false

0000717423

0000717423

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 20, 2024

____________________________

MURPHY OIL CORPORATION

(Exact Name of Registrant as Specified in Its

Charter)

____________________________

| Delaware |

1-8590 |

71-0361522 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

9805 Katy Fwy, Suite G-200

Houston, Texas |

77024 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s

telephone number, including area code: (281) 675-9000

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

____________________________

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| |

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $1.00 Par Value |

MUR |

New York Stock Exchange |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On November 21, 2024, members of management of

Murphy Oil Corporation (the “Company”), including Eric M. Hambly, President and Chief Operating Officer, and Kelly L. Whitley,

Vice President, Investor Relations and Communications, will host investor meetings in connection with the Company’s attendance at

the Wolfe Research Virtual Oil & Gas Conference. Attached hereto as Exhibit 99.1 is a copy of the presentation prepared by the Company

in connection therewith.

The information in this Item 7.01, including Exhibit

99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of

1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated

by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act,

except as otherwise expressly stated in such filing.

This Current Report on Form 8-K, including the

information furnished pursuant to Item 7.01 and the related Item 9.01 hereto, contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified through the inclusion of words

such as “aim”, “anticipate”, “believe”, “drive”, “estimate”, “expect”,

“expressed confidence”, “forecast”, “future”, “goal”, “guidance”, “intend”,

“may”, “objective”, “outlook”, “plan”, “position”, “potential”,

“project”, “seek”, “should”, “strategy”, “target”, “will” or variations

of such words and other similar expressions. These statements, which express management’s current views concerning future events,

results and plans, are subject to inherent risks, uncertainties and assumptions (many of which are beyond our control) and are not guarantees

of performance. In particular, statements, express or implied, concerning the company’s future operating results or activities and

returns or the company's ability and decisions to replace or increase reserves, increase production, generate returns and rates of return,

replace or increase drilling locations, reduce or otherwise control operating costs and expenditures, generate cash flows, pay down or

refinance indebtedness, achieve, reach or otherwise meet initiatives, plans, goals, ambitions or targets with respect to emissions, safety

matters or other ESG (environmental/social/governance) matters, make capital expenditures or pay and/or increase dividends or make share

repurchases and other capital allocation decisions are forward-looking statements. Factors that could cause one or more of these future

events, results or plans not to occur as implied by any forward-looking statement, which consequently could cause actual results or activities

to differ materially from the expectations expressed or implied by such forward-looking statements, include, but are not limited to: macro

conditions in the oil and gas industry, including supply/demand levels, actions taken by major oil exporters and the resulting impacts

on commodity prices; geopolitical concerns; increased volatility or deterioration in the success rate of our exploration programs or in

our ability to maintain production rates and replace reserves; reduced customer demand for our products due to environmental, regulatory,

technological or other reasons; adverse foreign exchange movements; political and regulatory instability in the markets where we do business;

the impact on our operations or market of health pandemics such as COVID-19 and related government responses; other natural hazards impacting

our operations or markets; any other deterioration in our business, markets or prospects; any failure to obtain necessary regulatory approvals;

any inability to service or refinance our outstanding debt or to access debt markets at acceptable prices; or adverse developments in

the U.S. or global capital markets, credit markets, banking system or economies in general, including inflation. For further discussion

of factors that could cause one or more of these future events or results not to occur as implied by any forward-looking statement, see

“Risk Factors” in our most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”)

and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K that we file, available from the SEC’s website and

from Murphy Oil Corporation’s website at http://ir.murphyoilcorp.com. Investors and others should note that we may announce material

information using SEC filings, press releases, public conference calls, webcasts and the investors page of our website. We may use these

channels to distribute material information about the company; therefore, we encourage investors, the media, business partners and others

interested in the company to review the information we post on our website. Murphy Oil Corporation undertakes no duty to publicly update

or revise any forward-looking statements.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| 104 | Cover Page Interactive Data File

(embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 20, 2024 |

MURPHY OIL CORPORATION |

| |

|

| |

|

| |

By: |

/s/ Paul D. Vaughan |

| |

|

Name: |

Paul D. Vaughan |

| |

|

Title: |

Vice President and Controller |

Exhibit 99.1

1 www.murphyoilcorp.com NYSE: MUR 1 INVESTOR UPDATE NOVEMBER 2024

2 www.murphyoilcorp.com NYSE: MUR 2 Cautionary Statement Cautionary Note to US Investors – The United States Securities and Exchange Commission (SEC) requires oil and natural gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions . We may use certain terms in this presentation, such as “resource”, “gross resource”, “recoverable resource”, “net risked PMEAN resource”, “recoverable oil”, “resource base”, “EUR” or “estimated ultimate recovery” and similar terms that the SEC’s rules prohibit us from including in filings with the SEC . The SEC permits the optional disclosure of probable and possible reserves in our filings with the SEC . Investors are urged to consider closely the disclosures and risk factors in our most recent Annual Report on Form 10 - K filed with the SEC and any subsequent Quarterly Report on Form 10 - Q or Current Report on Form 8 - K that we file, available from the SEC’s website . This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements are generally identified through the inclusion of words such as “aim”, “anticipate”, “believe”, “drive”, “estimate”, “expect”, “expressed confidence”, “forecast”, “future”, “goal”, “guidance”, “intend”, “may”, “objective”, “outlook”, “plan”, “position”, “potential”, “project”, “seek”, “should”, “strategy”, “target”, “will” or variations of such words and other similar expressions . These statements, which express management’s current views concerning future events, results and plans, are subject to inherent risks, uncertainties and assumptions (many of which are beyond our control) and are not guarantees of performance . In particular, statements, express or implied, concerning the company’s future operating results or activities and returns or the company's ability and decisions to replace or increase reserves, increase production, generate returns and rates of return, replace or increase drilling locations, reduce or otherwise control operating costs and expenditures, generate cash flows, pay down or refinance indebtedness, achieve, reach or otherwise meet initiatives, plans, goals, ambitions or targets with respect to emissions, safety matters or other ESG (environmental/social/governance) matters, make capital expenditures or pay and/or increase dividends or make share repurchases and other capital allocation decisions are forward - looking statements . Factors that could cause one or more of these future events, results or plans not to occur as implied by any forward - looking statement, which consequently could cause actual results or activities to differ materially from the expectations expressed or implied by such forward - looking statements, include, but are not limited to : macro conditions in the oil and gas industry, including supply/demand levels, actions taken by major oil exporters and the resulting impacts on commodity prices ; geopolitical concerns ; increased volatility or deterioration in the success rate of our exploration programs or in our ability to maintain production rates and replace reserves ; reduced customer demand for our products due to environmental, regulatory, technological or other reasons ; adverse foreign exchange movements ; political and regulatory instability in the markets where we do business ; the impact on our operations or market of health pandemics such as COVID - 19 and related government responses ; other natural hazards impacting our operations or markets ; any other deterioration in our business, markets or prospects ; any failure to obtain necessary regulatory approvals ; any inability to service or refinance our outstanding debt or to access debt markets at acceptable prices ; or adverse developments in the U . S . or global capital markets, credit markets, banking system or economies in general, including inflation . For further discussion of factors that could cause one or more of these future events or results not to occur as implied by any forward - looking statement, see “Risk Factors” in our most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”) and any subsequent Quarterly Report on Form 10 - Q or Current Report on Form 8 - K that we file, available from the SEC’s website and from Murphy Oil Corporation’s website at http : //ir . murphyoilcorp . com . Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the investors page of our website . We may use these channels to distribute material information about the company ; therefore, we encourage investors, the media, business partners and others interested in the company to review the information we post on our website . The information on our website is not part of, and is not incorporated into, this presentation . Murphy Oil Corporation undertakes no duty to publicly update or revise any forward - looking statements . Non - GAAP Financial Measures – This presentation refers to certain forward - looking non - GAAP measures . Definitions of these measures are included in the appendix .

