KKR Income Opportunities Fund Completes Acquisition of Assets of Insight Select Income Fund

February 10 2025 - 4:47PM

Business Wire

The Board of Trustees of KKR Income Opportunities Fund (NYSE:

KIO) today announced the closing of KIO’s previously announced

acquisition of the assets of Insight Select Income Fund

(“INSI”).

“We are thrilled to officially welcome INSI shareholders to

KIO,” said Jeremiah Lane, Co-Head of Global Leveraged Credit at

KKR. “We continue to believe this is a strong environment for

credit investing, and we look forward to leveraging the compelling

opportunities we see in the market to continue delivering value to

our shareholders.”

INSI’s shares ceased trading on The New York Stock Exchange on

January 31, 2025. KIO will continue to trade on the New York Stock

Exchange under its current ticker symbol, “KIO.”

INSI will receive shares of KIO based on the closing net asset

values on February 6, 2025, which were $17.62 and $13.08 for INSI

and KIO, respectively. Following the closing, shares of KIO will be

distributed to shareholders of INSI. Therefore, INSI shareholders

will receive 1.34709 shares of KIO for each share of INSI they

held. Only whole shares of KIO will be issued. Fractional shares

will be liquidated at market prices and proceeds will be

distributed to shareholders in cash.

INSI shareholders were given the option to receive a portion of

the consideration in cash subject to the adjustment and proration

procedures set forth in the Agreement and Plan of Reorganization;

55.6% of INSI shareholders elected to receive cash consideration.

Shareholders who made this election will receive approximately 8.8%

of the value of their INSI shares in cash with the rest in KIO

shares.

The cash election proceeds and whole shares will be distributed

on February 12, 2025, while cash resulting from the sale of

fractional shares will be paid out early the following week.

UBS Securities LLC served as financial advisor to Insight North

America LLC (“Insight”). Dechert LLP served as legal counsel to KIO

and KKR Credit Advisors (US) LLC. Clifford Chance LLP served as

legal counsel to Insight and Troutman Pepper Hamilton Sanders LLP

served as legal counsel to INSI.

KKR Income Opportunities Fund

KKR Income Opportunities Fund is a diversified, closed-end

management investment company managed by KKR Credit Advisors (US)

LLC (“KKR Credit”), an indirect subsidiary of KKR & Co. Inc.

(“KKR”). The Fund’s primary investment objective is to seek a high

level of current income with a secondary objective of capital

appreciation. The Fund will seek to achieve its investment

objective by investing primarily in first- and second-lien secured

loans, unsecured loans and high yield corporate debt instruments.

It seeks to employ a dynamic strategy of investing in a targeted

portfolio of loans and fixed-income instruments of U.S. and

non-U.S. issuers and implementing hedging strategies in order to

achieve attractive risk-adjusted returns. Please visit

www.kkrfunds.com/kio for additional information.

KIO invests in loans and other types of fixed-income

instruments and securities. Such investments may be secured,

partially secured or unsecured and may be unrated, and whether or

not rated, may have speculative characteristics. The market price

of KIO’s investments will change in response to changes in interest

rates and other factors. Generally, when interest rates rise, the

values of fixed-income instruments fall, and vice versa.

Use of leverage creates an opportunity for increased income

and return for common shareholders of KIO but, at the same time,

creates risks, including the likelihood of greater volatility in

the NAV and market price of, and distributions on, the common

shares of KIO. In particular, leverage may magnify interest rate

risk, which is the risk that the prices of portfolio securities

will fall (or rise) if market interest rates for those types of

securities rise (or fall). As a result, leverage may cause greater

changes in KIO’s NAV, which will be borne entirely by KIO’s common

shareholders.

Derivative investments have risks, including the imperfect

correlation between the value of such instruments and the

underlying assets of KIO. The risk of loss from a short sale is

unlimited because KIO must purchase the shorted security at a

higher price to complete the transaction and there is no upper

limit for the security price. The use of options, swaps, and

derivatives by KIO has the potential to significantly increase

KIO’s volatility. In addition to the normal risks associated with

investing, international investments may involve risk of capital

loss from unfavorable fluctuation in currency values, from

differences in generally accepted accounting principles or from

social, economic or political instability in other nations. KIO’s

investments in securities or other instruments of non-U.S. issuers

or borrowers may be traded in undeveloped, inefficient and less

liquid markets and may experience greater price volatility and

changes in value.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210410214/en/

Julia Kosygina or Lauren McCranie media@kkr.com

212-750-8300

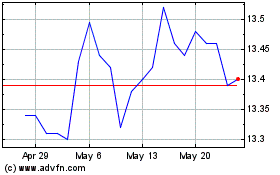

KKR Income Opportunities (NYSE:KIO)

Historical Stock Chart

From Jan 2025 to Feb 2025

KKR Income Opportunities (NYSE:KIO)

Historical Stock Chart

From Feb 2024 to Feb 2025