Form N-CSRS - Certified Shareholder Report, Semi-Annual

January 28 2025 - 5:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06629

Western Asset Managed Municipals Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York,

NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 1-888-777-0102

Date of fiscal year end: May 31

Date of reporting period: November 30, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed

herewith.

Semi-Annual Report

November 30, 2024

WESTERN ASSET

MANAGED MUNICIPALS

FUND INC. (MMU)

Fund objective

The Fund’s investment objective is to seek as high a level of current income exempt from federal income tax* as is consistent with preservation of capital.

When pursuing its investment objective, the Fund seeks to maximize current income

exempt from federal income tax as is consistent with preservation of principal.

The Fund seeks to achieve its objective by investing primarily in long-term investment

grade municipal debt securities issued by state and local governments, political subdivisions,

agencies and public authorities (municipal obligations). Under normal market conditions,

the Fund will invest at least 80% of its total assets in municipal obligations rated investment

grade at the time of investment.

* Certain investors may be subject to the federal alternative minimum tax (“AMT”), and state and local taxes will apply. Capital gains, if any, are fully taxable. Please consult your personal tax

or legal adviser.

Western Asset Managed Municipals Fund Inc.

Letter from the president

We are pleased to provide the semi-annual report of Western Asset Managed Municipals

Fund Inc. for the six-month reporting period ended November 30, 2024. Please read

on for Fund performance information during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full

spectrum of investment choices. We also remain committed to supplementing the support

you receive from your financial advisor. One way we accomplish this is through our

website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

•

Fund prices and performance,

•

Market insights and commentaries from our portfolio managers, and

•

A host of educational resources.

We look forward to helping you meet your financial goals.

Jane Trust, CFA

President and Chief Executive Officer

Western Asset Managed Municipals Fund Inc.

For the six months ended November 30, 2024, Western Asset Managed Municipals Fund Inc. returned 5.73% based on its net asset value (NAV)i and 10.81% based on its New York Stock Exchange (NYSE) market price per share. The Fund’s unmanaged benchmark, the Bloomberg Municipal Bond Indexii, returned 4.54% for the same period.

The Fund has a practice of seeking to maintain a relatively stable level of distributions

to shareholders. This practice has no impact on the Fund’s investment strategy and may reduce the Fund’s NAV. The Fund’s manager believes the practice helps maintain the Fund’s competitiveness and may benefit the Fund’s market price and premium/discount to the Fund’s NAV.

Certain investors may be subject to the federal alternative minimum tax, and state

and local taxes will apply. Capital gains, if any, are fully taxable. Please consult your personal

tax or legal adviser.

During this six-month period, the Fund made distributions to shareholders totaling

$0.33 per share. As of November 30, 2024, the Fund estimates that 58% of the distributions were

sourced from net investment income and 42% constituted a return of capital.* The performance table shows the Fund’s six-month total return based on its NAV and market price as of November 30, 2024. Past performance is no guarantee of future results.

Performance Snapshot as of November 30, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

All figures represent past performance and are not a guarantee of future results.

Performance figures for periods shorter than one year represent cumulative figures and are not

annualized.

** Total returns are based on changes in NAV or market price, respectively. Returns

reflect the deduction of all Fund expenses, including management fees, operating expenses, and

other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that

investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

*

These estimates are not for tax purposes. The Fund will issue a Form 1099 with final

composition of the distributions for tax purposes after year-end. A return of capital is not taxable

and results in a reduction in the tax basis of a shareholder’s investment. For more information about a distribution’s composition, please refer to the Fund’s distribution press release or, if applicable, the Section 19 notice located in the press release section of our website, www.franklintempleton.com.

Western Asset Managed Municipals Fund Inc.

Looking for additional information?

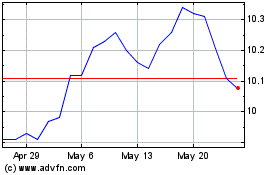

The Fund is traded under the symbol “MMU” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available online under the

symbol “XMMUX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information.

In addition, the Fund issues a quarterly press release that can be found on most major

financial websites as well as www.franklintempleton.com.

In a continuing effort to provide information concerning the Fund, shareholders may

call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern

Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in the Western Asset Managed Municipals Fund Inc. As

always, we appreciate that you have chosen us to manage your assets and we remain

focused on achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

RISKS: The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not

intended to be a complete investment program and, due to the uncertainty inherent in all investments,

there can be no assurance that the Fund will achieve its investment objective. The Fund’s common stock is traded on the New York Stock Exchange. Similar to stocks, the Fund’s share price will fluctuate with market conditions and, at the time of sale, may be worth more or less than the

original investment. Shares of closed-end funds often trade at a discount to their net asset

value. Because the Fund is non-diversified, it may be more susceptible to economic, political

or regulatory events than a diversified fund. The Fund’s investments are subject to a number of risks, including interest rate risk, credit risk, leveraging risk and management risk.

As interest rates rise, the price of fixed income investments declines. Lower rated, higher-yielding

bonds, known as “high yield” or “junk” bonds, are subject to greater liquidity and credit risk than higher rated investment grade securities. Municipal securities purchased by the Fund may

be adversely affected by changes in the financial condition of municipal issuers and insurers,

regulatory and political developments, uncertainties and public perceptions, and other factors. The

Fund may make significant investments in derivative instruments. Derivative instruments can

be illiquid, may disproportionately increase losses and could have a potentially large impact on

Fund performance. The Fund may enter into tender option bond (“TOB”) transactions, which expose the Fund to leverage and credit risk, and generally involve greater risk than investments

in fixed

Western Asset Managed Municipals Fund Inc.

