Mayville Engineering Company (NYSE: MEC) (the “Company” or

“MEC”), a leading value-added provider of design, prototyping and

manufacturing solutions serving diverse end markets, today

announced results for the three-months ended June 30, 2024.

SECOND QUARTER 2024 RESULTS

(All comparisons versus the prior-year period)

- Net sales of $163.6 million, or +17.7%, including organic

growth of 6.9%

- Net income of $3.8 million, or $0.18 per diluted share, an

increase of $2.2 million, or $0.10 per diluted share

- Non-GAAP Adjusted Diluted EPS of $0.26, an increase of

$0.06

- Adjusted EBITDA of $19.6 million, an increase of 28.4%

- Adjusted EBITDA margin of 12.0%, an increase of 100 bps

- Free Cash Flow of $19.2 million, an increase of $22.9

million

- Ratio of net debt to trailing twelve-month Adjusted EBITDA of

slightly below 1.7x as of June 30, 2024

- Full Year 2024 Free Cash Flow expected to be in a range of $45

million to $55 million

MANAGEMENT COMMENTARY

“We continued to demonstrate strong strategic execution during

the second quarter, as net sales, margin realization, and free cash

generation each increased significantly above prior-year levels,”

stated Jag Reddy, President and Chief Executive Officer. “Our

collective focus on higher-value, integrated solutions, increased

operational efficiency, and return-focused capital allocation

strategy has positioned MEC to outperform the broader market

through the current economic cycle.”

“Strong project volumes within our commercial vehicle,

powersports, agriculture, and construction & access markets

more than offset softness within our military vertical in the

period,” stated Reddy. “Going into the second half of 2024,

underlying demand is projected to soften in certain key end

markets, but we anticipate delivering continued above-market growth

across all of our end markets as a result of market share gains and

strong strategic execution.”

“Second quarter sales growth continues to reflect the

implementation of our value-added pricing model and the pricing

discipline our MEC Business Excellence (“MBX”) process drives,”

continued Reddy. “Operationally, we continued to implement MBX

which led to improvements across the organization that are expected

to result in additional cost savings, labor efficiency gains, and

working capital improvements. Our working capital improvements have

been particularly successful, as reflected by our

higher-than-expected free cash conversion through the first half of

2024. As a result, we are increasing our free cash flow guidance

for the full year 2024 to a range of between $45 million to $55

million.”

“Importantly, our MBX initiatives have driven ratable operating

leverage improvements across our manufacturing footprint, providing

for sustained margin expansion,” continued Reddy, “This progress,

together with improved utilization at our Hazel Park facility, have

put us on on-track to achieve meaningful margin expansion in 2024,

while remaining on-pace to realize an Adjusted EBITDA margin of

between 14% to 16% by year-end 2026.”

“Our strong free cash generation during the second quarter

allowed us to repay more than $17 million of debt during the

period, reducing our net leverage to slightly below 1.7x at the end

of the quarter, well within our target of between 1.5x and 2.0x by

year-end 2024. Additionally, during the second quarter, we

repurchased $1.0 million of common equity under our share

repurchase program, with $24.0 million remaining under the existing

authorization. As we further reduce our leverage, we intend to

prioritize strategic, bolt-on acquisitions that expand our

commercial reach and capabilities as well as a structured approach

to our share repurchase strategy. Our capital deployment priorities

will continue to be governed by our unwavering commitment to

maximize long-term shareholder value.”

PERFORMANCE SUMMARY

Net sales increased by 17.7% on a year-over-year basis in the

second quarter 2024, driven in part by the acquisition of

Mid-States Aluminum (MSA) in the third quarter of 2023 and

increased organic volumes in our powersports, commercial vehicle

and construction & access end markets because of new project

volumes resulting from the Company’s focus on growing its market

share with new and existing customers. The Company’s above-market

growth in its powersports, commercial vehicle and construction

& access markets was partly offset by softening demand in our

legacy agriculture end market and the foreseen roll-off of certain

military aftermarket programs at the end of 2023.

Manufacturing margin was $22.3 million in the second quarter of

2024, or 13.6% of net sales, as compared to $16.1 million, or 11.6%

of net sales, in the prior year period. The year-over-year increase

in manufacturing margin was driven by the increased organic sales

volumes, the MSA acquisition, MBX initiatives and commercial

pricing initiatives.

