McKesson Advances Specialty Leadership; Signs Agreement to Acquire Controlling Interest in PRISM Vision Holdings, LLC

February 04 2025 - 7:00AM

Business Wire

Acquisition enhances McKesson’s capabilities as

a national partner in retina and ophthalmology care

McKesson Corporation (NYSE: MCK) announced today that it signed

a definitive agreement to acquire a controlling interest in PRISM

Vision Holdings, LLC (PRISM Vision), a premier provider of general

ophthalmology and retina management services, from Quad-C.

McKesson will purchase an 80% interest for approximately $850

million. PRISM Vision physicians will continue to retain a 20%

interest in PRISM Vision.

“The acquisition of PRISM Vision will allow McKesson to build on

our leadership in community practice and specialty solutions, while

building a platform to serve the high-growth area of retina and

ophthalmology,” said Brian Tyler, chief executive officer of

McKesson. “PRISM Vision has a strong track record and value

proposition for community-based physicians and a strong leadership

team focused on delivering superior retinal care, enhancing the

provider experience and delivering innovative clinical research

capabilities. We intend to develop a leading platform for retinal

care, delivering differentiated solutions and value across

providers, biopharma partners and patients. McKesson has a long

track record of leading practice management and clinical research

outcomes with our differentiated Oncology platform, and we are

excited to leverage this expertise to serve the high-growth area of

retina and ophthalmology. This will allow us to expand our suite of

solutions and continue to pursue our purpose of advancing health

outcomes for all.”

This transaction will enable McKesson to deliver on several key

strategic objectives:

- Develop a leading retinal and ophthalmology platform, expanding

McKesson’s differentiated value proposition, clinical services and

distribution offerings. PRISM affiliated practices include more

than 180 providers, 91 office locations and seven ambulatory

surgery centers

- Expand data and analytics capabilities

- Further innovative investment in clinical research

opportunities

- Deepen biopharma partnerships

“McKesson’s long history of supporting specialty physicians by

emphasizing clinical quality and enhancing patients’ access to

care, is completely aligned with the core values and culture of

PRISM Vision Group,” said Dr. Steven Madreperla, chief executive

officer of PRISM Vision. “We are thrilled to be able to bring

together PRISM’s exceptional provider base and service delivery

platform with McKesson’s deep expertise in care delivery to further

develop and expand our eye care network together.”

Following completion of the transaction, PRISM Vision will be

consolidated within McKesson’s U.S. Pharmaceutical segment. The

transaction is subject to customary closing conditions, including

necessary regulatory clearances. Upon closing, PRISM Vision is

anticipated to be approximately $0.20 to $0.30 accretive to

McKesson’s Adjusted Earnings Per Diluted Share in the first 12

months, and $0.65 to $0.75 accretive by the end of the third year

following the close of the transaction.

Cautionary Statements

Except for historical information, statements in this press

release regarding McKesson’s proposed acquisition and related

arrangements constitute “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, that involve risks and

uncertainties that could cause actual results to differ materially

from those in those statements. It is not possible to identify all

such risks and uncertainties. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date they are first made. Except to the extent required by law, the

company undertakes no obligation to publicly update forward-looking

statements. We encourage investors to read the important risk

factors described in the company’s most recent Form 10-K filed with

the Securities and Exchange Commission. These risk factors include,

but are not limited to: we may be unable to obtain necessary

regulatory approvals; we may not achieve expected outcomes from the

transaction; we might be adversely impacted by delays or other

difficulties, including related to the transactions described in

this press release; we from time to time record significant charges

from impairment to goodwill, intangibles and other assets or

investments; we might be adversely impacted by events outside of

our control, such as widespread public health issues, natural

disasters, political events, economic events and other catastrophic

events.

About McKesson

McKesson Corporation is a diversified healthcare services leader

dedicated to advancing health outcomes for patients everywhere. Our

teams partner with biopharma companies, care providers, pharmacies,

manufacturers, governments, and others to deliver insights,

products, and services to help make quality care more accessible

and affordable. Learn more about how McKesson is impacting

virtually every aspect of healthcare at McKesson.com and read Our

Stories.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203778374/en/

Investors investors@mckesson.com

Media Relations mediarelations@mckesson.com

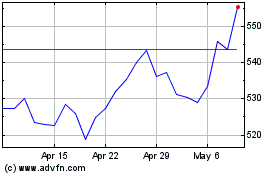

McKesson (NYSE:MCK)

Historical Stock Chart

From Jan 2025 to Feb 2025

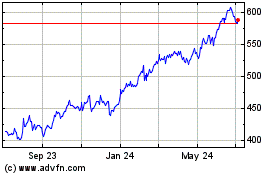

McKesson (NYSE:MCK)

Historical Stock Chart

From Feb 2024 to Feb 2025