false00018167082023Q212/310.07100018167082023-01-012023-06-3000018167082023-08-10xbrli:shares00018167082023-06-30iso4217:USD00018167082022-12-310001816708us-gaap:ConvertiblePreferredStockMember2022-12-31iso4217:USDxbrli:shares0001816708us-gaap:ConvertiblePreferredStockMember2023-06-3000018167082023-04-012023-06-3000018167082022-04-012022-06-3000018167082022-01-012022-06-300001816708us-gaap:SeriesAPreferredStockMember2021-12-310001816708us-gaap:CommonStockMember2021-12-310001816708us-gaap:AdditionalPaidInCapitalMember2021-12-310001816708us-gaap:RetainedEarningsMember2021-12-3100018167082021-12-310001816708us-gaap:CommonStockMember2022-01-012022-03-310001816708us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100018167082022-01-012022-03-310001816708us-gaap:RetainedEarningsMember2022-01-012022-03-310001816708us-gaap:SeriesAPreferredStockMember2022-03-310001816708us-gaap:CommonStockMember2022-03-310001816708us-gaap:AdditionalPaidInCapitalMember2022-03-310001816708us-gaap:RetainedEarningsMember2022-03-3100018167082022-03-310001816708us-gaap:CommonStockMember2022-04-012022-06-300001816708us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001816708us-gaap:RetainedEarningsMember2022-04-012022-06-300001816708us-gaap:SeriesAPreferredStockMember2022-06-300001816708us-gaap:CommonStockMember2022-06-300001816708us-gaap:AdditionalPaidInCapitalMember2022-06-300001816708us-gaap:RetainedEarningsMember2022-06-3000018167082022-06-300001816708us-gaap:SeriesAPreferredStockMember2022-12-310001816708us-gaap:CommonStockMember2022-12-310001816708us-gaap:AdditionalPaidInCapitalMember2022-12-310001816708us-gaap:RetainedEarningsMember2022-12-310001816708us-gaap:SeriesAPreferredStockMember2023-01-012023-03-310001816708us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100018167082023-01-012023-03-310001816708us-gaap:SeriesAPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001816708us-gaap:CommonStockMember2023-01-012023-03-310001816708us-gaap:RetainedEarningsMember2023-01-012023-03-310001816708us-gaap:SeriesAPreferredStockMember2023-03-310001816708us-gaap:CommonStockMember2023-03-310001816708us-gaap:AdditionalPaidInCapitalMember2023-03-310001816708us-gaap:RetainedEarningsMember2023-03-3100018167082023-03-310001816708us-gaap:SeriesAPreferredStockMember2023-04-012023-06-300001816708us-gaap:SeriesAPreferredStockMemberus-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001816708us-gaap:CommonStockMember2023-04-012023-06-300001816708us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001816708us-gaap:RetainedEarningsMember2023-04-012023-06-300001816708us-gaap:SeriesAPreferredStockMember2023-06-300001816708us-gaap:CommonStockMember2023-06-300001816708us-gaap:AdditionalPaidInCapitalMember2023-06-300001816708us-gaap:RetainedEarningsMember2023-06-300001816708us-gaap:SubsequentEventMember2023-07-072023-07-07xbrli:pure0001816708owlt:ToolingAndManufacturingEquipmentMember2023-06-300001816708owlt:ToolingAndManufacturingEquipmentMember2022-12-310001816708us-gaap:FurnitureAndFixturesMember2023-06-300001816708us-gaap:FurnitureAndFixturesMember2022-12-310001816708us-gaap:ComputerEquipmentMember2023-06-300001816708us-gaap:ComputerEquipmentMember2022-12-310001816708us-gaap:SoftwareDevelopmentMember2023-06-300001816708us-gaap:SoftwareDevelopmentMember2022-12-310001816708us-gaap:LeaseholdImprovementsMember2023-06-300001816708us-gaap:LeaseholdImprovementsMember2022-12-310001816708us-gaap:PropertyPlantAndEquipmentMember2023-04-012023-06-300001816708us-gaap:PropertyPlantAndEquipmentMember2022-04-012022-06-300001816708owlt:ToolingAndManufacturingEquipmentMember2023-04-012023-06-300001816708owlt:ToolingAndManufacturingEquipmentMember2022-04-012022-06-300001816708us-gaap:PropertyPlantAndEquipmentMember2023-01-012023-06-300001816708us-gaap:PropertyPlantAndEquipmentMember2022-01-012022-06-300001816708owlt:ToolingAndManufacturingEquipmentMember2023-01-012023-06-300001816708owlt:ToolingAndManufacturingEquipmentMember2022-01-012022-06-300001816708owlt:CustomersForWhichReturnsAreExpectedToBeReceivedMember2023-06-300001816708owlt:CustomersForWhichReturnsAreExpectedToBeReceivedMember2022-12-310001816708srt:MinimumMember2023-06-300001816708srt:MaximumMember2023-06-300001816708owlt:TermNotePayableToSvbMember2023-06-300001816708owlt:TermNotePayableToSvbMember2022-12-310001816708owlt:TotalFinancedInsurancePremiumMember2023-06-300001816708owlt:TotalFinancedInsurancePremiumMember2022-12-310001816708owlt:SVBWarrantsMember2023-03-270001816708us-gaap:LineOfCreditMember2023-06-300001816708owlt:StreamlinePeriodInEffectMemberus-gaap:LineOfCreditMembersrt:MaximumMember2023-06-300001816708owlt:StreamlinePeriodInEffectMemberus-gaap:PrimeRateMemberus-gaap:LineOfCreditMembersrt:MaximumMember2023-06-300001816708owlt:TermLoanMember2022-11-230001816708owlt:TermLoanMember2023-06-300001816708us-gaap:LineOfCreditMembersrt:MaximumMemberowlt:StreamlinePeriodNotInEffectMember2023-06-300001816708us-gaap:PrimeRateMemberus-gaap:LineOfCreditMembersrt:MaximumMemberowlt:StreamlinePeriodNotInEffectMember2023-06-300001816708owlt:FinancedInsurancePremiumOneMember2022-07-012022-07-31owlt:payment0001816708owlt:FinancedInsurancePremiumTwoMember2022-10-012022-10-310001816708us-gaap:SubsequentEventMemberowlt:FinancedInsurancePremiumOneMember2023-07-012023-07-3100018167082023-02-2800018167082021-11-012021-11-30owlt:claim0001816708us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001816708us-gaap:PerformanceSharesMember2023-01-012023-06-300001816708us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001816708us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001816708us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001816708us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001816708us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-06-300001816708us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001816708us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300001816708us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001816708us-gaap:SellingAndMarketingExpenseMember2022-01-012022-06-300001816708us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001816708us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001816708us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001816708us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001816708us-gaap:SoftwareDevelopmentMember2022-04-012022-06-300001816708us-gaap:SoftwareDevelopmentMember2022-01-012022-06-300001816708us-gaap:SoftwareDevelopmentMember2023-01-012023-06-300001816708us-gaap:SoftwareDevelopmentMember2023-04-012023-06-300001816708us-gaap:RestrictedStockUnitsRSUMember2023-06-300001816708us-gaap:PerformanceSharesMember2023-06-300001816708us-gaap:ConvertiblePreferredStockMember2023-02-170001816708owlt:February2023WarrantsMember2023-02-170001816708owlt:February2023WarrantsMember2023-02-172023-02-170001816708owlt:February2023WarrantsMember2023-01-012023-06-300001816708us-gaap:ConvertiblePreferredStockMember2023-04-012023-06-300001816708owlt:PublicSharesMemberus-gaap:IPOMember2020-09-172020-09-170001816708us-gaap:IPOMemberowlt:PublicWarrantMember2020-09-170001816708owlt:PrivatePlacementWarrantMember2020-09-170001816708owlt:SBGPublicWarrantsMember2022-12-310001816708owlt:SBGPublicWarrantsMember2023-01-012023-06-300001816708owlt:SBGPublicWarrantsMember2023-06-300001816708owlt:SBGPrivateWarrantsMember2022-12-310001816708owlt:SBGPrivateWarrantsMember2023-01-012023-06-300001816708owlt:SBGPrivateWarrantsMember2023-06-300001816708owlt:February2023WarrantsMember2022-12-310001816708owlt:February2023WarrantsMember2023-06-300001816708owlt:SVBWarrantsMember2022-12-310001816708owlt:SVBWarrantsMember2023-01-012023-06-300001816708owlt:SVBWarrantsMember2023-06-300001816708us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-06-300001816708us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-06-300001816708us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2023-06-300001816708us-gaap:MoneyMarketFundsMember2023-06-300001816708us-gaap:FairValueInputsLevel1Member2023-06-300001816708us-gaap:FairValueInputsLevel2Member2023-06-300001816708us-gaap:FairValueInputsLevel3Member2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:FairValueInputsLevel2Member2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:FairValueInputsLevel3Member2023-06-300001816708owlt:SBGPublicWarrantsMember2023-06-300001816708owlt:SBGPrivateWarrantsMemberus-gaap:FairValueInputsLevel1Member2023-06-300001816708us-gaap:FairValueInputsLevel2Memberowlt:SBGPrivateWarrantsMember2023-06-300001816708owlt:SBGPrivateWarrantsMemberus-gaap:FairValueInputsLevel3Member2023-06-300001816708owlt:SBGPrivateWarrantsMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:FairValueInputsLevel1Member2023-06-300001816708us-gaap:FairValueInputsLevel2Memberowlt:February2023WarrantsMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:FairValueInputsLevel3Member2023-06-300001816708owlt:February2023WarrantsMember2023-06-300001816708us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001816708us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001816708us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001816708us-gaap:MoneyMarketFundsMember2022-12-310001816708us-gaap:FairValueInputsLevel1Member2022-12-310001816708us-gaap:FairValueInputsLevel2Member2022-12-310001816708us-gaap:FairValueInputsLevel3Member2022-12-310001816708owlt:SBGPublicWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001816708owlt:SBGPublicWarrantsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001816708owlt:SBGPublicWarrantsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001816708owlt:SBGPublicWarrantsMember2022-12-310001816708owlt:SBGPrivateWarrantsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001816708us-gaap:FairValueInputsLevel2Memberowlt:SBGPrivateWarrantsMember2022-12-310001816708owlt:SBGPrivateWarrantsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001816708owlt:SBGPrivateWarrantsMember2022-12-310001816708owlt:SBGPublicWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-06-300001816708owlt:SBGPublicWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-02-170001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-02-170001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-02-170001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-02-170001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-06-300001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-02-170001816708owlt:February2023WarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-06-300001816708owlt:February2023WarrantsMember2022-12-310001816708owlt:February2023WarrantsMember2023-01-012023-06-300001816708owlt:SVBWarrantsMemberus-gaap:MeasurementInputSharePriceMember2023-03-270001816708owlt:SVBWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2023-03-270001816708owlt:SVBWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-03-270001816708owlt:SVBWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-03-270001816708owlt:SVBWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-03-270001816708us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001816708owlt:OldOwletMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001816708us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001816708us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001816708us-gaap:PerformanceSharesMember2023-01-012023-06-300001816708us-gaap:PerformanceSharesMember2022-01-012022-06-300001816708us-gaap:EmployeeStockMember2023-01-012023-06-300001816708us-gaap:EmployeeStockMember2022-01-012022-06-300001816708owlt:CommonStockWarrantsMember2023-01-012023-06-300001816708owlt:CommonStockWarrantsMember2022-01-012022-06-300001816708us-gaap:ConvertiblePreferredStockMember2023-01-012023-06-300001816708us-gaap:ConvertiblePreferredStockMember2022-01-012022-06-300001816708owlt:OldOwletMember2022-01-012022-06-30owlt:segment0001816708country:US2023-04-012023-06-300001816708country:US2022-04-012022-06-300001816708country:US2023-01-012023-06-300001816708country:US2022-01-012022-06-300001816708us-gaap:NonUsMember2023-04-012023-06-300001816708us-gaap:NonUsMember2022-04-012022-06-300001816708us-gaap:NonUsMember2023-01-012023-06-300001816708us-gaap:NonUsMember2022-01-012022-06-300001816708country:US2023-06-300001816708country:US2022-12-310001816708us-gaap:NonUsMember2023-06-300001816708us-gaap:NonUsMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________________________________________________________________

