As filed with the Securities and Exchange Commission on November 27, 2023

File No. 333-271820

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

☐ Pre-Effective Amendment No. __ |

|

|

☒ Post-Effective Amendment No. 1 |

NUVEEN PREFERRED & INCOME OPPORTUNITIES FUND

(Exact Name of Registrant as Specified in Charter)

333 West

Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

(312) 257-8787

(Area Code and Telephone Number)

Mark L.

Winget

Vice President and Secretary

Nuveen Investments

333

West Wacker Drive

Chicago, Illinois 60606

(Name and Address of Agent for Service)

Copies to:

|

|

|

| Deborah Bielicke Eades

Vedder Price P.C. 222

North LaSalle Street Chicago, Illinois 60601 |

|

Eric F. Fess

Chapman and Cutler LLP

320 South Canal Street, 27th Floor

Chicago, Illinois 60606 |

EXPLANATORY NOTE

The Joint Proxy Statement/Prospectus and Statement of Additional Information, each in the form filed on June 30, 2023, pursuant to Rule

497 of the General Rules and Regulations under the Securities Act of 1933, as amended (File No. 333-271820), are incorporated herein by reference.

This amendment is being filed for the sole purpose of adding to Part C of the Registration Statement the executed tax opinions of Vedder Price

P.C. and Stradley Ronon Stevens & Young, LLP, supporting the tax matters discussed in the Joint Proxy Statement/Prospectus as Exhibit 12(a) and Exhibit 12(b).

C-1

PART C

OTHER INFORMATION

Item 15.

Indemnification

Section 4 of Article XII of Registrant’s Declaration of Trust, as amended, provides as follows:

Subject to the exceptions and limitations contained in this Section 4, every person who is, or has been, a Trustee, officer, employee or

agent of the Trust, including persons who serve at the request of the Trust as directors, trustees, officers, employees or agents of another organization in which the Trust has an interest as a shareholder, creditor or otherwise (hereinafter

referred to as a “Covered Person”), shall be indemnified by the Trust to the fullest extent permitted by law against liability and against all expenses reasonably incurred or paid by him in connection with any claim, action, suit or

proceeding in which he becomes involved as a party or otherwise by virtue of his being or having been such a Trustee, director, officer, employee or agent and against amounts paid or incurred by him in settlement thereof.

No indemnification shall be provided hereunder to a Covered Person:

(a) against any liability to the Trust or its Shareholders by reason of a final adjudication by the court or other body before which the

proceeding was brought that he engaged in willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office;

(b) with respect to any matter as to which he shall have been finally adjudicated not to have acted in good faith in the reasonable belief that

his action was in the best interests of the Trust; or

(c) in the event of a settlement or other disposition not involving a final

adjudication (as provided in paragraph (a) or (b)) and resulting in a payment by a Covered Person, unless there has been either a determination that such Covered Person did not engage in willful misfeasance, bad faith, gross negligence or

reckless disregard of the duties involved in the conduct of his office by the court or other body approving the settlement or other disposition or a reasonable determination, based on a review of readily available facts (as opposed to a full

trial-type inquiry), that he did not engage in such conduct:

(i) by a vote of a majority of the Disinterested Trustees acting on the

matter (provided that a majority of the Disinterested Trustees then in office act on the matter); or

(ii) by written opinion of

independent legal counsel.

The rights of indemnification herein provided may be insured against by policies maintained by the Trust,

shall be severable, shall not affect any other rights to which any Covered Person may now or hereafter be entitled, shall continue as to a person who has ceased to be such a Covered Person and shall inure to the benefit of the heirs, executors and

administrators of such a person. Nothing contained herein shall affect any rights to indemnification to which Trust personnel other than Covered Persons may be entitled by contract or otherwise under law.

Expenses of preparation and presentation of a defense to any claim, action, suit or proceeding subject to a claim for indemnification under

this Section 4 shall be advanced by the Trust prior to final disposition thereof upon receipt of an undertaking by or on behalf of the recipient to repay such amount if it is ultimately determined that he is not entitled to indemnification

under this Section 4, provided that either:

(a) such undertaking is secured by a surety bond or some other appropriate security or

the Trust shall be insured against losses arising out of any such advances; or

(b) a majority of the Disinterested Trustees acting on the

matter (provided that a majority of the Disinterested Trustees then in office act on the matter) or independent legal counsel in a written opinion shall determine, based upon a review of the readily available facts (as opposed to a full trial-type

inquiry), that there is reason to believe that the recipient ultimately will be found entitled to indemnification.

C-2

As used in this Section 4, a “Disinterested Trustee” is one (x) who is not an

Interested Person of the Trust (including, as such Disinterested Trustee, anyone who has been exempted from being an Interested Person by any rule, regulation or order of the Commission), and (y) against whom none of such actions, suits or

other proceedings or another action, suit or other proceeding on the same or similar grounds is then or has been pending.

As used in this

Section 4, the words “claim,” “action,” “suit” or “proceeding” shall apply to all claims, actions, suits, proceedings (civil, criminal, administrative or other, including appeals), actual or threatened;

and the word “liability” and “expenses” shall include without limitation, attorneys’ fees, costs, judgments, amounts paid in settlement, fines, penalties and other liabilities.

The trustees and officers of the Registrant are covered by joint errors and omissions insurance policies against liability and expenses of

claims of wrongful acts arising out of their position with the Registrant and other Nuveen funds, subject to such policies’ coverage limits, exclusions and retention.

Insofar as the indemnification for liabilities arising under the Securities Act of 1933, as amended, (the “1933 Act”) may be

permitted to the officers, trustees or controlling persons of the Registrant pursuant to the Declaration of Trust of the Registrant or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such

indemnification is against public policy as expressed in the 1933 Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by

an officer or trustee or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such officer, trustee or controlling person in connection with the securities being registered, the Registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in the 1933 Act

and will be governed by the final adjudication of such issue.

