/£

|

|

1.24

|

|

1.26

|

|

Euro/£

|

|

1.15

|

|

1.18

|

|

CNY/£

|

|

8.75

|

|

8.27

|

Adjusted results

Adjusted results comprise Adjusted cost of sales, Adjusted gross

profit, Adjusted gross profit margin, Adjusted selling, general and

administration (SG&A), Adjusted research and development

(R&D), Adjusted other operating income/(expense), Adjusted

operating expenses, Adjusted operating profit, Adjusted operating

profit margin, Adjusted net finance costs, Adjusted profit before

tax, Adjusted income tax, Adjusted effective tax rate, Adjusted

profit after tax, Adjusted profit attributable to shareholders,

Adjusted diluted earnings per share. Adjusted results exclude net

amortisation and impairment of intangible assets, restructuring

costs, transaction-related costs, separation and admission costs,

and disposals and others, in each case net of the impact of taxes

(where applicable) (collectively the Adjusting items).

Management believes that Adjusted Results, when considered together

with the Group’s operating results as reported under IFRS,

provide investors, analysts and other stakeholders with helpful

complementary information to understand the financial performance

and position of the Group from period to period and allow the

Group’s performance to be more easily

comparable.

Adjusting items

Adjusted Results exclude the following items (net of the impact of

taxes, where applicable):

Net amortisation and impairment of intangible assets

Net impairment of intangibles, impairment of goodwill and

amortisation of acquired intangibles excluding computer software.

These adjustments are made to reflect the performance of the

business excluding the effect of acquisitions.

Restructuring costs

From time to time, the Group may undertake business restructuring

programmes that are structural in nature and significant in scale.

The cost associated with such programmes includes severance and

other personnel costs, professional fees, impairments of assets,

and other related items.

Transaction-related costs

Transaction related accounting or other adjustments related to

significant acquisitions including deal costs and other

pre-acquisition costs when there is certainty that an acquisition

will complete. It also includes costs of registering and issuing

debt and equity securities and the effect of inventory revaluations

on acquisitions.

Separation and admission costs

Costs incurred in relation to and in connection with separation, UK

Admission and registration of the Company’s Ordinary Shares

represented by the Company’s American Depositary Shares

(ADSs) under the US Exchange Act of 1934 and listing of ADSs on the

NYSE (the US Listing). These costs are not directly attributable to

the sale of the Group’s products and specifically relate to

the foregoing activities, affecting comparability of the

Group’s financial results in historical and future reporting

periods.

Disposals and others

Includes gains and losses on disposals of assets, businesses and

tax indemnities related to business combinations, legal settlement

and judgements, impact of changes in tax rates and tax laws on

deferred tax assets and liabilities, retained or uninsured losses

related to acts of terrorism, significant product recalls, natural

disasters and other items. These gains and losses are not directly

attributable to the sale of the Group’s products and vary

from period to period, which affects comparability of the

Group’s financial results. From period to period, the Group

will also need to apply judgement if items of unique nature arise

that are not specifically listed above.

The following tables set out a reconciliation between IFRS and

Adjusted Results for the three-month periods ended 30

September 2023 and 30 September 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

|

|

|

|

|

|

|

|

|

|

|

|

|

amortisation

|

|

|

|

|

|

|

|

|

|

|

|

|

and

|

|

|

|

|

|

|

|

|

|

|

|

|

impairment of

|

|

|

|

Transaction-

|

|

Separation

|

|

Disposals

|

|

|

|

IFRS

|

intangible

|

|

Restructuring

|

|

related

|

|

and admission

|

|

and

|

|

Adjusted

|

|

£m

|

Results

|

assets1

|

|

costs2

|

|

costs3

|

|

costs4

|

|

others5

|

|

Results

|

|

2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

2,798

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,798

|

|

Operating profit

|

584

|

7

|

|

60

|

|

1

|

|

34

|

|

3

|

|

689

|

|

Operating profit margin %

|

20.9%

|

|

|

|

|

|

|

|

|

|

|

24.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

2,892

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,892

|

|

Operating profit

|

569

|

10

|

|

4

|

|

—

|

|

142

|

|

—

|

|

725

|

|

Operating profit margin %

|

19.7%

|

|

|

|

|

|

|

|

|

|

|

25.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

Net amortisation and impairment

of intangible assets: includes

impairment of intangible assets £nil (2022: £nil), and

amortisation of intangible assets excluding computer software

£7m (2022: £10m).

