loanDepot Launches equityFREEDOM First-Lien HELOC Further Expanding Home Equity Product Suite

August 21 2024 - 3:23PM

Business Wire

loanDepot, Inc. ("LDI" or "Company") (NYSE: LDI), a leading

provider of products and services that power the homeownership

journey, has expanded its equityFREEDOM product suite to include a

first-lien home equity line of credit (HELOC). This new HELOC

allows the 38.5% of American homeowners without a mortgage1 to

borrow from their home’s equity for large expenses such as home

renovations or college tuition, or to consolidate high interest

credit card debt. It adds another powerful financial tool to

loanDepot's portfolio of products and services that support the

lifetime homeownership journey of its customers.

"Homeowners are sitting on unprecedented levels of equity right

now, particularly those who no longer carry a mortgage," said LDI

President Jeff Walsh. "However, even without a mortgage, many feel

the pinch of rising expenses, including insurance and property

taxes, which put more pressure on monthly budgets. That’s why we’ve

added the first-lien option to our equity lending portfolio to

support our customers through the entirety of their homeownership

journey, not just during the life of their mortgage."

The ability to tap into equity is a major advantage of

homeownership as it can lower the cost of borrowing for large

expenses - and, in many cases, the interest may be tax deductible2.

Many HELOCs on the market today are second-lien loans, requiring

homeowners to have an existing mortgage on their property. A

first-lien HELOC is for borrowers who don’t have an existing

mortgage on their house3.

The equityFREEDOM First-Lien HELOC allows such borrowers to

access the equity in their homes with flexible terms which include

a three-year draw period, and, in most states, a 10-year

interest-only payment period followed by a 20-year amortizing

repayment term4.

As part of its phased national roll out, loanDepot’s

equityFREEDOM First-Lien HELOC is available now in Arizona,

California, Florida, Georgia, Maryland, New Jersey and New Mexico,

and will be introduced in additional states across the country by

late 2024.

To learn more about loanDepot’s equityFREEDOM suite of home

equity lending products visit

https://getstarted.loandepot.com/equity-freedom.

About loanDepot

At loanDepot (NYSE: LDI), we know home means everything. That’s

why we are on a mission to support homeowners with a suite of

products and services that fuel the American Dream. Our portfolio

of digital-first home purchase, home refinance and home equity

lending products make homeownership more accessible, achievable,

and rewarding, especially for the increasingly diverse communities

of first-time homebuyers we serve. Headquartered in Southern

California with local market offices nationwide, loanDepot and its

sister real estate and home services company, mellohome, are

dedicated to helping customers put down roots and bring dreams to

life – all while building stronger communities and a better

tomorrow.

_____________________ 1 ResiClub Data:

https://www.resiclubanalytics.com/p/record-number-mortgagefree-homeowners-provide-economic-cushion-amid-feds-fastest-ratehiking-cycle-fo

2 loanDepot encourages consumers to consult tax advisors for

applicable requirements and details. 3 If a borrower defaults, the

lender holding the first lien HELOC would generally have a primary

claim on the property over other creditors. 4 In Texas, loanDepot’s

HELOC includes a three-year interest only period followed by a

27-year repayment period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240821844028/en/

Media Jonathan Fine VP, Public Relations (781) 248-3963

jfine@loandepot.com

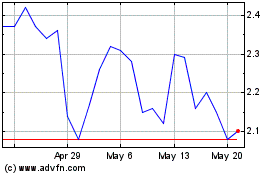

loanDepot (NYSE:LDI)

Historical Stock Chart

From Dec 2024 to Jan 2025

loanDepot (NYSE:LDI)

Historical Stock Chart

From Jan 2024 to Jan 2025