3 www.murphyoilcorp.com NYSE: MUR 3 Agenda 04 01 Murphy Exploration Murphy at a Glance 05 02 Looking Ahead Murphy Priorities 06 03 Appendix Murphy 2024 Plan

4 www.murphyoilcorp.com NYSE: MUR 4 Murphy at a Glance Murphy is an independent exploration and production company, with a diverse portfolio that provides exploration upside 18% 41% 42% 185 MBOEPD 3Q 2024 Production 1 22% 24% 54% 2023 Proved Reserves 1 724 MMBOE US Onshore Offshore Canada Onshore Multi - Basin Production Gulf of Mexico Deepwater execution ability is a competitive advantage Offshore Canada Non - operated partner in Terra Nova and Hibernia fields Onshore United States Eagle Ford Shale on private lands in Texas with ~1,200 future locations on ~120,000 net acres Onshore Canada Tupper Montney ~1,000 future locations on ~120,000 net acres Kaybob Duvernay ~500 future locations on ~110,000 net acres High - potential exploration focused in Gulf of Mexico, Vietnam, Côte d’lvoire Financial discipline maintaining leading balance sheet Long history of delivering shareholder returns through dividends and share buybacks Meaningful board and management ownership, supported by multi - decade founding family 1 Excluding noncontrolling interest. Proved reserves are based on year - end 2023 third - party audited volumes using SEC pricing. F igures may not add to 100 percent due to rounding Note: Future locations and net acres as of December 31, 2023

5 www.murphyoilcorp.com NYSE: MUR 5 MURPHY PRIORITIES

6 www.murphyoilcorp.com NYSE: MUR 6 • Reduced debt by $50 MM in YTD 2024 1 • Plan to call $79 MM of senior notes in 4Q 2024 • Committed to achieving long - term debt goal of ~$1.0 BN • Spud Hai Su Vang - 1X exploration well in 3Q 2024, the first of two Vietnam exploration wells • Produced 185 MBOEPD in 3Q 2024 • Completed offshore workovers as planned and progressed new well program • Delivered Eagle Ford Shale well program • Initiated construction of the Lac Da Vang platform in Vietnam in 4Q 2024 RETURN Advancing Strategic Priorities DELEVER EXECUTE EXPLORE Production volumes and financial amounts exclude noncontrolling interest, unless otherwise stated 1 As of September 30, 2024 2 Murphy 3.0 is when long - term debt is less than or equals $1.3 BN. During this time, a minimum of 50% of adjusted FCF is allocated to share buybacks and potential dividend increases, with the remainder of adjusted FCF allocated to the balance sheet 3 As of November 5, 2024 Progressed Murphy 3.0 of Capital Allocation Framework 2 • 3Q 2024 repurchases totaled $194 MM of stock, or 5.4 MM shares, at an average price of $36.12 / share • YTD 2024 3 repurchases totaled $300 MM of stock, or 8.0 MM shares, at an average price of $37.46 / share • $650 MM remaining under share repurchase authorization 3

7 www.murphyoilcorp.com NYSE: MUR 7 Strong Balance Sheet Positioned to Withstand Commodity Price Cycles Enhancing Financial Position Through Capital Markets Transactions in 4Q 2024 Issued $600 MM of 6.000% Senior Notes due 2032 Tendered $521 MM of long - term debt Plan to call $79 MM of senior notes in 4Q 2024 + + Entered New $1.2 BN Senior Unsecured Credit Facility Represents 50% increase from previous facility October 2029 maturity

8 www.murphyoilcorp.com NYSE: MUR 8 Consistent Discipline Drives Strong Financial Performance Peer - Leading Performance in 3Q 2024 • Share buybacks are meaningful with low share count • Financial strength provides sustainable returns • Oil - weighted assets generate substantial free cash flow Total Cash Return per Share 1 $ per share Source: Bloomberg, Murphy internal analysis as of September 30 , 2024 1 Total cash return is defined as dividends paid (+) share repurchases divided by shares outstanding 2 As defined in non - GAAP reconciliation slides in Appendix Note: Peer group includes APA, CIVI, CNX, CTRA, DVN, EOG, HES, KOS, MGY, MRO, MTDR, OVV, RRC, SM, TALO $0 $1 $2 $3 MUR 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x MUR (10%) (5%) 0% 5% 10% 15% MUR 0% 5% 10% 15% 20% 25% 30% 35% MUR TTM Free Cash Flow 2 / EV Percentage G&A / TTM EBITDAX 2 Percentage Debt / TTM EBITDAX 2 Peer Average = 1.3x

