0000067716false00000677162025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

MDU Resources Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-03480 | 30-1133956 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer |

| incorporation) | | Identification No.) |

1200 West Century Avenue

P.O. Box 5650

Bismarck, North Dakota | | |

(Address of principal executive offices) |

Registrant’s telephone number, including area code: (701) 530-1000

| | |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | | MDU | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 6, 2025, MDU Resources Group, Inc. (the “Company”) issued a news release (the “News Release”) announcing its financial results for the fourth quarter and full-year of 2024. A copy of the News Release is furnished as Exhibit 99 to this Current Report on Form 8-K, which, in its entirety, is incorporated herein by reference.

The Company is webcasting a conference call on February 6, 2025 to discuss its fourth quarter and full-year 2024 financial results, during which the Company will provide an update on the business.

The Company is making reference to certain financial measures not presented in accordance with U.S. generally accepted accounting principles (“GAAP”) in the News Release, an investor presentation concerning its fourth quarter and full-year 2024 financial results (the “Investor Presentation”), and a conference call. Reconciliations of the non-GAAP financial measures to the nearest comparable GAAP financial measures are contained in the News Release. The Company believes these non-GAAP financial measures provide useful information to investors because they allow for a more direct comparison of the fourth quarter and full-year 2024 performance to the performance of adjusted continuing operations and adjusted earnings per share in the comparable prior periods. The non-GAAP financial measures are provided in addition to, and not as alternatives to, the Company’s reported results prepared in accordance with GAAP. Reconciliations to GAAP are provided in the News Release and Investor Presentation.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

In conjunction with the News Release, the Company also made available the Investor Presentation. The Investor Presentation, which is available under the “Investor Relations” section of the Company’s corporate website, located at investor.mdu.com. Information on the Company’s corporate website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the U.S. Securities and Exchange Commission.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 6, 2025

| | | | | | | | |

| MDU Resources Group, Inc. |

| |

| |

| By: | /s/ Jason L. Vollmer |

| | |

| | Jason L. Vollmer |

| | Chief Financial Officer |

MDU Resources Reports Strong Performance; Initiates Guidance for 2025

•Net income of $281.1 million.

•Regulated energy delivery earnings totaled $189.7 million, 13.6% increase year-over-year.

•Record annual pipeline transportation volumes, up 8.1% year-over-year.

•Utility rate base grew 6.8% year-over-year.

•2025 guidance: earnings per share in the range of $0.88 to $0.98.

BISMARCK, N.D. – February 6, 2025 – MDU Resources Group Inc. (NYSE: MDU) today announced its financial results for 2024, showcasing strong year-over-year regulated growth. Key infrastructure projects and regulatory rate relief drove robust performance, positioning the company for continued success as a premier regulated energy delivery business following the successful spinoff of Everus Construction Group on Oct. 31, 2024.

“MDU Resources delivered exceptional results in 2024, underscoring the strength of our employees, strategic investments and continued focus on operational excellence,” said Nicole A. Kivisto, president and CEO of MDU Resources. “The growth in our regulated businesses is evidenced by our record annual transportation volumes, effective regulatory outcomes, and strong customer growth.”

The following summarizes the company's year-end results for the twelve months ended Dec. 31:

| | | | | | | | |

| 2024 | 2023 |

| (In millions, except per share amounts) |

| Net income | $ | 281.1 | | $ | 414.7 | |

| Earnings per share, diluted | $ | 1.37 | | $ | 2.03 | |

| | |

Income from continuing operations1 | $ | 181.1 | | $ | 330.1 | |

Earnings per share from continuing operations, diluted1 | $ | 0.88 | | $ | 1.62 | |

| | |

Adjusted income from continuing operations2,3 | $ | 184.4 | | $ | 150.8 | |

Adjusted earnings per share from continuing operations, diluted2,3 | $ | 0.90 | | $ | 0.74 | |

| | |

| Regulated energy delivery earnings | $ | 189.7 | | $ | 167.0 | |

1 Includes the gain of $186.6 million on the tax-free exchange of the retained shares of Knife River in the fourth quarter 2023. MDU Resources has reported Knife River’s and Everus' results and the transaction costs and certain interest expenses associated with the spinoffs as discontinued operations, and MDU Resources’ prior period results have been restated to reflect the spinoffs.

2 Adjusted income from continuing operations excludes the gain on the tax-free exchange of the retained shares of Knife River as well as costs associated with MDU Resources’ strategic initiatives which did not meet the criteria for discontinued operations.

3Adjusted income from continuing operations and adjusted earnings per share from continuing operations are non-GAAP financial measures. Additional explanation is provided in the "Non-GAAP Financial Measures" section of this news release.

"As we look to 2025 and beyond, MDU Resources is committed to further strengthening its position as a leading regulated energy delivery business,” Kivisto added. “Our new vision, energizing lives for a better tomorrow, sets our sights on sustained growth and building stockholder value while ensuring we continue to meet the evolving needs of the communities we serve.”

