UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the quarterly period ended March 31,

2024

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to

Commission File Number: 001-33219

MV OIL TRUST

(Exact name of registrant as specified in its charter)

| Delaware |

06-6554331 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

The Bank of New York Mellon Trust Company, N.A., Trustee

Global Corporate Trust

601 Travis Street, Floor 16

Houston, Texas |

77002 |

| (Address of principal executive offices) |

(Zip Code) |

1-713-483-6020

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units of Beneficial Interest |

|

MVO |

|

The New York Stock Exchange |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ¨ |

|

Accelerated

filer ¨ |

| Non-accelerated filer ⌧ |

|

Smaller reporting company ⌧ |

| |

|

Emerging

growth company¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

No x

As of May 8, 2024, 11,500,000 Units of Beneficial

Interest in MV Oil Trust were outstanding.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

MV OIL TRUST

CONDENSED STATEMENTS OF DISTRIBUTABLE INCOME

(Unaudited)

| | |

Three months ended

March 31, | |

| | |

2024 | | |

2023 | |

| Income from net profits interest | |

$ | 5,559,056 | | |

$ | 5,186,301 | |

| Cash on hand used (withheld) for Trust expenses | |

| 103,156 | | |

| (138,798 | ) |

| General and administrative expenses (1) | |

| (314,712 | ) | |

| (332,503 | ) |

| Distributable income | |

$ | 5,347,500 | | |

$ | 4,715,000 | |

| Distributions per Trust unit (11,500,000 Trust units issued and outstanding at March 31, 2024 and 2023) | |

$ | 0.465 | | |

$ | 0.410 | |

| (1) | Includes

$30,387 and $29,219 paid to MV Partners, LLC during the three months ended March 31, 2024 and 2023, respectively, and $37,500 paid

to The Bank of New York Mellon Trust Company, N.A. during each of the three-month periods ended March 31, 2024 and 2023. |

CONDENSED STATEMENTS OF ASSETS AND TRUST CORPUS

| | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

| (Unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,160,776 | | |

$ | 1,263,932 | |

| Investment in net profits interest | |

| 50,383,675 | | |

| 50,383,675 | |

| Accumulated amortization | |

| (46,604,298 | ) | |

| (46,191,522 | ) |

| Total assets | |

$ | 4,940,153 | | |

$ | 5,456,085 | |

| TRUST CORPUS | |

| | | |

| | |

| Trust corpus, 11,500,000 Trust units issued and outstanding at March 31, 2024 and December 31, 2023 | |

$ | 4,940,153 | | |

$ | 5,456,085 | |

CONDENSED STATEMENTS OF CHANGES IN TRUST CORPUS

(Unaudited)

| | |

Three months ended

March 31, | |

| | |

2024 | | |

2023 | |

| Trust corpus, beginning of period | |

$ | 5,456,085 | | |

$ | 6,883,554 | |

| Income from net profits interest | |

| 5,559,056 | | |

| 5,186,301 | |

| Cash distributions | |

| (5,347,500 | ) | |

| (4,715,000 | ) |

| Trust expenses | |

| (314,712 | ) | |

| (332,503 | ) |

| Amortization of net profits interest | |

| (412,776 | ) | |

| (424,850 | ) |

| Trust corpus, end of period | |

$ | 4,940,153 | | |

$ | 6,597,502 | |

The accompanying notes are an integral part of

these condensed financial statements.

MV OIL TRUST

NOTES TO CONDENSED FINANCIAL

STATEMENTS

(Unaudited)

Note 1—Organization of the Trust

MV Oil Trust (the “Trust”) is a statutory

trust formed on August 3, 2006, under the Delaware Statutory Trust Act pursuant to a Trust Agreement (the “Trust Agreement”)

among MV Partners, LLC, a Kansas limited liability company (“MV Partners”), as trustor, The Bank of New York Mellon Trust

Company, N.A., as Trustee (the “Trustee”), and Wilmington Trust Company, as Delaware Trustee (the “Delaware Trustee”).

The Trust was created to acquire and hold a term

net profits interest for the benefit of the Trust unitholders pursuant to a conveyance from MV Partners to the Trust. The term net profits

interest represents the right to receive 80% of the net proceeds (calculated as described below in Note 5) from production from the underlying

properties (as defined below) (the “net profits interest”). The net profits interest consists of MV Partners’ net interests

in all of its oil and natural gas properties located in the Mid-Continent region in the states of Kansas and Colorado (the “underlying

properties”). The underlying properties include approximately 850 producing oil and gas wells.