FORM 10-Q

____________________________________________________________________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission File Number: 001-39516

_____________________________________________

OWLET, INC.

(Exact Name of Registrant as Specified in its Charter)

_____________________________________________

| | | | | |

| Delaware | 85-1615012 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

3300 North Ashton Boulevard, Suite 300 Lehi, Utah | 84043 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (844) 334-5330

_____________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

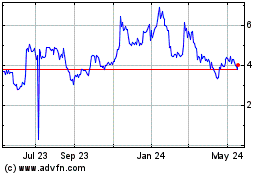

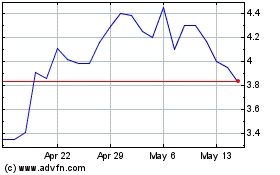

| Class A Common Stock, $0.0001 par value per share | | OWLT | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | x | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 10, 2023, the registrant had 8,477,224 shares of common stock, $0.0001 par value per share, outstanding.

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains certain statements that are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Reform Act"). All statements other than statements of historical facts contained in this Report, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Report and are subject to a number of risks, uncertainties and assumptions described under the sections in this Report and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the "Form 10-K") entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in this Report and our Form 10-K. These forward-looking statements are subject to numerous risks, including, without limitation, the following:

• our limited operating history;

• our history of net losses and our ability to achieve or maintain profitability;

•the impact of the warning letter, dated October 1, 2021, from the United States Food and Drug Administration (the “FDA”), later corrected in an amendment to such letter dated October 5, 2021 (the letter and amendment collectively, the “Warning Letter”) the subsequent suspension of distribution of the Owlet Smart Sock (the “Smart Sock”) in the U.S. and our ability to obtain necessary marketing authorization for the medical device features of the Owlet Dream Sock (the “Dream Sock”) and the Smart Sock where required;

•our ability to implement processes, procedures and operations necessary to market and sell medical devices

•our ability to grow and manage growth profitably, which may be affected by, among other things, our capital resources, inflation, recession, competition and the impact of discretionary consumer spending, retail sector and demographic trends, employee availability and other economic, business and regulatory conditions;

•our ability to enhance future operating and financial results and continue as a going concern;

•our ability to obtain additional financing in the future;

•risks associated with our current loan and debt agreements, including compliance with debt covenants, restrictions on our access to capital, the impact of our overall debt levels and our ability to generate sufficient future cash flows from operations to meet our debt service obligations and operate our business;

•our business strategies and plans and our ability to pursue and implement our strategic initiatives, reduce costs and grow revenues, as well as innovate existing products, continue developing new products, meet evolving customer demands and adapt to changes in consumer preferences and retail trends;

•the regulatory pathway for our products and communications from regulators, including the FDA and similar regulators outside of the United States, as well as legal proceedings, regulatory disputes and governmental inquiries;

•our ability to acquire, defend and protect our intellectual property and satisfy regulatory requirements, including but not limited to laws and requirements concerning privacy and data protection, privacy or data breaches, data loss and other risks associated with our digital platform and technologies;

•any defects in new products or enhancements to existing products;

•our ability to obtain and maintain regulatory approval or certification for our products, and any related restrictions and limitations of any approved or certified product;

•expectations regarding developments with regulatory bodies, and the timeline for related submissions by us and decisions by the regulatory bodies and notified bodies (including UK approved bodies);

•our ability to hire, retain, manage and motivate employees, including key personnel;

•our ability to upgrade and maintain our information technology systems;

•changes in and our compliance with laws and regulations applicable to our business;

•our ability to maintain our listing on The New York Stock Exchange ("NYSE"); and

•the impact and disruption to our business, financial condition, results of operations, supply chain constraints and logistics due to economic and other conditions beyond our control, such as health epidemics or pandemics, macro-economic uncertainties, social unrest, hostilities, natural disasters or other catastrophic events.

