0001360604False00013606042024-12-082024-12-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2024 (December 8, 2024)

Healthcare Realty Trust Incorporated

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | | 001-35568 | | 20-4738467 | |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3310 West End Avenue, Suite 700 | Nashville, | Tennessee | 37203 | | | | (615) | 269-8175 | | | |

| (Address of Principal Executive Office and Zip Code) | | | (Registrant’s telephone number, including area code) | | |

| | | | | | | |

| | |

www.healthcarerealty.com |

| (Internet address) |

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

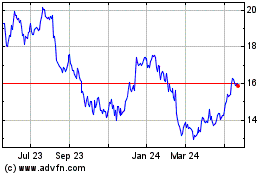

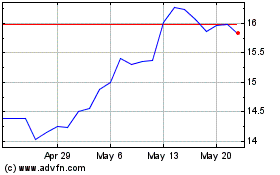

| Class A Common Stock, $0.01 par value per share | | HR | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter): If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Chief Financial Officer

On December 8, 2024, the Board of Directors of Healthcare Realty Trust Incorporated (the “Company”) appointed Austen B. Helfrich as the Company’s Executive Vice President and Chief Financial Officer. Mr. Helfrich, age 37, has been employed by the Company since June 2019, most recently serving as Interim Chief Financial Officer since October 1, 2024. Prior to that, Mr. Helfrich served in the roles of First Vice President, Portfolio Strategy; Vice President, Corporate Finance; and Associate Vice President, Corporate Finance. Prior to joining the Company, Mr. Helfrich was employed at Point72 Asset Management, Columbus Hill Capital Management, and Citigroup’s investment banking division. There is no arrangement or understanding between Mr. Helfrich and any other person pursuant to which Mr. Helfrich was selected as the Company’s Executive Vice President and Chief Financial Officer. Mr. Helfrich has no family relationships with any director, executive officer or person nominated or chosen by the Company to become a director or executive officer of the Company. Mr. Helfrich is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Effective December 8, 2024, the Company entered into an amended and restated employment agreement with Mr. Helfrich with material terms substantially similar to the employment agreements of the Company’s other Executive Vice Presidents. For his service as Executive Vice President and Chief Financial Officer, Mr. Helfrich is expected to receive a base salary equal to $450,000 on an annual basis and, beginning January 1, 2025, is expected to participate in the Company’s cash and equity incentive program for executive officers.

The foregoing description of Mr. Helfrich’s amended and restated employment agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the amended and restated employment agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Transition of General Counsel Role

Also on December 8, 2024, as part of a planned transition, the Board appointed Andrew E. Loope as the Company’s Executive Vice President, General Counsel, and Secretary, effective January 1, 2025. Mr. Loope, age 55, has been employed by the Company since July 2008 and currently serves as the Company’s Senior Vice President, Corporate Counsel, and Secretary. Mr. Loope is expected to receive a base salary equal to $450,000 on an annual basis and, beginning January 1, 2025, is expected to participate in the Company’s cash and equity incentive program for executive officers. The Company has entered into an Amended and Restated Employment Agreement with Mr. Loope, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

In connection with Mr. Loope’s appointment, on December 31, 2024, John M. Bryant, Jr. will step down from his position as Executive Vice President and General Counsel. Mr. Bryant, age 58, has served as the Company’s General Counsel since November 2003. On December 8, 2024, the Board appointed Mr. Bryant to serve as the Company’s Senior Vice President, Legal Affairs, effective January 1, 2025. Mr. Bryant is expected to serve in that role in the Company’s legal department through 2026. Beginning on January 1, 2025, Mr. Bryant will be paid a base salary of $450,000, be eligible for performance-based cash incentive bonuses, and will no longer participate in the Company’s equity incentive programs.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On December 9, 2024, the Company issued a press release announcing the management changes described above in Item 5.02. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. | | | | | |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

|

| | | |

| | Healthcare Realty Trust Incorporated | |

| Date: December 9, 2024 | By: | /s/ Austen B. Helfrich | |

| | | Name: Austen B. Helfrich | |

| | | Title: Executive Vice President and Chief Financial Officer | |

Healthcare Realty Trust Incorporated

AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (the “Agreement”) is effective as of December 8, 2024 (“Effective Date”) by and between HEALTHCARE REALTY TRUST INCORPORATED, a Maryland corporation (“Corporation”), and Austen B. Helfrich (“Officer”).

RECITALS

WHEREAS, the Corporation has employed Officer as its Interim Chief Financial Officer under the terms of an employment agreement dated January 1, 2021, as amended October 1, 2024 (the “Prior Agreement”); and

WHEREAS, the parties desire to modify the Prior Agreement with this amendment and restatement to acknowledge Officer’s appointment to the office of Executive Vice President and Chief Financial Officer and to conform terms of employment and the officer’s compensation with the Corporation’s current compensation practices and commensurate with Officer’s position;

NOW, THEREFORE, in consideration of the foregoing premises, and other good and valuable consideration, the receipt and sufficiency of which are hereby affirmed, the parties hereto agree to the following to supersede the Prior Agreement as a complete amendment and restatement thereof as of the Effective Date:

1. Duties. During the term of this Agreement, Officer agrees to be employed by and to serve Corporation as its Executive Vice President and Chief Financial Officer and Corporation agrees to employ and retain Officer in such capacity. Officer shall have such duties and responsibilities as may be prescribed by the Corporation’s Chief Executive Officer and/or the Board of Directors. Officer shall devote such of his business time, energy, and skill to the affairs of Corporation as shall be necessary to perform his duties under this Agreement. Officer shall report to Corporation’s Chief Executive Officer and at all times during the term of this Agreement shall have powers and duties at least commensurate with his position as Executive Vice President and Chief Financial Officer. Officer’s principal place of business with respect to his services to Corporation shall be within 35 miles of Nashville, Tennessee.

2. Term of Employment.

2.1 Definitions. For purposes of this Agreement the following terms shall have the following meanings:

(a) “Bonus Compensation” shall mean any cash bonus and any non-equity incentive plan compensation, whether pursuant to the Incentive Plans or awarded through the discretion of the Corporation.

(b) “Change in Control” shall mean (i) the acquisition by any person and all other persons who constitute a group (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934 (“Exchange Act”)) of direct or indirect beneficial ownership

(within the meaning of Rule 13d-3 under the Exchange Act) of 20 percent or more of Corporation’s outstanding securities, unless a majority of the “Continuing Directors” approves the acquisition not later than ten business days after Corporation makes that determination, or (ii) the first day on which a majority of the members of Corporation’s Board of Directors are not “Continuing Directors”.

(c) “Constructive Termination” shall mean (i) any material breach of this Agreement by Corporation, (ii) any substantial reduction in the authority or responsibility of Officer or other substantial reduction in the terms and conditions of Officer’s employment under circumstances which would not justify a Termination For Cause and which are not the result of a breach by Officer of this Agreement, (iii) any act(s) by Corporation which are designed to or have the effect of rendering Officer’s working conditions so intolerable or demeaning on a recurring basis that a reasonable person would resign such employment, or (iv) Corporation’s relocation of Officer to a location that is more than 35 miles from the location of Corporation’s headquarters on the date this Agreement is executed.

