UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2015

Hercules Technology Growth Capital, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

814-00702 |

|

74-3113410 |

| (State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

| 400 Hamilton Ave., Suite 310

Palo Alto, CA |

|

94301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (650) 289-3060

Not Applicable

(Former

name or address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01

On November 4, 2015, Hercules Technology Growth Capital, Inc. (the “Company”) issued a press release announcing that the Company’s Shelf

Registration Statement, as filed on September 29, 2015, has been declared effective by the Securities and Exchange Commission.

In addition, the

Company also issued a press release announcing its intention to redeem $40.0 million (face value) of the $85.9 million in issued and outstanding aggregate principal amount of the Company’s 7.00% Senior Unsecured Notes due September 2019 (CUSIP

No. 427096870) . The text of the press releases are included as exhibits to this Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

| 99.1 |

|

Press Release dated November 4, 2015. |

| 99.2 |

|

Press Release dated November 4, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HERCULES TECHNOLOGY GROWTH CAPITAL, INC. |

|

|

|

|

| November 4, 2015 |

|

|

|

By: |

|

/s/ Mark R. Harris |

|

|

|

|

|

|

|

|

Mark R. Harris Chief Financial

Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description of Exhibits |

|

|

| 99.1 |

|

Press Release dated November 4, 2015. |

| 99.2 |

|

Press Release dated November 4, 2015. |

Exhibit 99.1

Hercules Shelf Registration Statement Declared Effective by

the Securities and Exchange Commission

PALO ALTO, Calif., November 4, 2015 – Hercules Technology Growth Capital, Inc. (NYSE: HTGC) (“Hercules” or the

“Company”), the leading specialty financing provider to innovative venture growth stage companies backed by leading venture capital firms, today announced that Hercules’ Shelf Registration Statement, as filed on September 29,

2015 (the “Registration Statement”), has been declared effective by the Securities and Exchange Commission (“SEC”).

Hercules’

Chief Financial Officer, Mark R. Harris stated, “This new registration statement, combined with our existing strong liquidity position, provides us with the additional financial flexibility to access the financial markets to support our

corporate objectives, such as refinancing our current debt instruments, as well as accelerate our growth strategy should the opportunity present itself. However, given our current liquidity position, we have no current plans to issue any

equity.”

Under the Registration Statement, Hercules may from time to time, in one or more offerings or series, issue up to $500 million of any

combination of common stock, preferred stock, warrants, subscription rights or debt securities. The preferred stock, debt securities, subscription rights and warrants may be convertible or exchangeable into shares of the Company’s common stock.

The net proceeds of any such issuances by Hercules are expected to be used for general corporate purposes.

The terms of any issuance under the

Registration Statement will be determined at the time of such issuance and disclosed in a prospectus supplement filed with the SEC.

This press release

does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the laws of

any such state.

A copy of the prospectus included in the Registration Statement may be obtained at no charge at the SEC’s website at www.sec.gov. In

addition copies of the prospectus included in the Registration Statement, and, when available, any prospectus supplement relating to a particular offering, may be obtained by contacting Hercules Technology Growth Capital, Inc., 400 Hamilton Avenue,

Suite 310, Palo Alto, CA 94301, Attn: General Counsel, (650) 289-3060.

1

About Hercules Technology Growth Capital, Inc.

Hercules Technology Growth Capital, Inc. (NYSE: HTGC) is the leading specialty finance company focused on providing senior secured venture growth loans to

high-growth innovative venture capital-backed companies in the technology, biotechnology, life sciences, healthcare, and energy & renewable technology industries. Since inception (December 2003), Hercules has committed more than $5.5

billion to over 325 companies and is the lender of choice for entrepreneurs and venture capital firms seeking growth capital financing. Companies interested in learning more about financing opportunities should contact info@htgc.com, or call

650.289.3060.

Hercules’ common stock trades on the New York Stock Exchange (NYSE) under the ticker symbol “HTGC.”

In addition, Hercules has three outstanding bond issuances of 7.00% Notes due April 2019, 7.00% Notes due September 2019, and 6.25% Notes due July 2024, which

trade on the NYSE under the symbols “HTGZ,” “HTGY,” and “HTGX,” respectively.

