false 0001825024 0001825024 2024-08-05 2024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 05, 2024

Offerpad Solutions Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-39641 |

|

85-2800538 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 2150 E. Germann Road Suite 1 |

|

|

| Chandler, Arizona |

|

85286 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (844) 388-4539

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share |

|

OPAD |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 5, 2024, Offerpad Solutions Inc. issued a press release announcing its financial results for the three and six months ended June 30, 2024 and a Shareholder Letter. A copy of the press release and the Shareholder Letter are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

The information in this Item 2.02, including the information contained in Exhibit 99.1 and Exhibit 99.2 of this Current Report on Form 8-K, is furnished herewith and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Offerpad Solutions Inc. |

|

|

|

|

| Date: August 5, 2024 |

|

|

|

By: |

|

/s/ Peter Knag |

|

|

|

|

|

|

Peter Knag Chief Financial Officer |

Exhibit 99.1

Offerpad Reports Second Quarter 2024 Results

Gross Margin Improves for Third Consecutive Quarter

CHANDLER, Ariz.—(BUSINESS WIRE)— Offerpad Solutions Inc. (“Offerpad”) (NYSE: OPAD), a leading tech-enabled platform for residential real

estate, today released financial results for the three months ended June 30, 2024.

“During the second quarter, we delivered revenue within our

guidance and sequential improvement in Adjusted EBITDA. Our focus on expense management, and the continued growth in our asset light platform services, drove improvement in gross margin, contribution margin, and Adjusted EBITDA,” said Brian

Bair, Offerpad’s chief executive officer. “We intend to remain flexible to adapt quickly to market shifts and have adjusted our buy box, focusing more on wider margins per home and less on volume. We are pleased that our approach to

strategic operations and disciplined expense management is positioning us well on the path to sustained profitability, in any real estate market.”

Highlights include:

| |

• |

|

Improved Net Loss and Adjusted EBITDA 38% and 74%, respectively, from the prior year |

| |

• |

|

Gross margin of 8.7%, up 80bps from 7.9% in the prior quarter |

| |

• |

|

Gross profit per home sold of $29.5k, up 10% from the prior quarter |

| |

• |

|

Contribution profit after interest per home sold of $14.5k, up 22% from the prior quarter |

| |

• |

|

Time to Cash for homes sold in the quarter of 106 days, down from 138 the prior year |

| |

• |

|

Inventory owned 180+ days ended the quarter at 5.1% down from 8.5% the prior quarter |

| |

• |

|

Strong quarter for Renovate, with closed renovation projects growing 306% versus the prior year, generating $4.9M

in revenue. Began working on projects for new customers including Freddie Mac and Fannie Mae |

| |

• |

|

Requests from Offerpad’s Agent Partnership Program grew to 25% of total, driving most efficient Customer

Acquisition Cost (CAC) since Q2’22 |

“As we look at the back-half of 2024 and beyond, we are continuing to push hard on cost

management and profitability with a focus on building long-term value, regardless of the macro real estate environment,” said Peter Knag, Offerpad’s chief financial officer. “Offerpad’s business is uniquely positioned in this

shifting real estate landscape with significant opportunities ahead, and I am excited to be a part of this organization.”

Q2 2024 Financial Results (quarter over quarter)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q2 2024 |

|

|

Q1 2024 |

|

|

Percentage

Change |

|

| Homes acquired |

|

|

831 |

|

|

|

806 |

|

|

|

3 |

% |

| Homes sold |

|

|

742 |

|

|

|

847 |

|

|

|

(12 |

%) |

| Revenue |

|

$ |

251.1M |

|

|

$ |

285.4M |

|

|

|

(12 |

%) |

| Gross profit |

|

$ |

21.9M |

|

|

$ |

22.6M |

|

|

|

(3 |

%) |

| Net loss |

|

($ |

13.8M |

) |

|

($ |

17.5M |

) |

|

|

21 |

% |

| Adjusted EBITDA |

|

($ |

4.4M |

) |

|

($ |

7.1M |

) |

|

|

38 |

% |

| Diluted Net Loss per Share |

|

($ |

0.50 |

) |

|

($ |

0.64 |

) |

|

|

22 |

% |

| Gross profit per home sold |

|

$ |

29,500 |

|

|

$ |

26,700 |

|

|

|

10 |

% |

| Contribution profit after interest per home sold |

|

$ |

14,500 |

|

|

$ |

11,900 |

|

|

|

22 |

% |

| Cash and cash equivalents |

|

$ |

56.9M |

|

|

$ |

68.6M |

|

|

|

(17 |

%) |

Q2 2024 Financial Results (year over year)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q2 2024 |

|

|

Q2 2023 |

|

|

Percentage

Change |

|

| Homes acquired |

|

|

831 |

|

|

|

840 |

|

|

|

(1 |

%) |

| Homes sold |

|

|

742 |

|

|

|

650 |

|

|

|

14 |

% |

| Revenue |

|

$ |

251.1M |

|

|

$ |

230.1M |

|

|

|

9 |

% |

| Gross profit |

|

$ |

21.9M |

|

|

$ |

22.2M |

|

|

|

(2 |

%) |

| Net loss |

|

($ |

13.8M |

) |

|

($ |

22.3M |

) |

|

|

38 |

% |

| Adjusted EBITDA |

|

($ |

4.4M |

) |

|

($ |

17.3M |

) |

|

|

74 |

% |

| Diluted Net Loss per Share |

|

($ |

0.50 |

) |

|

($ |

0.82 |

) |

|

|

39 |

% |

| Gross profit per home sold |

|

$ |

29,500 |

|

|

$ |

34,200 |

|

|

|

(14 |

%) |

| Contribution profit (loss) after interest per home sold |

|

$ |

14,500 |

|

|

($ |

2,900 |

) |

|

|

n.a. |

|

| Cash and cash equivalents |

|

$ |

56.9M |

|

|

$ |

115.6M |

|

|

|

(51 |

%) |

Additional information regarding Offerpad’s second quarter 2024 financial results and management commentary can be found

by accessing the Company’s Quarterly Letter to Shareholders on the Offerpad investor relations website.