2.

Restructuring costs:

includes amounts related to business

transformation activities.

3.

Transaction-related

costs: includes amounts related

to acquisition of a manufacturing site.

4.

Separation and admission

costs: includes amounts

incurred in relation to and in connection with the separation

£34m (2022: £73m) and listing £nil (2022: £69m)

of the Group as a standalone business.

5.

Disposals and others:

includes net loss/(gains) on disposals

of assets and businesses and other items totalling £3m (2022:

£nil).

Organic revenue growth

Organic revenue growth represents the change in organic revenue at

CER from one accounting period to the next.

Organic revenue represents revenue, as determined under IFRS but

excluding the impact of acquisitions, divestments and closures of

brands or businesses, revenue attributable to manufacture and

supply agreements (MSAs) relating to divestments and the closure of

sites or brands, and the impact of currency exchange

movements.

Revenue attributable to MSAs relating to divestments and production

site or brand closures has been removed from organic revenue

because these agreements are transitional and, with respect to

production site closures, include a ramp-down period in which

revenue attributable to MSAs gradually reduces several months

before the production site closes. This revenue reduces the

comparability of prior and current year revenue and is

therefore adjusted for in the calculation of organic revenue

growth.

Organic revenue is calculated period-to-period as follows, with

prior year exchange rates to restate current year

comparatives:

–

Current year

organic revenue excludes revenue from brands or businesses acquired

in the current accounting period.

–

Current year

organic revenue excludes revenue attributable to brands or

businesses acquired in the prior year from 1 January of

the comparative period to the date of completion of the

acquisition.

–

Prior year

organic revenue excludes revenue in respect of brands or businesses

divested or closed in the current accounting period from

12 months prior to the completion of the disposal or closure

until the end of the prior accounting period.

–

Prior year

organic revenue excludes revenue in respect of brands or businesses

divested or closed in the previous accounting period in

full.

–

Prior year and

current year organic revenue excludes revenue attributable to

MSAs relating to divestments and production site closures taking

place in either the current or prior year, each an Organic

Adjustment.

To calculate organic revenue growth for the period, organic revenue

for the prior year is subtracted from organic revenue in the

current year and divided by organic revenue in the

prior year.

The Group believes that discussing organic revenue growth

contributes to the understanding of the Group’s performance

and trends because it allows for a period-on-period comparison

of revenue in a meaningful and consistent manner.

Organic revenue growth by individual geographical segment is

further discussed by price and volume/mix changes, which are

defined as follows:

–

Price: Defined as the variation in

revenue attributable to changes in prices during the period. Price

excludes the impact to organic revenue growth due to (i) the

volume of products sold during the period and (ii) the

composition of products sold during the period. Price is calculated

as current year net price minus prior year net price

multiplied by current year volume. Net price is the sales

price, after deduction of any trade, cash or volume discounts that

can be reliably estimated at point of sale. Value added tax and

other sales taxes are excluded from the net price.

–

Volume/Mix: Defined as the variation in

revenue attributable to changes in volumes and composition of

products in the period.

The following tables reconcile reported revenue growth for

the three-month periods ended 30 September 2023 and 30

September 2022 to organic revenue growth for the same periods by

geographical segment and by product category.

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographical Segments

|

|

Three months ended 30 September

|

|

North

|

|

EMEA and

|

|

|

|

|

|

2023 vs 2022 (%)

|

|

America

|

|

LatAm

|

|

APAC

|

|

Total

|

|

Revenue growth

|

|

(7.5)

|

|

1.7

|

|

(4.6)

|

|

(3.3)

|

|

Organic adjustments of which:

|

|

—

|

|

—

|

|

0.1

|

|

—

|

|

Effect

of Acquisitions

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Effect

of Divestments

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Effect

of MSAs

|

|

—

|

|

—

|

|

0.1

|

|

—

|

|

Effect of Exchange Rates

|

|

6.0

|

|

9.1

|

|

10.4

|

|

8.3

|

|

Organic revenue growth

|

|

(1.5)