(d) “Continuing Directors” shall mean, as of any date of determination, any member of the Board of Directors of Corporation who (i) was a member of that Board of Directors on the Effective Date, (ii) has been a member of that Board of Directors for the two years immediately preceding such date of determination, or (iii) was nominated for election or elected to the Board of Directors with the affirmative vote of the greater of (x) a majority of Continuing Directors who were members of the Board at the time of such nomination or election or (y) at least four Continuing Directors.

(e) “Incentive Plans” shall mean the Corporation’s Amended and Restated 2006 Incentive Plan, and any successor plans, or other equity-based plan or arrangement adopted by the Compensation and Human Capital Committee of the Board of Directors (the “Compensation Committee”) from time to time.

(f) “Termination For Cause” shall mean termination by Corporation of Officer’s employment by reason of Officer’s (i) dishonesty towards Corporation, (ii) fraud upon Corporation, or (iii) deliberate injury or attempted injury to Corporation, in each such case causing material injury to Corporation, or by reason of Officer’s breach of this Agreement causing material injury to Corporation. Corporation shall have the burden of establishing that any such termination of Officer’s employment by Corporation is a Termination For Cause.

(g) “Termination Other Than For Cause” shall mean any termination by Corporation of Officer’s employment by Corporation, other than (i) a Termination For Cause or (ii) termination by reason of Officer’s death or disability as described in Sections 2.5 and 2.6. Termination Other Than For Cause shall include a Constructive Termination of Officer’s employment, effective upon notice from Officer to Corporation of such Constructive Termination.

(h) “Termination Upon a Change in Control” shall mean a termination of Officer’s employment with Corporation within 12 months following a “Change in Control” that constitutes a Termination Other Than For Cause described in Section 2.1(g).

(i) “Voluntary Termination” shall mean termination by Officer of Officer’s employment by Corporation other than (i) a Constructive Termination as described in subsection 2.1(c), (ii) “Termination Upon a Change in Control” as described in Section 2.1(h), and (iii) termination by reason of Officer’s death or disability as described in Sections 2.5 and 2.6.

2.2 Basic Term. The term of this Agreement shall commence on the Effective Date and continue through December 31, 2024, unless terminated pursuant to this Section 2. On December 31, 2024, and on December 31 of each succeeding year, the first sentence of this Section 2.2 shall be automatically amended to provide that the term of the Agreement shall be renewed for a one-year period commencing on the next January 1 and continuing through December 31 of the same year, such that this Agreement shall be deemed to have been renewed each year for a one-year period prior to the expiration of the current term.

2.3 Termination For Cause. Termination For Cause may be effected by Corporation at any time during the term of this Agreement and shall be effected by written notification to Officer. Upon Termination For Cause, Officer immediately shall be paid all accrued Base Salary (as that term is defined below) adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded but not yet paid, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, but Officer shall not be paid any other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.4 Termination Other Than For Cause or Constructive Termination. Notwithstanding anything else in this Agreement, Corporation may effect a Termination Other Than For Cause at any time upon giving written notice to Officer of such termination. Upon any Termination Other Than For Cause, or upon a Constructive Termination, Officer shall immediately be paid all accrued Base Salary adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded but not yet paid, any benefits under any plans of the Corporation (including any benefits under any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, full vesting of all awards previously granted to Officer under the Incentive Plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, and all severance compensation provided in Section 4.2, but no other compensation or reimbursement of any kind.

2.5 Termination by Reason of Disability. If, during the term of this Agreement, Officer, in the reasonable judgment of the Board of Directors of Corporation, has failed to perform his duties under this Agreement on account of illness or physical or mental incapacity, and such illness or incapacity continues for a period of more than 12 consecutive months, Corporation shall have the right to terminate Officer’s employment hereunder by written notification to Officer and payment to Officer of all accrued Base Salary adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded but not yet paid, full vesting of any awards granted to Officer under the Incentive Plans, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, accrued vacation

pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, with the exception of medical and dental benefits which shall continue at Corporation’s expense through the then current one-year term of the Agreement, but Officer shall not be paid any other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.6 Death. In the event of Officer’s death during the term of this Agreement, Officer’s employment shall be deemed to have terminated as of the last day of the month during which his death occurs and Corporation shall pay to his estate or such beneficiaries as Officer may from time to time designate (a) all accrued Base Salary adjusted for any elective deferral, (b) Bonus Compensation, if any, to the extent awarded but not yet paid, (c) any pro-rated portion of the Bonus Compensation that Officer would have earned for a given period in which the termination occurs (if he had remained employed for the entire period), based on the number of days in such period that had elapsed as of the termination date, payable at the time that the Corporation pays bonuses to its executive officers for such period; provided, however, that such Bonus Compensation shall be payable only if Officer remained employed for at least half of the period for which the Bonus Compensation would have been payable, (d) full vesting of any awards granted to Officer under the Incentive Plans, (e) any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, (f) accrued vacation pay, and (g) any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, but Officer’s estate shall not be paid any other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.7 Voluntary Termination. In the event of a Voluntary Termination, Corporation shall immediately pay all accrued Base Salary, Bonus Compensation, if any, to the extent awarded but not yet paid, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, but no other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.8 Termination Upon a Change in Control. In the event of a Termination Upon a Change in Control, Officer shall immediately be paid all accrued Base Salary adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded through the date of termination but not yet paid, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, full vesting of shares awarded to Officer under the Incentive Plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, and all severance compensation provided in Section 4.1 in the event of a Termination Upon a Change in Control, but no other compensation or reimbursement of any kind.

2.9 Notice of Termination. Corporation may effect a termination of this Agreement pursuant to the provisions of this Section 2 upon giving 10 days written notice to Officer of such termination. Officer may effect a termination of this Agreement pursuant to the

provisions of this Section 2 upon giving 10 days written notice to Corporation of such termination.

3. Salary, Benefits and Bonus Compensation.

3.1 Base Salary. As payment for the services to be rendered by Officer as provided in Section 1 and subject to the terms and conditions of Section 2, Corporation agrees to pay to Officer a “Base Salary” at the rate of $450,000 per annum payable in equal semi-monthly installments, or in such other periodic installments as mutually agreed to by Corporation and Officer.

3.2 Bonuses. Beginning January 1, 2025, Officer shall be eligible to receive Bonus Compensation and equity incentive awards for each year (or portion thereof) during the term of this Agreement and any extensions thereof, in accordance with the Incentive Plans or other policy, plan or arrangement adopted by the Compensation Committee from time to time as applicable to Officer. Officer’s Bonus Compensation for calendar year 2024 shall be determined pursuant to the arrangement in place for Officer prior to his appointment as Interim Chief Financial Officer.

3.3 Additional Benefits. During the term of this Agreement, Officer shall be entitled to the following additional benefits:

(a) Officer Benefits. Officer shall be eligible to participate in such of Corporation’s benefits and deferred compensation plans as are now generally available or later made generally available to executive officers of Corporation, including, without limitation, the Incentive Plans, dental and medical plans, group life and disability insurance, perquisites, and retirement plans. For purposes of establishing the length of service under any benefit plans or programs of Corporation, Officer’s employment with Corporation will be deemed to have commenced on June 3, 2019.