These risks and other important factors, including those discussed in this Report, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and

uncertainties. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included elsewhere in this Report are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from the forward-looking statements included elsewhere in this Report. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements included elsewhere in this Report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Report speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this Report. For all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Reform Act.

As used in this Report, unless otherwise stated or the context otherwise requires: “we,” “us,” “our,” “Owlet,” the “Company,” and similar references refer to Owlet, Inc. and its subsidiaries, “common stock” refers to our Class A common stock.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Owlet, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | |

| Assets | | June 30, 2023 | | December 31, 2022 |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 24,746 | | | $ | 11,231 | |

Accounts receivable, net of allowance for doubtful accounts of $2,898 and $3,013, respectively | | 12,978 | | | 15,958 | |

| Inventory | | 12,389 | | | 18,515 | |

| Prepaid expenses and other current assets | | 1,633 | | | 5,558 | |

| Total current assets | | 51,746 | | | 51,262 | |

| Property and equipment, net | | 609 | | | 1,108 | |

| Right of use assets, net | | 1,639 | | | 2,260 | |

| Intangible assets, net | | 2,253 | | | 2,279 | |

| Other assets | | 1,017 | | | 1,195 | |

| Total assets | | $ | 57,264 | | | $ | 58,104 | |

| Liabilities, Convertible Preferred Stock, and Stockholders’ Deficit | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 22,758 | | | $ | 30,432 | |

| Accrued and other expenses | | 11,205 | | | 19,984 | |

| Current portion of deferred revenues | | 1,036 | | | 1,148 | |

| Line of credit | | 8,176 | | 4,685 | |

| Current portion of long-term debt | | 5,204 | | 10,353 | |

| Total current liabilities | | 48,379 | | | 66,602 | |

| Long-term debt, net | | 2,000 | | | — | |

| Noncurrent lease liabilities | | 265 | | | 1,162 | |

| Common stock warrant liabilities | | 26,574 | | | 724 | |

| Other long-term liabilities | | 1,769 | | | 251 | |

| Total liabilities | | 78,987 | | | 68,739 | |

Commitments and contingencies (Note 5) | | | | |

Series A convertible preferred stock, $0.0001 par value, 10,741,071 shares authorized as of June 30, 2023 and December 31, 2022; 30,000 and 0 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively (liquidation preference of $30,000) | | 5,593 | | | — | |

| Stockholders’ equity (deficit): | | | | |

Common stock, $0.0001 par value, 107,142,857 shares authorized as of June 30, 2023 and December 31, 2022; 8,441,683 and 8,242,009 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively. | | 1 | | | 1 | |

| Additional paid-in capital | | 215,775 | | | 212,122 | |

| Accumulated deficit | | (243,092) | | | (222,758) | |

| Total stockholders’ deficit | | (27,316) | | | (10,635) | |

| Total liabilities, convertible preferred stock, and stockholders’ deficit | | $ | 57,264 | | | $ | 58,104 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Owlet, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 13,088 | | | $ | 18,348 | | | $ | 23,824 | | | $ | 39,887 | |

| Cost of revenues | 7,855 | | | 11,726 | | | 14,438 | | | 24,507 | |

| Gross profit | 5,233 | | | 6,622 | | | 9,386 | | | 15,380 | |

| Operating expenses: | | | | | | | |

| General and administrative | 6,124 | | | 9,492 | | | 14,990 | | | 19,769 | |

| Sales and marketing | 3,078 | | | 9,723 | | | 6,431 | | | 21,354 | |

| Research and development | 2,745 | | | 7,770 | | | 5,635 | | | 16,315 | |

| Total operating expenses | 11,947 | | | 26,985 | | | 27,056 | | | 57,438 | |

| Operating loss | (6,714) | | | (20,363) | | | (17,670) | | | (42,058) | |

| Other (expense) income: | | | | | | | |

| Interest expense, net | (52) | | | (203) | | | (2,864) | | | (429) | |

| Common stock warrant liability adjustment | (1,629) | | | 8,811 | | | 283 | | | 1,935 | |

| Other (expense) income, net | (67) | | | 63 | | | (78) | | | 109 | |

| Total other (expense) income, net | (1,748) | | | 8,671 | | | (2,659) | | | 1,615 | |

| Loss before income tax provision | (8,462) | | | (11,692) | | | (20,329) | | | (40,443) | |

| Income tax provision | (5) | | | (26) | | | (5) | | | (33) | |

| Net loss and comprehensive loss | (8,467) | | | (11,718) | | | (20,334) | | | (40,476) | |

| Accretion on Series A convertible preferred stock | (1,326) | | | — | | | (1,979) | | | — | |

| Net loss attributable to common stockholders | $ | (9,793) | | | $ | (11,718) | | | $ | (22,313) | | | $ | (40,476) | |

| Net loss per share attributable to common stockholders, basic and diluted | $ | (1.19) | | | $ | (1.48) | | | $ | (2.73) | | | $ | (5.12) | |

| Weighted-average number of shares outstanding used to compute net loss per share attributable to common stockholders, basic and diluted | 8,213,247 | | | 7,915,156 | | | 8,162,102 | | | 7,899,959 | |

| | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Owlet, Inc.

Condensed Consolidated Statements of Convertible Preferred Stock and Stockholders’ Equity (Deficit)

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A Convertible Preferred Stock | | Common Stock | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-in

Capital | | Accumulated

Deficit | | Total Stockholders'

Equity (Deficit) |

Balance as of December 31, 2021 | — | | | $ | — | | | 8,071,183 | | | $ | 1 | | | $ | 198,612 | | | $ | (143,422) | | | $ | 55,191 | |

| Issuance of common stock upon exercise of stock options | — | | | — | | | 6,343 | | | — | | 48 | | — | | 48 |

| Issuance of common stock for restricted stock units vesting | — | | | — | | | 22,935 | | | — | | — | | — | | — |

| Share-based compensation | — | | | — | | | — | | | — | | 3,336 | | — | | 3,336 |

| Net loss | — | | | — | | | — | | | — | | — | | | (28,758) | | | (28,758) | |

| Balance as of March 31, 2022 | — | | | $ | — | | | 8,100,461 | | | $ | 1 | | | $ | 201,996 | | | $ | (172,180) | | | $ | 29,817 | |

| Issuance of common stock upon exercise of stock options | — | | | — | | | 29,866 | | | — | | | 166 | | | — | | | 166 | |

| Issuance of common stock for restricted stock units vesting | — | | | — | | | 16,454 | | | — | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 3,273 | | | — | | | 3,273 | |

| Net loss | — | | | — | | | — | | | — | | — | | (11,718) | | (11,718) |

| Balance as of June 30, 2022 | — | | | $ | — | | | 8,146,781 | | | $ | 1 | | | $ | 205,435 | | | $ | (183,898) | | | $ | 21,538 | |

Owlet, Inc.

