Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

November 26 2024 - 9:21AM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

JLS

(Unaudited)

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

LONG-TERM

INVESTMENTS

-

131.5%

(98.7%

of

Total

Investments)

–

MORTGAGE-BACKED

SECURITIES

-

89.7%

(67.3%

of

Total

Investments)

–

$

500,000

(a),(b)

Alen

2021-ACEN

Mortgage

Trust,

(TSFR1M

+

4.114%),

2021

ACEN

9.211

%

04/15/34

$

214,000

1,000,000

(c)

BANK

2017-BNK6,

2017

BNK6

3.851

07/15/60

901,512

1,000,000

(b)

BANK

2019-BNK21,

2019

BN21

2.500

10/17/52

688,885

1,000,000

(b)

BBCMS

Mortgage

Trust

2020-C6,

2020

C6

3.811

02/15/53

807,146

1,750,000

(b)

BBCMS

Trust

2015-SRCH,

2015

SRCH

5.122

08/10/35

1,524,048

1,500,000

(b)

Benchmark

2020-B18

Mortgage

Trust,

2020

B18

4.139

07/15/53

1,422,507

845,000

(c)

CD

2016-CD1

Mortgage

Trust,

2016

CD1

3.631

08/10/49

579,180

1,500,000

CD

2016-CD2

Mortgage

Trust,

2016

CD2

4.109

11/10/49

1,121,262

1,978,000

CD

2017-CD3

Mortgage

Trust,

2017

CD3

4.688

02/10/50

834,635

24,173

(b)

CF

2020-P1

Mortgage

Trust,

2020

P1

2.840

04/15/25

23,934

672,000

(b)

CFK

Trust

2019-FAX,

2019

FAX

4.791

01/15/39

617,779

368,328

CHL

Mortgage

Pass-Through

Trust

2006-HYB1,

2006

HYB1

4.936

03/20/36

337,154

1,500,000

(b),(c)

COMM

2013-LC13

Mortgage

Trust,

2013

LC13

5.577

08/10/46

1,288,771

925,000

(c)

COMM

2014-CCRE15

Mortgage

Trust,

2014

CR15

4.104

02/10/47

872,839

770,332

(c)

COMM

2014-CCRE17

Mortgage

Trust,

2014

CR17

4.377

05/10/47

752,542

1,500,000

(b)

COMM

2014-UBS3

Mortgage

Trust,

2014

UBS3

4.767

06/10/47

584,091

1,400,000

(b)

COMM

2015-CCRE22

Mortgage

Trust,

2015

CR22

3.000

03/10/48

949,240

2,000,000

(c)

COMM

2015-CCRE23

Mortgage

Trust,

2015

CR23

4.408

05/10/48

1,577,824

1,800,000

COMM

2015-CCRE24

Mortgage

Trust,

2015

CR24

3.463

08/10/48

1,581,100

892,000

(c)

COMM

2015-CCRE25

Mortgage

Trust,

2015

CR25

4.667

08/10/48

847,044

1,245,000

(c)

COMM

2015-CCRE25

Mortgage

Trust,

2015

CR25

3.768

08/10/48

1,117,793

650,569

(c)

COMM

Mortgage

Trust

4.585

02/10/47

625,238

625,000

(a),(b)

Connecticut

Avenue

Securities

Trust

2021-R03,

(SOFR30A

+

5.500%),

2021

R03

10.780

12/25/41

654,885

2,100,000

(a),(b)

Connecticut

Avenue

Securities

Trust

2022-R01,

(SOFR30A

+

6.000%),

2022

R01

11.280

12/25/41

2,210,006

1,000,000

(a),(b)

Connecticut

Avenue

Securities

Trust

2022-R03,

(SOFR30A

+

9.850%),

2022

R03

14.823

03/25/42

1,136,479

2,840,000

(a),(b),(c)