Other selling, general and administrative expenses were $8.3

million in the second quarter of 2024 as compared to $7.4 million

for the same prior year period. The increase in these expenses

during the second quarter primarily reflects the increase in legal

costs associated with litigation against the former fitness

customer, incremental expense associated with the MSA acquisition

and higher costs related to compliance requirements.

Interest expense was $3.0 million in the second quarter of 2024,

as compared to $2.0 million in the prior year period due to an

increase in borrowings. The increase in borrowings relative to the

prior year is due to the acquisition of MSA, which closed on July

1, 2023.

Net income for the second quarter of 2024 was $3.8 million, or

$0.18 per diluted share, versus $1.6 million, or $0.08 per diluted

share, in the prior-year period.

MEC reported Adjusted EBITDA of $19.6 million in the second

quarter of 2024, or 12.0% of net sales, versus $15.3 million, or

11.0% of net sales, in the prior-year period. The increase in

Adjusted EBITDA and Adjusted EBITDA margin, when compared to the

prior year, reflects the benefit of the MSA acquisition, continued

execution of the Company’s MBX strategic initiatives, improved

commercial pricing and higher volumes, partially offset by higher

SG&A expenses.

Second quarter Adjusted net income was $5.5 million, or $0.26

per diluted share, versus $4.1 million, or $0.20 per diluted share,

in the prior year period. The increase in adjusted net income

reflects an increase in income from operations, which was partially

offset by higher interest expense.

Free cash flow during the second quarter of 2024 was $19.2

million as compared to ($3.7) million in the prior year period. The

increase in free cash flow was primarily attributable to a $23.1

million increase in net cash provided by operating activities due

to improved working capital efficiency and the payout of deferred

compensation to a retired Company executive made in the prior year

period.

END MARKET UPDATE

Three Months Ended

June 30,

2024

2023

Commercial Vehicle

$

62,130

$

56,075

Construction & Access

27,230

26,522

Powersports

30,306

23,995

Agriculture

14,639

13,444

Military

6,579

8,910

Other

22,752

10,033

Net Sales

$

163,636

$

138,980

Commercial Vehicles

MEC is a Tier 1 supplier to many of the country’s top original

equipment manufacturers (OEM) of commercial vehicles providing

exhaust & aftertreatment, engine components, cooling, fuel and

structural systems for both heavy- and medium-duty commercial

vehicles.

Net sales to the commercial vehicle market were $62.1 million in

the second quarter of 2024, an increase of 10.8% versus the

prior-year period. The increase in net sales to this end market

during the quarter was attributable to organic volume growth from

new projects. The successful execution of the Company’s organic

growth strategy delivered above-market growth for this end-market

as overall commercial vehicle demand fell by 0.3%

year-over-year.

Construction & Access

MEC manufactures components and sub-assemblies for OEMs within

the construction & access market including fenders, hoods,

supports, frames, platforms, frame structures, doors and tubular

products such as exhaust & aftertreatment, engine components,

cooling system components, handrails and full electro-mechanical

assemblies.

Net sales to the construction & access market were $27.2

million in the second quarter of 2024, an increase of 2.7% versus

the prior-year period. The increase in sales was primarily due to

increased demand and new project wins associated with strong

end-market demand from infrastructure-related projects.

Powersports

MEC manufactures stampings and complex metal assemblies and

coatings for OEMs within marine propulsion, all-terrain vehicles

(ATV), multi-utility vehicles (MUV) and motorcycle markets. MEC’s

powersports expertise includes axle housings, steering columns,

swing arms, fenders, suspension components, ATV/MUV racks, cowl

assemblies and vehicle frames.

Net sales to the powersports market were $30.3 million in the

second quarter of 2024, an increase of 26.3% versus the prior-year

period. The increase in sales was the result of higher volumes from

new project wins and share gains from both new and existing

customers.

Agriculture

MEC is an integral partner in the supply chain of the world’s

leading agriculture OEMs manufacturing components and

sub-assemblies including fenders, hoods, supports, frames,

platforms, frame structures, doors, and tubular products such as

exhaust, engine components, cooling system components, handrails

and full electro-mechanical assemblies.