Electric Utility Segment

•Electric utility earnings up 4.5% year-over-year, totaling $74.8 million.

•Rate relief in North Dakota, South Dakota and Montana contributed $7.1 million in additional revenue.

The electric utility segment achieved solid growth in 2024, supported by rate relief. Gains were partially offset by lower volumes from the majority of customers, mainly from cooler weather during typically warm months, and higher operations and maintenance expense.

Natural Gas Distribution Segment

•Earnings of $46.9 million, a slight year-over-year decrease, primarily due to higher operations and maintenance and depreciation and amortization expenses.

•Benefited from rate relief primarily from North Dakota and South Dakota regulatory actions, contributing $14.1 million in revenue.

The natural gas distribution segment maintained stable performance, despite some higher expenses. Rate relief actions and customer growth contributed to consistent performance.

Regulatory Update

•On Nov. 7, 2024, the North Dakota Public Service Commission approved an all-party settlement reflecting an annual revenue increase of $9.4 million, effective Dec. 1, 2024, stemming from a general rate case the utility filed on Nov. 1, 2023, requesting $11.6 million in annual revenue.

•On Dec. 11, 2024, the utility filed a negotiated settlement agreement with the Washington Utilities and Transportation Commission relating to a multi-year general rate case filed March 29, 2024. The agreement calls for an annual revenue increase of $29.8 million effective March 1, 2025, and $10.8 million effective March 1, 2026.

•On Jan. 14, 2025, the utility was granted interim rate relief of $7.7 million by the Montana Public Service Commission for a general rate case filed July 15, 2024, requesting $9.4 million in annual revenue. The interim rate is effective Feb. 1, 2025.

Pipeline Segment

•Record earnings up 45.0% year-over-year, totaling $68.0 million.

•Record annual transportation volumes in 2024 due to new projects placed in service in late 2023 and throughout 2024.

•Storage-related revenue grew by $7.1 million in 2024, reflecting continued strong demand for natural gas storage services.

The pipeline segment delivered record annual results in 2024, driven by strong transportation and storage revenue from the successful execution of several strategic expansion projects and new Federal Energy Regulatory Commission approved rates effective Aug. 1, 2023. The business also benefited from non-recurring items, including proceeds received from a customer settlement that was recorded in other income and a decrease in the company's effective state income tax rate. Earnings were partially offset by higher operations and maintenance, depreciation and amortization, and interest expenses.

The pipeline segment continues to execute on its growth strategy with several projects completed in 2024 and additional projects in various stages of development, including:

•Purchase of a 28-mile natural gas pipeline lateral in northwestern North Dakota which closed on Nov. 1, 2024.

•The Wahpeton Expansion project in eastern North Dakota which was placed in service on Dec. 1, 2024. The project adds approximately 20 million cubic feet of natural gas transportation capacity per day.

•Signed agreements for an expansion project to serve a new electric generation facility in northwest North Dakota, with a targeted in-service date of late 2028.

•Potential Bakken East Pipeline project, which could consist of 375 miles of pipeline construction from western North Dakota to the eastern part of the state. A non-binding open season for the project concluded on Jan. 31, 2025. The company is currently evaluating the results.

Discontinued Operations and Adjusted Earnings

On October 31, 2024, MDU Resources successfully completed the spinoff of Everus Construction Group, which became an independent, publicly traded company. MDU Resources has reported Everus’ and Knife River's results and the transaction costs and certain interest expenses associated with the spinoffs as discontinued operations, and MDU Resources’ prior period results have been restated to reflect the spinoffs.

MDU Resources is reporting adjusted income from continuing operations and adjusted earnings per share that exclude the costs associated with its strategic initiatives which did not meet the criteria for discontinued operations. Adjusted income from continuing operations and adjusted earnings per share are non-GAAP measures. The “Non-GAAP Financial Measures” section of this news release explains the earnings adjustments. More information about MDU Resources’ strategic initiatives can be found on the company’s website at www.mdu.com.

Guidance

For 2025, MDU Resources expects earnings per share to be in the range of $0.88 to $0.98. In addition, the company has $533 million in capital investment planned for 2025.

The expected 2025 results are based on these assumptions:

•Normal weather, economic and operating conditions.

•Continued availability of necessary equipment and materials.

•Electric and natural gas customer growth continuing at a rate of 1%-2% annually.

•No equity issuances.

Corporate Strategy

MDU Resources is committed to its CORE strategy, which prioritizes customers and communities, operational excellence, returns focused initiatives and an employee-driven culture. The company anticipates a capital investment of approximately $3.1 billion for 2025-2029, 7% to 8% long-term compound annual growth on utility rate base and customer growth of 1%-2% annually. Additionally, the company anticipates 6% to 8% long-term compound annual growth on earnings per share while targeting a 60% to 70% annual dividend payout ratio.