Condensed Consolidated Statements of Convertible Preferred Stock and Stockholders’ Equity (Deficit) (Continued)

(in thousands, except share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Series A Convertible Preferred Stock | | Common Stock | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid-in

Capital | | Accumulated

Deficit | | Total Stockholders'

Equity (Deficit) |

| Balance as of December 31, 2022 | — | | | — | | | 8,242,009 | | | 1 | | | 212,122 | | | (222,758) | | | (10,635) | |

| Issuance of Series A convertible preferred stock | 30,000 | | | 3,867 | | | — | | | — | | | — | | | — | | | — | |

| Preferred stock issuance costs | — | | | (253) | | | — | | | — | | | — | | | — | | | — | |

| Accretion on Series A convertible preferred stock | — | | | 653 | | | — | | | — | | | (653) | | | — | | | (653) | |

| Issuance of SVB Warrants (Note 4) | — | | | — | | | — | | | — | | | 43 | | | — | | | 43 | |

| Issuance of common stock upon exercise of stock options | — | | | — | | | 18,054 | | | — | | | 55 | | | — | | | 55 | |

| Issuance of common stock for restricted stock units vesting | — | | | — | | | 115,257 | | | — | | | — | | | — | | | — | |

| Issuance of common stock for employee stock purchase plan | — | | | — | | | 15,104 | | | — | | | 101 | | | — | | | 101 | |

| Share-based compensation | — | | | — | | | — | | | — | | | 2,789 | | | — | | | 2,789 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (11,867) | | | (11,867) | |

| Balance as of March 31, 2023 | 30,000 | | | 4,267 | | | 8,390,424 | | | 1 | | | 214,457 | | | (234,625) | | | (20,167) | |

| Accretion on Series A convertible preferred stock | — | | | 1,326 | | | — | | | — | | | (1,326) | | | — | | | (1,326) | |

| Issuance of common stock for restricted stock units vesting | — | | | — | | | 51,259 | | | — | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 2,644 | | | — | | | 2,644 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (8,467) | | | (8,467) | |

| Balance as of June 30, 2023 | 30,000 | | | 5,593 | | | 8,441,683 | | | 1 | | | 215,775 | | | $ | (243,092) | | | $ | (27,316) | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Owlet, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (20,334) | | | $ | (40,476) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 530 | | | 707 | |

| Share-based compensation | 5,433 | | | 6,575 | |

| Common stock warrant liability adjustment | (283) | | | (1,935) | |

| Amortization of right of use assets | 667 | | | 602 | |

| Other adjustments, net | 94 | | | 512 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 2,925 | | | (13,922) | |

| Prepaid expenses and other assets | 4,103 | | | 8,756 | |

| Inventory | 6,222 | | | (11,392) | |

| Accounts payable and accrued and other expenses | (16,134) | | | (4,499) | |

| Other, net | 20 | | | (588) | |

| Net cash used in operating activities | (16,757) | | | (55,660) | |

| Cash flows from investing activities | | | |

| Purchase of property and equipment | (6) | | | (419) | |

| Purchase of intangible assets | (13) | | | (824) | |

| Net cash used in investing activities | (19) | | | (1,243) | |

| Cash flows from financing activities | | | |

Proceeds from issuance of preferred stock, net of $295 of paid transaction costs | 29,793 | | | — | |

| Proceeds from short-term borrowings | 52,531 | | | 22,583 | |

| Payments of short-term borrowings | (51,189) | | | (20,693) | |

| Proceeds from long-term borrowings | 500 | | | — | |

| Payments of long-term borrowings | (1,500) | | | (3,000) | |

| Other, net | 156 | | | 215 | |

| Net cash provided by (used in) financing activities | 30,291 | | | (895) | |

| Net change in cash and cash equivalents | 13,515 | | | (57,798) | |

| Cash and cash equivalents at beginning of period | 11,231 | | | 95,054 | |

| Cash and cash equivalents at end of period | $ | 24,746 | | | $ | 37,256 | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Owlet, Inc.

Notes to Condensed Consolidated Financial Statements

(in thousands, except share and per share amounts)

(unaudited)

Note 1. Basis of Presentation

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements of the Company and its subsidiaries have been prepared in accordance with accounting principles generally accepted in the United States ("GAAP") for interim financial information and applicable rules and regulations of the U.S. Securities and Exchange Commission (the "SEC") regarding interim financial reporting. The condensed consolidated balance sheet as of December 31, 2022, included herein, was derived from the audited consolidated financial statements as of that date, but does not include all disclosures including certain notes required by U.S. GAAP on an annual reporting basis. All intercompany transactions and balances have been eliminated in consolidation. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all normal recurring adjustments necessary for the fair statement of the Company’s financial position, results of operations, and cash flows for the interim periods presented. All dollar amounts, except per share amounts, in the notes are presented in thousands, unless otherwise specified.

Certain prior year amounts have been reclassified to conform to the current period presentation.

Reverse Stock Split

On July 7, 2023, the Company filed with the Secretary of State of the State of Delaware a Certificate of Amendment to its Second Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to effect a one-for-14 reverse stock split (the “Reverse Stock Split”) of the Company’s common stock and a reduction in the number of authorized shares of common stock and authorized but unissued shares of the Company’s preferred stock. The number of authorized shares of Common Stock was reduced from 1,000,000,000 shares to 107,142,857 shares, which reflects a reduction to 1.5 times the then current number of authorized shares of Common Stock, divided by the Reverse Stock Split ratio. The Reverse Stock Split also reduced the number of authorized shares of preferred stock from 100,000,000 shares to 10,741,071 shares, which reflects a reduction to 1.5 times the then current number of authorized but unissued shares of preferred stock, divided by the Reverse Stock Split ratio. The Reverse Stock Split became effective on July 7, 2023.

There was no net effect on total stockholders' equity, and the par value per share of our common stock remains unchanged at $0.0001 per share after the Reverse Stock Split. All references made to share or per share amounts in the accompanying condensed consolidated financial statements and applicable disclosures have been retroactively adjusted for all periods presented to reflect the applicable effects of the Reverse Stock Split and the reduction in the number of authorized shares of common stock and preferred stock effected by the Charter Amendment.

Risks and Uncertainties

In accordance with ASU No. 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (Subtopic 205-40), the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the condensed consolidated financial statements are issued.

Since inception, the Company has experienced recurring operating losses and generated negative cash flows from operations, resulting in an accumulated deficit of $243,092 as of June 30, 2023. During the six months ended June 30, 2023 and 2022, we had negative cash flows from operations of $16,757 and $55,660, respectively. As of June 30, 2023, we had $24,746 of cash on hand.

Year over year declines in revenue, the low, current cash balance, recurring operating losses, and negative cash flows from operations since inception raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the accompanying condensed consolidated financial statements are issued. The accompanying condensed consolidated financial statements have been prepared on a going concern basis and accordingly, do not include any adjustments relating to the recoverability and classification of asset carrying amounts, or the amount and classification of liabilities that might result should the Company be unable to continue as a going concern.

As the Company continues to address these financial conditions, management has undertaken the following actions:

•As described further in Note 7, on February 17, 2023 the Company consummated a sale of newly issued preferred stock and warrants to purchase its common stock for aggregate gross proceeds of $30,000.

•As described in Note 4, in March 2023 the Company further amended its financing arrangement with SVB, under which the principal payments on the term note will be deferred until September 2023. This most recent amendment also revised the financial covenants for future periods.

•During the year ended December 31, 2022, the Company undertook restructuring actions, which significantly reduced employee headcount and reduced operating spend. This included the reduction of consulting and outside services, the reduction of marketing programs, and the prioritization of and sequencing of research and development projects.