C-3

Item 16. Exhibits

|

|

|

| (1)(a) |

|

Declaration of Trust dated January 27, 2003.(1) |

|

|

| (1)(b) |

|

Amended and Restated Declaration of Trust of Registrant, dated May 7, 2007. (2) |

|

|

| (1)(c) |

|

Amended and Restated Declaration of Trust of Registrant, dated April 2, 2012. (2) |

|

|

| (2)(a) |

|

Amended and Restated By-Laws of Registrant, dated October 5, 2020. (3) |

|

|

| (2)(b) |

|

Amendment to the Amended and Restated By-Laws of Registrant, dated February 24,

2022. (4) |

|

|

| (3) |

|

Not applicable. |

|

|

| (4) |

|

Form of Agreement and Plan of Merger is filed herewith as Appendix A to the Joint Proxy Statement/Prospectus constituting Part A of the Registration Statement. |

|

|

| (5) |

|

Not applicable. |

|

|

| (6)(a) |

|

Investment Management Agreement, dated October 1, 2014. (2) |

|

|

| (6)(b) |

|

Renewal of Investment Management Agreement, dated July 28, 2015. (2) |

|

|

| (6)(c) |

|

Renewal of Investment Management Agreement, dated July 27, 2016. (2) |

|

|

| (6)(d) |

|

Renewal of Investment Management Agreement, dated July 24, 2017. (5) |

|

|

| (6)(e) |

|

Renewal of Investment Management Agreement, dated July 24, 2018. (6) |

|

|

| (6)(f) |

|

Continuance of Investment Management Agreement, dated July 30, 2019. (7) |

|

|

| (6)(g) |

|

Continuance of Investment Management Agreement, dated July 30, 2020. (8) |

|

|

| (6)(h) |

|

Continuance of Investment Management Agreement, dated July 30, 2021. (9) |

|

|

| (6)(i) |

|

Continuance of Investment Management Agreement, dated July 29, 2022. (10) |

|

|

| (6)(j) |

|

Investment Sub-Advisory Agreement, dated October 1, 2014. (2) |

|

|

| (6)(k) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 28,

2015 (2) |

|

|

| (6)(l) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 28, 2016.

(2) |

|

|

| (6)(m) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 24, 2017.

(5) |

|

|

| (6)(n) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 24, 2018.

(6) |

|

|

| (6)(o) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 24,

2019.(7) |

|

|

| (6)(p) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 31, 2020.

(3) |

|

|

| (6)(q) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 30, 2021.

(9) |

|

|

| (6)(r) |

|

Notice of Continuance of Investment Sub-Advisory Agreement, dated July 29, 2022.

(10) |

|

|

| (6)(s) |

|

Rule 12d1-4 Investment Agreement between RiverNorth Funds as Acquiring Funds and Nuveen CEFs as Acquiring

Funds, dated January 19, 2022. (13) |

|

|

| (7)(a) |

|

Distribution Agreement between the Registrant and Nuveen Securities, LLC, dated March 18, 2021. (11) |

C-4

|

|

|

| (7)(b) |

|

Dealer Agreement between Registrant and Nuveen Securities, LLC and Stifel, Nicolaus & Company Incorporated, dated March

18, 2021. (11) |

|

|

| (8) |

|

Amended and Restated Nuveen Open-End and Closed-End Funds Deferred

Compensation Plan for Independent Directors and Trustees, dated May 8, 2020. (3) |

|

|

| (9)(a) |

|

Amended and Restated Master Custodian Agreement between the Nuveen Investment Companies and State Street Bank and Trust Company, dated July 15,

2015. (2) |

|

|

| (9)(b) |

|

Amendment and revised Appendix A to Amended and Restated Master Custodian Agreement, dated July 31, 2020. (3) |

|

|

| (9)(c) |

|

Amendment and revised Appendix A to Amended and Restated Master Custodian Agreement, dated October 7, 2021. (12) |

|

|

| (10) |

|

Not applicable. |

|

|

| (11) |

|

Opinion and Consent of Counsel. (14) |

|

|

| (12)(a) |

|

Opinion and Consent of Vedder Price P.C. supporting the tax matters discussed in the Joint Proxy Statement/Prospectus is filed herewith. |

|

|

| (12)(b) |

|

Opinion and Consent of Stradley Ronon Stevens & Young, LLP supporting the tax matters discussed in the Joint Proxy Statement/Prospectus is filed herewith. |

|

|

| (13)(a) |

|

Transfer Agency and Service Agreement, dated June

15, 2017 between Registrant and Computershare Inc. and Computershare Trust Company, N.A. (3) |

|

|

| (13)(b) |

|

First Amendment and updated Schedule A, dated September

7, 2017, to the Transfer Agency Service Agreement between the Registrant and Computershare, Inc. and Computershare Trust Company, N.A., dated June 15, 2017. (3) |

|

|

| (13)(c) |

|

Second Amendment and updated Schedule A, dated February

26, 2018 to the Transfer Agency Service Agreement between the Registrant and Computershare, Inc. and Computershare Trust Company, N.A., dated June 15, 2017. (3) |

|

|

| (13)(d) |

|

Third Amendment and updated Schedule A, dated May

11, 2020 to the Transfer Agency Service Agreement between the Registrant and Computershare, Inc. and Computershare Trust Company, N.A., dated June 15, 2017. (3) |

|

|

| (14) |

|

Consent of Independent Auditor. (14) |

|

|

| (15) |

|

Not applicable. |

|

|

| (16) |

|

Powers of Attorney. (13) |

|

|

| (17) |

|

Form of Proxy is filed herein and appears following the Joint Proxy Statement/Prospectus constituting Part A of the Registration Statement. |

|

|

| (18) |

|

Calculation of Filing Fee Tables. (14) |

| (1) |

Filed on January 31, 2003 as an exhibit to the Registrant’s Registration Statement on Form N-2 (File No. 333-102903) and incorporated by reference herein. |

| (2) |

Filed on December 13, 2016 as an exhibit to the Registrant’s Registration Statement on Form N-14 (File No. 333-215072) and incorporated by reference herein. |

