Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

January 24 2025 - 3:49PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

95.9%

Brazil

:

2.8%

83,700

Banco

do

Brasil

SA

$

342,073

0.3

123,600

Caixa

Seguridade

Participacoes

S/A

293,963

0.3

166,200

CCR

SA

301,363

0.3

183,131

Cia

Siderurgica

Nacional

SA

336,324

0.3

218,321

Cosan

SA

360,312

0.3

98,000

(1)(2)

Hapvida

Participacoes

e

Investimentos

S/A

43,000

0.0

41,800

JBS

S/A

256,769

0.2

95,600

Natura

&

Co.

Holding

SA

214,976

0.2

9,000

Suzano

SA

92,965

0.1

38,664

Telefonica

Brasil

SA

316,674

0.3

146,619

TIM

SA/Brazil

377,708

0.4

5,571

Vale

SA

-

Foreign

54,730

0.1

2,990,857

2.8

Chile

:

0.4%

113,027

(2)

Falabella

SA

387,196

0.4

China

:

24.4%

27,500

37

Interactive

Entertainment

Network

Technology

Group

Co.

Ltd.

-

Class

A

64,525

0.1

39,500

AAC

Technologies

Holdings,

Inc.

178,544

0.2

200,300

Alibaba

Group

Holding

Ltd.

2,187,526

2.0

3,400

Anhui

Gujing

Distillery

Co.

Ltd.

-

Class

B

48,891

0.0

7,886

Autohome,

Inc.,

ADR

216,944

0.2

64,500

Bank

of

Chengdu

Co.

Ltd.

-

Class

A

142,477

0.1

1,468,000

Bank

of

China

Ltd.

-

Class

H

684,479

0.6

160,300

Bank

of

Jiangsu

Co.

Ltd.

-

Class

A

201,192

0.2

50,500

Bank

of

Nanjing

Co.

Ltd.

-

Class

A

73,901

0.1

18,100

Beijing

Tiantan

Biological

Products

Corp.

Ltd.

-

Class

A

53,949

0.1

204,800

BOE

Technology

Group

Co.

Ltd.

-

Class

A

122,235

0.1

9,500

BYD

Co.

Ltd.

-

Class

H

313,357

0.3

572,000

China

CITIC

Bank

Corp.

Ltd.

-

Class

H

365,474

0.3

774,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

407,905

0.4

1,300,000

China

Construction

Bank

Corp.

-

Class

H

982,877

0.9

86,000

(1)

China

Feihe

Ltd.

63,594

0.1

69,000

China

Hongqiao

Group

Ltd.

101,339

0.1

272,000

China

Minsheng

Banking

Corp.

Ltd.

-

Class

H

106,141

0.1

394,000

China

Oilfield

Services

Ltd.

-

Class

H

341,176

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

104,000

China

Railway

Group

Ltd.

-

Class

H

$

50,271

0.0

114,418

China

Railway

Signal

&

Communication

Corp.

Ltd.

-

Class

A

101,090

0.1

29,600

(1)

China

Resources

Mixc

Lifestyle

Services

Ltd.

112,247

0.1

196,000

(1)

China

Resources

Pharmaceutical

Group

Ltd.

132,515

0.1

2,772,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

364,754

0.3

119,900

China

XD

Electric

Co.

Ltd.

-

Class

A

125,742

0.1

51,400

China

Yangtze

Power

Co.

Ltd.

-

Class

A

194,143

0.2

294,000

CMOC

Group

Ltd.

-

Class

H

220,303

0.2

38,200

Dong-E-E-Jiao

Co.

Ltd.

-

Class

A

307,776

0.3

23,700

Dongfang

Electric

Corp.

Ltd.

-

Class

A

49,981

0.0

290,000

Fosun

International

Ltd.

157,708

0.1

8,000

(1)

Fuyao

Glass

Industry

Group

Co.

Ltd.

-

Class

H

53,830

0.1

16,800

(1)

Giant

Biogene

Holding

Co.

Ltd.

108,537

0.1

161,200

Goldwind

Science

&

Technology

Co.

Ltd.

-

Class

A

249,856

0.2

187,000

Great

Wall

Motor

Co.

Ltd.

-

Class

H

302,886

0.3

83,900

GRG

Banking

Equipment

Co.

Ltd.

-

Class

A

152,148

0.1

18,400

Haier

Smart

Home

Co.

Ltd.