Net sales to the agriculture market were $14.6 million in the

second quarter of 2024, an increase of 8.9% versus the prior-year

period. The increase in sales was mostly driven by the MSA

acquisition, which was somewhat offset by expected demand softness

in our legacy large-ag market.

Military

MEC holds the International Traffic in Arms Regulations (ITAR)

certification and produces components for the United States

military. Products include exhaust, engine components, cooling,

fuel, suspension, structural systems, and chemical agent resistant

coating (CARC) painting capabilities.

Net sales to the military market were $6.6 million in the second

quarter of 2024, a decrease of 26.2% versus the prior-year period.

The decrease in net sales compared to the prior year was primarily

attributable to the expected roll-off of certain aftermarket

programs at the end of 2023.

Other

MEC also produces a wide variety of components and assemblies

for customers in the power generation, industrial equipment &

fixtures, consumer tools, mining, forestry, automotive, and medical

markets.

Net sales to other end markets for the second quarter of 2024

were $22.8 million, an increase of 126.8% year-over-year. The

increase is primarily attributable to MSA-related contributions,

which was acquired on July 1, 2023.

STRATEGIC UPDATE

During the second quarter, MEC continued the successful

execution of our MEC Business Excellence (MBX) initiative, a

value-creation framework designed to drive sustained operational

and commercial excellence execution across all aspects of the

organization. Over the next two years, MEC expects that this value

creation framework will drive total net sales to between $750 to

$850 million, Adjusted EBITDA margin expansion to between 14% to

16% and free cash flow to between $65 to $75 million by year-end

2026.

- Drive a High-Performance Culture. The Company is focused

on effectuating cultural change across the organization by

implementing performance-based metrics, lean daily management and

other process-oriented strategies. Through these efforts, the

Company is building a high-performance culture capable of driving

improved performance, asset utilization and cost optimization.

During the second quarter, the Company continued the implementation

and alignment of processes and best practices across the enterprise

to drive strategic execution. Additionally, the Company launched an

employee recognition program aimed at further fostering our

high-performance culture. This peer recognition initiative allows

employees to nominate peers who consistently embody the Company

values and uphold the Company culture through their daily

interactions and exceptional performance.

- Drive Operational Excellence. The Company is focused on

leveraging technologies and capabilities to increase productivity

and reduce costs across the value chain. The Company intends to

achieve this objective through the implementation of lean

initiatives such as value stream mapping, sales, inventory, and

operations planning (SIOP), and further optimization of its supply

chain and procurement strategies. The Company’s operational

excellence initiatives also focus on improving fixed cost

absorption, labor productivity and inventory efficiency by

leveraging its recent investments in advanced manufacturing

capabilities and automation. As of the end of the second quarter of

2024, the Company had held over 65 MBX kaizen events in 2024 which

contributed to improved margins and inventory optimization.

Year-over-year, the Company recognized $0.9 million of savings

related to sourcing optimization and improved labor utilization.

The Company also realized a significant year-over-year improvement

in working capital efficiencies due to improvements in days sales

outstanding and inventory days-on-hand. Additionally, the Company

recognized $0.6 million, net of inflation, in year-over-year

pricing improvements as a result of its on-going commercial pricing

initiatives.

- Drive Commercial Expansion. The Company is focused on

driving commercial growth through an integrated, solutions-oriented

approach that leverages its full suite of design, prototyping, and

aftermarket services; an expansion of its fabrication capabilities

beyond steel, with an emphasis on lightweight aluminum, plastics

and composites; diversification within high-growth energy

transition markets; further market penetration within existing end

markets; and the implementation of value-based pricing. During the

third quarter of 2023, the Company closed the acquisition of MSA,

which positions MEC to capitalize on revenue synergies within its

existing legacy customer base and is now positioned to grow

organically by pursuing demand for light-weight aluminum products

in high-growth energy transition and fleet electrification

applications. During the second quarter of 2024, MEC made

substantial progress in growing its share of wallet with existing

customers with multiple multi-year contract wins with major

customers in the military, commercial vehicle, powersports and

other end-markets. Going forward, the Company will continue to

evaluate opportunistic acquisition opportunities to further expand

its differentiated suite of capabilities.