C-5

| (3) |

Filed on March 18, 2021 as an exhibit to the Registrant’s Registration Statement on Form N-2 (File No. 333-254473) and incorporated by reference herein. |

| (4) |

Filed on February 25, 2022 as an exhibit to the Registrant’s Form

8-K (File no. 811-21293) and incorporated by reference herein. |

| (5) |

Filed on November 16, 2017 as an exhibit to Post-Effective Amendment No. 1 to Nuveen California AMT-Free Quality Municipal Income Fund’s Registration Statement on Form N-2 (File No. 333-184971) and incorporated by

reference herein. |

| (6) |

Filed on October 1, 2018 as an exhibit to Nuveen Dow

30SM Dynamic Overwrite Fund’s Registration Statement on Form N-2 (File No. 333-226218) and incorporated by

reference herein. |

| (7) |

Filed on March 11, 2020 as an exhibit to Pre-Effective Amendment

No. 1 to Nuveen California AMT-Free Quality Municipal Income Fund’s Registration Statement on Form N-2 (File

No. 333-225399) and incorporated by reference herein. |

| (8) |

Filed on August 24, 2020 as an exhibit to Nuveen California Municipal Value Fund’s Registration

Statement on Form N-14 (File No. 333-248308) and incorporated by reference herein. |

| (9) |

Filed on August 26, 2021 as an exhibit to Nuveen Dynamic Municipal Opportunities Fund’s Registration

Statement on Form N-2 (File No. 333-259086) and incorporated by reference herein. |

| (10) |

Filed on November 10, 2022 as an exhibit to Nuveen Municipal Credit Income Fund’s Registration

Statement on Form N-14 (File No. 333-268294) and incorporated by reference herein. |

| (11) |

Filed on March 19, 2021 as an exhibit to Post-Effective Amendment No. 1 to the Registrant’s

Registration Statement on Form N-2 (File No. 333-254473) and incorporated by reference herein. |

| (12) |

Filed on July 29, 2022 as an exhibit to Post-Effective Amendment No. 2 to Nuveen Enhanced High Yield

Municipal Bond Fund’s Registration Statement on Form N-2 (File No. 333-231722) and incorporated by reference herein. |

| (13) |

Filed on May 11, 2023 as an exhibit to the Registrant’s Registration Statement on Form N-14 (File No. 333-271820) and incorporated by reference herein. |

| (14) |

Filed on June 23, 2023 as an exhibit to the Registrant’s Registration Statement on Form N-14 (File No. 333-271820) and incorporated by reference herein.. |

C-6

Item 17. Undertakings

(1) The undersigned Registrant agrees that prior to any public reoffering of the securities registered through the use of a prospectus which is

a part of this registration statement by any person or party who is deemed to be an underwriter within the meaning of Rule 145(c) of the Securities Act, the reoffering prospectus will contain the information called for by the applicable registration

form for reofferings by persons who may be deemed underwriters, in addition to the information called for by the other items of the applicable form.

(2) The undersigned Registrant agrees that every prospectus that is filed under paragraph (1) above will be filed as a part of an

amendment to the registration statement and will not be used until the amendment is effective, and that, in determining any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration statement for the

securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering of them.

C-7

SIGNATURES

As required by the Securities Act of 1933, the Registrant has duly caused this registration statement to be signed on its behalf by the

undersigned, thereunto duly authorized in the City of Chicago and the State of Illinois, on the 27th day of November, 2023.

|

|

|

| NUVEEN PREFERRED & INCOME OPPORTUNITIES FUND |

|

|

| By: |

|

/s/ Mark L. Winget |

|

|

Mark L. Winget |

|

|

Vice President and Secretary |

As required by the Securities Act of 1933, this Registrant’s registration statement has been signed

by the following persons in the capacities and on the dates indicated:

|

|

|

|

|

| Signature |

|

Capacity |

|

Date |

|

|

|

| /s/ David J. Lamb

David J. Lamb |

|

Chief Administrative Officer

(principal executive officer) |

|

|

|

|

|

| /s/ E. Scott Wickerham

E. Scott Wickerham |

|

Vice President and Controller

(principal financial and accounting officer) |

|

|

|

|

|

| Terence

J. Toth* |

|

Chairman of the Board and Trustee |

|

By:/s/ Mark L.

Winget

Mark L. Winget Attorney-in-Fact

November 27, 2023 |

|

|

|

| Jack B.

Evans* |

|

Trustee |

|

|

|

|

|

| William

C. Hunter* |

|

Trustee |

|

|

|

|

|

| Amy

B.R. Lancellotta* |

|

Trustee |

|

|

|

|

|

| Joanne

T. Medero |

|

Trustee |

|

|

|

|

|

| Albin

F. Moschner* |

|

Trustee |

|

|

|

|

|

| John K.

Nelson* |

|

Trustee |

|

|

|

|

|

|

Margaret L. Wolff* |

|

Trustee |

|

|

|

|

|

| Matthew

Thornton III* |

|

Trustee |

|

|

|

|

|

| Robert

L. Young* |

|

Trustee |

|

|

| * |

*An original power of attorney authorizing, among others, Mark L. Winget, Kevin J. McCarthy and Mark J.