The net profits interest is passive in nature,

and the Trustee has no management control over and no responsibility relating to the operation of the underlying properties. The net profits

interest entitles the Trust to receive 80% of the net proceeds attributable to MV Partners’ interest from the sale of production

from the underlying properties during the term of the Trust. The net profits interest will terminate on the later to occur of (1) June 30,

2026 or (2) the time when 14.4 million barrels of oil equivalent (“MMBoe”) have been produced from the underlying properties

and sold (which amount is the equivalent of 11.5 MMBoe with respect to the Trust’s net profits interest), and the Trust will soon

thereafter wind up its affairs and terminate. As of March 31, 2024, cumulatively, since inception, the Trust has received payment

for 80% of the net proceeds attributable to MV Partners’ interest from the sale of 14.3 MMBoe of production from the underlying

properties (which amount is the equivalent of 11.4 MMBoe with respect to the Trust’s net profits interest).

The Trustee can authorize the Trust to borrow money

to pay administrative or incidental expenses of the Trust that exceed cash held by the Trust. The Trustee may authorize the Trust to borrow

from the Trustee or the Delaware Trustee as a lender provided the terms of the loan are similar to the terms it would grant to a similarly

situated commercial customer with whom it did not have a fiduciary relationship. The Trustee may also deposit funds awaiting distribution

in an account with itself and make other short-term investments with the funds distributed to the Trust.

Note 2—Basis of Presentation

The accompanying Condensed Statement of Assets

and Trust Corpus as of December 31, 2023, which has been derived from audited financial statements, and the unaudited interim condensed

financial statements as of March 31, 2024 and for the three months ended March 31, 2024 and March 31, 2023, have been prepared

pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, certain information

and note disclosures normally included in annual financial statements have been condensed or omitted pursuant to those rules and

regulations.

The preparation of financial statements requires

the Trust to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period.

Actual results could differ from those estimates. The Trustee believes such information includes all the disclosures necessary to make

the information presented not misleading. The information furnished reflects all adjustments that are, in the opinion of the Trustee,

necessary for a fair presentation of the results of the interim period presented. The financial information should be read in conjunction

with the financial statements and notes thereto included in the Trust’s Annual Report on Form 10-K for the year ended December 31,

2023.

Note 3—Trust Accounting Policies

The Trust uses the modified cash basis of accounting

to report receipts of the net profits interest and payments of expenses incurred. The net profits interest represents the right to receive

revenues (oil, gas and natural gas liquid sales) less direct operating expenses (lease operating expenses, lease maintenance, lease overhead,

and production and property taxes) and an adjustment for lease equipment costs and lease development expenses (which are capitalized in

financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.

GAAP”)) of the underlying properties times 80%. Actual cash receipts may vary due to timing delays of actual cash receipts from

the property operators or purchasers and due to wellhead and pipeline volume balancing agreements or practices. The actual cash distributions

of the Trust will be made based on the terms of the conveyance that created the Trust’s net profits interest. Expenses of the Trust,

which include accounting, engineering, legal and other professional fees, Trustee fees, an administrative fee paid to MV Partners and

out-of-pocket expenses, are recognized when paid. Under U.S. GAAP, revenues and expenses would be recognized on an accrual basis. Amortization

of the investment in net profits interest is recorded on a unit-of-production method in the period in which the cash is received with

respect to such production. Such amortization does not reduce distributable income, rather it is charged directly to Trust corpus.

This comprehensive basis of accounting other than

U.S. GAAP corresponds to the accounting permitted for royalty trusts by the SEC as specified by Staff Accounting Bulletin Topic 12:E,

Financial Statements of Royalty Trusts.

Investment in the net profits interest was recorded

initially at the historical cost of MV Partners and is periodically assessed to determine whether its aggregate value has been impaired

below its total capitalized cost based on the underlying properties. The Trust will provide a write-down to its investment in the net

profits interest if and when total capitalized costs, less accumulated amortization, exceed undiscounted future net revenues attributable

to the proved oil and gas reserves of the underlying properties.

No new accounting pronouncements were adopted or

issued during the quarter ended March 31, 2024 that would impact the financial statements of the Trust.

