0001816708FALSE12/3100018167082023-07-072023-07-070001816708us-gaap:CommonStockMember2023-07-072023-07-070001816708us-gaap:WarrantMember2023-07-072023-07-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 7, 2023

____________________________

OWLET, INC.

(Exact name of registrant as specified in its charter)

____________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-39516 | | 85-1615012 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

3300 North Ashton Boulevard, Suite 300 Lehi, Utah | 84043 |

| (Address of principal executive offices) | (Zip Code) |

(844) 334-5330

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

Class A Common Stock, $0.0001 par value per share | | OWLT | | New York Stock Exchange | |

Warrants to purchase Class A Common Stock | | OWLT WS | | New York Stock Exchange | * |

*On June 15, 2023, Owlet, Inc. (the "Company") was notified by the New York Stock Exchange ("NYSE") that the NYSE had halted trading in the Company’s warrants due to the low trading price of the warrants. On July 5, 2023, the NYSE filed a Form 25 with the Securities and Exchange Commission to delist the warrants.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Item 3.03. Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information set forth under Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On July 7, 2023, Owlet, Inc. (the “Company”) filed with the Secretary of State of the State of Delaware a Certificate of Amendment to its Second Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to effect a one-for-14 reverse stock split (the “Reverse Stock Split”) of the Company’s Class A common stock (the “Common Stock”) and a reduction in the number of authorized shares of Common Stock and authorized but unissued shares of the Company’s preferred stock. The Reverse Stock Split became effective as of 5:00 p.m., Eastern Time, on July 7, 2023. The Common Stock will begin trading on the New York Stock Exchange (“NYSE”) on a split-adjusted basis when markets open on July 10, 2023 under the existing trading symbol “OWLT.” The Common Stock will have a new CUSIP number: 69120X206.

The foregoing description of the Charter Amendment is not complete and is subject to, and qualified in its entirety by, the complete text of the Charter Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference into this Item 5.03.

Item 8.01. Other Events.

On July 7, 2023, the Company issued a press release announcing the effectiveness of the Reverse Stock Split.

A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 8.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 3.1 | | |

| | |

| 99.1 | | |

| |

| 104 | | Cover Page Interactive Data file (the cover page XBRL tags are embedded within the Inline XBRL document). |

Cautionary Note Regarding Forward Looking Statements

This Current Report on Form 8-K contains certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Reverse Stock Split and the timing thereof. In some cases, you can identify forward-looking statements by terms such as “estimate,” “may,” “believes,” “plans,” “expects,” “anticipates,” “intends,” “goal,” “potential,” “upcoming,” “outlook,” “guidance,” the negation thereof, or similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on the Company’s expectations at the time such statements are made, speak only as of the dates they are made and are susceptible to a number of risks, uncertainties and other factors. For all such forward-looking statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. The Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by our forward-looking statements. Many important factors could affect the Company’s future results and cause those results to differ materially from those expressed in or implied by the Company’s forward-looking statements. Such factors include, but are not limited to, the Company’s ability to regain compliance with the continued listing standards of the NYSE, market conditions and their impact on the trading price of the Company’s common stock and other risks and uncertainties set forth in the Company’s other releases, public statements and filings with the U.S. Securities and Exchange Commission, including those identified in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 and as any such factors may be updated from time to time in the Company’s other filings with the SEC. All such forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Moreover, the Company operates in an evolving environment. New risk factors and uncertainties may emerge from time to time, and factors that the

Company currently deems immaterial may become material, and it is impossible for the Company to predict such events or how they may affect the Company. Except as required by law, the Company assumes no obligation to update any forward-looking statements after the date of this Current Report on Form 8-K, whether because of new information, future events or otherwise, although the Company may do so from time to time. The Company does not endorse any projections regarding future performance that may be made by third parties.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Owlet, Inc. |

| | |

| Date: July 7, 2023 | By: | /s/ Kathryn R. Scolnick |

| Name: | Kathryn R. Scolnick |

| Title: | Chief Financial Officer |

CERTIFICATE OF AMENDMENT

TO

SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

OWLET, INC.

