0001360604False00013606042024-11-112024-11-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2024 (November 11, 2024)

Healthcare Realty Trust Incorporated

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | (Healthcare Realty Trust Incorporated) | | 001-35568 | | 20-4738467 | |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3310 West End Avenue, Suite 700 | Nashville, | Tennessee | 37203 | | | | (615) | 269-8175 | | | |

| (Address of Principal Executive Office and Zip Code) | | | (Registrant’s telephone number, including area code) | | |

| | | | | | | |

| | |

www.healthcarerealty.com |

| (Internet address) |

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | | HR | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter): | | | | | | | | |

| Healthcare Realty Trust Incorporated | ☐ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | | | | | | | | | | |

| Healthcare Realty Trust Incorporated | ☐ | | |

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On November 12, 2024, Healthcare Realty Trust Incorporated (the “Company”) filed a Current Report on Form 8-K (the “Original Report”) to disclose, among other matters, the appointment of Constance B. Moore, as the Company’s Interim President and Chief Executive Officer, with such appointment effective on November 11, 2024. The Company is filing this Current Report on Form 8-K/A to amend the Original Report to disclose that, on December 8, 2024, the Company entered into a letter agreement (the “Letter Agreement”) with Ms. Moore relating to her service as Interim President and Chief Executive Officer of the Company.

Pursuant to the Letter Agreement, Ms. Moore will serve as Interim President and Chief Executive Officer until the earliest of: the appointment of a permanent Chief Executive Officer; her death or disability; or termination of her employment for any reason. Ms. Moore will continue her service on the Company’s board of directors during her tenure as Interim President and Chief Executive Officer. During the term of the Letter Agreement, Ms. Moore will be paid cash compensation of $150,000 per month. She will be entitled to receive a one-time cash bonus of $312,500 that is expected to be paid no later than December 31, 2024. Ms. Moore will also receive a grant of restricted stock having a market value of $1,250,000 on the grant date, as soon as practicable following the date of the Letter Agreement. The restricted stock award will have a vesting period of one year, subject to acceleration upon the earlier of a termination without cause, including death or disability, or the commencement of employment of a permanent Chief Executive Officer. Upon the request of a new permanent Chief Executive Officer, Ms. Moore would be paid $90,000 per month for a transition period of up to 60 days following the appointment of the permanent Chief Executive Officer. Ms. Moore is also eligible to receive up to $10,000 reimbursement of legal costs in connection with negotiating the Letter Agreement and her restricted stock award agreement. During the term of the Letter Agreement, Ms. Moore will not receive any additional fees or other compensation for service on the Company’s board of directors.

The foregoing description does not purport to be complete and is qualified in its entirety by the terms and conditions of the Letter Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. | | | | | |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

|

| | | |

| | Healthcare Realty Trust Incorporated | |

| Date: December 9, 2024 | By: | /s/ Austen B. Helfrich | |

| | | Name: Austen B. Helfrich | |

| | | Title: Executive Vice President and Chief Financial Officer | |

HEALTHCARE REALTY

3310 West End Avenue, Suite 700

Nashville, Tennessee37203

P 615.269.8175 F 615.269.8461

www.healthcarerealty.com

Exhibit 10.1

December 8, 2024

Constance B. Moore

3310 West End Avenue, Suite 700

Nashville, TN 37203

Via e-mail

Re: Appointment as Interim President and CEO of Healthcare Realty Trust Incorporated (the “Company”)

Dear Connie:

As we have discussed, this letter memorializes the terms and conditions of the Company’s appointment of you to serve as Interim President and Chief Executive Officer (“Interim CEO”). You shall devote substantially all your business time and attention to the performance of the Interim CEO role, but, without limitation of the foregoing, you may continue to engage in the following outside activities: (i) director service on the boards of TriPointe Homes and Civeo Corporation, and (ii) service on charitable or civic boards or committees and management of your personal, financial investment and legal affairs, provided that none of such activities interfere materially with the performance of your duties as Interim CEO.

Term: The Company engages you as of November 11, 2024 (the “Effective Date”), and continuing until the earliest to occur of: (i) the commencement of employment of a permanent Chief Executive Officer of the Company (the “New CEO Date”), which New CEO Date may be extended at the written request of the permanent CEO for a transition period (the “New CEO Transition Period”) not to exceed 60 days following the New CEO Date; (ii) your death or disability (as determined by the Board of Directors of the Company (the “Board”)); or (iii) termination of this engagement for any reason, including your resignation as Interim CEO or the Company’s termination of your employment as Interim CEO (the period through such earliest date, the “Term”). You will continue your service as a director on the Board during the Term, subject to election by the Company’s shareholders at the 2025 annual shareholders’ meeting.

Base Cash Compensation: During the Term, the Company shall pay you cash compensation of $150,000 per month, paid on the Company’s normal payroll schedule and subject to applicable withholding taxes, prorated for any partial month; provided, that service during the New CEO Transition Period, if any, will be paid at a rate of $90,000 per month.