Czarniecki to execute this registration statement, and amendments thereto, for each of the trustees of the Registrant on whose behalf this registration statement is filed, has been executed and is incorporated by reference herein.

|

C-8

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Name of Exhibit |

|

|

| (12)(a) |

|

Opinion and Consent of Vedder Price P.C. supporting the tax matters discussed in the Joint Proxy Statement/Prospectus. |

|

|

| (12)(b) |

|

Opinion and Consent of Stradley Ronon Stevens & Young, LLP supporting the tax matters discussed in the Joint Proxy Statement/Prospectus. |

C-9

|

|

|

|

|

|

|

|

|

Chicago |

| |

|

|

New York |

| |

|

|

Washington, DC |

| |

|

|

London |

| |

|

|

San Francisco |

| |

|

|

Los Angeles |

| |

|

|

Singapore |

| |

|

|

Dallas |

| |

|

|

Miami |

| |

|

|

vedderprice.com |

November 6, 2023

|

|

|

| Nuveen Preferred & Income Opportunities Fund |

|

Nuveen Preferred and Income Fund |

| 333 West Wacker Drive |

|

333 West Wacker Drive |

| Chicago, Illinois 60606 |

|

Chicago, Illinois 60606 |

Nuveen Preferred & Income Securities Fund

333 West Wacker Drive

Chicago, Illinois 60606

| Re: |

Reorganization of Nuveen Preferred and Income Fund and Nuveen Preferred & Income Securities Fund

into Nuveen Preferred & Income Opportunities Fund |

Ladies and Gentlemen:

You have requested our opinion regarding certain U.S. federal income tax consequences of certain transactions undertaken pursuant to the Agreement and Plan of

Merger dated as of June 29, 2023 by and among Nuveen Preferred and Income Fund, a Massachusetts business trust (“Preferred and Income”), Nuveen Preferred & Income Securities Fund, a Massachusetts business trust

(“Preferred & Income Securities” and together with Preferred and Income, each a “Target Fund” and collectively, the “Target Funds”), Nuveen Preferred & Income Opportunities Fund, a Massachusetts

business trust (the “Acquiring Fund”), and NPIOF Merger Sub, LLC, a Massachusetts limited liability company and a direct, wholly-owned subsidiary of the Acquiring Fund (“Merger Sub”) (the “Plan”). The Target Funds and

the Acquiring Fund are each referred to herein as a “Fund” and collectively, as the “Funds.”

The Plan contemplates that (i) each

Target Fund will merge pursuant to applicable state law with and into Merger Sub with Merger Sub surviving and with (a) the common shares of beneficial interest of the Target Fund converting into voting common shares of beneficial interest, par

value $0.01 per share, of the Acquiring Fund (“Acquiring Fund Common Shares”) and (b) the Taxable Fund Preferred Shares (“TFP Shares”) of Preferred & Income Securities converting into voting TFP Shares, par value

$0.01 per share and liquidation preference of $1,000 per share, of the Acquiring Fund having all the various rights, preferences and privileges set forth in the Statement Establishing and Fixing the Rights and Preferences of Series B Taxable Fund

Preferred Shares (“Acquiring Fund TFP Shares” and together with Acquiring Fund Common Shares, “Acquiring Fund Shares”) (each a “Merger” and collectively, the “Mergers”) and (ii) as soon as practicable

thereafter Merger Sub will distribute all its assets to the Acquiring Fund and the Acquiring Fund will assume all the liabilities of Merger Sub in complete liquidation and dissolution of Merger Sub (the “Liquidation”). The Mergers and the

Liquidation are referred to collectively herein as the “Reorganization.”

In rendering this opinion, we have examined the Plan and have reviewed

and relied upon (i) representations made to us by duly authorized officers of the Funds and Merger Sub in letters dated November 6, 2023 (collectively, the “Representation Letters”) and (ii) the opinion of Stradley Ronon

Stevens & Young, LLP dated November 6, 2023 regarding the Acquiring Fund TFP Shares issued in the Preferred & Income Securities Merger being treated as equity of the Acquiring Fund for U.S. federal

222 North LaSalle

Street | Chicago, Illinois 60601 | T +1 312 609 7500 | F +1 312 609 5005

Vedder Price P.C. is affiliated with Vedder Price LLP, which operates in England and Wales, Vedder Price (CA), LLP, which operates in California,

and Vedder Price Pte. Ltd., which operates in Singapore.

Nuveen Preferred & Income Opportunities Fund

Nuveen Preferred and Income Fund

Nuveen Preferred & Income

Securities Fund

November 6, 2023

Page

2

income tax purposes (the “Equity Opinion”). We have also examined such other agreements, documents, corporate records and other materials as we have deemed necessary in order for us to

render the opinions referred to in this letter. In such review and examination, we have assumed the genuineness of all signatures, the legal capacity and authority of the parties who executed such documents, the authenticity of all documents

submitted to us as originals, the conformity to originals of all documents submitted to us as copies and the authenticity of the originals of such latter documents.

Our opinion is based, in part, on the assumptions that (i) the Reorganization described herein will occur in accordance with the terms of the Plan

(without the waiver or modification of any terms or conditions thereof and without taking into account any amendment thereof that we have not approved) and the facts and representations set forth or referred to in this opinion letter, and that such

facts and representations, as well as the facts and representations set forth in the Plan, are true, correct and complete as of the date hereof and will be true, correct and complete as of the date and time of the Closing (as defined in the Plan)

(the “Effective Time”) through the date and time of the Liquidation, (ii) any representation set forth in the Representation Letters qualified by knowledge, intention, belief, disclaimer of responsibility or any similar qualification

is, and will be as of the Effective Time through the date and time of the Liquidation, true, correct and complete without such qualification, and (iii) the Acquiring Fund TFP Shares issued in the Preferred & Income Securities Merger

will be treated as stock of the Acquiring Fund for U.S. federal income tax purposes, which assumption is consistent with the Equity Opinion. You have not requested that we undertake, and we have not undertaken, any independent investigation of the

accuracy of the facts, representations and assumptions set forth or referred to herein.

For the purposes indicated above, and based upon the facts,

assumptions and representations set forth or referred to herein, it is our opinion, with respect to each Merger, that for U.S. federal income tax purposes:

1. The merger of the Target Fund with and into Merger Sub pursuant to applicable state laws will constitute a “reorganization” within

the meaning of section 368(a)(1) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Acquiring Fund and the Target Fund will each be a “party to a reorganization,” within the meaning of section 368(b) of the

Code, with respect to such merger.