(b) Vacation. Officer shall be entitled to four weeks of vacation during each year during the term of this Agreement and any extensions thereof, prorated for partial years.

(c) Reimbursement for Expenses. During the term of this Agreement, Corporation shall reimburse Officer for reasonable and properly documented out-of-pocket business and/or entertainment expenses incurred by Officer in connection with his duties under this Agreement.

4. Severance Compensation.

4.1 Severance Compensation in the Event of a Termination Upon a Change in Control. In the event Officer’s employment is terminated in a Termination Upon a Change in Control, Officer shall be paid as severance compensation an amount equal to (a) three times his annual Base Salary (at the rate payable at the time of such termination) plus (b) the greater of two times: (i) the average annual Bonus Compensation, if any, earned by Officer with respect to the two full calendar years immediately preceding the date of termination and (ii) Officer’s target annual Bonus Compensation at the date of termination, which solely for the

period prior to the Compensation Committee’s setting 2025 target annual Bonus Compensation shall be not less than $810,000, plus (c) any pro-rated portion of the Bonus Compensation that Officer would have earned for a given period in which the termination occurs (if he had remained employed for the entire period), based on the number of days in such period that had elapsed as of the termination date, payable at the time that the Corporation pays bonuses to its executive officers for such period; provided, however, that such Bonus Compensation shall be payable only if Officer remained employed for at least half of the period for which the Bonus Compensation would have been payable. Such severance compensation shall be paid in a lump sum promptly after the date of such termination, subject to the limitations of Section 4.4. The parties intend that, to the greatest extent possible, such severance compensation be treated as made pursuant to a “separation pay plan,” and not subject to the restrictions imposed by Section 4.4, as provided under Treas. Reg. § 1.409A-1(b)(9), and agree to pay such severance in separate installments if the amount of severance hereunder exceeds the limits thereof. To the extent permissible under the group health benefit plans of the Corporation (or its successor), Officer may continue to participate in such plans under the same terms as active employees, pursuant to continuation coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), until the expiration of such COBRA continuation coverage. Officer is under no obligation to mitigate the amount owed Officer pursuant to this Section 4.1 by seeking other employment or otherwise.

4.2 Severance Compensation in the Event of a Termination Other Than For Cause. In the event Officer’s employment is terminated in a Termination Other Than For Cause, Officer shall be paid as severance compensation his Base Salary (at the rate payable at the time of such termination), for a period of 18 months from the date of such termination, on the dates specified in Section 3.1. Officer is under no obligation to mitigate the amount owed Officer pursuant to this Section 4.2 by seeking other employment or otherwise. In addition to the severance payment payable under this Section 4.2, Officer shall be paid an amount equal to the greater of two times: (i) the average annual Bonus Compensation, if any, earned by Officer with respect to the two full calendar years immediately preceding the date of termination and (ii) Officer’s threshold annual Bonus Compensation at the date of termination, which solely for the period prior to the Compensation Committee’s setting 2025 threshold annual Bonus Compensation shall be not less than $435,375. In addition, Officer shall be paid (i) any pro-rated portion of the Bonus Compensation that Officer would have earned for a given period in which the termination occurs (if he had remained employed for the entire period), based on the number of days in such period that had elapsed as of the termination date, payable at the time that the Corporation pays bonuses to its executive officers for such period; provided, however, that such Bonus Compensation shall be payable only if Officer remained employed for at least half of the period for which the Bonus Compensation would have been payable. The parties intend that, to the greatest extent possible, such severance compensation be treated as made pursuant to a “separation pay plan,” and not subject to the restrictions imposed by Section 4.4, as provided under Treas. Reg. § 1.409A-1(b)(9), and agree to pay such severance in separate installments if the amount of severance hereunder exceeds the limits thereof. To the extent permissible under the group health benefit plans of the Corporation (or its successor), Officer may continue to participate in such plans under the same terms as active employees, pursuant to continuation coverage under COBRA, until the expiration of such COBRA continuation coverage.

4.3 No Severance Compensation Upon Other Termination. In the event of a Voluntary Termination, Termination For Cause, termination by reason of Officer’s disability

pursuant to Section 2.5, or termination by reason of Officer’s death pursuant to Section 2.6, Officer or his estate shall not be paid any severance compensation and shall receive only the benefits as provided in the appropriate section of Article II applicable to the respective termination.

4.4 Section 409A Payment Restrictions. The provisions of this Agreement shall be construed in a manner that is consistent with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) (Section 409A of the Code, together, with any state law of similar effect, “Section 409A”) in order to avoid any adverse tax consequences to the Officer. It is intended that each installment of the payments of the severance compensation described in this Section 4 together with all other payments and benefits provided to Officer by Corporation, whether under this Agreement or otherwise, is a separate “payment” for purposes of Treasury Regulation Section 1.409A-2(b)(2)(i) and satisfies, to the greatest extent possible, the exemptions from the application of Section 409A provided under Treas. Reg. §§ 1.409A-1(b)(4), 1.409A-1(b)(5) and 1.409A-1(b)(9). However, to the extent it is determined that such payments constitute “deferred compensation” under Section 409A and Officer is a “specified employee,” as such term is defined in Section 409A(a)(2)(B)(i) of the Code, then, solely to the extent necessary to avoid the incurrence of the adverse personal tax consequences under Section 409A, the timing of such payments shall be delayed as follows: on the earlier of six months and one day after Officer’s separation from service (as defined below) or the date of Officer’s death, the Corporation shall (A) pay to Officer a lump sum amount equal to the sum of the payments that Officer would otherwise have received through the delayed payment date, and (B) commence any remaining payments in accordance with the terms of this Agreement or such other plan or arrangement of deferred compensation, as applicable. To the extent that any such deferred compensation benefit is payable upon an event involving the Officer’s cessation of services, such payment(s) shall not be made unless such event constitutes a “separation from service” pursuant to the default definition in Treas. Reg. § 1.409A-1(h).

4.5 Golden Parachute Restrictions. Anything in this Agreement to the contrary notwithstanding, in the event it shall be determined that any payment or distribution by or on behalf of the Corporation to or for the benefit of the Officer as a result of and contingent on a “change in control,” as defined in section 280G of the Code, (such amounts contingent on a change in control as described in Treas. Reg. § 1.280G-1 Q/A-22) whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise, (together, the “Contingent Payment”) would constitute a “parachute payment,” as defined in Treas. Reg. § 1.280G-1 Q/A-30, the amount of the Contingent Payment to Officer shall be (A) reduced to an amount that is one dollar less than 300% of the Officer’s “base amount” (as defined in section 280G(b)(3)(A) of the Code), so that the amount of such payments do not constitute a parachute payment (the “Safe Harbor Payment”), or, if greater, (B) the entire Contingent Payment, unreduced by the calculation in clause (A), provided that the net value of such Contingent Payment to the Officer exceeds the Safe Harbor Payment, after taking into account the additional taxes to Officer that apply to the unreduced Contingent Payment, including the excise taxes imposed thereon under section 4999 of the Code. The determination of the amount to be paid to Officer on account of this Section 4.5 shall be made by the accountant, tax counsel or other similar expert advisor to Officer (the “Tax Advisor”), which shall, if requested, provide detailed supporting calculations both to the Corporation and the Officer and if requested, a written opinion. The supporting calculations shall include a valuation of the non-competition provisions

of Section 5. The costs and expenses of the Tax Advisor shall be the responsibility of the Corporation.

