UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

| ☐ |

|

Preliminary Proxy Statement. |

|

|

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

|

|

| ☒ |

|

Definitive Proxy Statement. |

|

|

| ☐ |

|

Definitive Additional Materials. |

|

|

| ☐ |

|

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

|

Nuveen California Select Tax-Free Income Portfolio (NXC) |

| (Name of Registrant as Specified In Its Charter) |

|

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (check the appropriate box): |

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

|

|

|

|

1) |

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

5) |

|

Total fee paid: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

1) |

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

3) |

|

Filing Party:

|

|

|

|

|

|

|

|

4) |

|

Date Filed:

|

|

|

|

|

|

|

|

|

| Notice of Annual Meeting

of Shareholders to be held on

August 9, 2023 |

|

333 West Wacker Drive

Chicago, Illinois 60606

(800) 257-8787 |

June 30, 2023

Nuveen AMT-Free Municipal Credit Income Fund (NVG)

Nuveen AMT-Free Municipal Value Fund (NUW)

Nuveen AMT-Free Quality Municipal Income Fund (NEA)

Nuveen California Select Tax-Free Income Portfolio (NXC)

Nuveen Dynamic Municipal Opportunities Fund (NDMO)

Nuveen Municipal Credit Income Fund (NZF)

Nuveen

Municipal High Income Opportunity Fund (NMZ)

Nuveen Municipal Income Fund, Inc. (NMI)

Nuveen Municipal Value Fund, Inc. (NUV)

Nuveen New

York AMT-Free Quality Municipal Income Fund (NRK)

Nuveen New York Municipal Value Fund (NNY)

Nuveen New York Quality Municipal Income Fund (NAN)

Nuveen New York Select Tax-Free Income Portfolio (NXN)

Nuveen Quality Municipal Income Fund (NAD)

Nuveen

Select Maturities Municipal Fund (NIM)

Nuveen Select Tax-Free Income Portfolio (NXP)

Nuveen Taxable Municipal Income Fund (NBB)

To the

Shareholders of the Above Funds:

Notice is hereby given that the Annual Meeting of Shareholders of each of Nuveen

AMT-Free Municipal Credit Income Fund (“AMT-Free Credit Income”), Nuveen AMT-Free Municipal Value Fund (“AMT-Free Value”), Nuveen AMT-Free Quality Municipal Income Fund (“AMT-Free Quality Income”), Nuveen California

Select Tax-Free Income Portfolio (“California Select”), Nuveen Dynamic Municipal Opportunities Fund (“Dynamic Municipal”), Nuveen Municipal Credit Income Fund (“Credit Income”),

Nuveen Municipal High Income Opportunity Fund (“Municipal High Income”), Nuveen New York AMT-Free Quality Municipal Income Fund (“New York

AMT-Free”), Nuveen New York Municipal Value Fund (“New York Value”), Nuveen New York Quality Municipal Income Fund (“New York Quality Income”), Nuveen New York Select Tax-Free Income Portfolio (“New York Select”), Nuveen Quality Municipal Income Fund (“Quality Income”), Nuveen Select Maturities Municipal Fund (“Select Maturities”), Nuveen Select Tax-Free Income Portfolio (“Select Tax-Free”) and Nuveen Taxable Municipal Income Fund (“Taxable Income”), each a Massachusetts business trust (each, a

“Massachusetts Fund” and collectively, the “Massachusetts Funds”), and Nuveen Municipal Income Fund, Inc. (“Municipal Income”) and Nuveen Municipal Value Fund, Inc. (“Municipal Value”), each a Minnesota

corporation (each, a “Minnesota Fund” and collectively, the “Minnesota Funds”) (the Massachusetts Funds and Minnesota Funds are each a “Fund” and collectively, the

“Funds”), will be held on Wednesday, August 9, 2023, at 8:30 a.m., Eastern time (for each Fund, an “Annual Meeting” and collectively, the “Annual Meetings”),

for the following purposes and to transact such other business, if any, as may properly come before the Annual Meeting.

We will be hosting this year’s Annual

Meeting as a completely virtual meeting of shareholders, which will be conducted online via live webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and

during the meeting by visiting: www.meetnow.global/M6HGXQA at the meeting date and time described in the accompanying Joint Proxy Statement. If your shares are registered in your name, to participate in the Annual Meeting, you will need to log on

using the control number from your proxy card or meeting notice. The control number can be found in the shaded box. If your shares are held through an intermediary, you will need to register for the Annual Meeting at least three (3) business

days prior to the Annual Meeting. Instructions for registering are set forth in the enclosed Joint Proxy Statement. There is no physical location for the Annual Meeting.

Matters to Be Voted on by Shareholders:

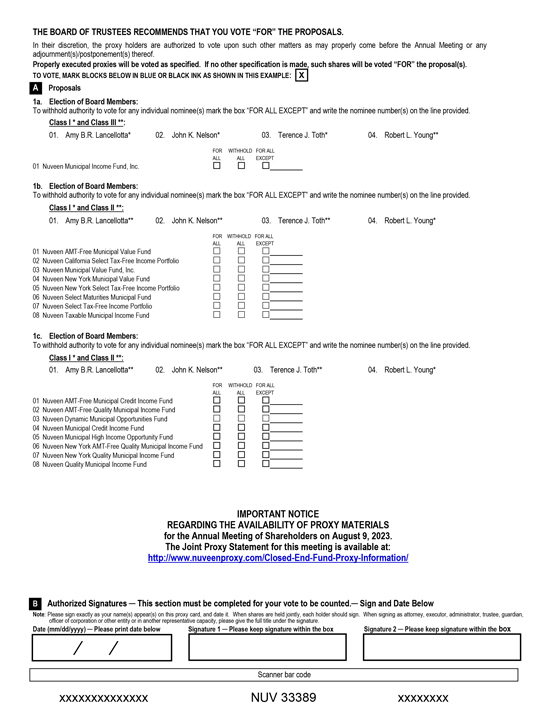

| 1. |

To elect Members to the Board of Directors/Trustees (each a “Board” and each Director or Trustee a “Board

Member”) of each Fund as outlined below: |

| |

a. |

For Municipal Income, to elect one (1) Class III Board Member and three (3) Class I Board Members.

|

| |

b. |

For Municipal Value and each Massachusetts Fund (except AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income), to elect one

(1) Class I Board Member and three (3) Class II Board Members. |

| |

c. |

For AMT-Free Credit Income, AMT-Free

Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income, to elect six (6) Board Members. |

| |

i) |

one (1) Class I Board Member and three (3) Class II Board Members to be elected by the holders of Common

Shares and Preferred Shares, voting together as a single class; and |

| |

ii) |

two (2) Board Members to be elected by the holders of Preferred Shares only, voting separately as a single class.

|

| 2. |

To transact such other business as may properly come before the Annual Meeting. |

Shareholders of record at the close of business on June 12, 2023 are entitled to notice of and to vote at the Annual Meeting.

While all shareholders are cordially invited to attend the virtual Annual Meeting, we encourage you to vote your shares promptly, whether or not you plan to attend

the virtual Annual Meeting in order to avoid delay and additional expense and to assure that your shares are represented. You may vote by mail, telephone or over the Internet. To vote by mail, please mark, sign, date and mail the enclosed proxy

card. No postage is required if mailed in the United States. To vote by telephone, please

call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote over the Internet, go to the Internet address provided on your

proxy card and follow the instructions, using your proxy card as a guide.

