Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 27 2024 - 5:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-39654

Lufax Holding Ltd

(Registrant’s name)

Building

No. 6

Lane 2777, Jinxiu East Road

Pudong New District, Shanghai

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F. Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Lufax Holding Ltd |

|

|

|

|

|

|

|

|

By: |

|

/s/ Alston Peiqing Zhu |

|

|

|

|

Name: |

|

Alston Peiqing Zhu |

|

|

|

|

Title: |

|

Chief Financial Officer |

|

|

|

| Date: September 27, 2024 |

|

|

|

|

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this joint announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this joint announcement.

This joint announcement appears for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for

securities of Lufax, nor is it a solicitation of any vote or approval in any jurisdiction. This joint announcement is not for release, publication or distribution into any jurisdiction where to do so would constitute a violation of the relevant laws

of such jurisdiction.

To the extent the Lufax Offers referred to in this joint announcement are being made into the U.S., they are being made

directly by the Joint Offerors. References in this joint announcement to the Lufax Offers being made by Morgan Stanley on behalf of the Joint Offerors should be construed accordingly.

Ping An Insurance (Group) Company of China, Ltd.

(A joint stock limited company incorporated in the

People’s Republic of China with limited liability)

Stock Code: 2318 (HKD counter) and

82318 (RMB counter)

An

Ke Technology

Company Limited

(Incorporated in Hong Kong with limited liability)

China Ping An Insurance

Overseas (Holdings) Limited

(Incorporated in Hong Kong with limited liability)

陆 金

所 控 股

有 限 公

司

(Incorporated in the Cayman Islands with limited liability)

(Stock Code: 6623)

(NYSE

Stock Ticker: LU)

JOINT ANNOUNCEMENT

(1) MANDATORY UNCONDITIONAL CASH OFFERS (TRIGGERED BY ELECTION OF LUFAX SPECIAL DIVIDEND) BY MORGAN STANLEY FOR AND ON BEHALF OF

THE JOINT OFFERORS (I) TO ACQUIRE ALL ISSUED LUFAX SHARES AND LUFAX ADSs AND LUFAX SHARES AND LUFAX ADSs TO BE ISSUED UNDER THE LUFAX 2014 SHARE INCENTIVE PLAN AND THE LUFAX 2019 PERFORMANCE SHARE UNIT PLAN (OTHER THAN THOSE ALREADY OWNED BY

THE OFFEROR GROUP) AND (II) TO CANCEL ALL OUTSTANDING LUFAX OPTIONS; AND

(2) LUFAX PSU ARRANGEMENT WITH RESPECT TO ALL UNVESTED

LUFAX PSUs

1

DESPATCH OF COMPOSITE DOCUMENT

|

|

|

| Financial adviser to the Joint Offerors |

|

Financial adviser to Lufax |

|

Morgan Stanley Asia Limited |

|

|

|

|

Independent Financial Adviser to the Lufax |

|

|

Independent Board Committee |

|

|

|

|

|

INTRODUCTION

References

are made to the joint announcements jointly published by the Offeror Group and Lufax on July 3, 2024 regarding the Lufax Offers (the “Rule 3.5 Announcement”) and on August 26, 2024 regarding satisfaction of all the pre-conditions. Unless the context requires otherwise, capitalized terms used herein shall have the same meanings as those defined in the Rule 3.5 Announcement.

DESPATCH OF THE COMPOSITE DOCUMENT

The Composite

Document (accompanied by the forms of acceptance), containing, among other things, (i) details of the Lufax Offers (including the expected timetable and terms of the Lufax Offers); (ii) a letter from the board of directors of Lufax;

(iii) a letter of recommendation from the Lufax Independent Board Committee to the Independent Lufax Shareholders, the holders of Lufax ADSs, the Lufax Optionholders and the Lufax PSU Holders regarding the Lufax Offers; and (iv) a letter of

advice from the independent financial adviser of Lufax to the Lufax Independent Board Committee regarding the Lufax Offers, has been despatched to the Independent Lufax Shareholders, the Lufax Optionholders and the Lufax PSU Holders on

September 27, 2024 in accordance with the Takeovers Code.

