UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Report on Form 6-K dated January 25, 2024

(Commission File No. 1-13202)

Nokia Corporation

Karakaari 7

FI-02610 Espoo

Finland

(Translation of the registrant’s name into English and address of registrant’s principal executive office)

| Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

| |

|

|

| Form 20-F: x |

|

Form 40-F: ¨ |

Enclosures:

| · | Stock

Exchange Release: Nokia Corporation Financial Report for Q4 and full year 2023 |

| · | Enclosures:

Report for Q4 and full year 2023 |

| | | 1 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

Nokia Corporation

Financial Statement Release

25 January 2024 at 08:00 EET

Nokia Corporation Financial Report

for Q4 and full year 2023

Improving order intake and cash flow

at the end of a challenging year

| • | Net

sales declined 21% y-o-y in constant currency (-23% reported) in Q4 as macroeconomic uncertainty

continues to pressure operator spending. Full year net sales declined 8% y-o-y in constant

currency (-11% reported). |

| • | In

Q4 the environment remained challenging however there are now signs of stabilization with

improving order trends. |

| • | Comparable

gross margin in Q4 declined by 40bps y-o-y to 43.1% (reported declined 100bps to 41.8%).

Significant improvements in Mobile Networks and Cloud and Network Services were offset by

lower contribution from Nokia Technologies which benefited from a significant one-off in

the prior year. |

| • | Q4

comparable operating margin declined 70bps y-o-y to 14.8% (reported down 220bps to 9.6%),

demonstrating the resilience of our profitability relative to the net sales decline. 2023

comparable operating margin 10.7% (reported 7.6%) |

| • | Q4

comparable diluted EPS of EUR 0.10; reported diluted EPS of EUR -0.01. Full year EUR 0.29

and EUR 0.12 respectively. Q4 reported EPS impacted by an operating model change that led

to non-cash remeasurement of deferred tax assets. |

| • | Q4

free cash flow positive EUR 1.7bn, net cash balance EUR 4.3bn. Full year free cash flow EUR

0.8bn. |

| • | Board

proposes dividend authorization of EUR 0.13 per share and initiates two year EUR 600 million

buyback program. |

| • | Nokia

expects full year 2024 comparable operating profit of between EUR 2.3 billion to 2.9 billion

and free cash flow conversion from comparable operating profit of between 30% and 60%. |

This is a summary of the Nokia Corporation

Financial Report for Q4 and full year 2023 published today. Nokia only publishes a summary

of its financial reports in stock exchange releases. The summary focuses on Nokia Group's financial information as well as on Nokia's

outlook. The detailed, segment-level discussion will be available in the complete financial report hosted at www.nokia.com/financials.

A video interview summarizing the key points of our Q4 results will also be published on the website. Investors should not solely rely

on summaries of Nokia's financial reports and should also review the complete reports with tables.

| | | 2 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

PEKKA LUNDMARK, PRESIDENT AND CEO,

ON Q4 AND FULL YEAR 2023 RESULTS

In 2023 we

saw a meaningful shift in customer behavior impacting our industry driven by the macro-economic environment and high interest rates along

with customer inventory digestion. This led to our full year net sales declining by 8% in constant currency. Proactive action across

our organization meant we were able to protect our profitability while continuing to invest in R&D and we delivered a comparable

operating margin of 10.7% for the full year. This was a resilient performance considering the challenging environment and lower contribution

from our high margin patent licensing business as some renewals remained outstanding.

Looking specifically

at the fourth quarter those same factors drove a net sales decline of 21% y-o-y in constant currency. Encouragingly we saw improvements

in our gross margin across several of our businesses which, combined with continued cost discipline, helped us to deliver a strong comparable

operating margin of 14.8%. In addition, we have seen a significant improvement in order intake in the fourth quarter, particularly in

Network Infrastructure, indicating at least some improvement in the overall spending environment.

We delivered well in 2023 against our

strategic pillar of growing in Enterprise with 16% net sales growth in constant currency and this customer segment now accounts for over

10% of our group net sales. Growth in the fourth quarter was muted at -3% in constant currency as we faced a tough comparison period.

We continue to have strong momentum in this segment and expect another year of double-digit growth in 2024.

In Network

Infrastructure we made important progress in a number of areas in the quarter. We received further webscale orders for our IP Routing

business which supports our expectations of significant growth in webscale in 2024. In the fourth quarter we also saw good progress in

the US government initiatives in Fixed Networks and we continue to expect these programs to increasingly benefit our net sales in the

second half of 2024 and into 2025. The fourth quarter also saw us sign a new and significant customer in Asia for our Fixed Wireless

Access products. In Optical Networks we continue to have good momentum and our new PSE-6s solutions are proving their capabilities in

the field; recent live network trials set a new record of 800Gbps transmission on a single wavelength over 6 600km.

Mobile Networks

net sales performance continued to be challenging in the fourth quarter, but we did see a further important improvement in gross margin

which benefited from a product mix shift towards software. AT&T’s announcement in December to move to a largely single-sourced

RAN network was a disappointing development. It does not reflect the technological competitiveness we have achieved with our products

as evidenced by our significant increase in RAN market share in recent years. I firmly believe we have the right strategy in place for

Mobile Networks to create value for our shareholders into the future with opportunities to gain share, diversify our business and achieve

a double-digit operating margin longer-term.

Our Cloud and

Network Services business had a strong year. We had a slight decline in net sales for the full year, but we made progress on profitability

with a largely stable gross margin and improved operating margin. The business continued to rebalance its portfolio, with the divestment

of its Device Management and Service Management Platform businesses in December. During 2023, we led the industry trend towards programmable

networks with the launch of our Network as Code platform which now has 9 commercial agreements and we also achieved our first commercial

deal for 5G Core as a service to CSPs.

| | | 3 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

In Nokia Technologies,

we signed significant long-term deals with both Apple and Samsung in 2023 and we also signed a deal with Honor late in the year. I am

also pleased that we have now signed a multi-year agreement with OPPO and we are close to concluding another agreement in China. After

these, we are in the final stages of our smartphone license renewal cycle with only one other, recently expired, major agreement outstanding.

This provides long-term stability to our Nokia Technologies business which will continue to focus on growing our licensing run-rate in

new growth areas including automotive, consumer electronics, IoT and multimedia. I remain confident that with growth in these areas we

can return to an annual net sales run-rate of EUR 1.4 to 1.5 billion in Nokia Technologies in the mid-term.

A clear positive

in the fourth quarter was our cash flow performance. We generated EUR 1.7 billion of free cash flow as we saw a significant improvement

in working capital in the quarter supported by a partial prepayment of a licensing agreement. We ended the year with a net cash position

of EUR 4.3 billion. The Board is proposing a dividend of EUR 0.13 per share in

respect of the financial year 2023 and considering we now hold excess cash at the end of the year, the Board is also instituting a new

share buyback program of EUR 600 million to be executed in the next two years.

Looking ahead,

we expect the challenging environment of 2023 to continue during the first half of 2024, particularly in the first quarter. However,

we are now starting to see some green shoots on the horizon, with improving order intake for Network Infrastructure and some of the specific

deals we have won. This is expected to drive a strong improvement in Network Infrastructure net sales growth in the second half of 2024

which we believe, even with a challenging first half, will drive solid growth for the full year. In Mobile Networks, we expect top line

challenges in 2024 related to a more normalized pace of investment in India and the AT&T decision. We do expect further improvement

in gross margin and then in the second half we will start to see more benefits from our cost savings program. At the Nokia level, we

currently estimate that we will deliver comparable operating profit of between EUR 2.3 and 2.9 billion

in 2024. We also target to deliver an improved free cash flow performance with conversion of between 30% and 60%.

I want to thank

all our people for their resilience and determination to deliver these results and executing on our corporate strategy in what can only

be described as a highly challenging market environment.

| | | 4 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

FINANCIAL RESULTS

| EUR million (except

for EPS in EUR) | |

Q4'23 | | |

Q4'22 | | |

YoY

change | | |

Constant

currency

YoY

change | | |

Q1-Q4'23 | | |

Q1-Q4'22 | | |

YoY

change | | |

Constant

currency

YoY

change | |

| Reported results | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

| 5 707 | | |

| 7 449 | | |

| (23 | )% | |

| (21 | )% | |

| 22 258 | | |

| 24 911 | | |

| (11 | )% | |

| (8 | )% |

| Gross margin % | |

| 41.8 | % | |

| 42.8 | % | |

| (100 | )bps | |

| | | |

| 39.0 | % | |

| 41.0 | % | |

| (200 | )bps | |

| | |

| Research and development expenses | |

| (1 092 | ) | |

| (1 222 | ) | |

| (11 | )% | |

| | | |

| (4 327 | ) | |

| (4 550 | ) | |

| (5 | )% | |

| | |

| Selling, general and administrative

expenses | |

| (787 | ) | |

| (838 | ) | |

| (6 | )% | |

| | | |

| (2 929 | ) | |

| (3 013 | ) | |

| (3 | )% | |

| | |

| Operating profit | |

| 547 | | |

| 882 | | |

| (38 | )% | |

| | | |

| 1 688 | | |

| 2 318 | | |

| (27 | )% | |

| | |

| Operating margin % | |

| 9.6 | % | |

| 11.8 | % | |

| (220 | )bps | |

| | | |

| 7.6 | % | |

| 9.3 | % | |

| (170 | )bps | |

| | |

| (Loss)/profit for the period | |

| (33 | ) | |

| 3 152 | | |

| (101 | )% | |

| | | |

| 679 | | |

| 4 259 | | |

| (84 | )% | |

| | |

| EPS, diluted | |

| -0.01 | | |

| 0.56 | | |

| (102 | )% | |

| | | |

| 0.12 | | |

| 0.75 | | |

| (84 | )% | |

| | |

| Net

cash and interest-bearing financial investments | |

| 4 323 | | |

| 4 767 | | |

| (9 | )% | |

| | | |

| 4 323 | | |

| 4 767 | | |

| (9 | )% | |

| | |

| Comparable

results | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

| 5 707 | | |

| 7 449 | | |

| (23 | )% | |

| (21 | )% | |

| 22 258 | | |

| 24 911 | | |

| (11 | )% | |

| (8 | )% |

| Gross margin % | |

| 43.1 | % | |

| 43.5 | % | |

| (40 | )bps | |

| | | |

| 39.7 | % | |

| 41.4 | % | |

| (170 | )bps | |

| | |

| Research and development expenses | |

| (1 034 | ) | |

| (1 189 | ) | |

| (13 | )% | |

| | | |

| (4 190 | ) | |

| (4 449 | ) | |

| (6 | )% | |

| | |

| Selling, general and administrative

expenses | |

| (626 | ) | |

| (727 | ) | |

| (14 | )% | |

| | | |

| (2 490 | ) | |

| (2 604 | ) | |

| (4 | )% | |

| | |

| Operating profit | |

| 846 | | |

| 1 154 | | |

| (27 | )% | |

| | | |

| 2 375 | | |

| 3 109 | | |

| (24 | )% | |

| | |

| Operating margin % | |

| 14.8 | % | |

| 15.5 | % | |

| (70 | )bps | |

| | | |

| 10.7 | % | |

| 12.5 | % | |

| (180 | )bps | |

| | |

| Profit for the period | |

| 568 | | |

| 929 | | |

| (39 | )% | |

| | | |

| 1 623 | | |

| 2 481 | | |

| (35 | )% | |

| | |

| EPS, diluted | |

| 0.10 | | |

| 0.16 | | |

| (38 | )% | |

| | | |

| 0.29 | | |

| 0.44 | | |

| (34 | )% | |

| | |

| ROIC1 | |

| 10.1 | % | |

| 17.5 | % | |

| (740 | )bps | |

| | | |

| 10.1 | % | |

| 17.5 | % | |

| (740 | )bps | |

| | |

1 Comparable ROIC = Comparable

operating profit after tax, last four quarters / invested capital, average of last five quarters ending balances. Refer to the Performance

measures section in Nokia Corporation Financial Report for Q4 and full year 2023 for details.