|

|

10.8

|

|

5.9

|

|

5.0

|

|

Price

|

|

2.6

|

|

12.7

|

|

2.9

|

|

6.6

|

|

Volume/Mix

|

|

(4.1)

|

|

(1.9)

|

|

3.0

|

|

(1.6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographical Segments

|

|

Three months ended 30 September

|

|

North

|

|

EMEA and

|

|

|

|

|

|

2022 vs 2021 (%)

|

|

America

|

|

LatAm

|

|

APAC

|

|

Total

|

|

Revenue growth

|

|

18.5

|

|

13.1

|

|

17.6

|

|

16.1

|

|

Organic adjustments of which:

|

|

0.1

|

|

0.6

|

|

(1.3)

|

|

—

|

|

Effect

of Acquisitions

|

|

—

|

|

—

|

|

(1.5)

|

|

(0.3)

|

|

Effect

of Divestments

|

|

—

|

|

0.2

|

|

—

|

|

0.1

|

|

Effect

of MSAs

|

|

0.1

|

|

0.4

|

|

0.2

|

|

0.2

|

|

Effect of Exchange Rates

|

|

(15.7)

|

|

(1.5)

|

|

(7.3)

|

|

(8.0)

|

|

Organic revenue growth

|

|

2.9

|

|

12.2

|

|

9.0

|

|

8.1

|

|

Price

|

|

4.2

|

|

8.3

|

|

2.7

|

|

5.5

|

|

Volume/Mix

|

|

(1.3)

|

|

3.9

|

|

6.3

|

|

2.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product Categories

|

|

|

|

|

|

|

|

|

|

|

|

Digestive

|

|

|

|

Three months ended 30 September

|

|

Oral

|

|

|

|

Pain

|

|

Respiratory

|

|

Health and

|

|

|

|

2023 vs 2022 (%)

|

|

Health

|

|

VMS

|

|

Relief

|

|

Health

|

|

Other

|

|

Total

|

|

Revenue growth

|

|

0.4

|

|

(6.2)

|

|

(1.9)

|

|

(3.9)

|

|

(7.1)

|

|

(3.3)

|

|

Organic adjustments of which:

|

|

—

|

|

—

|

|

0.2

|

|

—

|

|

(0.2)

|

|

—

|

|

Effect

of Acquisitions

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Effect

of Divestments

|

|

—

|

|

—

|

|

0.2

|

|

|

|

(0.2)

|

|

—

|

|

Effect

of MSAs

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Effect of Exchange Rates

|

|

9.0

|

|

7.6

|

|

7.9

|

|

8.1

|

|

8.2

|

|

8.3

|

|

Organic revenue growth

|

|

9.4

|

|

1.4

|

|

6.2

|

|

4.2

|

|

0.9

|

|

5.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product Categories

|

|

|

|

|

|

|

|

|

|

|

|

Digestive

|

|

|

|

Three months ended 30 September

|

|

Oral

|

|

|

|

Pain

|

|

Respiratory

|

|

Health and

|

|

|

|

2022 vs 2021 (%)

|

|

Health

|

|

VMS

|

|

Relief

|

|

Health

|

|

Other

|

|

Total

|

|

Revenue growth

|

|

12.3

|

|

8.2

|

|

11.5

|

|

40.2

|

|

17.8

|

|

16.1

|

|

Organic adjustments of which:

|

|

(0.2)

|

|

(0.5)

|

|

(0.5)

|

|

(0.4)

|

|

1.4

|

|

—

|

|

Effect

of Acquisitions

|

|

(0.2)

|

|

(0.5)

|

|

(0.8)

|

|

—

|

|

(0.1)

|

|

(0.3)

|

|

Effect

of Divestments

|

|

—

|

|

—

|

|

0.3

|

|

(0.4)

|

|

0.2

|

|

0.1

|

|

Effect

of MSAs

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1.3

|

|

0.2

|

|

Effect of Exchange Rates

|

|

(5.4)

|

|

(9.1)

|

|

(7.4)

|

|

(9.6)

|

|

(10.8)

|

|

(8.0)

|

|

Organic revenue growth

|

|

6.7

|

|

(1.4)

|

|

3.6

|

|

30.2

|

|

8.4

|

|

8.1

|

Adjusted results for the nine months ended 30 September 2023 and 30

September 2022 (unaudited)