4.6. Release of Claims. The payments set forth in Sections 4.1 and 4.2 of this Agreement and the vesting of any unvested awards granted under the Incentive Plans upon a termination are subject to the execution and delivery by Officer of a waiver and general release of claims (the “Release”) to Corporation substantially in the form attached hereto as Exhibit A (and having not revoked such Release for a period of seven (7) days following its execution by Officer and its delivery to the Corporation).

5. Non-Competition. During the term of this Agreement and for the longer of: (i) any period during which Officer is receiving periodic severance payments pursuant to Section 4.2, or (ii) one year following a Termination Upon a Change in Control, in either case so long as the payments provided for in Section 4.1 or 4.2 are made on a timely basis:

(a) Officer shall not, without the prior written consent of Corporation, directly or indirectly, own, manage, operate, control, be connected with as an officer, employee, partner, consultant or otherwise, or otherwise engage or participate in any corporation or other business entity engaged in the business of buying, selling, developing, building and/or managing real estate facilities for the medical and healthcare sectors of the real estate industry. Officer understands and acknowledges that Corporation carries on business nationwide and that the nature of Corporation’s activities cannot be confined to a limited area. Accordingly, Officer agrees that the geographic scope of this Section 5 shall include the United States of America. Notwithstanding the foregoing, the ownership by Officer of less than 2% of any class of the outstanding capital stock of any corporation conducting such a competitive business which is regularly traded on a national securities exchange or in the over-the-counter market shall not be a violation of the foregoing covenant.

(b) Simultaneously with Officer’s execution of this Agreement and upon each anniversary of the Effective Date, Officer shall notify the Chairman of the Compensation Committee of the nature and extent of Officer’s investments, stock holdings, employment as an employee, director, or any similar interest in any business or enterprise engaged in buying, selling, developing, building, and/or managing real estate facilities for the medical and healthcare sectors of the real estate industry other than Corporation; provided, however, that Officer shall have no obligation to disclose any investment under $100,000 in value or any holdings of publicly traded securities which are not in excess of one percent of the outstanding class of such securities.

(c) Officer shall not contact or solicit, directly or indirectly, any customer, client, tenant or account whose identity Officer obtained through association with Corporation, regardless of the geographical location of such customer, client, tenant or account, nor shall Officer, directly or indirectly, entice or induce, or attempt to entice or induce, any employee of Corporation to leave such employ, nor shall Officer employ any such person in any business similar to or in competition with that of Corporation. Officer hereby acknowledges and agrees that the provisions set forth in this Section 5 constitute a reasonable restriction on his ability to compete with Corporation and will not adversely affect his ability to earn income sufficient to support him and/or his family.

(d) The parties hereto agree that, in the event a court of competent jurisdiction shall determine that the geographical or durational elements of this covenant are unenforceable, such determination shall not render the entire covenant unenforceable. Rather, the excessive aspects of the covenant shall be reduced to the threshold which is enforceable, and the remaining aspects shall not be affected thereby.

6. Trade Secrets and Customer Lists. Officer agrees to hold in strict confidence all information concerning any matters affecting or relating to the business of Corporation and its subsidiaries and affiliates, including, without limiting the generality of the foregoing, its manner of operation, business plans, business prospects, agreements, protocols, processes, computer programs, customer lists, market strategies, internal performance statistics, financial data, marketing information and analyses, or other data, without regard to the capacity in which such information was acquired. Officer agrees that he will not, directly or indirectly, use any such information for the benefit of any person or entity other than Corporation or disclose or communicate any of such information in any manner whatsoever other than to the directors, officers, employees, agents, and representatives of Corporation who need to know such information, who shall be informed by Officer of the confidential nature of such information and directed by Officer to treat such information confidentially. Such information does not include information which (i) was disclosed to the public by Corporation or becomes generally available to the public other than as a result of an unauthorized disclosure by Officer or his representatives, or (ii) was or becomes available to Officer on a non‑confidential basis from a source other than Corporation or its advisors provided that such source is not known to Officer to be bound by a confidentiality agreement with Corporation, or otherwise prohibited from transmitting the information to Officer by a contractual, legal or fiduciary obligation; notwithstanding the foregoing, if any such information does become generally available to the public, Officer agrees not to further discuss or disseminate such information except in the performance of his duties as Officer. Upon Corporation's request, Officer will return all information furnished to him related to the business of Corporation. The parties hereto stipulate that all such information is material and confidential and gravely affects the effective and successful conduct of the business of Corporation and Corporation's goodwill, and that any breach of the terms of this Section 6 shall be a material breach of this Agreement. The terms of this Section 6 shall remain in effect following the termination of this Agreement.

7. Use of Proprietary Information. Officer recognizes that Corporation possesses a proprietary interest in all of the information described in Section 6 and has the exclusive right and privilege to use, protect by copyright, patent or trademark, manufacture or otherwise exploit the processes, ideas and concepts described therein to the exclusion of Officer, except as otherwise agreed between Corporation and Officer in writing. Officer expressly agrees that any products, inventions, discoveries or improvements made by Officer, his agents or affiliates based on or arising out of the information described in Section 6 shall be (i) deemed a work made for hire under the terms of United States Copyright Act, 17 U.S.C. § 101 et seq., and Corporation shall be the owner of all such rights with respect thereto and (ii) the property of and inure to the exclusive benefit of Corporation.

8. Miscellaneous.

8.1 Payment Obligations. Corporation’s obligation to pay Officer the compensation and to make the arrangements provided herein shall be unconditional, and Officer

shall have no obligation whatsoever to mitigate damages hereunder. In the event that any arbitration, litigation or other action after a Change in Control is brought to enforce or interpret any provision contained herein, Corporation, to the extent permitted by applicable law and Corporation’s Articles of Incorporation and Bylaws, hereby indemnifies Officer for Officer’s reasonable attorneys’ fees and disbursements incurred in such arbitration, litigation, or other action and shall advance payment of such attorneys’ fees and disbursements.

8.2 Waiver. The waiver of the breach of any provision of this Agreement shall not operate or be construed as a waiver of any subsequent breach of the same or other provision hereof.

8.3 Entire Agreement; Modifications. Except as otherwise provided herein, this Agreement represents the entire understanding among the parties with respect to the subject matter hereof, and, as of the Effective Date, this Agreement supersedes any and all prior understandings, agreements, plans and negotiations, whether written or oral, with respect to the subject matter hereof, including without limitation, the Prior Agreement. All modifications to the Agreement must be in writing and signed by the party against whom enforcement of such modification is sought.