-

Class

H

61,887

0.1

26,000

(1)

Hansoh

Pharmaceutical

Group

Co.

Ltd.

64,793

0.1

69,000

Hisense

Home

Appliances

Group

Co.

Ltd.

-

Class

H

195,672

0.2

67,600

(1)

Huatai

Securities

Co.

Ltd.

-

Class

H

116,921

0.1

256,592

Industrial

&

Commercial

Bank

of

China

Ltd.

-

Class

H

151,287

0.1

260,000

Inner

Mongolia

Yuan

Xing

Energy

Co.

Ltd.

-

Class

A

210,629

0.2

32,502

JD.com,

Inc.

-

Class

A

607,560

0.6

178,000

Jiangsu

Expressway

Co.

Ltd.

-

Class

H

180,876

0.2

22,400

Jiangsu

Zhongtian

Technology

Co.

Ltd.

-

Class

A

49,514

0.0

2,530

KE

Holdings,

Inc.,

ADR

47,691

0.0

100,200

Kingsoft

Corp.

Ltd.

407,560

0.4

400

Kweichow

Moutai

Co.

Ltd.

-

Class

A

84,941

0.1

346,000

Lenovo

Group

Ltd.

409,430

0.4

22,900

Livzon

Pharmaceutical

Group,

Inc.

-

Class

A

121,381

0.1

66,220

(1)(2)

Meituan

-

Class

B

1,396,797

1.3

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

30,400

MINISO

Group

Holding

Ltd.

$

152,046

0.1

32,000

NARI

Technology

Co.

Ltd.

-

Class

A

109,861

0.1

31,900

NetEase,

Inc.

555,356

0.5

25,700

Ningbo

Sanxing

Medical

Electric

Co.

Ltd.

-

Class

A

110,137

0.1

933,000

People's

Insurance

Co.

Group

of

China

Ltd.

-

Class

H

446,593

0.4

366,000

PetroChina

Co.

Ltd.

-

Class

H

260,593

0.2

324,000

PICC

Property

&

Casualty

Co.

Ltd.

-

Class

H

491,931

0.5

105,000

Ping

An

Insurance

Group

Co.

of

China

Ltd.

-

Class

H

610,657

0.6

20,000

(1)

Pop

Mart

International

Group

Ltd.

232,166

0.2

4,361

Qifu

Technology,

Inc.,

ADR

166,198

0.2

164,000

Shanghai

Baosight

Software

Co.

Ltd.

-

Class

B

272,509

0.3

209,300

Shanghai

Pharmaceuticals

Holding

Co.

Ltd.

-

Class

H

349,730

0.3

25,500

Shenzhen

YUTO

Packaging

Technology

Co.

Ltd.

-

Class

A

86,664

0.1

15,200

Sieyuan

Electric

Co.

Ltd.

-

Class

A

163,683

0.2

6,000

Silergy

Corp.

78,571

0.1

153,100

Sinoma

International

Engineering

Co.

-

Class

A

221,704

0.2

61,200

Sinopharm

Group

Co.

Ltd.

-

Class

H

160,424

0.1

42,500

Sinotruk

Hong

Kong

Ltd.

117,722

0.1

43,100

TBEA

Co.

Ltd.

-

Class

A

81,312

0.1

97,000

Tencent

Holdings

Ltd.

5,009,396

4.7

10,560

Tencent

Music

Entertainment

Group,

ADR

120,490

0.1

120,800

Tian

Di

Science

&

Technology

Co.

Ltd.

-

Class

A

100,198

0.1

36,600

Tianqi

Lithium

Corp.

-

Class

A

194,187

0.2

344,000

(1)

Topsports

International

Holdings

Ltd.

108,481

0.1

7,488

Vipshop

Holdings

Ltd.,

ADR

103,409

0.1

197,000

Weichai

Power

Co.

Ltd.

-

Class

H

273,172

0.3

94,500

Western

Mining

Co.

Ltd.

-

Class

A

221,814

0.2

3,700

Wuliangye

Yibin

Co.

Ltd.

-

Class

A

75,578

0.1

192,600

(1)(2)

Xiaomi

Corp.

-

Class

B

693,183

0.6

12,100

Yealink

Network

Technology

Corp.

Ltd.

-

Class

A

63,709

0.1

70,800

Yutong

Bus

Co.

Ltd.

-

Class

A

214,603

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

54,400

Zhejiang

Chint

Electrics

Co.

Ltd.

