U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

For the Month of February 2024

Nexa Resources S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

37A, Avenue J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether

by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 08, 2024

| Nexa Resources S.A. |

| By:/s/ José Carlos del Valle |

| Name: José Carlos del Valle |

| Title: Senior Vice President of Finance and Group Chief Financial Officer |

EXHIBIT INDEX

Nexa Reports Fourth Quarter and

Full Year 2023

Exploration Results

Luxembourg,

February 8, 2024 – Nexa Resources S.A. (“Nexa Resources”,

“Nexa”, or “Company”) is pleased to provide today the drilling and assay results from the fourth quarter and full

year of 2023. This document contains forward-looking statements.

Summary

Nexa’s drilling strategy for 2023

was focused on near-mine expansion brownfield and infill drilling, including the Aripuanã project which is in the final ramp-up

stage. Additional exploratory drilling also occurred in greenfield projects with a potential favorable perspective.

At the end of 2023, cumulative drilling

production reached 257,482 meters, of which 85,199 meters were exploratory drilling, including the Babaçu infill at Aripuanã,

and 172,284 meters were operational infill drilling. Total exploratory drilling in 4Q23 was 15,586 meters, of which 12,138 meters took

place in Peru, 2,281 meters in Brazil and 1,167 meters in Namibia. Exploratory drilling planned for 1Q24 includes 9,500 meters in Peru

with seven rigs and 2,500 meters in Brazil with three rigs, totaling 12,000 meters.

Commenting on the report, Jones Belther,

Senior Vice President of Mineral Exploration & Business Development, said “During 2023 we achieved 97% of the planned activities

with the execution of 85,199 meters of exploratory drilling out of the planned 88,196 meters. We achieved outstanding results in our brownfield

program at Aripuanã with the Babaçu infill drilling confirming thick and high-grade mineralization, supporting the expectation

of converting Inferred Mineral Resources into Probable Mineral Reserves. Drilling at Babaçu in 4Q23 also confirmed favorable high-grade

intersections such as holes BRAPD000218 and BRAPD000220, which displayed, respectively, 43.2 meters with

13.75% Zn, 5.68% Pb, 0.26% Cu, 85.09 g/t Ag and 0.29 g/t Au, and 24.5 meters with 21.44% Zn, 9.43% Pb, 0.08% Cu, 71.26 g/t Ag and 0.25

g/t Au.

During 4Q23 our brownfield exploration

programs have progressed as planned and assay results continue to indicate that we can potentially extend the life of mine of our current

operations. At Cerro Lindo, orebodies OB-8 and OB-9 continued to be extended with intersections greater than 4.0 meters as per hole PECLD07242

from OB-8 with 34.8 meters @ 2.81% Zn, 0.89% Pb and 0.12% Cu. At the Pasco complex, the Integración orebody confirmed continuity

in depth below the 3300 level in three holes as per hole PEEPD02702 with 3.5 meters @ 2.99% Zn, 1.15%

Pb, 0.46% Cu, 130.97 g/t Ag and 0.42g/t Au.

Finally, in respect of the Hilarión

project, at the El Padrino area, two holes confirmed mineralized skarn zone continuity to the southwest, displaying multiple parallel

lenses as was the case with hole PEPADD000001 with 6.2 meters @ 2.70% Zn, 0.37% Pb, 0.431% Cu, and 38.08g/t

Ag”.

Cerro Lindo

In 4Q23, the exploratory drilling program

at the Cerro Lindo project focused on extending the mineralization of the OB-8 and OB-9 targets, as well as identifying new mineralized

zones at the Pucasalla target and its extensions. In addition, we continue to drill the geophysical anomaly of the Patahuasi Millay target

to identify the presence of possible mineralized zones.

Exploration Report 4Q23 and 2023 |  |

| | |

During 4Q23, a total of 5,175 meters of

exploratory drilling and 7,524 meters of infill drilling were carried out, which totaled 27,510 meters and 51,401 meters in 2023, respectively.

Underground exploration drilling included 1,310 meters in OB-8. Surface drilling included 2,394 meters at Pucasalla and Pucasalla East,

and 1,471 meters at Patahuasi Millay.

The results obtained during the fourth

quarter reported the continuity of mineralization in the OB-8 and OB-9 orebodies, such as the 31.8 meter interval with 2.81% Zn, 0.89%

Pb, 0.12% Cu, 25.38 g/t Ag and 0.07 g /t Au and the 11.3 meter interval with 2.23% Zn, 0.21% Pb, 0.17% Cu, 13.43 g/t Ag and 0.08 g/t Au,

with both intercepts corresponding to the southeastern extension of the OB-8. In addition, we obtained a mineralized intercept in OB-9

measuring 7.3 meters with 2.26% Zn, 0.01% Pb, 0.06% Cu, 1.59 g/t Ag and 0.01 g/t Au.