- Drive Human Resource Optimization. The Company remains

focused on the recruitment and retention of skilled, experienced

employees to support the growth of its business. This component of

the MBX value creation framework is designed to provide

competitive, performance-based incentives; develop high-potential

candidates for internal development and advancement; ensure

business continuity through multi-tiered succession planning; and

to ensure a stable recruiting pipeline. During the second quarter,

the Company re-aligned its commercial team, further enhancing

customer experience, aligning technical aspects and standardizing

processes.

BALANCE SHEET UPDATE

As of June 30, 2024, MEC had net debt outstanding of $125.1

million and total cash and availability on its senior secured

revolving credit facility of $250.01 million. During the second

quarter of 2024, the Company repaid $17.8 million of debt incurred

in conjunction with the MSA acquisition. At the end of the second

quarter, the ratio of net debt to trailing twelve-month Adjusted

EBITDA was slightly below 1.7x, resulting in a 30 bps rate

reduction in the third quarter.

______________________

1 This amount is reduced to approximately

$127.9 million after taking into account the $122.1 million of

outstanding borrowings under the credit facility as of June 30,

2024.

FINANCIAL GUIDANCE

Today, the Company reaffirmed its financial guidance for Net

Sales and Adjusted EBITDA for the full year 2024 but increased its

guidance for full year Free Cash Flow. All guidance is current as

of the time provided and is subject to change.

FY 2023

FY 2024 Forecast

Prior FY 2024 Forecast

(in Millions)

Actual

Low

Mid

High

Low

Mid

High

Net Sales

$

588.4

$

620

$

630

$

640

$

620

$

630

$

640

Adjusted EBITDA

$

66.1

$

72

$

74

$

76

$

72

$

74

$

76

Free Cash Flow

$

23.8

$

45

$

50

$

55

$

35

$

40

$

45

The Company’s 2024 guidance reflects the expected softening in

commercial vehicle, powersports and agriculture end market demand

in the second half of the year as the result of various

macroeconomic factors, which the Company expects will be offset by

the continued ramp-up of new project work with both new and

existing customers. The Company’s 2024 financial guidance also

reflects incremental contribution from the MSA acquisition,

including $20 to $30 million of incremental net sales and $4 to $6

million of incremental Adjusted EBITDA.

The Company’s 2024 financial guidance also reflects incremental

contributions from MBX and commercial pricing related initiatives

of between $3 to $6 million. The impact of these initiatives is net

of normal annual cost inflation, representing the Company’s ability

to improve efficiency and manage price, given higher labor and

input costs.

The Company’s updated 2024 Free Cash Flow guidance demonstrates

strong cash flow generation in the first and second quarters of

2024 due to improved working capital utilization related to its MBX

initiatives. The Company also continues to expect that its capital

expenditures for the full year 2024 will be between $15 and $20

million.

SECOND QUARTER 2024 RESULTS CONFERENCE CALL

The Company will host a conference call on Wednesday, August 7,

2024 at 10:00 a.m. Eastern Time (9:00 a.m. Central Time).

For a live webcast of the conference call and to access the

accompanying investor presentation, please visit www.mecinc.com and

click on the link to the live webcast on the Investors page.

For telephone access to the conference, call (833) 470-1428

within the United States, or call (833) 950-0062 within Canada and

please use the Access Code: 300362.

FORWARD-LOOKING STATEMENTS

This press-release includes forward-looking statements that

reflect plans, estimates and beliefs. Such statements involve risk

and uncertainties. Actual results may differ materially from those

contemplated by these forward-looking statements as a result of

various factors. Important factors that could cause actual results

or events to differ materially from those expressed in

forward-looking statements include, but are not limited to:

macroeconomic conditions, including inflation, elevated interest

rates and recessionary concerns, as well as continuing supply chain

constraints affecting some of our customers, labor availability and

material cost pressures, have had, and may continue to have, a

negative impact on our business, financial condition, cash flows

and results of operations (including future uncertain impacts);