Conference Call

MDU Resources’ management will discuss on a webcast at 2 p.m. ET today the company’s 2024 results. The webcast can be accessed at www.mdu.com under the “Investors” heading. Select “Events & Presentations,” and click on “Year-End 2024 Earnings Conference Call.” A replay of the webcast will be available at the same location.

About MDU Resources

MDU Resources Group, Inc., a member of the S&P SmallCap 600 index, provides essential products and services through its regulated electric and natural gas distribution and pipeline segments. Founded in 1924 as a small electric utility, MDU Resources has grown to serve more than 1.2 million customers across eight states and is celebrating its 100th anniversary. Learn more at www.mdu.com/100th-anniversary. The company operates in the Pacific Northwest and Midwest, constructing and operating infrastructure that delivers natural gas and electricity that energizes homes and businesses. For more information about MDU Resources, visit www.mdu.com or contact the Investor Relations Department at investor@mduresources.com.

Financial Contact: Brent Miller, treasurer, 701-530-1730

Media Contact: Byron Pfordte, director of integrated communications, 208-377-6050

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the federal securities laws. Other than statements of historical facts, all statements which address activities, events or developments that the company anticipates will or may occur in the future, including, but not limited to, such things as estimates for growth, stockholder value creation, our CORE strategy, capital expenditures, financial guidance and other such matters, are forward-looking statements. These forward-looking statements are based on many assumptions and factors, which are detailed in the company's filings with the U.S. Securities and Exchange Commission.

While made in good faith, these forward-looking statements are based largely on our expectations and judgments and are subject to a number of risks and uncertainties, many of which are unforeseeable and beyond our control. For additional discussion regarding risks and uncertainties that may affect forward-looking statements, see "Risk Factors" disclosed in the company's most recent Annual Report on Form 10-K, and subsequent filings. Any changes in such assumptions or factors could produce significantly different results. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Except as required by applicable law, the company undertakes no obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise.

| | | | | | | | | | | | | | |

| Consolidated Statements of Income | | |

| Three Months Ended | Twelve Months Ended |

| December 31, | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions, except per share amounts) |

| (Unaudited) |

Operating revenues | $ | 535.5 | | $ | 499.9 | | $ | 1,758.0 | | $ | 1,803.4 | |

| Operating expenses: | | | | |

Operation and maintenance | 105.7 | | 99.9 | | 414.5 | | 407.1 | |

| Purchased natural gas sold | 223.8 | | 200.1 | | 630.4 | | 743.0 | |

| Electric fuel and purchased power | 32.2 | | 41.0 | | 141.2 | | 134.8 | |

| Depreciation and amortization | 50.8 | | 48.8 | | 200.1 | | 190.4 | |

| Taxes, other than income | 28.5 | | 22.2 | | 106.2 | | 103.1 | |

| Total operating expenses | 441.0 | | 412.0 | | 1,492.4 | | 1,578.4 | |

| Operating income | 94.5 | | 87.9 | | 265.6 | | 225.0 | |

Gain on tax-free exchange of retained shares in Knife River | — | | 16.4 | | — | | 186.6 | |

| Other income | 10.1 | | 11.2 | | 41.4 | | 33.3 | |

| Interest expense | 28.0 | | 28.6 | | 108.3 | | 104.6 | |

| Income before income taxes | 76.6 | | 86.9 | | 198.7 | | 340.3 | |

Income tax expense (benefit) | 6.1 | | (49.3) | | 17.6 | | 10.2 | |

| Income from continuing operations | 70.5 | | 136.2 | | 181.1 | | 330.1 | |

| Discontinued operations, net of tax | (15.3) | | 34.5 | | 100.0 | | 84.6 | |

| Net income | $ | 55.2 | | $ | 170.7 | | $ | 281.1 | | $ | 414.7 | |

| | | | |

| Earnings per share – basic: | | | | |

| Income from continuing operations | $ | .35 | | $ | .67 | | $ | .89 | | $ | 1.62 | |

| Discontinued operations, net of tax | (.08) | | .17 | | .49 | | .42 | |

| Earnings per share – basic | $ | .27 | | $ | .84 | | $ | 1.38 | | $ | 2.04 | |

| Earnings per share – diluted: | | | | |

| Income from continuing operations | $ | .34 | | $ | .67 | | $ | .88 | | $ | 1.62 | |

| Discontinued operations, net of tax | (.07) | | .17 | | .49 | | .41 | |

| Earnings per share – diluted | $ | .27 | | $ | .84 | | $ | 1.37 | | $ | 2.03 | |

| Weighted average common shares outstanding – basic | 203.9 | | 203.7 | | 203.9 | | 203.6 | |

| Weighted average common shares outstanding – diluted | 205.2 | | 204.1 | | 204.7 | | 203.9 | |

| | | | | | | | |

Selected Cash Flows Information1 |

| 2024 | 2023 |

| (In millions) |

| Net cash provided by operating activities | $ | 502.3 | | $ | 332.6 | |

| Net cash used in investing activities | (552.7) | | (540.7) | |

| Net cash provided by financing activities | 40.3 | | 204.6 | |

| Decrease in cash, cash equivalents and restricted cash | (10.1) | | (3.5) | |

Cash, cash equivalents and restricted cash - beginning of year | 77.0 | | 80.5 | |