Owlet, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify as follows:

FIRST: That the first paragraph of Article IV of the Second Amended and Restated Certificate of Incorporation of the Corporation, as amended and/or restated to date, be, and hereby is, amended and restated in its entirety to read as follows:

“The Corporation is authorized to issue two classes of stock to be designated, respectively, “Class A Common Stock” and “Preferred Stock.” The total number of shares of capital stock which the Corporation shall have authority to issue is 117,883,928. The total number of shares of Class A Common Stock that the Corporation is authorized to issue is 107,142,857, having a par value of $0.0001 per share, and the total number of shares of Preferred Stock that the Corporation is authorized to issue is 10,741,071, having a par value of $0.0001 per share. Upon this Certificate of Amendment to Second Amended and Restated Certificate of Incorporation of the Corporation becoming effective pursuant to the General Corporation Law of the State of Delaware (the “Effective Time”), the shares of Class A Common Stock issued and outstanding immediately prior to the Effective Time (the “Old Class A Common Stock”) shall be reclassified, combined and reconstituted into a different number of shares of Class A Common Stock (the “New Class A Common Stock”) such that each 14 shares of Old Class A Common Stock (the “Split Ratio”) shall, at the Effective Time, be automatically reclassified, combined and reconstituted into one share of New Class A Common Stock (such reclassification, combination and reconstitution of shares, the “Reverse Stock Split”). No fractional shares of Class A Common Stock shall be issued as a result of the Reverse Stock Split. In lieu thereof, (a) with respect to holders of one or more certificates, if any, which formerly represented shares of Old Class A Common Stock that were issued and outstanding immediately prior to the Effective Time, upon surrender after the Effective Time of such certificate or certificates, any holder who would otherwise be entitled to a fractional share of Class A Common Stock as a result of the Reverse Stock Split, following the Effective Time, shall be entitled to receive a cash payment (the “Fractional Share Payment”) equal to the fraction of which such holder would otherwise be entitled multiplied by the closing price per share on the trading day immediately preceding the Effective Time as reported by The New York Stock Exchange (as adjusted to give effect to the Reverse Stock Split); provided that, whether or not fractional shares would be issuable as a result of the Reverse Stock Split shall be determined on the basis of (i) the total number of shares of Old Class A Common Stock that were issued and outstanding immediately prior to the Effective Time formerly represented by certificates that the holder is at the time surrendering and (ii) the aggregate number of shares of New Class A Common Stock after the Effective Time into which the shares of Old Class A Common Stock formerly represented by such

certificates shall have been reclassified, combined and reconstituted; and (b) with respect to holders of shares of Old Class A Common Stock in book-entry form in the records of the Corporation’s transfer agent that were issued and outstanding immediately prior to the Effective Time, any holder who would otherwise be entitled to a fractional share of Class A Common Stock as a result of the Reverse Stock Split (after aggregating all fractional shares), following the Effective Time, shall be entitled to receive the Fractional Share Payment automatically and without any action by the holder. Any stock certificate and book-entry position that, immediately prior to the Effective Time, represented shares of the Old Class A Common Stock will, from and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent the number of shares of the New Class A Common Stock equal to the product obtained by multiplying the number of shares of Old Class A Common Stock represented by such certificate or book-entry position immediately prior to the Effective Time by one divided by the Split Ratio.”

SECOND: That, at a meeting of stockholders of the Corporation, the aforesaid amendment was duly adopted by the stockholders of the Corporation.

THIRD: That the aforesaid amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

FOURTH: This Certificate of Amendment will become effective at 5:00 p.m., Eastern Time, on the date this Certificate of Amendment is filed with the Secretary of State of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its President and Chief Executive Officer on this 7th day of July 2023.

| | | | | | | | |

| OWLET, INC. |

| By: | /s/ Kurt Workman |

| | Kurt Workman |

| | President and Chief Executive Officer |

OWLET, INC. ANNOUNCES

1-FOR-14 REVERSE STOCK SPLIT WILL BECOME EFFECTIVE

The Company’s Class A common stock will begin trading on a split-adjusted basis on July 10, 2023

Lehi, UT, July 7, 2023 – Owlet, Inc. (NYSE: OWLT) (“Owlet” or the “Company”) today announced that the previously announced 1-for-14 reverse stock split (“Reverse Split”) of its Class A common stock, $0.0001 par value per share (“Common Stock”), will become effective at 5:00 p.m. EDT today, July 7, 2023. The shares of the Company’s Common Stock will begin trading on the New York Stock Exchange (“NYSE”) on a split-adjusted basis when markets open on Monday, July 10, 2023 under the existing trading symbol “OWLT” and new CUSIP number: 69120X206.

The Company expects that the Reverse Split will allow the Company to regain compliance with the $1.00 minimum average closing price requirement of the NYSE.

