UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of August,

2023

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: UNAUDITED CONSOLIDATED CONDENSED INTERIM FINANCIAL STATEMENTS AS OF JUNE 30, 2023

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: August 15, 2023

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

Free translation from the original prepared in Spanish for

publication in Argentina

UNAUDITED CONSOLIDATED CONDENSED INTERIM FINANCIAL STATEMENTS

AS OF JUNE 30, 2023

AND FOR THE SIX AND THREE-MONTH PERIODS THEN ENDED

PRESENTED IN COMPARATIVE FORMAT

Free translation from the original prepared in Spanish for publication in Argentina |

| |

REPORT ON REVIEW OF THE CONSOLIDATED CONDENSED INTERIM FINANCIAL

STATEMENTS

To the Shareholders, President and Directors of

Pampa Energía S.A.

Legal address: Maipú, 1

Autonomous City of Buenos Aires

Tax Code No.: 30-52655265-9

Report on the consolidated condensed interim financial statements

Introduction

We have reviewed the accompanying consolidated condensed interim financial

statements of Pampa Energía S.A. and its subsidiaries (hereinafter "the Group"), which comprise the consolidated statement

of financial position as of June 30, 2023, the consolidated statements of comprehensive income for the periods of six and three months

ended June 30, 2023, of changes in equity and cash flows for the six months ended June 30, 2023, and selected explanatory notes.

Board's responsibility

The Board of Directors of the Company is responsible for the preparation

and presentation of the financial statements in accordance with International Financial Reporting Standards, adopted by the Argentine

Federation of Professional Councils in Economic Sciences (FACPCE, for its acronym in Spanish) as professional accounting standards and

incorporated by the National Securities Commission (CNV, for its acronym in Spanish) to its regulations, as approved by the International

Accounting Standards Board (IASB), and therefore is responsible for the preparation and presentation of the consolidated condensed interim

financial statements mentioned in the first paragraph, in accordance with International Accounting Standard 34 “Interim Financial

Reporting” (IAS 34).

Scope of the review

Our responsibility is to express a conclusion on these consolidated

condensed interim financial statements based on our review, which was performed in accordance with the International Standards on Review

Engagements ISRE 2410 Review of Interim Financial Information Performed by the Independent Auditor of the entity, adopted as a review

standard in Argentina by Technical Pronouncement No. 33 of the FACPCE and approved by the International Auditing and Assurance Standards

Board (IAASB). A review of consolidated condensed interim Financial Statements consists of inquiries primarily of Company staff responsible

for financial and accounting matters, and applying analytical and other review procedures. This review is substantially less in scope

than an audit examination conducted in accordance with international standards on auditing and consequently it does not enable us to obtain

assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an

audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes

us to believe that the consolidated condensed interim Financial Statements mentioned in the first paragraph of this report have not been

prepared, in all material respects, in accordance with International Accounting Standard 34.

Free translation from the original prepared in Spanish for publication in Argentina |

| |

Report on compliance with current regulations

In accordance with current regulations, we report, in connection

with Pampa Energía S.A., that:

| a) |

the consolidated condensed interim financial statements of Pampa Energía S.A. are recorded to the “Inventory and Balance

Sheet” book, and complies in what is a matter of our competence, with the provisions of the General Companies Law and in the pertinent

resolutions of the National Securities Commission; |

| b) |

the individual condensed interim financial statements of Pampa Energía S.A. arise from accounting records kept in their

formal aspects in accordance with legal regulations; |

| c) |

we have read the Summary of Activity (“Reseña Informativa”), on which, as regards those matters that are within our

competence, we have no observations to make; |

| d) |

as of June 30, 2023, the debt accrued by Pampa Energía S.A. in favor of the Argentine Integrated Social Security System

according to the Company's accounting records and calculations amounted to $ 845.6 millions, none of which was claimable at that date. |

Autonomous City of Buenos Aires, August 9, 2023

|

PRICE WATERHOUSE & CO. S.R.L.

(Partner) |

| Carlos Martín Barbafina |

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

GLOSSARY OF TERMS

The following are not technical definitions, but they

are helpful for the reader’s understanding of some terms used in the notes to the Unaudited Consolidated Condensed Interim Financial

Statements of the Company.