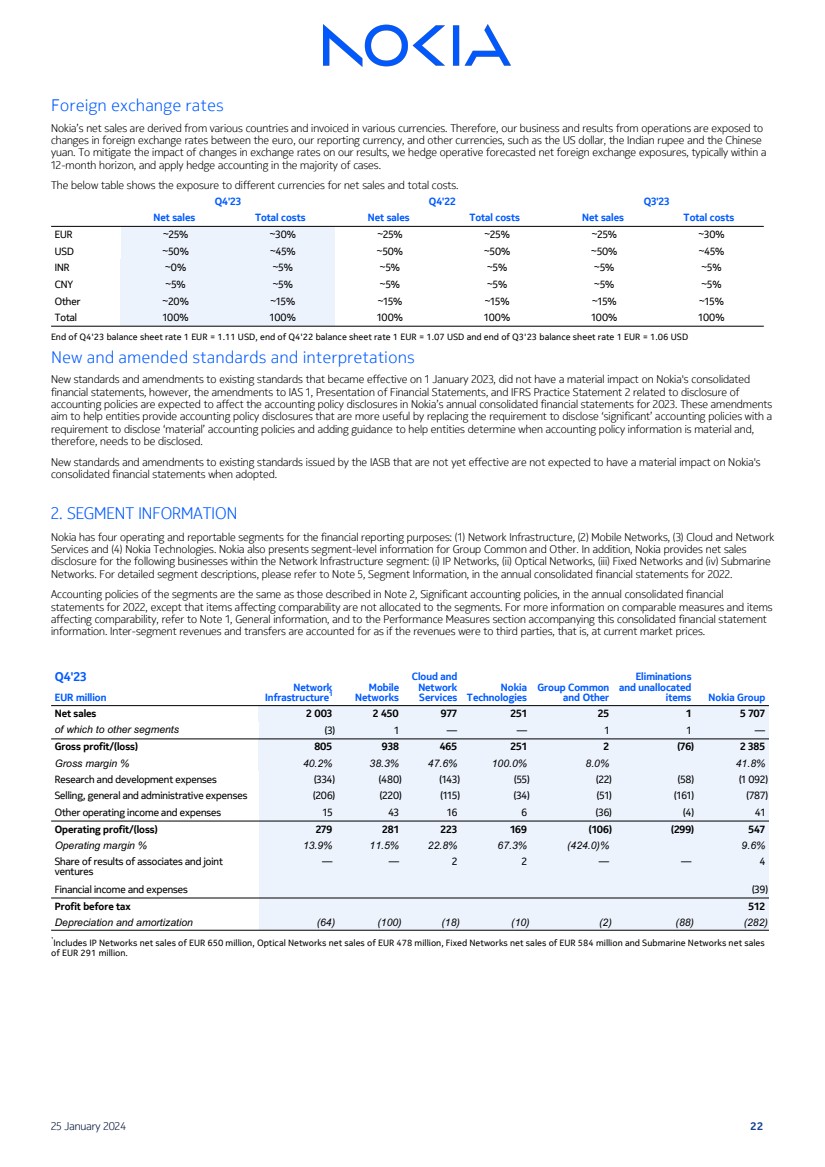

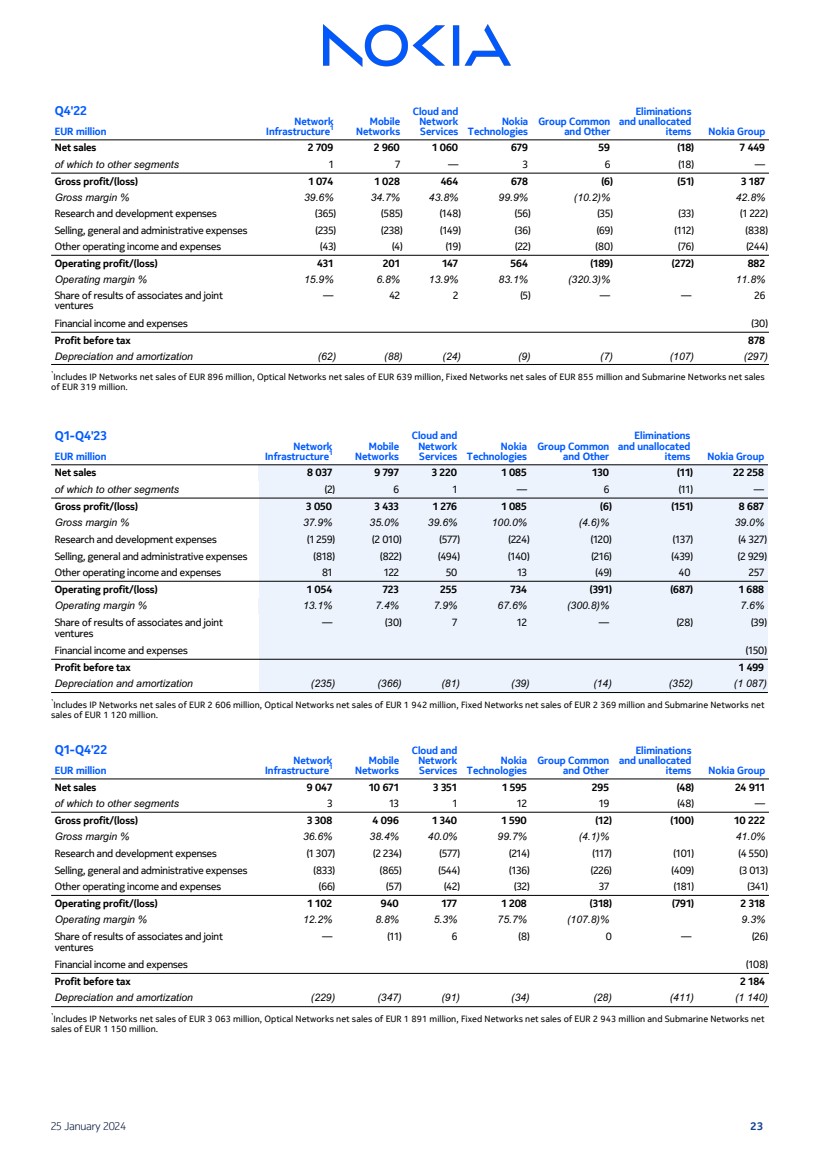

| Business group results | |

Network

Infrastructure | | |

Mobile

Networks | | |

Cloud and Network

Services | | |

Nokia

Technologies | | |

Group Common

and Other | |

| EUR million | |

Q4'23 | | |

Q4'22 | | |

Q4'23 | | |

Q4'22 | | |

Q4'23 | | |

Q4'22 | | |

Q4'23 | | |

Q4'22 | | |

Q4'23 | | |

Q4'22 | |

| Net sales | |

| 2 003 | | |

| 2 709 | | |

| 2 450 | | |

| 2 960 | | |

| 977 | | |

| 1 060 | | |

| 251 | | |

| 679 | | |

| 25 | | |

| 59 | |

| YoY change | |

| (26 | )% | |

| | | |

| (17 | )% | |

| | | |

| (8 | )% | |

| | | |

| (63 | )% | |

| | | |

| (58 | )% | |

| | |

| Constant currency YoY change | |

| (24 | )% | |

| | | |

| (14 | )% | |

| | | |

| (5 | )% | |

| | | |

| (63 | )% | |

| | | |

| (57 | )% | |

| | |

| Gross margin % | |

| 40.2 | % | |

| 39.6 | % | |

| 38.3 | % | |

| 34.7 | % | |

| 47.6 | % | |

| 43.8 | % | |

| 100.0 | % | |

| 99.9 | % | |

| 8.0 | % | |

| (10.2 | )% |

| Operating profit/(loss) | |

| 279 | | |

| 431 | | |

| 281 | | |

| 201 | | |

| 223 | | |

| 147 | | |

| 169 | | |

| 564 | | |

| (106 | ) | |

| (189 | ) |

| Operating

margin % | |

| 13.9 | % | |

| 15.9 | % | |

| 11.5 | % | |

| 6.8 | % | |

| 22.8 | % | |

| 13.9 | % | |

| 67.3 | % | |

| 83.1 | % | |

| (424.0 | )% | |

| (320.3 | )% |

SHAREHOLDER DISTRIBUTION

Dividend

The Board of Directors proposes that

the Annual General Meeting 2024 authorizes the Board to resolve on the distribution of an aggregate maximum of EUR 0.13 per share to

be paid in respect of the financial year 2023. The authorization would be used to distribute dividend and/or assets from the reserve

for invested unrestricted equity in four installments during the authorization period, in connection with the quarterly results, unless

the Board decides otherwise for a justified reason.

Under the authorization

by the Annual General Meeting held on 4 April 2023, the Board of Directors may resolve on the distribution of an aggregate maximum of

EUR 0.12 per share to be paid in respect of financial year 2022. The authorization will be used to distribute dividend and/or assets

from the reserve for invested unrestricted equity in four installments during the authorization period, in connection with the quarterly

results, unless the Board decides otherwise for a justified reason.

| | | 5 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

On 25 January

2024, the Board resolved to distribute a dividend of EUR 0.03 per

share. The dividend record date is on 30 January 2024 and the dividend will be paid on 8 February 2024. The actual dividend payment date

outside Finland will be determined by the practices of the intermediary banks transferring the dividend payments.

Following this

announced distribution of the fourth installment and executed payments of the previous installments, the Board has no remaining distribution

authorization.

Share buyback program

Nokia’s Board of Directors is

initiating a share buyback program under the current authorization from the Annual General Meeting to repurchase shares, with purchases

expected to begin in Q1. The program targets to return up to EUR 600 million of cash to shareholders in tranches over a period of two

years, subject to continued authorization from the Annual General Meeting.

In February

2022, Nokia’s Board of Directors initiated a share buyback program to repurchase shares to return up to EUR 600 million of cash

to shareholders in tranches over a period of two years. The second EUR 300 million phase of the share buyback program started in January

2023 and was completed in November 2023. Under this phase, Nokia repurchased

78 301 011 of its own shares at an average price per share of approximately EUR 3.83. The repurchases reduced the Company's unrestricted

equity by EUR 300 million and the repurchased shares were cancelled in November 2023.

OUTLOOK

| |

Full

Year 2024 |

| Comparable

operating profit1 |

EUR

2.3 billion to EUR 2.9 billion |

| Free

cash flow1 |

30%

to 60% conversion from comparable operating profit |

1Please refer to Performance

measures section in Nokia Corporation Financial Report for Q4 and full year 2023 for a full explanation of how these terms are defined.

The outlook, long-term targets and all

of the underlying outlook assumptions described below are forward-looking statements subject to a number of risks and uncertainties as

described or referred to in the Risk Factors section later in this release. Along with Nokia's official outlook targets provided above,

below are outlook assumptions by business group that support the group level outlook.

| |

Nokia

business group assumptions |

| |

Net

sales growth (constant currency) |

Operating

margin |

| Network

Infrastructure |

+2%

to +8% |

11.5%

to 14.5% |

| Mobile

Networks |

-15%

to -10% |

1.0%

to 4.0% |

| Cloud

and Network Services |

-2%

to +3% |

6.0%

to 9.0% |

| | | 6 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

Nokia provides the following approximate

outlook assumptions for additional items concerning 2024:

| |

Full

year 2024 |

Comment |

| Seasonality

|

H2

weighted |

Nokia

expects Q1 net sales in its networks businesses (consisting of Network Infrastructure, Mobile Networks and Cloud and Network Services)

to show an approximately normal seasonal decline sequentially. Since 2016 the average Q1 sequential decline in sales has been -23%.