EXPECTED TIMETABLE

The timetable set out below, as reproduced from the Composite Document, is indicative only and is subject to change. Any changes to the timetable will be

jointly announced by the Offeror Group and Lufax. Unless otherwise expressly stated, all time and date references contained in this joint announcement refer to Hong Kong time and dates unless otherwise stated.

2

|

|

|

|

|

| Despatch date of the Composite Document and the accompanying Form(s) of Acceptance and

commencement date of the Lufax Offers (Note 1) |

|

|

Friday,

September 27, 2024 |

|

|

|

| Latest time and date for acceptance of the Lufax non-US

Offer on the Closing Date (Notes 2, 5 and 6) |

|

|

4:00 p.m. on Monday,

October 28, 2024 |

|

|

|

| Latest time and date for withdrawal of Lufax US Offer (Note 6 and 7) |

|

|

4:00 a.m. on Monday,

October 28, 2024

(New York time) |

|

|

|

| Latest time and date for acceptance of the Lufax US Offer on the Closing Date (Notes 6 and 7)

|

|

|

4:00 a.m. on Monday,

October 28, 2024

(New York Time) |

|

|

|

| Closing Date (Notes 3 and 5) |

|

|

Monday,

October 28, 2024 |

|

|

|

| Announcement of the results of the Lufax Offers as at the Closing Date published (Notes 2 and

5) |

|

|

by 7:00 p.m. on Monday,

October 28, 2024 |

|

|

|

| Latest date for posting of remittances for the amount due in respect of valid acceptances received

under the Lufax Offers (Notes 4 and 5) |

|

|

Wednesday,

October 30, 2024 |

|

Notes:

| 1. |

The Lufax non-US Offer, which is unconditional, is open for acceptance

on and from Friday, September 27, 2024, being the date of posting of the Composite Document, until 4:00 p.m. on the Closing Date or such later time and/or date as the Joint Offerors may determine and announce with the consent of the Executive

and in accordance with the Takeovers Code. The Lufax US Offer, which is also unconditional, is open for acceptance on and from Friday, September 27, 2024, being the date of posting of US Offer Document, until 4:00 a.m. (New York time) on the

Closing Date or such later time and/or date as the Joint Offerors may determine and announce, in which case the Joint Offerors are required to extend the Lufax US Offer for the minimum period required by any rule, regulation, interpretation or

position of the SEC or its staff or by any rule, regulation or position of NYSE or by any applicable US federal securities law. |

| 2. |

Beneficial owners of Lufax Shares who hold their Lufax Shares in CCASS directly as an investor participant or

indirectly via a broker or custodian participant should note the timing requirements (as set out in Appendix I to the Composite Document) for causing instructions to be made to CCASS in accordance with the General Rules of CCASS and CCASS

Operational Procedures. |

3

| 3. |

In accordance with the Takeovers Code, the Lufax Offers must initially be opened for acceptance for at least twenty-one (21) days following the date on which the Composite Document is posted. As the Lufax Offers will, in addition to compliance with the Takeovers Code, also be made in the United States pursuant to the

applicable US tender offer rules, the Lufax Offers must remain open for at least twenty (20) US Business Days following the date on which the Composite Document is posted. Therefore, the Lufax non-US

Offer, Lufax Option Offer and Lufax PSU Arrangement will initially remain open for acceptances until 4:00 p.m. on Monday, October 28, 2024 (Hong Kong time) and the Lufax US Offer will initially remain open for acceptances until 4:00 a.m. on