Cash, cash equivalents and restricted cash - end of year | $ | 66.9 | | $ | 77.0 | |

1Includes cash flows from discontinued operations. | | |

| | | | | | | | | | | | | | | | | |

| Capital Expenditures | | | | | |

| Business Line | 2024 Actual | 2025 Estimated | 2026 Estimated | 2027 Estimated | 2025 - 2029 Total Estimated |

| | | (In millions) | | |

| Electric | $ | 116 | | $ | 154 | | $ | 494 | | $ | 205 | | $ | 1,178 | |

| Natural gas distribution | 285 | | 310 | | 258 | | 293 | | 1,410 | |

| Pipeline | 127 | | 69 | | 59 | | 95 | | 473 | |

Total capital expenditures1 | $ | 528 | | $ | 533 | | $ | 811 | | $ | 593 | | $ | 3,061 | |

| | | | | |

1Excludes Other category. |

The capital program is subject to continued review and modification by the company. Actual expenditures may vary from the estimates due to changes in load growth, regulatory decisions and other factors.

Non-GAAP Financial Measures

The company, in addition to presenting its earnings in conformity with GAAP, has provided non-GAAP financial measures of adjusted income from continuing operations and adjusted earnings per share from continuing operations. The company defines adjusted income (loss) from continuing operations as income from continuing operations attributable to the company before any transaction-related impacts from strategic initiatives which did not meet the criteria for discontinued operations and adjusted earnings per share from continuing operations as earnings per share from continuing operations before any transaction-related impacts from strategic initiatives which did not meet the criteria for discontinued operations, including the 2023 realized gain and the associated fourth quarter reversal of income taxes previously recorded on retained shares in Knife River.

The company believes these non-GAAP financial measures provide meaningful information to investors about the 2023 realized gain and the associated fourth quarter reversal of income taxes previously recorded on retained shares in Knife River and the costs associated with the company's strategic initiatives which did not meet the criteria for discontinued operations. The company’s management uses the non-GAAP financial measures in conjunction with GAAP results when evaluating the company’s operating results and calculating compensation packages. Non-GAAP financial measures are not standardized; therefore, it may not be possible to compare such financial measures with other companies’ non-GAAP financial measures having the same or similar names. The presentation of this additional information is not meant to be considered a substitution for financial measures prepared in accordance with GAAP. The company strongly encourages investors to review the consolidated financial statements in their entirety and to not rely on any single financial measure.

The following table provides a reconciliation of consolidated income from continuing operations to adjusted income from continuing operations and earnings per share from continuing operations to adjusted earnings per share from continuing operations:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| (In millions, except per share amounts) |

| (Unaudited) |

| Net income | $ | 55.2 | | $ | 170.7 | | | $ | 281.1 | | $ | 414.7 | |

Discontinued operations, net of tax | $ | (15.3) | | $ | 34.5 | | | $ | 100.0 | | $ | 84.6 | |

Income from continuing operations1 | $ | 70.5 | | $ | 136.2 | | | $ | 181.1 | | $ | 330.1 | |

Adjustments: | | | | | |

Less: Gain on tax-free exchange of retained shares in Knife River | — | | 16.4 | | | — | | 186.6 | |

Less: Reversal of previously recorded income taxes associated with the retained shares in Knife River | — | | 56.6 | | | — | | — | |

Costs attributable to strategic initiatives, net of tax1 | — | | .8 | | | 3.3 | | 7.3 | |

Adjusted income from continuing operations | $ | 70.5 | | $ | 64.0 | | | $ | 184.4 | | $ | 150.8 | |

| | | | | |

Earnings per share reconciliation - diluted | | | | | |

Earnings per share from continuing operations | $ | .34 | | $ | .67 | | | $ | .88 | | $ | 1.62 | |

Adjustments: | | | | | |

Less: Earnings per share attributable to gain on tax-free exchange of retained shares in Knife River | — | | .08 | | | — | | .91 | |

Less: Earnings per share attributable to the reversal of previously recorded income tax associated with the retained shares in Knife River | — | | .28 | | | — | | — | |

Loss per share attributable to strategic initiative costs1 | — | | — | | | .02 | | .03 | |

Adjusted earnings per share from continuing operations | $ | .34 | | $ | .31 | | | $ | .90 | | $ | .74 | |

