Dorian LPG Ltd. (NYSE: LPG) (the “Company,” “Dorian LPG,” “we,”

and “our”), a leading owner and operator of modern very large gas

carriers (“VLGCs”), today reported its financial results for the

three months and fiscal year ended March 31, 2024.

Key Recent Development

- Declared an irregular dividend totaling $40.6 million to be

paid on or about May 30, 2024.

Highlights for the Fourth Quarter Ended March 31,

2024

- Revenues of $141.4 million.

- Time charter equivalent (“TCE”)(1) per operating day rate for

our fleet of $72,202.

- Net income of $79.2 million, or $1.96 earnings per diluted

share (“EPS”), and adjusted net income(1) of $77.6 million, or

$1.91 adjusted diluted earnings per share (“adjusted EPS”)(1).

- Adjusted EBITDA(1) of $105.0 million.

- Declared and paid an irregular dividend totaling $40.6

million.

Highlights for the Fiscal Year Ended March 31, 2024

- Revenues of $560.7 million.

- TCE(1) per operating day rate for our fleet of $65,986.

- Net income of $307.4 million, or $7.60 EPS, and adjusted net

income(1) of $307.4 million, or $7.60 adjusted EPS(1).

- Adjusted EBITDA(1) of $417.4 million.

- Declared and paid four irregular dividends totaling $162.2

million.

- Entered into the 2023 A&R Debt Facility (amending and

restating the 2022 Debt Facility) to upsize the revolving credit

facility amount to $50.0 million and added a new, uncommitted

accordion term loan facility, in an aggregate principal amount of

up to $100.0 million.

- Entered into an agreement for a newbuilding Very Large Gas

Carrier / Ammonia Carrier expected to be delivered in the third

calendar quarter of 2026 for which we made the first $23.8 million

installment payment in January 2024.

(1)

TCE, adjusted net income, adjusted EPS and adjusted EBITDA are

non-U.S. GAAP measures. Refer to the reconciliation of revenues to

TCE, net income to adjusted net income, EPS to adjusted EPS and net

income to adjusted EBITDA included in this press release under the

heading “Financial Information.”

John Hadjipateras, Chairman, President, and Chief Executive

Officer of the Company, commented, “We generated a record-breaking

fiscal year 2024 TCE of nearly $66,000 per operating day, yielding

our highest ever net income and a more than 30% return on equity.

Including the $1.00 per share dividend recently declared, we will

have returned over $730 million to shareholders since our IPO. The

challenges from market volatility and geopolitical events continued

in the last quarter as we remain focused on the quality of our

service to customers and the strength of our balance sheet. I am

grateful to and commend our seafarers and shore staff for their

commitment to our mission to provide safe, reliable, clean, and

trouble-free transportation.”

Fourth Quarter Fiscal Year 2024 Results Summary

Our net income amounted to $79.2 million, or $1.96 per share,

for the three months ended March 31, 2024, compared to net income

of $76.0 million, or $1.89 per share, for the three months ended

March 31, 2023.

Our adjusted net income amounted to $77.6 million, or $1.91 per

share, for the three months ended March 31, 2024, compared to

adjusted net income of $78.1 million, or $1.94 per share, for the

three months ended March 31, 2023. We have adjusted our net income

for the three months ended March 31, 2024 for an unrealized gain on

derivative instruments of $1.7 million and we adjusted our net

income for the three months ended March 31, 2023 for an unrealized

loss on derivative instruments of $2.1 million. Please refer to the

reconciliation of net income to adjusted net income, which appears

later in this press release.

The $0.5 million decrease in adjusted net income for the three

months ended March 31, 2024 compared to the three months ended

March 31, 2023 is primarily attributable to increases of $5.5

million in charter hire expenses, $1.9 million in depreciation and

amortization, $1.4 million in vessel operating expenses, $1.0

million in general and administrative expenses, and $0.5 million in

interest and finance costs, partially offset by increases of $7.8

million and $1.4 million in revenues and interest income and a

decrease of $0.6 million in voyage expenses.

The TCE rate for our fleet was $72,202 for the three months

ended March 31, 2024, a 6.0% increase from the $68,135 TCE rate for

the same period in the prior year, as further described in

“Revenues” below. Please see footnote 7 to the table in “Financial

Information” below for other information related to how we

calculate TCE. Total fleet utilization (including the utilization

of our vessels deployed in the Helios Pool) decreased from 95.7%

for the three months ended March 31, 2023 to 87.7% for the three

months ended March 31, 2024.

Vessel operating expenses per day increased to $10,699 during

the three months ended March 31, 2024 from $10,528 in the same

period in the prior year. Please see “Vessel Operating Expenses”

below for more information.

Revenues

Revenues, which represent net pool revenues—related party, time

charters and other revenues earned by our vessels, were $141.4

million for the three months ended March 31, 2024, an increase of

$7.8 million, or 5.8%, from $133.6 million for the three months

ended March 31, 2023. The increase was primarily attributable to

increases in average TCE rates and fleet size, partially offset by

a decrease in fleet utilization. TCE rates of $72,202 for the three

months ended March 31, 2024 increased by $4,067 from $68,135 for

the three months ended March 31, 2023. Our available days increased

from 2,034 for the three months ended March 31, 2023 to 2,228 for

the three months ended March 31, 2024 due to additional vessels in

our fleet. Fleet utilization decreased from 95.7% during the three

months ended March 31, 2023 to 87.7% during the three months ended

March 31, 2024.