risks relating to developments in the industries in which our

customers operate; risks related to scheduling production

accurately and maximizing efficiency; our ability to realize net

sales represented by our awarded business; failure to compete

successfully in our markets; our ability to maintain our

manufacturing, engineering and technological expertise; the loss of

any of our large customers or the loss of their respective market

shares; risks related to entering new markets; our ability to

recruit and retain our key executive officers, managers and

trade-skilled personnel; volatility in the prices or availability

of raw materials critical to our business; manufacturing risks,

including delays and technical problems, issues with third-party

suppliers, environmental risks and applicable statutory and

regulatory requirements; our ability to successfully identify or

integrate acquisitions; our ability to develop new and innovative

processes and gain customer acceptance of such processes; risks

related to our information technology systems and infrastructure,

including cybersecurity risks and data leakage risks; geopolitical

and economic developments, including foreign trade relations and

associated tariffs; results of legal disputes, including product

liability, intellectual property infringement and other claims;

risks associated with our capital-intensive industry; risks related

to our treatment as an S Corporation prior to the consummation of

our initial public offering; risks related to our employee stock

ownership plan’s treatment as a tax-qualified retirement plan; and

other factors described in “Risk Factors” in Part I, Item 1A of our

Annual Report on Form 10-K for the year ended December 31, 2023, as

such may be amended or supplemented in our subsequently filed

Quarterly Reports on Form 10-Q. This discussion should be read in

conjunction with our audited consolidated financial statements

included in the Company’s previously filed Annual Report on Form

10-K for the year ended December 31, 2023. We undertake no

obligation to update or revise any forward-looking statements after

the date on which any such statement is made, whether as a result

of new information, future events or otherwise, except as required

by federal securities laws.

ABOUT MAYVILLE ENGINEERING COMPANY

Founded in 1945, MEC is a leading U.S.-based,

vertically-integrated, value-added manufacturing partner providing

a full suite of manufacturing solutions from concept to production,

including design, prototyping and tooling, fabrication, aluminum

extrusion, coating, assembly and aftermarket components. Our

customers operate in diverse end markets, including heavy- and

medium-duty commercial vehicles, construction & access

equipment, powersports, agriculture, military and other end

markets. Along with process engineering and development services,

MEC maintains an extensive manufacturing infrastructure with 23

facilities across seven states. These facilities make it possible

to offer conventional and CNC (computer numerical control)

stamping, shearing, fiber laser cutting, forming, drilling,

tapping, grinding, tube bending, machining, welding, assembly, and

logistic services. MEC also possesses a broad range of finishing

capabilities including shot blasting, e-coating, powder coating,

wet spray and military grade chemical agent resistant coating

(CARC) painting. For more information, please visit

www.mecinc.com.

NON-GAAP FINANCIAL MEASURES

This press release contains financial information calculated in

a manner other than in accordance with U.S. generally accepted

accounting principles (“GAAP”).

The non-GAAP measures used in this press release are EBITDA,

EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Net Income and Diluted EPS, and Free Cash Flow.

EBITDA represents net income before interest expense, provision

for income taxes, depreciation, and amortization. EBITDA Margin

represents EBITDA as a percentage of net sales for each period.

Adjusted EBITDA represents EBITDA before stock-based compensation

expense, loss on extinguishment of debt, MSA acquisition related

costs, field replacement claim and legal costs due to the former

fitness customer. Adjusted EBITDA Margin represents Adjusted EBITDA

as a percentage of net sales for each period. Adjusted Net Income

and Diluted EPS represent net income before the aforementioned

Adjusted EBITDA addback items which do not reflect our core

operating performance. Free Cash Flow represents net cash provided

by, or used in, operating activities, less cash flows used in the

purchase of property, plant and equipment. We present Adjusted

EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Diluted

EPS, and Free Cash Flow as management uses these measures as key

performance indicators, and we believe they are measures frequently

used by securities analysts, investors and other parties to

evaluate companies in our industry. These metrics are supplemental

measures of our operating performance that are neither required by,

nor presented in accordance with, GAAP. These measures should not

be considered as an alternative to net income or cash flow provided

by, or used in, operating activities, or any other performance

measure derived in accordance with GAAP as an indicator of our

operating performance. These measures may not be comparable to the

similarly named measures reported by other companies and have

limitations as analytical tools and should not be considered in

isolation or as substitutes for analysis of our results as reported

under GAAP.

Please reference our reconciliation of net income, the most

directly comparable measure calculated in accordance with GAAP, to

EBITDA, Adjusted EBITDA, Adjusted Net Income and Diluted EPS, Free

Cash Flow and the calculation of EBITDA Margin and Adjusted EBITDA

Margin included in this press release.