2. No gain or loss will be recognized by the Acquiring Fund or Merger Sub upon the merger of the Target

Fund with and into Merger Sub pursuant to applicable state laws or upon the liquidation of Merger Sub. (Section 1032(a) of the Code; Treas. Reg. Section 301.7701-2(a)).

3. No gain or loss will be recognized by the Target Fund upon the merger of the Target Fund with and into Merger Sub pursuant to applicable

state laws. (Sections 361(a) and (c) and 357(a) of the Code).

4. No gain or loss will be recognized by the Target Fund’s

shareholders upon the conversion of all their shares of the Target Fund solely into Acquiring Fund Shares in the merger of the Target Fund with and into Merger Sub pursuant to applicable state laws, except to the extent the Target Fund’s common

shareholders receive cash in lieu of a fractional Acquiring Fund Common Share. (Section 354(a) of the Code).

5. The aggregate basis of the

Acquiring Fund Shares received by each Target Fund shareholder pursuant to the merger (including any fractional Acquiring Fund Common Share to which a shareholder would be entitled) will be the same as the aggregate basis of the Target Fund shares

that were converted into such Acquiring Fund Shares. (Section 358(a)(1) of the Code).

Nuveen Preferred & Income Opportunities Fund

Nuveen Preferred and Income Fund

Nuveen Preferred & Income

Securities Fund

November 6, 2023

Page

3

6. The holding period of the Acquiring Fund Shares received by each Target Fund shareholder

in the merger (including any fractional Acquiring Fund Common Share to which a shareholder would be entitled) will include the period during which the shares of the Target Fund that were converted into Acquiring Fund Shares were held by such

shareholder, provided such Target Fund shares were held as capital assets at the Effective Time. (Section 1223(1) of the Code).

7. The

basis of the assets of the Target Fund received by Merger Sub in the merger will be the same as the basis of such assets in the hands of the Target Fund immediately before the Effective Time. (Section 362(b) of the Code).

8. The holding period of the assets of the Target Fund received by Merger Sub in the merger will include the period during which those assets

were held by the Target Fund. (Section 1223(2) of the Code).

Notwithstanding anything to the contrary herein, we express no opinion as to the effect of

the Reorganization (i) on the Target Funds, the Acquiring Fund, Merger Sub or any Target Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in section

1297(a) of the Code) as to which any gain or loss is required to be recognized under U.S. federal income tax principles (a) at the end of a taxable year or upon the termination thereof, or (b) upon the transfer of such asset regardless of

whether such transfer would otherwise be a non-taxable transaction under the Code, and (ii) under the alternative minimum tax imposed under section 55 of the Code on any direct or indirect shareholder of

a Target Fund that is a corporation.

FACTS

Our opinion is based upon the facts, representations and assumptions set forth or referred to above and the following facts and assumptions, any alteration of

which could adversely affect our conclusions.

Each Target Fund has been registered and operated, since it commenced operations, as a closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). Preferred and Income’s common shares are listed and traded on the New York Stock

Exchange (“NYSE”) under the symbol JPT and Preferred & Income Securities’ common shares are listed and traded on the NYSE under the symbol JPS. Preferred and Income has no shares outstanding other than common shares. Besides

common shares, the only shares Preferred & Income Securities currently has outstanding consist of TFP Shares, Series A. All the outstanding common shares of each Target Fund and the TFP Shares of Preferred & Income Securities are

treated as equity for U.S. federal income tax purposes. Each Target Fund is treated as a corporation for U.S. federal income tax purposes, has elected to be taxed as a regulated investment company under section 851 of the Code for all its taxable

years, including without limitation the taxable year in which its respective Merger occurs, and has qualified and will continue to qualify for the tax treatment afforded regulated investment companies under the Code for each of its taxable years,

including without limitation the taxable year in which its respective Merger occurs.

Nuveen Preferred & Income Opportunities Fund

Nuveen Preferred and Income Fund

Nuveen Preferred & Income

Securities Fund

November 6, 2023

Page

4

The Acquiring Fund similarly has been registered and operated, since it commenced operations, as a closed-end management investment company under the 1940 Act. The Acquiring Fund Common Shares are listed and traded on the NYSE under the symbol JPC. In addition, the Acquiring Fund currently has outstanding one

series of TFP Shares – Acquiring Fund TFP Shares, Series A. As part of the Preferred & Income Securities Merger, the Acquiring Fund will issue a new series of Acquiring Fund TFP Shares – Acquiring Fund TFP Shares, Series B. All the

outstanding shares of the Acquiring Fund are treated as equity for U.S. federal income tax purposes and all the Acquiring Fund Shares to be issued in the Mergers will be treated as equity of the Acquiring Fund for U.S. federal income tax purposes.

The Acquiring Fund is treated as a corporation for U.S. federal income tax purposes, has elected to be taxed as a regulated investment company under section 851 of the Code for all its taxable years, including without limitation the taxable year in

which the Mergers occur, and has qualified and will continue to qualify for the tax treatment afforded regulated investment companies under the Code for each of its taxable years, including without limitation the taxable year in which the Mergers

occur.

Merger Sub is a newly formed Massachusetts limited liability company and a direct, wholly-owned subsidiary of the Acquiring Fund that is and has

been since the date of its organization disregarded as an entity separate from its owner within the meaning of section 301.7701-3 of the Treasury Regulations. Merger Sub has not elected, and will not elect, to

be classified, with effect as of or prior to the Liquidation, as an association taxable as a corporation pursuant to section 301.7701-3 of the Treasury Regulations.

Upon satisfaction of certain terms and conditions set forth in the Plan, at the Effective Time each Target Fund will merge pursuant to applicable state law

with and into Merger Sub with Merger Sub surviving and the common shares of the Target Fund will convert into Acquiring Fund Common Shares and the TFP Shares of Preferred & Income Securities will convert into Acquiring Fund TFP Shares.