9 www.murphyoilcorp.com NYSE: MUR 9 Delivering Shareholder Returns Within Capital Allocation Framework 1 1 The timing and magnitude of debt reductions and share repurchases will largely depend on oil and natural gas prices, develo pme nt costs and operating expenses, as well as any high - return investment opportunities. Because of the uncertainties around these matters, it is not possible to forecast how and when the company’s targets might be achieved 2 The share repurchase program allows the company to repurchase shares through a variety of methods, including but not limite d t o open market purchases, privately negotiated transactions and other means in accordance with federal securities laws, such as through Rule 10b5 - 1 trading plans and under Rul e 10b - 18 of the Exchange Act. This repurchase program has no time limit and may be suspended or discontinued completely at any time without prior notice as determined by t he company at its discretion and dependent upon a variety of factors 3 Other projected payments such as withholding tax on incentive compensation Allocate adjusted FCF to long - term debt reduction Continue supporting the quarterly dividend Murphy 1.0 – Long - term debt > $1.8 BN ~75% of adjusted FCF allocated to debt reduction ~25% distributed through share buybacks and potential dividend increases Minimum of 50% of adjusted FCF allocated to share buybacks and potential dividend increases Up to 50% of adjusted FCF allocated to the balance sheet Murphy 2.0 – Long - term debt of $1.3 BN – $1.8 BN Murphy 3.0 – Long - term debt ≤ $1. 3 BN Board Authorized Share Repurchase Program 2 Remaining Balance as of November 5, 2024 $650 MM Cash Flow From Operations Before WC Change ( - ) Capital expenditures = Free Cash Flow ( - ) Distributions to NCI and projected payments 3 ( - ) Quarterly dividend ( - ) Accretive acquisitions = Adjusted Free Cash Flow (Adjusted FCF) Adjusted Free Cash Flow Formula

10 www.murphyoilcorp.com NYSE: MUR 10 Reducing Debt While Generating Shareholder Returns Consistent Focus on Balance Sheet and Increasing Shareholder Returns • Reduced debt by ~60% since YE 2020 • Returned 110% of adjusted free cash flow to shareholders in YTD 2024 through buybacks • Repurchased > 11 MM shares since Murphy 2.0 initiated in 3Q 2023 • Returned > $4.1 BN to shareholders since 2012 Total Debt Reduction $ MM Shareholder Returns Since Framework Announced $ MM $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 YE 2020 YE 2021 YE 2022 YE 2023 YE 2024E $450 $385 $385 $450 $0 $200 $400 $600 $800 $1,000 3Q 2022 4Q 2022 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Cumulative Dividends Cumulative Repurchases

11 www.murphyoilcorp.com NYSE: MUR 11 $0 $1,000 $2,000 $3,000 $4,000 $0 $2,500 $5,000 $7,500 $10,000 Cumulative Shareholder Returns ($MM) Market Cap ($MM) Long History of Benefitting Shareholders $4.1 Billion Returned to Shareholders Since 2012 > $2.0 Billion in Share Repurchases Since 2012 > $7.4 Billion Returned to Shareholders Since 1961 > Average: $839 MM MUR Peer Cumulative Shareholder Returns vs Market Cap < $10 BN Since January 1, 2013 Source: Company documents and Bloomberg as of November 13, 2024 Peers include AR, CIVI, CNX, CRGY, CRK, GPOR, HPK, KOS, MGY, MTDR, MUR, RRC, SM, TALO, VTLE, WTI * Financial restructuring occurred during time period * • Paying dividends for > 60 - year history • Maintaining balance sheet integrity with no equity issuances *

12 www.murphyoilcorp.com NYSE: MUR 12 CONTINUED ENVIRONMENTAL STEWARDSHIP STRONG GOVERNANCE OVERSIGHT POSITIVELY IMPACTING OUR PEOPLE AND COMMUNITIES ADVANCING OUR CLIMATE GOALS 15 - 20% REDUCTION IN GHG EMISSIONS INTENSITY by 2030 compared to 2019 HIGHEST WATER RECYCLING VOLUME in company history ZERO ROUTINE FLARING by 2030 ZERO OFFSHORE SPILLS OVER 1 BBL since 2003 LOWEST EMISSIONS INTENSITIES since 2013 AWARDS AND RECOGNITION BEST PLACE FOR WORKING PARENTS ® by the Greater Houston Partnership in 2022, 2023 and 2024 UNITED STATES PRESIDENT’S VOLUNTEER SERVICE AWARD by the Houston Food Bank in 2021, 2022 and 2023 CHAIRMAN’S DIVISION by United Way of Greater Houston for past nine years CONSISTENTLY OUTPERFORMING US Bureau of Labor Statistics for industry TRIR and LTIR minority representation among US employees 35% in charitable contributions over the last four years $11 MM more than students received El Dorado Promise scholarships since 2007 3,500 more than GHG INTENSITY GOAL IN ANNUAL INCENTIVE PLAN since 2021 Well - defined BOARD AND MANAGERIAL OVERSIGHT and management of ESG matters SUSTAINABILITY METRICS IN ANNUAL INCENTIVE PLAN weighting of 20% approved in 2023 NAMED ONE OF “AMERICA’S MOST RESPONSIBLE COMPANIES IN 2024” by Newsweek fourth consecutive year of THIRD - PARTY ASSURANCE of GHG Scope 1 and 2 data CO 2 GHG Ongoing Commitment to Sustainability Goals Acting to Support All Stakeholders Note: Metrics reflect 2023 performance unless otherwise specified