We have not generated sufficient cash flows from operations to satisfy our capital requirements. There can be no assurance that the Company will generate sufficient future cash flows from operations due to potential factors, including but not limited to inflation, recession, reduced demand for the Company’s products, or the FDA's denial of the Company's de novo classification request for marketing authorization. If revenues further decrease from current levels, the Company may be unable to further reduce costs, or such reductions may limit our ability to pursue strategic initiatives and grow revenues in the future.

There can be no assurance that we will be able to obtain additional financing on terms acceptable to us, if at all. Failure to secure additional funding may require us to modify, delay or abandon some of our planned future development, or to otherwise enact further operating cost reductions, which could have a material adverse effect on our business, operating results, financial condition and ability to achieve our intended business objectives.

If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to pursue our business objectives and to respond to business opportunities, challenges, or unforeseen circumstances could be significantly limited, and our business, financial condition and results of operations could be materially adversely affected. We also could be required to seek funds through arrangements with partners or others that may require us to relinquish rights or jointly own some aspects of our technologies, products or services that we would otherwise pursue on our own.

The Company maintains its cash in bank deposit accounts which, at times, exceed federally insured limits. As of June 30, 2023, substantially all of the Company's cash was held with Silicon Valley Bank and Citibank, and exceeded federally insured limits. On March 10, 2023, Silicon Valley Bank was closed by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation ("FDIC") as receiver. On March 12, 2023, the Secretary of the Treasury, the chair of the Federal Reserve Board and the chairman of the FDIC released a joint statement related to the FDIC's resolution of the Silicon Valley Bank receivership, which provided that all depositors would have access to all their money starting March 13, 2023. As of the issuance date of these financial statements, all cash deposited by the Company with Silicon Valley Bank, now a division of First Citizens Bank and Trust Company, has been accessible by the Company.

Note 2. Certain Balance Sheet Accounts

Inventory

Substantially all of the Company's inventory consisted of finished goods as of June 30, 2023 and December 31, 2022.

Property and Equipment, net

Property and equipment consisted of the following as of:

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Tooling and manufacturing equipment | $ | 2,731 | | | $ | 2,731 | |

| Furniture and fixtures | 639 | | | 639 | |

| Computer equipment | 601 | | | 660 | |

| Software | 106 | | | 106 | |

| Leasehold improvements | 35 | | | 29 | |

| Total property and equipment | 4,112 | | | 4,165 | |

| Less accumulated depreciation and amortization | (3,503) | | | (3,057) | |

| Property and equipment, net | $ | 609 | | | $ | 1,108 | |

Depreciation and amortization expense on property and equipment was $225 and $320 for the three months ended June 30, 2023 and June 30, 2022, respectively. For the three months ended June 30, 2023 and June 30, 2022, the Company allocated $148 and $208, respectively, of depreciation and amortization expense related to tooling and manufacturing equipment and software to cost of revenues.

Depreciation and amortization expense on property and equipment was $500 and $629 for the six months ended June 30, 2023 and June 30, 2022, respectively. For the six months ended June 30, 2023 and June 30, 2022, the Company allocated $330 and $398, respectively, of depreciation and amortization expense related to tooling and manufacturing equipment and software to cost of revenues.

Intangible Assets Subject to Amortization

Intangible assets were $2,253, net of accumulated amortization of $236 as of June 30, 2023 and $2,279, net of accumulated amortization of $206, as of December 31, 2022.

Capitalized software development costs were $1,873 on June 30, 2023 and December 31, 2022. The Company's internally developed software capitalized within intangible assets on the balance sheet is still in development and not ready for general release. As such, the Company has not recognized any amortization for the three or six months ended June 30, 2023 or 2022.

The Company did not recognize any impairment charges for intangible assets during the three or six months ended June 30, 2023 or 2022.

Accrued and Other Expenses

On October 1, 2021, the Company received a Warning Letter, later corrected in an amendment to the letter dated October 5, 2021 (the “Warning Letter”), from the U.S. Food and Drug Administration (the “FDA”) regarding the Owlet Smart Sock. During the fourth quarter of 2021, the Company agreed with certain customers and retailers to accept returns of the Owlet Smart Sock and Owlet Monitor Duo.

Accrued and other expenses, among other things, included accrued sales returns of $1,717 and $6,756 as of June 30, 2023 and December 31, 2022, respectively. Accrued sales returns included $36 and $4,958 as of June 30, 2023 and December 31, 2022, respectively, for product returns related to the Warning Letter.

Changes in accrued warranty were as follows:

| | | | | | | | | | | |

| For the Three Months Ended June 30, |

| 2023 | | 2022 |

| Accrued warranty, beginning of period | $ | 592 | | | $ | 725 | |

| Provision for warranties issued during the period | 81 | | | 193 | |

| Settlements of warranty claims during the period | (82) | | | (143) | |

| Accrued warranty, end of period | $ | 591 | | | $ | 775 | |

| | | | | | | | | | | |

| For the Six Months Ended June 30, |

| 2023 | | 2022 |

| Accrued warranty, beginning of period | $ | 712 | | | $ | 661 | |

| Provision for warranties issued during the period | 116 | | | 394 | |

| Settlements of warranty claims during the period | (237) | | | (280) | |

| Accrued warranty, end of period | $ | 591 | | | $ | 775 | |

Note 3. Deferred Revenues

Deferred revenues relate to performance obligations for which payments are received from customers prior to the satisfaction of the Company’s obligations to its customers. Deferred revenues primarily consist of amounts allocated to the mobile application, unspecified upgrade rights, and content, and are recognized over the service period of the performance obligations, which range from 5 to 27 months.

Changes in the total deferred revenues balance were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Beginning balance | $ | 1,257 | | | $ | 1,312 | | | $ | 1,386 | | | $ | 1,235 | |

| Deferral of revenues | 480 | | | 687 | | | 820 | | | 1,430 | |

| Recognition of deferred revenues | (514) | | | (620) | | | (983) | | | (1,286) | |

| Ending balance | $ | 1,223 | | | $ | 1,379 | | | $ | 1,223 | | | $ | 1,379 | |

The Company recognized $456 and $498 of revenue during the three months ended June 30, 2023 and 2022, respectively, that was included in the deferred revenue balance at the beginning of the respective period. The Company recognized $797 and $838 of revenue during the six months ended June 30, 2023 and 2022, respectively, that was included in the deferred revenue balance at the beginning of the respective period.

Note 4. Long-Term Debt and Other Financing Arrangements

The following is a summary of the Company’s long-term indebtedness as of:

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Term note payable to SVB, maturing on October 1, 2024 | $ | 7,000 | | | $ | 8,000 | |

| Financed insurance premium | 204 | | 2,353 |

| Total debt | 7,204 | | | 10,353 | |

| Less: current portion | (5,204) | | | (10,353) | |

| Total long-term debt, net | $ | 2,000 | | | $ | — | |

Third Amended and Restated Loan and Security Agreement

On November 23, 2022, the Company entered into the Third Amended and Restated Loan and Security Agreement (the “LSA”) with Silicon Valley Bank. The LSA amended, restated and replaced in its entirety the prior Second Amended and Restated Loan and Security Agreement, dated April 22, 2020, and all prior amendments. On March 27, 2023, the Company entered into the first amendment to the LSA with Silicon Valley Bank, now a division of First Citizens Bank and Trust Company (the “SVB Amendment”), that (i) deferred certain payments of principal by the Company until September 1, 2023, (ii) had Silicon Valley Bank waive certain stated events of default, (iii) to expand the eligibility of inventory and accounts that the Company can borrow against, (iv) to modify certain financial covenants required of the Company, and (v) certain other revisions.