Note 4—Investment in Net Profits Interest

The net profits interest was recorded at the historical

cost of MV Partners on January 24, 2007, the date of conveyance of the net profits interest to the Trust, and was calculated as follows:

| Oil and gas properties | |

$ | 96,210,819 | |

| Accumulated depreciation and depletion | |

| (40,468,762 | ) |

| Hedge asset | |

| 7,237,537 | |

| Net property value to be conveyed | |

| 62,979,594 | |

| Times 80% net profits interest to Trust | |

$ | 50,383,675 | |

Note 5—Income from Net Profits Interest

| | |

Three months ended

March 31, | |

| | |

2024 | | |

2023 | |

| Excess of revenues over direct operating expenses and lease equipment and development costs (1) | |

$ | 6,948,819 | | |

$ | 6,482,877 | |

| Times net profits interest over the term of the Trust | |

| 80 | % | |

| 80 | % |

| Income from net profits interest before reserve adjustments | |

| 5,559,056 | | |

| 5,186,301 | |

| MV Partners reserve for future capital expenditures (2) | |

| – | | |

| – | |

| Income from net profits interest (3) | |

$ | 5,559,056 | | |

$ | 5,186,301 | |

| (1) | Excess of revenues over direct operating expenses and lease equipment and development costs reflect expenses and costs incurred by

MV Partners during the September through November production period. Pursuant to the terms of the conveyance of the net profits

interest, lease equipment and development costs are to be deducted when calculating the distributable income to the Trust. |

| (2) | Pursuant to the terms of the conveyance of the net profits interest, MV Partners can reserve up to $1,000,000 for future capital expenditures

at any time. During the three months ended March 31, 2024 and 2023, MV Partners did not withhold or release any dollar amounts

due to the Trust. The reserve balance was $1,000,000 at March 31, 2024 and 2023. |

| (3) | The income from net profits interest is based upon the cash receipts from MV Partners for the oil and gas production. The revenues

from oil production are typically received by MV Partners one month after production; thus, the cash received by the Trust during the

three months ended March 31, 2024 substantially represents the production by MV Partners from September 2023 through November 2023,

and the cash received by the Trust during the three months ended March 31, 2022 substantially represents the production by MV Partners

from September 2022 through November 2022. |

For the three months ended March 31, 2024

and 2023, MV Purchasing, LLC, which is majority-owned by the indirect equity owners of MV Partners, purchased a majority of the production

from the underlying properties. Sales to MV Purchasing, LLC are under short-term arrangements, ranging from one to six months, using

market-sensitive pricing.

Note 6—Income Taxes

The Trust is a Delaware statutory trust and is

not required to pay federal or state income taxes. Accordingly, no provision for federal or state income taxes has been made.

Note 7—Distributions to Unitholders

MV

Partners makes quarterly payments of the net profits interest to the Trust. The Trustee determines for each quarter the amount available

for distribution to the Trust unitholders. This distribution is expected to be made on or before the 25th day of the month following the

end of each quarter to the Trust unitholders of record on the 15th day of the month following the end of each quarter (or the next succeeding

business day). Such amounts will be equal to the excess, if any, of the cash received by the Trust relating to the preceding quarter,

over the expenses of the Trust paid during such quarter, subject to adjustments for changes made by the Trustee during such quarter in

any cash reserves established for future expenses of the Trust. Beginning in the first quarter of 2022, the Trustee withheld a portion

of the proceeds otherwise available for distribution each quarter to gradually build an approximately $1.265 million cash reserve for

the payment of future known, anticipated or contingent expenses or liabilities of the Trust. The Trustee may increase or decrease the

targeted amount at any time and may increase or decrease the rate at which it withholds funds to build the cash reserve at any time, without

advance notice to the unitholders. Cash held in reserve will be invested as required by the Trust Agreement. Any cash reserved in excess

of the amount necessary to pay or provide for the payment of future known, anticipated or contingent expenses or liabilities eventually

will be distributed to unitholders, together with interest earned on the funds. This cash reserve is included in cash and cash equivalents on the accompanying Condensed Statements of Assets and Trust Corpus.

The first quarterly distribution during 2024 was

$5,347,500, or $0.465 per Trust unit, and was made on January 25, 2024 to Trust unitholders owning Trust units as of January 16,

2024. Such distribution included the net proceeds attributable to the sale of production received by MV Partners from October 1,

2023 through December 31, 2023.

