Hyliion Holdings Corp. (NYSE American: HYLN) (“Hyliion”), a

developer of sustainable electricity-producing technology, today

reported its third-quarter 2024 financial results.

Key Business Highlights

- On track to deliver initial customer units by year-end and

reaffirms guidance of low double-digit millions in revenue for

2025

- Secured customer commitments exceeding 2025 KARNO™ generator

production capacity

- Announced revenue recognition beginning in Q4 2024 for military

development projects

- Announced plans to develop a 2-megawatt KARNO generator product

targeting the data center market, with expected deployment in

2026

- Awarded a contract for up to $16.0 million by the U.S. Navy’s

Office of Naval Research (ONR) to explore the KARNO generator for

Navy ships and stationary power

- Executed an LOI with ANA, a leader in industrial equipment, for

up to 6 KARNO units in mobile power applications

- Announced the KARNO generator qualifies under California’s

Renewables Portfolio Standard using renewable fuels such as

landfill gas, biogas and hydrogen

- Successfully demonstrated the KARNO generator’s fuel-agnostic

capabilities by transitioning between multiple fuel types without

interrupting operation

- Ended the quarter with $237.5 million of cash and

investments

- Confirmed guidance of approximately $55 million in cash

expenditures in 2024 for KARNO development including capital

investments

Executive Commentary

"Hyliion is pleased to report several exciting developments this

quarter, including a significant contract with the ONR, the planned

development of a 2-megawatt KARNO system, and customer commitments

in excess of our 2025 production capacity," stated Thomas Healy,

Hyliion’s Founder and CEO. "These milestones highlight the strong

demand for the KARNO generator and its versatility as a power

generation solution across multiple applications. We are also

looking forward to our first customer deliveries later this year,

followed by a ramp-up in deliveries throughout next year."

KARNO Commercial Updates

Hyliion is developing a locally deployable 200kW generator

system which it intends to deliver to initial customers beginning

in late 2024. Target markets in the commercial power space include

EV Charging, Data Centers, Waste Gas & Heat, Prime Power, and

Mobility applications. Initial customer deployments will target

these markets to demonstrate the versatility of the KARNO generator

as well as key product attributes and differentiators versus

competing technologies, including efficiency, emissions, fuel

flexibility, and operating and maintenance costs. The Company will

also garner useful feedback and information on the performance of

the generator in these early deployments.

The Company announced during the quarter that a new contract

with the Office of Naval Research, combined with two earlier

contracts, will provide revenue of up to $17.2 million to perform

research and development services related to KARNO generator

applications for the U.S. Navy, including the purchase of up to

seven KARNO generators. Hyliion believes the KARNO generator can

provide a versatile, efficient, and reliable power solution to meet

the unique demands of U.S. naval operations in maritime

environments. Upon successful validation and demonstration, the

KARNO generator could be used as an electric power system in future

maritime platforms and for stationary power needs.

Hyliion anticipates beginning to recognize revenue in the fourth

quarter of 2024 related to the development work and delivery of

KARNO units associated with the military contracts.

Hyliion has now secured customer commitments exceeding its 2025

production capacity, with additional letters of intent already in

place for 2026 deliveries. During the quarter, Hyliion announced

the execution of a letter of intent (LOI) with ANA, a leading

provider of innovative and reliable solutions in the industrial

equipment industry, to procure up to six KARNO generators and

launch a mobile generator application pilot trial. These customer

commitments are executed as non-binding LOIs and are subject to the

execution of definitive sales agreements prior to deliveries.

In addition, Hyliion’s KARNO generator, when operating on select

renewable fuels, is set to qualify as an eligible technology under

California’s Renewables Portfolio Standard (RPS) following the

passage of Assembly Bill 1921. This eligibility positions KARNO

technology to support California’s climate goals by delivering a

versatile, low-emission power generation solution capable of

utilizing renewable fuels such as landfill gas, biogas, and

hydrogen.

KARNO Generator Development

The Company announced plans today to develop a 2-megawatt KARNO

generator system tailored to meet the growing electricity demands

of data center operations, driven by the rapid expansion of

computing needs and artificial intelligence applications. The

generator will provide data centers with a high-power, efficient,

and low emission solution within a compact footprint roughly the

size of a 20-foot shipping container. The KARNO generator's unique

fuel flexibility and high-power density offer data center operators

an advantage over other conventional power solutions. The Company

expects initial 2-megawatt systems to be deployed in 2026.

Hyliion successfully demonstrated the KARNO generator’s

fuel-agnostic capabilities by transitioning between multiple fuel

types during operation without interruption. This achievement

highlights the generator’s ability to handle impure or mixed fuels,

making it ideal for applications in industries like oil and gas,

waste gas recovery, and other environments where fuel flexibility

is advantageous.