Connecticut

Avenue

Securities

Trust

2022-R05,

(SOFR30A

+

7.000%),

2022

R05

12.280

04/25/42

3,100,038

960,000

(a),(b),(c)

Connecticut

Avenue

Securities

Trust

2022-R07,

(SOFR30A

+

6.800%),

2022

R07

12.063

06/25/42

1,080,012

1,900,000

(a),(b)

Connecticut

Avenue

Securities

Trust

2022-R07,

(SOFR30A

+

12.000%),

2022

R07

17.263

06/25/42

2,290,697

450,000

(a),(b)

Connecticut

Avenue

Securities

Trust

2022-R09,

(SOFR30A

+

6.750%),

2022

R09

12.013

09/25/42

500,996

4,000,000

(a),(b),(c)

Connecticut

Avenue

Securities

Trust

2023-R02,

(SOFR30A

+

5.550%),

2023

R02

10.830

01/25/43

4,428,815

2,000,000

(a),(b),(c)

Connecticut

Avenue

Securities

Trust

2023-R04,

(SOFR30A

+

5.350%),

2023

R04

10.613

05/25/43

2,208,194

2,250,000

(a),(b),(c)

Connecticut

Avenue

Securities

Trust

2023-R05,

(SOFR30A

+

4.750%),

2023

R05

10.013

06/25/43

2,448,493

2,650,000

(a),(b)

Connecticut

Avenue

Securities

Trust

2023-R06,

(SOFR30A

+

5.900%),

2023

R06

11.180

07/25/43

2,907,259

2,280,000

(a),(b),(c)

Connecticut

Avenue

Securities

Trust

2023-R06,

(SOFR30A

+

3.900%),

2023

R06

9.188

07/25/43

2,417,631

33,000,000

(b)

DOLP

Trust

2021-NYC,

2021

NYC,

(I/O)

0.665

05/10/41

1,104,762

80,558

(b)

Flagstar

Mortgage

Trust

2017-2,

2017

2

3.984

10/25/47

73,283

7,551,496

Freddie

Mac

Multifamily

ML

Certificates,

2021

ML12,

(I/O)

1.304

07/25/41

724,944

3,000,000

(a),(b),(c)

Freddie

Mac

STACR

REMIC

Trust

2021-DNA6,

(SOFR30A

+

7.500%),

2021

DNA6

12.780

10/25/41

3,235,468

2,270,000

(a),(b),(c)

Freddie

Mac

STACR

REMIC

Trust

2022-DNA1,

(SOFR30A

+

7.100%),

2022

DNA1

12.380

01/25/42

2,426,167

2,270,000

(a),(b)

Freddie

Mac

STACR

REMIC

Trust

2022-DNA2,

(SOFR30A

+

8.500%),

2022

DNA2

13.788

02/25/42

2,502,971

4,900,000

(a),(b)

Freddie

Mac

STACR

REMIC

Trust

2022-DNA2,

(SOFR30A

+

4.750%),

2022

DNA2

10.030

02/25/42

5,191,509

3,750,000

(a),(b),(c)

Freddie

Mac

STACR

REMIC

Trust

2022-DNA3,

(SOFR30A

+

5.650%),

2022

DNA3

8.647

04/25/42

4,051,980

Portfolio

of

Investments

September

30,

2024

(continued)

JLS

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

$

2,245,000

(a),(b)

Freddie

Mac

STACR

REMIC

Trust

2022-DNA3,

(SOFR30A

+

9.750%),

2022

DNA3

15.087

%

04/25/42

$

2,553,601

104,186

(a)

Freddie

Mac

Strips,

(SOFR30A

+

0.058%),

2014

327,

(I/O)

0.472

03/15/44

11,314

700,000

(a),(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

+

3.097%),

2018

TWR

8.194

07/15/31

95,550

1,100,000

(a),(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

+

1.897%),

2018

TWR

6.994

07/15/31

390,500

892,000

(a),(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

+

4.222%),

2018

TWR

9.319

07/15/31

18,545

1,000,000

(a),(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

+

1.747%),

2018

TWR

6.844

07/15/31

595,000

700,000

(a),(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

+

2.397%),

2018

TWR

7.494

07/15/31

176,400

1,400,000

(a),(b),(c)