The first quarterly distribution during 2023 was

$4,715,000, or $0.410 per Trust unit, and was made on January 25, 2023 to Trust unitholders owning Trust units as of January 17,

2023. Such distribution included the net proceeds attributable to the sale of production received by MV Partners from October 1,

2022 through December 31, 2022. The Trustee withheld $263,541 from the net proceeds otherwise available for distribution towards

the building of the cash reserve described above.

Note 8—Advance for Trust Expenses

Under the terms of the Trust Agreement, the Trustee

is allowed to borrow money to pay Trust expenses. During the three months ended March 31, 2024 and 2023, there were no borrowings

or amounts owed for money borrowed in previous quarters. MV Partners has provided a letter of credit in the amount of $1.8 million to

the Trustee to protect the Trust against the risk that it does not have sufficient cash to pay future expenses.

Note 9—Subsequent Events

The second quarterly distribution during 2024 was

$3,795,000, or $0.33 per Trust unit, and was made on April 25, 2024 to Trust unitholders owning Trust units as of April 15,

2024. Such distribution included the net proceeds attributable to the sale of production received by MV Partners from January 1,

2024 through March 31, 2024.

Item 2. Trustee’s Discussion and Analysis of Financial Condition

and Results of Operations.

The following discussion of the Trust’s financial

condition and results of operations should be read in conjunction with the financial statements and notes thereto. The Trust’s purpose

is, in general, to hold the net profits interest, to distribute to the Trust unitholders cash that the Trust receives in respect of the

net profits interest, and to perform certain administrative functions in respect of the net profits interest and the Trust units. The

Trust derives substantially all of its income and cash flows from the net profits interest. All information regarding operations has been

provided to the Trustee by MV Partners.

Results of Operations

Results of Operations for the Quarters Ended March 31, 2024

and 2023

The

cash received by the Trust from MV Partners during the quarter ended March 31, 2024 substantially represents the production by MV

Partners from September 2023 through November 2023. The cash received by the Trust from MV Partners during the quarter

ended March 31, 2023 substantially represents the production by MV Partners from September 2022 through November 2022.

The revenues from oil production are typically received by MV Partners one month after production. The Trust’s income from net profits

interest increased $372,755 to $5,559,056 for the quarter ended March 31, 2024 from $5,186,301 for the quarter ended March 31,

2023. The increase was primarily due to a $465,942 increase in excess of revenues over direct operating expenses and lease equipment and

development costs for the underlying properties to $6,948,819 from $6,482,877 for the same period in the prior year. These amounts were

reduced by a Trustee holdback for current Trust expenses of $211,556 and $207,760 for the quarters ended March 31, 2024 and 2023,

respectively, and a Trustee holdback for future estimated Trust expenses of $263,541 for the quarter ended March 31, 2023. The Trustee

paid general and administrative expenses of $314,712 and $332,503 for the quarters ended March 31, 2024 and 2023, respectively. During

the quarters ended March 31, 2024 and 2023, MV Partners did not withhold or release any dollar amounts due to the Trust from

the previously established reserve for future capital expenditures. These factors resulted in distributable income for the quarter

ended March 31, 2024 of $5,347,500, an increase of $632,500 from $4,715,000 for the quarter ended March 31, 2023.

The average price received for crude oil sold was

$80.07 per Bbl and the average price received for natural gas sold was $2.23 per Mcf for the period from October 1, 2023 through

December 31, 2023. The average price received for crude oil sold was $80.66 per Bbl and the average price received for natural gas

sold was $6.85 per Mcf for the period from October 1, 2022 through December 31, 2022.

The overall production sales volumes attributable

to the net profits interest for the oil and gas production collected during the period from October 1, 2023 through December 31,

2023 were 122,548 Bbls of oil, 5,977 Mcf of natural gas and 6 Bbls of natural gas liquids, for a total of 123,548 barrels of oil

equivalent. The overall production sales volumes attributable to the net profits interest for the oil and gas production collected during

the period from October 1, 2022 through December 31, 2022 were 124,305 Bbls of oil, 6,636 Mcf of natural gas and 22 Bbls of

natural gas liquids, for a total of 125,425 barrels of oil equivalent.

Liquidity and Capital Resources

Other than Trust administrative expenses, including

any reserves established by the Trustee for future liabilities, the Trust’s only use of cash is for distributions to Trust unitholders.