Charter Hire Expenses

Charter hire expenses for vessels time chartered-in from third

parties were $12.7 million for three months ended March 31, 2024

compared to $7.2 million for the three months ended March 31, 2023.

The increase of $5.5 million, or 75.9%, was mainly cause by an

increase in time chartered-in days from 241 for the three months

ended March 31, 2023 to 364 for the three months ended March 31,

2024.

Vessel Operating Expenses

Vessel operating expenses were $20.4 million during the three

months ended March 31, 2024, or $10,699 per vessel per calendar

day, which is calculated by dividing vessel operating expenses by

calendar days for the relevant time period for the technically

managed vessels that were in our fleet. This was a slight increase

of $1.4 million, or 7.8%, from $19.0 million, or $10,528 per vessel

per calendar day, for the three months ended March 31, 2023. The

increase was partially due to an increase in operating expenses per

vessel per calendar day along with an increase of calendar days for

our fleet from 1,801 during the three months ended March 31, 2023

to 1,911 days during the three months ended March 31, 2024

resulting from the delivery of our dual-fuel VLGC Captain Markos in

March 2023. The increase of $171 per vessel per calendar day, from

$10,528 for the three months ended March 31, 2023 to $10,699 per

vessel per calendar day for the three months ended March 31, 2024

was primarily driven by non-capitalizable drydock-related operating

expenses. Excluding those amounts, daily operating expenses

decreased by $257 from the three months ended March 31, 2023, which

was mainly due to a decrease of $237 per vessel per calendar day

for crew related costs.

Depreciation and Amortization

Depreciation and amortization was $17.6 million for the three

months ended March 31, 2024, an increase of $1.9 million, or 12.1%,

from $15.7 million for the three months ended March 31, 2023,

primarily resulting from the delivery of our Dual-fuel ECO VLGC

Captain Markos in March 2023.

General and Administrative Expenses

General and administrative expenses were $8.5 million for the

three months ended March 31, 2024, an increase of $1.0 million, or

13.2%, from $7.5 million for the three months ended March 31, 2023.

This increase was mainly attributed to an increase of $1.2 million

in stock-based compensation expense (largely due to higher stock

price on the grant date in fiscal year 2024 compared to fiscal year

2023), partially offset by a reduction of $0.2 million in other

general and administrative expenses.

Interest and Finance Costs

Interest and finance costs amounted to $9.7 million for the

three months ended March 31, 2024, an increase of $0.5 million, or

5.1%, from $9.2 million for the three months ended March 31, 2023.

The increase of $0.5 million during the three months ended March

31, 2024 was mainly due to a decrease of $0.4 million in

capitalized interest and an increase of $0.3 million in interest

incurred on our long-term debt, partially offset by decreases of

$0.1 million in amortization of financing fees and $0.1 million of

loan expenses. The increase in interest on our long-term debt was

driven by an increase in average interest rates due to rising SOFR

on our floating-rate long-term debt, and an increase in average

indebtedness. Average indebtedness, excluding deferred financing

fees, decreased from $630.8 million for the three months ended

March 31, 2023 to $619.9 million for the three months ended March

31, 2024. As of March 31, 2024, the outstanding balance of our

long-term debt was $610.5 million.

Unrealized Gain/(Loss) on Derivatives

Unrealized gain on derivatives amounted to approximately $1.7

million for the three months ended March 31, 2024, compared to loss

of $2.1 million for the three months ended March 31, 2023. The $3.8

million favorable change is primarily attributable to changes in

forward SOFR yield curves and reductions in notional amounts.

Realized Gain on Derivatives

Realized gain on derivatives was $1.8 million for the three

months ended March 31, 2024 and was relatively unchanged from the

three months ended March 31, 2023.

Fiscal Year 2024 Results Summary

Our net income amounted to $307.4 million, or $7.60 per share,

for the year ended March 31, 2024, compared to net income of $172.4

million, or $4.29 per share, for the year ended March 31, 2023.

Our adjusted net income amounted to $307.4 million, or $7.60 per

share, for the year ended March 31, 2024, compared to adjusted net

income of $169.7 million, or $4.22 per share, for the year ended

March 31, 2023. We have adjusted our net income for the year ended

March 31, 2023 for an unrealized gain on derivatives of $2.8

million and we have adjusted our net income for the year ended

March 31, 2024 for an unrealized gain on derivative instruments of

less than $0.1 million and Please refer to the reconciliation of

net income to adjusted net income, which appears later in this

press release.

The favorable change of $137.7 million in adjusted net income

for the year ended March 31, 2024 compared to the year ended March

31, 2023 is primarily attributable to increases in revenues of

$171.0 million, interest income of $5.7 million a favorable change

of $3.7 million in realized gain on derivatives, and a decrease of

$0.9 million in voyage expenses. These were partially offset by

increases of $20.5 million in charter hire expenses from our

chartered-in VLGCs, $9.0 million in vessel operating expenses, $6.9

million in general and administrative expenses, $5.3 million in

depreciation and amortization, and $2.7 million in interest and

finance costs.