GS

Mortgage

Securities

Corp

Trust

2021-ARDN,

(TSFR1M

+

3.464%),

2021

ARDN

8.561

11/15/36

1,385,571

1,000,000

(a),(b),(c)

GS

Mortgage

Securities

Corp

Trust

2021-ARDN,

(TSFR1M

+

2.864%),

2021

ARDN

7.961

11/15/36

990,733

2,000,000

(c)

GS

Mortgage

Securities

Trust

2016-GS4,

2016

GS4

4.075

11/10/49

1,725,633

1,000,000

(b)

Hudson

Yards

2019-55HY

Mortgage

Trust,

2019

55HY

3.041

12/10/41

756,608

377,000

(b)

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2019-

ICON

UES,

2019

UES

4.601

05/05/32

355,874

441,000

(b)

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2019-

ICON

UES,

2019

UES

4.601

05/05/32

413,642

366,000

(b)

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2020-

NNN,

2020

NNN

3.972

01/16/37

137,254

2,000,000

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2014-C22,

2014

C22

4.649

09/15/47

1,778,920

1,000,000

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2015-C27,

2015

C27

3.898

02/15/48

904,444

760,000

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2015-C29,

2015

C29

4.118

05/15/48

730,300

1,189,000

(c)

JPMBB

Commercial

Mortgage

Securities

Trust

2016-C1,

2016

C1

4.858

03/17/49

1,090,107

2,000,000

(c)

JPMCC

Commercial

Mortgage

Securities

Trust

2017-JP5,

2017

JP5

3.904

03/15/50

1,726,434

1,930,000

(c)

JPMCC

Commercial

Mortgage

Securities

Trust

2017-JP6,

2017

JP6

3.850

07/15/50

1,421,144

1,500,000

(b)

JPMCC

Commercial

Mortgage

Securities

Trust

2017-JP6,

2017

JP6

4.600

07/15/50

1,040,627

1,849,000

(b),(c)

JPMCC

Commercial

Mortgage

Securities

Trust

2017-JP7,

2017

JP7

4.494

09/15/50

1,080,243

1,214,000

(c)

Morgan

Stanley

Bank

of

America

Merrill

Lynch

Trust

2014

C19,

2014

C19

4.000

12/15/47

1,158,496

226,295

Morgan

Stanley

Capital

I

Trust

2015-MS1,

2015

MS1

4.157

05/15/48

214,262

178,460

Morgan

Stanley

Mortgage

Loan

Trust

2007-15AR,

2007

15AR

3.492

11/25/37

126,544

1,000,000

(b)

MRCD

2019-MARK

Mortgage

Trust,

2019

PARK

2.718

12/15/36

635,700

750,000

(b)

MSCG

Trust

2015-ALDR,

2015

ALDR

3.577

06/07/35

692,891

250,000

(b)

MSCG

Trust

2015-ALDR,

2015

ALDR

3.577

06/07/35

226,708

1,050,000

(a),(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

+

4.329%),

2019

MILE

9.426

07/15/36

676,248

600,000

(a),(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

+

2.279%),

2019

MILE

7.376

07/15/36

474,046

1,000,000

(a),(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

+

2.829%),

2019

MILE

7.926

07/15/36

752,466

443,175

(a),(b)

OPEN

Trust,

(TSFR1M

+

5.236%),

2023

AIR

10.332

10/15/28

448,337

1,000,000

(a),(b),(c)

PKHL

Commercial

Mortgage

Trust

2021-MF,

(TSFR1M

+

0.994%),

2021

MF

6.091

07/15/38

956,657

1,000,000

(a),(b)