Nokia expects significant seasonality in profit generation in 2024 with low sales coverage to weigh on operating profit in Q1, particularly

in MN and CNS. The company then expects progressive improvement in these businesses through the year. |

| Nokia

Technologies operating profit |

at

least

EUR 1.4 billion |

Nokia

assumes operating profit in 2024 for Nokia Technologies of at least EUR 1.4 billion which assumes resolution of outstanding renewals

and includes catch-up net sales related to prior periods. Nokia expects cash generation in Nokia Technologies to be EUR 700 million

below operating profit in 2024 due to prepayments received in 2023. From 2025 onwards Nokia expects greater alignment between cash

generation and operating profit in Nokia Technologies. |

| Group

Common and Other operating expenses |

EUR

350 million |

This

includes central function costs which are expected to be largely stable at approximately EUR 200 million and an increase in investment

in long-term research to approximately EUR 150 million. |

| Comparable

financial income and expenses |

EUR

0 to negative EUR 100 million |

|

| Comparable

income tax rate |

~25% |

|

| Cash

outflows related to income taxes |

EUR

500 million |

|

| Capital

Expenditures |

EUR

600 million |

|

2026 TARGETS

On 12 December 2023, as a conclusion

to Nokia's long-range planning process, the company decided to lower its comparable operating margin target to be achieved by 2026 from

the prior at least 14% to at least 13%. Nokia still sees a path to achieving the at least 14% comparable operating margin target but

considering the current market conditions in Mobile Networks, this was deemed a prudent change. Nokia sees further opportunities to increase

margins beyond 2026 and believes this 14% target remains achievable over the longer term.

| Net

sales |

Grow

faster than the market |

| Comparable

operating margin1 |

≥

13% |

| Free

cash flow1 |

55%

to 85% conversion from comparable operating profit |

1 Please refer to Performance

measures section in Nokia Corporation Financial Report for Q4 and full year 2023 report for a full explanation of how these terms are

defined.

The comparable operating margin target

for Nokia Group is built on the following assumptions by business group for 2026:

| Network

Infrastructure |

12

- 15% operating margin |

| Mobile

Networks |

6

- 9% operating margin |

| Cloud

and Network Services |

7

- 10% operating margin |

| Nokia

Technologies |

Operating

profit more than EUR 1.1 billion |

| Group

common and other |

Approximately

EUR 300 million of operating expenses |

| | | 7 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

RISK FACTORS

Nokia and its businesses are exposed

to a number of risks and uncertainties which include but are not limited to:

| • | Competitive

intensity, which is expected to continue at a high level as some competitors seek to take

share; |

| • | Our

ability to ensure competitiveness of our product roadmaps and costs through additional R&D

investments; |

| • | Our

ability to procure certain standard components and the costs thereof, such as semiconductors; |

| • | Disturbance

in the global supply chain; |

| • | Accelerating

inflation, increased global macro-uncertainty, major currency fluctuations and higher interest

rates; |

| • | Potential

economic impact and disruption of global pandemics; |

| • | War

or other geopolitical conflicts, disruptions and potential costs thereof; |

| • | Other

macroeconomic, industry and competitive developments; |

| • | Timing

and value of new, renewed and existing patent licensing agreements with smartphone vendors,

automotive companies, consumer electronics companies and other licensees; |

| • | Results

in brand and technology licensing; costs to protect and enforce our intellectual property

rights; on-going litigation with respect to licensing and regulatory landscape for patent

licensing; |

| • | The

outcomes of on-going and potential disputes and litigation; |

| • | Timing

of completions and acceptances of certain projects; |

| • | Our

product and regional mix; |

| • | Uncertainty

in forecasting income tax expenses and cash outflows, over the long-term, as they are also

subject to possible changes due to business mix, the timing of patent licensing cash flow

and changes in tax legislation, including potential tax reforms in various countries and

OECD initiatives; |

| • | Our

ability to utilize our Finnish deferred tax assets and their recognition on our balance sheet; |

| • | Our

ability to meet our sustainability and other ESG targets, including our targets relating

to greenhouse gas emissions; |

as well the risk factors specified under

Forward-looking statements of this release, and our 2022 annual report on Form 20-F published

on 2 March 2023 under Operating and financial review and prospects-Risk factors.

FORWARD-LOOKING STATEMENTS

Certain statements herein that are not

historical facts are forward-looking statements. These forward-looking statements reflect Nokia's current expectations and views of future

developments and include statements regarding: A) expectations, plans, benefits or outlook related to our strategies, product launches,

growth management, licenses, sustainability and other ESG targets, operational key performance indicators and decisions on market exits;

B) expectations, plans or benefits related to future performance of our businesses (including the expected impact, timing and duration

of potential global pandemics and the general or regional macroeconomic conditions on our businesses, our supply chain and our customers’

businesses) and any future dividends and other distributions of profit; C) expectations and targets regarding financial performance and

results of operations, including market share, prices, net sales, income, margins, cash flows, cost savings, the timing of receivables,

operating expenses, provisions, impairments, taxes, currency exchange rates, hedging, investment funds, inflation, product cost reductions,

competitiveness, revenue generation in any specific region, and licensing income and payments; D) ability to execute, expectations, plans

or benefits related to changes in organizational structure and operating model; E) impact on revenue with respect to litigation/renewal

discussions; and F) any statements preceded by or including "continue", “believe”, “commit”, “estimate”,

“expect”, “aim”, “influence”, "will”, “target”, “likely”, “intend”,

“may”, “could”, “would” or similar expressions. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ materially from

such statements. These statements are based on management’s best assumptions and beliefs in light of the information currently

available to them. These forward-looking statements are only predictions based upon our current expectations and views of future events

and developments and are subject to risks and uncertainties that are difficult to predict because they relate to events and depend on

circumstances that will occur in the future. Factors, including risks and uncertainties that could cause these differences, include those

risks and uncertainties identified in the Risk Factors above.

| | | 8 |

| | STOCK EXCHANGE RELEASE 25 January 2024 |

ANALYST WEBCAST

| • | Nokia's

webcast will begin on 25 January 2024 at 11.30 a.m. Finnish time (EET). The webcast

will last approximately 60 minutes. |

| • | The

webcast will be a presentation followed by a Q&A session. Presentation slides will be

available for download at www.nokia.com/financials. |

| • | A

link to the webcast will be available at www.nokia.com/financials. |

| • | Media

representatives can listen in via the link, or alternatively call +1-412-317-5619. |

FINANCIAL CALENDAR

| • | Nokia

plans to publish its "Nokia in 2023" annual report, which includes the review by

the Board of Directors and the audited annual accounts, during the week starting on 26 February

2024. |

| • | Nokia's

Annual General Meeting 2024 is planned to be held on 3 April 2024. |

| • | Nokia

plans to publish its first quarter 2024 results on 18 April 2024. |

| • | Nokia

plans to publish its second quarter and half year 2024 results on 18 July 2024. |

| • | Nokia

plans to publish its third quarter and January-September 2024 results on 17 October 2024. |

About Nokia

At Nokia, we create technology that

helps the world act together.

As a B2B technology innovation leader,

we are pioneering networks that sense, think and act by leveraging our work across mobile, fixed and cloud networks. In addition, we

create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Service providers, enterprises and partners

worldwide trust Nokia to deliver secure, reliable and sustainable networks today – and work with us to create the digital services

and applications of the future.

Inquiries:

Nokia

Communications

Phone: +358 10 448 4900

Email:

press.services@nokia.com

Kaisa Antikainen,

Communications Manager

Nokia

Investor Relations

Phone: +358 4080 3 4080

Email:

investor.relations@nokia.com

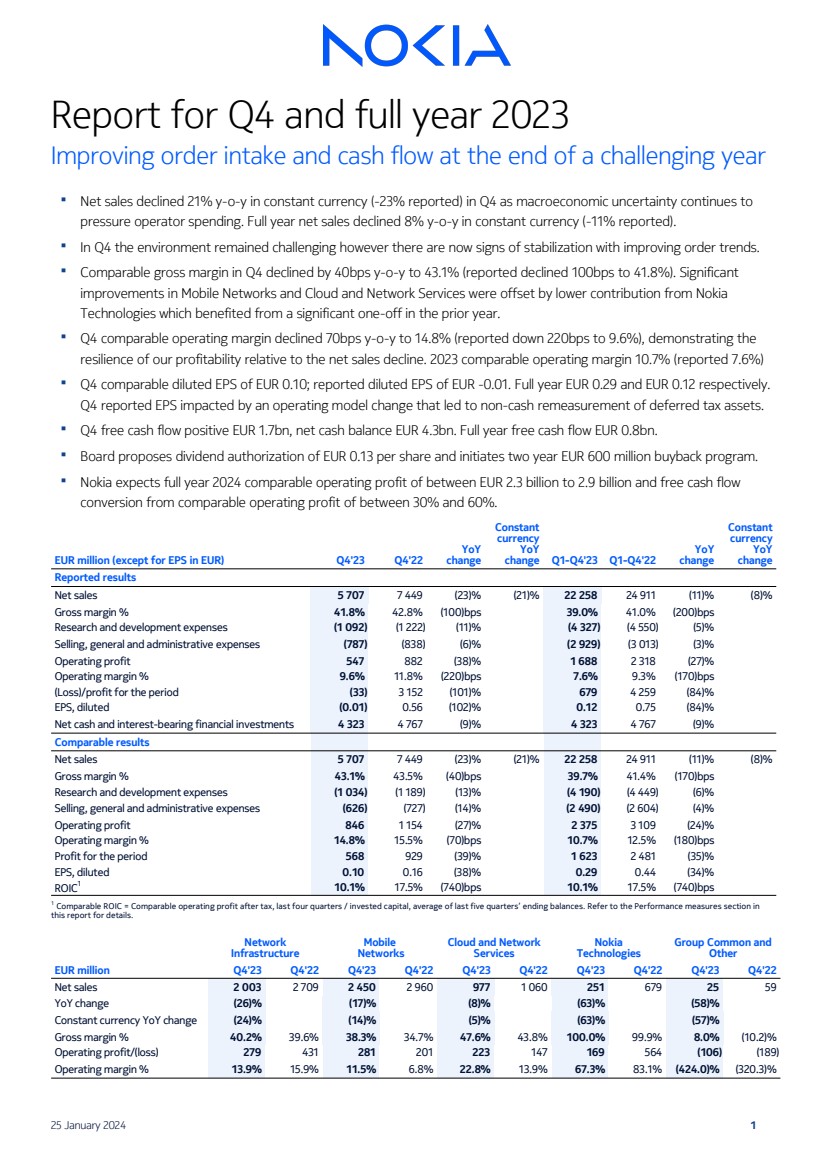

| Report for Q4 and full year 2023

Improving order intake and cash flow at the end of a challenging year

▪ Net sales declined 21% y-o-y in constant currency (-23% reported) in Q4 as macroeconomic uncertainty continues to

pressure operator spending. Full year net sales declined 8% y-o-y in constant currency (-11% reported).

▪ In Q4 the environment remained challenging however there are now signs of stabilization with improving order trends.

▪ Comparable gross margin in Q4 declined by 40bps y-o-y to 43.1% (reported declined 100bps to 41.8%). Significant

improvements in Mobile Networks and Cloud and Network Services were offset by lower contribution from Nokia

Technologies which benefited from a significant one-off in the prior year.

▪ Q4 comparable operating margin declined 70bps y-o-y to 14.8% (reported down 220bps to 9.6%), demonstrating the

resilience of our profitability relative to the net sales decline. 2023 comparable operating margin 10.7% (reported 7.6%)

▪ Q4 comparable diluted EPS of EUR 0.10; reported diluted EPS of EUR -0.01. Full year EUR 0.29 and EUR 0.12 respectively.

Q4 reported EPS impacted by an operating model change that led to non-cash remeasurement of deferred tax assets.

▪ Q4 free cash flow positive EUR 1.7bn, net cash balance EUR 4.3bn. Full year free cash flow EUR 0.8bn.

▪ Board proposes dividend authorization of EUR 0.13 per share and initiates two year EUR 600 million buyback program.

▪ Nokia expects full year 2024 comparable operating profit of between EUR 2.3 billion to 2.9 billion and free cash flow

conversion from comparable operating profit of between 30% and 60%.