Monday, October 28, 2024 (New York time), unless the Joint Offerors revise or extend the Lufax Offers in accordance with the Takeovers Code or required by applicable laws. The Joint Offerors do not intend to extend the Lufax Offers save in

wholly exceptional circumstances, as provided in Rule 18.2 of the Takeovers Code, or if required by a governmental body of competent jurisdiction. If the Joint Offerors are to extend the Lufax Offers, they are required to extend the Lufax Offers for

the minimum period required by any rule, regulation, interpretation or position of the SEC or its staff or by any rule, regulation or position of NYSE or by any applicable US federal securities law. The Offeror Group and Lufax will jointly issue an

announcement no later than 7:00 p.m. on Monday, October 28, 2024 (Hong Kong time) in relation to any extension of the Lufax Offers, in which the announcement will state either the next closing date or that the Lufax Offers will remain open

until further notice. In the latter case, at least fourteen (14) days’ notice by way of an announcement will be given before the Lufax Offers are closed to those Independent Lufax Shareholders, Lufax ADS Holders, Lufax Optionholders and

Lufax PSU Holders who have not accepted the Lufax Offers. |

| 4. |

For details of settlement of the Lufax Offers, please refer to the section headed “5. Settlement” in

Appendix I to the Composite Document. Acceptances of the Lufax Offers shall be irrevocable and not capable of being withdrawn, except in the circumstances set out in the section headed “9. Right of Withdrawal” in Appendix I to the

Composite Document. |

| 5. |

If there is a tropical cyclone warning signal no. 8 or above, a “black rainstorm warning signal”, or

an “extreme conditions” warning in force in Hong Kong and still in force at 12:00 noon on any of these dates, the relevant date and time will be moved to the same time, if applicable, on the next HK Business Day which does not have either

of those warnings in force after 12:00 noon. |

| 6. |

Please note that although the Lufax US Offer officially closes at 4:00 a.m. (New York time) on Monday,

October 28, 2024, the Tender Agent’s business hours are from 9:00 a.m. to 5:00 p.m. (New York time). |

| 7. |

To withdraw an acceptance in relation to the Lufax US Offer, you must deliver a written notice of withdrawal

with the required information to the Tender Agent. The Lufax US Offer will be deemed not to have been validly accepted in respect of any Lufax Shares or Lufax ADSs acceptances for which have been validly withdrawn. However, the Lufax US Offer may be

accepted again in respect of any withdrawn Lufax Shares or Lufax ADSs by following the procedures described in “Appendix I – Further Terms and Procedures for Acceptance of the Lufax Offers” at any time prior to expiry of the Lufax US

Offer. Acceptances under the Lufax non-US Offer, the Lufax Option Offer, and the Lufax PSU Arrangement are irrevocable and withdrawals will not be permitted. |

Save as mentioned above, if the latest time for acceptance of the Lufax Offers does not take effect on the date and time as stated above, the other dates

mentioned above may be affected. The Offeror Group and Lufax will notify the Independent Lufax Shareholders, Lufax ADS Holders, Lufax Optionholders and Lufax PSU Holders by way of announcement(s) on any change to the expected timetable as soon as

practicable.

Shareholders are encouraged to read the Composite Document and the forms of acceptance carefully, including the advice from the

independent financial adviser of Lufax to the Lufax Independent Board Committee and the recommendations from the Lufax Independent Board Committee in respect of the Lufax Offers, before deciding whether or not to accept the Lufax Offers.

4

Lufax Shareholders, holders of Lufax ADSs, Lufax Optionholders, Lufax PSU Holders and potential investors

in Lufax should exercise caution when dealing in the securities of Lufax and if they are in any doubt about their position, they should consult their professional adviser(s).

|

|

|

| By order of the board of directors of |

|

By order of the board of directors of |

| Ping An Insurance (Group) Company of |

|

Lufax Holding Ltd |

| China, Ltd. |

|

Yong Suk CHO |

| Sheng Ruisheng |

|

Chairman of the Board and |

| Company Secretary |

|

Chief Executive Officer |

|

|

| By order of the board of directors of |

|

|

| An Ke Technology Company Limited |

|

|

| Wang Shiyong |

|

|

| Director |

|

|

|

|

| By order of the board of directors of |

|

|

| China Ping An Insurance |

|

|

| Overseas (Holdings) Limited |

|

|

| Tung Hoi |

|

|

| Director |

|

|

|

|

| Shenzhen, the PRC, September 27, 2024 |

|

|

As at the date of this joint announcement, the executive directors of Ping An Group are Ma Mingzhe, Xie Yonglin, Michael