-

Class

A

$

171,503

0.2

91,200

Zhejiang

Longsheng

Group

Co.

Ltd.

-

Class

A

128,278

0.1

19,000

Zhejiang

NHU

Co.

Ltd.

-

Class

A

57,300

0.1

79,200

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

281,224

0.3

57,200

ZTE

Corp.

-

Class

H

139,771

0.1

26,071,405

24.4

Colombia

:

0.2%

61,660

Interconexion

Electrica

SA

ESP

233,668

0.2

Egypt

:

0.2%

451,351

Eastern

Co.

SAE

246,928

0.2

Greece

:

1.4%

168,142

Alpha

Services

and

Holdings

SA

261,510

0.2

155,568

Eurobank

Ergasias

Services

and

Holdings

SA

329,904

0.3

36,712

National

Bank

of

Greece

SA

259,166

0.2

5,137

OPAP

SA

84,278

0.1

80,766

Piraeus

Financial

Holdings

SA

296,983

0.3

21,767

Public

Power

Corp.

SA

263,763

0.3

1,495,604

1.4

Hong

Kong

:

1.4%

60,000

Beijing

Enterprises

Holdings

Ltd.

189,160

0.2

622,000

Bosideng

International

Holdings

Ltd.

324,782

0.3

158,000

China

Merchants

Port

Holdings

Co.

Ltd.

250,569

0.2

104,000

China

Overseas

Land

&

Investment

Ltd.

179,699

0.2

494,000

Far

East

Horizon

Ltd.

333,355

0.3

550,000

Sino

Biopharmaceutical

Ltd.

231,723

0.2

1,509,288

1.4

Hungary

:

0.4%

15,631

Richter

Gedeon

Nyrt

415,774

0.4

India

:

18.3%

3,444

ABB

India

Ltd.

303,227

0.3

18,424

Adani

Ports

&

Special

Economic

Zone

Ltd.

260,412

0.2

1,799

Apollo

Hospitals

Enterprise

Ltd.

145,590

0.1

18,414

Aurobindo

Pharma

Ltd.

275,852

0.3

66,623

Axis

Bank

Ltd.

898,651

0.8

145,249

Bharat

Electronics

Ltd.

531,375

0.5

20,245

Bharat

Heavy

Electricals

Ltd.

60,515

0.1

27,035

Bharti

Airtel

Ltd.

522,041

0.5

11,693

Cipla

Ltd./India

212,615

0.2

10,956

Colgate-Palmolive

India

Ltd.

375,237

0.4

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

India

(continued)

23,554

DLF

Ltd.

$

230,208

0.2

19,735

Havells

India

Ltd.

401,938

0.4

38,395

HCL

Technologies

Ltd.

842,378

0.8

7,171

(1)

HDFC

Asset

Management

Co.

Ltd.

357,660

0.3

8,721

HDFC

Bank

Ltd.

186,104

0.2

1,656

Hero

MotoCorp

Ltd.

93,532

0.1

56,018

Hindalco

Industries

Ltd.

436,320

0.4

1,116

Hindustan

Aeronautics

Ltd.

59,338

0.1

116,922

ICICI

Bank

Ltd.

1,798,925

1.7

5,711

(1)

ICICI

Lombard

General

Insurance

Co.

Ltd.

125,963

0.1

113,051

Indian

Oil

Corp.

Ltd.

186,254

0.2

580

Info

Edge

India

Ltd.

56,782

0.1

32,353

Infosys

Ltd.

713,535

0.7

58,628

ITC

Ltd.

331,500

0.3

21,951

Kotak

Mahindra

Bank

Ltd.

459,888

0.4

22,402

Larsen

&

Toubro

Ltd.

989,743

0.9

759

(1)

LTIMindtree

Ltd.

55,601

0.1

14,379

Lupin

Ltd.

349,386

0.3

2,073

Maruti

Suzuki

India

Ltd.

272,345

0.3

130,453

NMDC

Ltd.

356,752

0.3

176,313

Oil

&

Natural

Gas

Corp.

Ltd.

537,251

0.5

8,942

Oil

India

Ltd.

52,082

0.0

385

Oracle

Financial

Services

Software

Ltd.

53,495

0.1

1,893

PI

Industries

Ltd.

91,228

0.1

5,122

Pidilite

Industries

Ltd.

185,867

0.2

74,259

Power

Finance

Corp.

Ltd.