8.4 Notices. All notices and other communications under this Agreement shall be in writing and shall be given by personal delivery, nationally recognized overnight courier, email, or first class mail, certified or registered with return receipt requested, and shall be deemed to have been duly given upon receipt in the event of personal delivery or overnight courier, three days after mailing to the respective persons named below:

If to Corporation:

Healthcare Realty Trust Incorporated

3310 West End Avenue, Suite 700

Nashville, Tennessee 37203

Attention: Chief Executive Officer

Phone: (615) 269-8175

Fax: (615) 269-8122

Email address of Chief Executive Officer

If to Officer, by hand delivery to Officer on the premises of the Corporation or to the most recent address of Officer maintained in the records of the Corporation.

Any party may change such party’s address for notices by notice duly give pursuant to this Section 8.4.

8.5 Headings. The Section headings herein are intended for reference and shall not by themselves determine the construction or interpretation of this Agreement.

8.6 Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Tennessee.

8.7 Arbitration. Any controversy or claim arising out of or relating to this Agreement, or breach thereof, shall be settled by arbitration in Nashville, Tennessee in accordance with the Rules of the American Arbitration Association, and judgment upon any proper award rendered by the Arbitrators may be entered in any court having jurisdiction thereof. There shall be three arbitrators, one to be chosen directly by each party at will, and the third arbitrator to be selected by the two arbitrators so chosen. To the extent permitted by the Rules of the American Arbitration Association, the selected arbitrators may grant equitable relief. The cost of the arbitration, including the cost of the record or transcripts thereof, if any, administrative fees, and all other fees shall be borne by Corporation. Except as otherwise provided in Section 8.1 with respect to events following a Change in Control, to the extent that Officer prevails with respect to any portion of an arbitration award, Officer shall be reimbursed by Corporation for the costs and expenses incurred by Officer, including reasonable attorneys’ fees, in connection with the arbitration in an amount proportionate to the award to Officer as compared to the amount in dispute.

8.8 Severability. Should a court or other body of competent jurisdiction determine that any provision of this Agreement is excessive in scope or otherwise invalid or unenforceable, such provision shall be adjusted rather than voided, if possible, and all other provisions of this Agreement shall be deemed valid and enforceable to the extent possible.

8.9 Survival of Corporation’s Obligations. Corporation’s obligations hereunder shall not be terminated by reason of any liquidation, dissolution, bankruptcy, cessation of business, or similar event relating to Corporation. This Agreement shall not be terminated by any merger or consolidation or other reorganization of Corporation. In the event any such merger, consolidation or reorganization shall be accomplished by transfer of stock or by transfer of assets or otherwise, the provisions of this Agreement shall be binding upon and inure to the benefit of the surviving or resulting corporation or person. This Agreement shall be binding upon and inure to the benefit of the executors, administrators, heirs, successors and assigns of the parties; provided, however, that except as herein expressly provided, this Agreement shall not be assignable either by Corporation (except to an affiliate of Corporation in which event Corporation shall remain liable if the affiliate fails to meet any obligations to make payments or provide benefits or otherwise) or by Officer.

8.10 Counterparts. This Agreement may be executed in one or more counterparts, all of which taken together shall constitute one and the same Agreement.

8.11 Withholdings. All compensation and benefits to Officer hereunder shall be reduced only by all federal, state, local and other withholdings and similar taxes and payments that are required by applicable law. Except as otherwise specifically agreed by Officer, no other offsets or withholdings shall apply to reduce the payment of compensation and benefits hereunder.

8.12 Indemnification. In addition to any rights to indemnification to which Officer is entitled to under Corporation’s Articles of Incorporation and Bylaws, Corporation shall indemnify Officer at all times during and after the term of this Agreement to the maximum extent permitted under Section 2-418 of the General Corporation Law of the State of Maryland or any successor provision thereof and any other applicable state law, and shall pay Officer’s expenses in defending any civil or criminal action, suit, or proceeding (unrelated to a dispute

under this Agreement) in advance of the final disposition of such action, suit, or proceeding, to the maximum extent permitted under such applicable state laws. The Corporation will provide advance payment of legal costs and expenses that are reasonable and appropriate for defending such action, suit or proceeding. The indemnification provisions contained in this Section 8.12 shall survive the termination of this Agreement and Officer’s employment by Corporation indefinitely.

8.13 Clawback Policy. Officer acknowledges receipt of and having read and understands Corporation’s Policy for the Recovery of Erroneously Awarded Compensation (the “Clawback Policy”). Officer shall be subject to the terms of the Clawback Policy or other recoupment, clawback or similar policy of Corporation as may be in effect from time to time, as well as any similar provisions of applicable law, any of which could in certain circumstances require repayment or forfeiture of erroneously awarded incentive-based compensation, or other cash, securities or property received with respect to such incentive-based compensation (including any value received from a disposition of such securities or property).

[Execution Page Follows]

EXECUTION PAGE

IN WITNESS WHEREOF, the parties hereto have executed this Agreement to be effective as of the Effective Date.

CORPORATION:

HEALTHCARE REALTY TRUST INCORPORATED

By:/s/ Constance B. Moore

Name: Constance B. Moore

Title: Interim President and Chief Executive Officer

OFFICER:

/s/ Austen B. Helfrich

Austen B. Helfrich

Exhibit A

Form of Release

GENERAL RELEASE, dated as of [_______________], 20[__] (the “Effective Date”), entered into by Austen B. Helfrich (“Officer”) in favor of Healthcare Realty Trust Incorporated (along with its affiliates and subsidiaries, the “Corporation”) and the current and prior directors, officers, employees, agents and representatives of the Corporation and its subsidiaries, in their capacity as such (collectively, the “Released Parties”).

WHEREAS, Officer and the Corporation previously entered into an Amended and Restated Employment Agreement (the “Employment Agreement”), dated as of December __, 2024 that has governed the terms and conditions of Officer’s employment by the Corporation, and Officer’s retention thereunder has been terminated in accordance with the terms thereof.

WHEREAS, this General Release (this “Release”) is the release referred to in Section 4.6 of the Employment Agreement.

WHEREAS, following execution of this Release and expiration of the seven-day revocation period referred to in Section 5 below, Officer will be entitled to payment of certain amounts (such amounts, collectively, “Termination Payments”) and other rights and benefits (such other rights and benefits, collectively, “Termination Benefits”) referred to in Sections 4.1 and/or 4.2 of the Employment Agreement, as applicable.

WHEREAS, Officer desires to compromise, finally settle and fully release actual or potential claims, including, without limitation, those related to Officer’s retention and termination of retention that Officer in any capacity may have or claim to have against the Corporation or any of the other Released Parties, excepting only those claims expressly provided herein to be excluded.

WHEREAS, Officer acknowledges that he is waiving his rights or claims only in exchange for consideration in addition to anything of value to which he already is entitled.