| Terms |

|

Definitions |

| ADR |

|

American Depositary Receipt |

| AFIP |

|

Federal Administration of Public Revenue |

| BCRA |

|

Argentina’s Central Bank |

| BNA |

|

Banco de la Nación Argentina |

| BYMA |

|

Bolsas y Mercados Argentinos |

| CAMMESA |

|

Compañía Administradora del Mercado Eléctrico Mayorista S.A. |

| CB |

|

Corporate Bonds |

| CIESA |

|

Compañía de Inversiones de Energía S.A. |

| CISA |

|

Comercializadora e Inversora S.A. |

| Citelec |

|

Compañía Inversora en Transmisión Eléctrica Citelec S.A. |

| CNV |

|

National Securities Commission of Argentina |

| CSJN |

|

Argentina’ Supreme Court of Justice |

| CTB |

|

CT Barragán S.A |

| EAR |

|

Effective Annual Rate |

| EISA |

|

Energía Inversora S.A. |

| ENRE |

|

National Regulatory Authority of Electricity |

| GASA |

|

Generación Argentina S.A. |

| Greenwind |

|

Greenwind S.A. |

| GyP |

|

Gas y Petróleo del Neuquén S.A.P.E.M. |

| HIDISA |

|

Hidroeléctrica Diamante S.A. |

| HINISA |

|

Hidroeléctrica Los Nihuiles S.A. |

| IASB |

|

International Accounting Standards Board |

| MAT |

|

Forward Market |

| MATER |

|

Renewable Energy Forward Market |

| MLC |

|

Foreign Exchange Market |

| MW |

|

Megawatt |

| IAS |

|

International Accounting Standards |

| IFRS |

|

International Financial Reporting Standards |

| NYSE |

|

New York Stock Exchange |

| OCP Ltd |

|

Oleoductos de Crudos Pesados Ltd |

| OCP SA |

|

Oleoductos de Crudos Pesados S.A. |

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

GLOSSARY OF TERMS: (Continuation)

| Terms |

|

Definitions |

| PB18 |

|

Pampa Bloque 18 S.A. (former Ecuador TLC S.A.) |

| PEB |

|

Pampa Energía Bolivia S.A. |

| PEN |

|

Federal Executive Branch |

| PEPE II |

|

Pampa Energía II Wind Farm |

| PEPE III |

|

Pampa Energía III Wind Farm |

| PEPE IV |

|

Pampa Energía IV Wind Farm |

| PEPE VI |

|

Pampa Energía VI Wind Farm |

| PISA |

|

Pampa Inversiones S.A. |

| Refinor |

|

Refinería del Norte S.A. |

| SACDE |

|

Argentine Society of Construction and Strategic Development |

| SE |

|

Secretary of Energy |

| TGS |

|

Transportadora de Gas del Sur S.A. |

| TGU |

|

Transporte y Servicios de Gas en Uruguay S.A. |

| TJSM |

|

Termoeléctrica José de San Martín S.A. |

| TMB |

|

Termoeléctrica Manuel Belgrano S.A. |

| The Company / Pampa |

|

Pampa Energía S.A. |

| The Group |

|

Pampa Energía S.A. and its subsidiaries |

| Transba |

|

Empresa de Transporte de Energía Eléctrica por Distribución Troncal de la Provincia de Buenos Aires Transba S.A. |

| Transener |

|

Compañía de Transporte de Energía Eléctrica en Alta Tensión Transener S.A. |

| US$ |

|

U.S. dollar |

| UTE |

|

Unión Transitoria de Empresas |

| VAR |

|

Vientos de Arauco Renovables S.A.U. |

| YPF |

|

YPF S.A. |

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED

CONSOLIDATED CONDENSED INTERIM STATEMENT OF

COMPREHENSIVE INCOME

For

the six and three-month periods ended June 30, 2023, presented in comparative format.

(In

millions of Argentine Pesos (“$”))

