Murphy Oil Corporation Announces Quarterly Dividend

October 02 2024 - 9:05AM

Business Wire

The Board of Directors of Murphy Oil Corporation (NYSE: MUR)

today declared a quarterly cash dividend on the Common Stock of

Murphy Oil Corporation of $0.30 per share, or $1.20 per share on an

annualized basis. The dividend is payable on December 2, 2024, to

stockholders of record as of November 18, 2024.

ABOUT MURPHY OIL CORPORATION

As an independent oil and natural gas exploration and production

company, Murphy Oil Corporation believes in providing energy that

empowers people by doing right always, staying with it and thinking

beyond possible. Murphy challenges the norm, taps into its strong

legacy and uses its foresight and financial discipline to deliver

inspired energy solutions. Murphy sees a future where it is an

industry leader who is positively impacting lives for the next 100

years and beyond. Additional information can be found on the

company’s website at www.murphyoilcorp.com.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are generally identified through the

inclusion of words such as “aim”, “anticipate”, “believe”, “drive”,

“estimate”, “expect”, “expressed confidence”, “forecast”, “future”,

“goal”, “guidance”, “intend”, “may”, “objective”, “outlook”,

“plan”, “position”, “potential”, “project”, “seek”, “should”,

“strategy”, “target”, “will” or variations of such words and other

similar expressions. These statements, which express management’s

current views concerning future events, results and plans, are

subject to inherent risks, uncertainties and assumptions (many of

which are beyond our control) and are not guarantees of

performance. In particular, statements, express or implied,

concerning the company’s future operating results or activities and

returns or the company's ability and decisions to replace or

increase reserves, increase production, generate returns and rates

of return, replace or increase drilling locations, reduce or

otherwise control operating costs and expenditures, generate cash

flows, pay down or refinance indebtedness, achieve, reach or

otherwise meet initiatives, plans, goals, ambitions or targets with

respect to emissions, safety matters or other ESG

(environmental/social/governance) matters, make capital

expenditures or pay and/or increase dividends or make share

repurchases and other capital allocation decisions are

forward-looking statements. Factors that could cause one or more of

these future events, results or plans not to occur as implied by

any forward-looking statement, which consequently could cause

actual results or activities to differ materially from the

expectations expressed or implied by such forward-looking

statements, include, but are not limited to: macro conditions in

the oil and gas industry, including supply/demand levels, actions

taken by major oil exporters and the resulting impacts on commodity

prices; geopolitical concerns; increased volatility or

deterioration in the success rate of our exploration programs or in

our ability to maintain production rates and replace reserves;

reduced customer demand for our products due to environmental,

regulatory, technological or other reasons; adverse foreign

exchange movements; political and regulatory instability in the

markets where we do business; the impact on our operations or

market of health pandemics such as COVID-19 and related government

responses; other natural hazards impacting our operations or

markets; any other deterioration in our business, markets or

prospects; any failure to obtain necessary regulatory approvals;

any inability to service or refinance our outstanding debt or to

access debt markets at acceptable prices; or adverse developments

in the U.S. or global capital markets, credit markets, banking

system or economies in general, including inflation. For further

discussion of factors that could cause one or more of these future

events or results not to occur as implied by any forward-looking

statement, see “Risk Factors” in our most recent Annual Report on

Form 10-K filed with the U.S. Securities and Exchange Commission

(“SEC”) and any subsequent Quarterly Report on Form 10-Q or Current

Report on Form 8-K that we file, available from the SEC’s website

and from Murphy Oil Corporation’s website at

http://ir.murphyoilcorp.com. Investors and others should note that

we may announce material information using SEC filings, press

releases, public conference calls, webcasts and the investors page

of our website. We may use these channels to distribute material

information about the company; therefore, we encourage investors,

the media, business partners and others interested in the company

to review the information we post on our website. The information

on our website is not part of, and is not incorporated into, this

news release. Murphy Oil Corporation undertakes no duty to publicly

update or revise any forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001319622/en/

Investor Contacts: InvestorRelations@murphyoilcorp.com

Kelly Whitley, 281-675-9107 Megan Larson, 281-675-9470 Beth Heller,

832-506-6831

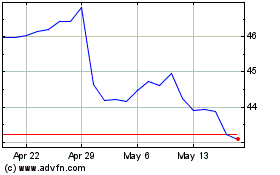

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

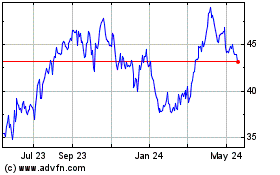

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Dec 2023 to Dec 2024