436,125

0.4

177,055

Power

Grid

Corp.

of

India

Ltd.

691,263

0.6

74,956

REC

Ltd.

473,734

0.4

50,984

Reliance

Industries

Ltd.

782,340

0.7

18,703

Shriram

Finance

Ltd.

669,401

0.6

15,073

Sun

Pharmaceutical

Industries

Ltd.

318,149

0.3

1,249

Supreme

Industries

Ltd.

68,834

0.1

23,206

Tata

Consultancy

Services

Ltd.

1,175,430

1.1

319,524

Tata

Steel

Ltd.

548,306

0.5

23,006

Tech

Mahindra

Ltd.

467,450

0.4

11,880

Torrent

Pharmaceuticals

Ltd.

468,076

0.4

104,110

Vedanta

Ltd.

560,232

0.5

7,264

Zydus

Lifesciences

Ltd.

83,227

0.1

19,552,157

18.3

Indonesia

:

1.0%

403,600

Astra

International

Tbk

PT

130,026

0.1

1,062,700

Bank

Central

Asia

Tbk

PT

670,685

0.6

214,000

Bank

Negara

Indonesia

Persero

Tbk

PT

67,349

0.1

469,500

Indah

Kiat

Pulp

&

Paper

Tbk

PT

215,066

0.2

1,083,126

1.0

Ireland

:

0.8%

9,361

(2)

PDD

Holdings,

Inc.,

ADR

903,898

0.8

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Luxembourg

:

0.3%

10,965

Reinet

Investments

SCA

$

294,325

0.3

Malaysia

:

2.0%

270,100

AMMB

Holdings

Bhd

327,555

0.3

126,300

Axiata

Group

Bhd

66,558

0.1

360,100

Genting

Bhd

303,242

0.3

722,800

Genting

Malaysia

Bhd

351,489

0.3

45,700

Hong

Leong

Bank

Bhd

212,737

0.2

82,300

Malayan

Banking

Bhd

188,853

0.2

424,800

Public

Bank

Bhd

427,391

0.4

218,000

Sime

Darby

Bhd

111,928

0.1

172,600

YTL

Power

International

Bhd

132,359

0.1

2,122,112

2.0

Mexico

:

1.8%

207,400

Alfa

SAB

de

CV

-

Class

A

157,294

0.2

168,900

America

Movil

SAB

de

CV

125,598

0.1

123,600

(1)

Banco

del

Bajio

SA

261,788

0.2

10,100

Coca-Cola

Femsa

SAB

de

CV

80,636

0.1

313,478

Fibra

Uno

Administracion

SA

de

CV

327,960

0.3

7,600

Grupo

Financiero

Banorte

SAB

de

CV

-

Class

O

50,988

0.1

165,509

Kimberly-Clark

de

Mexico

SAB

de

CV

-

Class

A

225,681

0.2

263,300

Orbia

Advance

Corp.

SAB

de

CV

236,409

0.2

153,614

Wal-Mart

de

Mexico

SAB

de

CV

408,779

0.4

1,875,133

1.8

Peru

:

0.1%

324

Credicorp

Ltd.

60,092

0.1

Philippines

:

0.6%

222,300

Ayala

Land,

Inc.

108,584

0.1

30,650

International

Container

Terminal

Services,

Inc.

193,409

0.2

132,800

JG

Summit

Holdings,

Inc.

50,006

0.0

148,490

Metropolitan

Bank

&

Trust

Co.

193,254

0.2

3,875

PLDT,

Inc.

85,913

0.1

631,166

0.6

Poland

:

0.8%

5,927

Alior

Bank

SA

133,554

0.1

2,775

Bank

Polska

Kasa

Opieki

SA

92,756

0.1

20

L.P.

SA

77,307

0.0

21,763

Powszechna

Kasa

Oszczednosci

Bank

Polski

SA

299,860

0.3

28,230

Powszechny

Zaklad

Ubezpieczen

SA

307,833

0.3

911,310

0.8

Qatar

:

0.9%

478,152

Barwa

Real

Estate

Co.

363,425

0.3

444,779

Mesaieed

Petrochemical

Holding

Co.