Third Quarter 2024 Outlook

Offerpad is providing its third quarter outlook for 2024 as follows:

|

|

|

| |

|

Q3 2024 Outlook |

| Homes Sold |

|

550 to 650 |

| Revenue |

|

$185M to $225M |

| Adjusted EBITDA1 |

|

Sequential Improvement |

| 1 |

See Non-GAAP financial measures below for an explanation of why a

reconciliation of this guidance cannot be provided. |

Conference Call and Webcast Details

Brian Bair, Chairman and CEO, and Peter Knag, CFO, will host a conference call and accompanying webcast on August 5, 2024, at 4:30 p.m. ET. The webcast

can be accessed on Offerpad’s Investor Relations website. Those interested can register here. Access to a replay of the webcast will be available from the same website address shortly after the live webcast concludes.

About Offerpad

Offerpad, dedicated to simplifying the

process of buying and selling homes, is a publicly traded company committed to providing comprehensive solutions that removes the friction from real estate. Our advanced real estate platform offers a range of services, from consumer cash offers to

B2B renovation solutions and industry partnership programs, all tailored to meet the unique needs of our clients. Since 2015, we’ve leveraged local expertise in residential real estate alongside proprietary technology to guide homeowners at

every step. Learn more at www.offerpad.com.

#OPAD_IR

Contacts

Investors

Investors@offerpad.com

Media

Press@offerpad.com

Forward-Looking Statements

Certain statements in this press release may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements generally relate to future events or Offerpad’s future financial or operating performance. For example, statements regarding Offerpad’s financial outlook, including homes sold, revenue and Adjusted

EBITDA, for the second quarter 2024, and expectations regarding market conditions, strategic imperatives and profitability, including the timing of reaching sustainable positive Adjusted EBITDA and cash flow, are forward-looking statements. In some

cases, you can identify forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,” “might,” “plan,” “possible,” “project,”

“strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or

“continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other important factors that could cause actual results to differ materially

from those expressed or implied by such forward-looking statements. Factors that may impact such forward-looking statements include, but are not limited to, Offerpad’s ability to respond to general economic conditions; the health of the U.S.

residential real estate industry; Offerpad’s ability to grow market share in its existing markets or any new markets it may enter; Offerpad’s ability to manage its growth and its costs structure effectively; Offerpad’s ability to

accurately value and manage real estate inventory, maintain an adequate and desirable supply of real estate

inventory, and manage renovations; Offerpad’s ability to successfully launch new product and service offerings, and to manage, develop and refine its technology platform; Offerpad’s

ability to maintain and enhance its products and brand, and to attract customers; Offerpad’s ability to achieve and maintain profitability in the future; and the success of strategic relationships with third parties. These and other important

factors discussed under the caption “Risk Factors” in Offerpad’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission on

February 27, 2024, and Offerpad’s other reports filed with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. These

forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Offerpad and its management, are inherently uncertain. Nothing in this press release should be regarded as a representation by any person that

the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of

the date they are made. Offerpad undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

OFFERPAD SOLUTIONS INC.

Condensed Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| (in thousands, except per share data) (Unaudited) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue |

|

$ |

251,122 |

|

|

$ |

230,147 |

|

|

$ |

536,480 |

|

|

$ |

839,726 |

|

| Cost of revenue |

|

|

229,251 |

|

|

|

207,916 |

|

|

|

492,014 |

|

|

|

810,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

21,871 |

|

|

|

22,231 |

|

|

|

44,466 |

|

|

|

29,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales, marketing and operating |

|

|

20,230 |

|

|

|

29,040 |

|

|

|

42,682 |

|

|

|

71,391 |

|

| General and administrative |

|

|

10,538 |

|

|

|

12,713 |

|

|

|

22,493 |

|

|

|

27,192 |

|

| Technology and development |

|

|

964 |

|

|

|

2,312 |

|

|

|

2,737 |

|

|

|

4,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

31,732 |

|

|

|

44,065 |

|

|

|

67,912 |

|

|

|

103,136 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(9,861 |

) |

|

|

(21,834 |

) |

|

|

(23,446 |

) |

|

|

(73,620 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value of warrant liabilities |

|

|

(9 |

) |

|

|

435 |

|

|

|

335 |

|

|

|

46 |

|

| Interest expense |

|

|

(4,581 |

) |

|

|

(1,867 |

) |

|

|

(9,486 |

) |

|

|

(9,299 |

) |

| Other income, net |

|

|

615 |

|

|

|

965 |

|

|

|

1,369 |

|

|

|

1,247 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

|

|

(3,975 |

) |

|

|

(467 |

) |

|

|

(7,782 |

) |

|

|

(8,006 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(13,836 |

) |

|

|

(22,301 |

) |

|

|

(31,228 |

) |

|

|

(81,626 |

) |

| Income tax benefit (expense) |

|

|

54 |

|

|

|

(43 |

) |

|

|

(69 |

) |

|

|

(165 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(13,782 |

) |

|

$ |

(22,344 |

) |

|

$ |

(31,297 |

) |

|

$ |

(81,791 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic |

|

$ |

(0.50 |

) |

|

$ |

(0.82 |

) |

|

$ |

(1.14 |

) |

|

$ |

(3.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, diluted |

|

$ |

(0.50 |

) |

|

$ |

(0.82 |

) |

|

$ |

(1.14 |

) |

|

$ |

(3.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding, basic |

|

|

27,385 |

|

|

|

27,258 |

|

|

|

27,362 |

|

|

|

25,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding, diluted |

|

|

27,385 |

|

|

|

27,258 |

|

|

|

27,362 |

|

|

|

25,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFERPAD SOLUTIONS INC.