Hyliion continued to take delivery of additive printing machines

during the quarter at its Austin, Texas manufacturing facility and

placed orders for additional printer deliveries extending through

mid 2025. The Company expects to take delivery of its first M Line

production additive printer from Colibrium Additive, a GE Aerospace

company, in the coming weeks. These advanced printers are designed

for volume production and will assist with Hyliion’s production

ramp.

Financial Highlights and Guidance

Third quarter operating expenses totaled $14.2 million, compared

to $33.3 million in the prior-year quarter. Expenses were offset by

a credit of $929 thousand from the sale of assets related to the

discontinued powertrain business. Net loss in the third quarter was

$11.2 million, compared with $30.3 million in the third quarter of

2023. Year-to-date net loss through September 2024 was $37.7

million, down significantly from $94.4 million during the first

three quarters of 2023. Losses in 2023 were primarily driven by

spending related to Hyliion’s discontinued powertrain business.

Total changes in cash and investment balances for the quarter

were $11.2 million, driven by net operating losses and capital

expenditures, partly offset by cash generated from interest income

and powertrain asset sales. Total cash and investments at the end

of the quarter were $237.5 million.

For 2024, total cash consumed for KARNO development and capital

investments is expected to be approximately $55 million. This

estimate excludes cash payments associated with share repurchases

that have already been conducted during 2024, and payments and

asset sales associated with the wind down of powertrain operations.

Hyliion continues to expect it will achieve commercialization of

the KARNO generator with capital on hand.

Projections for 2025 include growth of KARNO generator

deliveries, with proceeds from sales and research and development

services in the low double-digit millions of dollars. The Company

is also targeting approximately break-even gross margins on a cash

basis by late 2025 or early 2026, with cash spending to grow

modestly compared to 2024.

About Hyliion

Hyliion is committed to creating innovative solutions that

enable clean, flexible and affordable electricity production. The

Company’s primary focus is to provide distributed power generators

that can operate on various fuel sources to future-proof against an

ever-changing energy economy. Headquartered in Austin, Texas, and

with research and development in Cincinnati, Ohio, Hyliion is

initially targeting the commercial and waste management industries

with a locally deployable generator that can offer prime power as

well as energy arbitrage opportunities. Beyond stationary power,

Hyliion will address mobile applications such as vehicles and

marine. The KARNO generator is a fuel-agnostic solution, enabled by

additive manufacturing, that leverages a linear heat generator

architecture. The Company aims to offer innovative, yet practical

solutions that contribute positively to the environment in the

energy economy. For further information, please visit

www.hyliion.com.

Forward Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

present or historical fact included in this press release,

regarding Hyliion and its future financial and operational

performance, as well as its strategy, future operations, estimated

financial position, estimated revenues, and losses, projected

costs, prospects, plans and objectives of management are forward

looking statements. When used in this press release, including any

oral statements made in connection therewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” the negative of such terms and

other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. These forward-looking statements are based

on management’s current expectations and assumptions about future

events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required

by applicable law, Hyliion expressly disclaims any duty to update

any forward-looking statements, all of which are expressly

qualified by the statements herein, to reflect events or

circumstances after the date of this press release. Hyliion

cautions you that these forward-looking statements are subject to

numerous risks and uncertainties, most of which are difficult to

predict and many of which are beyond the control of Hyliion. These

risks include, but are not limited to, our status as an early stage

company with a history of losses, and our expectation of incurring

significant expenses and continuing losses for the foreseeable

future; our ability to develop to develop key commercial

relationships with suppliers and customers; our ability to retain

the services of Thomas Healy, our Chief Executive Officer; the

expected performance of the KARNO generator and system; the

execution of the strategic shift from our powertrain business to

our KARNO business; our ability to comply with governmental

regulations related to defense spending and procurement; the

suitability of our products for defense applications; and the other

risks and uncertainties described under the heading “Risk Factors”

in our SEC filings including in our Annual Report (See item 1A.

Risk Factors) on Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on February 13, 2024 for the year ended

December 31, 2023 and in our subsequently filed Forms 10-Q. Given

these risks and uncertainties, readers are cautioned not to place

undue reliance on such forward-looking statements. Should one or

more of the risks or uncertainties described in this press release

occur, or should underlying assumptions prove incorrect, actual

results and plans could differ materially from those expressed in

any forward-looking statements. Additional information concerning

these and other factors that may impact Hyliion’s operations and

projections can be found in its filings with the SEC. Hyliion’s SEC

Filings are available publicly on the SEC’s website at www.sec.gov, and readers are urged to carefully

review and consider the various disclosures made in such

filings.