Performance review (cont’d)

rate municipal bonds, including the risk of loss of principal. The interest payments

that the Fund would typically receive on inverse floaters acquired in such transactions vary inversely

with short-term interest rates and will be reduced (and potentially eliminated) when short-term

interest rates increase. Inverse floaters will generally underperform the market for

fixed rate municipal securities when interest rates rise. The value and market for inverse floaters

can be volatile, and inverse floaters can have limited liquidity. Investments in inverse

floaters issued in TOB transactions are derivative instruments and, therefore, are also subject to the

risks generally applicable to investments in derivatives. The Fund may invest in securities

of other investment companies. To the extent it does, Fund stockholders will indirectly pay

a portion of the operating costs of such companies, in addition to the expenses that the Fund bears

directly in connection with its own operations. Investing in securities issued by other investment

companies, including exchange-traded funds (“ETFs”) that invest primarily in municipal securities, involves risks similar to those of investing directly in the securities

in which those investment companies invest. To the extent the Fund invests in securities of other

investment companies, Fund stockholders will indirectly pay a portion of the operating costs

of such companies, in addition to the expenses that the Fund bears directly in connection

with its own operation. Leverage may result in greater volatility of NAV and market price of common

shares and increases a shareholder’s risk of loss. The market values of securities or other assets will fluctuate, sometimes sharply and unpredictably, due to changes in general market conditions,

overall economic trends or events, governmental actions or intervention, actions taken

by the U.S. Federal Reserve or foreign central banks, market disruptions caused by trade

disputes or other factors, political developments, armed conflicts, economic sanctions and countermeasures

in response to sanctions, major cybersecurity events, investor sentiment, the global

and domestic effects of a pandemic, and other factors that may or may not be related to

the issuer of the security or other asset. The Fund may also invest in money market funds, including

funds affiliated with the Fund’s manager and subadviser.

All investments are subject to risk including the possible loss of principal. Past

performance is no guarantee of future results. All index performance reflects no deduction for fees,

expenses or taxes. Please note that an investor cannot invest directly in an index.

i

Net asset value (NAV) is calculated by subtracting total liabilities, including liabilities

associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus

all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The

NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price

at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares.

ii

The Bloomberg Municipal Bond Index is a market value weighted index of investment

grade municipal bonds with maturities of one year or more.

Important data provider notices and terms available at www.franklintempletondatasources.com.

Western Asset Managed Municipals Fund Inc.

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

†

The bar graph above represents the composition of the Fund’s investments as of November 30, 2024, and May 31, 2024, and does not include derivatives, such as futures contracts. The Fund

is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

Black Belt Energy Gas District, AL, Gas Project

Revenue Bonds:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hoover, AL, IDA Revenue, United States Steel

Corp. Project, Series 2019

|

|

|

|

|

Jefferson County, AL, Sewer Revenue:

|

|

|

|

|

Warrants, Series 2024, Refunding

|

|

|

|

|

Warrants, Series 2024, Refunding

|

|

|

|

|

Warrants, Series 2024, Refunding

|

|

|

|

|

Mobile County, AL, IDA Revenue, Solid Waste

Disposal Facility, Calvert LLC Project, Series A

|

|

|

|

|

Southeast Alabama Gas Supply District, Gas

Supply Revenue, Project No 1, Series A,

Refunding

|

|

|

|

|

|

|

|

|

|

Alaska State Housing Finance Corp. Revenue,

State Capital Project II, Series B, Refunding

|

|

|

|

|

Anchorage, AK, Port Revenue, Series A

|

|

|

|

|

Northern Tobacco Securitization Corp., AK,

Tobacco Settlement Revenue:

|

|

|

|

|

Asset Backed Senior Bonds, Class 1, Series A,

Refunding

|

|

|

|

|

Asset Backed Senior Bonds, Series A, Class 1,

Refunding

|

|

|

|

|

|

|

|

|

|

Arizona State IDA, Education Revenue, Basis

School Project, Credit Enhanced, Series F,

Refunding, SD Credit Program

|

|

|

|

|

Chandler, AZ, IDA Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Navajo Nation, AZ, Revenue, Series A,

Refunding

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Queen Creek, AZ, Excise Tax & State Shared

Revenue, Series A

|

|

|

|

|

Salt Verde, AZ, Financial Corp., Natural Gas

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arkansas State Development Finance Authority,

Environmental Improvement Revenue,

United States Steel Corporation Project, Green

Bonds

|

|

|

|

|

|

|

Alameda, CA, Corridor Transportation Authority

Revenue:

|

|

|

|

|

Convertible CAB, Series C, AGM

|

|

|

|

|

Second Subordinated Lien, Series B,

Refunding

|

|

|

|

|

California State Community Choice Financing

Authority Revenue:

|

|

|

|

|

Clean Energy Project, Green Bonds, Series A-1

|

|

|

|

|

Clean Energy Project, Green Bonds, Series B

|

|

|

|

|

Clean Energy Project, Green Bonds, Series B-1

|

|

|

|

|

Clean Energy Project, Green Bonds, Series C

|

|

|

|

|

Clean Energy Project, Green Bonds, Series E

|

|

|

|

|

California State Health Facilities Financing

Authority Revenue, Lucile Salter Packard

Children’s Hospital at Stanford

|

|

|

|

|

California State MFA Revenue, Senior Lien,

LINXS APM Project, Series A

|

|

|

|

|

California State PCFA Water Furnishing Revenue,

Poseidon Resources Desalination Project

|

|

|

|

|

|

|

|

|

|

|

School Facilities Improvement District No 4,

GO, Series A, Refunding

|

|

|

|

|

School Facilities Improvement District No 5,

GO, Series B, Refunding

|

|

|

|

|

School Facilities Improvement District No 5,

GO, Series B, Refunding

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Los Angeles, CA, Department of Airports