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

| (in thousands, except par value per share) (Unaudited) |

|

June 30,

2024 |

|

|

December 31,

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

56,906 |

|

|

$ |

75,967 |

|

| Restricted cash |

|

|

16,092 |

|

|

|

3,967 |

|

| Accounts receivable |

|

|

6,745 |

|

|

|

9,935 |

|

| Real estate inventory |

|

|

307,750 |

|

|

|

276,500 |

|

| Prepaid expenses and other current assets |

|

|

3,545 |

|

|

|

5,236 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

391,038 |

|

|

|

371,605 |

|

| Property and equipment, net |

|

|

4,492 |

|

|

|

4,517 |

|

| Other non-current assets |

|

|

11,095 |

|

|

|

3,572 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

406,625 |

|

|

$ |

379,694 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

2,838 |

|

|

$ |

4,946 |

|

| Accrued and other current liabilities |

|

|

13,095 |

|

|

|

13,859 |

|

| Secured credit facilities and other debt, net |

|

|

271,887 |

|

|

|

227,132 |

|

| Secured credit facilities and other debt—related party |

|

|

31,899 |

|

|

|

30,092 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

319,719 |

|

|

|

276,029 |

|

| Warrant liabilities |

|

|

136 |

|

|

|

471 |

|

| Other long-term liabilities |

|

|

9,203 |

|

|

|

1,418 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

329,058 |

|

|

|

277,918 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Class A common stock, $0.0001 par value; 2,000,000 shares authorized; 27,329 and 27,233

shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively |

|

|

3 |

|

|

|

3 |

|

| Additional paid in capital |

|

|

506,748 |

|

|

|

499,660 |

|

| Accumulated deficit |

|

|

(429,184 |

) |

|

|

(397,887 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

77,567 |

|

|

|

101,776 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

406,625 |

|

|

$ |

379,694 |

|

|

|

|

|

|

|

|

|

|

OFFERPAD SOLUTIONS INC.

Condensed Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

| |

|

June 30, |

|

| ($ in thousands) (Unaudited) |

|

2024 |

|

|

2023 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(31,297 |

) |

|

$ |

(81,791 |

) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

314 |

|

|

|

380 |

|

| Amortization of debt financing costs |

|

|

1,153 |

|

|

|

1,980 |

|

| Real estate inventory valuation adjustment |

|

|

1,168 |

|

|

|

7,454 |

|

| Stock-based compensation |

|

|

7,116 |

|

|

|

3,898 |

|

| Change in fair value of warrant liabilities |

|

|

(335 |

) |

|

|

(46 |

) |

| Change in fair value of derivative instruments |

|

|

— |

|

|

|

715 |

|

| Loss on disposal of property and equipment |

|

|

29 |

|

|

|

30 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

3,190 |

|

|

|

871 |

|

| Real estate inventory |

|

|

(32,418 |

) |

|

|

446,124 |

|

| Prepaid expenses and other assets |

|

|

2,091 |

|

|

|

313 |

|

| Accounts payable |

|

|

(2,108 |

) |

|

|

1,693 |

|

| Accrued and other liabilities |

|

|

(902 |

) |

|

|

(10,126 |

) |

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by operating activities |

|

|

(51,999 |

) |

|

|

371,495 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(362 |

) |

|

|

(90 |

) |

| Proceeds from sale of property and equipment |

|

|

44 |

|

|

|

— |

|

| Purchases of derivative instruments |

|

|

— |

|

|

|

(1,872 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(318 |

) |

|

|

(1,962 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Borrowings from credit facilities and other debt |

|

|

495,955 |

|

|

|

411,990 |

|

| Repayments of credit facilities and other debt |

|

|

(450,546 |

) |

|

|

(889,773 |

) |

| Payment of debt financing costs |

|

|

— |

|

|

|

(172 |

) |

| Proceeds from exercise of stock options |

|

|

16 |

|

|

|

53 |

|

| Payments for taxes related to stock-based awards |

|

|

(44 |

) |

|

|

(52 |

) |

| Borrowings from warehouse lending facility |

|

|

— |

|

|

|

18,488 |

|

| Repayments of warehouse lending facility |

|

|

— |

|

|

|

(17,336 |

) |

| Proceeds from issuance of pre-funded warrants |

|

|

— |

|

|

|

90,000 |

|

| Proceeds from exercise of pre-funded warrants |

|

|

— |

|

|

|

11 |

|

| Issuance cost of pre-funded warrants |

|

|

— |

|

|

|

(784 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

45,381 |

|

|

|

(387,575 |

) |

|

|

|

|

|

|

|

|

|

| Net change in cash, cash equivalents and restricted cash |

|

|

(6,936 |

) |

|

|

(18,042 |

) |

| Cash, cash equivalents and restricted cash, beginning of period |

|

|

79,934 |

|

|

|

140,299 |

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash, end of period |

|

$ |

72,998 |

|

|

$ |

122,257 |

|

|

|

|

|

|

|

|

|

|

| Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated

balance sheet: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

56,906 |

|

|

$ |

115,599 |

|

| Restricted cash |

|

|

16,092 |

|

|

|

6,658 |

|

|

|

|

|

|

|

|

|

|

| Total cash, cash equivalents and restricted cash |

|

$ |

72,998 |

|

|

$ |

122,257 |

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

| Cash payments for interest |

|

$ |

12,624 |

|

|

$ |

13,932 |

|

Non-GAAP Financial Measures

In addition to Offerpad’s results of operations above, Offerpad reports certain financial measures that are not required by, or presented in accordance

with, U.S. generally accepted accounting principles (“GAAP”). These measures have limitations as analytical tools when assessing Offerpad’s operating performance and should not be considered in isolation or as a substitute for GAAP

measures, including gross profit and net income.

Offerpad may calculate or present its non-GAAP financial

measures differently than other companies who report measures with similar titles and, as a result, the non-GAAP financial measures Offerpad reports may not be comparable with those of companies in

Offerpad’s industry or in other industries. Offerpad has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted net income (loss) within this press release because Offerpad is unable to calculate certain

reconciling items without making unreasonable efforts. These items, which include, but are not limited to, stock-based compensation with respect to future grants and forfeitures, could materially affect the computation of forward-looking net income

(loss), are inherently uncertain and depend on various factors, some of which are outside of Offerpad’s control.

Adjusted Gross Profit,

Contribution Profit, and Contribution Profit After Interest (and related margins)

To provide investors with additional information regarding

Offerpad’s margins, Offerpad has included Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest (and related margins), which are non-GAAP financial measures. Offerpad believes

that Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest are useful financial measures for investors as they are used by management in evaluating unit level economics and operating performance across Offerpad’s

markets. Each of these measures is intended to present the economics related to homes sold during a given period. Offerpad does so by including revenue generated from homes sold (and ancillary services) in the period and only the expenses that are

directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in real estate inventory as of the end of the period presented. Contribution Profit provides

investors a measure to assess Offerpad’s ability to generate returns on homes sold during a reporting period after considering home acquisition costs, renovation and repair costs, and adjusting for holding costs and selling costs. Contribution

Profit After Interest further impacts gross profit by including interest costs (including senior and mezzanine secured credit facilities) attributable to homes sold during a reporting period. Offerpad believes these measures facilitate meaningful

period over period comparisons and illustrate Offerpad’s ability to generate returns on assets sold after considering the costs directly related to the assets sold in a presented period.