The TCE rate for our fleet was $65,986 for the year ended March

31, 2024, a 30.8% increase from the $50,462 TCE rate from the prior

year, as further described in “Revenues” below. Please see footnote

7 to the table in “Financial Information” below for other

information related to how we calculate TCE. Total fleet

utilization (including the utilization of our vessels deployed in

the Helios Pool) decreased from 95.0% in the year ended March 31,

2023 to 93.9% in the year ended March 31, 2024.

Vessel operating expenses per day increased to $10,469 in the

year ended March 31, 2024 from $9,793 in the prior year. Please see

“Vessel Operating Expenses” below for more information.

Revenues

Revenues, which represent net pool revenues—related party, time

charters and other revenues, net, were $560.7 million for the year

ended March 31, 2024, an increase of $171.0 million, or 43.9%, from

$389.7 million for the year ended March 31, 2023. The increase is

primarily attributable to increased average TCE rates and fleet

size, partially offset by a slight decrease in fleet utilization.

Average TCE rates of $65,986 for the year ended March 31, 2024

increased by $15,524 from $50,462 for the year ended March 31,

2023, primarily due to higher spot rates and lower bunker prices.

The Baltic Exchange Liquid Petroleum Gas Index, an index published

daily by the Baltic Exchange for the spot market rate for the

benchmark Ras Tanura-Chiba route (expressed as U.S. dollars per

metric ton), averaged $104.948 during the year ended March 31, 2024

compared to an average of $87.009 for the year ended March 31,

2023. The average price of very low sulfur fuel oil (expressed as

U.S. dollars per metric ton) from Singapore and Fujairah decreased

from $773 during the year ended March 31, 2023, to $623 during the

year ended March 31, 2024. Our available days increased from 8,053

for the year ended March 31, 2023 to 9,003 for the year ended March

31, 2024 due to three additional vessels in our fleet. Our fleet

utilization decreased from 95.0% during the year ended March 31,

2023 to 93.9% during the year ended March 31, 2024.

Charter Hire Expenses

Charter hire expenses for the vessels chartered in from third

parties were $43.7 million for the year ended March 31, 2024

compared to $23.2 million for the year ended March 31, 2023. The

increase of $20.5 million, or 88.3%, was mainly caused by an

increase in time chartered-in days from 791 for the year ended

March 31, 2023 to 1,512 for the year ended March 31, 2024,

partially offset by a slight decline in time charter hire expense

per day.

Vessel Operating Expenses

Vessel operating expenses were $80.5 million during the year

ended March 31, 2024, or $10,469 per vessel per calendar day, which

is calculated by dividing vessel operating expenses by calendar

days for the relevant time period for the technically managed

vessels that were in our fleet. This was an increase of $9.0

million, or 12.5%, from $71.5 million, or $9,793 per vessel per

calendar day, for the year ended March 31, 2023. The increase was

partially due to an increase in operating expenses per vessel per

calendar day along with an increase of calendar days for our fleet

from 7,301 during the year ended March 31, 2023 to 7,686 days

during the year ended March 31, 2024 resulting from the delivery of

our Dual-fuel ECO VLGC Captain Markos from Kawasaki Heavy

Industries in March 2023. The increase of $676 per vessel per

calendar day, from $9,793 for the year ended March 31, 2023 to

$10,469 per vessel per calendar day for the year ended March 31,

2024 was primarily the result of increases per vessel per calendar

day of $391 for spares and stores, $231 for repairs and

maintenance, and $191 for miscellaneous operating expenses,

partially offset by a decrease of $166 per vessel per calendar day

for crew related costs. Of the $676 per day increase in daily

operating expense, $307 per vessel per calendar day was related to

non-capitalizable drydock-related operating expenses. Excluding

those amounts, daily operating expenses increased by $369 from the

year ended March 31, 2023.

Depreciation and Amortization

Depreciation and amortization was $68.7 million for the year

ended March 31, 2024, an increase of $5.3 million, or 8.3%, from

$63.4 million for the year ended March 31, 2023, primarily

resulting from the full year effect of the delivery of our

Dual-fuel ECO VLGC Captain Markos in March 2023.

General and Administrative Expenses

General and administrative expenses were $39.0 million for the

year ended March 31, 2024, an increase of $6.9 million, or 21.6%,

from $32.1 million for the year ended March 31, 2023, primarily

driven by increases of a) $4.1 million in stock-based compensation

expense (largely due to higher stock price on the grant date in

fiscal year 2024 compared to fiscal year 2023), b) $1.8 million in

cash bonuses, and c) $1.5 million in employee-related costs and

benefits, partially offset by a reduction of $0.5 million in other

general and administrative expenses.

Interest and Finance Costs

Interest and finance costs amounted to $40.5 million for the

year ended March 31, 2024, an increase of $2.7 million from $37.8

million for the year ended March 31, 2023. The increase of $2.7

million during the year ended March 31, 2024 was driven by

increases of $6.6 million in interest incurred on our long-term

debt and a decrease of $1.4 million in capitalized interest,

partially offset by decreases of $4.4 million in amortization of

financing costs and $0.9 in loan expenses and bank charges. The

increase in interest on our long-term debt was driven by an

increase in average interest rates due to rising SOFR on our

floating-rate long-term debt, partially offset by a decrease in

average indebtedness, excluding deferred financing fees, from

$649.0 million for the year ended March 31, 2023 to $639.9 million

for the year ended March 31, 2024. As of March 31, 2024, the

outstanding balance of our long-term debt, excluding deferred

financing fees, was $610.5 million.

