Nokia Faces Revenue Hit From AT&T's Network Deal With Ericsson -- Update

December 05 2023 - 5:24AM

Dow Jones News

By Dominic Chopping

Nokia's revenue is set to fall after U.S. operator AT&T

selected other vendors to build out a new network, a blow to the

Finnish company's profitability targets that sent its shares

tumbling Tuesday.

AT&T said late Monday that it struck a deal with Ericsson to

buy up to $14 billion of so-called open radio access network

technology from the Swedish supplier. The five-year agreement moves

virtually all of AT&T's new purchases of certain cell-tower

equipment to Ericsson, replacing existing gear from Nokia in many

markets.

Nokia said that as a result of the decision, its share of

revenue from AT&T would fall over the next two to three years.

AT&T accounted for 5%-8% of Nokia's mobile networks net sales

in the year to date.

At 1030 GMT, Nokia shares traded at the bottom of the Stoxx

Europe 600 index, down 8% at EUR2.76.

Nokia said previously announced cost-reduction measures would

partially mitigate the impact of AT&T's move.

Open RAN technology allows operators to build telecom networks

using equipment from different suppliers rather than having to

commit to using gear from one. AT&T said the shift will sped up

its network overhaul and allow it to deepen its use of hardware and

software from niche suppliers, yielding more flexibility, lower

network costs and improved operational efficiencies.

Nokia expects its mobile networks business to remain profitable

over the coming years, but AT&T's decision will delay the

timeline of achieving a double-digit operating margin by up to two

years, it said.

Analysts at Citi had expected Nokia's mobile margins to improve

from 7% in 2023 to 10% in 2025, so the announcement is a big

setback, they said in a note.

"Nokia had been the primary share gainer within the RAN market

for the past two years, following the decline after it lost

significant share at Verizon in 2019. The loss of share at a second

North American customer, particularly given Nokia's legacy in that

market, is a considerable blow," Citi wrote.

However, Nokia said it remains fully committed to Open RAN, with

Japan's NTT Docomo recently selecting its O-RAN 5G network for its

commercial deployment.

"Whilst the news from AT&T is disappointing, our mobile

networks business has made significant progress in recent years,

increasing our RAN market share and technology leadership," said

Nokia Chief Executive Pekka Lundmark. "I firmly believe we have the

right strategy to create value for our shareholders into the future

with opportunities to gain share, diversify our business and

improve our profitability."

Nokia remains a key partner for AT&T within both its network

infrastructure and cloud and network services businesses. AT&T

said its Open RAN supplier decision was driven by reasons specific

to the U.S. company.

For Ericsson, the move is a boost as it becomes the first global

vendor to deploy Open RAN with a major operator into an existing

network, Citi said.

"The U.S. is the biggest market globally for telecom equipment

and AT&T is the biggest spender in that market (across mobile

and fixed), hence why we think this announcement is so meaningful,"

the bank wrote.

At 1030 GMT, Ericsson shares traded 5% higher at SEK57.01.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

December 05, 2023 06:09 ET (11:09 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

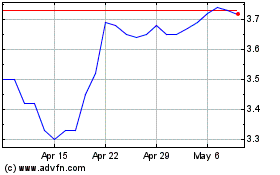

Nokia (NYSE:NOK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nokia (NYSE:NOK)

Historical Stock Chart

From Jan 2024 to Jan 2025