EUR million (except for EPS in EUR) Q4'23 Q4'22

YoY

change

Constant

currency

YoY

change Q1-Q4'23 Q1-Q4'22

YoY

change

Constant

currency

YoY

change

Reported results

Net sales 5 707 7 449 (23)% (21)% 22 258 24 911 (11)% (8)%

Gross margin % 41.8% 42.8% (100)bps 39.0% 41.0% (200)bps

Research and development expenses (1 092) (1 222) (11)% (4 327) (4 550) (5)%

Selling, general and administrative expenses (787) (838) (6)% (2 929) (3 013) (3)%

Operating profit 547 882 (38)% 1 688 2 318 (27)%

Operating margin % 9.6% 11.8% (220)bps 7.6% 9.3% (170)bps

(Loss)/profit for the period (33) 3 152 (101)% 679 4 259 (84)%

EPS, diluted (0.01) 0.56 (102)% 0.12 0.75 (84)%

Net cash and interest-bearing financial investments 4 323 4 767 (9)% 4 323 4 767 (9)%

Comparable results

Net sales 5 707 7 449 (23)% (21)% 22 258 24 911 (11)% (8)%

Gross margin % 43.1% 43.5% (40)bps 39.7% 41.4% (170)bps

Research and development expenses (1 034) (1 189) (13)% (4 190) (4 449) (6)%

Selling, general and administrative expenses (626) (727) (14)% (2 490) (2 604) (4)%

Operating profit 846 1 154 (27)% 2 375 3 109 (24)%

Operating margin % 14.8% 15.5% (70)bps 10.7% 12.5% (180)bps

Profit for the period 568 929 (39)% 1 623 2 481 (35)%

EPS, diluted 0.10 0.16 (38)% 0.29 0.44 (34)%

ROIC1

10.1% 17.5% (740)bps 10.1% 17.5% (740)bps

1

Comparable ROIC = Comparable operating profit after tax, last four quarters / invested capital, average of last five quarters’ ending balances. Refer to the Performance measures section in

this report for details.

Network

Infrastructure

Mobile

Networks

Cloud and Network

Services

Nokia

Technologies

Group Common and

Other

EUR million Q4'23 Q4'22 Q4'23 Q4'22 Q4'23 Q4'22 Q4'23 Q4'22 Q4'23 Q4'22

Net sales 2 003 2 709 2 450 2 960 977 1 060 251 679 25 59

YoY change (26)% (17)% (8)% (63)% (58)%

Constant currency YoY change (24)% (14)% (5)% (63)% (57)%

Gross margin % 40.2% 39.6% 38.3% 34.7% 47.6% 43.8% 100.0% 99.9% 8.0% (10.2)%

Operating profit/(loss) 279 431 281 201 223 147 169 564 (106) (189)

Operating margin % 13.9% 15.9% 11.5% 6.8% 22.8% 13.9% 67.3% 83.1% (424.0)% (320.3)%

25 January 2024 1 |

| In 2023 we saw a meaningful shift in customer behavior

impacting our industry driven by the macro-economic

environment and high interest rates along with customer

inventory digestion. This led to our full year net sales declining

by 8% in constant currency. Proactive action across our

organization meant we were able to protect our profitability

while continuing to invest in R&D and we delivered a

comparable operating margin of 10.7% for the full year. This

was a resilient performance considering the challenging

environment and lower contribution from our high margin

patent licensing business as some renewals remained

outstanding.

Looking specifically at the fourth quarter those same factors

drove a net sales decline of 21% y-o-y in constant currency.

Encouragingly we saw improvements in our gross margin across

several of our businesses which, combined with continued cost

discipline, helped us to deliver a strong comparable operating

margin of 14.8%. In addition, we have seen a significant

improvement in order intake in the fourth quarter, particularly

in Network Infrastructure, indicating at least some

improvement in the overall spending environment.

We delivered well in 2023 against our strategic pillar of growing

in Enterprise with 16% net sales growth in constant currency

and this customer segment now accounts for over 10% of our

group net sales. Growth in the fourth quarter was muted at

-3% in constant currency as we faced a tough comparison

period. We continue to have strong momentum in this segment

and expect another year of double-digit growth in 2024.

In Network Infrastructure we made important progress in a

number of areas in the quarter. We received further webscale

orders for our IP Routing business which supports our

expectations of significant growth in webscale in 2024. In the

fourth quarter we also saw good progress in the US

government initiatives in Fixed Networks and we continue to

expect these programs to increasingly benefit our net sales in

the second half of 2024 and into 2025. The fourth quarter also

saw us sign a new and significant customer in Asia for our Fixed

Wireless Access products. In Optical Networks we continue to

have good momentum and our new PSE-6s solutions are

proving their capabilities in the field; recent live network trials

set a new record of 800Gbps transmission on a single

wavelength over 6 600km.

Mobile Networks net sales performance continued to be

challenging in the fourth quarter, but we did see a further

important improvement in gross margin which benefited from

a product mix shift towards software. AT&T’s announcement in

December to move to a largely single-sourced RAN network

was a disappointing development. It does not reflect the

technological competitiveness we have achieved with our

products as evidenced by our significant increase in RAN

market share in recent years. I firmly believe we have the right

strategy in place for Mobile Networks to create value for our

shareholders into the future with opportunities to gain share,

diversify our business and achieve a double-digit operating

margin longer-term.

Our Cloud and Network Services business had a strong year. We

had a slight decline in net sales for the full year, but we made

progress on profitability with a largely stable gross margin and

improved operating margin. The business continued to

rebalance its portfolio, with the divestment of its Device

Management and Service Management Platform businesses in

December. During 2023, we led the industry trend towards

programmable networks with the launch of our Network as

Code platform which now has 9 commercial agreements and we

also achieved our first commercial deal for 5G Core as a service

to CSPs.

In Nokia Technologies, we signed significant long-term deals

with both Apple and Samsung in 2023 and we also signed a

deal with Honor late in the year. I am also pleased that we have

now signed a multi-year agreement with OPPO and we are

close to concluding another agreement in China. After these,

we are in the final stages of our smartphone license renewal

cycle with only one other, recently expired, major agreement

outstanding. This provides long-term stability to our Nokia

Technologies business which will continue to focus on growing

our licensing run-rate in new growth areas including

automotive, consumer electronics, IoT and multimedia. I remain

confident that with growth in these areas we can return to an

annual net sales run-rate of EUR 1.4 to 1.5 billion in Nokia

Technologies in the mid-term.

A clear positive in the fourth quarter was our cash flow

performance. We generated EUR 1.7 billion of free cash flow as

we saw a significant improvement in working capital in the

quarter supported by a partial prepayment of a licensing

agreement. We ended the year with a net cash position of EUR

4.3 billion. The Board is proposing a dividend of EUR 0.13 per

share in respect of the financial year 2023 and considering we

now hold excess cash at the end of the year, the Board is also

instituting a new share buyback program of EUR 600 million to

be executed in the next two years.

Looking ahead, we expect the challenging environment of 2023

to continue during the first half of 2024, particularly in the first

quarter. However, we are now starting to see some green

shoots on the horizon, with improving order intake for Network

Infrastructure and some of the specific deals we have won. This

is expected to drive a strong improvement in Network

Infrastructure net sales growth in the second half of 2024

which we believe, even with a challenging first half, will drive

solid growth for the full year. In Mobile Networks, we expect top

line challenges in 2024 related to a more normalized pace of

investment in India and the AT&T decision. We do expect

further improvement in gross margin and then in the second

half we will start to see more benefits from our cost savings

program. At the Nokia level, we currently estimate that we will

deliver comparable operating profit of between EUR 2.3 and

2.9 billion in 2024. We also target to deliver an improved free

cash flow performance with conversion of between 30% and

60%.

I want to thank all our people for their resilience and

determination to deliver these results and executing on our

corporate strategy in what can only be described as a highly

challenging market environment.

25 January 2024 2 |

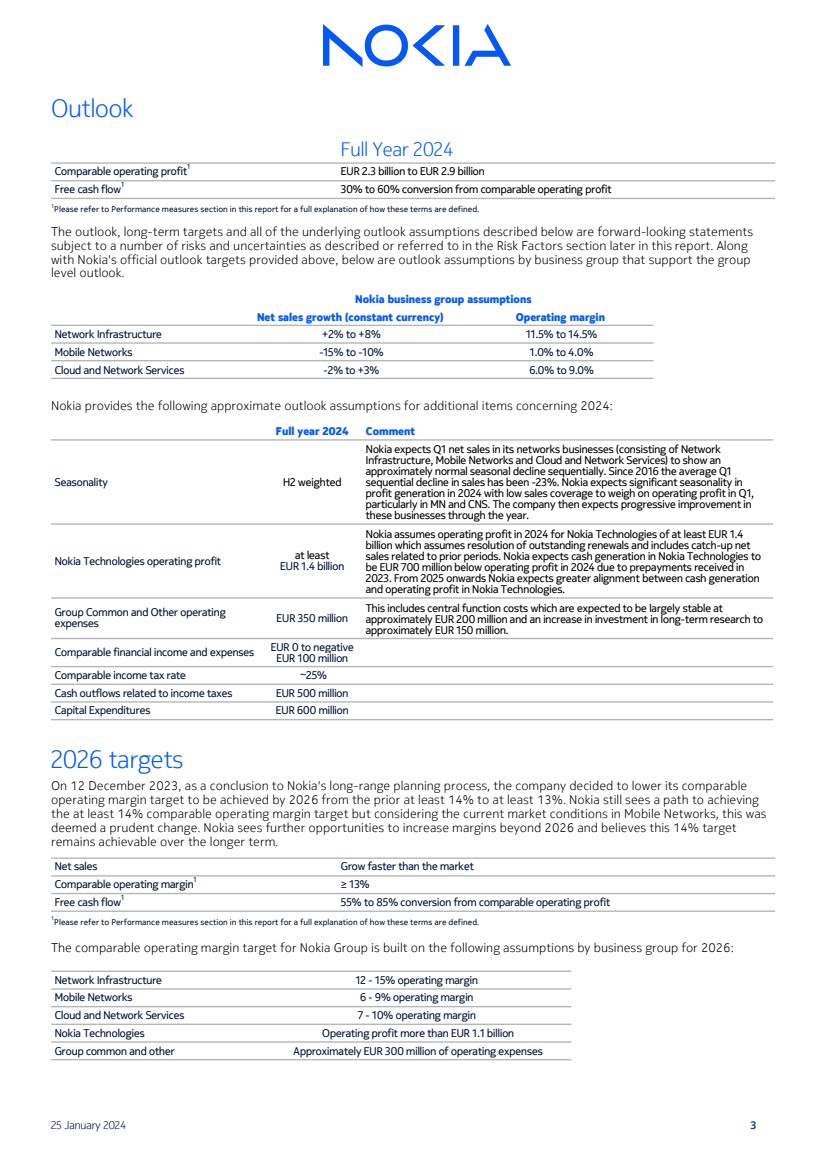

| Outlook

Full Year 2024

Comparable operating profit1

EUR 2.3 billion to EUR 2.9 billion

Free cash flow1

30% to 60% conversion from comparable operating profit

1

Please refer to Performance measures section in this report for a full explanation of how these terms are defined.

The outlook, long-term targets and all of the underlying outlook assumptions described below are forward-looking statements

subject to a number of risks and uncertainties as described or referred to in the Risk Factors section later in this report. Along

with Nokia's official outlook targets provided above, below are outlook assumptions by business group that support the group

level outlook.

Nokia business group assumptions

Net sales growth (constant currency) Operating margin

Network Infrastructure +2% to +8% 11.5% to 14.5%

Mobile Networks -15% to -10% 1.0% to 4.0%

Cloud and Network Services -2% to +3% 6.0% to 9.0%

Nokia provides the following approximate outlook assumptions for additional items concerning 2024:

Full year 2024 Comment

Seasonality H2 weighted

Nokia expects Q1 net sales in its networks businesses (consisting of Network

Infrastructure, Mobile Networks and Cloud and Network Services) to show an

approximately normal seasonal decline sequentially. Since 2016 the average Q1

sequential decline in sales has been -23%. Nokia expects significant seasonality in

profit generation in 2024 with low sales coverage to weigh on operating profit in Q1,

particularly in MN and CNS. The company then expects progressive improvement in

these businesses through the year.

Nokia Technologies operating profit at least

EUR 1.4 billion

Nokia assumes operating profit in 2024 for Nokia Technologies of at least EUR 1.4

billion which assumes resolution of outstanding renewals and includes catch-up net

sales related to prior periods. Nokia expects cash generation in Nokia Technologies to

be EUR 700 million below operating profit in 2024 due to prepayments received in

2023. From 2025 onwards Nokia expects greater alignment between cash generation

and operating profit in Nokia Technologies.

Group Common and Other operating

expenses EUR 350 million

This includes central function costs which are expected to be largely stable at

approximately EUR 200 million and an increase in investment in long-term research to

approximately EUR 150 million.