Mark L. Winget

Vice President and Secretary

|

|

|

| Joint Proxy Statement |

|

333 West Wacker Drive

Chicago, Illinois 60606

(800) 257-8787 |

June 30, 2023

This Joint Proxy

Statement is first being mailed to shareholders on or about July 6, 2023.

Nuveen AMT-Free Municipal Credit

Income Fund (NVG)

Nuveen AMT-Free Municipal Value Fund (NUW)

Nuveen AMT-Free Quality Municipal Income Fund (NEA)

Nuveen California Select Tax-Free Income Portfolio (NXC)

Nuveen Dynamic Municipal Opportunities Fund (NDMO)

Nuveen Municipal Credit Income Fund (NZF)

Nuveen

Municipal High Income Opportunity Fund (NMZ)

Nuveen Municipal Income Fund, Inc. (NMI)

Nuveen Municipal Value Fund, Inc. (NUV)

Nuveen New

York AMT-Free Quality Municipal Income Fund (NRK)

Nuveen New York Municipal Value Fund (NNY)

Nuveen New York Quality Municipal Income Fund (NAN)

Nuveen New York Select Tax-Free Income Portfolio (NXN)

Nuveen Quality Municipal Income Fund (NAD)

Nuveen

Select Maturities Municipal Fund (NIM)

Nuveen Select Tax-Free Income Portfolio (NXP)

Nuveen Taxable Municipal Income Fund (NBB)

General

Information

This Joint Proxy Statement is furnished in connection with the solicitation by the Board of Trustees or Directors (each a “Board” and

collectively, the “Boards,” and each Trustee or Director, a “Board Member” and collectively, the “Board Members”) of each of Nuveen AMT-Free Municipal Credit Income Fund (“AMT-Free Credit Income”), Nuveen AMT-Free Municipal Value Fund (“AMT-Free Value”), Nuveen AMT-Free Quality Municipal Income Fund (“AMT-Free Quality Income”), Nuveen California Select Tax-Free Income Portfolio

(“California Select”), Nuveen Dynamic Municipal Opportunities Fund (“Dynamic Municipal”), Nuveen Municipal Credit Income Fund (“Credit Income”), Nuveen Municipal High Income Opportunity Fund (“Municipal High

Income”), Nuveen New York AMT-Free Quality Municipal Income Fund (“New York AMT-Free”), Nuveen New York Municipal Value Fund (“New York Value”),

Nuveen New York Quality Municipal Income Fund (“New York Quality Income”), Nuveen New York Select Tax-Free Income Portfolio (“New York Select”), Nuveen Quality Municipal Income Fund

(“Quality Income”), Nuveen Select Maturities Municipal Fund (“Select Maturities”), Nuveen Select Tax-Free Income Portfolio (“Select

Tax-Free”) and Nuveen Taxable Municipal Income Fund (“Taxable Income”), each a Massachusetts business trust (each, a “Massachusetts Fund” and collectively, the “Massachusetts

Funds”), and Nuveen Municipal Income Fund, Inc. (“Municipal Income”) and Nuveen Municipal Value Fund, Inc. (“Municipal Value”), each a Minnesota corporation (each, a “Minnesota Fund” and collectively, the

“Minnesota Funds”)

1

(the Massachusetts Funds and Minnesota Funds are each a “Fund” and collectively, the “Funds”), of proxies to be voted at the Annual Meeting of Shareholders to be held on

Wednesday, August 9, 2023 at 8:30 a.m., Eastern time (for each Fund, an “Annual Meeting” and collectively, the “Annual Meetings”), and at any and all adjournments or postponements thereof.

The Annual Meeting will be held in a virtual meeting format only, which will be conducted online via live webcast. You will be able to attend and participate in the

Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetnow.global/M6HGXQA at the meeting date and time. If your shares are registered in your name, to participate in the

Annual Meeting, you will need to log on using the control number from your proxy card or meeting notice. The control number can be found in the shaded box. There is no physical location for the Annual Meeting.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet. To

register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare. You must contact the bank or broker who holds your

shares to obtain your legal proxy. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, three (3) business days prior to the meeting date. You will receive a confirmation of

your registration by email after we receive your registration materials. Requests for registration should be directed to us by emailing an image of your legal proxy to shareholdermeetings@computershare.com.

On the matters coming before each Annual Meeting as to which a choice has been specified by shareholders on the proxy, the shares will be voted accordingly. If a

properly executed proxy is returned and no choice is specified, the shares will be voted FOR the election of the nominees as listed in this Joint Proxy Statement. Shareholders of a Fund who execute proxies may revoke them at any time before

they are voted by filing with that Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date, or by attending the virtual Annual Meeting and voting at the Annual Meeting. A prior proxy can also be revoked by

voting again through the toll-free number or the Internet address listed in the proxy card. Merely attending the Annual Meeting, however, will not revoke any previously submitted proxy.

The Board of each Fund has determined that the use of this Joint Proxy Statement for each Annual Meeting is in the best interest of each Fund and its shareholders in

light of the similar matters being considered and voted on by the shareholders.

2

The following table indicates which shareholders are solicited with respect to each matter:

|

|

|

|

|

|

|

| Matter |

|

|

|

Common Shares |

|

Preferred Shares(1) |

| 1(a) |

|

For Municipal Income, election of one (1) Class III Board Member and (3) Class I Board Members by all shareholders. |

|

X |

|

N/A |

| 1(b) |

|

For Municipal Value and each Massachusetts Fund (except AMT-Free Credit Income,

AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income), election of one

(1) Class I Board Member and three (3) Class II Board Members by all shareholders. |

|

X |

|

N/A |

| 1(c)(i) |

|

For AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal,

Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income, election of one (1) Class I Board Member and (3) Class II Board Members by all

shareholders. |

|

X |

|

X |

| 1(c)(ii) |

|

For AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal,

Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income, election of two (2) Board Members by holders of Preferred Shares only. |

|

N/A |

|

X |

| (1) |

Variable Rate Demand Preferred Shares (“VRDP Shares”) for AMT-Free

Credit Income, AMT-Free Quality Income, Credit Income, New York AMT-Free, New York Quality Income and Quality Income; MuniFund Preferred Shares (“MFP Shares”)

for AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, New York AMT-Free and Quality Income; and

Adjustable Rate MuniFund Term Preferred Shares (“AMTP Shares”) for AMT-Free Credit Income, AMT-Free Quality Income, Municipal High Income, New York Quality

Income and Quality Income are collectively referred to herein as “Preferred Shares.” |

A quorum of shareholders is required to take action

at each Annual Meeting. A majority of the shares entitled to vote at each Annual Meeting, represented in person (through participation by means of remote or “virtual” communication) or by proxy, will constitute a quorum of shareholders at

that Annual Meeting, except that for the election of the two Board Member nominees by holders of Preferred Shares (for AMT-Free Credit Income, AMT-Free Quality Income,

Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income),

331⁄3% of the Preferred Shares entitled to vote and represented in person (through participation by means of remote or “virtual” communication) or by

proxy will constitute a quorum. Votes cast by proxy or in person (through participation by means of remote or “virtual” communication) at each Annual Meeting will be tabulated by the inspectors of election appointed for that Annual

Meeting. The inspectors of election will determine whether or not a quorum is present at the Annual Meeting. The inspectors of election will treat abstentions and “broker non-votes” (i.e., shares

held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting

power on a particular matter) as present for purposes of determining a quorum. The proposal described in this Joint Proxy Statement is considered a “routine” matter under the

3

rules of the New York Stock Exchange (“NYSE”), and beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their shares voted by broker-dealer

firms on the proposal in the discretion of such broker-dealer firms.