13 www.murphyoilcorp.com NYSE: MUR 13 MURPHY 2024 PLAN

14 www.murphyoilcorp.com NYSE: MUR 14 2024 Capital and Production Plan Prioritizing Capital To Maximize Production and Adjusted Free Cash Flow 1 4Q 2024 Guidance • 181.5 – 189.5 MBOEPD production, 94 MBOPD or 51% oil, 56% liquids volumes • Includes the following: • 1.5 MBOEPD of planned onshore downtime • 1.0 MBOEPD of planned downtime for maintenance at non - operated Terra Nova • $203 MM accrued CAPEX FY 2024 Guidance • 180 – 182 MBOEPD production, 90 MBOPD or 50% oil, 55% liquids volumes • Ongoing operational impacts at non - operated Terra Nova • Maintain $920 MM – $1.02 BN CAPEX Accrual CAPEX, based on midpoint of guidance range and excluding noncontrolling interest 1 Adjusted FCF is defined as cash flow from operations before working capital change, less capital expenditures, distributions to NCI and projected payments, quarterly dividend and accretive acquisitions FY 2024E CAPEX By Area 38% 33% 13% 12% 3% $970 MM Offshore US Onshore Canada Onshore Exploration Corporate FY 2024E Wells Online 0 10 20 30 1Q 2024A 2Q 2024A 3Q 2024A 4Q 2024E Eagle Ford Shale Kaybob Duvernay Tupper Montney Eagle Ford Shale (Non-Op) Note: Non - op well cadence subject to change per operator plans Eagle Ford Shale non - operated wells adjusted for 26% average working interest

15 www.murphyoilcorp.com NYSE: MUR 15 0 5 10 15 20 25 30 1Q 2024A 2Q 2024A 3Q 2024A 4Q 2024E Eagle Ford Shale Kaybob Duvernay Tupper Montney Eagle Ford Shale (Non-Op) 2024 North America Onshore Plan Balancing Investments for Free Cash Flow Generation Note: Non - op well cadence subject to change per operator plans Eagle Ford Shale non - operated wells adjusted for 26% average working interest FY 2024E Wells Online 98 MBOEPD Forecast for FY 2024 • 25% oil volumes, 30% liquids volumes Eagle Ford Shale • 20 operated wells online • 15 Catarina wells • 5 Tilden wells • 20 gross non - operated wells online • 17 gross Tilden wells • 3 gross Karnes wells • 8 operated Karnes wells drilled for 2025 completion Tupper Montney • 13 operated wells online • Assumes C$2.11 / MMBTU AECO • Initiate drilling for 2025 completion Kay bob Duvernay • 3 operated wells online

16 www.murphyoilcorp.com NYSE: MUR 16 Eagle Ford Shale Update Enhancing Portfolio Through Strong Execution 3Q 2024 32 MBOEPD, 72% Oil, 86% Liquids • 5 operated wells online in Tilden • 3 new wells and 2 refracs • 3 gross non - operated wells online in Karnes • 9 gross non - operated wells online in Tilden 4Q 2024 Plan • 4 operated wells online in Catarina • 8 operated Karnes wells to be drilled for 2025 completion Optimizing Completion Design While Reducing Cost • Cost per CLAT in YTD 2024 is lowest in company history • Increased completed lateral length and pumping hours per day YTD 2024 vs FY 2023 Eagle Ford Shale Acreage CATARINA TILDEN KARNES Murphy Acreage Active Rig Acreage as of November 5, 2024 16% Increase Eagle Ford Shale Completion Efficiency FY 2023 YTD 2024 Completed Lateral Lenth (CLAT) Feet Pumping Hours per Day Hours Cost per CLAT $ / CLAT 18% Increase 34% Decrease

17 www.murphyoilcorp.com NYSE: MUR 17 Tupper Montney Update Consistent Well Outperformance While Managing Price Risk Tupper Montney Acreage Acreage as of November 5, 2024 5 0 Miles BC Alberta TUPPER WEST TUPPER MAIN 3Q 2024 429 MMCFD Net, 100% Natural Gas • 2024 well delivery program completed in 2Q 2024 4Q 2024 Plan • Initiate drilling for 2025 completion Mitigated AECO Exposure • Achieved realized price of US$1.35 / MCF compared to US$0.50 / MCF AECO average • Sold 42% of 3Q 2024 volumes via fixed price forward sales contracts • Sold 33% of 3Q 2024 volumes to diversified price points, including Malin, Ventura, Emerson, Chicago and Dawn Tupper Montney Natural Gas Sales By Volume 3Q 2024 Murphy Acreage Facility 42% 33% 25% Fixed Price Exposure Diversified AECO

18 www.murphyoilcorp.com NYSE: MUR 18 Offshore Update Focusing on Executing Highly - Accretive Development Projects Total Offshore 3Q 2024 75 MBOEPD, 81% Oil • Gulf of Mexico 67 MBOEPD, 79% Oil • Canada 8 MBOEPD, 100% Oil Gulf of Mexico Workovers and Projects • Brought online all planned workovers in 3Q 2024 • $40 MM 4Q 2024 total workover expense for operated Samurai #3 (Green Canyon 432) and operated Marmalard #3 (Mississippi Canyon 255) • Operated Mormont #4 (Green Canyon 478) well spud in 3Q 2024 Highly - Accretive Development and Tieback Projects Online Completions Drilling Field 2Q 2024 Khaleesi 3Q 2024 Mormont #3 4Q 2024 Mormont #4 2025 Samurai 2025 Dalmatian 2026 Longclaw 1H 2024 - 2025 Lucius (non - op) In progress Planned activity Completed activity

19 www.murphyoilcorp.com NYSE: MUR 19 Lac Da Vang Field Development Project Update Cuu Long Basin, Vietnam Acreage as of November 5, 2024 Reserves are based on SEC year - end 2023 audited proved reserves Cuu Long Basin BLOCK 15 - 01/05 LAC DA VANG LAC DA HONG - 1X LAC DA TRANG DISCOVERY LAC DA TRANG WEST LAC DA TRANG NORTH WEST Murphy WI Block Murphy Inventory Discovered Field Planned Well Field Development Project Lac Da Vang Field Development Overview • Murphy 40% (Op), PetroVietnam Exploration Production 35%, SK Earthon 25% • 100 MMBOE estimated gross recoverable resource • 13 MMBOE of preliminary net proved reserves added at year - end 2023 • Estimated 10 – 15 MBOEPD net peak production • $40 MM capital plan for FY 2024 Initiated Platform Construction in 4Q 2024 • Targeting first oil in FY 2026, development through FY 2029