1 Income from continuing operations includes costs attributable to strategic initiatives which did not meet the criteria for discontinued operations in 2024 of $4.4 million, net of tax of $1.1 million for the year. Costs attributable to strategic initiatives which did not meet the criteria for discontinued operations in 2023 of $1.1 million, net of tax of $0.3 million for the fourth quarter and $9.7 million, net of tax of $2.4 million for the year. Certain strategic initiative costs associated with the Knife River and Everus separations are reflected in discontinued operations. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Electric | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | Variance | | 2024 | | 2023 | | Variance |

| (In millions) |

Operating revenues1,2 | $ | 99.0 | | $ | 106.3 | | (7) | % | | $ | 414.5 | | $ | 401.2 | | 3 | % |

| Operating expenses: | | | | | | | |

Electric fuel and purchased power1 | 32.2 | | 41.0 | | (21) | % | | 141.2 | | 134.8 | | 5 | % |

| Operation and maintenance | 24.9 | | 24.2 | | 3 | % | | 95.0 | | 92.7 | | 2 | % |

Depreciation and amortization | 16.8 | | 16.3 | | 3 | % | | 66.5 | | 64.2 | | 4 | % |

| Taxes, other than income | 4.4 | | 3.4 | | 29 | % | | 17.6 | | 16.7 | | 5 | % |

| Total operating expenses | 78.3 | | 84.9 | | (8) | % | | 320.3 | | 308.4 | | 4 | % |

| Operating income | 20.7 | | 21.4 | | (3) | % | | 94.2 | | 92.8 | | 2 | % |

| Other income | 2.8 | | 2.4 | | 17 | % | | 8.2 | | 5.8 | | 41 | % |

| Interest expense | 7.7 | | 7.6 | | 1 | % | | 30.0 | | 28.0 | | 7 | % |

| Income before taxes | 15.8 | | 16.2 | | (2) | % | | 72.4 | | 70.6 | | 3 | % |

Income tax benefit2 | (1.3) | | (1.5) | | (13) | % | | (2.4) | | (1.0) | | 140 | % |

| Net income | $ | 17.1 | | $ | 17.7 | | (3) | % | | $ | 74.8 | | $ | 71.6 | | 4 | % |

| | | | | | | | | | | | | | | | | |

| Operating Statistics | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | 2023 | | 2024 | 2023 |

Revenues (millions)1,2 | | | | | |

| Retail sales: | | | | | |

| Residential | $ | 33.1 | | $ | 33.7 | | | $ | 139.9 | | $ | 134.1 | |

| Commercial | 40.1 | | 45.1 | | | 165.8 | | 164.1 | |

| Industrial | 9.9 | | 11.2 | | | 42.3 | | 42.3 | |

| Other | 1.8 | | 1.9 | | | 7.8 | | 7.1 | |

| 84.9 | | 91.9 | | | 355.8 | | 347.6 | |

Other | 14.1 | | 14.4 | | | 58.7 | | 53.6 | |

| $ | 99.0 | | $ | 106.3 | | | $ | 414.5 | | $ | 401.2 | |

| Volumes (million kWh) | | | | | |

| Retail sales: | | | | | |

| Residential | 291.0 | | 280.9 | | | 1,159.5 | | 1,180.2 | |

| Commercial | 711.6 | | 730.6 | | | 2,474.5 | | 2,350.5 | |

| Industrial | 134.2 | | 148.0 | | | 528.9 | | 583.7 | |

| Other | 20.5 | | 20.3 | | | 81.6 | | 81.8 | |

| 1,157.3 | | 1,179.8 | | | 4,244.5 | | 4,196.2 | |

| Average cost of electric fuel and purchased power per kWh | $ | .021 | | $ | .027 | | | $ | .025 | | $ | .024 | |

The previous tables reflect items that are passed through to customers resulting in minimal impact to earnings. These items include: 1Electric fuel and purchased power costs, which impact both operating revenues and electric fuel and purchased power. 2Production tax credits, which impact income tax benefit and operating revenues. |

The electric business reported net income of $17.1 million for the fourth quarter of 2024, compared to $17.7 million for the same period in 2023. This decrease was largely the result of lower investment returns on nonqualified benefit plans, higher operation and maintenance expense, primarily payroll-related costs, and higher depreciation and amortization expense, primarily due to increased asset additions. The decrease in net income was partially offset by increased retail sales revenue.

For the full year, the electric business reported net income of $74.8 million, compared to $71.6 million in 2023. This increase was primarily the result of higher retail sales revenue due to rate relief in North Dakota, South Dakota and Montana. Lower volumes from the majority of customers, primarily due to cooler weather in the second quarter, and higher operation and maintenance expense, primarily contract services costs, partially offset the increases.

| | | | | | | | | | | | | | | | | | | | | | | |

| Natural Gas Distribution | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | Variance | | 2024 | | 2023 | | Variance |

| (In millions) |

Operating revenues1,2 | $ | 406.5 | | $ | 367.8 | | 11 | % | | $ | 1,201.1 | | $ | 1,287.5 | | (7) | % |

| Operating expenses: | | | | | | | |

Purchased natural gas sold1 | 249.7 | | 224.7 | | 11 | % | | 699.3 | | 805.1 | | (13) | % |

Operation and maintenance | 62.2 | | 54.4 | | 14 | % | | 231.2 | | 219.7 | | 5 | % |