| |

|

|

Six

months |

|

Three

months |

| |

Note |

|

06.30.2023 |

|

06.30.2022 |

|

06.30.2023 |

|

06.30.2022 |

| |

|

|

|

|

|

|

|

|

|

| Revenue |

8 |

|

194,256 |

|

99,523 |

|

110,341 |

|

55,512 |

| Cost

of sales |

9 |

|

(117,939) |

|

(60,896) |

|

(67,401) |

|

(34,652) |

| Gross

profit |

|

|

76,317 |

|

38,627 |

|

42,940 |

|

20,860 |

| |

|

|

|

|

|

|

|

|

|

| Selling

expenses |

10.1 |

|

(7,723) |

|

(3,721) |

|

(4,530) |

|

(1,658) |

| Administrative

expenses |

10.2 |

|

(19,564) |

|

(7,326) |

|

(11,254) |

|

(3,797) |

| Exploration expenses |

10.3 |

|

(1,750) |

|

(15) |

|

(1,702) |

|

(7) |

| Other

operating income |

10.4 |

|

14,289 |

|

4,357 |

|

9,430 |

|

3,057 |

| Other

operating expenses |

10.4 |

|

(7,375) |

|

(2,632) |

|

(3,530) |

|

(964) |

| Impairment of

property, plant and equipment, intangible assets and inventories |

|

|

(323) |

|

(4,384) |

|

(734) |

|

(4,375) |

| Impairment

of financial assets |

|

|

(937) |

|

(519) |

|

(646) |

|

(392) |

| Share

of profit from associates and joint ventures |

5.1.3 |

|

8,570 |

|

6,861 |

|

5,370 |

|

4,179 |

| Operating

income |

|

|

61,504 |

|

31,248 |

|

35,344 |

|

16,903 |

| |

|

|

|

|

|

|

|

|

|

| Financial

income |

10.5 |

|

428 |

|

450 |

|

235 |

|

204 |

| Financial

costs |

10.5 |

|

(41,078) |

|

(8,794) |

|

(26,367) |

|

(4,599) |

| Other financial results |

10.5 |

|

55,461 |

|

(4,170) |

|

40,818 |

|

(3,881) |

| Financial results, net |

|

|

14,811 |

|

(12,514) |

|

14,686 |

|

(8,276) |

| Profit before income tax |

|

|

76,315 |

|

18,734 |

|

50,030 |

|

8,627 |

| Income

tax |

10.6 |

|

(7,087) |

|

(29) |

|

(7,730) |

|

(376) |

| Profit

for the period |

|

|

69,228 |

|

18,705 |

|

42,300 |

|

8,251 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Other

comprehensive income |

|

|

|

|

|

|

|

|

|

| Items

that will not be reclassified to profit or loss |

|

|

|

|

|

|

|

|

|

| Exchange differences on translation |

|

|

193,260 |

|

42,435 |

|

116,450 |

|

27,064 |

| Items

that may be reclassified to profit or loss |

|

|

|

|

|

|

|

|

|

| Exchange differences on translation |

|

|

3,874 |

|

8,051 |

|

1,389 |

|

3,650 |

| Other comprehensive

income of the period |

|

|

197,134 |

|

50,486 |

|

117,839 |

|

30,714 |

| Total

comprehensive income of the period |

|

|

266,362 |

|

69,191 |

|

160,139 |

|

38,965 |

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED CONSOLIDATED CONDENSED INTERIM

STATEMENT OF COMPREHENSIVE

INCOME (Continuation)

For the six and three-month periods

ended June 30, 2023, presented in comparative format.

(In millions of Argentine Pesos (“$”))

| |

|

|

Six

months |

|

Three

months |

| |

Note |

|

06.30.2023 |

|

06.30.2022 |

|

06.30.2023 |

|

06.30.2022 |

| Total

income of the period attributable to: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Owners of the Company |

|

|

69,097 |

|

18,469 |

|

42,179 |

|

8,165 |

| Non-controlling

interest |

|

|

131 |

|

236 |

|

121 |

|

86 |

| |

|

|

69,228 |

|

18,705 |

|

42,300 |

|

8,251 |

| |

|

|

|

|

|

|

|

|

|

| Total

comprehensive income of the period attributable to: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Owners of the Company |

|

|

265,732 |

|

68,806 |

|

159,749 |

|

38,782 |

| Non-controlling interest |

|

|

630 |

|

385 |

|

390 |

|

183 |

| |

|

|

266,362 |

|

69,191 |

|

160,139 |

|

38,965 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Earnings

per share attributable to equity holders of the Company |

|

|

|

|

|

|

|

|

|

| Basic and diluted earnings

per share |

13.2 |

|

50.36 |

|

13.37 |

|

|

|

The accompanying notes are an integral part of these

Unaudited Consolidated Condensed Interim Financial Statements.

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED

CONSOLIDATED CONDENSED INTERIM STATEMENT

OF FINANCIAL POSITION

As

of June 30, 2023, presented in comparative format.

(In

millions of Argentine Pesos (“$”))

