UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Report on Form 6-K dated January 25,

2024

(Commission File No. 1-13202)

Nokia Corporation

Karakaari 7

FI-02610 Espoo

Finland

(Translation of the registrant’s name into English and address of registrant’s principal executive office)

| Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

| |

|

|

| Form 20-F: x |

|

Form 40-F: ¨ |

Enclosures:

| ● | Stock

Exchange Release: Nokia Board of Directors approved the Nokia Long-Term Incentive Plan 2024–2026

and the Employee Share Purchase Plan 2024–2026 |

|

Stock exchange release

25 January 2024 |

1 (3) |

Nokia Corporation

Stock Exchange Release

25 January 2024 at 8:15 EET

Nokia

Board of Directors approved the Nokia Long-Term Incentive Plan 2024–2026 and the Employee Share Purchase Plan 2024–2026

Espoo, Finland –Nokia

Board of Directors has approved the new share-based long-term incentive plan and an employee share purchase plan under which awards may

be granted until December 31, 2026.

Long-term Incentive Plan

2024–2026

Nokia seeks to recognise, reward

and retain its most talented employees. The share-based long-term incentive plan intends to effectively contribute to the long-term value

creation and sustainability of the Company and align the interests of the executives and employees with those of Nokia’s shareholders.

Nokia’s Long-term Incentive Plan for 2024–2026 (LTI Plan) is a key tool which supports these objectives. Under the LTI Plan

the company may grant eligible executives and other employees awards in the form of both performance shares and restricted shares.

Awards under the LTI Plan may

be granted between the date the plan is approved and December 31, 2026, subject to applicable performance metrics as well as performance

and/or restriction periods of up to 36 months depending on the award. Consequently, the restriction periods for the last awards granted

under the LTI Plan would end in 2029. Performance metrics as well as weightings and targets for the selected metrics for performance

shares are set by the Board of Directors annually to ensure they continue to support Nokia’s long-term business strategy and financial

success. Further disclosure on annual implementation of the LTI Plan is provided in the Company’s annual report and website.

The potential maximum aggregate

number of Nokia shares that may be issued based on awards granted under the LTI plan in 2024, 2025 and 2026 is 350 million shares. Until

the Nokia shares are delivered, the participants will not have any shareholder rights, such as voting or dividend rights associated with

the performance or restricted shares. If the participant’s employment with Nokia terminates before the vesting date of the award

or a part of an award, the individual is not, as a main rule, entitled to settlement based on the plan.

Employee Share Purchase Plan

2024–2026

The purpose of the Employee

Share Purchase Plan (ESPP) is to encourage share ownership within the Nokia employee population, increasing engagement and sense of ownership

in the company. Under the ESPP 2024–2026, subject to the Board commencing annual plan cycles, the eligible employees may elect

to make contributions from their monthly net salary to purchase Nokia shares at market value on pre-determined dates on a quarterly basis

during the applicable plan period. Nokia would deliver one matching share for every two purchased shares that the participant still holds

at the end of applicable plan cycle. In addition, the participants may be offered free shares subject to meeting certain conditions related

to participation as determined by the Board.

The maximum number of shares

that can be issued under all plan cycles commencing under the ESPP in 2024, 2025 and 2026 is 45 million. Participants have immediate

shareholder rights over all shares purchased from the market. Until the matching or free Nokia shares are delivered, the participants

will not have any shareholder rights, such as voting or dividend rights associated with the matching or free shares.

www.nokia.com

|

Stock exchange release

25 January 2024 |

2 (3) |

Dilution effect

As at December 31, 2023, the estimated

aggregate maximum number of shares that would be issued under Nokia’s outstanding equity programs, assuming the unvested performance

shares would be delivered at maximum level, represented approximately 2.40 per cent of Nokia's total number of shares (excluding the

treasury shares owned by Nokia Group). This represents the net number of shares that would be issued, once applicable estimated taxes

are deducted from the gross value of the awards.

The annual dilution impact of Nokia’s

outstanding equity programs, if maximum performance was achieved, in addition to the net number of shares that could be issued under

the new LTI Plan and the ESPP as a result of awards made in 2024, 2025 and 2026, would not exceed 5 per cent of Nokia’s current

total number of shares (excluding the treasury shares owned by Nokia Group).

About Nokia

At Nokia, we create technology that

helps the world act together.

As a B2B technology innovation leader,

we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks. In addition, we

create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Service providers, enterprises and partners

worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to create the digital services

and applications of the future.

Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Kaisa Antikainen, Communications Manager

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

|

Stock exchange release

25 January 2024 |

3 (3) |

Forward-looking statements

Certain statements

herein that are not historical facts are forward-looking statements. These forward-looking statements reflect Nokia's current expectations

and views of future developments and include statements regarding: A) expectations, plans, benefits or outlook related to our strategies,

product launches, growth management, licenses, sustainability and other ESG targets, operational key performance indicators and decisions

on market exits; B) expectations, plans or benefits related to future performance of our businesses (including the expected impact, timing

and duration of potential global pandemics and the general or regional macroeconomic conditions on our businesses, our supply chain and

our customers’ businesses) and any future dividends and other distributions of profit; C) expectations and targets regarding financial

performance and results of operations, including market share, prices, net sales, income, margins, cash flows, the timing of receivables,

operating expenses, provisions, impairments, taxes, currency exchange rates, hedging, investment funds, inflation, product cost reductions,

competitiveness, revenue generation in any specific region, and licensing income and payments; D) ability to execute, expectations, plans

or benefits related to changes in organizational structure and operating model; E) impact on revenue with respect to litigation/renewal

discussions; and F) any statements preceded by or including "continue", “believe”, “commit”, “estimate”,

“expect”, “aim”, “influence”, "will” or similar expressions. These forward-looking statements

are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ

materially from such statements. These statements are based on management’s best assumptions and beliefs in light of the information

currently available to them. These forward-looking statements are only predictions based upon our current expectations and views of future

events and developments and are subject to risks and uncertainties that are difficult to predict because they relate to events and depend

on circumstances that will occur in the future. Factors, including risks and uncertainties that could cause these differences, include

those risks and uncertainties specified in our 2022 annual report on Form 20-F published on 2 March 2023 under Operating and

financial review and prospects – Risk factors.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant, Nokia Corporation, has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: January 25, 2024 |

Nokia Corporation |

| |

By: |

/s/ Esa Niinimäki |

| |

Name: |

Esa Niinimäki |

| |

Title: |

Chief Legal Officer |

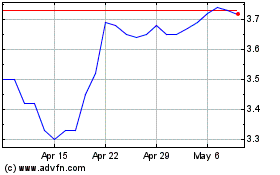

Nokia (NYSE:NOK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Dec 2023 to Dec 2024