PKHL

Commercial

Mortgage

Trust

2021-MF,

(TSFR1M

+

2.114%),

2021

MF

7.211

07/15/38

798,978

1,602,435

(a),(b),(c)

SMR

2022-IND

Mortgage

Trust,

(TSFR1M

+

3.950%),

2022

IND

9.047

02/15/39

1,524,610

127,100,000

(b)

SUMIT

2022-BVUE

Mortgage

Trust,

2022

BVUE,

(I/O)

0.179

02/12/41

546,123

1,000,000

(a),(b)

TX

Trust

2024-HOU,

(TSFR1M

+

3.239%),

2024

1

8.336

06/15/39

995,104

1,250,000

(b)

VNDO

Trust

2016-350P,

2016

350P

4.033

01/10/35

1,169,419

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

$

1,300,000

(c)

Wells

Fargo

Commercial

Mortgage

Trust

2015-NXS1,

2015

NXS1

4.220

%

05/15/48

$

1,197,968

TOTAL

MORTGAGE-BACKED

SECURITIES

(Cost

$106,175,052)

95,936,114

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

–

ASSET-BACKED

SECURITIES

-

41.8%

(31.4%

of

Total

Investments)

–

1,233,616

(b)

AASET

2020-1

Trust,

2020

1A

6.413

01/16/40

416,652

1,500,000

(a),(b)

ACRE

Commercial

Mortgage

2021-FL4

Ltd,

(TSFR1M

reference

rate

+

2.714%

spread),

2021

FL4

7.729

12/18/37

1,432,543

515,000

(b)

Affirm

Asset

Securitization

Trust

2023-B,

2023

B

11.320

09/15/28

537,819

490,059

(b)

Air

Canada

2020-2

Class

B

Pass

Through

Trust,

2020

A

9.000

10/01/25

498,699

550,000

(b)

Avis

Budget

Rental

Car

Funding

AESOP

LLC,

2021

2A

4.080

02/20/28

516,830

982,500

(b)

Bojangles

Issuer

LLC,

2020

1A

3.832

10/20/50

978,083

750,000

(a),(b)

Bonanza

RE

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

8.450%

spread)

12.787

01/08/26

778,200

250,000

(a),(b)

Bonanza

RE

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

5.620%

spread)

10.222

03/16/25

248,250

250,000

(b)

Bonanza

RE

Ltd

5.359

01/08/25

200,000

500,000

(a),(b)

Bonanza

RE

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

4.930%

spread),

2020

A

9.532

12/23/24

501,650

343,545

(b),(c)

British

Airways

2020-1

Class

B

Pass

Through

Trust,

2020

A

8.375

11/15/28

360,487

2,000,000

(b)

Cars

Net

Lease

Mortgage

Notes

Series

2020-1,

2020

1A

4.690

12/15/50

1,827,497

775,000

(b)

CARS-DB4

LP,

2020

1A

4.520

02/15/50

737,912

2,300

(b),(d)

Carvana

Auto

Receivables

Trust

2021-N1,

2021

N1

0.000

01/10/28

239,775

2,500

(b),(d)

Carvana

Auto

Receivables

Trust

2021-P2,

2021

P2

0.000

05/10/28

526,250

250,000

(a),(b)

Cayuga

Park

CLO

Ltd,

(TSFR3M

reference

rate

+

6.262%

spread),

2020

1A

1.000

07/17/34

251,275

385,000

(a),(b)

CIFC

Funding

2020-II

Ltd,

(3-Month

LIBOR

reference

rate

+

6.762%

spread),

2020

2A

12.044

10/20/34

386,299

375,000

(a),(b)

CIFC

Funding

2022-II

Ltd,

(TSFR3M

reference

rate

+

7.000%

spread),

2022

2A

12.279

04/19/35

377,500

750,000

(a),(b)

CIFC

Funding

2022-IV

Ltd,

(SOFR

reference

rate

+

3.550%

spread),

2022

4A

8.836

07/16/35

752,843

250,000

(a),(b)