187,147

0.2

111,396

Ooredoo

QPSC

362,243

0.3

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Qatar

(continued)

16,776

Qatar

Fuel

QSC

$

68,237

0.1

981,052

0.9

Russia

:

—%

354,185

(3)

Alrosa

PJSC

—

—

10,144,776

(3)

Inter

RAO

UES

PJSC

—

—

15,442

(3)

Lukoil

PJSC

—

—

9,459

(3)

Magnit

PJSC

—

—

116,758

(3)

Mobile

TeleSystems

PJSC

—

—

4,585

(3)

Severstal

PAO

—

—

130,134

(3)

Surgutneftegas

PJSC

—

—

125,422

(3)

Tatneft

PJSC

—

—

—

—

Saudi

Arabia

:

2.8%

5,795

Almarai

Co.

JSC

86,249

0.1

99,423

Arab

National

Bank

505,753

0.5

19,083

Etihad

Etisalat

Co.

280,386

0.3

41,053

Sahara

International

Petrochemical

Co.

265,589

0.2

55,795

Saudi

Awwal

Bank

460,477

0.4

29,885

Saudi

Basic

Industries

Corp.

548,079

0.5

72,639

Saudi

National

Bank

627,651

0.6

22,605

Yanbu

National

Petrochemical

Co.

224,746

0.2

2,998,930

2.8

Singapore

:

0.4%

52,300

(1)

BOC

Aviation

Ltd.

404,350

0.4

South

Africa

:

2.2%

60,851

Absa

Group

Ltd.

582,629

0.5

2,390

Bid

Corp.

Ltd.

58,286

0.0

28,387

Exxaro

Resources

Ltd.

263,151

0.2

20,922

Gold

Fields

Ltd.

299,909

0.3

2,240

Naspers

Ltd.

-

Class

N

505,783

0.5

5,345

Nedbank

Group

Ltd.

86,027

0.1

54,899

OUTsurance

Group

Ltd.

197,001

0.2

10,606

Shoprite

Holdings

Ltd.

174,694

0.2

49,531

(2)

Sibanye

Stillwater

Ltd.

49,705

0.0

13,520

Standard

Bank

Group

Ltd.

177,763

0.2

2,394,948

2.2

South

Korea

:

10.4%

1,216

CJ

CheilJedang

Corp.

230,578

0.2

1,226

Coway

Co.

Ltd.

58,098

0.0

4,203

DB

Insurance

Co.

Ltd.

329,749

0.3

5,648

GS

Holdings

Corp.

170,000

0.2

1,268

Hana

Financial

Group,

Inc.

56,861

0.0

7,459

Hankook

Tire

&

Technology

Co.

Ltd.

202,168

0.2

590

Hanmi

Pharm

Co.

Ltd.

115,625

0.1

6,516

HD

Hyundai

Co.

Ltd.

364,441

0.3

681

HD

Hyundai

Electric

Co.

Ltd.

173,032

0.2

2,935

(2)

HD

Korea

Shipbuilding

&

Offshore

Engineering

Co.

Ltd.

432,296

0.4

1,700

Hyundai

Mobis

Co.

Ltd.

292,746

0.3

13,177

Hyundai

Steel

Co.

198,599

0.2

7,915

KB

Financial

Group,

Inc.

546,650

0.5

7,052

Kia

Corp.

472,222

0.4

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

South

Korea

(continued)

7,853

Korea

Investment

Holdings

Co.

Ltd.

$

421,942

0.4

1,613

Kumho

Petrochemical

Co.

Ltd.

114,680

0.1

1,416

LG

Chem

Ltd.

289,705

0.3

2,774

LG

Electronics,

Inc.

179,302

0.2

861

LG

H&H

Co.

Ltd.

192,453

0.2

29,428

LG

Uplus

Corp.

244,896

0.2

1,695

Lotte

Chemical

Corp.

78,653

0.1

17,563

Mirae

Asset

Securities

Co.

Ltd.

108,106

0.1

39,706

NH

Investment

&

Securities

Co.

Ltd.

380,610

0.3

1,325

Samsung

C&T

Corp.

113,647

0.1

806

Samsung

Electro-

Mechanics

Co.

Ltd.

62,927

0.1

72,751

Samsung

Electronics

Co.

Ltd.

2,860,804

2.7

1,561

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

441,634

0.4

899

Samsung

Life

Insurance

Co.

Ltd.

69,259

0.1

998

Samsung

SDS

Co.

Ltd.

105,412

0.1

8,461

Shinhan

Financial

Group

Co.

Ltd.

324,201

0.3

5,641

SK

Hynix,

Inc.

658,605

0.6

6,986

SK

Telecom

Co.

Ltd.