Adjusted Gross Profit, Contribution Profit and Contribution Profit After Interest (and related margins) are supplemental measures of Offerpad’s operating

performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in real estate inventory at the end of the period, costs

required to be recorded under GAAP in the same period.

Accordingly, these measures should not be considered in isolation or as a substitute for analysis

of Offerpad’s results as reported under GAAP. Offerpad includes a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit.

Adjusted Gross Profit / Margin

Offerpad calculates Adjusted Gross Profit as gross profit under GAAP adjusted for (1) net real estate inventory valuation adjustment plus

(2) interest expense associated with homes sold in the presented period and recorded in cost of revenue. Net real estate inventory valuation adjustment is calculated by adding back the real estate inventory valuation adjustment charges recorded

during the period on homes that remain in real estate inventory at period end and subtracting the real estate inventory valuation adjustment charges recorded in prior periods on homes sold in the current period. Offerpad defines Adjusted Gross

Margin as Adjusted Gross Profit as a percentage of revenue.

Offerpad views this metric as an important measure of business performance, as it captures

gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit helps management assess performance across the key phases of processing a home (acquisitions, renovations,

and resale) for a specific resale cohort.

Contribution Profit / Margin

Offerpad calculates Contribution Profit as Adjusted Gross Profit, minus (1) direct selling costs incurred on homes sold during the presented period, minus

(2) holding costs incurred in the current period on homes sold during the period recorded in sales, marketing, and operating, minus (3) holding costs incurred in prior periods on homes sold in the current period recorded in sales,

marketing, and operating, plus (4) other income, net which is primarily comprised of interest income earned on our cash and cash equivalents and fair value adjustments of derivative financial instruments. The composition of Offerpad’s

holding costs is described in the footnotes to the reconciliation table below. Offerpad defines Contribution Margin as Contribution Profit as a percentage of revenue.

Offerpad views this metric as an important measure of business performance as it captures the unit level performance isolated to homes sold in a given period

and provides comparability across reporting periods. Contribution Profit helps management assess inflows and outflow directly associated with a specific resale cohort.

Contribution Profit / Margin After Interest

Offerpad

defines Contribution Profit After Interest as Contribution Profit, minus (1) interest expense associated with homes sold in the presented period and recorded in cost of revenue, minus (2) interest expense associated with homes sold in the

presented period, recorded in costs of sales, and previously excluded from Adjusted Gross Profit, and minus (3) interest expense under Offerpad’s senior and mezzanine secured credit facilities incurred on homes sold during the period. This

includes interest expense recorded in prior periods in which the sale occurred. Offerpad’s senior and mezzanine secured credit facilities are secured by their homes in real estate inventory and drawdowns are made on a per-home basis at the time of purchase and are required to be repaid at the time the homes are sold. Offerpad defines Contribution Margin After Interest as Contribution Profit After Interest as a percentage of

revenue.

Offerpad views this metric as an important measure of business performance. Contribution Profit After Interest helps management assess

Contribution Margin performance, per above, when fully burdened with costs of financing.

The following tables present a reconciliation of Offerpad’s

Adjusted Gross (Loss) Profit, Contribution (Loss) Profit and Contribution (Loss) Profit After Interest to Offerpad’s Gross (Loss) Profit, which is the most directly comparable GAAP measure, and Contribution (Loss) Profit Per Home Sold and

Contribution (Loss) Profit After Interest Per Home Sold to Offerpad’s Gross (Loss) Profit Per Home Sold, which is the most directly comparable GAAP measure, for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| (in thousands, except percentages and homes sold, unaudited) |

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| Gross profit (GAAP) |

|

$ |

21,871 |

|

|

$ |

22,595 |

|

|

$ |

22,231 |

|

|

$ |

44,466 |

|

|

$ |

29,516 |

|

| Gross margin |

|

|

8.7 |

% |

|

|

7.9 |

% |

|

|

9.7 |

% |

|

|

8.3 |

% |

|

|

3.5 |

% |

| Homes sold |

|

|

742 |

|

|

|

847 |

|

|

|

650 |

|

|

|

1,589 |

|

|

|

2,259 |

|

| Gross profit per home sold |

|

$ |

29.5 |

|

|

$ |

26.7 |

|

|

$ |

34.2 |

|

|

$ |

28.0 |

|

|

$ |

13.1 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Real estate inventory valuation adjustment - current period (1) |

|

|

544 |

|

|

|

623 |

|

|

|

169 |

|

|

|

683 |

|

|

|

290 |

|

| Real estate inventory valuation adjustment - prior period (2) |

|

|

(540 |

) |

|

|

(645 |

) |

|

|

(13,679 |

) |

|

|

(701 |

) |

|

|

(58,030 |

) |

| Interest expense capitalized (3) |

|

|

1,420 |

|

|

|

1,669 |

|

|

|

1,358 |

|

|

|

3,089 |

|

|

|

6,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross profit (loss) |

|

$ |

23,295 |

|

|

$ |

24,242 |

|

|

$ |

10,079 |

|

|

$ |

47,537 |

|

|

$ |

(22,189 |

) |

| Adjusted gross margin |

|

|

9.3 |

% |

|

|

8.5 |

% |

|

|

4.4 |

% |

|

|

8.9 |

% |

|

|

-2.6 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Direct selling costs (4) |

|

|

(6,461 |

) |

|

|

(6,969 |

) |

|

|

(5,743 |

) |

|

|

(13,430 |

) |

|

|

(23,804 |

) |

| Holding costs on sales - current period

(5)(6) |

|

|

(622 |

) |

|

|

(887 |

) |

|

|

(269 |

) |

|

|

(1,869 |

) |

|

|

(1,811 |

) |

| Holding costs on sales - prior period

(5)(7) |

|

|

(443 |

) |

|

|

(483 |

) |

|

|

(567 |

) |

|

|

(566 |

) |

|

|

(2,158 |

) |

| Other income, net (8) |

|

|

615 |

|

|

|

754 |

|

|

|

965 |

|

|

|

1,369 |

|

|

|

1,247 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contribution profit (loss) |