Depreciation and amortization | 25.9 | | 24.8 | | 4 | % | | 102.0 | | 95.3 | | 7 | % |

Taxes, other than income2 | 20.9 | | 17.4 | | 20 | % | | 76.0 | | 75.2 | | 1 | % |

Total operating expenses | 358.7 | | 321.3 | | 12 | % | | 1,108.5 | | 1,195.3 | | (7) | % |

| Operating income | 47.8 | | 46.5 | | 3 | % | | 92.6 | | 92.2 | | — | % |

| Other income | 6.0 | | 6.4 | | (6) | % | | 25.5 | | 20.8 | | 23 | % |

| Interest expense | 16.3 | | 15.4 | | 6 | % | | 63.2 | | 57.6 | | 10 | % |

| Income before taxes | 37.5 | | 37.5 | | — | % | | 54.9 | | 55.4 | | (1) | % |

| Income tax expense | 8.1 | | 7.0 | | 16 | % | | 8.0 | | 6.9 | | 16 | % |

| Net income | $ | 29.4 | | $ | 30.5 | | (4) | % | | $ | 46.9 | | $ | 48.5 | | (3) | % |

| | | | | | | | | | | | | | | | | |

| Operating Statistics | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 | |

Revenues (millions)1,2 | | | | | |

| Retail Sales: | | | | | |

| Residential | $ | 217.1 | | $ | 209.9 | | | $ | 651.8 | | $ | 726.1 | |

| Commercial | 135.8 | | 126.6 | | 400.8 | | 441.2 |

| Industrial | 11.8 | | 11.9 | | 42.7 | | 45.0 |

| 364.7 | | 348.4 | | | 1,095.3 | | 1,212.3 | |

| Transportation and other | 41.8 | | 19.4 | | 105.8 | | 75.2 |

| $ | 406.5 | | $ | 367.8 | | | $ | 1,201.1 | | $ | 1,287.5 | |

| Volumes (MMdk) | | | | | |

Retail sales: | | | | | |

Residential | 23.8 | | 22.7 | | | 67.2 | | 69.3 | |

Commercial | 16.1 | | 15.4 | | | 46.9 | | 47.9 | |

Industrial | 1.5 | | 1.6 | | | 5.4 | | 5.4 | |

| 41.4 | | 39.7 | | | 119.5 | | 122.6 | |

Transportation sales: | | | | | |

Commercial | .6 | | .5 | | | 1.9 | | 1.9 | |

Industrial | 51.0 | | 52.5 | | | 192.6 | | 188.4 | |

| 51.6 | | 53.0 | | | 194.5 | | 190.3 | |

Total throughput | 93.0 | | 92.7 | | | 314.0 | | 312.9 | |

Average cost of natural gas per dk | $ | 6.04 | | $ | 5.65 | | | $ | 5.85 | | $ | 6.57 | |

The previous tables reflect items that are passed through to customers resulting in minimal impact to earnings. These items include: 1Natural gas costs, which impact operating revenues and purchased natural gas sold. 2Revenue-based taxes that impact both operating revenues and taxes, other than income. |

The natural gas distribution business reported net income of $29.4 million in the fourth quarter of 2024, compared to $30.5 million for the same period in 2023. The decrease was largely the result of higher operation and maintenance expense, primarily higher payroll-related costs and higher contract service costs. Also decreasing net income were lower investment returns on nonqualified benefit plans. These decreases were partially offset by higher retail sales revenue, primarily due to rate relief in North Dakota and South Dakota. The business also experienced a 4.0% increase in retail sales volumes, primarily to residential and commercial customer classes, which was partially offset by weather normalization and decoupling mechanisms.

For the full year, the natural gas distribution business reported net income of $46.9 million, compared to $48.5 million in 2023. The decrease was largely the result of higher operation and maintenance expense, primarily higher contract service costs, higher payroll-related costs, and higher software expenses. Also decreasing net income was higher depreciation and amortization expense, primarily due to increased asset additions. These decreases were partially offset by higher retail sales revenue, primarily due to rate relief in North Dakota and South Dakota.

| | | | | | | | | | | | | | | | | | | | | | | |

Pipeline | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | Variance | | 2024 | | 2023 | | Variance |

| (In millions) |

Operating revenues | $ | 56.1 | | $ | 50.7 | | 11 | % | | $ | 211.8 | | $ | 177.6 | | 19 | % |

Operating expenses: | | | | | | | |

Operation and maintenance | 19.0 | | 18.2 | | 4 | % | | 75.7 | | 70.8 | | 7 | % |

Depreciation and amortization | 7.6 | | 6.8 | | 12 | % | | 29.4 | | 26.8 | | 10 | % |

Taxes, other than income | 3.1 | | 1.2 | | 158 | % | | 12.2 | | 10.8 | | 13 | % |