Unrealized Gain on Derivatives

Unrealized gain on derivatives amounted to less than $0.1

million for the year ended March 31, 2024 compared to $2.8 million

for the year ended March 31, 2023. The $2.8 million difference is

primarily attributable to changes in forward SOFR yield curves and

reductions in notional amounts.

Realized Gain on Derivatives

Realized gain on derivatives was $7.5 million for the year ended

March 31, 2024, compared to $3.8 million for the year ended March

31, 2023. The favorable $3.7 million difference is largely due to

an increase in floating SOFR resulting in the realized gain on our

interest rate swaps.

Fleet

The following table sets forth certain information regarding our

fleet as of May 17, 2024. We classify vessel employment as either

Time Charter, Pool or Pool-TCO.

Capacity (Cbm)

Shipyard

Year Built

ECO Vessel(1)

Scrubber Equipped or

Dual-Fuel

Employment

Time Charter-Out

Expiration(2)

Dorian VLGCs

Captain John NP

82,000

Hyundai

2007

—

—

Pool(4)

—

Comet

84,000

Hyundai

2014

X

S

Pool(4)

—

Corsair(3)

84,000

Hyundai

2014

X

S

Time Charter(6)

Q4 2024

Corvette

84,000

Hyundai

2015

X

S

Pool(4)

—

Cougar(3)

84,000

Hyundai

2015

X

—

Pool-TCO(5)

Q2 2025

Concorde

84,000

Hyundai

2015

X

S

Pool(4)

—

Cobra

84,000

Hyundai

2015

X

—

Pool(4)

—

Continental

84,000

Hyundai

2015

X

—

Pool(4)

—

Constitution

84,000

Hyundai

2015

X

S

Pool(4)

—

Commodore

84,000

Hyundai

2015

X

—

Pool-TCO(5)

Q2 2027

Cresques(3)

84,000

Daewoo

2015

X

S

Pool-TCO(5)

Q2 2025

Constellation

84,000

Hyundai

2015

X

S

Pool(4)

—

Cheyenne

84,000

Hyundai

2015

X

S

Pool(4)

—

Clermont

84,000

Hyundai

2015

X

S

Pool(4)

—

Cratis(3)

84,000

Daewoo

2015

X

S

Pool(4)

—

Chaparral(3)

84,000

Hyundai

2015

X

—

Pool-TCO(5)

Q2 2025

Copernicus(3)

84,000

Daewoo

2015

X

S

Pool(4)

—

Commander

84,000

Hyundai

2015

X

S

Pool(4)

—

Challenger

84,000

Hyundai

2015

X

S

Pool-TCO(5)

Q3 2026

Caravelle(3)

84,000

Hyundai

2016

X

S

Pool(4)

—

Captain Markos(3)

84,000

Kawasaki

2023

X

DF

Pool(4)

—

Total

1,762,000

Time chartered-in VLGCs

Future Diamond(7)

80,876

Hyundai

2020

X

S

Pool(4)

—

HLS Citrine(8)

86,090

Hyundai

2023

X

DF

Pool(4)

—

HLS Diamond(9)

86,090

Hyundai

2023

X

DF

Pool(4)

—

Cristobal(10)

86,980

Hyundai

2023

X

DF

Pool(4)

—

________________________

(1)

Represents vessels with very low revolutions per minute,

long-stroke, electronically controlled engines, larger propellers,

advanced hull design, and low friction paint.

(2)

Represents calendar year quarters.

(3)

Operated pursuant to a bareboat chartering agreement.

(4)

“Pool” indicates that the vessel operates in the Helios Pool on a

voyage charter with a third party and we receive a portion of the

pool profits calculated according to a formula based on the

vessel’s pro rata performance in the pool.

(5)

“Pool-TCO” indicates that the vessel is operated in the Helios Pool

on a time charter out to a third party and we receive a portion of

the pool profits calculated according to a formula based on the

vessel’s pro rata performance in the pool.

(6)

Currently on a time charter with an oil major that began in

November 2019.

(7)

Currently time chartered-in to our fleet with an expiration during

the first calendar quarter of 2025.

(8)

Vessel has a Panamax beam and is currently time chartered-in to our

fleet with an expiration during the first calendar quarter of 2030

and purchase options beginning in year seven.

(9)

Vessel has a Panamax beam and is currently time chartered-in to our

fleet with an expiration during the first calendar quarter of 2030

and purchase options beginning in year seven.

(10)

Vessel has a Panamax beam and shaft generator and is currently time

chartered-in to our fleet with an expiration during the third

calendar quarter of 2030 and purchase options beginning in year

seven.

Market Outlook Update

The largest change in the LPG market in the first quarter of

calendar year 2024 (“Q1 2024”) occurred in the U.S., where cold

weather in January and February increased domestic demand for

propane and, at one point, also limited production growth. As a

result, propane prices rose from an average of 36% of West Texas

Intermediate (“WTI”) in the fourth quarter of calendar year 2023

(“Q4 2023”) to nearly 50% in February 2024. U.S. LPG exports

remained above 5 million metric tons (“MM MT”) per month, leading

inventory levels to fall from above the 5-year average levels to

around the average level seen over the last 5 years.