Comparable financial income and expenses EUR 0 to negative

EUR 100 million

Comparable income tax rate ~25%

Cash outflows related to income taxes EUR 500 million

Capital Expenditures EUR 600 million

2026 targets

On 12 December 2023, as a conclusion to Nokia's long-range planning process, the company decided to lower its comparable

operating margin target to be achieved by 2026 from the prior at least 14% to at least 13%. Nokia still sees a path to achieving

the at least 14% comparable operating margin target but considering the current market conditions in Mobile Networks, this was

deemed a prudent change. Nokia sees further opportunities to increase margins beyond 2026 and believes this 14% target

remains achievable over the longer term.

Net sales Grow faster than the market

Comparable operating margin1

≥ 13%

Free cash flow1

55% to 85% conversion from comparable operating profit

1

Please refer to Performance measures section in this report for a full explanation of how these terms are defined.

The comparable operating margin target for Nokia Group is built on the following assumptions by business group for 2026:

Network Infrastructure 12 - 15% operating margin

Mobile Networks 6 - 9% operating margin

Cloud and Network Services 7 - 10% operating margin

Nokia Technologies Operating profit more than EUR 1.1 billion

Group common and other Approximately EUR 300 million of operating expenses

25 January 2024 3 |

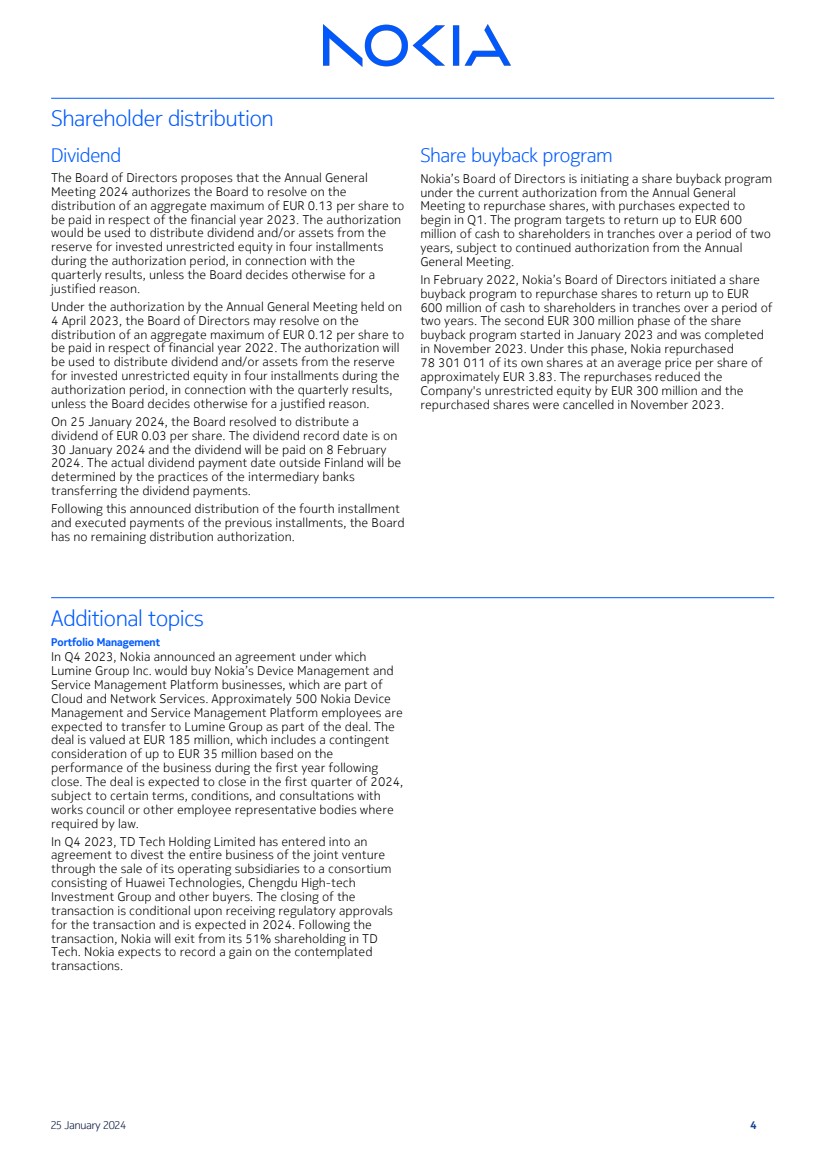

| Shareholder distribution

Dividend

The Board of Directors proposes that the Annual General

Meeting 2024 authorizes the Board to resolve on the

distribution of an aggregate maximum of EUR 0.13 per share to

be paid in respect of the financial year 2023. The authorization

would be used to distribute dividend and/or assets from the

reserve for invested unrestricted equity in four installments

during the authorization period, in connection with the

quarterly results, unless the Board decides otherwise for a

justified reason.

Under the authorization by the Annual General Meeting held on

4 April 2023, the Board of Directors may resolve on the

distribution of an aggregate maximum of EUR 0.12 per share to

be paid in respect of financial year 2022. The authorization will

be used to distribute dividend and/or assets from the reserve

for invested unrestricted equity in four installments during the

authorization period, in connection with the quarterly results,

unless the Board decides otherwise for a justified reason.

On 25 January 2024, the Board resolved to distribute a

dividend of EUR 0.03 per share. The dividend record date is on

30 January 2024 and the dividend will be paid on 8 February

2024. The actual dividend payment date outside Finland will be

determined by the practices of the intermediary banks

transferring the dividend payments.

Following this announced distribution of the fourth installment

and executed payments of the previous installments, the Board

has no remaining distribution authorization.

Share buyback program

Nokia’s Board of Directors is initiating a share buyback program

under the current authorization from the Annual General

Meeting to repurchase shares, with purchases expected to

begin in Q1. The program targets to return up to EUR 600

million of cash to shareholders in tranches over a period of two

years, subject to continued authorization from the Annual

General Meeting.

In February 2022, Nokia’s Board of Directors initiated a share

buyback program to repurchase shares to return up to EUR

600 million of cash to shareholders in tranches over a period of

two years. The second EUR 300 million phase of the share

buyback program started in January 2023 and was completed

in November 2023. Under this phase, Nokia repurchased

78 301 011 of its own shares at an average price per share of

approximately EUR 3.83. The repurchases reduced the

Company's unrestricted equity by EUR 300 million and the

repurchased shares were cancelled in November 2023.

Additional topics

Portfolio Management

In Q4 2023, Nokia announced an agreement under which

Lumine Group Inc. would buy Nokia’s Device Management and

Service Management Platform businesses, which are part of

Cloud and Network Services. Approximately 500 Nokia Device

Management and Service Management Platform employees are

expected to transfer to Lumine Group as part of the deal. The

deal is valued at EUR 185 million, which includes a contingent

consideration of up to EUR 35 million based on the

performance of the business during the first year following

close. The deal is expected to close in the first quarter of 2024,

subject to certain terms, conditions, and consultations with

works council or other employee representative bodies where

required by law.

In Q4 2023, TD Tech Holding Limited has entered into an

agreement to divest the entire business of the joint venture

through the sale of its operating subsidiaries to a consortium

consisting of Huawei Technologies, Chengdu High-tech

Investment Group and other buyers. The closing of the

transaction is conditional upon receiving regulatory approvals

for the transaction and is expected in 2024. Following the

transaction, Nokia will exit from its 51% shareholding in TD

Tech. Nokia expects to record a gain on the contemplated

transactions.

25 January 2024 4 |

| Financial Results

Q4 2023 compared to Q4 2022

Net sales

In Q4 2023, reported net sales decreased 23% and were

negatively impacted by foreign exchange rate fluctuations

along with the following drivers.

On a constant currency basis, Nokia's net sales decreased 21%

year-on-year, with declines across all business groups,

particularly Network Infrastructure, Mobile Networks and Nokia

Technologies. Network Infrastructure declined 24% as it

continued to experience weaker demand largely related to

macroeconomic uncertainty. Mobile Networks decreased 14%

largely driven by North America, where customers continued to

prioritize cash flow and deplete their inventories, as well as

India where 5G deployments continued to normalize from

elevated levels. Nokia Technologies net sales were down 63%,

largely related to a benefit booked in the year-ago quarter

related to a long-term licensee exercising an option. Cloud and

Network Services net sales decreased 5%.

Gross margin

Reported gross margin decreased 100 basis points to 41.8% in

Q4 2023 and comparable gross margin decreased 40 basis

points to 43.1%. Gross margin performance mainly reflected

lower Nokia Technologies net sales which was somewhat offset

by improvements in Mobile Networks and Cloud and Network

Services.

Operating profit and margin

Reported operating profit in Q4 2023 was EUR 547 million, or

9.6% of net sales, down from 11.8% in the year-ago quarter.

Comparable operating profit decreased to EUR 846 million,

while comparable operating margin was 14.8%, down from

15.5% in the year-ago quarter. This decline reflected lower

gross profit, in addition to operating expenses declining at a

slower rate than net sales. Operating expenses reflected lower

variable pay accruals and the impact of foreign exchange

fluctuations, in addition to continued cost control which helped

to offset the impact of inflation. Additionally, a net positive

fluctuation in other operating income and expenses benefited

operating profit and was related to lower losses from Nokia's

venture fund investments, in addition to the positive impacts

of hedging and the sale of digital assets.

Nokia's venture fund investments generated a loss of

approximately EUR 40 million in Q4 2023 compared to a loss of

EUR 90 million in Q4 2022. The impact of hedging in Q4 2023

was positive EUR 18 million, compared to a negative impact of

EUR 33 million in Q4 2022.

In Q4 2023, the difference between reported and comparable

operating profit was primarily related to restructuring and

associated charges, the amortization of acquired intangible

assets and the impairment and write-off of assets. In Q4 2022,

the difference between reported and comparable operating

profit was related to the amortization of acquired intangible

assets, the impairment and write-off of assets and

restructuring and associated charges.

Profit for the period

Reported net loss in Q4 2023 was EUR 33 million, compared to

net profit of EUR 3 152 million in Q4 2022. Comparable net

profit in Q4 2023 was EUR 568 million, compared to EUR 929

million in Q4 2022. The decline in comparable net profit was

primarily driven by the lower comparable operating profit, a

lower share of results of associates and joint ventures and a

net negative fluctuation in financial income and expenses,

which mainly reflected unfavorable foreign exchange

fluctuations. This was somewhat offset by lower income tax

expense.

Apart from the items affecting comparability included in

operating profit (and their associated tax effects), the

difference between reported and comparable net profit in Q4

2023 was mainly due to a non-recurring tax expense of EUR

392 million related to an internal operating model change that

led to a remeasurement of deferred tax assets. This has no

immediate impact on our cash tax. Additionally, the difference

also included a deferred tax benefit due to tax rate changes

and the change in financial liability to acquire Nokia Shanghai

Bell non-controlling interest. In Q4 2022, the difference

between reported and comparable net profit was primarily

related to the changes in the recognition of deferred tax assets

in Finland, loss allowances and impairments on customer

financing loans and a deferred tax expense due to tax rate

changes.

Earnings per share

Reported diluted EPS was negative EUR 0.01 in Q4 2023,

compared to EUR 0.56 in Q4 2022. Comparable diluted EPS was

EUR 0.10 in Q4 2023 compared to EUR 0.16 in Q4 2022.

Comparable return on Invested Capital (ROIC)

Q4 2023 comparable ROIC was 10.1%, compared to 17.5% in

Q4 2022. The decrease reflected higher average invested

capital for the rolling four quarters, combined with lower

operating profit after tax for the rolling four quarters. The

higher average invested capital reflected growth in average

total equity and a decrease in average total cash and interest-bearing financial investments, partially offset by a decrease in

average total interest-bearing liabilities.

Cash performance

During Q4 2023, net cash increased EUR 1 363 million,

resulting in an end-of-quarter net cash balance of EUR 4 323

million, benefiting from a partial prepayment related to a

licensing deal signed in 2023. Total cash increased EUR 1 417

million sequentially to EUR 8 514 million. Free cash flow was

positive EUR 1 744 million in Q4 2023.