Pursuant to such state law and without any further action or deed being required, as of the Effective Time, all the rights, privileges, powers, assets, property and liabilities of each Target Fund and Merger Sub will become the rights, privileges,

powers, assets, property and liabilities of Merger Sub and the separate legal existence of each Target Fund shall cease for all purposes. Each common share of each Target Fund outstanding immediately prior to the Effective Time will be converted

into a number of Acquiring Fund Common Shares equal to one multiplied by the quotient of the net asset value per common share of the Target Fund as of the Valuation Time (as defined in the Plan) divided by the net asset value of an Acquiring Fund

Common Share as of the Valuation Time. Each outstanding TFP Share of Preferred & Income Securities will be converted into one Acquiring Fund TFP Share, Series B. The Acquiring Fund TFP Shares issued in the Preferred & Income

Securities Merger will have the same liquidation preference and value as of the Effective Time as the TFP Shares of Preferred & Income Securities outstanding at the Effective Time and the terms of the Acquiring Fund TFP Shares received by a

holder of TFP Shares of Preferred & Income Securities will be substantially similar as the terms of the Preferred & Income Securities TFP Shares surrendered by such shareholder in the Merger. No fractional Acquiring Fund Common

Shares will be issued to Target Fund shareholders in connection with any Merger. In lieu thereof, the Acquiring Fund’s transfer agent, on behalf of the shareholders entitled to receive fractional Acquiring Fund Common Shares, will aggregate all

fractional Acquiring Fund Common Shares and sell the resulting whole shares on the NYSE for the account of all shareholders of fractional interests, and each such shareholder will be entitled to a pro rata share of the proceeds from such sale.

Nuveen Preferred & Income Opportunities Fund

Nuveen Preferred and Income Fund

Nuveen Preferred & Income

Securities Fund

November 6, 2023

Page

5

As a result of each Merger, every common shareholder of the Target Fund will own Acquiring Fund Common Shares

(including for this purpose any fractional shares to which they would be entitled) that will have an aggregate per share net asset value as of the Valuation Time equal to the aggregate per share net asset value of the Target Fund common shares held

by such shareholder as of the Valuation Time and each holder of Preferred & Income Securities TFP Shares will own Acquiring Fund TFP Shares with an aggregate liquidation preference and value as of the Effective Time equal to the aggregate

liquidation preference and value of the Preferred & Income Securities TFP Shares held by such shareholder as of the Effective Time.

As soon as

practicable after the Effective Time, Merger Sub will dissolve under applicable state law and the Acquiring Fund will assume all Merger Sub’s liabilities and obligations, known and unknown, contingent or otherwise, whether or not determinable,

and Merger Sub will distribute to the Acquiring Fund, which will be the sole member of Merger Sub at such time, all the assets of Merger Sub in complete liquidation of its interest in Merger Sub in accordance with a plan of dissolution adopted by

Merger Sub.

Following each Merger, the Acquiring Fund (directly or indirectly through Merger Sub) will continue the Target Fund’s historic business

in that it will have an investment objective and investment strategies, policies, risks and restrictions similar to those of the Target Fund. In addition, the Acquiring Fund will use a significant portion of the Target Fund’s historic business

assets in its business. At the Effective Time, at least thirty-four percent (34%) of the total fair market value of each Target Fund’s portfolio assets will meet the investment objective, strategies, policies, risks and restrictions of the

Acquiring Fund. Neither Target Fund altered, or will alter, its portfolio in connection with the Reorganization to meet this thirty-four percent (34%) threshold. No Fund modified any of its investment objective, strategies, policies, risks or

restrictions in connection with the Reorganization and the Acquiring Fund has no plan or intention to change any of its investment objective, strategies, policies, risks or restrictions after the Mergers.

In approving a Merger, the Board of Trustees of each Fund (collectively, the “Boards”) participating in such Merger determined that the Plan and the

transactions contemplated thereunder are in the best interests of its Fund and that the interests of the shareholders of its Fund will not be diluted as a result of the Merger. In making such determination, the Boards considered a number of factors

as set forth under the heading “Proposal No. 1 – Merger of Each Target Fund into the Acquiring Fund – Information about the Mergers – Reasons for the Mergers” in the Joint Proxy Statement/Prospectus dated June 29, 2023

relating to the Registration Statement (as defined below).

CONCLUSION

Based on the foregoing, it is our opinion with respect to each Merger (subject to the conditions and limitations set forth above) that the merger under

applicable state law of the Target Fund with and into Merger Sub with Merger Sub surviving, in accordance with the terms of the Plan, will qualify as a reorganization under section 368(a)(1) of the Code.

The opinions set forth above (subject to the conditions and limitations set forth above) with respect to (i) the nonrecognition of gain or loss by the

Target Funds, the Acquiring Fund and Merger Sub, (ii) the basis and holding period of the assets received by Merger Sub, (iii) the nonrecognition of gain or loss by each Target Fund’s shareholders upon the receipt of the Acquiring

Fund Shares, except with respect to cash received in lieu of a fractional Acquiring Fund Common Share, and (iv) the basis and holding period of the Acquiring Fund Shares received by each Target Fund’s shareholders follow as a matter of law

from the opinion that the transfers under the Plan will qualify as reorganizations under section 368(a)(1) of the Code.

Nuveen Preferred & Income Opportunities Fund

Nuveen Preferred and Income Fund

Nuveen Preferred & Income

Securities Fund

November 6, 2023

Page

6

The opinions expressed in this letter are based on the Code, the Income Tax Regulations promulgated by the

Treasury Department thereunder and judicial authority reported as of the date hereof. We have also considered the positions of the Internal Revenue Service (the “Service”) reflected in published and private rulings. Although we are not

aware of any pending changes to these authorities that would alter our opinions, there can be no assurances that future legislative or administrative changes, court decisions or Service interpretations will not significantly modify the statements or

opinions expressed herein. We do not undertake to make any continuing analysis of the facts or relevant law following the date of this letter or to notify you of any changes to such facts or law.

