Conoco Executive: On Track To Spend $5 Billion In Share Buybacks In 1st Half

April 16 2012 - 12:53PM

Dow Jones News

ConocoPhillips (COP) said Monday it is on track to spend $5

billion on share repurchases in the first half of the year and that

it expects to spend the same amount in the second half.

Speaking to analysts in a conference call, ConocoPhillips

incoming Chief Executive Ryan Lance said the company expects to

fund the share buybacks with the proceeds of its previously

announced asset sale, which this year is estimated to be $8 billion

to $10 billion.

Lance, who will assume his new position when the spin-off of

ConocoPhillips' refining arm is completed May 1, said the company

is evaluating the disposition of assets that no longer are

strategic for a stand-alone production company. The executive

didn't specify the assets.

ConocoPhillips is at the end of a three-year restructuring plan

aimed at improving its finances and creating more value for

shareholders. The plan includes a large scale asset sale and the

spin-off of its refining, chemical and pipeline segments into an

independent company, named Phillips 66. ConocoPhillips will become

a pure oil and gas exploration and production firm.

Lance confirmed ConocoPhillips plans to have an annual capital

expenditure budget of about $15 billion through 2016 and compound

annual production growth between 3% and 5% in the same period.

Production growth is expected to be driven by the development of an

oil-sand project in Canada, several shale fields the U.S., offshore

projects in U.K.'s North Sea and Malasia and the Australian Pacific

LNG project in Australia, the company said.

Conoco also expects to grow its cash flow to $22 billion by

2016, up from about $16 billion this year, and it plans to spend

about 20% to 25% of its annual cash flow on dividends.

ConocoPhillips is looking for opportunities to acquire more

shale properties internationally as it believes it can transfer the

knowledge it has acquired developing unconventional fields in the

U.S. overseas, Lance said. Conoco currently has shale assets in

Poland.

Separately, ConocoPhillips also announced Monday the names of

the future board of directors for Phillips 66.

Greg Garland, who previously was named president and chief

executive of the company, will serve as chairman of the board. He

was previously CEO of Chevron Phillips Chemical.

Other directors include: J. Brian Ferguson, who was chairman and

CEO of Eastman Chemical Co. (EMN), and currently serves on the

boards of Owens Corning (OC) and NextEra Energy Inc. (NEE); William

R. Loomis Jr., who has been an independent financial advisor since

2009 and currently serves on the boards of Pacific Capital Bancorp

(PCBC) and Limited Brands Inc. (LTD), and is also a senior advisor

to Lazard LLC (LAZ) and China International Capital Corporation;

John E. Lowe, who currently serves as assistant to the CEO of

ConocoPhillips and serves on the board of Agrium Inc.; Harold W.

McGraw III, who currently serves as chairman, president and CEO of

The McGraw-Hill Cos. (MHP); Glenn F. Tilton, chairman of the

Midwest of J.P. Morgan Chase & Co. (JPM) and was previously

chairman and CEO of United Airlines Inc.; and Victoria J.

Tschinkel, chairwoman of 1000 Friends of Florida. She currently

serves on the board of ConocoPhillips.

All elections will be effective at the completion of

ConocoPhillips' spinoff, the company said.

-By Isabel Ordonez, Dow Jones Newswires; 713-547-9207;

isabel.ordonez@dowjones.com

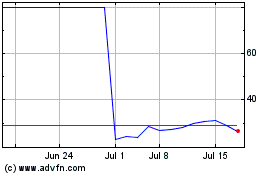

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

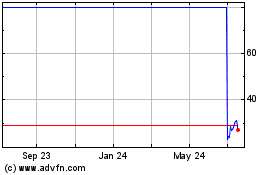

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024