Limited Brands Inc. (LTD), a specialty retailer

of women’s intimate and other apparel, beauty and personal care

products, posted its second-quarter 2012 results on August 15.

Here, we will discuss the company’s scorecard, based on its recent

earnings announcement, subsequent estimate revisions by analysts as

well as the Zacks Rank and long-term recommendation for the

stock.

Review of the Last Quarter

Limited Brands posted second-quarter 2012 earnings of 50 cents a

share, beating the Zacks Consensus Estimate as well as the

prior-year quarter profit by a couple of cents. Management had

earlier projected quarterly earnings between 46 cents and 48 cents

a share.

Limited Brands reported net sales of $2,399.1 million, falling

2% from $2,458.1 million reported in the prior-year quarter,

marginally surpassed the Zacks Consensus Estimate of $2,398

million. The prior-year period sales included $216.6 million from a

third-party apparel sourcing business that was sold in November

2011.

Limited Brands posted comparable-store sales growth of 8% during

the second quarter of 2012 compared with 7% in the previous quarter

and 9% in the prior-year quarter. Comps grew 6% in May, 7% in June,

and 12% in July.

(Read full report on earnings: Limited Brands Beats, Ups

Outlook)

Guidance

Management now expects earnings in the range of 15 - 20 cents

for the third quarter and between $2.73 and $2.88 per share for

fiscal 2012, up from its previous guidance range of $2.63 - $2.83.

The current Zacks Consensus Estimates for the third quarter and

fiscal 2012 are 21 cents and $2.85, respectively. For the month of

August, management expects comparable-store sales to rise in the

low single-digit range.

Agreement of Estimate Revision

In the last 30 days, 13 out of 16 analysts covering the stock

lowered their estimates, whereas one of the estimates was revised

upwards for the third quarter of 2012. On the other hand, for the

fourth quarter, 13 analysts (out of 17) made upward revisions,

whereas one estimate was

trimmed.

For fiscal 2012, 12 analysts (out of 18) revised their estimates

upward, and two lowered the same in the last 30 days. For fiscal

2013, 12 analysts (out of a total of 18) increased their estimates

and only 1 analyst made downward revisions.

What Drives Estimate Revision

For the upcoming quarter, majority of the analysts trimmed their

estimates mainly due to management’s expectation of huge rise in

selling, general and administrative (SG&A) expenses in third

quarter 2012.

Management’s projects third-quarter SG&A rate to jump

considerably 370 basis points approximately due to adverse impact

from the sale of the third-party apparel sourcing business. Absent

of this, the SG&A rate is expected to rise in the third quarter

due to investments in store selling, store openings and remodels

expenses, and marketing costs. As a result, the analysts remain

skeptical on such rise in expenses, and therefore lowered their

estimates for the third-quarter 2012.

However, the analysts remain positive for the fourth-quarter and

fiscal 2012, on the back of company’s focus on cost containment,

inventory management, and merchandise initiatives, which will

assist the company to survive in the weak consumer environment.

Moreover, Limited Brands was encouraged by the first-quarter

2012 sales results and seeks to expand aggressively in Canada and

internationally. The stores are generating sales volumes, nearly

two and a half times more than the U.S. average.

Magnitude of Estimate Revision

The magnitude of estimate revisions by the analysts is clearly

reflected through changes in the Zacks Consensus

Estimates.

The Zacks Consensus Estimate for the third quarter of 2012 has

moved down by 3 cents to 21 cents a share in the last 7 days. The

Zacks Consensus Estimate for the fourth quarter has increased by 3

cents to

$1.75.

For fiscal 2012, the Zacks Consensus Estimate inched up by a

penny to $2.85 in the last 7 days. For fiscal 2013, the Zacks

Consensus Estimate increased by couple of cents to $3.22.

Conclusion

Limited Brands is strategizing to revamp its La Senza brand both

at home in Canada and internationally by improving product

assortments, store operations and layout. The company had also

completed the closure of the La Senza Girl freestanding stores,

which had been adversely affecting the company’s overall

performance.

Bath & Body Works segment is also gaining strength

steadily, primarily driven by a rise in store transactions,

enhancement in the direct channel business and growth from new and

expanded stores. During the second quarter of 2012, Bath & Body

Works’ total sales hiked 8% to $609.1 million, with a 7% increase

in comps.

However, most of the company’s stores are located in retail

shopping areas, such as malls and other types of retail centers,

which have been adversely impacted by the recent economic turmoil.

These malls have been registering lower sales volume and declining

traffic, as consumers grappling with the recent economic downturn

have been trading down to cheaper brands.

Limited Brands, which faces stiff competition from Gap Inc.

(GPS) and Hanesbrands Inc. (HBI), carries a Zacks

#2 Rank, implying short-term Buy rating for the next 1-3 months,

whereas we maintain our long-term ‘Neutral’ recommendation on the

stock.

About Earnings Estimate Scorecard

As a PhD from MIT, Len Zacks proved over 30 years ago that

earnings estimate revisions are the most powerful force impacting

stock prices. He turned this ground breaking discovery into two of

the most celebrating stock rating systems in use today. The Zacks

Rank for stock trading in a 1 to 3 month time horizon and the Zacks

Recommendation for long-term investing (6+ months). These “Earnings

Estimate Scorecard” articles help analyze the important aspects of

estimate revisions for each stock after their quarterly earnings

announcements. Learn more about earnings estimates and our proven

stock ratings at http://www.zacks.com/education

GAP INC (GPS): Free Stock Analysis Report

HANESBRANDS INC (HBI): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

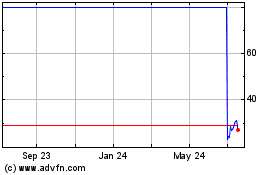

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

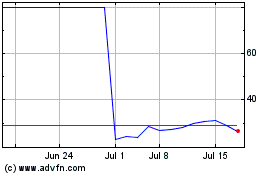

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024