| |

Note |

|

06.30.2023 |

|

12.31.2022 |

| ASSETS |

|

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

|

| Property, plant and equipment |

11.1 |

|

585,004 |

|

383,464 |

| Intangible assets |

11.2 |

|

25,252 |

|

24,364 |

| Right-of-use assets |

|

|

1,982 |

|

1,521 |

| Deferred tax asset |

11.3 |

|

8,491 |

|

6,326 |

| Investments in associates and joint ventures |

5.1.3 |

|

240,004 |

|

159,833 |

| Financial assets at amortized cost |

12.1 |

|

25,853 |

|

18,000 |

| Financial assets at fair value through profit and loss |

12.2 |

|

7,053 |

|

4,867 |

| Other assets |

|

|

121 |

|

91 |

| Trade and other receivables |

12.3 |

|

6,660 |

|

3,415 |

| Total non-current assets |

|

|

900,420 |

|

601,881 |

| |

|

|

|

|

|

| CURRENT

ASSETS |

|

|

|

|

|

| Inventories |

11.4 |

|

47,714 |

|

30,724 |

| Financial assets at amortized cost |

12.1 |

|

3,006 |

|

1,357 |

| Financial assets at fair value through profit and loss |

12.2 |

|

169,968 |

|

103,856 |

| Derivative financial instruments |

|

|

146 |

|

161 |

| Trade and other receivables |

12.3 |

|

116,646 |

|

83,328 |

| Cash and cash equivalents |

12.4 |

|

50,749 |

|

18,757 |

| Total current

assets |

|

|

388,229 |

|

238,183 |

| Held for sale assets |

5.1.1 |

|

46,631 |

|

- |

| Total assets |

|

|

1,335,280 |

|

840,064 |

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED

CONSOLIDATED CONDENSED INTERIM STATEMENT

OF

FINANCIAL POSITION (Continuation)

As

of June 30, 2023, presented in comparative format.

(In

millions of Argentine Pesos (“$”))

| |

Note |

|

06.30.2023 |

|

12.31.2022 |

| SHAREHOLDERS´

EQUITY |

|

|

|

|

|

| Share capital |

13.1 |

|

1,360 |

|

1,380 |

| Share capital adjustment |

|

|

7,126 |

|

7,231 |

| Share premium |

|

|

19,950 |

|

19,950 |

| Treasury shares |

13.1 |

|

4 |

|

4 |

| Treasury shares adjustment |

|

|

21 |

|

21 |

| Treasury shares cost |

|

|

(211) |

|

(2,280) |

| Legal reserve |

|

|

11,767 |

|

8,137 |

| Voluntary reserve |

|

|

367,495 |

|

171,243 |

| Other reserves |

|

|

(278) |

|

(448) |

| Other comprehensive income |

|

|

181,684 |

|

113,720 |

| Retained earnings |

|

|

80,447 |

|

84,505 |

| Equity

attributable to owners of the company |

|

|

669,365 |

|

403,463 |

| Non-controlling interest |

|

|

1,684 |

|

1,157 |

| Total equity |

|

|

671,049 |

|

404,620 |

| |

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

| NON-CURRENT

LIABILITIES |

|

|

|

|

|

| Provisions |

11.5 |

|

38,250 |

|

26,062 |

| Income tax and minimum notional income tax provision |

11.6 |

|

37,356 |

|

31,728 |

| Deferred tax liability |

11.3 |

|

17,596 |

|

19,854 |

| Defined benefit plans |

|

|

8,362 |

|

4,908 |

| Borrowings |

12.5 |

|

333,830 |

|

237,437 |

| Trade and other payables |

12.6 |

|

8,485 |

|

3,757 |

| Total non-current

liabilities |

|

|

443,879 |

|

323,746 |

| |

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

| Provisions |

11.5 |

|

1,003 |

|

779 |

| Income tax liability |

11.6 |

|

4,493 |

|

927 |

| Tax liabilities |

|

|

7,398 |

|

4,966 |

| Defined benefit plans |

|

|

928 |

|

1,021 |

| Salaries and social security payable |

|

|

5,404 |

|

5,627 |

| Derivative financial instruments |

|

|

133 |

|

318 |

| Borrowings |

12.5 |

|

91,688 |

|

48,329 |

| Trade and other payables |

12.6 |

|

74,368 |

|

49,731 |

| Total current

liabilities |

|

|

185,415 |

|

111,698 |

| Liabilities associated to held for sale assets |

5.1.1 |

|

34,937 |

|

- |

| Total liabilities |

|

|

664,231 |

|

435,444 |

| Total liabilities and equity |

|

|

1,335,280 |

|

840,064 |

The accompanying notes are an integral part of these Unaudited

Consolidated Condensed Interim Financial Statements.

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED

CONSOLIDATED CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

For

the six-month period ended June 30, 2023, presented in comparative format.

(In

millions of Argentine Pesos (“$”))

| |

Attributable

to owners |

|

|

|

|

| |

Equity

holders of the company |

|

Retained

earnings |

|

|

|

|

|

|

| |

Share

capital |

|

Share

capital adjustment |

|

Share

premium |

|

Treasury

shares |

|

Treasury

shares adjustment |

|

Treasury

shares cost |

|

Legal

reserve |

|

Voluntary

reserve |

|

Other

reserves |

|

Other

comprehensive income |

|

Retained

earnings |

|

Subtotal |

|

Non-controlling

interest |

|

Total

equity |

| Balance as of December 31,

2021 |

1,382 |

|

7,245 |

|

19,950 |

|

4 |

|

21 |

|

(238) |

|

5,203 |

|

54,528 |

|

(550) |

|

51,432 |

|

44,454 |

|

183,431 |

|

609 |

|

184,040 |

| Constitution of legal

and voluntary reserve |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

(485) |

|

44,939 |

|

- |

|

- |

|

(44,454) |

|

- |

|

- |

|

- |

| Capital reduction |

|

|

- |

|

- |

|

(2) |

|

(14) |

|

209 |

|

- |

|

(193) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

| Treasury shares acquisition |

(2) |

|

(14) |

|

- |

|

2 |

|

14 |

|

(1,171) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(1,171) |

|

- |

|

(1,171) |

| Stock compensation plans |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(113) |

