Retailers' September Sales Strong, Raising Holiday Hopes

October 07 2010 - 7:26AM

Dow Jones News

Back-to-school buying finally arrived, aided by plenty of

promotions, with September same-store sales coming in better than

expected and raising hopes for the holidays.

Teen retailers, most vulnerable to the fall season, are largely

surpassing expectations. But the strength is pretty much across the

board, suggesting that some pent up buying demand is being

released.

A number of the early reporters are raising third-quarter

guidance on the heels of their solid showing, including

surfwear-oriented Zumiez Inc. (ZUMZ) and women's apparel retailer

Cato Corp. (CATO).

Zumiez, whose same-store sales grew 17% when 12.4% was expected,

is part of a teen retail group that includes Hot Topic (HOTT),

which posted a 2.6% drop, when a 3.5% decline was projected; and

Wet Seal, whose sales declined 0.7% when analysts were expecting a

2.3% drop.

Among regional department stores, Stage Stores Inc. (SSI) saw

its September same-store sales rise 1.8%, when 1.5% was

expected.

Limited Brands Inc. (LTD), which counts adults and teens among

its shoppers, smashed through estimates, posting a 12% rise in

sales when 4.1% was expected. The company's Victoria's Secret unit

led the upsurge, posting 13% growth, followed closely by Bath &

Body Works at 11%.

The 28 retailers tracked by Thomson Reuters are expected to show

a 2.1% rise for September at stores open more than a year. Wal-Mart

Stores Inc. (WMT) is not included in the group.

Retailers as a group are up against the first positive

comparable store sales number in a year, when September 2009 showed

a 0.6% advance.

While the year-ago gain was small, there is still significance

in beating a positive number because it can supply a psychological

boost amid what is still a lot of downbeat sentiment, said Mike

Berry, director of industry research for the SpendingPulse unit of

MasterCard Inc. (MA). "Anything that can perhaps be viewed as

positive news can perhaps make a difference."

Still, "We're seeing a continuation of consumers buying close to

their needs, in this case back to school," Berry said.

And there was no change on the promotional front, with some

stores marking down already discounted merchandise toward the end

of the month.

"Consumers are remaining highly value-centric and purchasing

largely only with coupon in hand or because of special offers,"

said Thomas Filandro, retail analyst at Susquehanna Financial

Group.

Major chains have yet to report, but department store executives

telegraphed good things at conferences during September.

"Back-to-school was very good," said Terry Lundgren, chief

executive of Macy's Inc. (M) at a Goldman Sachs conference on Sept.

14.

Even later in the month, on Sept. 28, J.C. Penney Co.'s (JCP)

Myron Ullman said the company exceeded internal expectations for

back-to-school sales.

And, "Obviously, back-to-school is equivalent to holiday for the

'young businesses,' young men's, juniors and the kids businesses,"

Ullman said.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

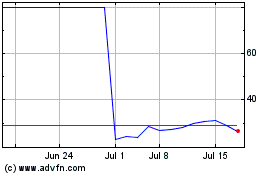

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

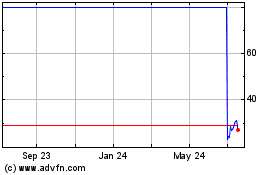

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024