Our opinion is limited to those U.S. federal income tax issues specifically considered herein. We do not express any opinion as to any other federal tax

issues, or any state, local or foreign tax law issues, arising from or related to the transactions contemplated by the Plan. Although the discussion herein is based upon our best interpretation of existing sources of law and expresses what we

believe a court would properly conclude if presented with these issues, our opinion is not binding on the courts or the Service and no assurance can be given that such interpretations would be followed by the courts or the Service if they were to

become the subject of judicial or administrative proceedings.

This opinion is furnished to the Funds for their benefit in connection with the

Reorganization and is not to be relied upon, for any other purpose, in whole or in part, without our express prior written consent. Shareholders of the Funds may rely on this opinion, it being understood that we are not establishing any

attorney-client relationship with any shareholder of any of the Funds. This letter is not to be relied upon for the benefit of any other person.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement on Form N-14 (File No. 333-271820) relating to the Reorganization filed by

the Acquiring Fund with the Securities and Exchange Commission (the “Registration Statement”); to the discussion of this opinion in the Joint Proxy Statement/Prospectus dated June 29, 2023 relating to the Registration Statement and in the

Joint Proxy Statement for holders of TFP Shares of Preferred & Income Securities and the Acquiring Fund dated June 29, 2023 (the “TFP Proxy Statement”); and to the use of our name and to any reference to our firm in the

Registration Statement and TFP Proxy Statement. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under section 7 of the Securities Act of 1933, as amended, or the rules and

regulations of the Securities and Exchange Commission thereunder.

|

| Very truly yours, |

|

| /s/ Vedder Price P.C. |

|

| VEDDER PRICE P.C. |

|

|

|

|

|

|

Stradley Ronon Stevens & Young, LLP

|

| |

2005 Market Street |

| |

Suite 2600 |

| |

Philadelphia, PA 19103 |

| |

Telephone 215.564.8000 |

| |

Fax 215.564.8120

www.stradley.com |

November 6, 2023

Nuveen Preferred & Income Opportunities Fund

333 West

Wacker Drive

Suite 3300

Chicago, IL 60606

Re: Nuveen Preferred & Income Opportunities Fund (JPC Series B)

Ladies and Gentlemen:

We have acted as special

tax counsel for Nuveen Preferred & Income Opportunities Fund, a Massachusetts business trust (the “Fund”), with respect to the Fund’s issuance of Series B Taxable Fund Preferred Shares (the “Series B TFP

Shares”) in connection with the merger of Nuveen Preferred & Income Securities Fund (the “Target Fund”) with and into NPIOF Merger Sub, LLC (the “Merger”) pursuant to the Agreement and Plan of

Merger, dated as of June 29, 2023 (the “Plan”).

Capitalized terms unless otherwise defined herein shall have the

meanings ascribed to such in the Agreement.

In this connection, we have examined originals, or copies certified or otherwise identified

to our satisfaction, of: (1) the Variable Rate Demand Mode (VRDM) Fee Agreement, dated as of November 6, 2023 (the “Agreement”), between the Fund and Barclays Bank PLC, as liquidity provider, with respect to the Series B TFP

Shares; (2) the Plan; (3) the Registration Statement on Form N-14 (333-271820) filed by the Fund with the Securities and Exchange Commission (the

“SEC”) pertaining to the Merger (the “Registration Statement”) and the Joint Proxy Statement/Prospectus forming a part thereof (the “Joint Proxy Statement/Prospectus”); (4) the Joint Proxy Statement

for Holders of Taxable Fund Preferred Shares dated June 29, 2023 pertaining to the Merger (the “Proxy Statement”), which includes the Confidential Information Memorandum of even date (the “Memorandum”); (5)

resolutions adopted by the Board of Trustees pertaining to the Plan and resulting Merger; (6) a copy of the Statement Establishing and Fixing the Rights and Preferences of Series B Taxable Fund Preferred Shares and the Supplement to the

Statement Establishing and Fixing the Rights and Preferences of Series B Taxable Fund Preferred Shares Initially Designating the Variable Rate Demand Mode for the Series B Taxable Fund Preferred Shares, each as filed with the Secretary of the

Commonwealth of Massachusetts on November 2, 2023 (together, the “Statement”); and (7) such other records, certificates, documents and other papers as we deemed it necessary to examine for the

Philadelphia, PA •

Malvern, PA • Cherry Hill, NJ • Newark, NJ • Wilmington, DE • Washington, DC • New York, NY • Chicago, IL

A Pennsylvania Limited Liability Partnership

Nuveen Preferred & Income Opportunities Fund

November 6, 2023

Page

2

purpose of this opinion. In such examination, we have assumed the genuineness of all signatures, the conformity to the originals of all of the documents reviewed by us as copies, the authenticity

and completeness of all original documents reviewed by us in original or copy form and the legal competence of each individual executing any document. The items described in (1) through (7) above are referred to herein collectively as the

“Documents.”

The opinions herein are subject to and conditioned upon the representations made by the Fund concerning factual

matters (but not conclusions of law) and the assumptions set forth herein. The initial and continuing truth and accuracy of the Documents and such representations and assumptions at all relevant times constitute an integral basis for the opinions

expressed herein and these opinions are conditioned thereon.

Without limiting the foregoing, in rendering the opinions herein, we have

relied, with the consent of the Fund, upon the written representations and covenants, among other things, concerning the issuance of the Series B TFP Shares of the Fund in connection with the Merger, set forth in the Officer’s Certificate to

Counsel of even date herewith from authorized officers of the Fund, which Officer’s Certificate to Counsel has been received by Counsel, and which representations, covenants and statements contained therein we have neither investigated nor

verified. We have assumed and rely on the fact that such representations, covenants and statements of the Fund are true, correct and complete as of the date hereof and we rely on them in rendering the opinions herein.