Citrus

Re

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

5.060%

spread)

5.100

06/07/25

256,400

250,000

(b)

Cologix

Data

Centers

US

Issuer

LLC,

2021

1A

5.990

12/26/51

234,087

1,000,000

(a),(b)

Elmwood

CLO

26

Ltd,

(TSFR3M

reference

rate

+

6.450%

spread),

2024

1A

11.741

04/18/37

1,031,198

909,075

(b)

EWC

Master

Issuer

LLC,

2022

1A

5.500

03/15/52

890,915

500,000

(b)

ExteNet

Issuer

LLC,

2024

1A

9.050

07/25/54

507,672

1,500,000

(b)

Frontier

Issuer

LLC,

2023

1

11.500

08/20/53

1,620,491

1,500,000

(b)

Frontier

Issuer

LLC,

2023

1

8.300

08/20/53

1,568,807

500,000

(a),(b)

GoldentTree

Loan

Management

US

CLO

1

Ltd,

(3-Month

LIBOR

reference

rate

+

7.762%

spread),

2021

11A

8.563

10/20/34

490,169

1,000,000

(a),(b)

GRACIE

POINT

INTERNATIONAL

FUNDING

2023-2,

(SOFR90A

reference

rate

+

5.400%

spread),

2023

2A

10.769

03/01/27

1,015,198

173,000

(a),(b)

Gracie

Point

International

Funding

2024-1

LLC,

(SOFR90A

reference

rate

+

7.150%

spread),

2024

1A

12.518

03/01/28

173,191

481,250

(b)

Hardee's

Funding

LLC,

2020

1A

3.981

12/20/50

452,277

500,000

(b)

Hertz

Vehicle

Financing

III

LLC,

2022

1A

4.850

06/25/26

490,640

250,000

(a),(b)

Hestia

Re

Ltd,

(1-Month

U.S.

Treasury

Bill

reference

rate

+

10.080%

spread)

14.682

04/22/25

230,000

201,829

(b)

HIN

Timeshare

Trust

2020-A,

2020

A

5.500

10/09/39

194,457

144,164

(b)

HIN

Timeshare

Trust

2020-A,

2020

A

6.500

10/09/39

137,284

750,000

(b)

Hotwire

Funding

LLC,

2024

1A

9.188

06/20/54

791,381

259,468

(b)

LUNAR

AIRCRAFT

2020-1

LTD,

2020

1A

3.376

02/15/45

248,596

500,000

(a),(b)

Madison

Park

Funding

XXXVI

Ltd,

(TSFR3M

reference

rate

+

5.460%

spread),

2019

36A

5.764

04/15/35

498,495

1,125,000

(a),(b)

Magnetite

XXIII

Ltd,

(TSFR3M

reference

rate

+

6.562%

spread),

2019

23A

7.484

01/25/35

1,129,758

250,000

(a),(b)

Matterhorn

Re

Ltd,

(SOFR

reference

rate

+

5.250%

spread)

5.889

03/24/25

253,275

500,000

(b)

Mercury

Financial

Credit

Card

Master

Trust,

2022

3A

10.680

06/21/27

503,898

500,000

(b)

Mercury

Financial

Credit

Card

Master

Trust,

2023

1A

9.590

09/20/27

503,514

500,000

(b)

Mercury

Financial

Credit

Card

Master

Trust,

2023

1A

8.040

09/20/27

502,433

Portfolio

of

Investments

September

30,

2024

(continued)

JLS

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

$

125,000

(b)

MetroNet

Infrastructure

Issuer

LLC,

2023

1A

10.850

%

04/20/53

$

128,803

1,000,000

(b)

MetroNet

Infrastructure

Issuer

LLC,

2024

1A

10.860

04/20/54

1,031,759

125,000

(b)

MetroNet

Infrastructure

Issuer

LLC,

2023

1A

8.010

04/20/53

130,762

1,141,000

(b)