307,547

0.3

3,209

SK,

Inc.

315,246

0.3

14,687

Woori

Financial

Group,

Inc.

176,345

0.2

11,089,039

10.4

Taiwan

:

17.7%

73,000

ASE

Technology

Holding

Co.

Ltd.

346,816

0.3

46,000

Cheng

Shin

Rubber

Industry

Co.

Ltd.

71,889

0.1

328,000

Compal

Electronics,

Inc.

374,124

0.3

52,000

Delta

Electronics,

Inc.

616,508

0.6

52,000

Evergreen

Marine

Corp.

Taiwan

Ltd.

349,356

0.3

225,000

Far

Eastern

New

Century

Corp.

232,482

0.2

9,000

Fortune

Electric

Co.

Ltd.

153,496

0.1

220,000

Hon

Hai

Precision

Industry

Co.

Ltd.

1,339,732

1.3

90,000

Inventec

Corp.

137,177

0.1

26,000

MediaTek,

Inc.

1,020,870

1.0

51,000

Micro-Star

International

Co.

Ltd.

270,333

0.2

51,000

President

Chain

Store

Corp.

425,063

0.4

18,000

Quanta

Computer,

Inc.

163,637

0.1

27,000

Realtek

Semiconductor

Corp.

398,927

0.4

345,962

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

10,780,369

10.1

159,000

Uni-President

Enterprises

Corp.

415,188

0.4

310,000

United

Microelectronics

Corp.

420,570

0.4

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Taiwan

(continued)

3,000

Voltronic

Power

Technology

Corp.

$

170,959

0.2

420,000

(2)

Winbond

Electronics

Corp.

208,993

0.2

71,000

Wistron

Corp.

250,647

0.2

3,000

Wiwynn

Corp.

181,029

0.2

147,000

Yang

Ming

Marine

Transport

Corp.

333,144

0.3

81,000

Zhen

Ding

Technology

Holding

Ltd.

288,166

0.3

18,949,475

17.7

Thailand

:

1.5%

31,100

Bumrungrad

Hospital

PCL

189,052

0.2

58,400

Central

Retail

Corp.

PCL

57,297

0.1

81,700

Kasikornbank

PCL

-

Foreign

358,956

0.3

428,900

Krung

Thai

Bank

PCL

250,651

0.2

93,600

PTT

Exploration

&

Production

PCL

348,702

0.3

123,000

SCB

X

PCL

-

Foreign

410,628

0.4

1,615,286

1.5

Turkey

:

0.1%

11,863

KOC

Holding

AS

68,554

0.1

United

Arab

Emirates

:

2.7%

242,642

Abu

Dhabi

Commercial

Bank

PJSC

662,117

0.6

226,236

Aldar

Properties

PJSC

464,283

0.4

198,450

Dubai

Islamic

Bank

PJSC

367,644

0.4

279,364

Emaar

Properties

PJSC

726,762

0.7

115,438

Emirates

NBD

Bank

PJSC

628,966

0.6

2,849,772

2.7

United

Kingdom

:

0.3%

11,355

Anglogold

Ashanti

PLC

285,055

0.3

Total

Common

Stock

(Cost

$91,752,230)

102,420,500

95.9

EXCHANGE-TRADED

FUNDS

:

2.7%

66,518

iShares

MSCI

Emerging

Markets

ETF

2,877,569

2.7

Total

Exchange-Traded

Funds

(Cost

$2,997,934)

2,877,569

2.7

PREFERRED

STOCK

:

1.3%

Brazil

:

1.3%

65,800

Centrais

Eletricas

Brasileiras

SA

422,350

0.4

36,309

Cia

Energetica

de

Minas

Gerais

70,787

0.1

42,800

Itau

Unibanco

Holding

SA

230,332

0.2

103,475

Petroleo

Brasileiro

SA

673,977

0.6

1,397,446

1.3

Total

Preferred

Stock

(Cost

$1,173,845)

1,397,446

1.3

Total

Long-Term

Investments

(Cost

$95,924,009)

106,695,515

99.9

Shares

RA

Value

Percentage

of

Net

Assets

SHORT-TERM

INVESTMENTS

:

0.7%

Mutual

Funds

:

0.7%

754,000

(4)

BlackRock

Liquidity

Funds,

FedFund,

Institutional

Class,

4.530%

(Cost

$754,000)

$

754,000

0.7

Total

Short-Term

Investments

(Cost

$754,000)

$

754,000

0.7

Total

Investments

in

Securities

(Cost

$96,678,009)

$

107,449,515

100.6

Liabilities

in

Excess

of

Other

Assets

(607,994)

(0.6)

Net

Assets

$

106,841,521

100.0

ADR

American

Depositary

Receipt

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2024.