Pursuant to Rule 452 of the NYSE, certain Preferred Shares held in “street name” as

to which voting instructions have not been received from the beneficial owners or persons otherwise entitled to vote as of one business day before the Annual Meeting, or, if adjourned or postponed, one business day before the day to which the Annual

Meeting is adjourned or postponed, may be voted by the broker on the proposal in the same proportion as the votes cast by all holders of Preferred Shares as a class who have voted on the proposal. Rule 452 permits proportionate voting of Preferred

Shares with respect to a particular item if, among other things, (i) a minimum of 30% of the Preferred Shares (or shares of a series of Preferred Shares if the matter must be voted on separately by series) outstanding has been voted by the

holders of such shares with respect to such item, (ii) less than 10% of the Preferred Shares (or shares of a series of Preferred Shares if the matter must be voted on separately by series) outstanding has been voted by the holders of such

shares against such item and (iii) for any proposal as to which holders of Common Shares and Preferred Shares vote as a single class, holders of Common Shares approve the proposal. For the purpose of meeting the 30% test, abstentions will be

treated as shares “voted” and, for the purpose of meeting the 10% test, abstentions will not be treated as shares “voted” against the item. Rule 452 proportionate voting applies only to certain auction rate and remarketed

preferred securities. AMTP Shares are not remarketed, thus the proportionate voting provisions of Rule 452 do not apply to these shares. The proportionate voting provisions of Rule 452 may apply to MFP Shares depending on their mode. The

proportionate voting provisions of Rule 452 may apply to VRDP Shares depending on their current rate period. The following table indicates whether the proportionate voting provisions of Rule 452 apply to each series of Preferred Shares.

|

|

|

|

|

|

|

| |

|

|

|

| Fund |

|

Preferred Shares |

|

Mode(1) |

|

NYSE Rule

452 Applies? |

| AMT-Free Credit Income |

|

MFP Series A |

|

Variable Rate Mode |

|

No |

|

|

MFP Series B |

|

Variable Rate Remarketed Mode |

|

Yes |

|

|

MFP Series C |

|

Variable Rate Remarketed Mode |

|

Yes |

|

|

VRDP Series 1 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 2 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 4 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 5 |

|

Remarketing Mode |

|

Yes |

| |

|

VRDP Series 6 |

|

Remarketing Mode |

|

Yes |

AMT-Free Quality

Income |

|

MFP Series A |

|

Variable Rate Mode |

|

No |

|

|

MFP Series B |

|

Variable Rate Mode |

|

No |

|

|

MFP Series C |

|

Variable Rate Demand Mode |

|

Yes |

|

|

MFP Series D |

|

Variable Rate Demand Mode |

|

Yes |

|

|

VRDP Series 1 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 3 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 4 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 5 |

|

Remarketing Mode |

|

Yes |

| |

|

AMTP Series 2028-1 |

|

N/A |

|

No |

4

|

|

|

|

|

|

|

| |

|

|

|

| Fund |

|

Preferred Shares |

|

Mode(1) |

|

NYSE Rule

452 Applies? |

| Dynamic Municipal |

|

MFP Series A |

|

Variable Rate Mode |

|

No |

| Credit Income |

|

MFP Series A |

|

Variable Rate Mode |

|

No |

|

|

MFP Series B |

|

Variable Rate Mode |

|

No |

|

|

MFP Series C |

|

Variable Rate Mode |

|

No |

|

|

VRDP Series 1 |

|

Special Rate Period VRDP |

|

No |

|

|

VRDP Series 2 |

|

Special Rate Period VRDP |

|

No |

| |

|

VRDP Series 3 |

|

Remarketing Mode |

|

Yes |

| Municipal High Income |

|

AMTP Series 2028 |

|

N/A |

|

No |

|

|

AMTP Series 2031 |

|

N/A |

|

No |

| |

|

AMTP Series 2032 |

|

N/A |

|

No |

| New York AMT-Free |

|

MFP Series A |

|

Variable Rate Remarketed Mode |

|

Yes |

|

|

VRDP Series 1 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 2 |

|

Remarketing Mode |

|

Yes |

|

|

VRDP Series 3 |

|

Remarketing Mode |

|

Yes |

| |

|

VRDP Series 5 |

|

Remarketing Mode |

|

Yes |

| New York Quality Income |

|

AMTP Series 2028 |

|

N/A |

|

No |

| |

|

VRDP Series 1 |

|

Remarketing Mode |

|

Yes |

| Quality Income |

|

MFP Series A |

|

Variable Rate Mode |

|

No |

|

|

MFP Series B |

|

Variable Rate Mode |

|

No |

|

|

AMTP Series 2028 |

|

N/A |

|

No |

|

|

AMTP Series 2028-1 |

|

N/A |

|

No |

|

|

AMTP Series 2028-2 |

|

N/A |

|

No |

|

|

VRDP Series 1 |

|

Remarketing Mode |

|

Yes |

| |

|

VRDP Series 2 |

|

Remarketing Mode |

|

Yes |

| (1) |

As of June 12, 2023. The terms and conditions of each series of Preferred Shares, as well as the rights and

privileges of each mode, if any, are described in the Statement Establishing and Designating the Rights and Preferences for each series of Preferred Shares, and any supplement or appendix thereto. |

Broker-dealers who are not members of the NYSE may be subject to other rules, which may or may not permit them to vote your shares without instruction. We urge you to

provide instructions to your broker or nominee so that your votes may be counted.

For each Fund, because the number of persons nominated for election as Board

Members in accordance with the Fund’s By-Laws equals the number of Board Members to be elected, the affirmative vote of a plurality (the greatest number of affirmative votes) of the shares present and

entitled to vote at the Annual Meeting will be required to elect each Board Member of that Fund. For example, if there are four nominees for election to the Board and four Board Members to be elected, a vote by plurality means the four nominees with

the highest number of affirmative votes, regardless of the votes withheld for the nominees, will be elected. Because the election of Board Members in this case does not require that a minimum percentage of a Fund’s outstanding Common Shares be

voted in favor of any nominee, assuming the presence of a quorum, abstentions and broker non-votes will have no effect on the outcome of the election of that Fund’s Board Members by holders of Common

Shares.