Mexico

Remittances

Funding

Fiduciary

Estate

Management

Sarl

4.875

01/15/28

1,035,157

1,525,000

(b),(d)

Mosaic

Solar

Loan

Trust

2019-2,

2019

2A

0.000

09/20/40

588,650

1,000,000

(b),(d)

Mosaic

Solar

Loan

Trust

2020-1,

2020

20-1A

0.000

04/20/46

513,200

631,015

(b)

Mosaic

Solar

Loan

Trust

2020-2,

2020

2A

5.420

08/20/46

572,669

1,000,000

(b)

Mosaic

Solar

Loan

Trust

2024-1,

2024

1A

10.000

09/20/49

889,089

154,559

(b)

MVW

2020-1

LLC,

2020

1A

7.140

10/20/37

152,843

500,000

(a),(b)

Neuberger

Berman

CLO

Ltd,

(TSFR3M

reference

rate

+

7.625%

spread),

2023

23-53A

12.908

10/24/32

505,272

500,000

(b)

Oportun

Funding

2022-1

LLC,

2022

1

6.000

06/15/29

499,301

107,242

(b)

Oportun

Funding

XIV

LLC,

2021

A

5.400

03/08/28

103,894

764,151

(b)

Oportun

Issuance

Trust

2021-B,

2021

B

5.410

05/08/31

726,397

350,000

(b)

Oportun

Issuance

Trust

2021-C,

2021

C

5.570

10/08/31

331,439

2,000,000

(b)

Oportun

Issuance

Trust

2024-1,

2024

1A

12.072

04/08/31

2,042,700

925,000

(a),(b)

Palmer

Square

CLO

2023-1

Ltd,

(TSFR3M

reference

rate

+

5.300%

spread),

2023

1A

10.582

01/20/36

936,156

625,000

(a),(b)

Palmer

Square

CLO

Ltd,

(TSFR3M

reference

rate

+

6.350%

spread),

2022

1A

11.632

04/20/35

628,828

750,000

(a),(b)

Rad

CLO

7

Ltd,

(TSFR3M

reference

rate

+

4.150%

spread),

2020

7A

9.436

04/17/36

752,426

400,000

(a),(b)

Residential

Reinsurance

2020

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

6.290%

spread),

2020

A

6.510

12/06/24

399,600

500,000

(a),(b)

Residential

Reinsurance

2022

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

7.690%

spread)

12.292

12/06/26

519,700

500,000

(a),(b)

SD

Re

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

9.250%

spread)

13.852

11/19/24

498,500

171,829

(b)

Sierra

Timeshare

2020-2

Receivables

Funding

LLC,

2020

2A

6.590

07/20/37

170,393

1,000,000

(a),(b)

Sixth

Street

CLO

XIX

Ltd,

(3-Month

LIBOR

reference

rate

+

6.162%

spread),

2021

19A

6.035

07/20/34

1,005,158

504,291

(b)

Start

II

LTD,

2019

1

5.095

03/15/44

479,106

468,872

(b)

Sunnova

Helios

XII

Issuer

LLC,

2023

B

6.000

08/22/50

395,306

1,000,000

(a),(b)

TCW

CLO

2021-2

Ltd,

(3-Month

LIBOR

reference

rate

+

7.122%

spread),

2021

2A

6.985

07/25/34

987,758

500,000

(a),(b)

Ursa

Re

II

Ltd,

(3-Month

U.S.