The following tables set out a reconciliation between IFRS and

Adjusted Results for the nine-month periods ended 30 September

2023 and 30 September 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

amortisation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

impairment of

|

|

|

|

Transaction-

|

|

Separation

|

|

Disposals

|

|

|

|

|

|

IFRS

|

|

intangible

|

|

Restructuring

|

|

related

|

|

and admission

|

|

and

|

|

Adjusted

|

|

£m

|

|

Results

|

|

assets1

|

|

costs2

|

|

costs3

|

|

costs4

|

|

others5

|

|

Results

|

|

2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

8,536

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

8,536

|

|

Operating profit

|

|

1,725

|

|

30

|

|

90

|

|

8

|

|

94

|

|

13

|

|

1,960

|

|

Operating profit margin %

|

|

20.2%

|

|

|

|

|

|

|

|

|

|

|

|

23.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

8,080

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

8,080

|

|

Operating profit

|

|

1,469

|

|

50

|

|

24

|

|

—

|

|

371

|

|

2

|

|

1,916

|

|

Operating profit margin %

|

|

18.2%

|

|

|

|

|

|

|

|

|

|

|

|

23.7%

|

1.

Net amortisation and impairment

of intangible assets: includes

impairment of intangible assets £nil (2022: £18m), and

amortisation of intangible assets excluding computer software

£30m (2022: £32m).

2.

Restructuring costs:

includes amounts related to business

transformation activities.

3.

Transaction-related

costs: includes amounts related

to acquisition of a manufacturing site.

4.

Separation and admission

costs: includes amounts

incurred in relation to and in connection with the separation

£94m (2022: £259m) and listing £nil (2022:

£112m) of the Group as a standalone

business.

5.

Disposals and others:

includes net loss/(gains) on disposals

of assets and businesses and other items totalling £13m (2022:

£2m).

Organic revenue growth for the nine months ended 30 September 2023

and 30 September 2022 (unaudited)

The following tables reconcile reported revenue growth for

the nine-month periods ended 30 September 2023 and 30

September 2022 to organic revenue growth for the same periods by

geographical segment and by product category.

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographical Segments

|

|

Nine months ended 30 September

|

|

North

|

|

EMEA and

|

|

|

|

|

|

2023 vs 2022 (%)

|

|

America

|

|

LatAm

|

|

APAC

|

|

Total

|

|

Revenue growth

|

|

3.0

|

|

8.5

|

|

4.9

|

|

5.6

|

|

Organic adjustments of which:

|

|

—

|

|

0.2

|

|

(0.1)

|

|

—

|

|

Effect

of Acquisitions

|

|

—

|

|

—

|

|

(0.2)

|

|

(0.1)

|

|

Effect

of Divestments

|

|

—

|

|

0.2

|

|

—

|

|

0.1

|

|

Effect

of MSAs

|

|

—

|

|

—

|

|

0.1

|

|

—

|

|

Effect of Exchange Rates

|

|

(0.6)

|

|

4.7

|

|

4.8

|

|

2.9

|

|

Organic revenue growth

|

|

2.4

|

|

13.4

|

|

9.6

|

|

8.5

|

|

Price

|

|

3.9

|

|

13.0

|

|

2.5

|

|

7.2

|

|

Volume/Mix

|

|

(1.5)

|

|

0.4

|

|

7.1

|

|

1.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographical Segments

|

|

Nine months ended 30 September

|

|

North

|

|

EMEA and

|

|

|

|

|

|

2022 vs 2021 (%)

|

|

America

|

|

LatAm

|

|

APAC

|

|

Total

|

|

Revenue growth

|

|

17.8

|

|

10.3

|

|

16.3

|

|

14.4

|

|

Organic adjustments of which:

|

|

0.4

|

|

1.2

|

|

(0.9)

|

|

0.4

|

|

Effect

of Acquisitions

|

|

—

|

|

—

|

|

(1.0)

|

|

(0.2)