This rise in U.S. Mt Belvieu prices, at the same time as limited

change in Far Eastern prices due to milder winter conditions and

continued subdued petrochemical demand, as reported by industry

consultants NGLStrategy, in Q1 2024, led to a narrowing of the

U.S.-Asia arbitrage. Freight rates were consequently squeezed, with

the average Baltic Freight rate falling from over $132 per metric

ton in Q4 2023 to $68 per metric ton in Q1 2024. At times, the

AG-Japan rate fell below $60 per metric ton.

With the rising temperatures seen towards the second half of the

quarter in the U.S., production levels have continued to grow, with

NGLs remaining optimized for U.S. producers where possible.

Subsiding domestic demand as a result of the milder temperatures,

afforded higher availability of product for export and inventory

levels to build. As a result, Mt Belvieu propane prices have fallen

from the high seen in February 2024 where prices reached an average

of $473 per metric ton, to an average of 41% of WTI in March 2024,

or $419 per metric ton.

Unrest in the Middle East, including Suez Canal limitations,

maintained the strength in crude oil prices along with the

continuation of additional voluntary production cuts in Saudi

Arabia. Brent crude oil averaged $85 per metric ton in Q1 202,

similar to the level seen in the third quarter of calendar year

2023 and Q4 2023.

Petrochemical demand remained subdued globally, however, naphtha

margins in Europe finally returned to positive territory in

February 2024 after remaining under pressure and at times heavily

negative for most of 2023. Naphtha margins in Asia also improved

but remained at an average of ($121) per metric ton in Q1 2024,

compared to ($143) per metric ton in Q4 2023. Propane continued to

be advantageous as a feedstock in flexible steam crackers for the

production of ethylene in both the East and West. The

propane-naphtha spread in NW Europe widened to ($146) per metric

ton encouraging higher consumption of propane in steam

crackers.

LPG imports for steam cracking in Asia reached 2.8 MM MT in Q1

2024 according to NGLStrategy models, an increase of nearly 200,000

tons from the previous quarter, and nearly 1 MM MT higher than seen

in the first quarter of calendar 2023. LPG imports for steam

cracking in NW Europe also rose in Q1 2024 by around 300,000 tons

from the previous quarter. According to NGLStrategy, supply chain

logistics at times saw some ethylene producers utilizing naphtha

over LPG in NW Europe.

PDH margins remained under pressure with over-capacity and

sluggish growth in China for olefins and polyolefins. A further two

new PDH plants started operating in China in Q1 2024, however,

propane demand for PDH operations in China decreased from 3.4 MM MT

in Q4 2023 to 3.1 MM MT in Q1 2024.

Although a further 10 new VLGCs were added during Q1 2024, which

initially exacerbated the freight market weakness caused by the

narrower East West arb as note above. After declining steadily

through February, VLGC rates steadily increased from March through

April and May to today’s healthy levels. The average age of the

global fleet is now approximately 10.7 years old. Currently the

VLGC orderbook stands at approximately 45 VLGCs or 12% of the

global fleet, excluding the VLAC (Very Large Ammonia Carriers) and

VLEC (Very Large Ethane Carriers) orderbook which totals 84 vessels

with potential capability to carry LPG as a product.

The above market outlook update is based on information, data

and estimates derived from industry sources available as of the

date of this release, and there can be no assurances that such

trends will continue or that anticipated developments in freight

rates, export volumes, the VLGC orderbook or other market

indicators will materialize. This information, data and estimates

involve a number of assumptions and limitations, are subject to

risks and uncertainties, and are subject to change based on various

factors. You are cautioned not to give undue weight to such

information, data and estimates. We have not independently verified

any third-party information, verified that more recent information

is not available and undertake no obligation to update this

information unless legally obligated.

Seasonality

Liquefied gases are primarily used for industrial and domestic

heating, as chemical and refinery feedstock, as transportation fuel

and in agriculture. The LPG shipping market historically has been

stronger in the spring and summer months in anticipation of

increased consumption of propane and butane for heating during the

winter months. In addition, unpredictable weather patterns in these

months tend to disrupt vessel scheduling and the supply of certain

commodities. Demand for our vessels therefore may be stronger in

our quarters ending June 30 and September 30 and relatively weaker

during our quarters ending December 31 and March 31, although

12-month time charter rates tend to smooth out these short-term

fluctuations and recent LPG shipping market activity has not

yielded the typical seasonal results. The increase in petrochemical

industry buying has contributed to less marked seasonality than in

the past, but there can no guarantee that this trend will continue.

To the extent any of our time charters expire during the typically

weaker fiscal quarters ending December 31 and March 31, it may not

be possible to re-charter our vessels at similar rates. As a

result, we may have to accept lower rates or experience off-hire

time for our vessels, which may adversely impact our business,

financial condition and operating results.