|

$ |

16,384 |

|

|

$ |

16,657 |

|

|

$ |

4,465 |

|

|

$ |

33,041 |

|

|

$ |

(48,715 |

) |

| Contribution margin |

|

|

6.5 |

% |

|

|

5.8 |

% |

|

|

1.9 |

% |

|

|

6.2 |

% |

|

|

-5.8 |

% |

| Homes sold |

|

|

742 |

|

|

|

847 |

|

|

|

650 |

|

|

|

1,589 |

|

|

|

2,259 |

|

| Contribution profit (loss) per home sold |

|

$ |

22.1 |

|

|

$ |

19.7 |

|

|

$ |

6.9 |

|

|

$ |

20.8 |

|

|

$ |

(21.6 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense capitalized (3) |

|

|

(1,420 |

) |

|

|

(1,669 |

) |

|

|

(1,358 |

) |

|

|

(3,089 |

) |

|

|

(6,035 |

) |

| Interest expense on homes sold - current period

(9) |

|

|

(2,103 |

) |

|

|

(2,521 |

) |

|

|

(1,292 |

) |

|

|

(6,313 |

) |

|

|

(8,631 |

) |

| Interest expense on homes sold - prior period

(10) |

|

|

(2,133 |

) |

|

|

(2,426 |

) |

|

|

(3,708 |

) |

|

|

(2,870 |

) |

|

|

(13,899 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contribution profit (loss) after interest |

|

$ |

10,728 |

|

|

$ |

10,041 |

|

|

$ |

(1,893 |

) |

|

$ |

20,769 |

|

|

$ |

(77,280 |

) |

| Contribution margin after interest |

|

|

4.3 |

% |

|

|

3.5 |

% |

|

|

-0.8 |

% |

|

|

3.9 |

% |

|

|

-9.2 |

% |

| Homes sold |

|

|

742 |

|

|

|

847 |

|

|

|

650 |

|

|

|

1,589 |

|

|

|

2,259 |

|

| Contribution profit (loss) after interest per home sold |

|

$ |

14.5 |

|

|

$ |

11.9 |

|

|

$ |

(2.9 |

) |

|

$ |

13.1 |

|

|

$ |

(34.2 |

) |

| (1) |

Real estate inventory valuation adjustment – current period is the real estate inventory valuation

adjustments recorded during the period presented associated with homes that remain in real estate inventory at period end. |

| (2) |

Real estate inventory valuation adjustment – prior period is the real estate inventory valuation

adjustments recorded in prior periods associated with homes that sold in the period presented. |

| (3) |

Interest expense capitalized represents all interest related costs, including senior and mezzanine secured

credit facilities, incurred on homes sold in the period presented that were capitalized and expensed in cost of sales at the time of sale. |

| (4) |

Direct selling costs represents selling costs incurred related to homes sold in the period presented. This

primarily includes broker commissions and title and escrow closing fees. |

| (5) |

Holding costs primarily include insurance, utilities, homeowners association dues, property taxes, cleaning,

and maintenance costs. |

| (6) |

Represents holding costs incurred on homes sold in the period presented and expensed to Sales, marketing, and

operating on the Condensed Consolidated Statements of Operations. |

| (7) |

Represents holding costs incurred in prior periods on homes sold in the period presented and expensed to Sales,

marketing, and operating on the Condensed Consolidated Statements of Operations. |

| (8) |

Other income, net principally represents interest income earned on our cash and cash equivalents and fair value

adjustments of derivative financial instruments. |

| (9) |

Represents both senior and mezzanine interest expense incurred on homes sold in the period presented and

expensed to interest expense on the Condensed Consolidated Statements of Operations. |

| (10) |

Represents both senior and mezzanine secured credit facilities interest expense incurred in prior periods on

homes sold in the period presented and expensed to interest expense on the Condensed Consolidated Statements of Operations. |

Adjusted

Net Income (Loss) and Adjusted EBITDA

Offerpad also presents Adjusted Net Income (Loss) and Adjusted EBITDA, which are

non-GAAP financial measures, which the management team uses to assess Offerpad’s underlying financial performance. Offerpad believes these measures provide insight into period over period performance,

adjusted for non-recurring or non-cash items.

Offerpad calculates

Adjusted Net Income (Loss) as GAAP Net Income (Loss) adjusted for the change in fair value of warrant liabilities. Offerpad defines Adjusted Net Income (Loss) Margin as Adjusted Net Income (Loss) as a percentage of revenue.

Offerpad calculates Adjusted EBITDA as Adjusted Net Income (Loss) adjusted for interest expense, amortization of capitalized interest, taxes, depreciation and

amortization and stock-based compensation expense. Offerpad defines Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue.

Adjusted Net

Income (Loss) and Adjusted EBITDA are supplemental to Offerpad’s operating performance measures calculated in accordance with GAAP and have important limitations. For example, Adjusted Net Income (Loss) and Adjusted EBITDA exclude the impact of

certain costs required to be recorded under GAAP and could differ substantially from similarly titled measures presented by other companies in Offerpad’s industry or companies in other industries. Accordingly, these measures should not be

considered in isolation or as a substitute for analysis of Offerpad’s results as reported under GAAP.

The following table presents a reconciliation of Offerpad’s Adjusted Net Income (Loss) and Adjusted

EBITDA to their GAAP Net Income (Loss), which is the most directly comparable GAAP measure, for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| (in thousands, except percentages, unaudited) |