Exploratory drilling to identify new mineralized

zones in the Pucasalla target and extensions and in Patahuasi Millay identified the presence of sulfide zones, but without significant

results during this quarter.

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to “no significant intercept”. PAR refers to “pending assay results”.

| | |

| 2 |

Exploration Report 4Q23 and 2023 |  |

| | |

For 1Q24, we plan to continue drilling

from surface the Pucasalla target with one rig towards the southeast extension (1,500m) and, investigating the Patahuasi Millay target

with one rig (2,700m) and the extensions of orebodies OB-8, OB-6A and OB-9 with three additional rigs (3,990m).

Vazante

In 2023, the brownfield exploration at Vazante

focused on expanding existing mineralized zones in the northern and southern extensions of the mine. In 4Q23, 99 meters of exploratory

drilling were completed in the Vazante Sul target with one rig. Another 8,804 meters of infill drilling were carried out with three rigs

at the Vazante mine totaling 7,296 meters and 37,870 meters in 2023, respectively.

The exploratory drilling program at the

Vazante project ended in the first week of October with a total of 99 meters of drilling in order to complete the exploratory holes not

completed during the third quarter. Therefore, the results reported in this report refer to chemical analysis pending to date. The reported

results identified the extent of the Sucuri orebody at depth, such as the results from hole MVZMV420P13925D10 that intercepted three mineralized

zones, highlighting the 1.2 meter interval with 5.53% Zn, 0.13% Pb and 0.25 g/t Ag.

| | |

| 3 |

Exploration Report 4Q23 and 2023 |  |

| | |

Note: Intervals with assays not reported

here have no consistent samples > 2.5% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to” no significant intercept”. PAR refers to “pending assay results”.

For 1Q24, we plan to continue the extension

drilling program in the Sucuri area, where we plan to drill 1,100 meters with one rig.

| | |

| 4 |

Exploration Report 4Q23 and 2023 |  |

| | |

Aripuanã

During 4Q23, the Aripuanã exploration

strategy focused on increasing Mineral Resources at the Babaçu exploration target, which lies to the southeast of the Ambrex deposit,

and on starting drill at the Massaranduba target to the southeast of Babaçu.

In 4Q23, 771 meters of exploration infill

drilling were completed at Babaçu with one rig and an additional 1,411 meters of exploratory drilling was completed at Massaranduba

with one rig, totaling 19,645 meters and 2,135 meters in 2023, respectively. At the Aripuanã mine, a total of 7,537 meters of mining

infill drilling was completed in 4Q23 with five rigs, totaling 38,922 meters in 2023.

During 4Q23, the last three scheduled holes

of the Babaçu deposit infill campaign were carried out. The results obtained confirmed the continuity of mineralization with high

polymetallic contents, as in the case of holes BRAPD000218 and BRAPD000220, for example, which displayed, respectively, 43.2 meters with

13.75% Zn, 5.68% Pb, 0.26% Cu, 85.09 g/t Ag and 0.29 g/t Au and 24.5 meters with 21.44% Zn, 9.43% Pb, 0.08% Cu, 71.26 g/t Ag and 0.25

g/t Au.

Drill hole BRAPD000221 also intercepted

the Ambrex orebody, a portion known as the "ramp", due to its offset, intersecting several mineralized zones such as the 25.6

meters interval with 7.12% Zn, 5.21% Pb, 0.17% Cu, 191.85 g/t Ag and 0.13 g/t Au.

In addition, we began exploratory drilling

at the Massaranduba target, a possible southeastern continuation of the Aripuanã deposit, with visual evidence of mineralization,

but with pending assay results. This target will be the focus of the project exploration program in 2024.

Note: Intervals with assays not reported

here have no consistent samples > 3.0% Zinc or >0.5% Copper or >0.5 g/t Gold or assay results are pending. True widths of the

mineralized intervals are unknown at this time.

| | |

| 5 |

Exploration Report 4Q23 and 2023 |  |

| | |

| | |

| 6 |

Exploration Report 4Q23 and 2023 |  |

| | |

For 1Q24, we will continue drilling the

Massaranduba target focused on identifying new mineralized zones. We plan to drill 1,400 meters with two rigs.