20 www.murphyoilcorp.com NYSE: MUR 20 MURPHY EXPLORATION

21 www.murphyoilcorp.com NYSE: MUR 21 Exploration Update Cuu Long Basin, Vietnam Asset Overview • Murphy 40% (Op), PetroVietnam Exploration Production 35%, SK Earthon 25% • $30 MM total net well cost Block 15 - 2/17 • Spud Hai Su Vang - 1X exploration well in 3Q 2024 • Mean to upward gross resource potential • 170 MMBOE – 430 MMBOE Block 15 - 1/05 • Targeting spud of Lac Da Hong - 1X exploration well in 4Q 2024 • Mean to upward gross resource potential • 65 MMBOE – 135 MMBOE Acreage as of November 5, 2024 Cuu Long Basin BLOCK 15 - 02/17 15 - 2 15 - 2 16 - 1 15 - 1 09 - 2 - 10 BLOCK 15 - 01/05 SU TU VANG LAC DA VANG TE GIAC TRANG RANG DONG JVPC PHUONG DONG HAI SU DEN HAI SU TRANG LAC DA HONG - 1X HAI SU HONG HAI SU BAC HAI SU VANG - 1X LAC DA TRANG DISCOVERY SU TU TRANG LAC DA TRANG WEST LAC DA TRANG NORTH WEST 15 km Murphy WI Block Murphy Inventory Discovered Field Field Development Project Planned Well

22 www.murphyoilcorp.com NYSE: MUR 22 Acreage as of November 5, 2024 1 Murene 1X exploration well on the Calao discovery 2 Société Nationale d’Opérations Pétrolières de la Côte d’Ivoire Development and Exploration Update Tano Basin, Côte d’Ivoire Asset Overview • ~1.5 MM gross acres, equivalent to 256 Gulf of Mexico blocks • Seismic reprocessing ongoing; final data expected 4Q 2024 Diverse Opportunities Adjacent to Oil Discoveries • Bordered by Baleine and Murene 1 discoveries by ENI • Opportunities across various exploration play types Blocks CI - 102, CI - 502, CI - 531 and CI - 709 • Murphy 90% (Op), PETROCI 2 10% Block CI - 103 • Murphy 85% (Op), PETROCI 2 15% Includes Undeveloped Paon Discovery • Commitment to submit field development plan by YE 2025 • Reviewing commerciality and field development concepts Tano Basin Murphy WI Block Other Block Discovery Key Producing Field CÔTE D’IVOIRE GHANA CI - 102 CI - 531 CI - 103 CI - 709 CI - 502 Paon Baleine Pecan TEN Jubilee 50 0 kilometers Sankofa Murene 1X

23 www.murphyoilcorp.com NYSE: MUR 23 LOOKING AHEAD

24 www.murphyoilcorp.com NYSE: MUR 24 North America Onshore Locations More Than 50 Years of Robust Inventory with Low Breakeven Rates Diversified, Low Breakeven Portfolio • Multi - basin portfolio provides optionality in all price environments • Focus on capital efficiency • Culture of continuous improvement leads to value - added shared learnings As of December 31, 2023 Note: Breakeven rates are based on estimated costs of a 4 - well pad program at a 10% rate of return. Tupper Montney inventory ass umes an annual 20 - well program. Eagle Ford Shale and Kaybob Duvernay combined inventory, and Eagle Ford Shale standalone inventory, assume an annual 30 - well program. Eagle Ford Shale and Kaybob Duvernay > 25 years of inventory < $50 / BBL ~ 55 years of total inventory > 15 years of Eagle Ford Shale inventory < $50 / BBL Tupper Montney ~ 50 years of inventory Eagle Ford Shale and Kaybob Duvernay – Oil Remaining Locations Tupper Montney – Natural Gas Remaining Locations 0 100 200 300 400 500 600 700 <$1.45 $1.45 - $1.55 $1.55 - $1.65 Breakeven Natural Gas Price (US$ / MCF) 0 100 200 300 400 500 < $45 $45-$50 $50-$60 > $60 Break Even Oil Price (US$/BBL WTI) Eagle Ford Shale Kaybob Duvernay

25 www.murphyoilcorp.com NYSE: MUR 25 Offshore Development Opportunities Multi - Year Inventory of High - Return Projects Diversified, Low Breakeven Opportunities in Offshore Portfolio • Multi - year inventory of identified offshore projects in current portfolio • Maintaining annual offshore production of 90 – 100 MBOEPD with average annual CAPEX of ~$380 MM from FY 2024 – FY 2028 Identified Offshore Project Portfolio Percent MMBOE by Area As of December 31, 2023 Note: Breakeven rates are based on current estimated costs at a 10% rate of return Gulf of Mexico SE Asia Offshore Canada 77% 13% 10% 22% 9% 20% 8% 7% 34% 2024 2025 2026 2027 2028 2029+ Resources To Be Developed By Year Percent MMBOE by Year Projects Include 37 projects 8 projects 209 MMBOE of total resources with < $35 / BBL WTI breakeven 20 MMBOE of total resources with $35 to $50 / BBL WTI breakeven

26 www.murphyoilcorp.com NYSE: MUR 26 Disciplined Strategy Leads to Long - Term Value With Current Assets 1 As of August 7, 2024 Note: Strategy is as of January 25, 2024. Assumes $75 WTI oil price, $3.50 HH natural gas price and no exploration success. • Realizing average annual production of 210 - 220 MBOEPD with > 50% average oil weighting • Reinvesting ~45% of operating cash flow • Allocating capital to high - returning investment opportunities for further growth in 2028+ • Exploration portfolio provides upside to plan • Ample free cash flow funds further debt reductions, continuing cash returns to shareholders and accretive investments • Achieving metrics that are consistent with an investment grade rating • Reducing debt to reach $1 .0 BN debt target in mid - 2025 1 with no debt maturities until Dec 2027 • Reinvesting ~50% of operating cash flow to maintain average 53% oil - weighting near - term to enhance oil production long - term • Delivering average production of ~195 MBOEPD with CAGR of 5% • Maintaining offshore production average of ~95 MBOEPD • Spending annual average CAPEX of ~$1.1 BN • Targeting enhanced payouts to shareholders through dividend increases and share buybacks while delevering • Targeting first oil in Vietnam in 2026 • Drilling high - impact exploration wells in Gulf of Mexico, Vietnam and Côte d'Ivoire and conducting additional geophysical studies LONG - TERM NEAR - TERM 2024 2025 2026 DELEVER EXECUTE EXPLORE RETURN 2027 2028