Revenue:

|

|

|

|

|

Los Angeles International Airport,

Subordinated, Series C, Refunding

|

|

|

|

|

Los Angeles International Airport,

Subordinated, Series C, Refunding

|

|

|

|

|

Los Angeles International Airport,

Subordinated, Series D

|

|

|

|

|

Los Angeles International Airport,

Subordinated, Series F, Refunding

|

|

|

|

|

Los Angeles, CA, Department of Water & Power,

Power System Revenue, Series C

|

|

|

|

|

Los Angeles, CA, Department of Water & Power,

Waterworks Revenue, Series A

|

|

|

|

|

Los Angeles, CA, Wastewater System Revenue,

Green Bonds, Subordinated, Series A

|

|

|

|

|

M-S-R Energy Authority, CA, Natural Gas

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

River Islands, CA, Public Financing Authority,

Special Tax Revenue:

|

|

|

|

|

Community Facilities District No 2003-1

|

|

|

|

|

Community Facilities District No 2003-1

|

|

|

|

|

Community Facilities District No 2023-1

|

|

|

|

|

Riverside, CA, Electric Revenue, Series A,

Refunding

|

|

|

|

|

San Diego County, CA, Regional Airport

Authority Revenue, Series B

|

|

|

|

|

San Francisco, CA, City & County Airport

Commission, International Airport Revenue:

|

|

|

|

|

Second Series A, Unrefunded

|

|

|

|

|

SFO Fuel Company LLC, Series A, Refunding

|

|

|

|

|

San Mateo County, CA, Joint Powers Financing

Authority, Lease Revenue, Capital Project, Series

A

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Tobacco Securitization Authority of Southern

California Revenue:

|

|

|

|

|

Asset Backed Refunding, San Diego County

Tobacco Asset Securitization Corporation,

Class 1, Series A

|

|

|

|

|

Asset Backed Refunding, San Diego County

Tobacco Asset Securitization Corporation,

Class 1, Series A

|

|

|

|

|

Tulare, CA, Sewer Revenue, Refunding, AGM

|

|

|

|

|

|

|

|

|

|

Base Village Metropolitan District No 2, CO, GO,

Series A, Refunding

|

|

|

|

|

Colorado State Educational & Cultural Facilities

Authority Revenue, University of Denver Project,

Series A

|

|

|

|

|

Colorado State Health Facilities Authority

Revenue:

|

|

|

|

|

Commonspirit Health Initiatives, Series B-2

|

|

|

|

|

Commonspirit Health Project, Series A-2,

Refunding

|

|

|

|

|

Colorado State High Performance Transportation

Enterprise Revenue, C-470 Express Lanes

|

|

|

|

|

Denver, CO, Airport System Revenue:

|

|

|

|

|

|

|

|

|

|

|

Subordinated, Series B, Refunding

|

|

|

|

|

Public Authority for Colorado Energy, Natural

Gas Purchase Revenue

|

|

|

|

|

|

|

|

|

|

Connecticut State Special Tax Revenue,

Transportation Infrastructure, Series A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Harbor Point, CT, Infrastructure Improvement

District, Special Obligation Revenue, Harbor

Point Project Ltd., Refunding

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

University of Connecticut, Student Fee Revenue,

Series A

|

|

|

|

|

|

|

|

|

|

Delaware State Health Facilities Authority

Revenue, Beebe Medical Center Project

|

|

|

|

|

District of Columbia — 1.1%

|

District of Columbia Revenue:

|

|

|

|

|

KIPP DC Issue, Series A, Refunding

|

|

|

|

|

KIPP DC Project, Series B, Refunding

|

|

|

|

|

Metropolitan Washington, DC, Airports Authority

Aviation Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total District of Columbia

|

|

|

|

Broward County, FL, Airport System Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Broward County, FL, Port Facilities Revenue,

Series 2022

|

|

|

|

|

Florida State Development Finance Corp.,

Educational Facilities Revenue, Renaissance

Charter School Inc. Projects, Series A

|

|

|

|

|

Florida State Development Finance Corp.,

Revenue, Brightline Passenger Rail Project,

Refunding, AGM

|

|

|

|

|

Florida State Insurance Assistance Interlocal

Agency Inc., Revenue, Series A-1, Refunding

|

|

|

|

|

Florida State Mid-Bay Bridge Authority Revenue:

|

|

|

|

|

First Senior Lien, Series A, Refunding

|

|

|

|

|

|

|

|

|

|

|

Fort Pierce, FL, Utilities Authority Revenue,

Series A, Refunding, AGM

|

|

|

|

|

Greater Orlando, FL, Aviation Authority, Airport

Facilities Revenue:

|

|

|

|

|

Priority Subordinated, Series A

|

|

|

|

|

Priority Subordinated, Series A

|

|

|

|

|

Hillsborough County, FL, Aviation Authority

Revenue, Tampa International Airport, Series E

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Miami-Dade County, FL, Aviation Revenue,

Series A, Refunding

|

|

|

|

|

Miami-Dade County, FL, Expressway Authority,

Series A, Refunding

|

|

|

|

|

Miami-Dade County, FL, Seaport Revenue:

|

|

|

|

|

Senior Bonds, Series A, Refunding

|

|

|

|

|

Senior Bonds, Series A, Refunding

|

|

|

|

|

Orange County, FL, Health Facilities Authority

Revenue, Orlando Health Inc., Series A

|

|

|

|

|

Palm Beach County, FL, Health Facilities

Authority Revenue:

|

|

|

|

|

Acts Retirement-Life Communities

|

|

|

|

|

Jupiter Medical Center Project, Series A

|

|

|

|

|

Toby & Leon Cooperman Sinai Residences of

Boca Raton Expansion, Refunding

|

|

|

|

|

Pasco County, FL, Capital Improvement, Cigarette

Tax Allocation Bonds, H. Lee Moffitt Cancer

Center Project, Series A, AGM

|

|

|

|

|

Volusia County, FL, EFA Revenue, Educational

Facilities Embry-Riddle Aeronautical

University Inc. Project, Refunding

|

|

|

|

|

Wildwood, FL, Village Community Development

District No 15, Special Assessment Revenue,

Series 2024

|

|

|

|

|

|

|

|

|

|

Cobb County, GA, Kennestone Hospital Authority

Revenue, Wellstar Health System, Inc. Project,

Series A, Refunding

|

|

|

|

|

Georgia State Municipal Electric Authority,

Power Revenue:

|

|

|

|

|

Plant Vogtle Units 3&4, Project M, Series A

|

|

|

|

|

Plant Vogtle Units 3&4, Project P, Series A

|

|

|

|

|

Plant Vogtle Units 3&4, Project P, Series A,

Refunding

|

|

|

|

|

Project One, Series A, Refunding

|

|

|

|

|

Main Street Natural Gas Inc., GA, Gas Project

Revenue:

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guam Government, Business Privilege Tax

Revenue, Series F, Refunding

|

|

|

|

|

|

|

Honolulu, HI, City & County Wastewater System

Revenue:

|

|

|

|

|

First Senior Bond Resolution, Series A

|

|

|

|

|

First Senior Bond Resolution, Series A,

Refunding

|

|

|

|

|

|

|

|

|

|

Idaho State Health Facilities Authority Revenue,

Trinity Health Credit Group, Series A

|

|

|

|

|

|

|

Chicago, IL, Board of Education, Dedicated

Capital Improvement, Special Tax Revenue,

Series 2018

|

|

|

|

|

Chicago, IL, Board of Education, GO:

|

|

|

|

|

|

|

|

|

|

|

Dedicated, Series G, Refunding

|

|

|

|

|

Dedicated, Series G, Refunding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chicago, IL, O’Hare International Airport

Revenue:

|

|

|

|

|

General Senior Lien, Series B, Refunding

|

|

|

|

|

General Senior Lien, Series C, Refunding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Chicago, IL, Transit Authority, Sales Tax Receipts

Revenue:

|

|

|

|

|

|

|

|

|

|

|

Second Lien, Series A, Refunding

|

|

|

|

|

Second Lien, Series A, Refunding

|

|

|

|

|

Chicago, IL, Wastewater Transmission Revenue:

|

|

|

|

|

|

|

|

|

|

|

Second Lien, Series A, AGM

|

|

|

|

|

Second Lien, Series B, Refunding

|

|

|

|

|

Chicago, IL, Waterworks Revenue:

|

|

|

|

|

|

|

|

|

|

|

Second Lien, Series 2017, Refunding

|

|

|

|

|

Second Lien, Series 2017-2, Refunding, AGM

|

|

|

|

|

Second Lien, Series 2017-2, Refunding, AGM

|

|

|

|

|

Second Lien, Series 2017-2, Refunding, AGM

|

|

|

|

|

Cook County, IL, Sales Tax Revenue, Series A,

Refunding

|

|

|

|

|

Illinois State Finance Authority Revenue,

Northshore University Healthsystem, Series A,

Refunding

|

|

|

|

|

Illinois State Finance Authority, Student Housing

& Academic Facilities Revenue, CHF

Chicago LLC, University of Illinois Chicago

Project

|

|

|

|

|

Illinois State Sports Facilities Authority Revenue:

|

|

|

|

|

Sport Facilities Project, Series 2019,

Refunding, BAM

|

|

|

|

|

Sport Facilities Project, Series 2019,

Refunding, BAM

|

|

|

|

|

Illinois State Toll Highway Authority Revenue,

Series A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metropolitan Pier & Exposition Authority, IL,

Revenue:

|

|

|

|

|

McCormick Place Expansion Project, Series A,

Refunding

|

|

|

|

|

McCormick Place Expansion Project, Series A,

Refunding

|

|

|

|

|

McCormick Place Expansion Project, Series A,

Refunding

|

|

|

|

|

McCormick Place Expansion Project, Series B,

Refunding

|

|

|

|

|

McCormick Place Expansion Project, Series

B-1, Refunding, AGM

|

|

|

|

|

|

|

|

|

|

Indiana State Finance Authority Revenue:

|

|

|

|

|

BHI Senior Living Inc., Series A, Refunding

|

|

|

|

|

Marion General Hospital, Series A

|

|

|

|

|

Midwestern Disaster Relief, Ohio Valley

Electric Corp. Project, Series A

|

|

|

|

|

Indianapolis, IN, Local Public Improvement Bond

Bank:

|

|

|

|

|

Courthouse and Jail Project, Series A

|

|

|

|

|

Courthouse and Jail Project, Series A

|

|

|

|

|

Valparaiso, IN, Exempt Facilities Revenue:

|

|

|

|

|

Pratt Paper LLC Project, Refunding

|

|

|

|

|

Pratt Paper LLC Project, Refunding

|

|

|

|

|

|

|

|

|

|

Iowa State Tobacco Settlement Authority

Revenue, Asset Backed Senior Bonds, Class 1,

Series A-2, Refunding

|

|

|

|

|

|

|

Kentucky State Economic Development Finance

Authority Revenue, Louisville Arena, Louisville

Arena Authority Inc., Refunding, AGM

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Kentucky State PEA, Gas Supply Revenue, Series

A

|

|

|

|

|

|

|

|

|

|

Port New Orleans, LA, Board of Commissioners

Revenue, Series B, Refunding, AGM

|

|

|

|

|

Shreveport, LA, Water & Sewer Revenue,

Refunding, AGM

|

|

|

|

|

St. John the Baptist Parish, LA, State Revenue:

|

|

|

|

|

Marathon Oil Corp. Project, Series A-3,

Refunding

|

|

|

|

|

Marathon Oil Corp. Project, Series B-2,

Refunding

|

|

|

|

|

|

|

|

|

|

Maryland State EDC, Senior Student Housing

Revenue:

|

|

|

|

|

Morgan State University Project

|

|

|

|

|

Morgan State University Project

|

|

|

|

|

Maryland State Stadium Authority, Built to Learn

Revenue, Series 2021

|

|

|

|

|

|

|

|

|

|

Massachusetts State DFA Revenue:

|

|

|

|

|

Boston Medical Center, Sustainability Bonds,

Series G, Refunding

|

|

|

|

|

International Charter School, Refunding

|

|

|

|

|

Milford Regional Medical Center, Series F,

Refunding

|

|

|

|

|

Northeastern University Issue, Refunding

|

|

|

|

|

UMass Boston Student Housing Project

|

|

|

|

|

Massachusetts State Port Authority Revenue:

|

|

|

|

|

Bosfuel Project, Series A, Refunding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Great Lakes, MI, Water Authority, Sewage

Disposal System Revenue, Senior Lien, Series C

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Great Lakes, MI, Water Authority, Water Supply

System Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior Lien, Series C, Refunding

|

|

|

|

|

Kent County, MI, Gerald R. Ford International

Airport, GO, Authority Revenue, County GTD

|

|

|

|

|

Michigan State Finance Authority Revenue:

|

|

|

|

|

Local Government Loan Program, Detroit, MI,

Water & Sewer Department, Second Lien

Local Project, Series C, Refunding

|

|

|

|

|

Local Government Loan Program, Detroit, MI,

Water & Sewer Department, Series D-2,

Refunding

|

|

|

|

|

The Henry Ford Health Detroit South Campus

Central Utility Plant Project, Act 38 Facilities,

Senior Green Bonds

|

|

|

|

|

Tobacco Settlement Asset Backed Senior

Bonds, Series B-1, Refunding

|

|

|

|

|

Michigan State Hospital Finance Authority

Revenue, Ascension Health Senior Credit Group,

Series 2010 F-4, Refunding

|

|

|

|

|

Michigan State Strategic Fund Limited

Obligation Revenue, I-75 Improvement Project

|

|

|

|

|

|

|

|

|

|

Missouri State HEFA Revenue, Senior Living

Facilities, Lutheran Senior Services Projects,

Series A

|

|

|

|

|

St. Louis County, MO, IDA, Senior Living

Facilities Revenue, Friendship Village, St. Louis

Obligated Group, Series A

|

|

|

|

|

|

|

|

|

|

Omaha, NE, Public Power District, Electric

System Revenue, Series B, Refunding

|

|

|

|

|

|

|

National Finance Authority, NH, Revenue,

Presbyterian Senior Living Project, Series A

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

New Jersey State EDA Revenue:

|

|

|

|

|

Private Activity-The Goethals Bridge

Replacement Project

|

|

|

|

|

Private Activity-The Goethals Bridge

Replacement Project, AGM

|

|

|

|

|

Provident Group - Rowan Properties LLC,

Rowan University Housing Project

|

|

|

|

|

Special Facility, Port Newark Container

Terminal LLC Project, Refunding

|

|

|

|

|

New Jersey State EDA, Lease Revenue, State

House Project, Series B

|

|

|

|

|

New Jersey State EDA, Special Facility Revenue,

Continental Airlines Inc. Project

|

|

|

|

|

New Jersey State EFA Revenue, Stevens

Institute of Technology, Refunding

|

|

|

|

|

New Jersey State Health Care Facilities

Financing Authority Revenue, RWJ Barnabas

Health Obligation Group, Series A, Refunding

|

|

|

|

|

New Jersey State Institute of Technology, GO,

Series A

|

|

|

|

|

New Jersey State Transportation Trust Fund

Authority Revenue:

|

|

|

|

|

Transportation Program, Series AA

|

|

|

|

|

Transportation Program, Series AA

|

|

|

|

|

Transportation Program, Series AA, Refunding

|

|

|

|

|

Transportation Program, Series AA, Refunding

|

|

|

|

|

Transportation Program, Series AA, Refunding

|

|

|

|

|

Transportation Program, Series AA,

Unrefunded

|

|

|

|

|

Transportation Program, Series BB

|

|

|

|

|

Transportation Program, Series BB

|

|

|

|

|

Transportation System, Series A, Refunding

|

|

|

|

|

Transportation System, Series A, Refunding

|

|

|

|

|

New Jersey State Turnpike Authority Revenue,

Series C, Refunding

|

|

|

|

|

Tobacco Settlement Financing Corp., NJ,

Revenue, Series A, Refunding

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Brookhaven, NY, Local Development Corp.

Revenue, Long Island Community Hospital

Project, Series A, Refunding

|

|

|

|

|

Long Island, NY, Power Authority Electric System

Revenue, Series B

|

|

|

|

|

MTA, NY, Dedicated Tax Fund Revenue:

|

|

|

|

|

|

|

|

|

|

|

Green Bonds, Subseries B-1, Refunding

|

|

|

|

|

MTA, NY, Transportation Revenue:

|

|

|

|

|

Green Bonds, Series C-1, Refunding

|

|

|

|

|

Green Bonds, Series E, Refunding

|

|

|

|

|

Green Bonds, Series E, Refunding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York City, NY, Industrial Development

Agency Revenue:

|

|

|

|

|

Yankee Stadium Project, Refunding

|

|

|

|

|

Yankee Stadium Project, Refunding, AGM

|

|

|

|

|

New York City, NY, Municipal Water Finance

Authority, Water & Sewer System Revenue:

|

|

|

|

|

Second General Resolution Fiscal 2022,

Series AA, Subseries AA-1

|

|

|

|

|

Second General Resolution Fiscal 2023,

Series AA, Subseries AA-1

|

|

|

|

|

Second General Resolution, Series CC

|

|

|

|

|

Second General Resolution, Series CC-1,

Refunding

|

|

|

|

|

New York City, NY, TFA, Future Tax Secured

Revenue:

|

|

|

|

|

Subordinated, Series F, Subseries F-1

|

|

|

|

|

Subordinated, Subseries F-1

|

|

|

|

|

New York State Dormitory Authority Revenue:

|

|

|

|

|

Non-State Supported Debt, Memorial Sloan-

Kettering Cancer Center, Series B-1

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Non-State Supported Debt, New School

University, Series A, Unrefunded

|

|

|

|

|

Non-State Supported Debt, SD, Series A,

Refunding, AGM

|

|

|

|

|

New York State Dormitory Authority, Sales Tax

Revenue:

|

|

|

|

|

Bidding Group 4, Series A

|

|

|

|

|

Bidding Group 4, Series E, Refunding

|

|

|

|

|

New York State Dormitory Authority, State

Personal Income Tax Revenue:

|

|

|

|

|

Bidding Group 3, Series B, Refunding

|

|

|

|

|

Bidding Group 3, Series B, Refunding

|

|

|

|

|

Bidding Group 3, Series B, Unrefunded

|

|

|

|

|

Bidding Group 4, Series A, Refunding

|

|

|

|

|

Bidding Group 4, Series A, Refunding

|

|

|

|

|

Bidding Group 4, Series D, Refunding

|

|

|

|

|

New York State Liberty Development Corp.,

Revenue:

|

|

|

|

|

3 World Trade Center Project, Class 1,

Refunding

|

|

|

|

|

7 World Trade Center Project, Class 2,

Refunding

|

|

|

|

|

Goldman Sachs Headquarters

|

|

|

|

|

New York State Thruway Authority General

Revenue, Junior Indebtedness Obligations,

Junior Lien, Series B, Refunding

|

|

|

|

|

New York State Transportation Development

Corp., Special Facilities Revenue:

|

|

|

|

|

Delta Air Lines Inc., LaGuardia Airport

Terminals C and D Redevelopment Project

|

|

|

|

|

Delta Air Lines Inc., LaGuardia Airport

Terminals C and D Redevelopment Project

|

|

|

|

|

Delta Air Lines Inc., LaGuardia Airport

Terminals C and D Redevelopment Project

|

|

|

|

|

Delta Air Lines Inc., LaGuardia Airport

Terminals C and D Redevelopment Project

|

|

|

|

|

Delta Air Lines Inc., LaGuardia Airport

Terminals C and D Redevelopment Project

|

|

|

|

|

Delta Air Lines Inc., LaGuardia Airport

Terminals C and D Redevelopment Project

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

John F. Kennedy International Airport New

Terminal One Project, Green Bonds

|

|

|

|

|

John F. Kennedy International Airport New

Terminal One Project, Green Bonds

|

|

|

|

|

John F. Kennedy International Airport New

Terminal One Project, Green Bonds, AGM

|

|

|

|

|

John F. Kennedy International Airport Terminal

4 Project, Series C, Refunding

|

|

|

|

|

John F. Kennedy International Airport Terminal

Six Redevelopment Project, Green Bonds,

Series A, Refunding

|

|

|

|

|

John F. Kennedy International Airport Terminal

Six Redevelopment Project, Green Bonds,

Series A, Refunding, AGC

|

|

|

|

|

John F. Kennedy International Airport Terminal

Six Redevelopment Project, Green Bonds,

Series B, Refunding, AGC

|

|

|

|

|

LaGuardia Airport Terminal B Redevelopment

Project, Series A

|

|

|

|

|

LaGuardia Airport Terminal B Redevelopment

Project, Series A

|

|

|

|

|

New York State Urban Development Corp.,

Revenue, State Personal Income Tax, Series C,

Refunding

|

|

|

|

|

Port Authority of New York & New Jersey

Revenue:

|

|

|

|

|

Consolidated Series 194, Refunding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Triborough Bridge & Tunnel Authority, NY,

Revenue:

|

|

|

|

|

General-MTA Bridges & Tunnels, Series A

|

|

|

|

|

General-MTA Bridges & Tunnels, Series A

|

|

|

|

|

General-MTA Bridges & Tunnels, Series A

|

|

|

|

|

General-MTA Bridges & Tunnels, Series A

|

|

|

|

|

MTA Bridges & Tunnels, Senior Lien, Series

A-1, Refunding

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

North Carolina State Medical Care Commission,

Retirement Facilities Revenue:

|

|

|

|

|

The Forest at Duke Project

|

|

|

|

|

The Forest at Duke Project

|

|

|

|

|

The Forest at Duke Project

|

|

|

|

|

North Carolina State Turnpike Authority, Monroe

Expressway Toll Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grand Forks, ND, Health Care System Revenue,

Altru Health System, Refunding, AGM

|

|

|

|

|

|

|

Buckeye, OH, Tobacco Settlement Financing

Authority Revenue, Senior Bonds, Series B-2,

Refunding

|

|

|

|

|

Ohio State Air Quality Development Authority

Revenue:

|

|

|

|

|

American Electric Co. Project, Series B

|

|

|

|

|

American Electric Co. Project, Series D,

Refunding

|

|

|

|

|

AMG Vanadium Project, Series 2019

|

|

|

|

|

Duke Energy Corp. Project, Series B,

Refunding

|

|

|

|

|

|

|

|

|

|

Multnomah County, OR, School District No 7,

Reynolds, GO, Deferred Interest, Series B,

School Board Guaranty

|

|

|

|

|

Oregon State Business Development

Commission Revenue, Recovery Zone Facility

Bonds, Intel Corp. Project, Series 232

|

|

|

|

|

Oregon State Facilities Authority Revenue,

Legacy Health Project, Series A, Refunding

|

|

|

|

|

|

|

|

|

|

Allegheny County, PA, HDA Revenue, University

of Pittsburgh Medical Center, Series A,

Refunding

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Commonwealth Financing Authority, PA, Tobacco

Master Settlement Payment Revenue Bonds,

Series 2018

|

|

|

|

|

Cumberland County, PA, Municipal Authority

Revenue:

|

|

|

|

|

Diakon Lutheran Social Ministries, Refunding

|

|

|

|

|

Diakon Lutheran Social Ministries,

Unrefunded

|

|

|

|

|

Diakon Lutheran Social Ministries,

Unrefunded

|

|

|

|

|

Lancaster County, PA, Convention Center

Authority Revenue, Hotel Room Rental Tax:

|

|

|

|

|

Series B, Refunding, County GTD

|

|

|

|

|

Series B, Refunding, County GTD

|

|

|

|

|

Lancaster County, PA, Hospital Authority

Revenue, Penn State Health, Series 2021

|

|

|

|

|

Pennsylvania State Economic Development

Financing Authority Exempt Facilities Revenue,

PPL Energy Supply LLC Project, Series B,

Refunding

|

|

|

|

|

Pennsylvania State Economic Development

Financing Authority Revenue:

|

|

|

|

|

Exempt Facilities Bonds, PPL Energy

Supply LLC Project, Series C, Refunding

|

|

|

|

|

Tax-Exempt Private Activity, The Penndot

Major Bridges Package One Project

|

|

|

|

|

Tax-Exempt Private Activity, The Penndot

Major Bridges Package One Project

|

|

|

|

|

Pennsylvania State Turnpike Commission

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philadelphia, PA, Airport Revenue, Series A,