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| Net loss (GAAP) |

|

$ |

(13,782 |

) |

|

$ |

(17,515 |

) |

|

$ |

(22,344 |

) |

|

$ |

(31,297 |

) |

|

$ |

(81,791 |

) |

| Net loss margin |

|

|

-5.5 |

% |

|

|

-6.1 |

% |

|

|

-9.7 |

% |

|

|

-5.8 |

% |

|

|

-9.7 |

% |

| Change in fair value of warrant liabilities |

|

|

9 |

|

|

|

(344 |

) |

|

|

(435 |

) |

|

|

(335 |

) |

|

|

(46 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss |

|

$ |

(13,773 |

) |

|

$ |

(17,859 |

) |

|

$ |

(22,779 |

) |

|

$ |

(31,632 |

) |

|

$ |

(81,837 |

) |

| Adjusted net loss margin |

|

|

(5.5% |

) |

|

|

(6.3% |

) |

|

|

(9.9% |

) |

|

|

(5.9% |

) |

|

|

(9.7% |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

4,581 |

|

|

|

4,905 |

|

|

|

1,867 |

|

|

|

9,486 |

|

|

|

9,299 |

|

| Amortization of capitalized interest

(1) |

|

|

1,420 |

|

|

|

1,669 |

|

|

|

1,358 |

|

|

|

3,089 |

|

|

|

6,035 |

|

| Income tax (benefit) expense |

|

|

(54 |

) |

|

|

123 |

|

|

|

43 |

|

|

|

69 |

|

|

|

165 |

|

| Depreciation and amortization |

|

|

148 |

|

|

|

166 |

|

|

|

178 |

|

|

|

314 |

|

|

|

380 |

|

| Amortization of stock-based compensation |

|

|

3,249 |

|

|

|

3,867 |

|

|

|

2,055 |

|

|

|

7,116 |

|

|

|

3,898 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

(4,429 |

) |

|

$ |

(7,129 |

) |

|

$ |

(17,278 |

) |

|

$ |

(11,558 |

) |

|

$ |

(62,060 |

) |

| Adjusted EBITDA margin |

|

|

(1.8% |

) |

|

|

(2.5% |

) |

|

|

(7.5% |

) |

|

|

(2.2% |

) |

|

|

(7.4% |

) |

| (1) |

Amortization of capitalized interest represents all interest related costs, including senior and mezzanine

secured interest related costs, incurred on homes sold in the period presented that were capitalized and expensed in cost of sales at the time of sale. |

Exhibit 99.2 Letter to shareholders Q2 2024

A FEW THOUGHTS FROM BRIAN Dear Shareholders, In the second quarter of

2024, we delivered revenue within our guidance and achieved another quarter of incremental improvement in adjusted EBITDA. Despite the ongoing uncertainty in the macro-economy and real estate market, our disciplined approach to inventory management

has enabled us to navigate the challenging environment effectively, while marching toward sustained profitability. This discipline led to an improved gross margin for the third consecutive quarter of 8.7%. Our strategy of tightly managing our buy

box allows us to adapt quickly to market shifts. Over the last few quarters, in response to the volatile market conditions, we have adjusted our buy box, focusing on higher margins per home rather than volumes of homes. We are leveraging our

renovation expertise to add strategic value to our homes. By increasing our assumed hold times and limiting purchases in areas with high inventory, we are navigating the constraints of the current high-interest rate market. Despite market

conditions, we are proud of our unwavering commitment to providing the best possible experience for our customers. Our Net Promoter Score (NPS) of 73 and Customer Satisfaction (CSAT) score of 93% reflect our dedication to exceptional service and

commitment to our customers. As we anticipate an imminent shift to a market where inventory is less constrained and prices potentially come down – we believe our position as one of the largest home buyers in America gives us a competitive

advantage. We believe this market shift can present significant opportunities for our cash offer business. While we position our cash offer business for a market shift, we continue to grow our asset light platform services. Offerpad Renovate closed

renovation projects increased over 300% compared to the prior year, generating approximately $5 million in revenue. We’re expanding our client base, including newly added partners Freddie Mac and Fannie Mae. We also launched our Reno Captain

technology platform in several markets with plans to roll out the remaining in the third quarter. Reno Captain is being embraced by our B2B customers to enhance transparency and efficiency for them. We are expanding our partnership channels,

including a recent integration with Realtor.com, to provide cash offers directly through their platform. This collaboration has already resulted in thousands of cash offer requests, exceeding our initial expectations. Our revamped Agent Partner

Program (APP) has also shown impressive results, with agent offer requests expanding. In Q2, agent requests represented over 25% of total requests and produced nearly a third of our acquisitions. Looking forward, we continue to focus on our key

strategic imperatives of taking the friction out of real estate, advancing Offerpad’s asset-light businesses and expanding our partner ecosystem. We made progress on all of these in the quarter, while streamlining costs and improving margins.

We are well positioned for sequential improvements in Adjusted EBITDA and cash flow through the end of the year. We are confident that our disciplined, and prepared approach will position Offerpad for sustained profitability in any market condition.

Thank you for your continued support and confidence in Offerpad. We are proud of our team's ability to innovate and navigate short- term challenges while planning for long-term success. Together, we will continue to drive growth and deliver

exceptional value to our shareholders. Sincerely, Brian Bair Chairman & CEO Q2 2024 1

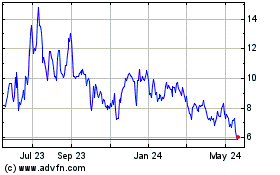

TOTAL REVENUE ($M) & HOMES ACQUIRED $300 1,50 0 $285 $251 1,30 0

$240 $250 $234 $230 1,10 0 $200 930 900 840 831 806 $150 700 678 500 $100 300 $50 100 $0 (1 00) Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 RETURNS PER HOME SOLD Gross Profit per Home Sold Contribution Profit After Interest per Home Sold $40K $35K $30K $25K $20K

$15K $10K $5K $0K -$5K Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q2 2024 2

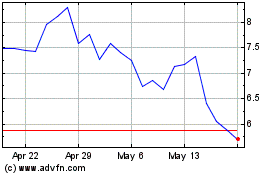

NET INCOME (LOSS), ADJ. NET INCOME (LOSS) & ADJ. EBITDA ($M) Net

Income (Loss) Adj. Net Income (Loss) Adj. EBITDA ($4.4) ($7.0) ($7.1) ($13.3) ($13.8) ($15.3) ($17.5) ($17.3) ($13.8) ($15.4) ($20.0) ($17.9) ($22.3) ($20.1) ($22.8) Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q2 ‘24 TOTAL CONTRIBUTION MARGIN AFTER INTEREST

