The Thanksgiving weekend brought

record sales for retailers who went on to post better-than-expected

November comparable-store sales and are now padding up for the

holiday season. Does this indicate that the retail party has just

begun?

Early hours store openings, huge

discounts, promotional activities and free shipping on online

purchases were enough to lure customers on Black Friday that turned

out to be a bonanza for both brick-and-mortar as well as e-commerce

retailers.

The data released by Swampscott,

Massachusetts-based Retail Metrics, reveals that comparable-store

sales of over 20 companies rose 3.2% beating the expectation of

3.1%. The data provider further added that 57% of retailers

outpaced while 33% missed their expectations. Yes, there were

retailers that stuck to old traditions and were not bold to think

out of the box. These missed the boat and failed to seize the

opportunity of pent-up demand.

Season’s Blast Breaching

Economy

An economy plagued by financial

crisis and high unemployment, remains a bitter truth, but

Thanksgiving, Black Friday and Cyber Monday all have stories to

tell, the story of regained consumer confidence that looked far

stronger than the prior-year period. It seems that consumers who

were saving up for the holiday season, shrugged off the economic

gloom and went from shop to shop to grab the best available

deal.

According to the data released by

National Retail Federation (NRF), sales on the Thanksgiving weekend

surged 16.4% to $52.4 billion. The survey also revealed that as

many as 226 million bargain hunters visited stores and browsed the

Internet over the past weekend compared with 212 million in the

prior year. The average spending per customer rose to $398.6 from

$365.3 in the prior year, over the four-day period from

Thanksgiving to Sunday.

The economy, which was believed to

be heading towards a recessionary downturn early in the year, has

started looking up again. What’s more, consumer confidence remains

high. Conference Board data suggests that Consumer Confidence Index

rose to 56.0 in November from 40.9 in October, and attained the

highest level since July, when the index touched 59.2. This is

prompting consumers to loosen their purse strings.

Further, the data from the Commerce

Department indicates that consumer spending, which represented 70%

of the economy, increased at an annualized growth rate of 2.3% in

the third quarter, reflecting the fastest rate so far in 2011.

What Comps

Say…..

Record Black Friday weekend sales

provided an impetus to the retailers’ November sales who tried all

means to woo customers and gain market share amid fierce

competition and sluggish economy. Total retail sales on Black

Friday, which kicks off holiday sales, rose 6.6% to $11.4 billion

according to the data released ShopperTrak. November

comparable-store sales results are a significant indicator for the

retailers, as it gives an insight of the days ahead.

The saying early bird catches the

worm goes well with the retailer Macy’s Inc. (M)

that for the first time opened its doors at the stroke of midnight

on Black Friday to attract customers. The leading department store

retailer in the U.S. saw its comparable-store sales rising 4.8%

that fared better than what analysts expected.Online sales, which

include sales from macys.com and bloomingdales.com, continued to

show growth momentum in November, soaring 49.6%.

Comps for the luxury department

store, Saks Incorporated (SKS) increased 9.3%,

exceeding the estimate. Ross Stores Inc. (ROST),

the off-price retailer of apparel and home accessories,witnessed a

5% growth in its comps.

Costco Wholesale

Corporation (COST) sustained its sales momentum, and

registered a comps growth of 9%. Excluding the effects of higher

gasoline prices and foreign currencies fluctuation, Costco’s

comparable-store sales climbed 7%.

Limited Brands Inc.

(LTD), a specialty retailer of women’s intimate and other apparel,

beauty and personal care products, posted healthy sales results.

The company’s comparable-store sales for November 2011 rose 7%,

following an increase of 6% in October 2011.

Other retailers that opened their

stores at midnight included Target Corporation

(TGT), Best Buy Co. Inc. (BBY) and Kohl’s

Corporation (KSS).

In contrast, J. C. Penney

Company Inc. (JCP) followed its old tradition of opening

stores at 4 a.m. on Black Friday. The decision hurt its

comparable-store sales that fell 2% compared with an increase of

9.2% in the year-ago period. However, the drop of 6.2% at Kohl’s

comps sales during the month under review came as a surprise,

particularly after it registered a growth of 3.9% in October.

The retail companies targeting lower

and middle-class customers however had a tough time, as their

target consumers remained frugal in spending or did selective

shopping.

Target posted a 1.8% increase in

comparable-store sales that missed analysts’ expectation,

indicating that consumers still remain cautious. The company hinted

that although sales surged on Black Friday, the rise was not enough

to boost its November sales. The company now foresees an intense

competitive and promotional environment in December.

We believe that retailers will leave

no stone unturned to drive sales. But there’s a nagging fear that

if recession-hit consumers decide to be cautious on their spending

in this holiday season or if the economic crisis aggravates, the

picture will only have dull colors. A pick-up in demand would

definitely augur well for the economy.

Unanswered

Questions

Retailers are using different

arsenals to fire on all cylinders. These include offering discounts

and indulging in promotional activities, which are reflecting on

their sales. But we wonder whether these are coming at the price of

margins. Moreover, what impact will these have on the bottom

line?

Let’s

Conclude

The sea doesn’t seem calm, waves are

high and waters are rough. It is evident that customers remain

sensitive to macroeconomic factors including high fuel and energy

costs, credit availability, unemployment levels, and high household

debt levels, which may affect their discretionary spending, and in

turn curtail the sector’s growth and profitability.

Going by the pulse of the economy,

we could see more competitive pricing and new products to attract

shoppers in the holiday season. We believe that retail companies

will move heaven and earth to win the hearts of bargain hunters and

it definitely remains a wait-and-watch story as to who emerges

successful in wooing consumers in this distressed economy.

BEST BUY (BBY): Free Stock Analysis Report

COSTCO WHOLE CP (COST): Free Stock Analysis Report

PENNEY (JC) INC (JCP): Free Stock Analysis Report

KOHLS CORP (KSS): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

MACYS INC (M): Free Stock Analysis Report

ROSS STORES (ROST): Free Stock Analysis Report

SAKS INC (SKS): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

Zacks Investment Research

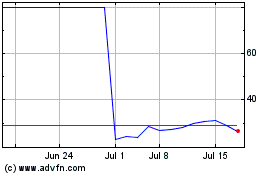

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024