Refunding

|

|

|

|

|

Philadelphia, PA, Authority for IDR:

|

|

|

|

|

Charter School Revenue, A String Theory

Charter School Project, Refunding

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

City Service Agreement Revenue, Rebuild

Project

|

|

|

|

|

City Service Agreement Revenue, Rebuild

Project

|

|

|

|

|

Philadelphia, PA, SD, GO, Series A, State Aid

Withholding

|

|

|

|

|

State Public School Building Authority, PA, Lease

Revenue:

|

|

|

|

|

Philadelphia SD Project, Series A, Refunding,

AGM, State Aid Withholding

|

|

|

|

|

Philadelphia SD Project, Series A, Refunding,

AGM, State Aid Withholding

|

|

|

|

|

|

|

|

|

|

Puerto Rico Commonwealth Aqueduct & Sewer

Authority Revenue:

|

|

|

|

|

Senior Lien, Series A, Refunding

|

|

|

|

|

Senior Lien, Series A, Refunding

|

|

|

|

|

Puerto Rico Commonwealth, GO:

|

|

|

|

|

CAB, Restructured, Series A-1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Puerto Rico Electric Power Authority Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Puerto Rico Sales Tax Financing Corp., Sales Tax

Revenue:

|

|

|

|

|

CAB, Restructured, Series A-1

|

|

|

|

|

CAB, Restructured, Series A-1

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructured, Series A-2A

|

|

|

|

|

|

|

|

|

|

Patriots Energy Group Financing Agency, SC, Gas

Supply Revenue, Subseries B-2, Refunding (SOFR

x 0.670 + 1.900%)

|

|

|

|

|

South Carolina State Jobs-EDA Hospital

Facilities Revenue, Bon Secours Mercy

Health Inc., Series A, Refunding

|

|

|

|

|

South Carolina State Ports Authority Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Dakota State HEFA Revenue, Regional

Health

|

|

|

|

|

|

|

Clarksville, TN, Water, Sewer & Gas Revenue,

Series A

|

|

|

|

|

Knox County, TN, Health, Educational & Housing

Facility Board Revenue, University Health

System Inc., Series A

|

|

|

|

|

Metropolitan Government of Nashville &

Davidson County, TN, Sports Authority Revenue,

Series A, AGM

|

|

|

|

|

Metropolitan Government of Nashville &

Davidson County, TN, Water & Sewer Revenue:

|

|

|

|

|

Subordinated, Green Bonds, Series A,

Refunding

|

|

|

|

|

Subordinated, Series B, Refunding

|

|

|

|

|

Tennessee State Energy Acquisition Corp.,

Natural Gas Revenue, Series 2018

|

|

|

|

|

|

|

|

|

|

Arlington, TX, Higher Education Finance Corp.,

Education Revenue, Uplift Education, Series A,

Refunding, PSF - GTD

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Arlington, TX, Special Tax Revenue, Senior Lien,

Series A, AGM

|

|

|

|

|

Austin, TX, Airport System Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Central Texas Regional Mobility Authority

Revenue, Senior Lien, Series B

|

|

|

|

|

Central Texas Turnpike System Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elgin, TX, ISD, GO, Unlimited Tax School Building

Bonds, PSF - GTD

|

|

|

|

|

Forney, TX, ISD, GO, Unlimited Tax School

Building Bonds, Series 2019, PSF - GTD

|

|

|

|

|

Galveston, TX, Wharves & Terminal Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grand Parkway Transportation Corp., TX, System

Toll Revenue, Convertible CAB, Series A, B and C

|

|

|

|

|

Harris County, TX, Cultural Education Facilities

Finance Corp., Hospital Revenue, Texas

Children’s Hospital, Series B, Refunding

|

|

|

|

|

Harris County, TX, GO, Certificates of Obligation

|

|

|

|

|

Hays, TX, ISD, GO, Unlimited Tax School Building

Bonds, PSF - GTD

|

|

|

|

|

Houston, TX, GO, Series A

|

|

|

|

|

Houston, TX, Airport System Revenue:

|

|

|

|

|

|

|

|

|

|

|

Special Facilities, United Airlines Inc.,

Terminal Improvement Project, Series B-1

|

|

|

|

|

Subordinated Lien, Series A, Refunding

|

|

|

|

|

Subordinated Lien, Series A, Refunding

|

|

|

|

|

Houston, TX, Combined Utility System Revenue,

First Lien, Series D, Refunding

|

|

|

|

|

Longview, TX, ISD, GO, Unlimited Tax School

Building Bonds, PSF - GTD

|

|

|

|

|

Love Field, TX, Airport Modernization Corp.,

General Airport Revenue:

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Hope Cultural Education Facilities Finance

Corp., TX, Student Housing Revenue, Collegiate

Housing College Station, AGM

|

|

|

|

|

Newark, TX, Higher Education Finance Corp.,

Education Revenue, TLC Academy, Series A

|

|

|

|

|

Port Beaumont, TX, Navigation District Dock and

Wharf Facility Revenue, Jefferson Gulf Coast

Energy Project, Series A

|

|

|

|

|

Tarrant County, TX, Cultural Education Facilities

Finance Corp., Hospital Revenue, Methodist

Hospitals of Dallas

|

|

|

|

|

Texas State Private Activity Bond Surface

Transportation Corp. Revenue, Senior Lien, NTE

Mobility Partners Segments 3 LLC, Refunding

|

|

|

|

|

|

|

|

|

|

Salt Lake City, UT, Airport Revenue, Salt Lake

City International Airport, Series A

|

|

|

|

|

Utah State Charter School Finance Authority,

Charter School Revenue:

|

|

|

|

|

Syracuse Arts Academy Project, UT CSCE

|

|

|

|

|

Syracuse Arts Academy Project, UT CSCE

|

|

|

|

|

Utah State Infrastructure Agency,

Telecommunications Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arlington County, VA, IDA, Hospital Revenue,

Virginia Hospital Center, Refunding

|

|

|

|

|

Isle of Wight County, VA, EDA Revenue:

|

|

|

|

|

Riverside Health System, Series 2023, AGM

|

|

|

|

|

Riverside Health System, Series 2023, AGM

|

|

|

|

|

Virginia State Port Authority, Port Facilities

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Virginia State Small Business Financing