In connection with the amendment to the LSA executed on March 27, 2023, the Company granted Silicon Valley Bank a warrant to purchase 10,714 shares of the Company's common stock at a price of $5.32 per share, expiring on

March 27, 2035 (the "SVB Warrants"). The warrant was valued at $43 and is classified as equity and included within additional paid-in capital on the condensed consolidated balance sheet. See Note 7 for a summary of all common stock warrants currently outstanding.

On August 10, 2023, the Company entered into the second amendment to the LSA with Silicon Valley Bank, now a division of First Citizens Bank and Trust Company, that clarified the calculation of the financial covenants under the agreement.

As of the date of this Report, the Company was in compliance with all applicable covenants under the LSA.

Line of Credit

The LSA provides for a $10,000 revolving line of credit (the “SVB Revolver”) as of June 30, 2023. The SVB Revolver is an asset-based lending facility subject to borrowing base availability, which is limited by specified percentages of eligible accounts receivable and eligible inventory. Borrowing base availability can be impacted based upon the period's eligible accounts receivable and eligible inventory and may be significantly lower than the full $10,000 line of credit. As of June 30, 2023, borrowing base availability was $8,364.

The SVB Revolver facility matures and terminates on April 22, 2024. As of June 30, 2023, the SVB Revolver bore interest on the outstanding principal amount at a floating rate per annum equal to the greater of (i) 5.00% and (ii) the prime rate plus the prime rate margin, which is 2.25% for advances on the SVB Revolver, as defined by the LSA. As of June 30, 2023 there was $8,176 of outstanding borrowings under the SVB Revolver.

Term Loan

The LSA also provided for an $8,500 term loan (the “Term Loan”), replacing the term loans made under the previous agreement, of which $7,000 was outstanding as of June 30, 2023. The Term Loan amortizes with equal monthly installments of $500 and matures on October 1, 2024 (the "Term Loan Maturity Date").

The Term Loan accrues interest on the outstanding principal amount at a floating rate per annum equal to the greater of (i) five and three-quarters percent (5.75%) and (ii) the prime rate plus the prime rate margin, which is 3.50% for the Term Loan (as defined in the LSA), and such interest is payable (a) monthly in arrears, (b) on each prepayment date and (c) on the Term Loan Maturity Date. All outstanding principal and accrued and unpaid interest and all other Term Loan-related outstanding obligations shall become due and payable in full on the Term Loan Maturity Date.

The Company believes that the fair value of the Term Loan approximates the recorded amount as of June 30, 2023 and December 31, 2022, as the interest rates on the long-term debt are variable and the rates are based on market interest rates (bank's prime rate) after consideration of default and credit risk (using Level 2 inputs).

Future Aggregate Maturities

As of June 30, 2023, future aggregate maturities of the Term Note and Financed Insurance Premium payables were as follows:

| | | | | | | | |

| Years Ending December 31, | | Amount |

| 2023 (excluding the six months ended June 30, 2023) | | $ | 2,204 | |

| 2024 | | 5,000 | |

| Total | | $ | 7,204 | |

Financed Insurance Premium

In July 2022, the Company renewed its corporate directors & officers and employment liability policies and entered into a new short-term commercial premium finance agreement with First Insurance Funding totaling $3,041 to be paid in eleven equal monthly payments, all of which accrue interest at a rate of 4.40%. In October 2022, the Company obtained additional general corporate liability policies and entered into an additional short-term commercial premium finance agreement with First Insurance Funding totaling $826 to be paid in eleven equal monthly payments, accruing interest at a rate of 6.80%. As of June 30, 2023, the remaining principal balance on the combined financed insurance premiums was $204.

In July 2023, the Company renewed its corporate directors & officers and employment liability policies and entered into a new short-term commercial premium finance agreement with First Insurance Funding totaling $927 to be paid in eleven equal monthly payments, accruing interest at a rate of 8.29%.

Note 5. Commitments and Contingencies

During February 2023, the Company entered an agreement with a significant vendor to pay $3,000 of interest over 36 months with respect to past due payables. The present value of the future payments was expensed and included within interest expense, net on the condensed consolidated statements of operations for the six months ended June 30, 2023.

Litigation

The Company is involved in legal proceedings from time to time arising in the normal course of business. Management, after consultation with legal counsel, believes that the outcome of these proceedings will not have a material impact on the Company’s financial position, results of operations, or liquidity.

In November 2021, two putative class action complaints were filed against us in the U.S. District Court for the Central District of California, Butala v. Owlet, Inc., et al., Case No. 2:21-cv-09016, and Cherian v. Owlet, Inc., et al., Case No. 2:21-cv-09293. Both complaints allege violations of the Securities Exchange Act of 1934 ("Exchange Act") against the Company and certain of its officers and directors on behalf of a putative class of investors who (i) purchased the Company’s common stock between March 31, 2021 and October 4, 2021 or (ii) held common stock in Sandbridge Acquisition Corporation (“SBG”) as of June 1, 2021 and were eligible to vote at SBG’s special meeting held on July 14, 2021. Both complaints allege, among other things, that the Company and certain of its officers and directors made false and/or misleading statements and failed to disclose certain information regarding the FDA’s likely classification of the Smart Sock product as a medical device requiring marketing authorization. The Court has consolidated the Butala and Cherian cases but has yet to appoint a lead plaintiff. The Company intends to vigorously defend itself against these claims, including by filing a motion to dismiss on behalf of itself and the named officers and directors.

Indemnification

In the ordinary course of business, the Company enters into agreements that may include indemnification provisions. Pursuant to such agreements, the Company may indemnify, hold harmless, and defend an indemnified party for losses suffered or incurred by the indemnified party. Some of the provisions will limit losses to those arising from third party actions. In some cases, the indemnification will continue after the termination of the agreement. The maximum potential amount of future payments the Company could be required to make under these provisions is not determinable. The Company has never incurred material costs to defend lawsuits or settle claims related to these indemnification provisions. The Company has entered into indemnification agreements with its directors and officers that may require the Company to indemnify its directors and officers against liabilities that may arise by reason of their status or service as directors or officers to the fullest extent permitted by Delaware corporate law. The Company currently has directors’ and officers’ insurance coverage that reduces its exposure and enables the Company to recover a portion of any future amounts paid. The Company believes the estimated fair value of these indemnification agreements in excess of applicable insurance coverage is immaterial.

Note 6. Stock-based Compensation

The Company has various stock compensation plans, which are more fully described in Part II, Item 8 "Financial Statements and Supplementary Data - Note 10 to the Consolidated Financial Statements - Share-based Compensation" in the 2022 Annual Report on Form 10-K. Under the 2021 Incentive Award Plan, the Company has the ability to grant options, stock appreciation rights, restricted stock, restricted stock units ("RSU"), performance stock units ("PRSU"), dividend equivalents, or other stock or cash-based awards to employees, directors, or consultants.

Option awards are generally granted with an exercise price equal to the fair value of the Company’s common stock at the date of grant. Options, RSU, and PRSU awards generally vest over a period of four years.

Stock-based Compensation Expense

Total stock-based compensation was recognized as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| General and administrative | $ | 1,461 | | | $ | 1,864 | | | $ | 2,897 | | | $ | 3408 | |

| Sales and marketing | 476 | | | 673 | | 968 | | | 1,413 |

| Research and development | 707 | | | 720 | | 1,568 | | | 1,754 |

| Total stock-based compensation | $ | 2,644 | | | $ | 3,257 | | | $ | 5,433 | | | $ | 6,575 | |

During the three and six months ended June 30, 2022, the Company capitalized $16 and $33 of stock-based compensation attributable to internally developed software. There was no stock-based compensation capitalized during the three or six months ended June 30, 2023.