Total operating expenses | 29.7 | | 26.2 | | 13 | % | | 117.3 | | 108.4 | | 8 | % |

| Operating income | 26.4 | | 24.5 | | 8 | % | | 94.5 | | 69.2 | | 37 | % |

| Other income | 1.2 | | 1.4 | | (14) | % | | 6.5 | | 3.9 | | 67 | % |

| Interest expense | 4.1 | | 3.7 | | 11 | % | | 15.5 | | 13.3 | | 17 | % |

| Income before taxes | 23.5 | | 22.2 | | 6 | % | | 85.5 | | 59.8 | | 43 | % |

| Income tax expense | 3.0 | | 4.2 | | (29) | % | | 17.5 | | 12.4 | | 41 | % |

Income from continuing operations | 20.5 | | 18.0 | | 14 | % | | 68.0 | | 47.4 | | 43 | % |

Discontinued operations, net of tax1 | — | | — | | — | % | | — | | (.5) | | (100) | % |

| Net income | $ | 20.5 | | $ | 18.0 | | 14 | % | | $ | 68.0 | | $ | 46.9 | | 45 | % |

1Discontinued operations includes interest on debt facilities repaid in connection with the Knife River separation. |

| | | | | | | | | | | | | | | | | |

| Operating Statistics | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 | |

Transportation volumes (MMdk) | 149.7 | | 148.0 | | | 613.2 | | 567.2 | |

| | | | | |

| | | | | |

Customer natural gas storage balance (MMdk): | | | | |

Beginning of period | 54.6 | | 42.8 | | | 37.7 | | 21.2 | |

| Net injection (withdrawal) | (10.5) | | (5.1) | | | 6.4 | | 16.5 | |

End of period | 44.1 | | 37.7 | | | 44.1 | | 37.7 | |

The pipeline business reported net income of $20.5 million in the fourth quarter of 2024, compared to $18.0 million for the same period in 2023. The increase was driven by higher transportation volumes, primarily from growth projects placed in service in November 2023 and throughout 2024. The business also benefited from a decrease in the company's effective state income tax rate. Higher storage-related revenue further drove the increase. The increase was offset in part by higher operation and maintenance expense, primarily attributable to higher materials and contract services. The business also incurred higher depreciation and amortization expense and property taxes due to growth projects placed in service as discussed earlier.

For the full year, the pipeline business reported net income of $68.0 million, compared to $46.9 million in 2023. The earnings increase was driven by higher transportation volumes, primarily from growth projects placed in service in November 2023 and throughout 2024 and increased contracted volume commitments beginning February 2023 from the North Bakken Expansion project. Higher storage-related revenue and a full year of new transportation and storage service rates in 2024 further drove the increase. The business also benefited from proceeds received from a customer settlement that was recorded in other income and a decrease in the company's effective state income tax rate. The increase was offset in part by higher operation and maintenance expense primarily attributable to payroll-related costs and higher materials, contract services and pipeline safety fees. The business incurred higher depreciation and amortization expense due to growth projects placed in service as discussed earlier, which was partially offset by fully depreciated assets. The business also incurred higher interest expense largely as a result of higher debt balances and higher property taxes in Montana and North Dakota.

| | | | | | | | | | | | | | | | | | | | | | | |

Other | Three Months Ended | | Twelve Months Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | Variance | | 2024 | | 2023 | | Variance |

| (In millions) |

Operating revenues | $ | .1 | | $ | — | | 100 | % | | $ | .2 | | $ | .2 | | — | % |

Operating expenses: | | | | | | | |

Operation and maintenance | (.1) | | 3.4 | | (103) | % | | 13.3 | | 24.9 | | (47) | % |

Depreciation and amortization | .5 | | .9 | | (44) | % | | 2.2 | | 4.1 | | (46) | % |

Taxes, other than income | .1 | | .2 | | (50) | % | | .4 | | .4 | | — | % |

Total operating expenses | .5 | | 4.5 | | (89) | % | | 15.9 | | 29.4 | | (46) | % |

Operating loss | (.4) | | (4.5) | | (91) | % | | (15.7) | | (29.2) | | (46) | % |

Gain on tax-free exchange of retained shares in Knife River | — | | 16.4 | | (100) | % | | — | | 186.6 | | (100) | % |

| Other income | 2.6 | | 6.1 | | (57) | % | | 16.6 | | 16.4 | | 1 | % |

| Interest expense | 2.4 | | 7.0 | | (66) | % | | 15.0 | | 19.3 | | (22) | % |

Income (loss) before taxes | (.2) | | 11.0 | | (102) | % | | (14.1) | | 154.5 | | (109) | % |

Income tax benefit | (3.7) | | (59.0) | | (94) | % | | (5.5) | | (8.1) | | (32) | % |

Income (loss) from continuing operations1 | 3.5 | | 70.0 | | (95) | % | | (8.6) | | 162.6 | | (105) | % |

Discontinued operations, net of tax | (15.3) | | 34.5 | | (144) | % | | 100.0 | | 85.1 | | 18 | % |

