From $1 Billion to $10 Billion: Lemonade’s Investor Day To Focus On The Next 10x

November 12 2024 - 8:00AM

Business Wire

Lemonade, Inc. (NYSE: LMND) will hold its in-person Investor Day

in a week’s time, on Tuesday, November 19, 2024 in New York

City.

At Investor Day, management will provide detailed updates on how

the company expects to 10x, going from an estimated $1 billion next

quarter to $10 billion in force premium in the coming years. The

sessions will cover Lemonade’s strategic expansion plans, a behind

the scenes look at Lemonade’s AI, and a walkthrough of the model

and mechanics that delivered cashflow positivity in the third

quarter, and are expected to deliver Adjusted EBITDA profitability

during 2026.

Attendees can join in-person at the company’s headquarters or

virtually through a live webcast. Please note that in-person

attendance is by invitation only and advance registration is

required. If you are interested in attending in-person, please

email Lemonade’s Investor Relations team: ir@lemonade.com

A live webcast of the event will be available on the Lemonade

Investor Relations website, investor.lemonade.com. Following the

event, a replay will also be made available at

investor.lemonade.com.

To register for the online event, please use this link.

About Lemonade

Lemonade offers renters, homeowners, car, pet, and life

insurance. Powered by artificial intelligence and social impact,

Lemonade’s full stack insurance carriers in the US and the EU

replace brokers and bureaucracy with bots and machine learning,

aiming for zero paperwork and instant everything. A Certified

B-Corp, Lemonade gives unused premiums to nonprofits selected by

its community, during its annual Giveback. Lemonade is currently

available in the United States, Germany, the Netherlands, France,

and the UK, and continues to expand globally.

Follow @lemonade_inc on Twitter for updates.

FORWARD LOOKING STATEMENTS

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements including statement regarding our

anticipated financial performance, including our future

profitability, our in force premium growth to $10 billion, our

expectations regarding our growth, our Adjusted EBITDA

profitability, strategic expansion plans, accuracy and use of our

predictive and generative AI models, and other financial and

operating information. These statements are neither promises nor

guarantees, but involve known and unknown risks, uncertainties and

other important factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements, including but not limited to, the

following: our history of losses and that we may not achieve or

maintain profitability in the future; our financial outlook, our

success and ability to retain and expand our customer base; the

"Lemonade" brand may not become as widely known as incumbents'

brands or the brand may become tarnished; the denial of claims or

our failure to accurately and timely pay claims; our ability to

attain greater value from each user; availability of reinsurance at

current levels and prices; the impact of our agreement with General

Catalyst as a synthetic agent; our exposure to counterparty risks;

our limited operating history; our ability to manage our growth

effectively; our proprietary artificial intelligence algorithms may

not operate properly or as expected; the intense competition in the

segments of the insurance industry in which we operate; our ability

to maintain our risk-based capital at the required levels; our

ability to expand our product offerings; the novelty of our

business model and its unpredictable efficacy and susceptibility to

unintended consequences; the possibility that we could be forced to

modify or eliminate our Giveback; regulatory risks, related to the

operation, development, and implementation of our proprietary

artificial intelligence algorithms and telematics based pricing

model; legislation or legal requirements that may affect how we

communicate with customers; the cyclical nature of the insurance

industry; our reliance on artificial intelligence, telematics,

mobile technology, and our digital platforms to collect data that

we utilize in our business; our ability to obtain additional

capital to the extent required to grow our business, which may not

be available on terms acceptable to us or at all; our actual or

perceived failure to protect customer information and other data as

a result of security incidents or real or perceived errors,

failures or bugs in our systems, website or app, respect customers’

privacy, or comply with data privacy and security laws and

regulations; periodic examinations by state insurance regulators;

underwriting risks accurately and charging competitive yet

profitable rates to customers; our ability to underwrite risks

accurately and charge competitive yet profitable rates to our

customers; potentially significant expenses incurred in connection

with any new products before generating revenue from such products;

risks associated with any costs incurred and other risks as we

expand our business in the U.S. and internationally; our ability to

comply with extensive insurance industry regulations; our ability

to comply with insurance regulators and additional reporting

requirements on insurance holding companies; our ability to predict

the impacts of severe weather events and catastrophes, including

the effects of climate change and global pandemics, on our business

and the global economy generally; increasing scrutiny, actions, and

changing expectations on environmental, social, and governance

matters; fluctuations of our results of operations on a quarterly

and annual basis; our utilization of customer and third party data

in underwriting our policies; limitations in the analytical models

used to assess and predict our exposure to catastrophe losses;

potential losses could be greater than our loss and loss adjustment

expense reserves; the minimum capital and surplus requirements our

insurance subsidiaries are required to have; assessments and other

surcharges from state guaranty funds; our status and obligations as

a public benefit corporation; our operations in Israel and the

current political, economic, and military instability, including

the evolving conflict in Israel and surrounding region.

These and other important factors are discussed under the

caption “Risk Factors” in our Form 10-K filed with the SEC on

February 28, 2024 and in our other filings with the SEC, these

factors could cause actual results to differ materially from those

indicated by the forward-looking statements made in this letter to

shareholders. Any such forward-looking statements represent

management’s beliefs as of the date of this letter to shareholders.

While we may elect to update such forward-looking statements at

some point in the future, we disclaim any obligation to do so, even

if subsequent events cause our views to change.

We may use our website (investor.lemonade.com), blog

(lemonade.com/blog), and our company account on X and LinkedIn as a

means of disclosing information and for complying with our

disclosure obligations under Regulation FD.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112992479/en/

press@lemonade.com

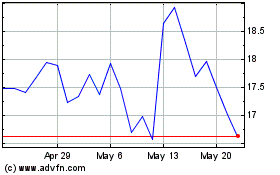

Lemonade (NYSE:LMND)

Historical Stock Chart

From Nov 2024 to Dec 2024

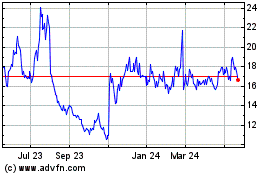

Lemonade (NYSE:LMND)

Historical Stock Chart

From Dec 2023 to Dec 2024