|

|

Effect

of Divestments

|

|

0.2

|

|

0.6

|

|

—

|

|

0.3

|

|

Effect

of MSAs

|

|

0.2

|

|

0.6

|

|

0.1

|

|

0.3

|

|

Effect of Exchange Rates

|

|

(10.5)

|

|

0.6

|

|

(4.2)

|

|

(4.5)

|

|

Organic revenue growth

|

|

7.7

|

|

12.1

|

|

11.2

|

|

10.3

|

|

Price

|

|

2.9

|

|

5.6

|

|

2.9

|

|

4.0

|

|

Volume/Mix

|

|

4.8

|

|

6.5

|

|

8.3

|

|

6.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product Categories

|

|

|

|

|

|

|

|

|

|

|

|

Digestive

|

|

|

|

Nine months ended 30 September

|

|

Oral

|

|

|

|

Pain

|

|

Respiratory

|

|

Health and

|

|

|

|

2023 vs 2022 (%)

|

|

Health

|

|

VMS

|

|

Relief

|

|

Health

|

|

Other

|

|

Total

|

|

Revenue growth

|

|

6.9

|

|

(2.2)

|

|

7.6

|

|

12.1

|

|

2.9

|

|

5.6

|

|

Organic adjustments of which:

|

|

—

|

|

(0.1)

|

|

0.2

|

|

—

|

|

(0.1)

|

|

—

|

|

Effect

of Acquisitions

|

|

—

|

|

(0.1)

|

|

(0.2)

|

|

—

|

|

—

|

|

(0.1)

|

|

Effect

of Divestments

|

|

—

|

|

—

|

|

0.4

|

|

—

|

|

(0.1)

|

|

0.1

|

|

Effect

of MSAs

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Effect of Exchange Rates

|

|

3.4

|

|

2.5

|

|

2.8

|

|

2.7

|

|

2.5

|

|

2.9

|

|

Organic revenue growth

|

|

10.3

|

|

0.2

|

|

10.6

|

|

14.8

|

|

5.3

|

|

8.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product Categories

|

|

|

|

|

|

|

|

|

|

|

|

Digestive

|

|

|

|

Nine months ended 30 September

|

|

Oral

|

|

|

|

Pain

|

|

Respiratory

|

|

Health and

|

|

|

|

2022 vs 2021 (%)

|

|

Health

|

|

VMS

|

|

Relief

|

|

Health

|

|

Other

|

|

Total

|

|

Revenue growth

|

|

8.0

|

|

13.3

|

|

13.3

|

|

46.0

|

|

8.5

|

|

14.4

|

|

Organic adjustments of which:

|

|

(0.3)

|

|

(0.2)

|

|

(0.2)

|

|

—

|

|

2.7

|

|

0.4

|

|

Effect

of Acquisitions

|

|

(0.3)

|

|

(0.3)

|

|

(0.4)

|

|

—

|

|

—

|

|

(0.2)

|

|

Effect

of Divestments

|

|

—

|

|

0.1

|

|

0.2

|

|

—

|

|

1.1

|

|

0.3

|

|

Effect

of MSAs

|

|

—

|

|

—

|

|

—

|

|

—

|

|

1.6

|

|

0.3

|

|

Effect of Exchange Rates

|

|

(2.1)

|

|

(6.1)

|

|

(4.2)

|

|

(6.2)

|

|

(6.1)

|

|

(4.5)

|

|

Organic revenue growth

|

|

5.6

|

|

7.0

|

|

8.9

|

|

39.8

|

|

5.1

|

|

10.3

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

HALEON PLC

(Registrant)

|

|

Date:

November 2, 2023

|

By:

|

/s/

Amanda Mellor

|

|

|

|

Name:

|

Amanda

Mellor

|

|

|

|

Title:

|

Company

Secretary

|

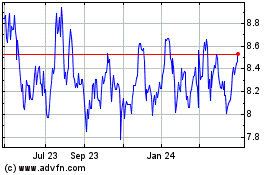

Haleon (NYSE:HLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

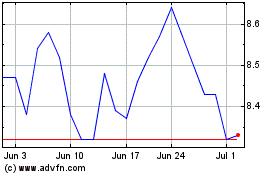

Haleon (NYSE:HLN)

Historical Stock Chart

From Jan 2024 to Jan 2025