HEALTHCARE REALTY

3310 West End Avenue, Suite 700

Nashville, Tennessee37203

P 615.269.8175 F 615.269.8461

www.healthcarerealty.com

Exhibit 10.1

Sign-on Cash Compensation: The Company shall pay you a one-time cash sign-on bonus of $312,500, payable no later than December 31, 2024 and subject to applicable withholding taxes.

Equity Grant: As soon as practicable after the date of this letter, the Company shall grant you an award of unvested Class A common stock (“Common Stock”) having a market value of $1,250,000. The number of shares of Common Stock subject to the award will be determined by dividing $1,250,000 by the closing price of a share of Common Stock on the applicable grant date. Such award will be subject to the terms and conditions of the award agreement attached to this letter (the “Award Agreement”). Pursuant to the terms of the Award Agreement, such unvested shares shall vest on the first anniversary of the grant date, subject to your continued service as Interim CEO. Vesting will accelerate upon the earlier of: (i) the termination of your service as Interim CEO for any reason (including your death or disability (as determined by the Board)) other than due to your voluntary resignation or under circumstances constituting a termination for “cause” (as defined in the Award Agreement); or (ii) the New CEO Date.

Business Expenses: Reasonable and necessary business expenses incurred by you in the performance of your duties as Interim CEO will be reimbursed under the Company’s expense reimbursement policies and procedures and subject to audit committee oversight.

Director Compensation During Term: You acknowledge and agree that you shall not receive any additional fees or other compensation (excluding (i) reimbursements consistent with the immediately preceding section, (ii) equity awards previously granted and (iii) the cash portion of any director fees attributable to periods prior to the Effective Date, such as meeting fees and the pro-rata portion of any cash retainers) for your service on the Board (e.g., as a director or for any activities on any Board committee), during the Term, and that the compensation set forth in this letter is the only compensation from the Company to which you shall be entitled during the Term.

Legal Fees: The Company will reimburse you for up to $10,000 in legal fees incurred in connection with the negotiation of the terms of the engagement set forth herein (including the Award Agreement). Such reimbursement will be paid to you promptly following your submission of an invoice for such legal fees from your attorney.

Miscellaneous: This letter, together with the Award Agreement, contains all of the understandings and agreements between you and the Company pertaining to the

HEALTHCARE REALTY

3310 West End Avenue, Suite 700

Nashville, Tennessee37203

P 615.269.8175 F 615.269.8461

www.healthcarerealty.com

Exhibit 10.1

subject matter of this letter, and supersedes all prior and contemporaneous agreements and understandings between the parties hereto regarding the subject matter hereof (including, without limitation, any term sheet). The terms of this letter may not be modified except in a writing signed by you and the Company. The headings in this letter are inserted for convenience only, and do not form a part of the agreement contained herein. This letter will be governed by and construed in accordance with the laws of the State of Tennessee, without regard to conflicts of law principles thereunder. This letter may be executed in one or more counterparts (including, without limitation, in .pdf or other electronic format), all of which when taken together shall constitute one and the same agreement. The Company shall cause you to be covered under its directors’ and officers’ insurance policies and shall indemnify you under the indemnification provisions of its governing documents and your Indemnification Agreement dated April 12, 2022, in each case, with respect to your actions or omissions as the Company’s Interim CEO.

Code Section 409A: The parties intend that this letter agreement will be interpreted in accordance with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that any provision of this letter agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so that all payments hereunder comply with, or are exempt from, Section 409A of the Code. Each payment pursuant to this letter agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2). All reimbursements shall be paid as soon as administratively practicable, but in no event shall any reimbursement be paid after the last day of the taxable year immediately following the taxable year in which the expense was incurred.

Please sign and return to the Company a copy of this letter to confirm agreement with the terms set forth above.

Sincerely,

HEALTHCARE REALTY TRUST INCORPORATED

By: /s/ John M. Bryant, Jr.

Title: Executive Vice President and General Counsel

HEALTHCARE REALTY

3310 West End Avenue, Suite 700

Nashville, Tennessee37203

P 615.269.8175 F 615.269.8461

www.healthcarerealty.com

Exhibit 10.1

ACKNOWLEDGED AND AGREED:

/s/ Constance B. Moore

Constance B. Moore

Attachment: Award Agreement

v3.24.3

Cover Page

|

Nov. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Nov. 11, 2024

|

| Entity Registrant Name |

Healthcare Realty Trust Incorporated

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35568

|

| Entity Tax Identification Number |

20-4738467

|

| Entity Address, Address Line One |

3310 West End Avenue, Suite 700

|

| Entity Address, City or Town |

Nashville,

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37203

|

| City Area Code |

(615)

|

| Local Phone Number |

269-8175

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

HR

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001360604

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

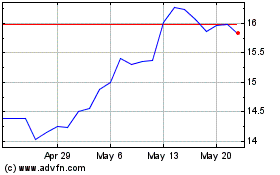

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Nov 2024 to Dec 2024

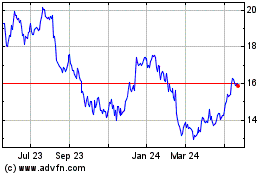

Healthcare Realty (NYSE:HR)

Historical Stock Chart

From Dec 2023 to Dec 2024