Financial Information

The following table presents our selected financial data

(unaudited) and other information for the periods presented:

Three months ended

Year ended

(in U.S. dollars, except fleet

data)

March 31, 2024

March 31, 2023

March 31, 2024

March 31, 2023

Statement of Operations Data

Revenues

$

141,391,564

$

133,635,050

$

560,717,436

$

389,749,215

Expenses

Voyage expenses

381,689

1,043,946

2,674,179

3,611,452

Charter hire expenses

12,698,350

7,219,090

43,673,387

23,194,712

Vessel operating expenses

20,446,088

18,960,093

80,461,690

71,501,771

Depreciation and amortization

17,583,971

15,689,206

68,666,053

63,396,131

General and administrative expenses

8,547,932

7,549,248

39,004,183

32,086,382

Total expenses

59,658,030

50,461,583

234,479,492

193,790,448

Other income—related parties

645,454

608,106

2,592,291

2,401,701

Operating income

82,378,988

83,781,573

328,830,235

198,360,468

Other income/(expenses)

Interest and finance costs

(9,685,060

)

(9,211,683

)

(40,480,428

)

(37,803,787

)

Interest income

2,863,734

1,467,724

9,488,328

3,808,809

Unrealized gain/(loss) on derivatives

1,656,117

(2,080,999

)

5,665

2,766,065

Realized gain on derivatives

1,800,918

1,773,707

7,493,246

3,771,522

Other gain/(loss), net

225,501

290,713

2,109,867

1,540,853

Total other income/(expenses), net

(3,138,790

)

(7,760,538

)

(21,383,322

)

(25,916,538

)

Net income

$

79,240,198

$

76,021,035

$

307,446,913

$

172,443,930

Earnings per common share—basic

1.96

1.90

7.63

4.31

Earnings per common share—diluted

$

1.96

$

1.89

$

7.60

4.29

Financial Data

Adjusted EBITDA(1)

$

105,046,547

$

102,065,758

$

417,429,321

$

271,386,648

Fleet Data

Calendar days(2)

1,911

1,801

7,686

7,301

Time chartered-in days(3)

364

241

1,512

791

Available days(4)

2,228

2,034

9,003

8,053

Operating days(5)(8)

1,953

1,946

8,457

7,652

Fleet utilization(6)(8)

87.7

%

95.7

%

93.9

%

95.0

%

Average Daily Results

Time charter equivalent rate(7)(8)

$

72,202

$

68,135

$

65,986

$

50,462

Daily vessel operating expenses(9)

$

10,699

$

10,528

$

10,469

$

9,793

___________________

(1)

Adjusted EBITDA is an unaudited non-U.S. GAAP financial measure and

represents net income before interest and finance costs, unrealized

(gain)/loss on derivatives, realized (gain)/loss on interest rate

swaps, stock-based compensation expense, impairment, and

depreciation and amortization and is used as a supplemental

financial measure by management to assess our financial and

operating performance. We believe that adjusted EBITDA assists our

management and investors by increasing the comparability of our

performance from period to period. This increased comparability is

achieved by excluding the potentially disparate effects between

periods of derivatives, interest and finance costs, stock-based

compensation expense, impairment, and depreciation and amortization

expense, which items are affected by various and possibly changing

financing methods, capital structure and historical cost basis and

which items may significantly affect net income between periods. We

believe that including adjusted EBITDA as a financial and operating

measure benefits investors in selecting between investing in us and

other investment alternatives.

Adjusted EBITDA has certain limitations in

use and should not be considered an alternative to net

income/(loss), operating income, cash flow from operating

activities or any other measure of financial performance presented

in accordance with GAAP. Adjusted EBITDA excludes some, but not

all, items that affect net income. Adjusted EBITDA as presented

below may not be computed consistently with similarly titled

measures of other companies and, therefore, might not be comparable

with other companies.

The following table sets forth a

reconciliation (unaudited) of net income to Adjusted EBITDA for the

periods presented:

Three months ended

Year ended

(in U.S. dollars)

March 31, 2024

March 31, 2023

March 31, 2024

March 31, 2023

Net income

$

79,240,198

$

76,021,035

$

307,446,913

$

172,443,930

Interest and finance costs

9,685,060

9,211,683

40,480,428

37,803,787

Unrealized (gain)/loss on derivatives

(1,656,117

)

2,080,999

(5,665

)

(2,766,065

)

Realized gain on interest rate swaps

(1,800,918

)

(1,773,707

)

(7,493,246

)

(3,771,522

)

Stock-based compensation expense

1,994,353

836,542

8,334,838

4,280,387

Depreciation and amortization

17,583,971

15,689,206

68,666,053

63,396,131

Adjusted EBITDA

$

105,046,547

$

102,065,758

$

417,429,321

$

271,386,648

(2)

We define calendar days as the total number of days in a period

during which each vessel in our fleet was owned or operated

pursuant to a bareboat charter. Calendar days are an indicator of

the size of the fleet over a period and affect the amount of

expenses that are recorded during that period.

(3)

We define time chartered-in days as the aggregate number of days in

a period during which we time chartered-in vessels from third

parties. Time chartered-in days are an indicator of the size of the

fleet over a period and affect both the amount of revenues and the

amount of charter hire expenses that are recorded during that

period.

(4)

We define available days as the sum of calendar days and time

chartered-in days (collectively representing our

commercially-managed vessels) less aggregate off hire days

associated with scheduled maintenance, which include major repairs,

drydockings, vessel upgrades or special or intermediate surveys. We

use available days to measure the aggregate number of days in a

period that our vessels should be capable of generating revenues.

(5)

We define operating days as available days less the aggregate

number of days that the commercially-managed vessels in our fleet

are off‑hire for any reason other than scheduled maintenance. We

use operating days to measure the number of days in a period that

our operating vessels are on hire (refer to 8 below).