Forward-Looking Statements:

The information disclosed in this press release is made as of the date hereof and reflects Hercules most current assessment of its historical financial

performance. Actual financial results filed with the SEC may differ from those contained herein due to timing delays between the date of this release and confirmation of final audit results. These forward-looking statements are not guarantees of

future performance and are subject to uncertainties and other factors that could cause actual results to differ materially from those expressed in the forward-looking statements including, without limitation, the risks, uncertainties, including the

uncertainties surrounding the current market volatility, and other factors the Company identifies from time to time in its filings with the SEC. Although Hercules believes that the assumptions on which these forward-looking statements are based are

reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statements based on those assumptions also could be incorrect. You should not place undue reliance on these forward-looking statements. The

forward-looking statements contained in this release are made as of the date hereof, and Hercules assumes no obligation to update the forward-looking statements for subsequent events.

Contact:

Michael Hara

Investor Relations and Corporate Communications

Hercules

Technology Growth Capital, Inc.

650-433-5578 HT-HN

mhara@htgc.com

2

Exhibit 99.2

Hercules Technology Growth Capital Announces Intention to Partially Redeem

its 7.00% Senior Unsecured Notes due September 2019

Palo Alto, Calif., November 4, 2015 – Hercules Technology Growth Capital, Inc. (NYSE: HTGC)(“Hercules” or the

“Company”), the leading specialty financing provider to innovative venture growth stage companies backed by leading venture capital firms, today announced it intends to redeem $40.0 million (face value) of the $85.9 million in issued and

outstanding aggregate principal amount of the Company’s 7.00% Senior Unsecured Notes due September 2019 (CUSIP No. 427096870) (the “Notes”), which were issued pursuant to the indenture (the “Base Indenture”) dated as of

March 6, 2012, between the Company and U.S. National Bank Association, as trustee, as supplemented by the second supplemental indenture dated as of September 24, 2012 (together with the Base Indenture, the “Indenture”). The

partial redemption of the Notes will result in interest expense savings if the Notes were otherwise left outstanding through maturity, but will also accelerate the amortization of certain underwriting fees and other debt issuance costs resulting in

an increase in related expenses in the period the Notes are redeemed. Hercules currently intends to make additional redemptions on the Notes throughout calendar year 2016, depending on its anticipated liquidity position. The Company will provide

notice for, and complete all, redemptions in compliance with the terms of the Indenture.

About Hercules Technology Growth Capital, Inc.

Hercules Technology Growth Capital, Inc. (NYSE: HTGC) is the leading specialty finance company focused on providing senior secured venture growth loans to

high-growth, innovative venture capital-backed companies in the technology, biotechnology, life sciences, healthcare, and energy & renewable technology industries. Since inception (December 2003), Hercules has committed more than $5.5

billion to over 325 companies and is the lender of choice for entrepreneurs and venture capital firms seeking growth capital financing. Companies interested in learning more about financing opportunities should contact info@htgc.com, or call

650.289.3060.

Hercules’ common stock trades on the New York Stock Exchange under the ticker symbol “HTGC.”

In addition to the Notes which trade on the NYSE under the symbol “HTGY”, Hercules has two outstanding bond issuances of 7.00% Senior Notes due

April 2019 and 6.25% Notes due July 2024, which trade on the NYSE under the symbols “HTGZ,” and “HTGX,” respectively.

Forward-Looking Statements

The information disclosed in

this press release is made as of the date hereof and reflects Hercules most current assessment of its historical financial performance. Actual financial results filed with the Securities and Exchange Commission may differ from those contained herein

due to timing delays between the date of this release and confirmation of final audit results. These forward-looking statements are not guarantees of future performance and are subject to uncertainties and other factors that could cause actual

results to differ materially from those expressed in the forward-looking statements including, without limitation, the risks, uncertainties, including the uncertainties surrounding the current market volatility, and other factors the Company

identifies from time to time in its filings with the Securities and Exchange Commission. Although Hercules believes that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be

inaccurate and, as a result, the forward-looking statements based on those assumptions also could be incorrect. You should not place undue reliance on these forward-looking statements. The forward-looking statements contained in this release are

made as of the date hereof, and Hercules assumes no obligation to update the forward-looking statements for subsequent events.

Contact:

Michael Hara

Investor Relations and Corporate Communications

Hercules Technology Growth Capital, Inc.

(650) 433-5578

HT-HN

mhara@htgc.com

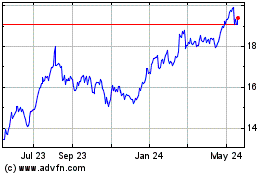

Hercules Capital (NYSE:HTGC)

Historical Stock Chart

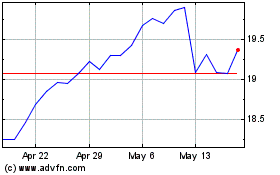

From Jun 2024 to Jul 2024

Hercules Capital (NYSE:HTGC)

Historical Stock Chart

From Jul 2023 to Jul 2024