NOW, THEREFORE, in consideration of the foregoing and the Corporation’s agreement to pay the Termination Benefits and to provide the Termination Benefits, Officer, intending to be legally bound hereby, for himself and his heirs, executors, administrators, legal representatives, successors and assigns, does hereby agree as follows:

1. The recitals above are true and correct.

2. Except as expressly provided in Section 4 below, Officer does hereby completely release and forever discharge the Corporation and the other Released Parties of and from any and all actions, causes of action, suits, counterclaims, debts, dues, covenants, contracts, bonuses, controversies, agreements, promises, rights, claims, charges, complaints, expenses, costs (including, without limitation, attorneys’ fees and other costs of defense or prosecution), damages, losses, liabilities and demands whatsoever in law or equity (all of the foregoing, collectively, “Claims”) whatsoever and of every nature and description, whether known or unknown, suspected or unsuspected, foreseen or unforeseen, real or imaginary, actual or potential, liquidated or unliquidated, contingent or certain, and whether arising at law or in

equity, under the common law, state law, federal law or any other law or otherwise, that Officer ever had, may now have or hereafter can, shall or may have against the Corporation or any of the other Released Parties, for, upon or by reason of any matter, cause or thing whatsoever from the beginning of time to the date of this Release.

3. The release set forth in Section 2 above shall extend and apply, without limitation, to any and all Claims in connection with Officer's employment or the termination thereof, including, without limitation, wrongful termination, breach of express or implied contract or unpaid wages or pursuant to any federal, state or local employment laws, regulations or executive orders prohibiting, inter alia, discrimination on the basis of age, race, sex, national origin, religion, handicap and/or disability; and any and all other federal, state and local laws and regulations prohibiting, without limitation, discrimination in employment, retaliation, conspiracy, tortious or wrongful discharge, breach of an express or implied contract, breach of a covenant of good faith and fair dealing, intentional and/or negligent infliction of emotional distress, defamation, misrepresentation or fraud, negligence, negligent supervision, hiring or retention, assault, battery, detrimental reliance or any other offense.

4. Officer’s release provided in Sections 2 and 3 above does not extend or apply to any Claims with respect to the following (“Excluded Claims”): (a) the Corporation’s obligations to pay the Termination Payments or to pay or provide the Termination Benefits, (b) Officer’s entitlement to be indemnified by the Corporation with respect to Claims relating to any action or inaction, or any conduct or misconduct, by Officer in his capacity as an Executive Vice President of the Corporation or otherwise as a director, officer or employee of the Corporation (or in any similar capacity), whether pursuant to (i) the Corporation’s articles of incorporation (as amended, restated or otherwise modified and in effect at the relevant time), (ii) the Corporation’s bylaws (as amended, restated or otherwise modified and in effect at the relevant time), (iii) any resolution duly adopted by the Corporation’s Board of Directors or shareholders and in effect at the relevant time, (iv) the Maryland General Corporation Law, (v) any other applicable law, rule or regulation or court order or judgment or any other agreement in effect at the relevant time or (c) any other rights or claims that may arise after the date of this Release, and/or (vi) Corporation’s obligations to indemnify Officer pursuant to Section 8.12 of the Employment Agreement. For avoidance of doubt, nothing contained herein shall be deemed a waiver or release by Officer with respect to any protections or other rights to which he may be entitled under any D&O or other insurance policy.

5. Pursuant to the provisions of the Older Workers Benefit Protection Act (“OWBPA”), which applies to Officer’s waiver of rights under the Age Discrimination in Employment Act, Officer has had a period of at least twenty-one (21) days within which to consider whether to execute this Release. Also pursuant to the OWBPA, Officer may revoke the Release within seven (7) days of its execution. It is specifically understood that this Release shall not become effective or enforceable until the seven-day revocation period has expired. Consideration for this Release will not be paid until the later of (a) expiration of the seven-day revocation period or (b) the date provided for in the Employment Agreement.

6. Officer acknowledges that, pursuant to the OWBPA, the Corporation has advised Officer, in writing, to consult with an attorney before executing this Release.

7. Officer covenants and agrees that he will not bring, initiate, enter into, maintain or participate in any suit, arbitration or other administrative or judicial proceeding, by means of a direct claim, cross claim, counterclaim, setoff or otherwise, against any Released Party based or premised on any of the Claims released above.

8. Officer acknowledges that the Corporation will not pay or be obligated to pay, and Officer shall not be entitled to, any consideration other than as expressly provided for by this Release or the Employment Agreement or with respect to Excluded Claims.

9. This Release does not constitute an admission by the Corporation or any other Released Party of a violation of any law, order, regulation or enactment or of wrongdoing of any kind.

10. Officer acknowledges that the provisions of Sections 5 and 6 of the Employment Agreement shall survive Officer’s termination of employment. Further, for a period through the date periodic severance payments are made (but in no event less than one year following the Effective Date), Officer shall provide consulting services to the Corporation on matters relating to Officer’s former position and duties with the Corporation at such times as the Corporation may reasonably request (during regular business hours), provided that Officer’s consulting obligation shall not exceed 25 hours per month, nor more than 15 hours in any week.

11. Any controversy or claim arising out of or relating to this Release, or breach thereof, shall be settled by arbitration in Nashville, Tennessee in accordance with the Rules of the American Arbitration Association, and judgment upon any proper award rendered by the Arbitrators may be entered in any court having jurisdiction thereof. There shall be three arbitrators, one to be chosen directly by each party at will, and the third arbitrator to be selected by the two arbitrators so chosen. To the extent permitted by the Rules of the American Arbitration Association, the selected arbitrators may grant equitable relief. The cost of the arbitration, including the cost of the record or transcripts thereof, if any, administrative fees, and all other fees shall be borne by Corporation. To the extent that Officer prevails with respect to any portion of an arbitration award, Officer shall be reimbursed by Corporation for the costs and expenses incurred by Officer, including reasonable attorneys’ fees, in connection with the arbitration in an amount proportionate to the award to Officer as compared to the amount in dispute.

12. The failure of any provision of this Release shall in no manner affect the right to enforce the same, and the waiver by any party of any breach of any provision of this Release shall not be construed to be a waiver of such party of any succeeding breach of such provision or a waiver by such party of any breach of any other provision. In the event that any provision or portion of this Release shall be determined to be invalid or unenforceable for any reason, the remaining provisions of this Release shall be unaffected thereby and shall remain in full force and effect.

13. This Release represents the entire understanding and agreement of Officer and the Released Parties with respect to the subject matter hereof, and there are no promises, agreements, conditions, undertakings, warranties or representations, whether written or oral, express or implied, by or among Officer and the Released Parties with respect to such subject matter other than as set forth herein. This Release cannot be amended, supplemented or modified except by an

instrument in writing signed by Officer and the Corporation, and no waiver of this Release or any provision hereof shall be effective except to the extent such waiver is in writing, specifies that the purpose thereof is to waive this Release or a provision hereof and is executed and delivered by the party to be charged therewith.

14. This Release shall be binding upon and be enforceable against Officer and his heirs, executors, administrators, legal representatives, successors and assigns and shall inure to the benefit of and be enforceable by each of the Released Parties and his, her or its heirs, executors, administrators, legal representatives, successors and assigns.