El Porvenir

The El Porvenir exploration drilling program,

completed in 4Q23, focused on the extension of mineralization at Target Integración. In 4Q23, 1,338 meters of underground exploratory

drilling with one rig and 124 meters of mining infill drilling were executed, totaling 9,321 meters and 34,565 meters in 2023, respectively.

We continue drilling the Integración target from the 3300 level and the results intercepted during 4Q23 confirmed the extent of

mineralization with high metal content, as evidenced in drill hole PEEPD02702 with an intercept of 3.5 meters with 2.99% Zn, 1.15% Pb,

0.46% Cu, 130.97 g/t Ag and 0.42 g/t Au.

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to no significant intercept. PAR refers to pending assay results.

| | |

| 7 |

Exploration Report 4Q23 and 2023 |  |

| | |

| | |

| 8 |

Exploration Report 4Q23 and 2023 |  |

| | |

For 1Q24, we will continue drilling the

south extension of the Integración target at the 3300 level and start drilling the VAM, Dom Lucho and Porvenir 9 targets with the

objetive of extending the known mineralization and identifying new mineralized zones. We plan to drill 2,650 meters with two rigs.

| | |

| 9 |

Exploration Report 4Q23 and 2023 |  |

| | |

Atacocha

During 4Q23, drilling was focused on the

Asunción Orebody and Norte Orebody. In 4Q23, 1,044 meters were drilled with one rig, totaling 2,941 meters in 2023. No significant

result was reported in 4Q23.

We will start drilling at Atacocha in 2Q24,

focusing on the extension of the Integración target to upper levels of the mine with one rig (1,000m).

Morro Agudo

In 4Q23, 1,626 meters of mining infill

drilling was carried out in the underground mine at Morro Agudo, totaling 6,585 meters in 2023. No exploratory drilling was carried out

in the Morro Agudo/Bonsucesso areas.

Hilarión

In 4Q23, a total of 1,652 meters were drilled

at Hilarión with two rigs, totaling 4,100 meters in 2023.

During 4Q23, drilling of the PEHILD000061

hole began at the Chaupijanca South Target, cutting part of the Chaupijanca stock with little development of skarn alteration at the contact

between the stock and limestones of the Pariatambo Superior formation. In this hole three veins of 0.5 to 0.8 meters were intercepted

with grades of 1.86% Zn to 3.16% Zn and at a depth of 655.5 meters, 10.4 meters were intercepted with 467.4ppm Mo on average.

Drill hole PEPADD000001 was completed at

the El Padrino Target, intercepting three zinc mineralized horizons within the Pariatambo Formation, 3.3 meters with 3.97% Zn, 3.5 meters

with 2.27% Zn and 6.1 meters with 2.70% Zn. From a depth of 260.1 meters, the mixed skarn - porphyry zone presents a stockwork zone of

veins of qz-py-mo-cpy, considering a main intercept of 102.5 meters with marginal grades of 0.15% Cu and 291.11ppm Mo. At the contact

between the mixed zone and the porphyry zone, thin and marginal lenses of copper bearing massive sulfides occur over a broad interval

highlighting the interval from 817.9 to 820.0 meters with 2.1 meters with 0.82% Cu. Between 374 and 405 meters, a 31meter interval displays

Mo grades averaging about 440 ppm, and from 756 to 778 meters, a 22meter interval with 400 ppm Mo. In hole PEPADD000002, lead mineralization

was identified below 1,100 meters showing 3.8 meters with 0.37% Zn, 4.92% Pb, 0.20% Cu, 522.91g/t Ag and 0.22g/t Au. Copper mineralization

was identified below 800 meters in two intervals of 2.5 meters each with 1.10 and 1.38% Cu. From 759 to 780 meters, a zone of 11 meters

averaged about 600ppm Mo, similar to hole PEPADD000001.

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to “no significant intercept”. PAR refers to “pending assay results”.

| | |

| 10 |

Exploration Report 4Q23 and 2023 |  |

| | |

| | |

| 11 |

Exploration Report 4Q23 and 2023 |  |

| | |

The main objective at Hilarión

in 2024 is to consolidate the geological information to define the project strategy for the next years. For 1Q24, we have only scheduled

environmental monitoring and road maintenance activities.

Florida Canyon

During 4Q23, 1,362 meters of an initially

scheduled 2,770 meters were carried out with one rig due to the internal reprioritization of projects. This reprioritization is consequence

of the largest meter executed by the Hilarión project, and the initial marginal results obtained by the exploratory drilling campaign

in the Florida Sur target, such as the half-meter intercept with 2.05% Zn, 0.47% Pb and 2.58 g/t Ag.