|

- |

|

- |

|

(113) |

|

- |

|

(113) |

| Dividens ditribution |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(25) |

|

(25) |

| Profit for the six-month

period |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

18,469 |

|

18,469 |

|

236 |

|

18,705 |

| Other comprehensive income for the six-month period |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1,034 |

|

21,773 |

|

- |

|

22,911 |

|

4,619 |

|

50,337 |

|

149 |

|

50,486 |

| Balance as of June 30, 2022 |

1,380 |

|

7,231 |

|

19,950 |

|

4 |

|

21 |

|

(1,200) |

|

5,752 |

|

121,047 |

|

(663) |

|

74,343 |

|

23,088 |

|

250,953 |

|

969 |

|

251,922 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Treasury shares acquisition |

- |

|

- |

|

- |

|

- |

|

- |

|

(1,080) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(1,080) |

|

- |

|

(1,080) |

| Stock compensation plans |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

215 |

|

- |

|

- |

|

215 |

|

- |

|

215 |

| Profit (Loss) for the complementary six-month period |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

46,390 |

|

46,390 |

|

(195) |

|

46,195 |

| Other comprehensive income for the complementary six-month

period |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

2,385 |

|

50,196 |

|

- |

|

39,377 |

|

15,027 |

|

106,985 |

|

383 |

|

107,368 |

| Balance as of December 31,

2022 |

1,380 |

|

7,231 |

|

19,950 |

|

4 |

|

21 |

|

(2,280) |

|

8,137 |

|

171,243 |

|

(448) |

|

113,720 |

|

84,505 |

|

403,463 |

|

1,157 |

|

404,620 |

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED

CONSOLIDATED CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY (Continuation)

For

the six-month period ended June 30, 2023, presented in comparative format

(In

millions of Argentine Pesos (“$”))

| |

Attributable

to owners |

|

|

|

|

| |

Equity

holders of the company |

|

Retained

earnings |

|

|

|

|

|

|

| |

Share

capital |

|

Share

capital adjustment |

|

Share

premium |

|

Treasury

shares |

|

Treasury

shares adjustment |

|

Treasury

shares cost |

|

Legal

reserve |

|

Voluntary

reserve |

|

Other

reserves |

|

Other

comprehensive income |

|

Retained

earnings |

|

Subtotal |

|

Non-controlling

interest |

|

Total

equity |

| Balance

as of December 31, 2022 |

1,380 |

|

7,231 |

|

19,950 |

|

4 |

|

21 |

|

(2,280) |

|

8,137 |

|

171,243 |

|

(448) |

|

113,720 |

|

84,505 |

|

403,463 |

|

1,157 |

|

404,620 |

| Constitution of legal

and voluntary reserve |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(16) |

|

84,521 |

|

- |

|

- |

|

(84,505) |

|

- |

|

- |

|

- |

| Capital reduction |

- |

|

- |

|

- |

|

(20) |

|

(105) |

|

2,069 |

|

- |

|

(1,944) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

| Treasury shares acquisition |

(20) |

|

(105) |

|

- |

|

20 |

|

105 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

| Stock compensation plans |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

170 |

|

- |

|

- |

|

170 |

|

- |

|

170 |

| Dividens ditribution |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(103) |

|

(103) |

| Profit for the six-month

period |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

69,097 |

|

69,097 |

|

131 |

|

69,228 |

| Other comprehensive

income for the six-month period |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

3,646 |

|

113,675 |

|

- |

|

67,964 |

|

11,350 |

|

196,635 |

|

499 |

|

197,134 |

| Balance as of June 30, 2023 |

1,360 |

|

7,126 |

|

19,950 |

|

4 |

|

21 |

|

(211) |

|

11,767 |

|

367,495 |

|

(278) |

|

181,684 |

|

80,447 |

|

669,365 |

|

1,684 |

|

671,049 |

The accompanying notes are an integral part of these Unaudited Consolidated Condensed

Interim Financial Statements.

Free translation from the original prepared in Spanish for publication in Argentina |

|

| |

UNAUDITED

CONSOLIDATED CONDENSED INTERIM STATEMENT OF CASH FLOWS

For

the six-month period ended June 30, 2023, presented in comparative format.