25 January 2024 5 |

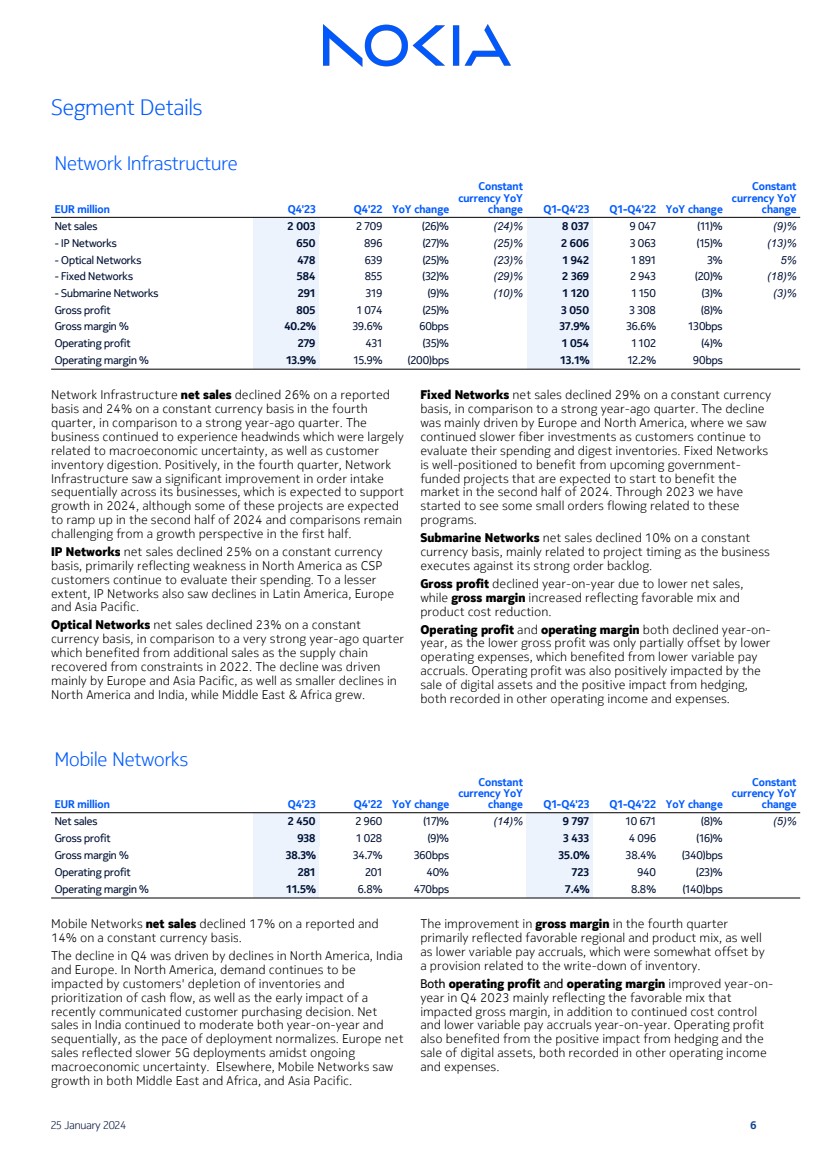

| Segment Details

Network Infrastructure

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Net sales 2 003 2 709 (26)% (24)% 8 037 9 047 (11)% (9)%

- IP Networks 650 896 (27)% (25)% 2 606 3 063 (15)% (13)%

- Optical Networks 478 639 (25)% (23)% 1 942 1 891 3% 5%

- Fixed Networks 584 855 (32)% (29)% 2 369 2 943 (20)% (18)%

- Submarine Networks 291 319 (9)% (10)% 1 120 1 150 (3)% (3)%

Gross profit 805 1 074 (25)% 3 050 3 308 (8)%

Gross margin % 40.2% 39.6% 60bps 37.9% 36.6% 130bps

Operating profit 279 431 (35)% 1 054 1 102 (4)%

Operating margin % 13.9% 15.9% (200)bps 13.1% 12.2% 90bps

Network Infrastructure net sales declined 26% on a reported

basis and 24% on a constant currency basis in the fourth

quarter, in comparison to a strong year-ago quarter. The

business continued to experience headwinds which were largely

related to macroeconomic uncertainty, as well as customer

inventory digestion. Positively, in the fourth quarter, Network

Infrastructure saw a significant improvement in order intake

sequentially across its businesses, which is expected to support

growth in 2024, although some of these projects are expected

to ramp up in the second half of 2024 and comparisons remain

challenging from a growth perspective in the first half.

IP Networks net sales declined 25% on a constant currency

basis, primarily reflecting weakness in North America as CSP

customers continue to evaluate their spending. To a lesser

extent, IP Networks also saw declines in Latin America, Europe

and Asia Pacific.

Optical Networks net sales declined 23% on a constant

currency basis, in comparison to a very strong year-ago quarter

which benefited from additional sales as the supply chain

recovered from constraints in 2022. The decline was driven

mainly by Europe and Asia Pacific, as well as smaller declines in

North America and India, while Middle East & Africa grew.

Fixed Networks net sales declined 29% on a constant currency

basis, in comparison to a strong year-ago quarter. The decline

was mainly driven by Europe and North America, where we saw

continued slower fiber investments as customers continue to

evaluate their spending and digest inventories. Fixed Networks

is well-positioned to benefit from upcoming government-funded projects that are expected to start to benefit the

market in the second half of 2024. Through 2023 we have

started to see some small orders flowing related to these

programs.

Submarine Networks net sales declined 10% on a constant

currency basis, mainly related to project timing as the business

executes against its strong order backlog.

Gross profit declined year-on-year due to lower net sales,

while gross margin increased reflecting favorable mix and

product cost reduction.

Operating profit and operating margin both declined year-on-year, as the lower gross profit was only partially offset by lower

operating expenses, which benefited from lower variable pay

accruals. Operating profit was also positively impacted by the

sale of digital assets and the positive impact from hedging,

both recorded in other operating income and expenses.

Mobile Networks

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Net sales 2 450 2 960 (17)% (14)% 9 797 10 671 (8)% (5)%

Gross profit 938 1 028 (9)% 3 433 4 096 (16)%

Gross margin % 38.3% 34.7% 360bps 35.0% 38.4% (340)bps

Operating profit 281 201 40% 723 940 (23)%

Operating margin % 11.5% 6.8% 470bps 7.4% 8.8% (140)bps

Mobile Networks net sales declined 17% on a reported and

14% on a constant currency basis.

The decline in Q4 was driven by declines in North America, India

and Europe. In North America, demand continues to be

impacted by customers' depletion of inventories and

prioritization of cash flow, as well as the early impact of a

recently communicated customer purchasing decision. Net

sales in India continued to moderate both year-on-year and

sequentially, as the pace of deployment normalizes. Europe net

sales reflected slower 5G deployments amidst ongoing

macroeconomic uncertainty. Elsewhere, Mobile Networks saw

growth in both Middle East and Africa, and Asia Pacific.

The improvement in gross margin in the fourth quarter

primarily reflected favorable regional and product mix, as well

as lower variable pay accruals, which were somewhat offset by

a provision related to the write-down of inventory.

Both operating profit and operating margin improved year-on-year in Q4 2023 mainly reflecting the favorable mix that

impacted gross margin, in addition to continued cost control

and lower variable pay accruals year-on-year. Operating profit

also benefited from the positive impact from hedging and the

sale of digital assets, both recorded in other operating income

and expenses.

25 January 2024 6 |

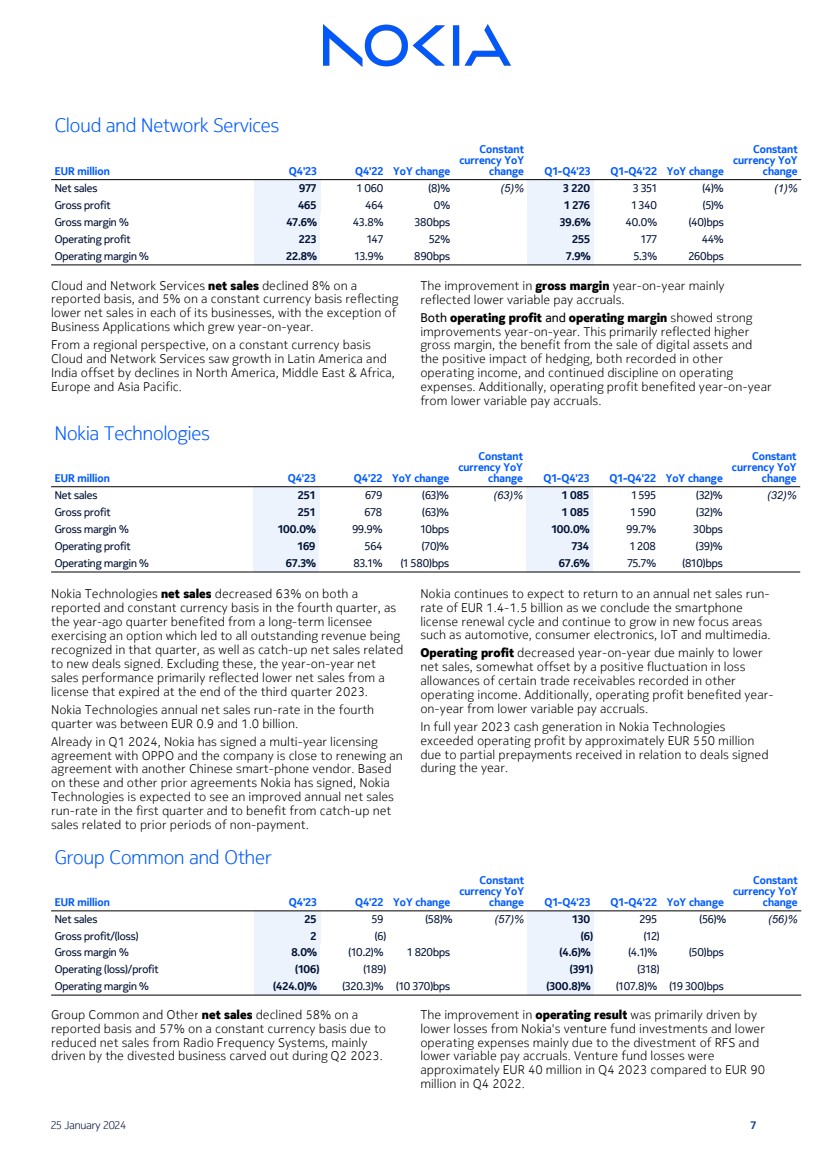

| Cloud and Network Services

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Net sales 977 1 060 (8)% (5)% 3 220 3 351 (4)% (1)%

Gross profit 465 464 0% 1 276 1 340 (5)%

Gross margin % 47.6% 43.8% 380bps 39.6% 40.0% (40)bps

Operating profit 223 147 52% 255 177 44%

Operating margin % 22.8% 13.9% 890bps 7.9% 5.3% 260bps

Cloud and Network Services net sales declined 8% on a

reported basis, and 5% on a constant currency basis reflecting

lower net sales in each of its businesses, with the exception of

Business Applications which grew year-on-year.

From a regional perspective, on a constant currency basis

Cloud and Network Services saw growth in Latin America and

India offset by declines in North America, Middle East & Africa,

Europe and Asia Pacific.

The improvement in gross margin year-on-year mainly

reflected lower variable pay accruals.

Both operating profit and operating margin showed strong

improvements year-on-year. This primarily reflected higher

gross margin, the benefit from the sale of digital assets and

the positive impact of hedging, both recorded in other

operating income, and continued discipline on operating

expenses. Additionally, operating profit benefited year-on-year

from lower variable pay accruals.

Nokia Technologies

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Net sales 251 679 (63)% (63)% 1 085 1 595 (32)% (32)%

Gross profit 251 678 (63)% 1 085 1 590 (32)%

Gross margin % 100.0% 99.9% 10bps 100.0% 99.7% 30bps

Operating profit 169 564 (70)% 734 1 208 (39)%

Operating margin % 67.3% 83.1% (1 580)bps 67.6% 75.7% (810)bps

Nokia Technologies net sales decreased 63% on both a

reported and constant currency basis in the fourth quarter, as

the year-ago quarter benefited from a long-term licensee

exercising an option which led to all outstanding revenue being

recognized in that quarter, as well as catch-up net sales related

to new deals signed. Excluding these, the year-on-year net

sales performance primarily reflected lower net sales from a

license that expired at the end of the third quarter 2023.