27 www.murphyoilcorp.com NYSE: MUR 27 Progressing On 2024 Goals Delivering shareholder returns through capital allocation framework Enhancing financial position through capital markets Exceeding production guidance across onshore assets Executing Gulf of Mexico well program Advancing Vietnam development and exploration Expanding portfolio with exploration opportunities

28 www.murphyoilcorp.com NYSE: MUR 28 INVESTOR UPDATE NOVEMBER 2024

29 www.murphyoilcorp.com NYSE: MUR 29 Appendix 1 Glossary of Abbreviations 2 4Q 2024 Guidance 4 Supplemental Information 3 Current Fixed Price Contracts 5 Acreage Maps 6 Non - GAAP Definitions, Reconciliations and Measures

30 www.murphyoilcorp.com NYSE: MUR 30 Non - GAAP Financial Measure Definitions and Reconciliations The following list of Non - GAAP financial measure definitions and related reconciliations is intended to satisfy the requirements of Regulation G of the Securities Exchange Act of 1934, as amended. This information is historical in nature. Murphy undertakes no obligation to publicly update or revise any Non - GAAP financial measure definitions and related reconciliations.

31 www.murphyoilcorp.com NYSE: MUR 31 Non - GAAP Reconciliation EBITDA and EBITDAX Murphy defines EBITDA as net income (loss) attributable to Murphy 1 before interest, taxes, depreciation, depletion and amortization (DD&A). Murphy defines EBITDAX as net income (loss) attributable to Murphy before interest, taxes, DD&A and exploration expense. Management believes that EBITDA and EBITDAX provide useful information for assessing Murphy's financial condition and results of operations and are widely accepted financial indicators of the ability of a company to incur and service debt, fund capital expenditure programs, pay dividends and make other distributions to stockholders. EBITDA and EBITDAX, as reported by Murphy, may not be comparable to similarly titled measures used by other companies and sho uld be considered in conjunction with net income, cash flow from operations and other performance measures prepared in accordance with generally accepted accountin g p rinciples (GAAP). EBITDA and EBITDAX have certain limitations regarding financial assessments because they exclude certain items that affect net income an d n et cash provided by operating activities. EBITDA and EBITDAX should not be considered in isolation or as a substitute for an analysis of Murphy's GAAP results as repor ted . Trailing Twelve Months – Sept 30, 2023 Trailing Twelve Months – Sept 30, 2024 (Millions of dollars) 744.7 473.1 Net income attributable to Murphy (GAAP) 1 228.7 94.0 Income tax expense 123.4 86.0 Interest expense, net 826.5 831.8 Depreciation, depletion and amortization expense 2 1,923.3 1,484.9 EBITDA attributable to Murphy (Non - GAAP) 183.6 200.4 Exploration expenses 2 2,106.9 1,685.3 EBITDAX attributable to Murphy (Non - GAAP) 1 ‘Attributable to Murphy’ represents the economic interest of Murphy excluding noncontrolling interest in MP GOM 2 Depreciation, depletion, and amortization expense and exploration expenses used in the computation of EBITDA and EBITDAX exclude the portion attributable to the noncontrolling int ere st (NCI)

32 www.murphyoilcorp.com NYSE: MUR 32 Non - GAAP Reconciliation Free Cash Flow Presented below is free cash flow (a non - GAAP financial measure calculated as net cash provided by continuing operations activit ies, less non - cash working capital changes, property additions and dry hole costs). Management believes free cash flow is important information to provide as it is used by management to evaluate the Company’s ability to generate additional cash from business operations. Free cash flow is a non - GAAP financial measure and shoul d not be considered a substitute for other financial measures as determined in accordance with accounting principles generally accepted in the United States of Am eri ca. Additionally, our definition of free cash flow is limited and does not represent residual cash flows available for discretionary expenditures due to the fact that th e measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Therefore, we believe it is impor tan t to view free cash flow as supplemental to our entire statement of cash flows. Trailing Twelve Months – Sept 30, 2023 Trailing Twelve Months – Sept 30, 2024 (Millions of dollars) 1,707.3 1,838.5 Net Cash provided by continuing operations activities (GAAP) 1 (1,086.9) (897.0) Property additions and dry hole costs 148.6 (75.3) Net increase (decrease) in non - cash working capital - (12.8) Acquisition of oil and natural gas properties 769.0 853.4 Free Cash Flow (Non - GAAP) 1 Includes noncontrolling interest in MP GOM

33 www.murphyoilcorp.com NYSE: MUR 33 Non - GAAP Reconciliation Free Cash Flow Presented below is free cash flow (a non - GAAP financial measure calculated as net cash provided by continuing operations activit ies, less non - cash working capital changes, property additions and dry hole costs). Management believes free cash flow is important information to provide as it is used by management to evaluate the Company’s ability to generate additional cash from business operations. Free cash flow is a non - GAAP financial measure and shoul d not be considered a substitute for other financial measures as determined in accordance with accounting principles generally accepted in the United States of Am eri ca. Additionally, our definition of free cash flow is limited and does not represent residual cash flows available for discretionary expenditures due to the fact that th e measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Therefore, we believe it is impor tan t to view free cash flow as supplemental to our entire statement of cash flows. Year Ended – Dec 31, 2022 Year Ended – Dec 31, 2023 (Millions of dollars) 2,180.2 1,748.8 Net Cash provided by continuing operations activities 1 (985.5) (1,066.0) Property additions and dry hole costs 65.7 99.4 Net increase (decrease) in non - cash working capital (128.5) (35.6) Acquisition of oil and natural gas properties 1,131.9 746.6 Free Cash Flow 1 Includes noncontrolling interest in MP GOM

34 www.murphyoilcorp.com NYSE: MUR 34 Non - GAAP Financial Measure Enterprise Value Presented below is enterprise value (EV), defined as market capitalization plus outstanding indebtedness less cash and cash e qui valents. Enterprise value is a non - GAAP financial measure and should not be considered a substitute for other financial measures as determined in accordance with acc oun ting principles generally accepted in the United States of America. Quarter Ended – Sept 30, 2023 Quarter Ended – Sept 30, 2024 (Millions of dollars except shares outstanding and share price) $45.35 $33.74 Share price 154,473,141 145,843,359 Shares outstanding 7,005.4 4,920.8 Market capitalization 1,572.6 1,276.5 Debt, excluding finance leases (327.8) (271.2) Cash, including marketable securities 8,250.2 5,926.1 Enterprise Value