5

Those persons who were shareholders of record at the close of business on Monday, June 12, 2023 will be entitled to

one vote for each share held and a proportionate fractional vote for each fractional vote held. As of June 12, 2023, the shares of the Funds were issued and outstanding as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Fund |

|

Ticker Symbol(1) |

|

Common Shares |

|

|

Preferred Shares |

|

| AMT-Free Credit Income |

|

NVG |

|

|

213,522,362 |

|

|

MFP Series A |

|

|

674 |

|

|

|

|

|

|

|

|

|

MFP Series B |

|

|

200,000 |

|

|

|

|

|

|

|

|

|

MFP Series C |

|

|

250,000 |

|

|

|

|

|

|

|

|

|

VRDP Series 1 |

|

|

1,790 |

|

|

|

|

|

|

|

|

|

VRDP Series 2 |

|

|

2,954 |

|

|

|

|

|

|

|

|

|

VRDP Series 4 |

|

|

1,800 |

|

|

|

|

|

|

|

|

|

VRDP Series 5 |

|

|

2,955 |

|

| |

|

|

|

|

|

|

|

VRDP Series 6 |

|

|

2,867 |

|

| AMT-Free Value |

|

NUW |

|

|

17,951,336 |

|

|

N/A |

|

|

|

|

| AMT-Free Quality Income |

|

NEA |

|

|

299,037,391 |

|

|

MFP Series A |

|

|

1,350 |

|

|

|

|

|

|

|

|

|

MFP Series B |

|

|

3,350 |

|

|

|

|

|

|

|

|

|

MFP Series C |

|

|

2,380 |

|

|

|

|

|

|

|

|

|

MFP Series D |

|

|

330,900 |

|

|

|

|

|

|

|

|

|

VRDP Series 1 |

|

|

2,190 |

|

|

|

|

|

|

|

|

|

VRDP Series 3 |

|

|

3,509 |

|

|

|

|

|

|

|

|

|

VRDP Series 4 |

|

|

4,895 |

|

|

|

|

|

|

|

|

|

VRDP Series 5 |

|

|

1,000 |

|

| |

|

|

|

|

|

|

|

AMTP Series 2028-1 |

|

|

1,730 |

|

| California Select |

|

NXC |

|

|

6,362,276 |

|

|

N/A |

|

|

|

|

| Dynamic Municipal |

|

NDMO |

|

|

59,535,109 |

|

|

MFP Series A |

|

|

2,400 |

|

| Credit Income |

|

NZF |

|

|

193,749,050 |

|

|

MFP Series A |

|

|

1,500 |

|

|

|

|

|

|

|

|

|

MFP Series B |

|

|

1,550 |

|

|

|

|

|

|

|

|

|

MFP Series C |

|

|

3,360 |

|

|

|

|

|

|

|

|

|

VRDP Series 1 |

|

|

2,688 |

|

|

|

|

|

|

|

|

|

VRDP Series 2 |

|

|

2,622 |

|

| |

|

|

|

|

|

|

|

VRDP Series 3 |

|

|

1,460 |

|

| Municipal High Income |

|

NMZ |

|

|

110,539,337 |

|

|

AMTP Series 2028 |

|

|

870 |

|

|

|

|

|

|

|

|

|

AMTP Series 2031 |

|

|

1,700 |

|

| |

|

|

|

|

|

|

|

AMTP Series 2032 |

|

|

1,000 |

|

| Municipal Income |

|

NMI |

|

|

10,051,095 |

|

|

N/A |

|

|

|

|

| Municipal Value |

|

NUV |

|

|

207,541,595 |

|

|

N/A |

|

|

|

|

| New York AMT-Free |

|

NRK |

|

|

87,235,304 |

|

|

MFP Series A |

|

|

800 |

|

|

|

|

|

|

|

|

|

VRDP Series 1 |

|

|

1,123 |

|

|

|

|

|

|

|

|

|

VRDP Series 2 |

|

|

1,348 |

|

|

|

|

|

|

|

|

|

VRDP Series 3 |

|

|

1,617 |

|

| |

|

|

|

|

|

|

|

VRDP Series 5 |

|

|

1,750 |

|

| New York Value |

|

NNY |

|

|

18,886,051 |

|

|

N/A |

|

|

|

|

| New York Quality Income |

|

NAN |

|

|

30,851,332 |

|

|

AMTP Series 2028 |

|

|

1,270 |

|

| |

|

|

|

|

|

|

|

VRDP Series 1 |

|

|

890 |

|

| New York Select |

|

NXN |

|

|

3,924,894 |

|

|

N/A |

|

|

|

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| Fund |

|

Ticker Symbol(1) |

|

Common Shares |

|

|

Preferred Shares |

|

| Quality Income |

|

NAD |

|

|

233,404,655 |

|

|

MFP Series A |

|

|

6,070 |

|

|

|

|

|

|

|

|

|

MFP Series B |

|

|

720 |

|

|

|

|

|

|

|

|

|

AMTP Series 2028 |

|

|

3,370 |

|

|

|

|

|

|

|

|

|

AMTP Series 2028-1 |

|

|

2,085 |

|

|

|

|

|

|

|

|

|

AMTP Series 2028-2 |

|

|

1,820 |

|

|

|

|

|

|

|

|

|

VRDP Series 1 |

|

|

2,368 |

|

| |

|

|

|

|

|

|

|

VRDP Series 2 |

|

|

2,675 |

|

| Select Maturities |

|

NIM |

|

|

12,446,597 |

|

|

N/A |

|

|

|

|

| Select Tax-Free |

|

NXP |

|

|

46,815,492 |

|

|

N/A |

|

|

|

|

| Taxable Income |

|

NBB |

|

|

29,394,751 |

|

|

N/A |

|

|

|

|

| (1) |

The Common Shares of each Fund are listed on the NYSE. Reports, proxy statements and other information concerning the

Funds can be inspected at the offices of the NYSE, 11 Wall Street, New York, New York 10005. |

| 1.Election |

of Board Members |

Pursuant to the organizational documents of each Fund, each Board is divided into three classes, Class I, Class II and Class III, to be elected by the

holders of the outstanding Common Shares and any outstanding Preferred Shares, voting together as a single class, to serve until the third succeeding annual meeting subsequent to their election or thereafter, in each case until their successors have

been duly elected and qualified. For AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income, each a Massachusetts Fund with Preferred Shares outstanding, holders of Preferred Shares are entitled to elect two (2) Board Members. The Board Members

elected by holders of Preferred Shares will be elected to serve until the next annual meeting or until their successors have been duly elected and qualified.

(a) For Municipal Income: four (4) Board Members are to be elected by all shareholders. Current Board Members Lancellotta,

Nelson and Toth have been designated as Class I Board Members and are nominees for election at the Annual Meeting to serve for a term expiring at the 2026 annual meeting of shareholders or until their successors have been duly elected and

qualified. Current Board Member Young, previously designated as a Class I Board Member, has been designated as a Class III Board Member and is a nominee for election at the Annual Meeting to serve for a term expiring at the 2025 annual

meeting of shareholders or until his successor has been duly elected and qualified. Board Members Evans, Hunter, Medero, Moschner, Thornton and Wolff are current and continuing Board Members. Current Board Members Hunter and Wolff have been

designated as Class III Board Members for a term expiring at the 2025 annual meeting of shareholders or until their successors have been duly elected and qualified. Board Members Evans, Medero, Moschner and Thornton have been designated as

Class II Board Members for a term expiring at the 2024 annual meeting of shareholders or until their successors have been duly elected and qualified.

(b) For Municipal Value and each Massachusetts Fund, except AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and

7

Quality Income: four (4) Board Members are to be elected by all shareholders. Current Board Members Lancellotta, Nelson and Toth have been designated as Class II Board Members

and are nominees for election at the Annual Meeting to serve for a term expiring at the 2026 annual meeting of shareholders or until their successors have been duly elected and qualified. Current Board Member Young, previously designated as a

Class II Board Member, has been designated as a Class I Board Member and is a nominee for election at the Annual Meeting to serve for a term expiring at the 2025 annual meeting of shareholders or until his successor has been duly elected

and qualified. Current Board Members Evans, Hunter, Medero, Moschner, Thornton and Wolff are current and continuing Board Members. Current Board Members Hunter and Wolff have been designated as Class I Board Members for a term expiring at the

2025 annual meeting of shareholders or until their successors have been duly elected and qualified. Current Board Members Evans, Medero, Moschner and Thornton have been designated as Class III Board Members for a term expiring at the 2024

annual meeting of shareholders or until their successors have been duly elected and qualified.