Treasury

Bill

reference

rate

+

7.000%

spread)

11.602

12/06/25

518,000

915,440

(b)

Vivint

Solar

Financing

V

LLC,

2018

1A

7.370

04/30/48

869,359

490,922

(b)

VR

Funding

LLC,

2020

1A

6.420

11/15/50

460,221

500,000

(b)

Ziply

Fiber

Issuer

LLC,

2024

1A

7.810

04/20/54

520,055

1,000,000

(b)

Ziply

Fiber

Issuer

LLC,

2024

1A

11.170

04/20/54

1,069,901

TOTAL

ASSET-BACKED

SECURITIES

(Cost

$46,889,049)

44,755,102

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$153,064,101)

140,691,216

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

1.7% (1.3%

of

Total

Investments)

X

1,839,762

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

-

1.7%

(1.3%

of

Total

Investments)

X

1,839,762

$

1,740,000

Federal

Home

Loan

Bank

Discount

Notes

0.000

10/01/24

$

1,739,775

100,000

Freddie

Mac

Discount

Notes

0.000

10/01/24

99,987

TOTAL

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

(Cost

$1,840,000)

1,839,762

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$1,840,000)

1,839,762

TOTAL

INVESTMENTS

-

133.2%

(Cost

$154,904,101

)

142,530,978

BORROWINGS

-

(3.3)%

(e),(f)

(3,520,000)

REVERSE

REPURCHASE

AGREEMENTS,

INCLUDING

ACCRUED

INTEREST

-

(28.7)%(g)

(30,715,677)

OTHER

ASSETS

&

LIABILITIES,

NET

- (1.2)%

(1,288,277)

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

107,007,024

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

The

following

is

a

reconciliation

of

the

Fund’s

Level

3

investments

held

at

the

beginning

and

end

of

the

measurement

period:

The

valuation

techniques

and

significant

unobservable

inputs

used

in

recurring

Level

3

fair

value

measurements

of

assets

as

of

the

end

of

the

reporting

period,

were

as

follows:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Mortgage-Backed

Securities

$

–

$

95,936,114

$

–

$

95,936,114

Asset-Backed

Securities

–

42,887,227

1,867,875

44,755,102

Short-Term

Investments:

U.S.

Government

and

Agency

Obligations

–

1,839,762

–

1,839,762

Total

$

–

$

140,663,103

$

1,867,875

$

142,530,978

Level

3

JLS

Asset-Backed

Securities

Balance

at

the

beginning

of

period

$

1,379,951

Gains

(losses):

-

Net

realized

gains

(losses)

(108,596)

Change

in

net

unrealized

appreciation

(depreciation)

(194,205)

Purchases

at

cost

794,402

Sales

at

proceeds

(44,836)

Net

discounts

(premiums)

41,159

Transfers

into

-

Transfers

(out

of)

-

Balance

at

the

end

of

period

$

1,867,875

Change

in

net

unrealized

appreciation

(depreciation)

during

the

period

of

Level

3

securities

held

as

of

period

end

$

(194,205)

Fund

Asset

Class

Market

Value

Techniques

Unobservable

Inputs

Range

Weighted

Average

JLS

Asset-Backed

Securities

$1,867,875

Indicative

Trade

Broker

Quote

$38.60-$21,050

$7,295.07

Portfolio

of

Investments

September

30,

2024

(continued)

JLS

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(b)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$116,732,583

or

81.9%

of

Total

Investments.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$47,718,811

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(d)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(e)

Borrowings

as

a

percentage

of

Total

Investments

is

2.5%.

(f)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$28,592,770

have

been

pledged

as

collateral

for

borrowings.

(g)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

21.6%.

I/O

Interest

only

security

LIBOR

London

Inter-Bank

Offered

Rate

SOFR

30A

30

Day

Average

Secured

Overnight

Financing

Rate

SOFR

90A

90

Day

Average

Secured

Overnight

Financing

Rate

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

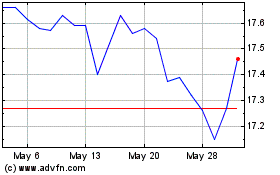

Nuveen Mortgage and Income (NYSE:JLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

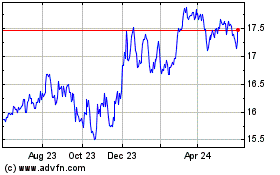

Nuveen Mortgage and Income (NYSE:JLS)

Historical Stock Chart

From Feb 2024 to Feb 2025