(In

millions of Argentine Pesos (“$”))

| |

Note |

|

06.30.2023 |

|

06.30.2022 |

| Cash

flows from operating activities: |

|

|

|

|

|

| Profit

for the period |

|

|

69,228 |

|

18,705 |

| Adjustments

to reconcile net profit to cash flows from operating activities: |

14.1 |

|

17,407 |

|

23,759 |

| Changes

in operating assets and liabilities |

14.2 |

|

(11,120) |

|

(17,286) |

| Net

cash generated by operating activities |

|

|

75,515 |

|

25,178 |

| |

|

|

|

|

|

| Cash

flows from investing activities |

|

|

|

|

|

| Payment

for property, plant and equipment acquisitions |

|

|

(74,884) |

|

(19,645) |

| Payment

for intangibles assets |

|

|

- |

|

(3,312) |

| Collections

for sales (Payment for) public securities and shares acquisitions, net |

|

|

9,212 |

|

(6,969) |

| Recovery

of mutual funds, net |

|

|

1,094 |

|

2,125 |

| Payment

for the acquisition of associates |

|

|

- |

|

(62) |

| Collection

for equity interests in companies sales |

|

|

1,416 |

|

2,842 |

| Collections

for property, plant and equipment sales |

|

|

62 |

|

20 |

| Collections

for intangible assets sales |

|

|

1,626 |

|

2,060 |

| Dividends

received |

|

|

- |

|

523 |

| (Payment)

Collection of loans |

|

|

(217) |

|

1,172 |

| Net

cash used in investing activities |

|

|

(61,691) |

|

(21,246) |

| |

|

|

|

|

|

| Cash

flows from financing activities |

|

|

|

|

|

| Proceeds

from borrowings |

12.5 |

|

46,753 |

|

3,946 |

| Payment

of borrowings |

12.5 |

|

(3,357) |

|

(459) |

| Payment

of borrowings interests |

12.5 |

|

(29,710) |

|

(6,257) |

| Payment

for treasury shares acquisition |

|

|

- |

|

(1,171) |

| Repurchase

of corporate bonds |

12.5 |

|

(1,335) |

|

- |

| Payments

of leases |

|

|

(75) |

|

(281) |

| Payments

of dividends |

|

|

(139) |

|

(30) |

| Net

cash generated by (used in) financing activities |

|

|

12,137 |

|

(4,252) |

| |

|

|

|

|

|

| Increase

(Decrease) in cash and cash equivalents |

|

|

25,961 |

|

(320) |

| |

|

|

|

|

|

| Cash

and cash equivalents at the beginning of the year |

12.4 |

|

18,757 |

|

11,283 |

| Cash

and cash equivalents at the end of the year of held for sale assets |

|

|

(4,908) |

|

- |

| Exchange

and conversion difference generated by cash and cash equivalents |

|

|

10,939 |

|

2,209 |

| Increase

(Decrease) in cash and cash equivalents |

|

|

25,961 |

|

(320) |

| Cash

and cash equivalents at the end of the period |

12.4 |

|

50,749 |

|

13,172 |

The accompanying notes are an integral part of these Unaudited Consolidated Condensed

Interim Financial Statements.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM FINANCIAL STATEMENTS For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

NOTE 1: GENERAL INFORMATION

General information of the Company

The Company is a fully integrated power company in

Argentina, which mainly participates in the electric energy and gas value chains.

In the generation segment, the Company, directly and

through its subsidiaries and joint ventures, has a 5,432 MW installed capacity as of June 30, 2023, which represents approximately 13%

of Argentina’s installed capacity, and being one of the four largest independent generators in the country. Additionally, the Company

is currently undergoing a process to expand its installed capacity by an additional 140 MW.

In the oil and gas segment, the Company develops an

important activity in gas and oil exploration and production, with operations in 11 production areas and 4 exploratory areas reaching

a production level of 9.7 million m3/day of natural gas and 5.1 thousand boe/day of oil in Argentina, during the first semester ended

June 30, 2023. Its main natural gas production blocks are located in the Provinces of Neuquén and Río Negro.

In the petrochemicals segment, operations are located

in Argentina, where the Company operates two high-complexity plants producing styrene, synthetic rubber and polystyrene, with a domestic

market share ranging between 94% and 100%.

Finally, through the holding and others segment, the

Company participates in the electricity transmission and oil and gas transportation businesses. In the electricity transmission business,

the Company jointly controls Citelec, which has a controlling interest in Transener, a company engaged in the operation and maintenance

of a 21,697 km high-voltage electricity transmission network in Argentina with an 86% share in the Argentine electricity transmission

market. In the gas transportation business, the Company jointly controls CIESA, which has a controlling interest in TGS, a company holding

a concession for the transportation of natural gas with 9,220 km of gas pipelines in the center, west and south of Argentina, and which

is also engaged in the processing and sale of natural gas liquids through the Cerri Complex, located in Bahía Blanca, in the Province

of Buenos Aires, in addition to shale gas transportation and conditioning at Vaca Muerta. Besides, the Company owns a 30.1% indirect interest

in OCP (see Note 5.1.4), licensee company of an oil pipeline in Ecuador that has a transportation capacity of 450 thousand barrels/day.