In addition, the construction and maintenance

activity of the project's access road continued, which aims to reach the La Florida Annex.

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to “no significant intercept”. PAR refers to “pending assay results”.

| | |

| 12 |

Exploration Report 4Q23 and 2023 |  |

| | |

For 1Q24, we only scheduled environmental

monitoring and social agreements activities.

Namibia

Namibia is strategically important to

Nexa for the development of copper exploration projects and mining activities outside Latin America. The Otavi and Namibia North joint

venture projects are strategically placed in a copper province in the northern part of the country. Exploratory work in Namibia is expected

to target high-grade copper sediment hosted deposits along the fertile Tsumeb and Kombat belts.

The 2023 drilling program was completed,

with a total of 4,933 meters drilled at the Namibia North project. The focus was testing the potential of the Deblin fault system at Namibia

North.

Otavi Project

No drilling activity occurred at the Otavi

project in 4Q23 and 2023. No drilling is planned for 2024 at this project.

Namibia North

Project

During 4Q23, drilling activity was mainly

focused on exploratory diamond drilling in early-stage targets along important Cu trends in the belt. Exploratory work in Namibia is targeting

high-grade Copper sediment hosted deposits along the fertile OML (Otavi Mountainlands) belt. In 4Q23, the exploration program in Namibia

North executed 1,167 meters with two rigs over 3 drillholes as part of our activities to assess Cu potential along the Ondjondjo Target

(located only 6km from the Deblin Ore body) and Otavi Valley Targets. In 2023, a total of 4,933 meters were drilled at this project.

The last drill rig was demobilized in December

2023 due to the rainy season and is expected to be mobilized back to the project in March 2024 after budget definition. No significant

intersection was observed in the holes.

Note: Intervals with assays not reported

here have no consistent samples > 0.5% Copper over three meters or assay results are pending. True widths of the mineralized intervals

are unknown at this time. NSI refers to “no significant intercept”. PAR refers to “pending assay results”.

| | |

| 13 |

Exploration Report 4Q23 and 2023 |  |

| | |

Drilling

will resume in April 2024, with meterage still to be defined due to the beginning of the fiscal year in Namibia occurring in April.

2024 Mineral Exploration

Strategy

Our exploration strategy for 2024 is aimed

at focusing on Mineral Resource expansion through brownfield and infill drilling near operating mines and extension drilling on advanced

projects. A total of 66,050 meters of drilling is planned for 2024, including 42,100 meters in Peru (63%) and 23,950 meters in Brazil

(37%). At Cerro Lindo, we plan to drill a total of 23,100 meters including exploratory drilling at Patahuasi Millay, Pucasalla and its

extensions, located in the northern side of the Cerro Lindo mine and extension drilling at Orebodies 8B, 9, 5 and 6A, located southeast

of the mine. At the Pasco Complex (El Porvenir and Atacocha), we plan to drill 8,500 meters divided between the Integración target

to extend the mineralized hydrothermal breccia to upper levels of the deposit and at Don Lucho, VAM and Porvenir 9 targets. At the Hilarión

and Florida Canyon projects, our focus will be to advance geological mapping and integration of geological data to define the exploration

strategy for the years ahead. At Aripuanã, the strategy will be to drill 9,000 meters to identify the mineralization in the Massaranduba

target to validate the continuation of the deposit in the southeast side of the Aripuanã mine. At Vazante, we plan to carry out

12,350 meters of brownfield drilling, 7,050 to extend known orebodies such as Sucuri and Sucuri North and 5,300 meters of infill drilling

at the BDMG Orebody to convert Inferred Mineral Resources into Indicated Mineral Resources. In Namibia, we plan to drill to continue investigating

copper mineralization in the Tsumeb trend, however, the drilling program remains under review*. We expect to continue advancing our drilling

campaigns and developing our pipeline of projects in regional areas with additional 13,100 meters of diamond drilling, prioritizing belts

for exploratory drilling and Mineral Resource expansion to consolidate our Zinc and Copper portfolio with optimized investments between

them.

* The

fiscal year in Namibia starts in April and budget discussions are ongoing.

| | |

| 14 |

Exploration Report 4Q23 and 2023 |  |

| | |

Note 1 – Laboratory

Reference

The laboratories used to test our assays

were: ALS Global for Brazil, Namibia, and Peruvian Greenfield and brownfield projects; Certimin S.A. for Cerro Lindo; and Inspectorate

Limited for El Porvenir.

Technical Information

Jose Antonio Lopes, MAusIMM (Geo): 224829,

a mineral resources manager, a qualified person for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral

Projects and a Nexa employee, has approved the scientific and technical information contained in this news release.