(c) For AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York

Quality Income and Quality Income:

| |

(i) |

four (4) Board Members are to be elected by holders of Common and Preferred Shares, voting together as a single

class. Current Board Members Lancellotta, Nelson and Toth have been designated as Class II Board Members and are nominees for election at the Annual Meeting to serve for a term expiring at the 2026 annual meeting of shareholders or until their

successors have been duly elected and qualified. Current Board Member Young, previously designated as a Class II Board Member, has been designated as a Class I Board Member and is a nominee for election at the Annual Meeting to serve for a

term expiring at the 2025 annual meeting of shareholders or until his successor has been duly elected and qualified. Board Members Evans, Medero, Thornton and Wolff are current and continuing Board Members. Board Member Wolff has been designated as

a Class I Board Member for a term expiring at the 2025 annual meeting of shareholders or until her successor has been duly elected and qualified. Board Members Evans, Medero and Thornton have been designated as Class III Board Members for

a term expiring at the 2024 annual meeting of shareholders or until their successors have been duly elected and qualified. |

| |

(ii) |

two (2) Board Members are to be elected by holders of Preferred Shares, voting separately as a single class. Board

Members Hunter and Moschner are nominees for election by holders of Preferred Shares for a term expiring at the next annual meeting or until their successors have been duly elected and qualified. |

It is the intention of the persons named in the enclosed proxy to vote the shares represented thereby for the election of the nominees listed in the table below unless

the proxy is marked otherwise. Each of the nominees has agreed to serve as a Board Member of each Fund if elected. However, should any nominee become unable to serve or for good cause will not serve, the proxies will be voted for substitute

nominees, if any, designated by that Fund’s present Board.

8

Class I Board Members: For each Fund other than Municipal Income,

AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New

York Quality Income and Quality Income, Board Members Hunter and Wolff were last elected to the Fund’s Board as Class I Board Members at the annual meeting of shareholders held on August 5, 2022. For

AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New

York Quality Income and Quality Income, Board Member Wolff was last elected to the Fund’s Board as a Class I Board Member at the annual meeting of shareholders held on August 5, 2022. For Municipal Income, Board Members Nelson, Toth

and Young were last elected to the Fund’s Board as Class I Board Members at the annual meeting of shareholders held on August 5, 2020. Board Member Lancellotta was appointed to Municipal Income’s Board as a Class I Board

Member effective June 1, 2021.

Class II Board Members: For each Fund other than Municipal Income and Dynamic Municipal, Board Members

Nelson, Toth and Young were last elected to each Fund’s Board as Class II Board Members at the annual meeting of shareholders held on August 5, 2020. For Dynamic Municipal, the appointment of Board Members Nelson, Toth and Young was

ratified and approved by the initial shareholder on August 26, 2020. For each Fund other than Municipal Income, Board Member Lancellotta was appointed to the Fund’s Board as a Class II Board Member effective June 1, 2021. For

Municipal Income, Board Members Evans, Medero, Moschner and Thornton were last elected to the Fund’s Board as Class II Board Members at the annual meeting of shareholders held on August 4, 2021.

Class III Board Members: For each Fund other than Municipal Income, Select Tax-Free, AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York

Quality Income and Quality Income, Board Members Evans, Medero, Moschner and Thornton were last elected to each Fund’s Board as Class III Board Members at the annual meeting of shareholders held on August 4, 2021. For AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York

Quality Income and Quality Income, Board Members Evans, Medero and Thornton were last elected to each Fund’s Board as Class III Board Members at the annual meeting of shareholders held on August 4, 2021. For Select Tax-Free, Board Members Evans, Medero, Moschner and Thornton were last elected to the Fund’s Board as Class III Board Members at the annual meeting of shareholders held on September 22, 2021. For

Municipal Income, Board Members Hunter and Wolff were last elected to the Fund’s Board as Class III Board Members at the annual meeting of shareholders held on August 5, 2022.

Board Members Elected by Holders of Preferred Shares: For AMT-Free Credit Income,

AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income, Board Members Hunter and

Moschner were lasted elected to each Fund’s Board at the annual meeting of shareholders held on August 5, 2022.

All Board Member nominees and current and

continuing Board Members are not “interested persons,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Funds or Nuveen Fund Advisors, LLC (the “Adviser”) and have never been an

employee or director of Nuveen, LLC (“Nuveen”), the Adviser’s parent company, or any affiliate. Accordingly, such Board Members are deemed “Independent Board Members.”

The Board unanimously recommends that shareholders vote FOR the election of the nominees.

9

Board Nominees/Board Members

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name, Business Address

and Year of Birth |

|

Position(s)

Held with

Fund |

|

Term of Office

and Length of

Time Served

with Funds in

the Fund Complex(1) |

|

Principal Occupation(s)

During Past 5 Years |

|

Number of

Portfolios

in Fund

Complex

Overseen

by Board

Member |

|

Other

Directorships

Held by

Board

Member

During the

Past 5 Years |

|

| Board Members/Nominees who are not “interested persons” of the Funds |

|

|

|

|

|

|

Terence J. Toth

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606

1959 |

|

Chair of the Board; Board Member |

|

Term: Class I or II Board Member until 2023 annual shareholder meeting(2) and nominee as

Class I or II Board Member until 2026 annual shareholder meeting Length of Service: Since

2008, Chair of the Board since July 2018 |

|

Formerly, Co-Founding Partner, Promus Capital (investment advisory firm) (2008-2017); formerly, Director of Quality Control Corporation (manufacturing) (2012-2021); formerly, Director of

Fulcrum IT Services LLC (information technology services firm to government entities) (2010-2019); formerly, Director, LogicMark LLC (health services) (2012-2016); formerly, Director, Legal & General Investment Management America, Inc.

(asset management) (2008-2013); formerly, CEO and President, Northern Trust Global Investments (financial services) (2004-2007); Executive Vice President, Quantitative Management & Securities Lending (2000-2004); prior thereto, various

positions with Northern Trust Company (financial services) (since 1994); Chair of the Board of the Kehrein Center for the Arts (philanthropy) (since 2021); Member of Catalyst Schools of Chicago Board (since 2008) and Mather Foundation Board

(philanthropy) (since 2012), formerly Chair of its Investment Committee (2017-2022); formerly, Member, Chicago Fellowship Board (philanthropy) (2005-2016); formerly, Member, Northern Trust Mutual Funds Board (2005-2007), Northern Trust Global

Investments Board (2004-2007), Northern Trust Japan Board (2004-2007), Northern Trust Securities Inc. |

|

139 |

|

None |

10

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name, Business Address

and Year of Birth |

|

Position(s)

Held with

Fund |

|

Term of Office

and Length of

Time Served

with Funds in

the Fund Complex(1) |

|

Principal Occupation(s)

During Past 5 Years |

|

Number of

Portfolios

in Fund

Complex

Overseen

by Board

Member |

|

Other

Directorships

Held by

Board

Member

During the

Past 5 Years |

|

|

|

|

|

|

Board (2003-2007) and Northern Trust Hong Kong Board (1997-2004). |

|

|

|

|

|

|

|

|

|

|

Jack B. Evans

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606

1948 |

|

Board Member |

|

Term: Class II or III Board Member until 2024 annual shareholder meeting(2)