Additionally, the segment includes advisory services provided to related companies.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 2: REGULATORY FRAMEWORK

| 2.1.1 | Sales contracts with large users within

the MAT |

| 2.1.1.1 | Renewable Energy Term Market (“MATER” Regime) |

On March 20, 2023, SE Resolution No. 165/23 was passed,

which modified the penalty system applicable to MATER and Renovar projects, including projects awarded under the Renovar MiniRen Program,

Round 3. Penalties for breaches in the committed supply of energy were incorporated into the system, to be discounted in 12 monthly and

consecutive installments as from commercial commissioning, keeping the generator’s option to cancel the penalties in 48 monthly

and consecutive installments with the application of a 1.7% EAR in U.S. dollars. To avoid affecting the projects’ minimum maintenance,

a 20% discount cap for the monthly transaction was established for those generators opting into the 48-installment scheme. The balance

following the application of this cap will be discounted in the first transaction in which the penalty is below the stated cap; if the

number of installments is exceeded, the scheme will be maintained until the penalties’ full cancellation and, in case the contract

term is exceeded, the payment scheme may be restructured, or the discount cap may be increased to 40% of the transaction.

2.1.1.2 Amendment to the dispatch priority system

SE Resolution No. 360/23 introduced several changes

to the effective priority dispatch system. These modifications include the granting of a dispatch priority to renewable generation projects

to be sold in the MATER that finance the corresponding transmission expansions and/or renewable energy generation projects with an associated

demand larger than 10 MW.

Besides, it established a new referential dispatch

priority system in corridors without full availability at every hour of the year. In this way, the dispatch priority will have an injection

probability of 92% of the typical annual energy.

Moreover, it establishes that parcially commissioned

projects regarding the committed capacity will pay the dispatch priority charge exclusively for the difference between the assigned power

capacity and that commissioned, provided the accumulated commissioned capacity is at least 50% of that assigned.

Finally, projects with commissioned power capacity

lower than assigned power capacity will lose dispatch priority for uncommissioned power capacity.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 2: (Continuation)

| 2.1.2 | Supply Agreements with CAMMESA |

2.1.2.1 Renovar Programs

In line with the scheme set forth by SE Resolution

No. 1,260/21 and to address the issue of projects under the different Renovar rounds breaching the committed commercial commissioning

dates, on April 25, 2023, the SE passed Resolution No. 284/23 to release the transportation capacity committed under different Renovar

Rounds having difficulties with the projects' conclusion. The new scheme authorizes holders of these projects to terminate the Supply

Agreement with CAMMESA against the payment of an amount equivalent to US$ 35,000 per MW of the project’s power capacity, the waiver

of claims against the Federal Government, the SE and/or CAMMESA, an indemnity commitment to realease these authorities against claims

by its shareholders or controlling, controlled and/or affiliated companies, and the waiver of granted and unused fiscal benefits. Applications

should be presented to CAMMESA within 30 calendar days from the resolution’s publication; the above-stated documentation should

be completed within 90 calendar days, and agreements opting into the Fund for Renewable Energy Development (Fondo para el Desarrollo

de Energía Renovables, "FODER") should be terminated.

2.1.2.2 Remuneration for combined cycles

SE Resolution No. 59/23 dated February 7, 2023 established

an opt-in system under which combined cycles’ owners could execute an availability and efficiency optimization agreement with CAMMESA.

The agreement contemplates an availability commitment for 85% of the net power capacity for a maximum term of 5 years and sets a US$ 2,000/MW-month

remuneration for the available power capacity and the dollarization of the energy price based on the fuel used (US$ 3.5/MWh for natural

gas and US$ 6.1/MWh for fuel oil and gas oil). Besides, it provides for a 35% and 15% reduction in the remuneration collectible for guaranteed

power capacity for generators with availability commitments in the spot market for the summer-winter and autumn-spring periods, respectively.

The Company executed agreements with CAMMESA for its

CTLL and Genelba power plants’ combined cycles. On the other side, CTB executed an agreement with CAMMESA for its open cycle’s

gas turbines units. In all cases, agreements are effective from March 1, 2023 to February 29, 2028.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 2: (Continuation)

2.1.2.3 RenMDI Call

Pursuant to SE Resolution No. 609/23, projects submitted

under the RenMDI call for tenders were awarded. Under line 1, destined for the substitution of forced generation, 514 MW of power

capacity were awarded, distributed among 46 projects, for an average price of US$ 73.1/MWh. Under line 2, destined for the diversification

of the energy matrix, 52 projects were awarded for a total 119.57 MW power capacity and an average price of US$ 145.8/MWh.