(6)

We calculate fleet utilization by dividing the number of operating

days during a period by the number of available days during that

period. An increase in non-scheduled off hire days would reduce our

operating days, and, therefore, our fleet utilization. We use fleet

utilization to measure our ability to efficiently find suitable

employment for our vessels.

(7)

Time charter equivalent rate, or TCE rate, is a non-U.S. GAAP

measure of the average daily revenue performance of a vessel. TCE

rate is a shipping industry performance measure used primarily to

compare period‑to‑period changes in a shipping company’s

performance despite changes in the mix of charter types (such as

time charters, voyage charters) under which the vessels may be

employed between the periods. Our method of calculating TCE rate is

to divide revenue net of voyage expenses by operating days for the

relevant time period, which may not be calculated the same by other

companies. The following table sets forth a reconciliation

(unaudited) of revenues to TCE rate for the periods presented:

Three months ended

Year ended

(in U.S. dollars, except operating

days)

March 31, 2024

March 31, 2023

March 31, 2024

March 31, 2023

Numerator:

Revenues

$

141,391,564

$

133,635,050

$

560,717,436

$

389,749,215

Voyage expenses

(381,689

)

(1,043,946

)

(2,674,179

)

(3,611,452

)

Time charter equivalent

$

141,009,875

$

132,591,104

$

558,043,257

$

386,137,763

Pool adjustment*

—

—

1,416,187

(514,015

)

Time charter equivalent excluding pool

adjustment*

$

141,009,875

$

132,591,104

$

559,459,444

$

385,623,748

Denominator:

Operating days

1,953

1,946

8,457

7,652

TCE rate:

Time charter equivalent rate

$

72,202

$

68,135

$

65,986

$

50,462

TCE rate excluding pool adjustment*

$

72,202

$

68,135

$

66,153

$

50,395

* Adjusted for the effects of reallocations of pool profits in

accordance with the pool participation agreements as a result of

the actual speed and consumption performance of the vessels

operating in the Helios Pool exceeding the originally estimated

speed and consumption levels.

(8)

We determine operating days for each vessel based on the underlying

vessel employment, including our vessels in the Helios Pool, or the

Company Methodology. If we were to calculate operating days for

each vessel within the Helios Pool as a variable rate time charter,

or the Alternate Methodology, our operating days and fleet

utilization would be increased with a corresponding reduction to

our TCE rate. Operating data (unaudited) using both methodologies

is as follows:

Three months ended

Year ended

March 31, 2024

March 31, 2023

March 31, 2024

March 31, 2023

Company Methodology:

Operating Days

1,953

1,946

8,457

7,652

Fleet Utilization

87.7

%

95.7

%

93.9

%

95.0

%

Time charter equivalent rate

$

72,202

$

68,135

$

65,986

$

50,462

Alternate Methodology:

Operating Days

2,228

2,033

9,002

8,035

Fleet Utilization

100.0

%

100.0

%

100.0

%

99.8

%

Time charter equivalent rate

$

63,290

$

65,219

$

61,991

$

48,057

We believe that Our Methodology using the underlying vessel

employment provides more meaningful insight into market conditions

and the performance of our vessels.

(9)

Daily vessel operating expenses are calculated by dividing vessel

operating expenses by calendar days for the relevant time period.

In addition to the results of operations presented in accordance

with U.S. GAAP, we provide adjusted net income and adjusted EPS. We

believe that adjusted net income and adjusted EPS are useful to

investors in understanding our underlying performance and business

trends. Adjusted net income and adjusted EPS are not a measurement

of financial performance or liquidity under U.S. GAAP; therefore,

these non-U.S. GAAP financial measures should not be considered as

an alternative or substitute for U.S. GAAP. The following table

reconciles (unaudited) net income and EPS to adjusted net income

and adjusted EPS, respectively, for the periods presented:

Three months ended

Year ended

(in U.S. dollars, except share

data)

March 31, 2024

March 31, 2023

March 31, 2024

March 31, 2023

Net income

$

79,240,198

$

76,021,035

$

307,446,913

$

172,443,930

Unrealized (gain)/loss on derivatives

(1,656,117

)

2,080,999

(5,665

)

(2,766,065

)

Adjusted net income

$

77,584,081

$

78,102,034

$

307,441,248

$

169,677,865

Earnings per common share—diluted

$

1.96

$

1.89

$

7.60

$

4.29

Unrealized (gain)/loss on derivatives

(0.05

)

0.05

—

(0.07

)

Adjusted earnings per common

share—diluted

$

1.91

$

1.94

$

7.60

$

4.22

The following table presents our unaudited balance sheets as of

the dates presented:

As of

As of

March 31, 2024

March 31, 2023

Assets

Current assets

Cash and cash equivalents

$

282,507,971

$

148,797,232

Trade receivables, net and accrued

revenues

659,567

3,282,256

Due from related parties

52,352,942

73,070,095

Inventories

2,393,379

2,642,395

Available-for-sale debt securities

11,530,939

—

Derivative instruments

5,139,056

—

Prepaid expenses and other current

assets

14,297,917

8,507,007

Total current assets

368,881,771

236,298,985

Fixed assets

Vessels, net

1,208,588,213

1,263,928,605

Vessel under construction

23,829,678

—

Other fixed assets, net

—

48,213

Total fixed assets

1,232,417,891

1,263,976,818

Other non-current assets

Deferred charges, net

12,544,098

8,367,301

Derivative instruments

4,145,153

9,278,544

Due from related parties—non-current

25,300,000

20,900,000

Restricted cash—non-current

75,798

76,418

Operating lease right-of-use assets

191,700,338

158,179,398

Available-for-sale debt securities

—

11,366,838

Other non-current assets

2,585,116

469,227

Total assets

$

1,837,650,165

$

1,708,913,529

Liabilities and shareholders’