35 www.murphyoilcorp.com NYSE: MUR 35 AECO: Alberta Energy Company, the Canadian benchmark price for natural gas BBL: Barrels (equal to 42 US gallons) BCF: Billions of cubic feet BCFE: Billions of cubic feet equivalent BN: Billions BOE: Barrels of oil equivalent (1 barrel of oil or 6,000 cubic feet of natural gas) BOEPD: Barrels of oil equivalent per day BOPD: Barrels of oil per day CAGR: Compound annual growth rate D&C: Drilling and completions DD&A: Depreciation, depletion and amortization EBITDA: Income from continuing operations before taxes, depreciation, depletion and amortization, and net interest expense EBITDAX: Income from continuing operations before taxes, depreciation, depletion and amortization, net interest expense, and exploration expenses EFS: Eagle Ford Shale EUR: Estimated ultimate recovery F&D: Finding and development G&A: General and administrative expenses GOM: Gulf of Mexico IP: Initial production rate LOE: Lease operating expense MBO: Thousands of barrels of oil MBOE: Thousands of barrels of oil equivalent MBOEPD: Thousands of barrels of oil equivalent per day MBOPD: Thousands of barrels of oil per day MCF: Thousands of cubic feet MCFD: Thousands of cubic feet per day MM: Millions MMBOE: Millions of barrels of oil equivalent MMCF: Millions of cubic feet MMCFD: Millions of cubic feet per day NGL: Natural gas liquids ROR: Rate of return R/P: Ratio of reserves to annual production TCF: Trillions of cubic feet WI: Working interest WTI: West Texas Intermediate (a grade of crude oil) Glossary of Abbreviations

36 www.murphyoilcorp.com NYSE: MUR 36 4Q 2024 Guidance Total (BOEPD) Gas (MCFD) NGLs (BOPD) Oil (BOPD) Producing Asset 33,600 27,300 4,800 24,200 US – Eagle Ford Shale 74,900 60,500 4,900 59,900 – Gulf of Mexico excluding NCI 1 65,200 388,800 – 400 Canada – Tupper Montney 4,600 9,400 600 2,400 – Kaybob Duvernay 7,000 – – 7,000 – Offshore 200 – – 200 Other 181,500 – 189,500 4Q Production Volume (BOEPD) excl. NCI 1 $38 4Q Exploration Expense ($MM) $920 – $1,020 Full Year 2024 CAPEX ($MM) excl. NCI 2 180,000 – 182,000 Full Year 2024 Production Volume (BOEPD) excl. NCI 3 1 Excludes noncontrolling interest of MP GOM of 7,500 BOPD oil, 300 BOPD NGLs and 2,900 MCFD natural gas 2 Excludes noncontrolling interest of MP GOM of $17 MM 3 Excludes noncontrolling interest of MP GOM of 6,700 BOPD oil, 200 BOPD NGLs and 2,200 MCFD natural gas $264 $292 $211 $203 $- $200 $400 $600 $800 $1,000 $1,200 1Q 2024 2Q 2024 3Q 2024 4Q 2024E FY 2024E $970 2024E Accrued CAPEX by Quarter $ MM Forecast CAPEX Actual CAPEX

37 www.murphyoilcorp.com NYSE: MUR 37 Current Fixed Price Contracts End Date Start Date Price (MCF) Volumes (MMCF/D) Type Commodity 12/31/2024 10/1/2024 C$2.39 162 Fixed Price Forward Sales at AECO 1 Natural Gas 12/31/2025 1/1/2025 C$2.75 40 Fixed Price Forward Sales at AECO 1 Natural Gas 12/31/2026 1/1/2026 C$3.03 50 Fixed Price Forward Sales at AECO 1 Natural Gas 10/31/2024 10/1/2024 US$1.98 25 Fixed Price Forward Sales at AECO 1 Natural Gas 12/31/2024 11/1/2024 US$1.98 15 Fixed Price Forward Sales at AECO 1 Natural Gas As of November 5, 2024 1 These contracts are for physical delivery of natural gas volumes at a fixed price, with no mark - to - market income adjustment End Date Start Date Price (MCF) Volumes (MMCF/D) Type Commodity 12/31/2025 1/1/2025 US$3.20 20 NYMEX Swap Natural Gas AECO Price Risk Mitigation – Tupper Montney, Canada Current Hedge Position

38 www.murphyoilcorp.com NYSE: MUR 38 36% 5% 59% 22% 24% 54% 2023 Proved Reserves Maintaining Proved Reserves and Reserve Life • Total proved reserves 724 MMBOE at YE 2023 vs 697 MMBOE at YE 2022 • Achieved 139% total reserve replacement • Added ~13 MMBOE of proved reserves for Lac Da Vang field in Vietnam • Maintained proved reserves from FY 2020 – FY 2023 with average annual CAPEX of ~$1.07 BN, excluding NCI and including acquisitions • 57% proved developed reserves with 41% liquids - weighting • Proved reserve life ~11 years Note: Production volumes, sales volumes, reserves and financial amounts exclude noncontrolling interest, unless otherwise sta ted Reserves are based on SEC year - end 2023 audited proved reserves and exclude noncontrolling interest 724 MMBOE 2023 Proved Reserves By Area US Onshore Offshore Canada Onshore 57% 58% 60% 57% 0 100 200 300 400 500 600 700 800 YE 2020 YE 2021 YE 2022 YE 2023 Proved Developed Proved Undeveloped Proved Reserves MMBOE 41 % Liquids - Weighted 2023 Proved Reserves By Product Oil NGL Natural Gas