Net income (loss) | $ | (11.8) | | $ | 104.5 | | (111) | % | | $ | 91.4 | | $ | 247.7 | | (63) | % |

| | | | | | | |

Income (loss) from continuing operations1 | $ | 3.5 | | $ | 70.0 | | (95) | % | | $ | (8.6) | | $ | 162.6 | | (105) | % |

Adjustments: | | | | | | | |

Less: Gain on tax-free exchange of retained shares in Knife River | — | | 16.4 | | (100) | % | | — | | 186.6 | | (100) | % |

| Less: Reversal of previously recorded income taxes associated with the retained shares in Knife River | — | | 56.6 | | (100) | % | | — | | — | | — | % |

Costs attributable to strategic initiatives, net of tax1 | — | | .8 | | (100) | % | | 3.3 | | 7.3 | | (55) | % |

Adjusted income (loss) from continuing operations | $ | 3.5 | | $ | (2.2) | | 259 | % | | $ | (5.3) | | $ | (16.7) | | (68) | % |

1 Income (loss) from continuing operations includes costs attributable to strategic initiatives which did not meet the criteria for discontinued operations in 2024 of $4.4 million, net of tax of $1.1 million for the year. Costs attributable to strategic initiatives which did not meet the criteria for discontinued operations in 2023 of $1.1 million, net of tax of $0.3 million for the fourth quarter and $9.7 million, net of tax of $2.4 million for the year. Certain strategic initiative costs associated with the Knife River and Everus separations are reflected in discontinued operations. |

|

The company completed the separations of Knife River on May 31, 2023, its former construction materials and contracting segment, and of Everus on October 31, 2024, its former construction services segment, into new independent publicly-traded companies. As a result of these separations, the historical results of operations for Knife River and Everus are shown in discontinued operations, net of tax, except for allocated general corporate overhead costs of the company which did not meet the criteria for discontinued operations. Also included in discontinued operations are certain strategic initiative costs associated with the separations of Knife River and Everus.

During the fourth quarter of 2024, Other reported a net loss compared to net income in the same period in 2023. The decrease was primarily due to a decrease in results from discontinued operations, largely transaction related costs in 2024 and one month of Everus results compared to a full quarter in 2023. Other was also impacted by the absence of the company's 2023 $16.4 million gain on the tax-free exchange of its retained interest in Knife River and the associated reversal of income taxes previously recorded of $56.6 million. The company had recorded income tax expense on the unrealized gain and once it completed the tax-free monetization of the retained interest, the taxes were reversed. Partially offsetting the decrease in net income was lower operation and maintenance expense due to lower corporate overhead costs classified as continuing operations allocated to the construction services business in 2023, strategic initiative costs which did not meet the criteria for discontinued operations, as well as lower interest expense.

For the full year, Other was impacted by the absence of the company's 2023 gain of $186.6 million related to the tax-free exchange of its retained shares in Knife River. Partially offsetting the decrease in net income was lower operation and maintenance expense, largely a result of corporate overhead costs classified as continuing operations allocated to the construction materials business in 2023, which are not included in Other in 2024, and lower strategic initiative costs. Other also benefited from lower interest expense due to lower borrowings associated with funding strategic initiatives.

Also included in Other is insurance activity at the company's captive insurer, annualized income tax adjustments of the holding company primarily associated with corporate functions, and general and administrative costs and interest expense previously allocated to the exploration and production and refining businesses that did not meet the criteria for discontinued operations.

| | | | | |

Other Financial Data | |

| December 31, 2024 |

| (In millions, except per share amounts) |

| (Unaudited) |

| Book value per common share | $ | 13.19 | |

| Market price per common share | $ | 18.02 | |

| Market value as a percent of book value | 136.6 | % |

| Total assets | $ | 7,039 | |

| Total equity | $ | 2,691 | |

| Total debt | $ | 2,293 | |

| Capitalization ratios: | |

| Total equity | 54.0 | % |

| Total debt | 46.0 | % |

| 100.0 | % |

Cover

|

Feb. 06, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

MDU Resources Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-03480

|

| Entity Tax Identification Number |

30-1133956

|

| Entity Address, Address Line One |

1200 West Century Avenue

|

| Entity Address, Address Line Two |

P.O. Box 5650

|

| Entity Address, City or Town |

Bismarck

|

| Entity Address, State or Province |

ND

|

| Entity Address, Postal Zip Code |

58506

|

| City Area Code |

701

|

| Local Phone Number |

530-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $1.00 per share

|

| Trading Symbol |

MDU

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000067716

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

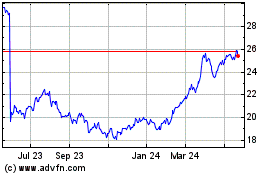

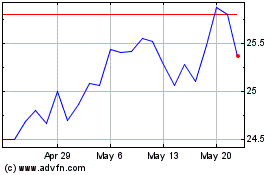

MDU Resources (NYSE:MDU)

Historical Stock Chart

From Jan 2025 to Feb 2025

MDU Resources (NYSE:MDU)

Historical Stock Chart

From Feb 2024 to Feb 2025