Mayville Engineering Company,

Inc.

Consolidated Balance

Sheet

(in thousands, except share

amounts)

June 30,

December 31,

2024

2023

ASSETS

Cash and cash equivalents

$

314

$

672

Receivables, net of allowances for

doubtful accounts of $697 at June 30, 2024 and $685 at December 31,

2023

67,853

57,445

Inventories, net

60,816

67,782

Tooling in progress

6,074

5,457

Prepaid expenses and other current

assets

5,155

3,267

Total current assets

140,212

134,623

Property, plant and equipment, net

168,757

175,745

Goodwill

92,650

92,650

Intangible assets, net

55,201

58,667

Operating lease assets

29,868

32,233

Other long-term assets

1,463

2,743

Total assets

$

488,151

$

496,661

LIABILITIES AND SHAREHOLDERS’

EQUITY

Accounts payable

$

53,963

$

46,526

Current portion of operating lease

obligation

4,856

5,064

Accrued liabilities:

Salaries, wages, and payroll taxes

7,211

6,368

Profit sharing and bonus

3,275

3,107

Other current liabilities

12,523

10,644

Total current liabilities

81,828

71,709

Bank revolving credit notes

122,063

147,493

Operating lease obligation, less current

maturities

26,616

28,606

Deferred compensation, less current

portion

4,315

3,816

Deferred income tax liability

12,847

12,606

Other long-term liabilities

2,398

2,453

Total liabilities

$

250,067

$

266,683

Commitments and contingencies

Common shares, no par value, 75,000,000

authorized, 22,077,389 shares issued at June 30, 2024 and

21,853,477 at December 31, 2023

—

—

Additional paid-in-capital

207,454

205,373

Retained earnings

41,141

34,118

Treasury shares at cost, 1,604,090 shares

at June 30, 2024 and 1,542,893 at December 31, 2023

(10,511

)

(9,513

)

Total shareholders’ equity

238,084

229,978

Total

$

488,151

$

496,661

Mayville Engineering Company,

Inc.

Consolidated Statement of Net

Income

(in thousands, except share

amounts and per share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net sales

$

163,636

$

138,980

$

324,905

$

281,626

Cost of sales

141,359

122,885

281,696

249,154

Amortization of intangible assets

1,733

1,738

3,466

3,476

Profit sharing, bonuses, and deferred

compensation

4,133

2,688

7,933

5,690

Other selling, general and administrative

expenses

8,261

7,396

16,030

14,363

Income from operations

8,150

4,273

15,780

8,943

Interest expense

(2,969

)

(1,968

)

(6,324

)

(3,626

)

Loss on extinguishment of debt

—

(216

)

—

(216

)

Income before taxes

5,181

2,089

9,456

5,101

Income tax expense

1,399

475

2,433

916

Net income and comprehensive

income

$

3,782

$

1,614

$

7,023

$

4,185

Earnings per share:

Basic

$

0.18

$

0.08

$

0.34

$

0.21

Diluted

$

0.18

$

0.08

$

0.34

$

0.20

Weighted average shares

outstanding:

Basic

20,602,650

20,494,437

20,544,292

20,405,383

Diluted

21,034,780

20,827,728

20,914,499

20,789,175

Mayville Engineering Company,

Inc.

Consolidated Statement of Cash

Flows

(in thousands)

Six Months Ended

June 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

7,023

$

4,185

Adjustments to reconcile net income to net

cash provided (used in) by operating activities:

Depreciation

15,179

12,415

Amortization

3,466

3,476

Allowance for doubtful accounts

12

6

Inventory excess and obsolescence

reserve

(164

)

41

Stock-based compensation expense

2,495

2,420

Loss (gain) on disposal of property, plant

and equipment

2

(135

)

Deferred compensation

451

(17,475

)

Loss on extinguishment of debt

—

216

Non-cash lease expense

2,702

2,144

Other non-cash adjustments

143

184

Changes in operating assets and

liabilities:

Accounts receivable

(10,420

)

(11,071

)

Inventories

7,130

4,839

Tooling in progress

(617

)

111

Prepaids and other current assets

(1,951

)

(897

)

Accounts payable

6,391

(3,061

)

Deferred income taxes

1,764

638

Operating lease obligations

(2,535

)

(1,986

)