39 www.murphyoilcorp.com NYSE: MUR 39 North America Onshore Well Locations Gross Remaining Locations Inter - Well Spacing (ft) Reservoir Net Acres Area 91 300 Lower EFS 10,155 Karnes 150 850 Upper EFS 104 1,100 Austin Chalk 202 600 Lower EFS 61,611 Tilden 51 1,200 Upper EFS 86 1,200 Austin Chalk 190 560 Lower EFS 47,733 Catarina 189 1,280 Upper EFS 97 1,600 Austin Chalk 1,160 119,549 Total Gross Remaining Locations Inter - Well Spacing (ft) Net Acres Area 120 984 28,064 Two Creeks 152 984 32,825 Kaybob East 103 984 26,192 Kaybob West 113 984 23,604 Kaybob North 488 110,685 Total Kaybob Duvernay Well Locations Eagle Ford Shale Operated Well Locations As of December 31, 2023 Gross Remaining Locations Inter - Well Spacing (ft) Net Acres Area 976 984 - 1,323 118,235 Tupper Montney Tupper Montney Well Locations

40 www.murphyoilcorp.com NYSE: MUR 40 Benefits of Multi - Basin Portfolio Oil - Weighted Offshore Assets Generate High - Margin Barrels World - Class Offshore Operating Capabilities Create Competitive Advantage • Offshore projects are among the highest - returning investments in portfolio • Oil - weighted assets generate substantial free cash flow • Uniquely positioned to benefit from successful exploration • Industry - leading track record of time from FID to first oil Ability to Leverage Offshore Operating Capabilities Around the World • Capable of unlocking value in international opportunities that may be too small for a major but still create significant value • Strategy of establishing low - cost entries to emerging and frontier basins 0 2 4 6 8 10 King's Quay A B C D B E F G Time from FID to First Production Years Source: Corporate news releases. Projects include Appomattox, Argos, Bigfoot, Heidelberg, Jack St. Malo, Lucius, Stones, Vito Free Cash Flow 1 per BOE $ / BOE $0 $10 $20 Murphy Total Peer Average Source: Bloomberg, Murphy internal analysis as of December 31, 2023 Peer group includes APA, CIVI, CPE, CNX, CTRA, DVN, HES, KOS, MTDR, MRO, OVV, RRC, SM, SWN, TALO 1 As defined in non - GAAP reconciliation slides in Appendix

41 www.murphyoilcorp.com NYSE: MUR 41 Eagle Ford Shale Peer Acreage Acreage as of November 5, 2024

42 www.murphyoilcorp.com NYSE: MUR 42 Kaybob Duvernay Peer Acreage Paramount Chevron Murphy Kiwetinohk Cenovus Veren Whitecap Other Leased Open Crown Facility Battery PCC GMT Hitic Halo Acreage as of November 5, 2024 Cygnet Duvernay Energy 6 Miles

43 www.murphyoilcorp.com NYSE: MUR 43 Acreage as of November 5, 2024 ARC Montney Tourmaline Montney Advantage Montney Other Competitors Open Crown Shell Montney Ovintiv Montney Birchcliff Montney TCPL Pipeline Murphy Facility Battery Murphy Pipeline 0 10 Miles Peyto Montney Tupper Montney Peer Acreage

44 www.murphyoilcorp.com NYSE: MUR 44 Gulf of Mexico Murphy Blocks Acreage as of November 5, 2024 1 Excluding noncontrolling interest 2 Anadarko is a wholly - owned subsidiary of Occidental Petroleum PRODUCING ASSETS Murphy WI 1 Operator Asset 80% Murphy Cascade 86% Murphy Chinook 80% Murphy Clipper 56% Murphy Dalmatian 50% Murphy Front Runner 27% Shell Habanero 34% Murphy Khaleesi 59% Kosmos Kodiak 16% Anadarko 2 Lucius 24% Murphy Marmalard 65% Murphy Marmalard East 48% Murphy Medusa 34% Murphy Mormont 27% Murphy Nearly Headless Nick 53% Murphy Neidermeyer 75% Murphy Powerball 50% Murphy Samurai 27% Murphy Son of Bluto II 20% Chevron St. Malo 24% W&T Tahoe Gulf of Mexico Exploration Area Miles 50 0 Offshore Platform FPSO Murphy WI Block Discovery Key Exploration Project Kodiak Front Runner Medusa Guilder Silver Dollar West Silver Dollar Liberty Longclaw Powerball Ninja Cascade Chinook Lucius St. Malo Whydah/Leibniz/ Guadalupe Delta House Rushmore King’s Quay Ocotillo Dalmatian S. Nearly Headless Nick

45 www.murphyoilcorp.com NYSE: MUR 45 Exploration Update Sergipe - Alagoas Basin, Brazil Asset Overview • ExxonMobil 50% (Op), Enauta Energia S.A. 30%, Murphy 20% • Hold WI in 9 blocks, spanning >1.6 MM gross acres • >2.8 BN BOE discovered in basin • >1.2 BN BOE in deepwater since 2007 • Evaluating next steps with partners Sergipe - Alagoas Basin All blocks begin with SEAL - M 0 50 Kilometers 351 428 430 503 505 501 575 573 637 Murphy WI Block Other Block Discovered Field BRAZIL Acreage as of November 5, 2024

46 www.murphyoilcorp.com NYSE: MUR 46 Exploration Update Potiguar Basin, Brazil Asset Overview • Murphy 100% (Op) • Hold WI in 3 blocks, spanning ~775 M gross acres • Proven oil basin in proximity to Pitu oil discovery Extending the Play Into the Deepwater • >2.1 BBOE discovered in basin • Onshore and shelf • Pitu was first step - out into deepwater Potiguar Basin Petrobras/ Shell Shell Petrobras/ Shell Petrobras Petrobras Petrobras POT - M - 857 POT - M - 863 POT - M - 865 Pitu BRAZIL 0 50 Kilometers Murphy WI Block Other Block Discovered Field Acreage as of November 5, 2024

47 www.murphyoilcorp.com NYSE: MUR 47 INVESTOR UPDATE NOVEMBER 2024

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

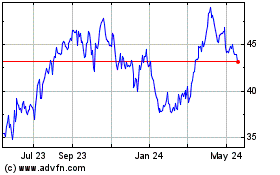

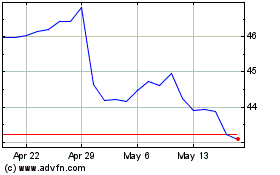

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Mar 2025 to Apr 2025

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Apr 2024 to Apr 2025