Length of Service: Since 1999 |

|

Chairman (since 2019), formerly, President (1996-2019), The Hall-Perrine Foundation (private philanthropic corporation); Life Trustee of Coe College; formerly, Director, Public Member, American Board of Orthopaedic Surgery

(2015-2020); Director (1997-2003) Federal Reserve Bank of Chicago; President and Chief Operating Officer (1972-1995), SCI Financial Group, Inc. (regional financial services firm); Member and President Pro Tem of the Board of Regents for the State of

Iowa University System (2007-2013); Director (1996-2015), The Gazette Company (media and publishing). |

|

139 |

|

Formerly, Director and Chairman (2009-2021), United Fire Group, a publicly held company; Director (2000-2004), Alliant Energy. |

|

|

|

|

|

|

William C. Hunter

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606

1948 |

|

Board Member |

|

Term: Annual Board Member until 2023 annual shareholder meeting and nominee for term until 2024 annual shareholder meeting or Class I or III Board

Member until 2025 annual shareholder meeting(2)

Length of Service: Since 2004 |

|

Dean Emeritus, formerly, Dean (2006-2012), Tippie College of Business, University of Iowa; past Director (2005-2015) and past President (2010-2014) of Beta Gamma Sigma, Inc., The International Business Honor Society; formerly,

Director (1997-2007), Credit Research Center at Georgetown University; formerly, Dean and Distinguished Professor of Finance (2003-2006), School of Business at the University of Connecticut; previously, Senior Vice President and Director of Research

(1995-2003) at the Federal Reserve Bank of Chicago. |

|

139 |

|

Director (since 2009) of Wellmark, Inc.; formerly, Director (2004-2018) of Xerox Corporation. |

11

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name, Business Address

and Year of Birth |

|

Position(s)

Held with

Fund |

|

Term of Office

and Length of

Time Served

with Funds in

the Fund Complex(1) |

|

Principal Occupation(s)

During Past 5 Years |

|

Number of

Portfolios

in Fund

Complex

Overseen

by Board

Member |

|

Other

Directorships

Held by

Board

Member

During the

Past 5 Years |

|

|

|

|

|

|

| Amy B. R. Lancellotta c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606 1959 |

|

Board Member |

|

Term: Class I or II Board Member until 2023 annual shareholder meeting(2) and nominee for

Class I or II Board Member until 2026 annual shareholder meeting Length of Service: Since

2021 |

|

Formerly, Managing Director, Independent Directors Council (IDC) (supports the fund independent director community and is part of the Investment Company Institute (ICI), which represents regulated investment companies) (2006-2019);

formerly, various positions with ICI (1989-2006); Member of the Board of Directors, Jewish Coalition Against Domestic Abuse (JCADA) (since 2020). |

|

139 |

|

None |

|

|

|

|

|

|

| Joanne T. Medero c/o Nuveen

333 West Wacker Drive

Chicago, IL

60606 1954 |

|

Board Member |

|

Term: Class II or III Board Member until 2024 annual shareholder meeting(2)

Length of Service: Since 2021 |

|

Formerly, Managing Director, Government Relations and Public Policy (2009-2020) and Senior Advisor to the Vice Chairman (2018-2020), BlackRock, Inc. (global investment management firm); formerly, Managing Director, Global Head of

Government Relations and Public Policy, Barclays Group (IBIM) (investment banking, investment management and wealth management businesses) (2006-2009); formerly, Managing Director, Global General Counsel and Corporate Secretary, Barclays Global

Investors (global investment management firm) (1996-2006); formerly, Partner, Orrick, Herrington & Sutcliffe LLP (law firm) (1993-1995); formerly, General Counsel, Commodity Futures Trading Commission (government agency overseeing U.S.

derivatives markets) (1989-1993); formerly, Deputy Associate Director/Associate |

|

139 |

|

None |

12

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name, Business Address

and Year of Birth |

|

Position(s)

Held with

Fund |

|

Term of Office

and Length of

Time Served

with Funds in

the Fund Complex(1) |

|

Principal Occupation(s)

During Past 5 Years |

|

Number of

Portfolios

in Fund

Complex

Overseen

by Board

Member |

|

Other

Directorships

Held by

Board

Member

During the

Past 5 Years |

|

|

|

|

|

|

Director for Legal and Financial Affairs, Office of Presidential Personnel, The White House (1986-1989); Member of the Board of Directors, Baltic-American Freedom Foundation (seeks to provide opportunities for citizens of the Baltic

states to gain education and professional development through exchanges in the U.S.) (since 2019). |

|

|

|

|

|

|

|

|

|

|

Albin F. Moschner

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606 1952 |

|

Board Member |

|

Term: Annual Board Member until 2023 annual shareholder meeting and nominee for term until 2024 annual shareholder meeting or Class II or III Board

Member until 2024 annual shareholder meeting(2)

Length of Service: Since 2016 |

|

Founder and Chief Executive Officer, Northcroft Partners, LLC (management consulting) (since 2012); previously, held positions at Leap Wireless International, Inc. (consumer wireless services), including Consultant (2011-2012),

Chief Operating Officer (2008-2011) and Chief Marketing Officer (2004-2008); formerly, President, Verizon Card Services division of Verizon Communications, Inc. (telecommunications services) (2000-2003); formerly, President, One Point Services at

One Point Communications (telecommunications services) (1999-2000); formerly, Vice Chairman of the Board, Diba, Incorporated (internet technology provider) (1996-1997); formerly, various executive positions (1991-1996), including Chief Executive

Officer (1995-1996) of Zenith Electronics Corporation (consumer electronics). |

|

139 |

|

Formerly, Chairman (2019) and Director (2012-2019), USA Technologies, Inc., a provider of solutions and services to facilitate electronic payment transactions; formerly, Director, Wintrust Financial Corporation

(1996-2016). |

13

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name, Business Address

and Year of Birth |

|

Position(s)

Held with

Fund |

|

Term of Office

and Length of

Time Served

with Funds in

the Fund Complex(1) |

|

Principal Occupation(s)

During Past 5 Years |

|

Number of

Portfolios

in Fund

Complex

Overseen

by Board

Member |

|

Other

Directorships

Held by

Board

Member

During the

Past 5 Years |

|

|

|

|

|

|

John K. Nelson

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606

1962 |

|

Board Member |

|

Term: Class I or II Board Member until 2023 annual shareholder meeting(2) and nominee for

Class I or II Board Member term until 2026 annual shareholder meeting Length of Service:

Since 2013 |

|

Member of Board of Directors of Core12 LLC (private firm which develops branding, marketing and communications strategies for clients) (since 2008); served on The President’s Council of Fordham University (2010-2019) and

previously a Director of the Curran Center for Catholic American Studies (2009-2018); formerly, senior external advisor to the Financial Services practice of Deloitte Consulting LLP (2012-2014); former Chair of the Board of Trustees of Marian

University (2010-2014 as trustee, 2011-2014 as Chair); formerly Chief Executive Officer of ABN AMRO Bank N.V., North America, and Global Head of the Financial Markets Division (2007-2008), with various executive leadership roles in ABN AMRO Bank

N.V. between 1996 and 2007. |

|

139 |

|

None |

|

|

|

|

|

|

| Matthew Thornton III c/o Nuveen

333 West Wacker Drive Chicago, IL 60606

1958 |

|

Board Member |

|

Term: Class II or III Board Member until 2024 annual shareholder meeting(2)