PER HOME SOLD $33k $(3k) $(11k) $19k $3k $14k $11k Total Contribution Net Sales Holding Selling Contribution Other Contribution Margin After Proceeds Costs Costs Margin Services Margin After Interest Interest See Appendix for a reconciliation to the

most directly comparable GAAP measure and additional information Q2 2024 3

Traction in Renovations Since 2015, Offerpad’s core business model

has been buying, renovating, and selling homes. Delivering efficient and quality renovations has always been a significant contributor to the performance of our portfolio of properties. We are very proud of our commitment to excellence when it comes

to our renovations, considering we utilize in-house talent and vetted external specialists to increase quality and control. OFFERPAD-OWNED PORTFOLIO RENOVATION IMPACT SINCE INCEPTION Q2 2024 ~36k $20k Renovations completed Average cost of

renovations completed +$620m 22 days Invested into improving properties Average time for renovation completion Our expertise in renovations speaks for itself. Over time, investor clients we’ve sold homes to requested we renovate homes they

owned, knowing we deliver efficient and quality renovations. To meet that need, we built Offerpad Renovate , a sophisticated renovation operation that leverages our existing teams and technology, such as Reno Captain, to offer stand-alone renovation

services to clients who need renovations done at scale. This new business allows us to expand our market opportunities outside of just buying and selling homes. 2023 was our flagship year, and we are already building some exciting momentum. OFFERPAD

RENOVATE → THIRD PARTY RENOVATION SERVICES Q2 2024 HIGHLIGHTS 284 20 Total projects completed Markets with projects completed $4.9m 1.8 Total revenue Average days in renovation per $1k spent $17.1k Average revenue per project Q2 2024

4

Q3 2024 Outlook 1 HOMES SOLD REVENUE ADJ. EBITDA 550 to $185m to

Sequential 650 $225m Improvement 1. See Non-GAAP financial measures in Appendix for an explanation of why a reconciliation of this guidance cannot be provided. Q2 2024 5

APPENDIX Forward-Looking Statements Certain statements in this press

release may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Offerpad’s future financial or operating

performance. For example, statements regarding Offerpad’s financial outlook, including homes sold and Adjusted EBITDA, for the second quarter 2024, and expectations regarding profitability, including the timing of reaching sustainable positive

Adjusted EBITDA and cash flow, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,”

“might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to

risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may impact such forward-looking statements include, but are not

limited to, Offerpad’s ability to respond to general economic conditions; the health of the U.S. residential real estate industry; Offerpad’s ability to grow market share in its existing markets or any new markets it may enter;

Offerpad’s ability to manage its growth and its costs structure effectively; Offerpad’s ability to accurately value and manage real estate inventory, maintain an adequate and desirable supply of real estate inventory, and manage

renovations; Offerpad’s ability to successfully launch new product and service offerings, and to manage, develop and refine its technology platform; Offerpad’s ability to maintain and enhance its products and brand, and to attract

customers; Offerpad’s ability to achieve and maintain profitability in the future; and the success of strategic relationships with third parties. These and other important factors discussed under the caption Risk Factors in Offerpad’s

Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission on February 27, 2024, and Offerpad’s other reports filed with the Securities and Exchange Commission could cause actual results

to differ materially from those indicated by the forward-looking statements made in this press release. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Offerpad and its management, are

inherently uncertain. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements

will be achieved. You should not place undue reliance on forward- looking statements, which speak only as of the date they are made. Offerpad undertakes no obligation to update or revise any forward- looking statements, whether as a result of new

information, future events or otherwise, except as may be required under applicable securities laws. Q2 2024 6

APPENDIX OFFERPAD SOLUTIONS INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS Three Months Ended June 30, Six Months Ended June 30, (in thousands, except per share data) 2024 2023 2024 2023 (Unaudited) Revenue $ 251,122 $ 230,147 $ 536,480 $ 839,726 Cost of revenue 229,251 207,916 492,014 810,210 Gross profit

21,871 22,231 44,466 29,516 Operating expenses: Sales, marketing and operating 20,230 29,040 42,682 71,391 General and administrative 10,538 12,713 22,493 27,192 Technology and development 964 2,312 2,737 4,553 Total operating expenses 31,732 44,065

67,912 103,136 Loss from operations (9,861) (21,834) (23,446) (73,620) Other income (expense): Change in fair value of warrant liabilities (9) 435 335 46 Interest expense (4,581) (1,867) (9,486) (9,299) Other income, net 615 965 1,369 1,247 Total

other expense (3,975) (467) (7,782) (8,006) Loss before income taxes (13,836) (22,301) (31,228) (81,626) Income tax benefit (expense) 54 (43) (69) (165) Net loss $ (13,782) $ (22,344) $ (31,297) $ (81,791) Net loss per share, basic $ (0.50) $ (0.82)

$ (1.14) $ (3.21) Net loss per share, diluted $ (0.50) $ (0.82) $ (1.14) $ (3.21) Weighted average common shares outstanding, 27,385 27,258 27,362 25,470 basic Weighted average common shares outstanding, 27,385 27,258 27,362 25,470 diluted Q2 2024

7

APPENDIX OFFERPAD SOLUTIONS INC. CONDENSED CONSOLIDATED BALANCE SHEETS

As of (in thousands, except par value per share) (Unaudited) June 30, 2024 December 31, 2023 ASSETS Current assets: Cash and cash equivalents $ 56,906 $ 75,967 Restricted cash 16,092 3,967 Accounts receivable 6,745 9,935 Real estate inventory

307,750 276,500 Prepaid expenses and other current assets 3,545 5,236 Total current assets 391,038 371,605 Property and equipment, net 4,492 4,517 Other non-current assets 11,095 3,572 TOTAL ASSETS $ 406,625 $ 379,694 LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 2,838 $ 4,946 Accrued and other current liabilities 13,095 13,859 Secured credit facilities and other debt, net 271,887 227,132 Secured credit facilities and other debt - related

party 31,899 30,092 Total current liabilities 319,719 276,029 Warrant liabilities 136 471 Other long-term liabilities 9,203 1,418 Total liabilities 329,058 277,918 Commitments and contingencies Stockholders’ equity: Class A common stock,

$0.0001 par value; 2,000,000 shares authorized; 27,329 and 27,233 shares issued and outstanding as of June 30, 2024 and December 31, 2023, 3 3 respectively Additional paid in capital 506,748 499,660 Accumulated deficit (429,184) (397,887) Total

stockholders’ equity 77,567 101,776 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 406,625 $ 379,694 Q2 2024 8

APPENDIX OFFERPAD SOLUTIONS INC. CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS Six Months Ended June 30, ($ in thousands) (Unaudited) 2024 2023 Cash flows from operating activities: Net loss $ (31,297) $ (81,791) Adjustments to reconcile net loss to net cash (used in) provided by operating activities: Depreciation