Administrative expenses include payments to the Trustee as well as an annual administrative fee to MV Partners pursuant to an administrative

services agreement. Each quarter, the Trustee determines the amount of funds available for distribution. Available funds are the excess

cash, if any, received by the Trust from the net profits interest and payments from other sources (such as interest earned on any amounts

reserved by the Trustee) in that quarter, over the Trust’s expenses paid for that quarter. Available funds are reduced by any cash

the Trustee decides to hold as a reserve against future expenses.

Beginning in the first quarter of 2022, the

trustee withheld a portion of the proceeds otherwise available for distribution each quarter to gradually build a cash reserve for

the payment of future known, anticipated or contingent expenses or liabilities. This amount is in addition to the $1.8 million

letter of credit described below. The Trustee may increase or decrease the targeted amount and may increase or decrease the rate at

which it withholds funds to build the cash reserve at any time, without advance notice to the unitholders. Cash held in reserve

will be invested as required by the Trust Agreement. Any cash reserved in excess of the amount necessary to pay or provide for the

payment of future known, anticipated or contingent expenses or liabilities eventually will be distributed to unitholders, together

with interest earned on the funds. As of March 31, 2024, $1,160,776 was held by the Trustee and is reported as cash and cash equivalents.

The Trustee may cause the Trust to borrow funds

required to pay expenses if the Trustee determines that the cash on hand and the cash to be received are insufficient to cover the Trust’s

expenses. If the Trust borrows funds, the Trust unitholders will not receive distributions until the borrowed funds are repaid. During

the three months ended March 31, 2024 and 2023, there were no such borrowings. MV Partners has provided a letter of credit in the

amount of $1.8 million to the Trustee to protect the Trust against the risk that it does not have sufficient cash to pay future expenses.

Income to the Trust from the net profits interest

is based on the calculation and definitions of “gross proceeds” and “net proceeds” contained in the conveyance.

Substantially all of the underlying properties

are located in mature fields, and MV Partners does not expect future costs for the underlying properties to change significantly as compared

to recent historical costs other than changes due to fluctuations in the general cost of oilfield services. MV Partners may establish

a capital reserve of up to $1,000,000 in the aggregate at any given time to reduce the impact on distributions of uneven capital expenditure

timing. As of March 31, 2024, $1,000,000 was held by MV Partners as a capital reserve.

The Trust does not have any transactions, arrangements

or other relationships with unconsolidated entities or persons that could materially affect the Trust’s liquidity or the availability

of capital resources.

Note Regarding Forward-Looking Statements

This Form 10-Q includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact included in

this Form 10-Q, including without limitation the statements under “Trustee’s Discussion and Analysis of Financial Condition

and Results of Operations” are forward-looking statements. Although MV Partners advised the Trust that it believes that the expectations

reflected in the forward-looking statements contained herein are reasonable, no assurance can be given that such expectations will prove

to have been correct. Important factors that could cause actual results to differ materially from expectations (“Cautionary Statements”)

are disclosed in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”),

including under the section “Item 1A. Risk Factors”. All subsequent written and oral forward-looking statements attributable

to the Trust or persons acting on its behalf are expressly qualified in their entirety by the Cautionary Statements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

The Trust is a smaller reporting company as defined

by Rule 12b-2 of the Exchange Act and is not required to provide the information under this Item.

Item 4. Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures. The Trustee maintains disclosure controls and procedures designed to ensure that

information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is recorded, processed,

summarized and reported within the time periods specified in the rules and regulations promulgated by the SEC. Disclosure controls

and procedures include controls and procedures designed to ensure that information required to be disclosed by the Trust is accumulated

and communicated by MV Partners to The Bank of New York Mellon Trust Company, N.A., as Trustee of the Trust, and its employees who participate

in the preparation of the Trust’s periodic reports as appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report,

the Trustee carried out an evaluation of the Trust’s disclosure controls and procedures. A Trust Officer of the Trustee has concluded

that the disclosure controls and procedures of the Trust are effective.

Due to the contractual arrangements of (i) the

Trust Agreement and (ii) the conveyance of the net profits interest, the Trustee relies on (A) information provided by MV Partners,

including historical operating data, plans for future operating and capital expenditures, reserve information and information relating

to projected production, and (B) conclusions and reports regarding reserves by the Trust’s independent reserve engineers. See

“Risk Factors—The Trust and the public Trust unitholders have no voting or managerial rights with respect to MV Partners,

the operator of the underlying properties. As a result, public Trust unitholders have no ability to influence the operation of the underlying

properties” and “Trustee’s Discussion and Analysis of Financial Condition and Results of Operations” in the Form 10-K

for a description of certain risks relating to these arrangements and reliance on information when reported by MV Partners to the Trustee

and recorded in the Trust’s results of operations.