15. OFFICER REPRESENTS AND CONFIRMS THAT HE HAS CAREFULLY READ THIS RELEASE, THAT THIS RELEASE HAS BEEN FULLY EXPLAINED TO HIM, THAT HE HAS HAD THE OPPORTUNITY TO HAVE THIS RELEASE REVIEWED BY AN ATTORNEY, THAT HE FULLY UNDERSTANDS THE FINAL AND BINDING EFFECT OF THIS RELEASE, THAT THE ONLY PROMISES MADE TO HIM TO SIGN THE RELEASE ARE THOSE STATED IN THIS RELEASE AND THAT OFFICER IS SIGNING THIS RELEASE VOLUNTARILY WITH THE FULL INTENT OF RELEASING THE RELEASED PARTIES OF ALL CLAIMS DESCRIBED HEREIN.

Officer has executed and delivered this Release as of the date set forth below and this Release is and shall be effective, subject to expiration of the seven-day revocation period referred to in Section 5 above.

Dated: _________________, 20__

________________________

Austen B. Helfrich

Healthcare Realty Trust Incorporated

AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (the “Agreement”) is effective as of December 8, 2024 (“Effective Date”) by and between HEALTHCARE REALTY TRUST INCORPORATED, a Maryland corporation (“Corporation”) and Andrew E. Loope (“Officer”).

RECITALS

WHEREAS, the Corporation has employed Officer as its Senior Vice President and Corporate Counsel under the terms of an employment agreement dated July 28, 2008 (the “Prior Agreement”); and

WHEREAS, the parties desire to modify the Prior Agreement with this amendment and restatement to acknowledge Officer’s appointment to the office of Executive Vice President, General Counsel, and Secretary and to conform the terms of employment and the officer’s compensation with the Corporation’s current compensation practices and commensurate with Officer’s position;

NOW, THEREFORE, in consideration of the foregoing premises, and other good and valuable consideration, the receipt and sufficiency of which are hereby affirmed, the parties hereto agree to the following to supersede the Prior Agreement as a complete amendment and restatement thereof as of the Effective Date:

1. Duties. From the Effective Date through December 31, 2024, Officer agrees to be employed by and to continue to serve Corporation as its Senior Vice President, Corporate Counsel, and Secretary and Corporation agrees to employ and retain Officer in such capacity. Effective January 1, 2025 (the “Promotion Date”) and during the remaining term of this Agreement, Officer agrees to be employed by and to serve Corporation as its Executive Vice President, General Counsel, and Secretary and Corporation agrees to employ and retain Officer in such capacity. Prior to the Promotion Date, Officer shall report to and have such duties and responsibilities as may be prescribed by the Corporation’s Executive Vice President and General Counsel. On and after the Promotion Date, Officer shall report to, and have such duties and responsibilities as may be prescribed by, the Corporation’s Chief Executive Officer and/or the Board of Directors. Officer shall devote such of his business time, energy, and skill to the affairs of Corporation as shall be necessary to perform his duties under this Agreement. On and after the Promotion Date, Officer shall have powers and duties at least commensurate with his position as Executive Vice President, General Counsel, and Secretary. Officer’s principal place of business with respect to his services to Corporation shall be within 35 miles of Nashville, Tennessee.

2. Term of Employment.

2.1 Definitions. For purposes of this Agreement the following terms shall have the following meanings:

(a) “Bonus Compensation” shall mean any cash bonus and any non-equity incentive plan compensation, whether pursuant to the Incentive Plans or awarded through the discretion of the Corporation.

(b) “Change in Control” shall mean (i) the acquisition by any person and all other persons who constitute a group (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934 (“Exchange Act”)) of direct or indirect beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of 20 percent or more of Corporation’s outstanding securities, unless a majority of the “Continuing Directors” approves the acquisition not later than ten business days after Corporation makes that determination, or (ii) the first day on which a majority of the members of Corporation’s Board of Directors are not “Continuing Directors”.

(c) “Constructive Termination” shall mean (i) any material breach of this Agreement by Corporation, (ii) any substantial reduction in the authority or responsibility of Officer or other substantial reduction in the terms and conditions of Officer’s employment under circumstances which would not justify a Termination For Cause and which are not the result of a breach by Officer of this Agreement, (iii) any act(s) by Corporation which are designed to or have the effect of rendering Officer’s working conditions so intolerable or demeaning on a recurring basis that a reasonable person would resign such employment, or (iv) Corporation’s relocation of Officer to a location that is more than 35 miles from the location of Corporation’s headquarters on the date this Agreement is executed.

(d) “Continuing Directors” shall mean, as of any date of determination, any member of the Board of Directors of Corporation who (i) was a member of that Board of Directors on the Effective Date, (ii) has been a member of that Board of Directors for the two years immediately preceding such date of determination, or (iii) was nominated for election or elected to the Board of Directors with the affirmative vote of the greater of (x) a majority of Continuing Directors who were members of the Board at the time of such nomination or election or (y) at least four Continuing Directors.

(e) “Incentive Plans” shall mean the Corporation’s Amended and Restated 2006 Incentive Plan, and any successor plans, or other equity-based plan or arrangement adopted by the Compensation and Human Capital Committee of the Board of Directors (the “Compensation Committee”) from time to time.

(f) “Termination For Cause” shall mean termination by Corporation of Officer’s employment by reason of Officer’s (i) dishonesty towards Corporation, (ii) fraud upon Corporation, or (iii) deliberate injury or attempted injury to Corporation, in each such case causing material injury to Corporation, or by reason of Officer’s breach of this Agreement causing material injury to Corporation. Corporation shall have the burden of establishing that any such termination of Officer’s employment by Corporation is a Termination For Cause.

(g) “Termination Other Than For Cause” shall mean any termination by Corporation of Officer’s employment by Corporation, other than (i) a Termination For Cause or (ii) termination by reason of Officer’s death or disability as described in Sections 2.5 and 2.6. Termination Other Than For Cause shall include a Constructive

Termination of Officer’s employment, effective upon notice from Officer to Corporation of such Constructive Termination.

(h) “Termination Upon a Change in Control” shall mean a termination of Officer’s employment with Corporation within 12 months following a “Change in Control” that constitutes a Termination Other Than For Cause described in Section 2.1(g).

(i) “Voluntary Termination” shall mean termination by Officer of Officer’s employment by Corporation other than (i) a Constructive Termination as described in subsection 2.1(c), (ii) “Termination Upon a Change in Control” as described in Section 2.1(h), and (iii) termination by reason of Officer’s death or disability as described in Sections 2.5 and 2.6.

2.2 Basic Term. The term of this Agreement shall commence on the Effective Date and continue through December 31, 2025, unless terminated pursuant to this Section 2. On December 31, 2025, and on December 31 of each succeeding year, the first sentence of this Section 2.2 shall be automatically amended to provide that the term of the Agreement shall be renewed for a one-year period commencing on the next January 1 and continuing through December 31 of the same year, such that this Agreement shall be deemed to have been renewed each year for a one-year period prior to the expiration of the current term.