Further information, including key assumptions,

parameters, and methods used to estimate Mineral Reserves and Mineral Resources of the mines and/or projects referenced in the tables

above can be found in the applicable technical reports, each of which is available at www.sedarplus.com under Nexa’s SEDAR+ profile.

About Nexa

Nexa is a large-scale, low-cost integrated

zinc producer with over 65 years of experience developing and operating mining and smelting assets in Latin America. Nexa currently owns

and operates five long-life mines - three located in the Central Andes of Peru and two located in the state of Minas Gerais in Brazil

- and it is ramping up Aripuanã, its sixth mine in Mato Grosso, Brazil. Nexa also currently owns and operates three smelters, two

located in Minas Gerais, Brazil and one in Peru, Cajamarquilla, which is the largest smelter in the Americas.

Nexa was among the top five producers

of mined zinc globally in 2023 and one of the top five metallic zinc producers worldwide in 2023, according to Wood Mackenzie.

Cautionary Statement

on Forward-Looking Statements

This news release contains certain forward-looking

information and forward-looking statements as defined in applicable securities laws (collectively referred to in this news release as

“forward-looking statements”). All statements other than statements of historical fact are forward-looking statements. The

words “believe,” “will,” “may,” “may have,” “would,” “estimate,”

“continues,” “anticipates,” “intends,” “plans,” “expects,” “budget,”

“scheduled,” “forecasts” and similar words are intended to identify estimates and forward-looking statements.

Forward-looking statements are not guarantees and involve known and unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of NEXA to be materially different from any future results, performance or achievements expressed

or implied by the forward-looking statements. Actual results and developments may be substantially different from the expectations described

in the forward-looking statements for a number of reasons, many of which are not under our control, among them, the activities of our

competition, the future global economic situation, weather conditions, market prices and conditions, exchange rates, and operational and

financial risks. The unexpected occurrence of one or more of the abovementioned events may significantly change the results of our operations

on which we have based our estimates and forward-looking statements. Our estimates and forward-looking statements may also be influenced

by, among others, legal, political, environmental or other risks that could materially affect the potential development of our projects,

including risks related to outbreaks of contagious diseases or health crises impacting overall economic activity regionally or globally.

These forward-looking statements related

to future events or future performance and include current estimates, predictions, forecasts, beliefs and statements as to management’s

expectations with respect to, but not limited to, the business and operations of the Company and mining production our growth strategy,

the impact of applicable laws and regulations, future zinc and other metal prices, smelting sales, CAPEX, expenses related to exploration

and project evaluation, estimation of mineral reserves and/or mineral resources, mine life and our financial liquidity.

| | |

| 15 |

Exploration Report 4Q23 and 2023 |  |

| | |

Forward-looking statements are necessarily

based upon a number of factors and assumptions that, while considered reasonable and appropriate by management, are inherently subject

to significant business, economic and competitive uncertainties and contingencies and may prove to be incorrect. Statements concerning

future production costs or volumes are based on numerous assumptions of management regarding operating matters and on assumptions that

demand for products develops as anticipated, that customers and other counterparties perform their contractual obligations, full integration

of mining and smelting operations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability

of parts and supplies, labor disturbances, interruption in transportation or utilities, adverse weather conditions, and other COVID-19

related impacts, and that there are no material unanticipated variations in metal prices, exchange rates, or the cost of energy, supplies

or transportation, among other assumptions.

We assume no obligation to update forward-looking

statements except as required under securities laws. Estimates and forward-looking statements involve risks and uncertainties and do not

guarantee future performance, as actual results or developments may be substantially different from the expectations described in the

forward-looking statements. Further information concerning risks and uncertainties associated with these forward-looking statements and

our business can be found in our public disclosures filed under our profile on SEDAR (www.sedarplus.com) and on EDGAR (www.sec.gov).

For further information,

please contact:

Investor Relations Team

ir@nexaresources.com

| | |

| 16 |

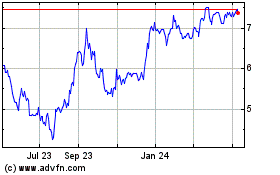

Nexa Resources (NYSE:NEXA)

Historical Stock Chart

From Jan 2025 to Feb 2025

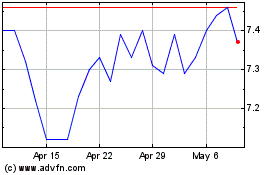

Nexa Resources (NYSE:NEXA)

Historical Stock Chart

From Feb 2024 to Feb 2025