UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 6-K

_______________________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

_______________________________________________

For the month of May 2024

Commission File Number: 001-37669

_______________________________________________

Nomad Foods Limited

(Translation of registrant’s name in English)

_______________________________________________

Forge, 43 Church Street West

Woking, GU21 6HT

+ (44) 208 918 3200

(Address of Principal Executive Offices)

_______________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Appointment of New Chief Financial Officer

On May 24, 2024, the Company determined to appoint Ruben Baldew as its Chief Financial Officer, effective as of June 17, 2024 (subject to, and conditioned upon, receipt of applicable work authorizations). Mr. Baldew, 47, joins the Company with over 20 years of global consumer products experience, most recently as CFO of Accell Group from November 2018 until October 2023. Prior to Accell Group, Mr. Baldew spent over 15 years at Unilever in various finance roles with broad, international experience in the Netherlands, Belgium, Switzerland and Thailand.

In connection with his appointment, on May 24, 2024, the Company, Nomad Foods Europe Limited and Mr. Baldew entered into a Service Agreement (the “Service Agreement”). Under the terms of the Service Agreement, Mr. Baldew will (i) receive an annual salary of £483,700 that will be reviewed, but not necessarily increased, in April of each year (with the first review to take place in 2025), (ii) be eligible for performance-related discretionary cash bonuses (up to 100% of salary with an opportunity to increase this to 200% depending on business performance), subject to the achievement of financial and other performance targets as the Company may decide; and (iii) be granted an award equal to $3,000,000 in ordinary shares to be issued in 2024 with a three year vesting period as a joining incentive under the LTIP, subject to terms and conditions set forth in a share grant award agreement, and (iv) an award equal to $1,500,000 in ordinary shares consisting of (a) $750,000 in ordinary shares to be issued in 2024 and (b) $750,000 in ordinary shares to be issued in 2025, in each case subject to a three year vesting period under the LTIP, subject to certain performance conditions and terms and conditions set forth in a share grant award agreement. Mr. Baldew will be eligible for an annual award under the LTIP beginning in 2026. The Service Agreement contains customary confidentiality provisions and non-competition and non-solicitation restrictive covenants for a period of 12 months after the termination of his employment, subject to an off-set for paid leave.

There is no arrangement or understanding between Mr. Baldew and any other person pursuant to which Mr. Baldew has been appointed as the CFO. There are no family relationships between Mr. Baldew and any of the Company’s directors and executive officers, and Mr. Baldew is not a party to any transaction, or any proposed transaction, required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Departure of Chief Financial Officer

On May 24, 2024, Nomad Foods Limited (the “Company”) and its Chief Financial Officer, Samy Zekhout, mutually decided that Mr. Zekhout will leave his position to explore new opportunities outside of the Company. He will continue to serve in his current role until July 31, 2024 to assist in the transition of his duties and will not be standing for re-election as a director of the Company at the Company’s next annual general meeting.

Mr. Zekhout and the Company entered into a Separation Agreement, dated May 24, 2024 (the “Separation Agreement”), pursuant to which Mr. Zekhout is entitled to (i) payment of salary and benefits up to the agreed separation date of July 31, 2024 including pro-rated bonus for 2024; (ii) a payment in lieu of notice of £280,071; (iii) a severance payment of £398,000; (iv) receive grants under the Company’s 2015 Amended and Restated Long Term Incentive Plan (“LTIP”) of 60,144 ordinary shares vesting in 2025 and 40,000 ordinary shares vesting in 2026, in each case, subject to the achievement by the Company of certain performance criteria; and (v) retain previously issued grants under the LTIP of 15,000, 10,000, and 10,000 ordinary shares vesting in 2025, 2026 and 2027, respectively. The Separation Agreement includes a customary release of claims.

The press release announcing Mr. Baldew’s appointment and Mr. Zekhout’s departure is furnished as Exhibit 99.1 to this Report on Form 6-K. This Report on Form 6-K (other than Exhibit 99.1) is hereby incorporated by reference into the registration statements on (i) Form S-8 filed with the Securities and Exchange Commission (the “Commission”) on May 3, 2016 (File No. 333-211095), (ii) Form F-3, initially filed with the Commission on March 30, 2017 and declared effective on May 2, 2017 (File No. 333-217044), and (iii) Form F-3ASR filed with the Commission on March 1, 2023, which was automatically effective upon filing with the Commission (File No. 333-270190).