Nokia Technologies annual net sales run-rate in the fourth

quarter was between EUR 0.9 and 1.0 billion.

Already in Q1 2024, Nokia has signed a multi-year licensing

agreement with OPPO and the company is close to renewing an

agreement with another Chinese smart-phone vendor. Based

on these and other prior agreements Nokia has signed, Nokia

Technologies is expected to see an improved annual net sales

run-rate in the first quarter and to benefit from catch-up net

sales related to prior periods of non-payment.

Nokia continues to expect to return to an annual net sales run-rate of EUR 1.4-1.5 billion as we conclude the smartphone

license renewal cycle and continue to grow in new focus areas

such as automotive, consumer electronics, IoT and multimedia.

Operating profit decreased year-on-year due mainly to lower

net sales, somewhat offset by a positive fluctuation in loss

allowances of certain trade receivables recorded in other

operating income. Additionally, operating profit benefited year-on-year from lower variable pay accruals.

In full year 2023 cash generation in Nokia Technologies

exceeded operating profit by approximately EUR 550 million

due to partial prepayments received in relation to deals signed

during the year.

Group Common and Other

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Net sales 25 59 (58) % (57)% 130 295 (56) % (56)%

Gross profit/(loss) 2 (6) (6) (12)

Gross margin % 8.0% (10.2)% 1 820bps (4.6)% (4.1)% (50)bps

Operating (loss)/profit (106) (189) (391) (318)

Operating margin % (424.0)% (320.3)% (10 370)bps (300.8)% (107.8)% (19 300)bps

Group Common and Other net sales declined 58% on a

reported basis and 57% on a constant currency basis due to

reduced net sales from Radio Frequency Systems, mainly

driven by the divested business carved out during Q2 2023.

The improvement in operating result was primarily driven by

lower losses from Nokia's venture fund investments and lower

operating expenses mainly due to the divestment of RFS and

lower variable pay accruals. Venture fund losses were

approximately EUR 40 million in Q4 2023 compared to EUR 90

million in Q4 2022.

25 January 2024 7 |

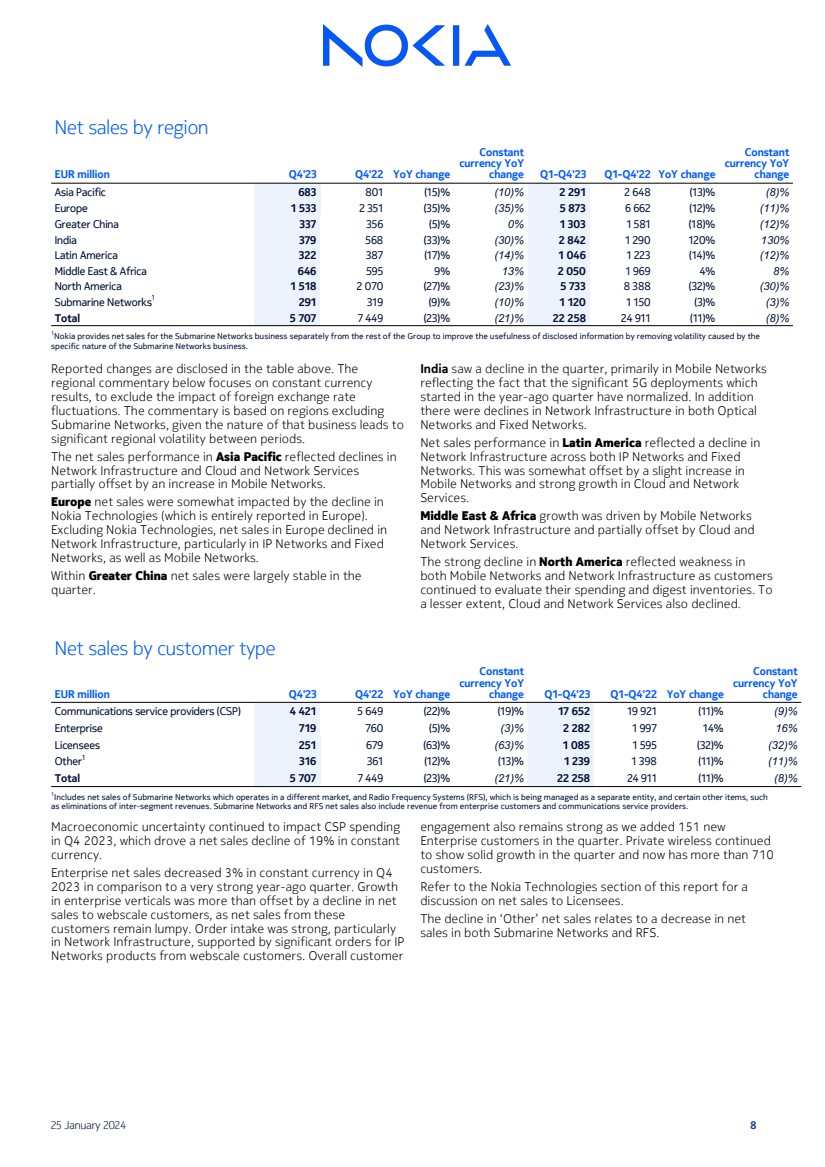

| Net sales by region

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Asia Pacific 683 801 (15)% (10)% 2 291 2 648 (13)% (8)%

Europe 1 533 2 351 (35)% (35)% 5 873 6 662 (12)% (11)%

Greater China 337 356 (5)% 0% 1 303 1 581 (18)% (12)%

India 379 568 (33)% (30)% 2 842 1 290 120% 130%

Latin America 322 387 (17)% (14)% 1 046 1 223 (14)% (12)%

Middle East & Africa 646 595 9% 13% 2 050 1 969 4% 8%

North America 1 518 2 070 (27)% (23)% 5 733 8 388 (32)% (30)%

Submarine Networks1

291 319 (9)% (10)% 1 120 1 150 (3)% (3)%

Total 5 707 7 449 (23)% (21)% 22 258 24 911 (11)% (8)%

1Nokia provides net sales for the Submarine Networks business separately from the rest of the Group to improve the usefulness of disclosed information by removing volatility caused by the

specific nature of the Submarine Networks business.

Reported changes are disclosed in the table above. The

regional commentary below focuses on constant currency

results, to exclude the impact of foreign exchange rate

fluctuations. The commentary is based on regions excluding

Submarine Networks, given the nature of that business leads to

significant regional volatility between periods.

The net sales performance in Asia Pacific reflected declines in

Network Infrastructure and Cloud and Network Services

partially offset by an increase in Mobile Networks.

Europe net sales were somewhat impacted by the decline in

Nokia Technologies (which is entirely reported in Europe).

Excluding Nokia Technologies, net sales in Europe declined in

Network Infrastructure, particularly in IP Networks and Fixed

Networks, as well as Mobile Networks.

Within Greater China net sales were largely stable in the

quarter.

India saw a decline in the quarter, primarily in Mobile Networks

reflecting the fact that the significant 5G deployments which

started in the year-ago quarter have normalized. In addition

there were declines in Network Infrastructure in both Optical

Networks and Fixed Networks.

Net sales performance in Latin America reflected a decline in

Network Infrastructure across both IP Networks and Fixed

Networks. This was somewhat offset by a slight increase in

Mobile Networks and strong growth in Cloud and Network

Services.

Middle East & Africa growth was driven by Mobile Networks

and Network Infrastructure and partially offset by Cloud and

Network Services.

The strong decline in North America reflected weakness in

both Mobile Networks and Network Infrastructure as customers

continued to evaluate their spending and digest inventories. To

a lesser extent, Cloud and Network Services also declined.

Net sales by customer type

EUR million Q4'23 Q4'22 YoY change

Constant

currency YoY

change Q1-Q4'23 Q1-Q4'22 YoY change

Constant

currency YoY

change

Communications service providers (CSP) 4 421 5 649 (22)% (19)% 17 652 19 921 (11)% (9)%

Enterprise 719 760 (5)% (3)% 2 282 1 997 14% 16%

Licensees 251 679 (63)% (63)% 1 085 1 595 (32)% (32)%

Other1

316 361 (12)% (13)% 1 239 1 398 (11)% (11)%

Total 5 707 7 449 (23)% (21)% 22 258 24 911 (11)% (8)%

1

Includes net sales of Submarine Networks which operates in a different market, and Radio Frequency Systems (RFS), which is being managed as a separate entity, and certain other items, such

as eliminations of inter-segment revenues. Submarine Networks and RFS net sales also include revenue from enterprise customers and communications service providers.

Macroeconomic uncertainty continued to impact CSP spending

in Q4 2023, which drove a net sales decline of 19% in constant

currency.

Enterprise net sales decreased 3% in constant currency in Q4

2023 in comparison to a very strong year-ago quarter. Growth

in enterprise verticals was more than offset by a decline in net

sales to webscale customers, as net sales from these

customers remain lumpy. Order intake was strong, particularly

in Network Infrastructure, supported by significant orders for IP

Networks products from webscale customers. Overall customer

engagement also remains strong as we added 151 new

Enterprise customers in the quarter. Private wireless continued

to show solid growth in the quarter and now has more than 710

customers.

Refer to the Nokia Technologies section of this report for a

discussion on net sales to Licensees.

The decline in ‘Other’ net sales relates to a decrease in net

sales in both Submarine Networks and RFS.