Accrued liabilities

2,829

(1,915

)

Net cash provided by (used in) operating

activities

33,900

(5,865

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchase of property, plant and

equipment

(6,874

)

(6,320

)

Proceeds from sale of property, plant and

equipment

107

153

Net cash used in investing activities

(6,767

)

(6,167

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from bank revolving credit

notes

273,536

347,324

Payments on bank revolving credit

notes

(298,967

)

(241,618

)

Repayments of other long-term debt

(306

)

(575

)

Payments of financing costs

—

(1,248

)

Shares withheld for employees' taxes

(758

)

—

Purchase of treasury stock

(998

)

(1,661

)

Payments on finance leases

(343

)

(192

)

Proceeds from the exercise of stock

options

345

—

Net cash provided by (used in) financing

activities

(27,491

)

102,030

Net increase (decrease) in cash and cash

equivalents

(358

)

89,998

Cash and cash equivalents at beginning of

period

672

127

Cash and cash equivalents at end

of period

$

314

$

90,125

Mayville Engineering Company,

Inc.

Reconciliation of Net Income

to EBITDA and Adjusted EBITDA

(in thousands)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net income and comprehensive income

$

3,782

$

1,614

$

7,023

$

4,185

Interest expense

2,969

1,968

6,324

3,626

Provision for income taxes

1,399

475

2,433

916

Depreciation and amortization

9,391

8,011

18,645

15,891

EBITDA

17,541

12,068

34,425

24,618

Loss on extinguishment of debt

—

216

—

216

MSA acquisition related costs

—

899

—

899

Stock-based compensation expense

1,338

1,354

2,495

2,420

Field replacement claim

—

490

—

490

Legal costs due to former fitness

customer

760

272

1,239

495

Adjusted EBITDA

$

19,639

$

15,299

$

38,159

$

29,138

Net sales

$

163,636

$

138,980

$

324,905

$

281,626

EBITDA Margin

10.7

%

8.7

%

10.6

%

8.7

%

Adjusted EBITDA Margin

12.0

%

11.0

%

11.7

%

10.3

%

Mayville Engineering Company,

Inc.

Reconciliation of Net Income

and Diluted EPS to Adjusted Net Income and Diluted EPS

(in thousands, except share

amounts and per share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Earnings

Diluted EPS

Earnings

Diluted EPS

Earnings

Diluted EPS

Earnings

Diluted EPS

Net income and comprehensive income

$

3,782

$

0.18

$

1,614

$

0.08

$

7,023

$

0.34

$

4,185

$

0.20

Loss on extinguishment of debt

—

—

216

0.01

—

—

216

0.01

MSA acquisition related costs

—

—

899

0.04

—

—

899

0.04

Stock-based compensation expense

1,338

0.06

1,354

0.07

2,495

0.12

2,420

0.12

Field replacement claim

—

—

490

0.02

—

—

490

0.02

Legal costs due to former fitness

customer

760

0.04

272

0.01

1,239

0.06

495

0.02

Tax effect of above adjustments

(383)

(0.02)

(783)

(0.04)

(654)

(0.04)

(1,095)

(0.05)

Adjusted net income and comprehensive

income

$

5,497

$

0.26

$

4,062

$

0.20

$

10,103

$

0.48

$

7,610

$

0.37

Mayville Engineering Company,

Inc.

Reconciliation of Free Cash

Flow

(in thousands)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

$

23,275

$

178

$

33,900

$

(5,865

)

Less: Capital expenditures

4,099

3,912

6,874

6,320

Free cash flow

$

19,176

$

(3,734

)

$

27,026

$

(12,185

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806890570/en/

INVESTOR CONTACT Stefan Neely or Noel Ryan (615) 844-6248

MEC@val-adv.com

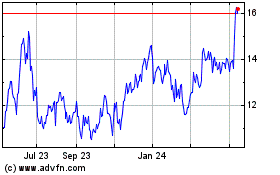

Mayville Engineering (NYSE:MEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

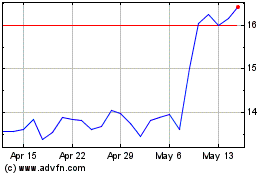

Mayville Engineering (NYSE:MEC)

Historical Stock Chart

From Dec 2023 to Dec 2024