As of June 30, 2023, the Company had $1,565 of unrecognized stock-based compensation costs related to non-vested options that will be recognized over a weighted-average period of 1.4 years, $8,503 of unrecognized stock-based compensation costs related to unvested RSUs that will be recognized over a weighted-average period of 2.4 years, and $651 of unrecognized stock-based compensation costs related to unvested PRSUs that will be recognized over a weighted-average period of 1.7 years.

Note 7. Convertible Preferred Stock and Common Stock Warrants

February 2023 Offering

On February 17, 2023 the Company entered into private placement investment agreements with certain investors, pursuant to which the Company issued and sold to the investors (i) an aggregate of 30,000 shares of the Company’s Series A convertible preferred stock, par value $0.0001 per share and (ii) warrants to purchase an aggregate of 7,871,712 shares of the Company’s common stock, par value $0.0001 per share, (“February 2023 Warrants”) for an aggregate purchase price of $30,000.

The Series A convertible preferred stock is convertible into common stock at the option of the holder at any time after February 17, 2023 and ranks, with respect to dividend rights, rights of redemption and rights upon a liquidation event, (i) senior to the common stock and all other classes or series of equity securities of the Company established after February 17, 2023, unless such shares or equity securities expressly provide that they rank in parity with or senior to the Series A convertible preferred stock with respect to dividend rights, rights of redemption or rights upon a liquidation event, (ii) on parity with each class or series of equity securities of the Company established after the February 17, 2023, the terms of which expressly provide that it ranks on parity with the Series A convertible preferred stock with respect to dividend rights, rights of redemption and rights upon a liquidation event and (iii) junior to each class or series of equity securities of the Company established after February 17, 2023, the terms of which expressly provide that it ranks senior to the Series A convertible preferred stock with respect to dividend rights, rights of redemption and rights upon a liquidation event. Except as otherwise provided in the certificate of designation relating to the Series A convertible preferred stock or as required by law, holders of shares of Series A convertible preferred stock are entitled to vote with the holders of shares of common stock (and any other class or series that may similarly be entitled to vote with the holders of common stock) on an as-converted to common stock basis at any annual or special meeting of stockholders of the Company, and not as a separate class.

At any time from and after February 17, 2028, the holders of at least a majority of the then outstanding shares of Series A convertible preferred stock may specify a date and time or the occurrence of an event by vote or written consent that all, and not less than all, of the outstanding shares of Series A preferred stock will automatically be: (i) converted into shares of common stock at a conversion rate of 145.7726 per share (the "Conversion Rate"), (ii) subject to certain exceptions and limitations, redeemed for an amount per share of Series A preferred stock equal to the liquidation preference of one thousand dollars per share, plus all accrued or declared but unpaid dividends as of the redemption date and time or (iii) a combination of the foregoing.

Subject to certain exceptions, upon the occurrence of a fundamental change, voluntary or involuntary liquidation, dissolution or winding-up of the Company, the Company will be required to pay an amount per share of Series A Preferred Stock equal to the greater of (i) one thousand dollars per share or (ii) the consideration per share of Series

A Preferred Stock as would have been payable had all such shares been converted to common stock immediately prior to the liquidation event, plus, in each case, the aggregate amount of all declared but unpaid dividends thereon to the date of final distribution to the holders of Series A Preferred Stock.

Each of the February 2023 Warrants sold in the private placement offering is exercisable for one share of common stock at an exercise price of $4.66 per share, is immediately exercisable, and will expire on February 17, 2028. None of the warrants have been exercised as of June 30, 2023. As the February 2023 Warrants could require cash settlement in certain scenarios, the warrants were classified as liabilities upon issuance and were initially recorded at an aggregate estimated fair value of $26,133. The total proceeds from the offering were first allocated to the liability classified warrants, based on their fair values, with the residual $3,867 allocated to the Series A convertible preferred stock. The Series A convertible stock will accrete to its redemption value, starting from the issuance date to the date at which the shares become redeemable on February 17, 2028. Accretion will be recorded as a deemed dividend.

The Company incurred $1,963 of issuance costs related to the offering, of which $295 were paid as of June 30, 2023. Issuance costs allocated to the preferred stock of $253 were recorded as a reduction to the Series A preferred stock. Issuance costs allocated to the liability classified warrants of $1,710 were recorded as an expense within general and administrative expenses. In connection with the issuance of these interim statements we have updated the classification of the preferred stock issuance costs incurred during the three months ended March 31, 2023 from a reduction of APIC to a reduction of the preferred stock carrying amount.

SBG Common Stock Warrants

As a result of the merger completed with Sandbridge Acquisition Corporation ("SBG") on July 15, 2021 (the "Merger"), the Company continues to record liabilities for warrants issued by SBG prior to the Merger.

Pursuant to the SBG initial public offering, SBG sold warrants to purchase an aggregate of 821,428 shares of the Company’s common stock at a price of $161.00 per share (“SBG Public Warrants”). Following the closing of the Initial Public Offering on September 17, 2020, the Company completed the sale of warrants to purchase an aggregate of 471,428 shares of the Company’s common stock at a price of $161.00 per share in a private placement to Sandbridge Acquisition Holdings LLC (the “SBG Private Placement Warrants”). Together, the SBG Public Warrants and SBG Private Placement Warrants are referred to as the "SBG Common Stock Warrants." The SBG Public Warrants became exercisable 12 months from the closing of the Initial Public Offering. The SBG Common Stock Warrants will expire five years after the completion of the Merger or earlier upon redemption or liquidation.

See Part II, Item 8 "Financial Statements and Supplementary Data - Note 3 to the Consolidated Financial Statements - Merger" in the 2022 Annual Report on Form 10-K for the year ended December 31, 2022 (the "Form 10-K") for more information.

The following table summarizes issuable shares of the Company's common stock based on warrant activity for the six months ended June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2022 | | Shares Issuable by New Warrants | | Shares Purchased by Exercise | | As of June 30, 2023 |

| SBG Public Warrants | 821,428 | | — | | — | | 821,428 |

| SBG Private Placement Warrants | 471,428 | | — | | — | | 471,428 |

| February 2023 Warrants | — | | 7,871,712 | | — | | 7,871,712 |

| SVB Warrants (Note 4) | — | | 10,714 | | — | | 10,714 |

| Total | 1,292,856 | | 7,882,426 | | — | | 9,175,282 |

Note 8. Fair Value Measurements

The following table presents information about the Company's assets and liabilities measured and reported in the financial statements at fair value on a recurring basis and indicates the fair value hierarchy of the valuation techniques utilized to determine such fair value.

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2023 |

| Level 1 | | Level 2 | | Level 3 | | Balance |

| Assets: | | | | | | | |

| Money market funds | $ | 20,556 | | $ | — | | $ | — | | $ | 20,556 |

| Total assets | $ | 20,556 | | $ | — | | $ | — | | $ | 20,556 |

| Liabilities: | | | | | | | |

| SBG Public Warrants | $ | — | | | $ | — | | | $ | 149 | | | $ | 149 | |

| SBG Private Placement Warrants | — | | | — | | | 86 | | | 86 | |

| February 2023 Warrants | — | | — | | 26,339 | | 26,339 |

| Total liabilities | $ | — | | $ | — | | $ | 26,574 | | $ | 26,574 |

| | | | | | | |

| December 31, 2022 |

| Level 1 | | Level 2 | | Level 3 | | Balance |

| Assets: | | | | | | | |

| Money market funds | $ | 11,070 | | | $ | — | | | $ | — | | | $ | 11,070 | |

| Total assets | $ | 11,070 | | $ | — | | $ | — | | $ | 11,070 |

| Liabilities: | | | | | | | |

| SBG Public Warrants | $ | 460 | | | $ | — | | | $ | — | | | $ | 460 | |

| SBG Private Placement Warrants | — | | 264 | | — | | 264 |

| Total liabilities | $ | 460 | | $ | 264 | | $ | — | | $ | 724 |

Money market funds are included within Level 1 of the fair value hierarchy because they are valued using quoted market prices.