Length of Service: Since 2020 |

|

Formerly, Executive Vice President and Chief Operating Officer (2018-2019), FedEx Freight Corporation, a subsidiary of FedEx Corporation (“FedEx”) (provider of transportation,

e-commerce and business services through its portfolio of companies); formerly, Senior Vice President, U.S. Operations (2006-2018), Federal Express Corporation, a subsidiary of FedEx; formerly, Member of the

Board of Directors (2012-2018), Safe Kids Worldwide® (non-profit organization dedicated to preventing childhood injuries). |

|

139 |

|

Member of the Board of Directors (since 2014), The Sherwin-Williams Company (develops, manufactures, distributes and sells paints, coatings and related products); Member of the Board of Directors (since 2020), Crown Castle

International (provider of communications infrastructure). |

14

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Name, Business Address

and Year of Birth |

|

Position(s)

Held with

Fund |

|

Term of Office

and Length of

Time Served

with Funds in

the Fund Complex(1) |

|

Principal Occupation(s)

During Past 5 Years |

|

Number of

Portfolios

in Fund

Complex

Overseen

by Board

Member |

|

Other

Directorships

Held by

Board

Member

During the

Past 5 Years |

|

|

|

|

|

|

Margaret L. Wolff

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606

1955 |

|

Board Member |

|

Term: Class I or III Board Member until 2025 annual shareholder meeting(2)

Length of Service: Since 2016 |

|

Formerly, Of Counsel (2005-2014), Skadden, Arps, Slate, Meagher & Flom LLP (Mergers & Acquisitions Group) (legal services); Member of the Board of Trustees of New York-Presbyterian Hospital (since 2005); Member

(since 2004), formerly, Chair (2015-2022) of the Board of Trustees of The John A. Hartford Foundation (philanthropy dedicated to improving the care of older adults); formerly, Member (2005-2015) and Vice Chair (2011-2015) of the Board of Trustees of

Mt. Holyoke College. |

|

139 |

|

Formerly, Member of the Board of Directors (2013- 2017) of Travelers Insurance Company of Canada and The Dominion of Canada General Insurance Company (each, a part of Travelers Canada, the Canadian operation of The Travelers

Companies, Inc.) |

|

|

|

|

|

|

Robert L. Young

c/o Nuveen

333 West Wacker Drive

Chicago, IL 60606

1963 |

|

Board Member |

|

Term: Class I or II Board Member until 2023 annual shareholder meeting and nominee as Class I or III

Board Member until 2025 annual shareholder meeting (2)

Length of Service: Since 2017 |

|

Formerly, Chief Operating Officer and Director, J.P. Morgan Investment Management Inc. (financial services) (2010-2016); formerly, President and Principal Executive Officer (2013-2016), and

Senior Vice President and Chief Operating Officer (2005-2010), of J.P. Morgan Funds; formerly, Director and various officer positions for J.P. Morgan Investment Management Inc. (formerly, JPMorgan Funds Management, Inc. and formerly, One Group

Administrative Services) and JPMorgan Distribution Services, Inc. (financial services) (formerly, One Group Dealer Services, Inc.) (1999-2017). |

|

139 |

|

None |

| (1) |

Length of Time Served indicates the year in which the individual became a Board Member of a fund in the Nuveen fund

complex. |

| (2) |

For Municipal Value and each Massachusetts Fund, except AMT-Free Credit Income, AMT-Free Quality Income, Dynamic Municipal, Credit Income, Municipal High Income, New York AMT-Free, New York Quality Income and Quality Income, Board Member Hunter serves as

a Class I Board Member and Board Member Moschner serves as a Class III Board Member. For Municipal Income, Board Members Lancellotta, Nelson, Toth and Young serve as Class I Board Members; Board Members Evans, Medero, Moschner and

Thornton serve as Class II Board Members; and Board Members Hunter and Wolff serve as Class III Board Members. |

15

Board Member Investments in the Funds

In order to create an appropriate identity of interests between Board Members and shareholders, the Boards of Directors/Trustees of the Nuveen funds have adopted a

governance principle pursuant to which each Board Member is expected to invest, either directly or on a deferred basis, at least the equivalent of one year of compensation in the funds in the Nuveen fund complex.

The dollar range of equity securities beneficially owned by each Board Member in each Fund and all Nuveen funds overseen by the Board Member as of May 31, 2023 is

set forth in Appendix A. The number of shares of each Fund beneficially owned by each Board Member and by the Board Members and officers of the Funds as a group as of May 31, 2023 is also set forth in

Appendix A. As of June 12, 2023, each Board Member’s individual beneficial shareholdings of each Fund constituted less than 1% of the outstanding shares of the Fund. As of June 12, 2023, the Board Members and

executive officers as a group beneficially owned less than 1% of the outstanding shares of each Fund.

Compensation

Prior to January 1, 2023, independent trustees received a $205,000 annual retainer, plus they received (a) a fee of $7,000 per day for attendance in person or

by telephone at regularly scheduled meetings of the Board; (b) a fee of $3,000 per meeting for attendance in person or by telephone at special, non-regularly scheduled Board meetings where in-person attendance was required and $3,000 per meeting for attendance by telephone or in person at such meetings where in-person attendance was not required; (c) a fee

of $2,500 per meeting for attendance in person or by telephone at Audit Committee meetings where in-person attendance was required and $2,250 per meeting for attendance by telephone or in person at such

meetings where in-person attendance was not required; (d) a fee of $5,000 per meeting for attendance in person or by telephone at Compliance, Risk Management and Regulatory Oversight Committee meetings

where in-person attendance was required and $2,000 per meeting for attendance by telephone or in person at such meetings where in-person attendance was not required;

(e) a fee of $1,250 per meeting for attendance in person or by telephone at Dividend Committee meetings; (f) a fee of $500 per meeting for attendance in person or by telephone at all other committee meetings ($1,000 for shareholder

meetings) where in-person attendance was required and $250 per meeting for attendance by telephone or in person at such committee meetings (excluding shareholder meetings) where

in-person attendance was not required, and $100 per meeting when the Executive Committee acted as pricing committee for IPOs, plus, in each case, expenses incurred in attending such meetings, provided that no

fees were received for meetings held on days on which regularly scheduled Board meetings were held; and (g) a fee of $2,500 per meeting for attendance in person or by telephone at Closed-End Funds

Committee meetings where in-person attendance was required and $2,000 per meeting for attendance by telephone or in person at such meetings where in-person attendance

was not required; provided that no fees were received for meetings held on days on which regularly scheduled Board meetings were held. In addition to the payments described above, the Chair of the Board received $125,000, and the chairpersons of the

Audit Committee, the Dividend Committee, the Compliance, Risk Management and Regulatory Oversight Committee, the Nominating and Governance Committee and the Closed-End Funds Committee received $20,000 each as

additional retainers. Independent trustees also received a fee of $3,500 per

16

day for site visits to entities that provide services to the Nuveen Funds on days on which no Board meeting was held. When ad hoc committees are organized, the Nominating and Governance Committee

at the time of formation determined compensation to be paid to the members of such committee; however, in general, such fees were $1,000 per meeting for attendance in person or by telephone at ad hoc committee meetings where in-person attendance was required and $500 per meeting for attendance by telephone or in person at such meetings where in-person attendance was not required. Any compensation

paid to the independent directors as members of ad hoc committees is temporary in nature and not expected to be long-term, ongoing compensation. The annual retainer, fees and expenses were allocated among the Nuveen Funds on the basis of relative

net assets, although management may have, in its discretion, established a minimum amount to be allocated to each fund. In certain instances fees and expenses were allocated only to those Nuveen Funds that were discussed at a given meeting. In

certain circumstances, such as during the COVID-19 pandemic, the Board may have held n-person meetings by telephonic or videographic means and were compensated at the in-person rate.