Forward-Looking Statements

This Report on Form 6-K contains “forward-looking” statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding Mr. Baldew’s appointment. These statements are based on management's estimates and assumptions with respect to future events, and are believed to be reasonable, though are inherently difficult to predict. The Company cautions that these forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in these forward-looking statements. Undue reliance should, therefore, not be placed on such forward-looking statements. Any forward-looking statements contained in this Report apply only as at the date of this Report and are not intended to give any assurance as to future results. The Company will update this Report on Form 6-K as required by applicable law or regulations, but otherwise expressly disclaims

any obligation or undertaking to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| NOMAD FOODS LIMITED |

| |

| By: | | /s/ Stéfan Descheemaeker |

| Name: | | Stéfan Descheemaeker |

| Title: | | Chief Executive Officer |

Dated: May 28, 2024

Exhibit Index

| | | | | | | | |

Exhibit

Number | | Exhibit Title |

| |

| | Press Release issued by Nomad Foods Limited on May 28, 2024. |

Nomad Foods Announces Appointment of Chief Financial Officer

WOKING, England - May 28, 2024 - Nomad Foods Limited (NYSE: NOMD) today announced the appointment of Ruben Baldew as Chief Financial Officer, effective June 17, 2024 (subject to, and conditioned upon, receipt of applicable work authorizations). Mr. Baldew will succeed Samy Zekhout, who is leaving his position to explore new opportunities outside of Nomad Foods. Mr. Zekhout will remain with the Company until July 31, 2024 to assist in the orderly transition of his duties.

Mr. Baldew joins Nomad Foods with over 20 years of global consumer products experience, most recently as CFO of Accell Group from November 2018 until October 2023. During his tenure at Accell Group, he led multiple value creation initiatives prior to the successful sale of the business. Prior to Accell Group, Mr. Baldew spent over 15 years at Unilever in various finance roles with broad, international experience in the Netherlands, Belgium, Switzerland and Thailand.

Stefan Descheemaeker, Chief Executive Officer of Nomad Foods, said, “We are delighted to welcome Ruben to Nomad Foods. He is a dynamic leader with extensive experience in both financial leadership as well as other senior executive positions which will bolster our strong foundations and strategic plans. On behalf of everyone at Nomad Foods, I would like to thank Samy for his significant contributions to the company and wish him success in his future endeavors. I am particularly grateful for his leadership and support over the six years that we have worked together. Samy leaves a strong finance organization that has been instrumental to our success, as evidenced by our consistent organic revenue, EBITDA and EPS growth, during his time with us. He has been a critical player to drive our strategic agenda, leading key initiatives such as Revenue Growth Management and Business Transformation which will benefit us for many years to come”.

Noam Gottesman, Nomad Foods’ Co-Chairman and Founder, said “We are pleased that Ruben is joining the team. He is an accomplished CFO with a strong track record of developing and leading key strategic initiatives. We look forward to working together and welcome his contributions to our business.”

Mr. Gottesman continued, “Samy made a huge impact over his tenure, driving strong shareholder value as Nomad became the undisputed Frozen Food leader in Europe. On behalf of the Board, I would like to thank Samy for his leadership and celebrate his accomplishments which helped to deliver great business results, build a strong organization, and position us for future success.”

Enquiries

John Mills

ICR, Partner

+1-646-277-1254

About Nomad Foods

Nomad Foods (NYSE: NOMD) is Europe's leading frozen food company. The Company's portfolio of iconic brands, which includes Birds Eye, Findus, iglo, Ledo and Frikom, have been a part of consumers' meals for generations, standing for great tasting food that is convenient, high quality and nutritious. Nomad Foods is headquartered in the United Kingdom. Additional information may be found at www.nomadfoods.com.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding the Company’s intention to appoint a new Chief Financial Officer. These statements are based on management's estimates and assumptions with respect to future events, and are believed to be reasonable, though are inherently difficult to predict. The Company cautions that these forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in these forward-looking statements. Undue reliance should, therefore, not be placed on such forward-looking statements. Any forward-looking statements contained in this announcement apply only as at the date of this announcement and are not intended to give any assurance as to future results. The Company will update this announcement as required by applicable law, including the Prospectus Rules, the Listing Rules, the Disclosure and Transparency Rules, and any other applicable law or regulations, but otherwise expressly disclaims any obligation or undertaking to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

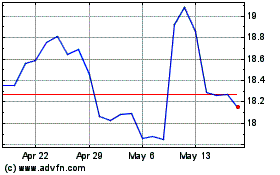

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From May 2024 to Jun 2024

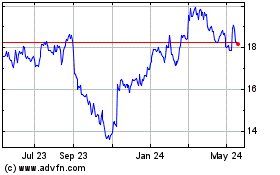

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Jun 2023 to Jun 2024