0000062709false00000627092024-05-162024-05-160000062709mmc:XNYSMember2024-05-162024-05-160000062709mmc:XCHIMember2024-05-162024-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of report (Date of earliest event reported) | November 15, 2024 |

| | |

| Marsh & McLennan Companies, Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| | | | | | | | |

| Delaware | 001-5998 | 36-2668272 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 1166 Avenue of the Americas, | New York, | NY | | 10036 | |

| (Address of Principal Executive Offices) | | (Zip Code) | |

| | | | | | | | | | | | | | | | | |

| Registrant’s telephone number, including area code | | (212) | 345-5000 | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of exchange on which registered |

| Common Stock, par value $1.00 per share | | MMC | | New York Stock Exchange |

| | | | Chicago Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 1.02 Termination of a Material Definitive Agreement.

On November 8, 2024, the Company terminated its Commitment Letter, dated September 29, 2024, with Citigroup Global Markets Inc. related to a short-term unsecured bridge term loan facility (the “Bridge Facility”). The Bridge Facility was not required by the Company and no payments resulted from the termination.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On November 15, 2024, Marsh & McLennan Agency LLC (“MMA”), an indirect wholly-owned subsidiary of Marsh & McLennan Companies, Inc. (the “Company”), consummated the previously announced acquisition of TIH Blocker II, Inc., a Delaware corporation (the “McGriff Parent”), pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) dated as of September 29, 2024, among the Company, BD Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of MMA (“Merger Sub”) and TIH Platform Midco, L.P., a Delaware limited partnership (“Company Stockholder”) for an aggregate purchase price of $7.75 billion in cash, subject to certain customary adjustments as set forth in the Merger Agreement. Pursuant to the Merger Agreement, at the effective time of the merger, Merger Sub merged with and into McGriff Parent, with McGriff Parent continuing as the surviving corporation and a wholly owned subsidiary of MMA (the “Transaction”). In conjunction with the Transaction, the Company will assume a deferred tax asset valued at approximately $500 million.

The foregoing description of the Transaction and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which was filed as Exhibit 2.1 to the Company’s Form 8-K filed with the Securities and Exchange Commission on September 30, 2024 and is incorporated herein by reference. The representations, warranties and covenants in the Merger Agreement were made solely for the benefit of the parties to the Merger Agreement for the purpose of allocating contractual risk between those parties and do not establish these matters as facts. Investors should not rely on the representations, warranties and covenants as characterizations of the actual state of facts or condition of the Company, MMA, Company Stockholder, McGriff Parent or any of their respective subsidiaries or affiliates.

Item 8.01 Other Events.

On November 15, 2024, the Company issued a press release announcing the Transaction. The press release, filed as Exhibit 99.1 to this Current Report on Form 8-K, is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

Exhibit No. Document

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | MARSH & McLENNAN COMPANIES, INC. |

| | | |

| | By: | /s/ Connor Kuratek |

| | Name: | Connor Kuratek |

| | Title: | Deputy General Counsel and Corporate Secretary |

| | | |

Date: November 15, 2024

Exhibit Index

Exhibit No.

| | |

Marsh McLennan 1166 Avenue of the Americas New York, New York, 10036-2774 T +212 345 5000 www.marshmclennan.com

|

News release

| | | | | |

Media contact: Erick Gustafson Marsh McLennan +1 202 263 7788 erick.gustafson@mmc.com | Investor contact: Jay Gelb Marsh McLennan +1 212 345 1569 jay.gelb@mmc.com |

Marsh McLennan completes acquisition of McGriff Insurance Services

NEW YORK, November 15, 2024 – Marsh McLennan (NYSE: MMC), a global leader in risk, strategy and people, today completed the acquisition of McGriff Insurance Services, LLC. With the closing of this acquisition, McGriff’s more than 3,500 colleagues will join Marsh McLennan Agency.

“We are thrilled to welcome the McGriff team to Marsh McLennan,” said John Doyle, President and CEO of Marsh McLennan. “Their deep specialty and industry capabilities will strengthen Marsh McLennan Agency’s value proposition and expand our reach in the growing middle market. Together, McGriff and MMA will deliver even greater value to clients.”

“Armed with McGriff’s outstanding talent, leadership and expertise, we look forward to enhancing our client-centric capabilities to serve even more businesses and communities across the country,” commented David Eslick, Chairman and CEO of Marsh McLennan Agency.

“By joining Marsh McLennan Agency, our teammates gain access to expanded global resources and industry knowledge to build their career growth and bring innovative, actionable solutions to clients—who will continue to be served by the same dedicated teams and client-first strategy they know and trust,” said Read Davis, CEO of McGriff.

Founded in 1886, McGriff is a leading provider of insurance broking and risk management services in the United States.

About Marsh McLennan

Marsh McLennan (NYSE: MMC) is a global leader in risk, strategy and people, advising clients in 130 countries across four businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With annual revenue of $23 billion and more than 85,000 colleagues, Marsh McLennan helps build the confidence to thrive through the power of perspective. For more information, visit marshmclennan.com, or follow on LinkedIn and X.

About McGriff

McGriff Insurance Services, LLC is a full-service insurance broker providing risk management and insurance solutions to clients across the United States. The firm’s coverages include commercial property and casualty, corporate bonding and surety services, cyber, management liability, captives, and alternative risk transfer programs, small business, employee benefits, title insurance, personal lines, and life and health. For more information, please visit www.McGriff.com.

v3.24.3

Document and Entity Information

|

May 16, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 15, 2024

|

| Entity Registrant Name |

Marsh & McLennan Companies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-5998

|

| Entity Tax Identification Number |

36-2668272

|

| Entity Address, Address Line One |

1166 Avenue of the Americas,

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

(212)

|

| Local Phone Number |

345-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $1.00 per share

|

| Trading Symbol |

MMC

|

| Entity Central Index Key |

0000062709

|

| Amendment Flag |

false

|

| NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| X C H I |

|

| Entity Information [Line Items] |

|

| Security Exchange Name |

CHX

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=mmc_XNYSMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=mmc_XCHIMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

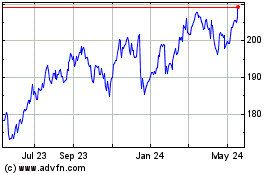

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Nov 2023 to Nov 2024