The Reverse Split will reduce the number of issued and outstanding shares of Common Stock from approximately 118,078,000 to approximately 8,434,142. The number of authorized shares of Common Stock will be reduced from 1,000,000,000 shares to 107,142,857 shares, which reflects a reduction to 1.5 times the current number of authorized shares of Common Stock, divided by the Reverse Split ratio. The 30,000 shares of Series A convertible preferred stock currently issued and outstanding will not be reduced by the Reverse Split, but the rate at which these shares are convertible into Common Stock will be adjusted in accordance with the Certificate of Designation for the Series A convertible preferred stock. The Reverse Split will also reduce the number of authorized but unissued shares of preferred stock from 99,970,000 shares to 10,711,071 shares, which reflects a reduction to 1.5 times the current number of authorized but unissued shares of preferred stock, divided by the Reverse Split ratio. All other outstanding options, warrants, and other securities entitling their holders to purchase or otherwise receive shares of Common Stock will be adjusted as a result of the Reverse Split, as required by the terms of each security. The number of shares available to be awarded under the Company’s equity incentive plans will also be appropriately adjusted. Following the Reverse Split, the par value of the Common Stock will remain unchanged at $0.0001 par value per share. No fractional shares will be issued in connection with the Reverse Split, and stockholders who would otherwise be entitled to receive a fractional share will instead receive a cash payment equal to the fraction of a share of Common Stock in lieu of such fractional share.

Additional information regarding the Reverse Split is available in the Company’s definitive proxy statement originally filed with the U.S. Securities and Exchange Commission (SEC) on May 12, 2023.

About Owlet, Inc.

Owlet was founded by a team of parents in 2012. Owlet’s mission is to empower parents with the right information at the right time, to give them more peace of mind and help them find more joy in the journey of parenting. Owlet’s digital parenting platform aims to give parents real-time data and insights to help parents feel calmer and more confident. Owlet believes that every parent deserves peace of mind and the opportunity to feel their well-rested best. Owlet also believes that every child deserves to live a long, happy, and healthy life, and is working to develop products to help further that belief. To learn more, visit www.owletcare.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including,

without limitation, statements regarding the Reverse Split and the timing thereof and expectations with respect to the Company’s compliance with the minimum average closing price required for continued listing on the NYSE. In some cases, you can identify forward-looking statements by terms such as “estimate,” “may,” “believes,” “plans,” “expects,” “anticipates,” “intends,” “goal,” “potential,” “upcoming,” “outlook,” “guidance,” the negation thereof, or similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on the Company’s expectations at the time such statements are made, speak only as of the dates they are made and are susceptible to a number of risks, uncertainties and other factors. For all such forward-looking statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. The Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by our forward-looking statements. Many important factors could affect the Company’s future results and cause those results to differ materially from those expressed in or implied by the Company’s forward-looking statements. Such factors include, but are not limited to, the Company’s ability to regain compliance with the continued listing standards of the NYSE, market conditions and their impact on the trading price of our common stock and other risks and uncertainties set forth in the Company’s other releases, public statements and filings with the U.S. Securities and Exchange Commission, including those identified in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 and as any such factors may be updated from time to time in the Company’s other filings with the SEC. All such forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Moreover, the Company operates in an evolving environment. New risk factors and uncertainties may emerge from time to time, and factors that the Company currently deems immaterial may become material, and it is impossible for the Company to predict such events or how they may affect Owlet. Except as required by law, the Company assumes no obligation to update any forward-looking statements after the date of this press release, whether because of new information, future events or otherwise, although Owlet may do so from time to time. The Company does not endorse any projections regarding future performance that may be made by third parties.

Contacts

Investors and Media

Mike Cavanaugh Westwicke/ICR

Phone: +1.617.877.9641

mike.cavanaugh@westwicke.com

v3.23.2

Cover

|

Jul. 07, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 07, 2023

|

| Entity Registrant Name |

OWLET, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39516

|

| Entity Tax Identification Number |

85-1615012

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Lehi

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84043

|

| City Area Code |

844

|

| Local Phone Number |

334-5330

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001816708

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Entity Address, Address Line One |

3300 North Ashton Boulevard

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

OWLT

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Class A Common Stock

|

| Trading Symbol |

OWLT WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

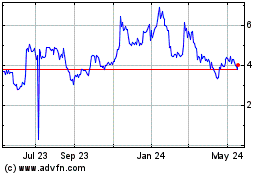

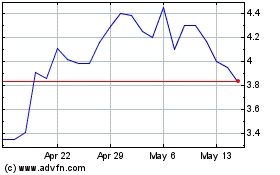

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From Apr 2024 to May 2024

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

From May 2023 to May 2024