Changes

in Internal Control over Financial Reporting. During the quarter ended March 31, 2024, there was no change in the

Trust’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the

Trust’s internal control over financial reporting. The Trustee notes for purposes of clarification that it has no authority over,

and makes no statement concerning, the internal control over financial reporting of MV Partners.

PART II—OTHER INFORMATION

Item 1A. Risk Factors.

There have not been any material changes from the

risk factors previously disclosed in the Trust’s response to Item 1A to Part I of the Form 10-K.

Item 5. Other Information.

Rule 10b5-1

Trading Plans. During the three months ended March 31, 2024, no officer or employee of the Trustee

who performs policy-making functions for the Trust adopted, modified, or terminated any Rule 10b5-1 trading arrangement or non-Rule 10b5-1

trading arrangement, as such terms are defined in Item 408(a) of Regulation S-K, with respect to the Trust units.

Item 6. Exhibits.

The exhibits listed below are filed or furnished

as part of this Quarterly Report on Form 10-Q.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

MV OIL TRUST |

| |

|

|

| |

By: |

The Bank of New York Mellon Trust Company, N.A., as Trustee |

| |

|

|

| |

By: |

/s/ ELAINA C. RODGERS |

| |

|

Elaina C. Rodgers |

| |

|

Vice President |

| |

|

| Date: May 8, 2024 |

|

The Registrant, MV Oil Trust, has no principal

executive officer, principal financial officer, board of directors or persons performing similar functions. Accordingly, no additional

signatures are available and none have been provided. In signing the report above, the Trustee does not imply that it has performed any

such function or that such function exists pursuant to the terms of the Trust Agreement under which it serves.

EXHIBIT 31

CERTIFICATION

I, Elaina C. Rodgers, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of MV Oil Trust (the “Trust”), for which The Bank of New York

Mellon Trust Company, N.A., acts as Trustee; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period

covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, distributable income and changes in Trust corpus of the registrant as of, and for, the periods presented

in this report; |

| 4. | I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the

registrant and I have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to me by others

within those entities, particularly during the period in which this report is being prepared; |

| b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; |

| c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report my conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and |

| d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors: |

| a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which

are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and |

| b) | Any fraud, whether or not material, that involves any persons who have a significant role in the registrant’s internal control

over financial reporting. |

In giving the foregoing certifications in paragraphs 4

and 5, I have relied to the extent I consider reasonable on information provided to me by MV Partners, LLC.

| Date: May 8, 2024 |

/s/ ELAINA C. RODGERS |

| |

Elaina C. Rodgers |

| |

Vice President |

| |

The Bank of New York Mellon Trust Company, N.A., |

| |

Trustee for MV Oil Trust |

EXHIBIT 32

May 8, 2024

Via EDGAR

Securities and Exchange Commission

Judiciary Plaza

450 Fifth Street, N.W.

Washington, D.C. 20549

| Re: | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

Ladies and Gentlemen:

In connection with the Quarterly Report of MV Oil

Trust (the “Trust”) on Form 10-Q for the quarterly period ended March 31, 2024 as filed with the Securities and

Exchange Commission on the date hereof (the “Report”), the undersigned, not in its individual capacity but solely as the trustee

of the Trust, certifies pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to

its knowledge:

| (1) | The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as

amended; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations

of the Trust. |

The above certification is furnished solely pursuant

to Section 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) and is not being filed as part of the Report or as a separate disclosure

document.

| |

The Bank of New York Mellon Trust Company, N.A. |

| |

Trustee for MV Oil Trust |

| |

|

|

| |

By: |

/s/ ELAINA C. RODGERS |

| |

|

Elaina C. Rodgers |

| |

|

Vice President and Trust Officer |

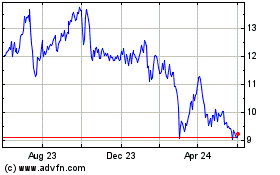

MV Oil (NYSE:MVO)

Historical Stock Chart

From Nov 2024 to Dec 2024

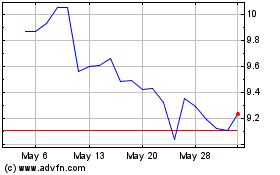

MV Oil (NYSE:MVO)

Historical Stock Chart

From Dec 2023 to Dec 2024