Authority Revenue:

|

|

|

|

|

National Senior Campuses, Inc., Series A,

Refunding

|

|

|

|

|

National Senior Campuses, Inc., Series A,

Refunding

|

|

|

|

|

Senior Lien, 95 Express Lanes LLC Project,

Refunding

|

|

|

|

|

Senior Lien, 95 Express Lanes LLC Project,

Refunding

|

|

|

|

|

Senior Lien, 95 Express Lanes LLC Project,

Refunding

|

|

|

|

|

Senior Lien, I-495 HOT Lanes Project,

Refunding

|

|

|

|

|

|

|

|

|

|

Port of Seattle, WA, Intermediate Lien Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington State Health Care Facilities

Authority Revenue:

|

|

|

|

|

Seattle Cancer Care Alliance, Refunding

|

|

|

|

|

Seattle Cancer Care Alliance, Refunding

|

|

|

|

|

Seattle Cancer Care Alliance, Refunding

|

|

|

|

|

|

|

|

|

|

Public Finance Authority, WI, Airport Facilities

Revenue, Transportation Infrastructure

Properties LLC, Series B, Refunding

|

|

|

|

|

Public Finance Authority, WI, Revenue:

|

|

|

|

|

|

|

|

|

|

|

The Carmelite System Inc. Obligated Group,

Refunding

|

|

|

|

|

Public Finance Authority, WI, Student Housing

Revenue, University of Hawai’i Foundation

Project, Green Bonds, Series A-1

|

|

|

|

|

Village of Mount Pleasant, WI, Tax Increment

Revenue, Series A, Moral Obligations

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Wisconsin State HEFA Revenue, Bellin Memorial

Hospital Inc., Series A

|

|

|

|

|

|

|

|

|

|

Total Municipal Bonds (Cost — $878,672,785)

|

|

Municipal Bonds Deposited in Tender Option Bond Trusts(k) — 6.0%

|

|

|

Florida State Department of Transportation

Turnpike Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York City, NY, Municipal Water Finance

Authority, Water & Sewer System Revenue,

Second General Resolution Fiscal 2023,

Subseries AA-1

|

|

|

|

|

New York State Dormitory Authority, State

Personal Income Tax Revenue, Series A

|

|

|

|

|

New York State Urban Development Corp., State

Sales Tax Revenue, Series A

|

|

|

|

|

|

|

|

|

|

Total Municipal Bonds Deposited in Tender Option Bond Trusts

(Cost — $37,113,817)

|

|

Total Investments before Short-Term Investments (Cost — $915,786,602)

|

|

|

|

Short-Term Investments — 0.4%

|

|

|

|

|

Massachusetts State DFA Revenue:

|

|

|

|

|

Boston University Issue, Series U-6E,

Refunding, LOC - TD Bank N.A.

|

|

|

|

|

Children Hospital Issue, Series U-1,

Refunding, LOC - TD Bank N.A.

|

|

|

|

|

|

|

|

|

|

University of Michigan, MI, General Revenue,

Series D-1, Refunding

|

|

|

|

|

|

|

Mississippi State Business Finance Corp., Gulf

Opportunity Zone, IDR, Chevron USA Inc. Project,

Series G

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Western Asset Managed Municipals Fund Inc.

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Short-Term Investments — continued

|

|

|

New York State Dormitory Authority Revenue,

Non-State Supported Debt, Rockefeller

University, Series A-2, SPA - JPMorgan Chase &

Co.

|

|

|

|

|

|

|

Lower Neches Valley Authority, TX, Industrial

Development Corp. Revenue, ExxonMobil Corp.,

Series A, Refunding

|

|

|

|

|

|

|

King County, WA, GO, Series A, Refunding, SPA -

TD Bank N.A.

|

|

|

|

|

|

|

Total Short-Term Investments (Cost — $2,750,000)

|

|

Total Investments — 147.2% (Cost — $918,536,602)

|

|

Variable Rate Demand Preferred Stock, at Liquidation Value — (44.4)%

|

|

TOB Floating Rate Notes — (3.4)%

|

|

Other Assets in Excess of Other Liabilities — 0.6%

|

|

Total Net Assets Applicable to Common Shareholders — 100.0%

|

|

See Notes to Financial Statements.

Western Asset Managed Municipals Fund Inc. 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

November 30, 2024

Western Asset Managed Municipals Fund Inc.

|

|

Represents less than 0.1%.

|

|

|

Non-income producing security.

|

|

|

Maturity date shown represents the mandatory tender date.

|

|

|

Variable rate security. Interest rate disclosed is as of the most recent information

available. Certain variable rate

securities are not based on a published reference rate and spread but are determined

by the issuer or agent and

are based on current market conditions. These securities do not indicate a reference

rate and spread in their

description above.

|

|

|

Income from this issue is considered a preference item for purposes of calculating

the alternative minimum tax

(“AMT”).

|

|

|

Security is exempt from registration under Rule 144A of the Securities Act of 1933.

This security may be resold in

transactions that are exempt from registration, normally to qualified institutional

buyers. This security has been

deemed liquid pursuant to guidelines approved by the Board of Directors.

|

|

|

Securities traded on a when-issued or delayed delivery basis.

|

|

|

Bonds are generally escrowed to maturity by government securities and/or U.S. government

agency securities.

|

|

|

Pre-Refunded bonds are generally escrowed with U.S. government obligations and/or

U.S. government agency

securities.

|

|

|

All or a portion of this security is held at the broker as collateral for open futures

contracts.

|

|

|

The coupon payment on this security is currently in default as of November 30, 2024.

|

|

|

The maturity principal is currently in default as of November 30, 2024.

|

|

|

Represents securities deposited into a special purpose entity, referred to as a Tender

Option Bond (“TOB”) trust

(Note 1).

|

|

|

Variable rate demand obligations (“VRDOs”) have a demand feature under which the Fund can tender them back to

the issuer or liquidity provider on no more than 7 days notice. The interest rate

generally resets on a daily or