Mizuho Americas today announced its first loan to Grameen America,

a certified U.S. Community Development Financial Institution (CDFI)

dedicated to helping low-income entrepreneurial women build

businesses to enable financial mobility. Mizuho provided $5 million

in debt capital to Grameen America and its microlending program as

part of the firm’s ongoing commitment to CDFIs and financial

inclusion. In past years, the Mizuho USA Foundation has awarded

Grameen America with grant support for the non-profit’s financial

education and other community programs.

“We are proud to support Grameen America and its deliberate

approach to providing women with capital needed to start a small

business, achieve financial mobility, and contribute to greater

prosperity in their communities by creating jobs.” said Michal

Katz, Head of Investment & Corporate Banking, Mizuho

Americas.

Expressing Grameen America’s appreciation in deepening its

partnership with Mizuho, Lucas Ramirez, Chief Financial Officer at

Grameen America, remarked, "We are thrilled to strengthen our

partnership with Mizuho, an organization that shares our passion

for creating lasting social and economic change for women

entrepreneurs. Together, we are committed to driving positive

change and creating opportunities for economic advancement in

underserved communities."

The credit facility was arranged through Mizuho Bank (USA), a

subsidiary of Mizuho Americas headed by Noriko Ito, President and

CEO. The Bank is a wholesale commercial banking institution based

in New York City that engages in traditional lending, corporate

finance activities and other financial services with a broad range

of corporate clients located in the Americas.

About Mizuho Mizuho Financial Group, Inc. is

the 15th largest bank in the world as measured by total assets of

~$2 trillion, according to S&P Global 2022. Mizuho’s 60,000

employees worldwide offer comprehensive financial services to

clients in 36 countries and 800 offices throughout the Americas,

EMEA, and Asia.

Mizuho Americas is a leading provider of corporate and

investment banking, capital markets, equity and fixed income sales

& trading, derivatives, FX, custody, and research to corporate,

private equity, and institutional clients in the US, Canada, and

Latin America. Through its acquisition of Greenhill, Mizuho

provides M&A, restructuring, and private capital advisory

capabilities across Americas, Europe, and Asia. Mizuho employs

approximately 3,500 professionals, for more information visit

www.mizuhoamericas.com

About Grameen America Grameen America is a

501(c)(3) nonprofit microfinance organization dedicated to helping

underserved women build small businesses to create better lives for

their families. The organization offers microloans, training, and

support to transform communities and fight poverty in the United

States. Since opening in January 2008, Grameen America has invested

$4 billion in nearly 190,000 low-income women entrepreneurs.

Opening initially in Jackson Heights, Queens, Grameen America has

expanded to 27 cities in Atlanta, GA, Austin, TX, Boston, MA,

Camden, NJ, Charlotte, NC, Chicago, IL, Bridgeport, CT, Hartford,

CT, New Haven, CT, Dallas, TX, Fresno, CA, Houston, TX,

Indianapolis, IN, Los Angeles, CA, Memphis, TN, Miami, FL, Newark,

NJ, New York City, NY, Omaha, NE, Oakland, CA, Phoenix, AZ,

Riverside, CA, San Antonio, TX, San Bernadino, CA, San Jose, CA,

Trenton, NJ and Union City, NJ.

For inquiries, please contact: Jim GormanExecutive Director,

Media Relations, Mizuho

Americas+1-212-282-3867jim.gorman@mizuhogroup.com

Laura LondonDirector, Media Relations, Mizuho

Americas+1-212-282-4446laura.london@mizuhogroup.com

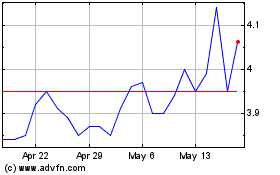

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

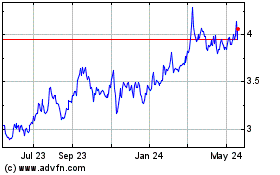

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Nov 2023 to Nov 2024