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollar amounts in thousands,

except share and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

Product sales and other

$

—

$

96

$

—

$

672

Total revenues

—

96

—

672

Cost of revenues

Product sales and other

—

677

—

1,675

Total cost of revenues

—

677

—

1,675

Gross loss

—

(581

)

—

(1,003

)

Operating expenses

Research and development

9,462

25,115

25,741

73,472

Selling, general and administrative

5,648

8,186

18,502

30,265

Exit and termination costs

(929

)

—

2,946

—

Total operating expenses

14,181

33,301

47,189

103,737

Loss from operations

(14,181

)

(33,882

)

(47,189

)

(104,740

)

Interest income

2,979

3,534

9,504

10,345

Gain on disposal of assets

—

—

3

1

Other income, net

—

26

32

14

Net loss

$

(11,202

)

$

(30,322

)

$

(37,650

)

$

(94,380

)

Net loss per share, basic and diluted

$

(0.06

)

$

(0.17

)

$

(0.21

)

$

(0.52

)

Weighted-average shares outstanding, basic

and diluted

173,612,768

181,641,060

175,302,069

180,914,250

HYLIION HOLDINGS CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollar amounts in thousands,

except share data)

September 30,

2024

December 31,

2023

(Unaudited)

Assets

Current assets

Cash and cash equivalents

$

28,065

$

12,881

Accounts receivable

1,257

40

Prepaid expenses and other current

assets

5,678

18,483

Short-term investments

122,897

150,297

Assets held for sale

3,463

—

Total current assets

161,360

181,701

Property and equipment, net

17,428

9,987

Operating lease right-of-use assets

5,779

7,070

Other assets

1,173

1,439

Long-term investments

86,545

128,186

Total assets

$

272,285

$

328,383

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

1,654

$

4,224

Current portion of operating lease

liabilities

1,531

847

Accrued expenses and other current

liabilities

5,975

10,051

Total current liabilities

9,160

15,122

Operating lease liabilities, net of

current portion

4,997

6,792

Other liabilities

400

203

Total liabilities

14,557

22,117

Commitments and contingencies

Stockholders’ equity

Common stock, $0.0001 par value;

250,000,000 shares authorized; 184,335,183 and 183,071,317 shares

issued at September 30, 2024 and December 31, 2023, respectively;

173,725,113 and 183,034,255 shares outstanding as of September 30,

2024 and December 31, 2023, respectively

18

18

Additional paid-in capital

407,259

404,045

Treasury stock, at cost; 10,610,070 and

37,062 shares as of September 30, 2024 and December 31, 2023,

respectively

(14,135

)

(33

)

Accumulated deficit

(135,414

)

(97,764

)

Total stockholders’ equity

257,728

306,266

Total liabilities and stockholders’

equity

$

272,285

$

328,383

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollar amounts in

thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities

Net loss

$

(37,650

)

$

(94,380

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

2,140

1,796

Amortization and accretion of investments,

net

(2,489

)

(1,821

)

Noncash lease expense

1,291

1,072

Inventory write-down

—

992

Gain on disposal of assets, including

assets held for sale

(2,109

)

(1

)

Share-based compensation

3,541

5,170

Carrying value adjustment to assets held

for sale

5,564

—

Changes in operating assets and

liabilities:

Accounts receivable

(580

)

996

Inventory

—

(1,057

)

Prepaid expenses and other assets

(5,215

)

(1,200

)

Accounts payable

(2,655

)

555

Accrued expenses and other liabilities

(4,018

)

(3,295

)

Operating lease liabilities

(1,111

)

(1,254

)

Net cash used in operating activities

(43,291

)

(92,427

)

Cash flows from investing

activities

Purchase of property and equipment

(10,548

)

(6,755

)

Proceeds from sale of property and

equipment

4,110

2

Payments for security deposit, net

—

(45

)

Purchase of investments

(55,383

)

(170,197

)

Proceeds from sale and maturity of

investments

126,686

178,556

Net cash provided by investing

activities

64,865

1,561

Cash flows from financing

activities

Proceeds from exercise of common stock

options

67

230

Taxes paid related to net share settlement

of equity awards

(393

)

(232

)

Repurchase of treasury stock

(13,982

)

—

Net cash used in financing activities

(14,308

)

(2

)

Net increase (decrease) in cash and cash

equivalents and restricted cash

7,266

(90,868

)

Cash and cash equivalents and restricted

cash, beginning of period

21,464

120,133

Cash and cash equivalents and restricted

cash, end of period

$

28,730

$

29,265

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114223188/en/

Hyliion Holdings Corp. press@hyliion.com

Investor Relations ir@hyliion.com

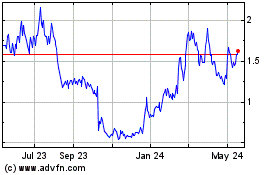

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

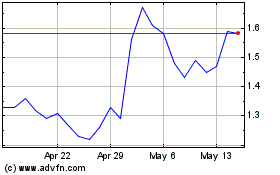

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Feb 2024 to Feb 2025