Effective January 1, 2023, independent trustees receive a $210,000 annual retainer, plus they receive

(a) a fee of $7,250 per day for attendance at regularly scheduled meetings of the Board; (b) a fee of $4,000 per meeting for attendance at special, non-regularly scheduled Board meetings; (c) a

fee of $2,500 per meeting for attendance at Audit Committee meetings, Closed-End Fund Committee meetings and Investment Committee Meetings; (d) a fee of $5,000 per meeting for attendance at Compliance,

Risk Management and Regulatory Oversight Committee meetings; (e) a fee of $1,250 per meeting for attendance at Dividend Committee meetings; and (f) a fee of $500 per meeting for attendance at all other committee meetings, and $100 per

meeting when the Executive Committee acts as pricing committee for IPOs, plus, in each case, expenses incurred in attending such meetings, provided that no fees are received for meetings held on days on which regularly scheduled Board meetings are

held. In addition to the payments described above, the Chair of the Board receives $140,000, and the chairpersons of the Audit Committee, the Dividend Committee, the Compliance, Risk Management and Regulatory Oversight Committee, the Nominating and

Governance Committee, the Closed-End Funds Committee and the Investment Committee receive $20,000 each as additional retainers. Independent trustees also receive a fee of $5,000 per day for site visits to

entities that provide services to the Nuveen Funds on days on which no Board meeting is held. Per meeting fees for unscheduled Committee meetings or meetings of Ad Hoc or Special Assignment Committees will be determined by the Chair of such

Committee based on the complexity or time commitment associated with the particular meeting. The annual retainer, fees and expenses are allocated among the Nuveen Funds on the basis of relative net assets, although management may, in its discretion,

establish a minimum amount to be allocated to each fund. In certain instance fees and expenses will be allocated only to those Nuveen Funds that are discussed at a given meeting.

The Funds do not have retirement or pension plans. Certain Nuveen funds (the “Participating Funds”) participate in a deferred compensation plan (the

“Deferred Compensation Plan”) that permits an Independent Board Member to elect to defer receipt of all or a portion of his or her compensation as an Independent Board Member. The deferred compensation of a participating Independent Board

Member is credited to a book reserve account of the Participating Fund when the compensation would otherwise have been paid to such Independent Board Member. The value of an Independent Board Member’s deferral account at any time is equal to

the value that the account would have had if contributions to the account had been invested and

17

reinvested in shares of one or more of the eligible Nuveen funds. At the time for commencing distributions from an Independent Board Member’s deferral account, the Independent Board Member

may elect to receive distributions in a lump sum or over a period of five years. The Participating Fund will not be liable for any other fund’s obligations to make distributions under the Deferred Compensation Plan.

The Funds have no employees. The officers of the Funds and the Board Members of each Fund who are not Independent Board Members serve without any compensation from the

Funds. The Funds’ Chief Compliance Officer’s (“CCO”) compensation, which is composed of base salary and incentive compensation, is paid by the Adviser, with review and input by the Board. The Funds reimburse the Adviser for an

allocable portion of the Adviser’s cost of the CCO’s incentive compensation.

18

The table below shows, for each Independent Board Member, the aggregate compensation paid by each Fund to the Independent

Board Member/nominee for its last fiscal year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aggregate Compensation from the Funds(*) |

|

| Fund Name |

|

Jack B.

Evans |

|

|

William C.

Hunter |

|

|

Amy B. R.

Lancellotta(1) |

|

|

Joanne T.

Medero(1) |

|

|

Albin F.

Moschner |

|

|

John K.

Nelson |

|

|

Judith M.

Stockdale(2) |

|

|

Carole E.

Stone(2) |

|

|

Matthew

Thornton III |

|

|

Terence

J. Toth |

|

|

Margaret

L. Wolff |

|

|

Robert L.

Young |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AMT-Free Credit Income |

|

$ |

11,800 |

|

|

$ |

11,076 |

|

|

$ |

10,561 |

|

|

$ |

10,457 |

|

|

$ |

12,927 |

|

|

$ |

12,376 |

|

|

$ |

10,647 |

|

|

$ |

11,579 |

|

|

$ |

11,201 |

|

|

$ |

15,058 |

|

|

$ |

11,581 |

|

|

$ |

12,147 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AMT-Free Quality Income |

|

|

14,891 |

|

|

|

13,954 |

|

|

|

13,301 |

|

|

|

13,171 |

|

|

|

16,211 |

|

|

|

15,630 |

|

|

|

13,423 |

|

|

|

14,610 |

|

|

|

14,117 |

|

|

|

18,897 |

|

|

|

14,428 |

|

|

|

15,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AMT-Free Value |

|

|

722 |

|

|

|

678 |

|

|

|

645 |

|

|

|

639 |

|

|

|

788 |

|

|

|

753 |

|

|

|

651 |

|

|

|

710 |

|

|

|

685 |

|

|

|

934 |

|

|

|

700 |

|

|

|

744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| California Select |

|

|

216 |

|

|

|

198 |

|

|

|

193 |

|

|

|

192 |

|

|

|

237 |

|

|

|

226 |

|

|

|

198 |

|

|

|

213 |

|

|

|

206 |

|

|

|

284 |

|

|

|

211 |

|

|

|

236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Income |

|

|

8,237 |

|

|

|

7,697 |

|

|

|

7,399 |

|

|

|

7,355 |

|

|

|

8,939 |

|

|

|

8,620 |

|

|

|

7,537 |

|

|

|

8,111 |

|

|

|

7,800 |

|

|

|

10,421 |

|

|

|

8,041 |

|

|

|

8,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dynamic Municipal |

|

|

2,487 |

|

|

|

2,298 |

|

|

|

2,232 |

|

|

|

2,211 |

|

|

|

3,071 |

|

|

|

3,015 |

|

|

|

2,248 |

|

|

|

2,442 |

|

|

|

2,780 |

|

|

|

3,210 |

|

|

|

2,427 |

|

|

|

2,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Municipal High Income |

|

|

3,940 |

|

|

|

3,697 |

|

|

|

3,524 |

|

|

|

3,490 |

|

|

|

4,289 |

|

|

|

4,121 |

|

|

|

3,552 |

|

|

|

3,868 |

|

|

|

3,741 |

|

|

|

5,133 |

|

|

|

3,913 |

|

|

|

4,143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Municipal Income |

|

|

266 |

|

|

|

249 |

|

|

|

237 |

|

|

|

235 |

|

|

|

290 |

|

|

|

277 |

|

|

|

241 |

|

|

|

262 |

|

|

|

252 |

|

|

|

343 |

|

|

|

259 |

|

|

|

278 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Municipal Value |

|

|

5,164 |

|

|

|

4,845 |

|

|

|

4,610 |

|

|

|

4,567 |

|

|

|

5,633 |

|

|

|

5,383 |

|

|

|

4,652 |

|

|

|

5,073 |

|

|

|

4,896 |

|

|

|

6,679 |

|

|

|

5,007 |

|

|

|

5,320 |

|

|

|

|

|

|

|

|

|

|

|