25 January 2024 8 |

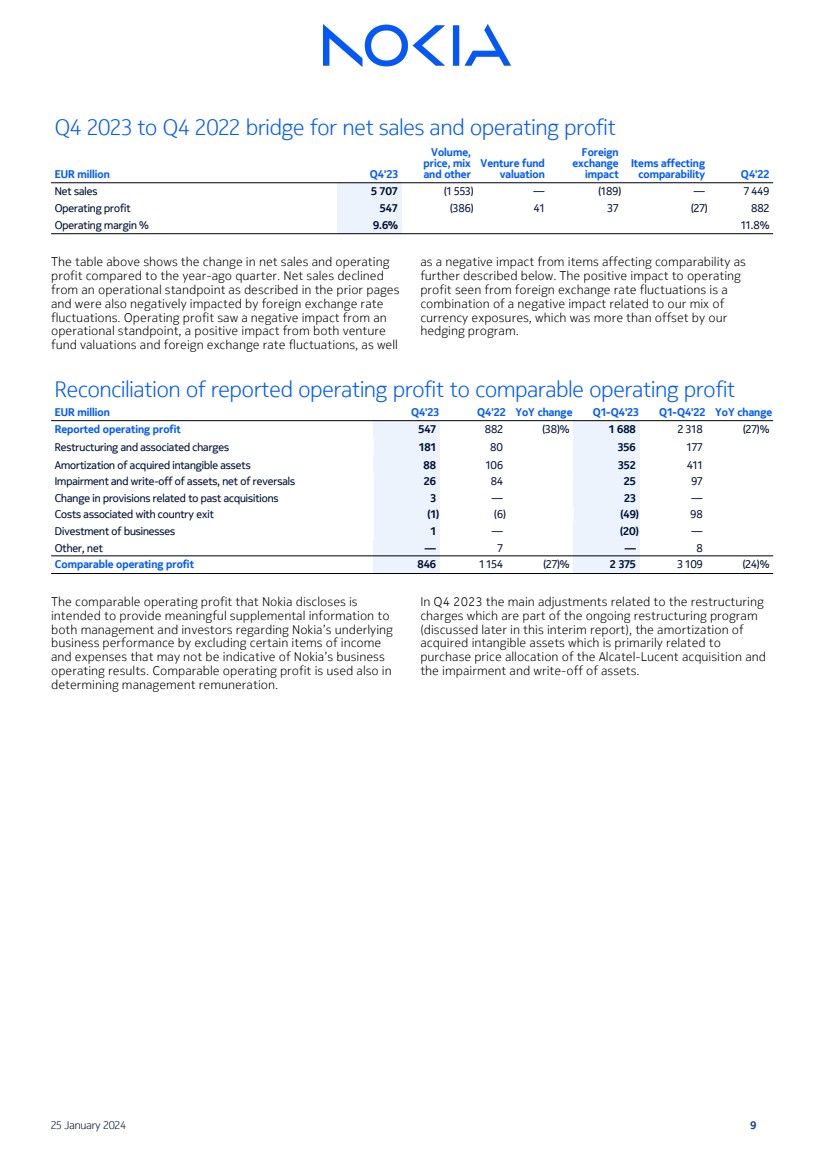

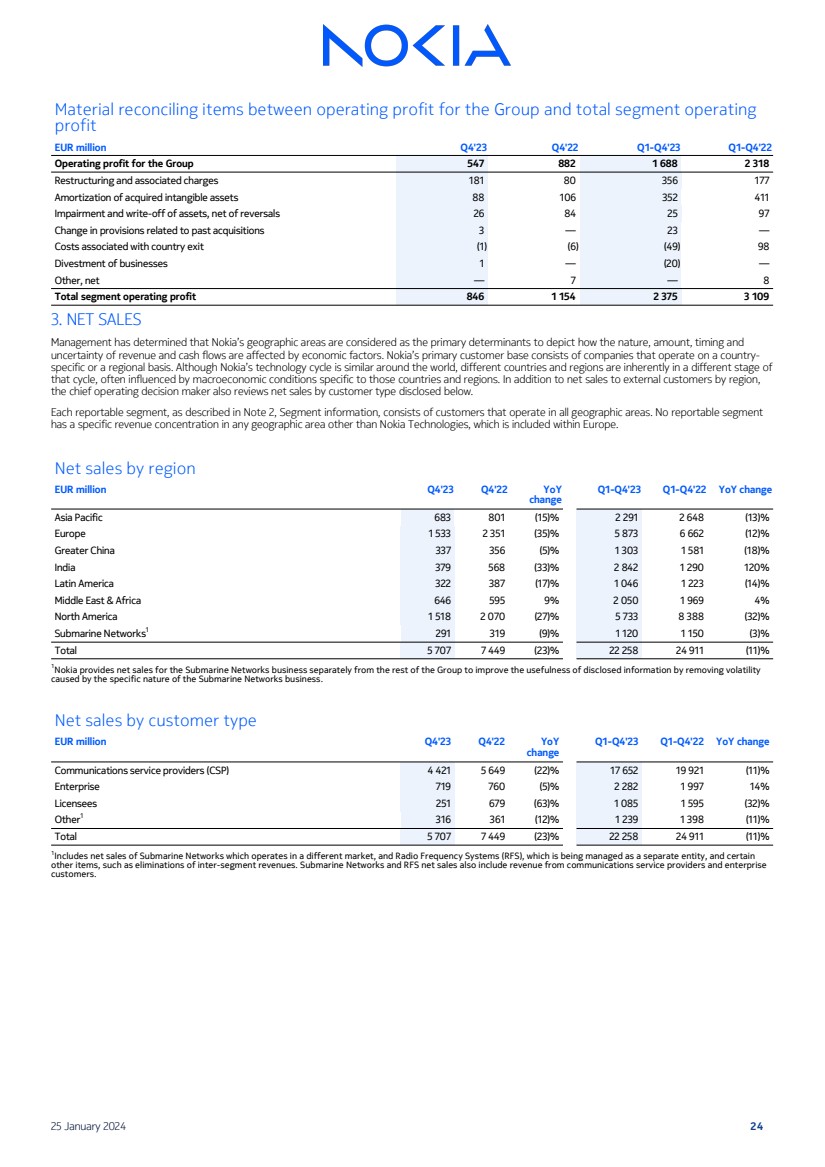

| Q4 2023 to Q4 2022 bridge for net sales and operating profit

EUR million Q4'23

Volume,

price, mix

and other

Venture fund

valuation

Foreign

exchange

impact

Items affecting

comparability Q4'22

Net sales 5 707 (1 553) — (189) — 7 449

Operating profit 547 (386) 41 37 (27) 882

Operating margin % 9.6% 11.8%

The table above shows the change in net sales and operating

profit compared to the year-ago quarter. Net sales declined

from an operational standpoint as described in the prior pages

and were also negatively impacted by foreign exchange rate

fluctuations. Operating profit saw a negative impact from an

operational standpoint, a positive impact from both venture

fund valuations and foreign exchange rate fluctuations, as well

as a negative impact from items affecting comparability as

further described below. The positive impact to operating

profit seen from foreign exchange rate fluctuations is a

combination of a negative impact related to our mix of

currency exposures, which was more than offset by our

hedging program.

Reconciliation of reported operating profit to comparable operating profit

EUR million Q4'23 Q4'22 YoY change Q1-Q4'23 Q1-Q4'22 YoY change

Reported operating profit 547 882 (38)% 1 688 2 318 (27)%

Restructuring and associated charges 181 80 356 177

Amortization of acquired intangible assets 88 106 352 411

Impairment and write-off of assets, net of reversals 26 84 25 97

Change in provisions related to past acquisitions 3 — 23 —

Costs associated with country exit (1) (6) (49) 98

Divestment of businesses 1 — (20) —

Other, net — 7 — 8

Comparable operating profit 846 1 154 (27)% 2 375 3 109 (24)%

The comparable operating profit that Nokia discloses is

intended to provide meaningful supplemental information to

both management and investors regarding Nokia’s underlying

business performance by excluding certain items of income

and expenses that may not be indicative of Nokia’s business

operating results. Comparable operating profit is used also in

determining management remuneration.

In Q4 2023 the main adjustments related to the restructuring

charges which are part of the ongoing restructuring program

(discussed later in this interim report), the amortization of

acquired intangible assets which is primarily related to

purchase price allocation of the Alcatel-Lucent acquisition and

the impairment and write-off of assets.

25 January 2024 9 |

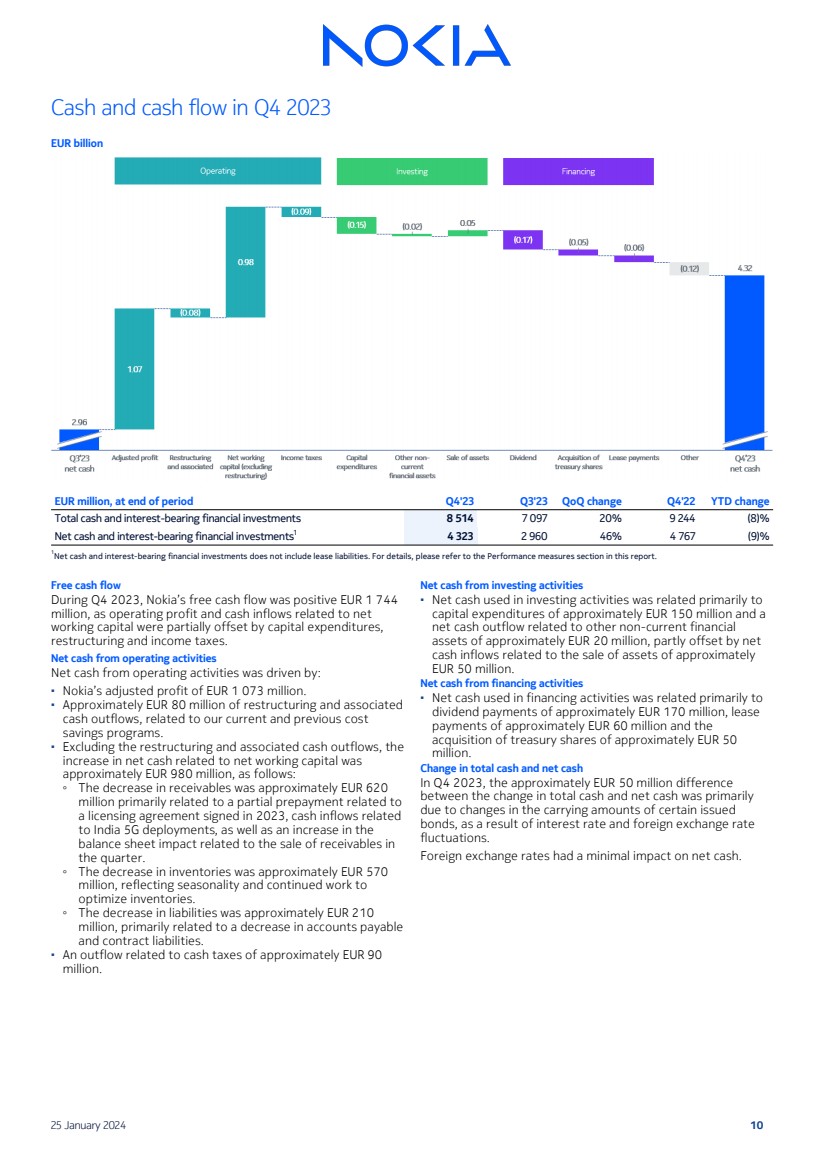

| Cash and cash flow in Q4 2023

EUR billion

EUR million, at end of period Q4'23 Q3'23 QoQ change Q4'22 YTD change

Total cash and interest-bearing financial investments 8 514 7 097 20% 9 244 (8)%

Net cash and interest-bearing financial investments1

4 323 2 960 46% 4 767 (9)%

1Net cash and interest-bearing financial investments does not include lease liabilities. For details, please refer to the Performance measures section in this report.

Free cash flow

During Q4 2023, Nokia’s free cash flow was positive EUR 1 744

million, as operating profit and cash inflows related to net

working capital were partially offset by capital expenditures,

restructuring and income taxes.

Net cash from operating activities

Net cash from operating activities was driven by:

▪ Nokia’s adjusted profit of EUR 1 073 million.

▪ Approximately EUR 80 million of restructuring and associated

cash outflows, related to our current and previous cost

savings programs.

▪ Excluding the restructuring and associated cash outflows, the

increase in net cash related to net working capital was

approximately EUR 980 million, as follows:

◦ The decrease in receivables was approximately EUR 620

million primarily related to a partial prepayment related to

a licensing agreement signed in 2023, cash inflows related

to India 5G deployments, as well as an increase in the

balance sheet impact related to the sale of receivables in

the quarter.

◦ The decrease in inventories was approximately EUR 570

million, reflecting seasonality and continued work to

optimize inventories.

◦ The decrease in liabilities was approximately EUR 210

million, primarily related to a decrease in accounts payable

and contract liabilities.

▪ An outflow related to cash taxes of approximately EUR 90

million.

Net cash from investing activities

▪ Net cash used in investing activities was related primarily to

capital expenditures of approximately EUR 150 million and a

net cash outflow related to other non-current financial

assets of approximately EUR 20 million, partly offset by net

cash inflows related to the sale of assets of approximately

EUR 50 million.

Net cash from financing activities

▪ Net cash used in financing activities was related primarily to

dividend payments of approximately EUR 170 million, lease

payments of approximately EUR 60 million and the

acquisition of treasury shares of approximately EUR 50

million.

Change in total cash and net cash

In Q4 2023, the approximately EUR 50 million difference

between the change in total cash and net cash was primarily

due to changes in the carrying amounts of certain issued

bonds, as a result of interest rate and foreign exchange rate

fluctuations.

Foreign exchange rates had a minimal impact on net cash.

25 January 2024 10 |

| January-December 2023 compared to

January-December 2022

Net sales

In 2023, reported net sales decreased 11%, with a negative

impact from foreign exchange rate fluctuations along with the

following drivers.

On a constant currency basis, Nokia net sales decreased 8%

driven by declines across all business groups, with particular

weakness in Network Infrastructure, Mobile Networks and Nokia

Technologies.

Gross margin

Both reported and comparable gross margin declined year-on-year in 2023. Reported gross margin decreased 200 basis

points to 39.0% and comparable gross margin decreased 170

basis points to 39.7%. The gross margin decline was primarily

driven by a lower contribution from Nokia Technologies along

with unfavorable regional mix in Mobile Networks.

Operating profit and margin

Reported operating profit in 2023 was EUR 1 688 million, or

7.6% of net sales, down from EUR 2 318 million or 9.3% in

2022. Comparable operating profit decreased to EUR 2 375

million from EUR 3 109 million year-on-year, while comparable

operating margin declined 180 basis points year-on-year to