Guo, Cai Fangfang and Fu Xin; the non-executive directors of Ping An Group are Soopakij Chearavanont, Yang Xiaoping, He Jianfeng and Cai Xun; and the independent

non-executive directors of Ping An Group are Ng Sing Yip, Chu Yiyun, Liu Hong, Ng Kong Ping Albert, Jin Li and Wang Guangqian.

The directors of Ping An Group jointly and severally accept full responsibility for the accuracy of the information contained in this joint announcement

(other than the information relating to the Lufax Group) and confirm, having made all reasonable inquiries, that to the best of their knowledge, opinions expressed in this joint announcement (other than those expressed by the directors of the Lufax,

An Ke Technology and Ping An Overseas Holdings) have been arrived at after due and careful consideration and there are no other facts not contained in this joint announcement the omission of which would make any statement in this joint announcement

misleading.

As at the date of this joint announcement, the directors of An Ke Technology are Wang Shiyong, Huang Philip and Cheung Siu Man.

The directors of An Ke Technology jointly and severally accept full responsibility for the accuracy of the information contained in this joint

announcement (other than the information relating to the Lufax Group, Ping An Group and Ping An Overseas Holdings) and confirm, having made all reasonable inquiries, that to the best of their knowledge, opinions expressed in this joint announcement

(other than those expressed by the directors of Lufax, Ping An Group and Ping An Overseas Holdings) have been arrived at after due and careful consideration and there are no other facts not contained in this joint announcement the omission of which

would make any statement in this joint announcement misleading.

5

As at the date of this joint announcement, the directors of Ping An Overseas Holdings are Cheng Jianxin,

Deng Benjamin Bin, Tung Hoi and Zhang Zhichun.

The directors of Ping An Overseas Holdings jointly and severally accept full responsibility for the

accuracy of the information contained in this joint announcement (other than the information relating to the Lufax Group, Ping An Group and An Ke Technology) and confirm, having made all reasonable inquiries, that to the best of their knowledge,

opinions expressed in this joint announcement (other than those expressed by the directors of Lufax, Ping An Group and An Ke Technology) have been arrived at after due and careful consideration and there are no other facts not contained in this

joint announcement the omission of which would make any statement in this joint announcement misleading.

As at the date of this joint

announcement, the board of directors of Lufax comprises Mr. Yong Suk CHO and Mr. Gregory Dean GIBB as the executive directors, Mr. Yonglin XIE, Ms. Xin FU and Mr. Yuqiang HUANG as the

non-executive directors and, Mr. Rusheng YANG, Mr. Weidong LI, Mr. Xudong ZHANG and Mr. David Xianglin LI as the independent non-executive directors.

The directors of Lufax jointly and severally accept full responsibility for the accuracy of the information contained in this joint announcement

(other than the information relating to the Offeror Group) and confirm, having made all reasonable inquiries, that to the best of their knowledge, opinions expressed in this joint announcement (other than those expressed by the directors of the

Offeror Group) have been arrived at after due and careful consideration and there are no other facts not contained in this joint announcement the omission of which would make any statement in this joint announcement misleading.

6

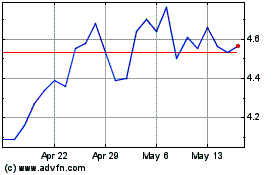

Lufax (NYSE:LU)

Historical Stock Chart

From Feb 2025 to Mar 2025

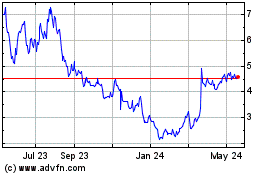

Lufax (NYSE:LU)

Historical Stock Chart

From Mar 2024 to Mar 2025