2.3 Termination For Cause. Termination For Cause may be effected by Corporation at any time during the term of this Agreement and shall be effected by written notification to Officer. Upon Termination For Cause, Officer immediately shall be paid all accrued Base Salary (as that term is defined below) adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded but not yet paid, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, but Officer shall not be paid any other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.4 Termination Other Than For Cause or Constructive Termination. Notwithstanding anything else in this Agreement, Corporation may effect a Termination Other Than For Cause at any time upon giving written notice to Officer of such termination. Upon any Termination Other Than For Cause, or upon a Constructive Termination, Officer shall immediately be paid all accrued Base Salary adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded but not yet paid, any benefits under any plans of the Corporation (including any benefits under any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, full vesting of all awards previously granted to Officer under the Incentive Plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, and all severance compensation provided in Section 4.2, but no other compensation or reimbursement of any kind.

2.5 Termination by Reason of Disability. If, during the term of this Agreement, Officer, in the reasonable judgment of the Board of Directors of Corporation, has failed to perform his duties under this Agreement on account of illness or physical or mental

incapacity, and such illness or incapacity continues for a period of more than 12 consecutive months, Corporation shall have the right to terminate Officer’s employment hereunder by written notification to Officer and payment to Officer of all accrued Base Salary adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded but not yet paid, full vesting of any awards granted to Officer under the Incentive Plans, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, with the exception of medical and dental benefits which shall continue at Corporation’s expense through the then current one-year term of the Agreement, but Officer shall not be paid any other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.6 Death. In the event of Officer’s death during the term of this Agreement, Officer’s employment shall be deemed to have terminated as of the last day of the month during which his death occurs and Corporation shall pay to his estate or such beneficiaries as Officer may from time to time designate (a) all accrued Base Salary adjusted for any elective deferral, (b) Bonus Compensation, if any, to the extent awarded but not yet paid, (c) any pro-rated portion of the Bonus Compensation that Officer would have earned for a given period in which the termination occurs (if he had remained employed for the entire period), based on the number of days in such period that had elapsed as of the termination date, payable at the time that the Corporation pays bonuses to its executive officers for such period; provided, however, that such Bonus Compensation shall be payable only if Officer remained employed for at least half of the period for which the Bonus Compensation would have been payable, (d) full vesting of any awards granted to Officer under the Incentive Plans, (e) any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, (f) accrued vacation pay, and (g) any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, but Officer’s estate shall not be paid any other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.7 Voluntary Termination. In the event of a Voluntary Termination, Corporation shall immediately pay all accrued Base Salary, Bonus Compensation, if any, to the extent awarded but not yet paid, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, but no other compensation or reimbursement of any kind, including without limitation, severance compensation.

2.8 Termination Upon a Change in Control. In the event of a Termination Upon a Change in Control, Officer shall immediately be paid all accrued Base Salary adjusted for any elective deferral, Bonus Compensation, if any, to the extent awarded through the date of termination but not yet paid, any benefits under any plans of the Corporation (including any defined contribution or health and welfare benefit plans) in which Officer is a participant to the full extent of Officer’s rights under such plans, full vesting of shares awarded to Officer under the Incentive Plans, accrued vacation pay and any appropriate business expenses incurred by Officer in connection with his duties hereunder, all to the date of termination, and all severance

compensation provided in Section 4.1 in the event of a Termination Upon a Change in Control, but no other compensation or reimbursement of any kind.

2.9 Notice of Termination. Corporation may effect a termination of this Agreement pursuant to the provisions of this Section 2 upon giving 10 days written notice to Officer of such termination. Officer may effect a termination of this Agreement pursuant to the provisions of this Section 2 upon giving 10 days written notice to Corporation of such termination.

3. Salary, Benefits and Bonus Compensation.

3.1 Base Salary. For the period from the Effective Date through December 31, 2024, as payment for the services to be rendered by Officer as provided in Section 1 and subject to the terms and conditions of Section 2, Corporation agrees to pay to Officer a “Base Salary” at the rate of $325,000 per annum payable in equal semi-monthly installments. For the period beginning with the Promotion Date, as payment for the services to be rendered by Officer as provided in Section 1 and subject to the terms and conditions of Section 2, Corporation agrees to pay to Officer a “Base Salary” at the rate of $450,000 per annum payable in equal semi-monthly installments, or in such other periodic installments as mutually agreed to by Corporation and Officer.

3.2 Bonuses. Officer shall be eligible to receive Bonus Compensation and equity incentive awards for each year (or portion thereof) during the term of this Agreement and any extensions thereof, in accordance with the Incentive Plans or other policy, plan or arrangement adopted by the Compensation Committee from time to time as applicable to Officer. For the avoidance of doubt, Officer’s Bonus Compensation for calendar year 2024 performance shall be determined pursuant to the policy, plan or arrangement adopted by the Compensation Committee for senior vice president officers.

3.3 Additional Benefits. During the term of this Agreement, Officer shall be entitled to the following additional benefits:

(a) Officer Benefits. Officer shall be eligible to participate in such of Corporation’s benefits and deferred compensation plans as are now generally available or later made generally available to executive officers of Corporation, including, without limitation, the Incentive Plans, dental and medical plans, group life and disability insurance, perquisites, and retirement plans. For purposes of establishing the length of service under any benefit plans or programs of Corporation, Officer’s employment with Corporation will be deemed to have commenced on July 28, 2008.

(b) Vacation. Officer shall be entitled to four weeks of vacation during each year during the term of this Agreement and any extensions thereof, prorated for partial years.

(c) Reimbursement for Expenses. During the term of this Agreement, Corporation shall reimburse Officer for reasonable and properly documented out-of-pocket business and/or entertainment expenses incurred by Officer in connection with his duties under this Agreement.

4. Severance Compensation.

4.1 Severance Compensation in the Event of a Termination Upon a Change in Control. In the event Officer’s employment is terminated in a Termination Upon a Change in Control, Officer shall be paid as severance compensation an amount equal to (a) three times his annual Base Salary (at the rate payable at the time of such termination) plus (b) the greater of two times: (i) the average annual Bonus Compensation, if any, earned by Officer with respect to the two full calendar years immediately preceding the date of termination and (ii) Officer’s target annual Bonus Compensation at the date of termination, which solely for the period from January 1, 2025 through the later date which is immediately prior to the date the Compensation Committee sets 2025 target annual Bonus Compensation shall be not less than $810,000, plus (c) any pro-rated portion of the Bonus Compensation that Officer would have earned for a given period in which the termination occurs (if he had remained employed for the entire period), based on the number of days in such period that had elapsed as of the termination date, payable at the time that the Corporation pays bonuses to its executive officers for such period; provided, however, that such Bonus Compensation shall be payable only if Officer remained employed for at least half of the period for which the Bonus Compensation would have been payable. Such severance compensation shall be paid in a lump sum promptly after the date of such termination, subject to the limitations of Section 4.4. The parties intend that, to the greatest extent possible, such severance compensation be treated as made pursuant to a “separation pay plan,” and not subject to the restrictions imposed by Section 4.4, as provided under Treas. Reg. § 1.409A-1(b)(9), and agree to pay such severance in separate installments if the amount of severance hereunder exceeds the limits thereof. To the extent permissible under the group health benefit plans of the Corporation (or its successor), Officer may continue to participate in such plans under the same terms as active employees, pursuant to continuation coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), until the expiration of such COBRA continuation coverage. Officer is under no obligation to mitigate the amount owed Officer pursuant to this Section 4.1 by seeking other employment or otherwise.