314 380 Amortization of debt financing costs 1,153 1,980 Real estate inventory valuation adjustment 1,168 7,454 Stock-based compensation 7,116 3,898 Change in fair value of warrant liabilities (335) (46) Change in fair value of derivative

instruments — 715 Loss on disposal of property and equipment 29 30 Changes in operating assets and liabilities: Accounts receivable 3,190 871 Real estate inventory (32,418) 446,124 Prepaid expenses and other assets 2,091 313 Accounts payable

(2,108) 1,693 Accrued and other liabilities (902) (10,126) Net cash (used in) provided by operating activities (51,999) 371,495 Cash flows from investing activities: Purchases of property and equipment (362) (90) Proceeds from sale of property and

equipment 44 — Purchases of derivative instruments — (1,872) Net cash used in investing activities (318) (1,962) Cash flows from financing activities: Borrowings from credit facilities and other debt 495,955 411,990 Repayments of credit

facilities and other debt (450,546) (889,773) Payment of debt financing costs — (172) Proceeds from exercise of stock options 16 53 Payments for taxes related to stock-based awards (44) (52) Borrowings from warehouse lending facility —

18,488 Repayments of warehouse lending facility — (17,336) Proceeds from issuance of pre-funded warrants — 90,000 Proceeds from exercise of pre-funded warrants — 11 Issuance cost of pre-funded warrants — (784) Net cash

provided by (used in) by financing activities 45,381 (387,575) Net change in cash, cash equivalents and restricted cash (6,936) (18,042) Cash, cash equivalents and restricted cash, beginning of period 79,934 140,299 Cash, cash equivalents and

restricted cash, end of period $ 72,998 122,257 Reconciliation of cash, cash equivalents and restricted cash to the condensed consolidated balance sheet: Cash and cash equivalents $ 56,906 115,599 Restricted cash 16,092 6,658 Total cash, cash

equivalents and restricted cash $ 72,998 122,257 Supplemental disclosure of cash flow information: Cash payments for interest $ 12,624 13,932 Q2 2024 9

APPENDIX Non-GAAP Financial Measures In addition to Offerpad’s

results of operations above, Offerpad reports certain financial measures that are not required by, or presented in accordance with, U.S. generally accepted accounting principles (“GAAP”). These measures have limitations as analytical

tools when assessing Offerpad’s operating performance and should not be considered in isolation or as a substitute for GAAP measures, including gross profit and net income. Offerpad may calculate or present its non-GAAP financial measures

differently than other companies who report measures with similar titles and, as a result, the non-GAAP financial measures Offerpad reports may not be comparable with those of companies in Offerpad’s industry or in other industries. Offerpad

has not provided a quantitative reconciliation of forecasted Adjusted EBITDA to forecasted net income (loss) within this press release because Offerpad is unable to calculate certain reconciling items without making unreasonable efforts. These

items, which include, but are not limited to, stock-based compensation with respect to future grants and forfeitures, could materially affect the computation of forward-looking net income (loss), are inherently uncertain and depend on various

factors, some of which are outside of Offerpad’s control. Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest (and related margins) To provide investors with additional information regarding Offerpad’s

margins, Offerpad has included Adjusted Gross Profit, Contribution Profit, and Contribution Profit After Interest (and related margins), which are non-GAAP financial measures. Offerpad believes that Adjusted Gross Profit, Contribution Profit, and

Contribution Profit After Interest are useful financial measures for investors as they are used by management in evaluating unit level economics and operating performance across Offerpad’s markets. Each of these measures is intended to present

the economics related to homes sold during a given period. Offerpad does so by including revenue generated from homes sold (and ancillary services) in the period and only the expenses that are directly attributable to such home sales, even if such

expenses were recognized in prior periods, and excluding expenses related to homes that remain in real estate inventory as ofthe end of the period presented. Contribution Profit provides investors a measure to assess Offerpad’s ability to

generate returns on homes sold during a reporting period after considering home acquisition costs, renovation and repair costs, and adjusting for holding costs and selling costs. Contribution Profit After Interest further impacts gross profit by

including interest costs (including senior and mezzanine secured credit facilities) attributable to homes sold during a reporting period. Offerpad believes these measures facilitate meaningful period over period comparisons and illustrate

Offerpad’s ability to generate returns on assets sold after considering the costs directly related to the assets sold in a presented period. Adjusted Gross Profit, Contribution Profit and Contribution Profit After Interest (and related

margins) are supplemental measures of Offerpad’s operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes

held in real estate inventory at the end of the period, costs required to be recorded under GAAP in the same period. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of Offerpad’s results as

reported under GAAP. Offerpad includes a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit. Q2 2024 10

APPENDIX Adjusted Gross Profit / Margin Offerpad calculates Adjusted

Gross Profit as gross profit under GAAP adjusted for (1) net real estate inventory valuation adjustment plus (2) interest expense associated with homes sold in the presented period and recorded in cost of revenue. Net real estate inventory valuation

adjustment is calculated by adding back the real estate inventory valuation adjustment charges recorded during the period on homes that remain in real estate inventory at period end and subtracting the real estate inventory valuation adjustment

charges recorded in prior periods on homes sold in the current period. Offerpad defines Adjusted Gross Margin as Adjusted Gross Profit as a percentage of revenue. Offerpad views this metric as an important measure of business performance, as it

captures gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit helps management assess performance across the key phases of processing a home (acquisitions,

renovations, and resale) for a specific resale cohort. Contribution Profit / Margin Offerpad calculates Contribution Profit as Adjusted Gross Profit, minus (1) direct selling costs incurred on homes sold during the presented period, minus (2)

holding costs incurred in the current period on homes sold during the period recorded in sales, marketing, and operating, minus (3) holding costs incurred in prior periods on homes sold in the current period recorded in sales, marketing, and

operating, plus (4) other income, net which is primarily comprised of interest income earned on our cash and cash equivalents and fair value adjustments of derivative financial instruments. The composition of Offerpad’s holding costs is

described in the footnotes to the reconciliation table below. Offerpad defines Contribution Margin as Contribution Profit as a percentage of revenue. Offerpad views this metric as an important measure of business performance as it captures the unit

level performance isolated to homes sold in a given period and provides comparability across reporting periods. Contribution Profit helps management assess inflows and outflow directly associated with a specific resale cohort. Contribution Profit /