The SBG Public Warrants and SBG Private Placement Warrants as of June 30, 2023 are presented in Level 3 of the fair value hierarchy. On June 15, 2023, the Company received notice from the New York Stock Exchange (the “NYSE”) that the NYSE had halted trading in the SBG Public Warrants due to the low trading price of those warrants. On June 16, 2023, the NYSE provided written notice to the Company and publicly announced that NYSE Regulation had determined to commence proceedings to delist the SBG Public Warrants and that such warrants were no longer suitable for listing based on “abnormally low” price levels, pursuant to Section 802.01D of the NYSE Listed Company Manual. As such, these instruments are no longer valued using quoted market prices and correspondingly, the SBG Private Placement Warrants can no longer be valued based on a quoted market price of the SBG Public Warrants. The Company measured the fair value of both the SBG Public Warrants and the SBG Private Placement Warrants as of June 30, 2023, using the Black-Scholes option pricing model with the following assumptions:

| | | | | |

| SBG Common Stock Warrants - Black-Scholes Inputs | June 30, 2023 |

| OWLT stock price | $ | 4.76 | |

| Exercise price of warrants | $ | 161.00 | |

| Term in years | 3.04 |

| Risk-free interest rate | 4.48 | % |

| Volatility | 90.00 | % |

The February 2023 Warrants are presented as Level 3 measurements, relying on unobservable inputs reflecting the Company's own assumptions. Level 3 measurements, which are not based on quoted prices in active markets, introduce a higher degree of subjectivity and may be more sensitive to fluctuations in stock price, volatility rates, and U.S. Treasury Bond rates.

The Company measured the fair value of the February 2023 Warrants at issuance and again as of June 30, 2023, using the Black-Scholes option pricing model with the following assumptions:

| | | | | | | | | | | |

| February 2023 Warrants - Black-Scholes Inputs | February 17, 2023 | | June 30, 2023 |

| OWLT stock price | $ | 4.78 | | | $ | 4.76 | |

| Exercise price of warrants | $ | 4.66 | | | $ | 4.66 | |

| Term in years | 5.00 | | 4.63 |

| Risk-free interest rate | 4.10 | % | | 4.20 | % |

| Volatility | 85.00 | % | | 90.00 | % |

The following table presents a reconciliation of the Company’s SBG Public Warrants, SBG Private Placement Warrants, and February 2023 Warrants (together, the "Level 3 Warrants") measured at fair value on a recurring basis as of June 30, 2023:

| | | | | |

| Level 3 Warrants |

| Balance as of December 31, 2022 | $ | 724 | |

| Issuance of February 2023 Warrants | 26,133 | |

| Change in fair value included within common stock warrant liability adjustment | (283) | |

| Balance as of June 30, 2023 | $ | 26,574 | |

There were no transfers between Level 1 and Level 2 in the periods reported. The SBG Public Warrants and SBG Private Placement Warrants were transferred into Level 3 in the period reported, as discussed above.

The Company measured the fair value of the SVB Warrants (see Note 4) at issuance as of March 27, 2023, using the Black-Scholes option pricing model with the following assumptions:

| | | | | |

| SVB Warrants - Black-Scholes Inputs | March 27, 2023 |

| OWLT stock price | $ | 4.62 | |

| Exercise price of warrants | $ | 5.32 | |

| Term in years | 12.00 |

| Risk-free interest rate | 3.60 | % |

| Volatility | 85.00 | % |

Note 9. Net Loss Per Share Attributable to Common Stockholders

Basic and diluted net loss per share attributable to common stockholders is presented in conformity with the two-class method required for participating securities. Under the two-class method, net loss is attributed to common stockholders and participating securities according to dividends declared or accumulated and participation rights in undistributed earnings. The two-class method requires income available to common stockholders for the period to be allocated between common and participating securities based upon their respective rights to receive dividends as if all income for the period had been distributed.

The Company considers its convertible preferred stock to be participating securities. Under the two-class method, the net loss attributable to common stockholders is not allocated to the convertible preferred stock as the holders of the Company’s convertible preferred stock do not have a contractual obligation to share in the Company’s losses.

The following table presents the calculation of basic and diluted net loss per share attributable to common stockholders (in thousands, except share and per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Numerator: | | | | | | | |

| Net loss and comprehensive loss | $ | (8,467) | | | $ | (11,718) | | | $ | (20,334) | | | $ | (40,476) | |

| Accretion on Series A convertible preferred stock | (1,326) | | | — | | | (1,979) | | | — | |

Net loss attributable to common stockholders (1) | $ | (9,793) | | | $ | (11,718) | | | $ | (22,313) | | | $ | (40,476) | |

| Denominator: | | | | | | | |

| Weighted-average common shares used in computed net loss per share attributable to common stockholders basic and diluted | 8,213,247 | | 7,915,156 | | 8,162,102 | | 7,899,959 |

| Net loss per share attributable to common stockholders basic and diluted | $ | (1.19) | | | $ | (1.48) | | | $ | (2.73) | | | $ | (5.12) | |

(1) For the three and six months ended June 30, 2023, the Company did not allocate its net loss to participating convertible preferred stock as those shares are not obligated to share in the losses of the Company. There were no shares of convertible preferred stock outstanding during the three or six months ended June 30, 2022.

.

The following table summarizes the common stock equivalents of potentially dilutive outstanding securities excluded from the computation of diluted net loss per share due to their anti-dilutive effect:

| | | | | | | | | | | |

| As of June 30, | | As of June 30, |

| 2023 | | 2022 |

| Stock options | 473,240 | | | 665,117 | |

| RSUs | 299,646 | | | 482,987 | |

| PRSUs | 79,803 | | | 131,578 | |

| ESPP shares committed | 28,721 | | | 17,849 | |

| Common stock warrants | 9,175,289 | | | 1,292,857 | |

| Convertible preferred stock | 4,373,178 | | | — | |

| Total | 14,429,877 | | | 2,590,388 | |

The Company’s 200,536 unvested earnout shares, described in Part II, Item 8 "Financial Statements and Supplementary Data - Note 11 to the Consolidated Financial Statements - Common Stock Warrants and Earnout

Shares" in the 2022 Form 10-K, were excluded from the calculation of basic and diluted per share calculations as the vesting conditions have not yet been met as of June 30, 2023.

Note 10. Segments

The Company operates as a single operating segment. The Company’s chief operating decision maker manages the Company's operations on a consolidated basis for purposes of allocating resources, making operating decisions, and evaluating financial performance. Since the Company operates in one operating segment, all required financial segment information can be found in these consolidated financial statements.

Revenue by geographic area is based on the delivery address of the customer and is summarized as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| United States | $ | 11,834 | | | $ | 15,876 | | | $ | 21,377 | | | $ | 34,589 | |

| International | 1,254 | | 2,472 | | 2,447 | | 5,298 |

| Total revenues | $ | 13,088 | | | $ | 18,348 | | | $ | 23,824 | | | $ | 39,887 | |

Other than the United States, no individual country exceeded 10% of total revenues for the three or six months ended June 30, 2023 and June 30, 2022.

The Company’s long-lived assets are composed of property and equipment and right of use assets, net, and are summarized by geographic area as follows as of (in thousands):

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| United States | $ | 1,813 | | | $ | 2,615 | |

| International | 435 | | | 753 | |

| Total long-lived assets, net | $ | 2,248 | | | $ | 3,368 | |

Note 11. New Accounting Pronouncements

Recently Adopted Accounting Pronouncements