Sector

Diversification

Percentage

of

Net

Assets

Information

Technology

24.3

%

Financials

22.5

Consumer

Discretionary

9.7

Industrials

9.2

Communication

Services

8.9

Materials

6.5

Energy

3.9

Consumer

Staples

3.9

Health

Care

3.8

Exchange-Traded

Funds

2.7

Real

Estate

2.4

Utilities

2.1

Short-Term

Investments

0.7

Liabilities

in

Excess

of

Other

Assets

(0.6)

Net

Assets

100.0%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2024

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2024

Asset

Table

Investments,

at

fair

value

Common

Stock

Brazil

$

2,990,857

$

—

$

—

$

2,990,857

Chile

387,196

—

—

387,196

China

1,533,840

24,537,565

—

26,071,405

Colombia

233,668

—

—

233,668

Egypt

246,928

—

—

246,928

Greece

—

1,495,604

—

1,495,604

Hong

Kong

333,355

1,175,933

—

1,509,288

Hungary

—

415,774

—

415,774

India

185,867

19,366,290

—

19,552,157

Indonesia

670,685

412,441

—

1,083,126

Ireland

903,898

—

—

903,898

Luxembourg

—

294,325

—

294,325

Malaysia

—

2,122,112

—

2,122,112

Mexico

1,875,133

—

—

1,875,133

Peru

60,092

—

—

60,092

Philippines

193,409

437,757

—

631,166

Poland

—

911,310

—

911,310

Qatar

617,627

363,425

—

981,052

Russia

—

—

—

—

Saudi

Arabia

828,465

2,170,465

—

2,998,930

Singapore

404,350

—

—

404,350

South

Africa

1,463,176

931,772

—

2,394,948

South

Korea

—

11,089,039

—

11,089,039

Taiwan

—

18,949,475

—

18,949,475

Thailand

410,628

1,204,658

—

1,615,286

Turkey

68,554

—

—

68,554

United

Arab

Emirates

—

2,849,772

—

2,849,772

United

Kingdom

—

285,055

—

285,055

Total

Common

Stock

13,407,728

89,012,772

—

102,420,500

Exchange-Traded

Funds

2,877,569

—

—

2,877,569

Preferred

Stock

1,397,446

—

—

1,397,446

Short-Term

Investments

754,000

—

—

754,000

Total

Investments,

at

fair

value

$

18,436,743

$

89,012,772

$

—

$

107,449,515

Liabilities

Table

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

$

—

$

(4)

$

—

$

(4)

Written

Options

—

(251,016)

—

(251,016)

Total

Liabilities

$

—

$

(251,020)

$

—

$

(251,020)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

At

November

30,

2024,

the

following

forward

foreign

currency

contracts

were

outstanding

for

Voya

Emerging

Markets

High

Dividend

Equity

Fund:

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

8,643

EGP

428,783

The

Bank

of

New

York

Mellon

12/02/24

$

(4)

$

(4)

At

November

30,

2024,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Emerging

Markets

High

Dividend

Equity

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

iShares

MSCI

Emerging

Markets

ETF

Royal

Bank

of

Canada

Call

12/20/24

USD

42.950

246,799

USD

10,676,525

$

163,233

$

(116,610)

iShares

MSCI

Emerging

Markets

ETF

Royal

Bank

of

Canada

Call

01/03/25

USD

43.190

245,427

USD

10,617,172

132,506

(134,406)

$

295,739

$

(251,016)

Currency

Abbreviations:

EGP

—

Egyptian

Pound

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

22,653,506

Gross

Unrealized

Depreciation

(11,891,560)

Net

Unrealized

Appreciation

$

10,761,946

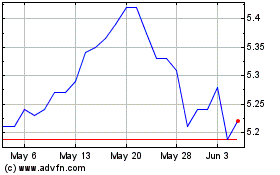

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Dec 2024 to Jan 2025

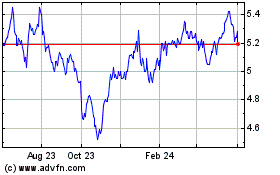

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Jan 2024 to Jan 2025