equity

Current liabilities

Trade accounts payable

$

10,185,962

$

10,807,376

Accrued expenses

3,948,420

5,637,725

Due to related parties

7,283

168,793

Deferred income

486,868

208,558

Current portion of long-term operating

lease liabilities

32,491,122

23,407,555

Current portion of long-term debt

53,543,315

53,110,676

Dividends payable

1,149,665

1,255,861

Total current liabilities

101,812,635

94,596,544

Long-term liabilities

Long-term debt—net of current portion and

deferred financing fees

551,549,215

604,256,670

Long-term operating lease liabilities

159,226,326

134,782,483

Other long-term liabilities

1,528,906

1,431,510

Total long-term liabilities

712,304,447

740,470,663

Total liabilities

814,117,082

835,067,207

Commitments and contingencies

—

—

Shareholders’ equity

Preferred stock, $0.01 par value,

50,000,000 shares authorized, none issued nor outstanding

—

—

Common stock, $0.01 par value, 450,000,000

shares authorized, 51,995,027 and 51,630,593 shares issued,

40,619,448 and 40,382,730 shares outstanding (net of treasury

stock), as of March 31, 2024 and March 31, 2023, respectively

519,950

516,306

Additional paid-in-capital

772,714,486

764,383,292

Treasury stock, at cost; 11,375,579 and

11,247,863 shares as of March 31, 2024 and March 31, 2023,

respectively

(126,837,239

)

(122,896,838

)

Retained earnings

377,135,886

231,843,562

Total shareholders’ equity

1,023,533,083

873,846,322

Total liabilities and shareholders’

equity

$

1,837,650,165

$

1,708,913,529

Conference Call

A conference call to discuss the results will be held on

Wednesday, May 22, 2024 at 10:00 a.m. ET. The conference call can

be accessed live by dialing 1-877-407-9716, or for international

callers, 1-201-493-6779, and requesting to be joined into the

Dorian LPG call.

A live webcast of the conference call will also be available

under the investor section at www.dorianlpg.com.

A replay will be available at 1:00 p.m. ET the same day and can

be accessed by dialing 1-844-512-2921, or for international

callers, 1-412-317-6671. The passcode for the replay is 13746707.

The replay will be available until May 29, 2024, at 11:59 p.m.

ET.

About Dorian LPG Ltd.

Dorian LPG is a leading owner and operator of modern Very Large

Gas Carriers (“VLGCs”) that transport liquefied petroleum gas

globally. Our fleet currently consists of twenty-five modern VLGCs,

including twenty ECO VLGCs and four dual-fuel ECO VLGCs. Dorian LPG

has offices in Stamford, Connecticut, USA; Copenhagen, Denmark; and

Athens, Greece.

Visit our website at www.dorianlpg.com. Information on the

Company’s website does not constitute a part of and is not

incorporated by reference into this press release.

Forward-Looking & Other Cautionary Statements

The cash dividends referenced in this release are irregular

dividends. All declarations of dividends are subject to the

determination and discretion of our Board of Directors based on its

consideration of various factors, including the Company’s results

of operations, financial condition, level of indebtedness,

anticipated capital requirements, contractual restrictions,

restrictions in its debt agreements, restrictions under applicable

law, its business prospects and other factors that our Board of

Directors may deem relevant.

This press release contains "forward-looking statements."

Statements that are predictive in nature, that depend upon or refer

to future events or conditions, or that include words such as

"expects," "anticipates," "intends," "plans," "believes,"

"estimates," "projects," "forecasts," "may," "will," "should" and

similar expressions are forward-looking statements. These

statements are not historical facts but instead represent only the

Company's current expectations and observations regarding future

results, many of which, by their nature are inherently uncertain

and outside of the Company's control. Where the Company expresses

an expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, the Company’s forward-looking

statements are subject to risks, uncertainties, and other factors,

which could cause actual results to differ materially from future

results expressed, projected, or implied by those forward-looking

statements. The Company’s actual results may differ, possibly

materially, from those anticipated in these forward-looking

statements as a result of certain factors, including changes in the

Company’s financial resources and operational capabilities and as a

result of certain other factors listed from time to time in the

Company's filings with the U.S. Securities and Exchange Commission.

For more information about risks and uncertainties associated with

Dorian LPG’s business, please refer to the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of Dorian LPG’s SEC filings, including, but

not limited to, its annual report on Form 10-K and quarterly

reports on Form 10-Q. The Company does not assume any obligation to

update the information contained in this press release.

Source: Dorian LPG Ltd.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240522761238/en/

Ted Young Chief Financial Officer +1 (203) 674-9900

IR@dorianlpg.com

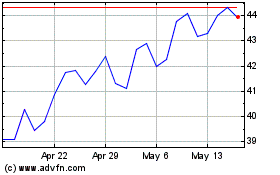

Dorian LPG (NYSE:LPG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dorian LPG (NYSE:LPG)

Historical Stock Chart

From Jan 2024 to Jan 2025