We have reviewed the descriptions set forth in the Joint Proxy Statement/Prospectus, the Proxy Statement and the Memorandum of the Fund’s

investments, activities, operations, and governance, and the provisions of the Plan and the Statement. We have relied upon the facts set forth in the Joint Proxy Statement/Prospectus, the Proxy Statement and the Memorandum, and upon factual

representations of officers of the Fund. In addition, we have relied on certain additional facts and assumptions described below. In connection with rendering this opinion, we have assumed to be true and are relying upon (without any independent

investigation or review thereof):

A. The authenticity of all documents submitted to us as originals, the conformity to

original documents of all documents submitted to us as copies, the authenticity of the originals of such documents, the conformity of final documents to all documents submitted to us as drafts, and the authenticity of such final documents;

B. The genuineness of all signatures and the authority and capacity of the individual or individuals who executed any such

document on behalf of any person;

C. The accuracy of all factual representations, warranties and other statements made by

all parties or as set forth in such documents;

D. The performance and satisfaction of all obligations imposed by any such

documents on the parties thereto in accordance with their terms; and

Nuveen Preferred & Income Opportunities Fund

November 6, 2023

Page

3

E. The completeness and accuracy of all records made available to us.

We have further assumed the accuracy of the statements and descriptions of the Merger and the Fund’s intended activities as described in

the Joint Proxy Statement/Prospectus, the Proxy Statement and Memorandum. We have also assumed, without investigation, that all documents, certificates, representations, warranties and covenants upon which we have relied in rendering the opinions

set forth below and that were given on or dated earlier than the date of this opinion continue to remain accurate, insofar as relevant to the opinions set forth herein, from such earlier date through and including the date of this opinion.

Based solely on the foregoing, and subject to the qualifications, exceptions, assumptions and limitations expressed herein, we are of the

opinion that, for U.S. federal income tax purposes and as of the effective time of the Merger, the Series B TFP Shares issued by the Fund in connection with the Merger will qualify as equity in the Fund.

This opinion is furnished to the Fund solely for its benefit in connection with the Plan and resulting Merger and is not to be relied upon for

any other purpose, in whole or in part, without our express prior written consent. This opinion may be disclosed to shareholders of the Fund and the Target Fund and they may rely on it as if they were addressees of this opinion, it being understood

that we are not establishing any lawyer-client relationship with the shareholders of the Fund or the Target Fund (or the beneficial owners of shares of the Fund or the Target Fund). This opinion is not to be relied upon for the benefit of any other

person without our express prior written consent. Except in the Registration Statement, the Joint Proxy Statement/Prospectus and the Proxy Statement relating to the Merger filed by the Fund with the SEC, this opinion is not to be referred to or

quoted in any document, report or financial statement, or filed with, or delivered to, any other person or entity, in each instance without our prior written consent, except such disclosure as may be required by law or pursuant to the request of any

governmental authority or regulator having regulatory authority over the Fund.

In addition to the assumptions set forth above, this

opinion is subject to the following exceptions, limitations and qualifications:

A. Our opinions are based upon our

interpretation of the current provisions of the Internal Revenue Code of 1986 (the “Code”) and current judicial decisions, administrative regulations and published notices, rulings and procedures. We note that there is no authority

directly on point dealing with securities like the Series B TFP Shares. Our opinions only represent our best judgment and are not binding on the Internal Revenue Service (the “IRS”) or the courts and there is no assurance that the

IRS will not successfully challenge the conclusions set forth herein. The IRS and the Treasury Department have not yet issued regulations or administrative interpretations with respect to various provisions of the Code relating to regulated

investment company (“RIC”) qualification. Consequently, no assurance can be given that future legislative, judicial or administrative changes, on either a prospective or retroactive basis, would not adversely affect the accuracy of

the conclusions stated herein. We undertake no duty or obligation to advise you of any factual changes or changes in law which may occur after the date hereof.

Nuveen Preferred & Income Opportunities Fund

November 6, 2023

Page

4

B. Our opinions are limited to the U.S. federal income tax matters

specifically addressed herein, and no other opinions are rendered with respect to any other matter not specifically set forth in the foregoing opinions (including whether the Fund qualifies or will continue to qualify as a RIC).

C. Our opinions are limited in all respects to the federal tax law of the United States and we express no opinion on various

state, local, or foreign tax consequences.

D. The Fund’s qualification and taxation as a RIC depend upon the

Fund’s ability to satisfy through actual operations the applicable asset composition, source of income, distribution and other requirements of the Code necessary to qualify and be taxed as a RIC, which operations we will not and have not

reviewed.

E. The foregoing opinions are based upon the proposed method of operation of the Fund as described in the Joint

Proxy Statement/Prospectus, the Proxy Statement and Memorandum, and the representations and covenants set forth in the documents described and the assumptions set forth herein. We undertake no obligation to review at any time in the future either

the Fund’s operations or its compliance with such representations, covenants and assumptions. No assurance can be given that the Fund will satisfy the requirements of the Code necessary to qualify or be taxed as a RIC for any particular taxable

year. Further, we assume no obligation to advise you of any changes in our opinions subsequent to the delivery of this opinion.

F. In the event any one of the statements, representations, warranties, covenants or assumptions we have relied upon to issue

these opinions is incorrect in a material respect, our opinions might be adversely affected and if so may not be relied on.

We hereby

consent to the filing of this opinion as an exhibit to the Registration Statement and to the discussion of this opinion, to the use of our name and to any reference to our firm in the Joint Proxy Statement/Prospectus. In giving such consent, we do

not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the SEC thereunder.

|

| Very truly yours, |

|

| /s/ Stradley Ronon Stevens & Young, LLP |

|

| STRADLEY RONON STEVENS & YOUNG, LLP |

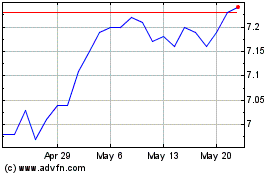

Nuveen Preferred and Inc... (NYSE:JPC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nuveen Preferred and Inc... (NYSE:JPC)

Historical Stock Chart

From Feb 2024 to Feb 2025