Pampa has not participated in this call.

Natural gas exports

On April 19, 2023, the SE notified the Company of the

extension of the Neuquina basin’s natural gas export quota for the next winter period, consisting of: (i) an extraordinary and priority

quota of 2 million m3/d for the months of May and June 2023, assignable pro rata among the “July Flat Gas Commitment” awardees,

and (ii) a firm winter export quota under Plan GasAr for a 3 million m3/d volume for the months of July, August and September 2023.

In this sense, the Company was assigned an additional

volume of 872,727 m3/, totaling a 2,181,818 m3/d export quota for the months of May and June. The volume assigned for the months of July,

August and September was 857,449 m3/d. Regarding the minimum price for export permits, it will remain at US$ 7.73/MMBTU.

Besides, the following summer export quotas were assigned:

9 million m3/d for the Neuquina Basin and 2 million m3/d for the Austral Basin. The minimum price will result from calculating the simple

average Brent oil prices in the first fifteen days of the month prior to delivery, multiplied by 7%. The Company was assigned a 1,452,878

m3/d volume.

TGS’s Tariff situation

On March 16, 2023, TGS’s Board of Directors approved

a proposed addendum to the renegotiation transitionary agreement (the “2023 RTT”) sent by ENARGAS. On April 27, 2023, ENARGAS

issued Resolution No. 186/23 publishing the new effective tariff schemes. The 2023 RTT was later ratified by PEN Executive Order No. 250/23

dated April 29, 2023.

The 2023 RTT includes, effective from April 29, 2023, a 95%

transitionary tariff increase on the natural gas transportation tariff and the access and use charge. While it is in force, TGS may not

distribute dividends or directly or indirectly early cancel financial and commercial debts taken on with shareholders, acquire other companies

or grant loans, except for loans benefiting users or granted to contractors not covered by the previously indicated cases. If TGS deems

it appropriate to act otherwise, it should require the corresponding authorization.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 2: (Continuation)

Transener and Transba’s tariff situation

On April 20, 2023, under ENRE Resolution No. 364/23,

the ENRE launched the comprehensive tariff review process for electricity transmission companies pursuant to Act No. 24,065 and Act No.

27,541, setting a 30-day term to draw up the guidelines and schedule for its development.

On May 29, 2023, ENRE Resolution No. 421/23 approved the transmission

tariff review program for the year 2023 and the first quarter of 2024, providing for the ENRE´s notification of the schedule and

information requirements during the months of September and October 2023.

| 2.5 | Regulations on access to the MLC |

The main updates introduced by the BCRA on MLC inflow

and outflow regulations which were disclosed in the Consolidated Financial Statements as of December 31, 2022, are summarized below.

On April 20, 2023, for the provision of certain services,

the BCRA prior authorization was incorporated as requirement to access the MLC before 60 calendar days as from approval of the Argentine

Republic’s Imports and Foreign Service Payments System (“SIRASE”)’s affidavit. This requirement is not applicable

in the following cases: (i) payments through a swap and/or arbitrage against a foreign-currency domestic account; (ii) access simultaneously

with the settlement of a new foreign financial indebtedness for which the principal matures after the stated term; and (iii) access with

funds originated in the financing of service imports granted by a domestic financial entity with a commercial credit line abroad when

the total principal of the financing matures after the stated term. On May 11, 2023, the BCRA established that financial entities should

verify that the corresponding SIRA affidavit with an "approved" (salida) status has been assigned a term of 0 calendar

days to access the MLC before granting access to pay imports of goods with a pending customs entry record (advance and sight payments)

and payments of commercial debts without a customs entry record (in accordance with the exceptions set by the regulation).

As regards transactions with stock market assets, the

term during which transactions may not be conducted is extended to 180 calendar days for securities issued under foreign law and maintained

at 90 days for securities issued under Argentine law, to be submitted in the affidavits to access the MLC. On May 11, 2023, the BCRA broadened

the scope of the affidavits for deliveries made as from May 12, 2023 to include legal entities that are part of the same economic group

as the affiant (that is, companies sharing a control relationship under the "Large credit risk exposures" regulations).

More information on Argentina’s foreign exchange

regulations can be found at the BCRA’s website: www.bcra.gov.ar.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 3: BASIS OF PREPARATION

These Consolidated Condensed Interim Financial Statements

for the six-month period ended June 30, 2023 have been prepared pursuant to the provisions of IAS 34, “Interim Financial Information”,

are expressed in million pesos and were approved for their issuance by the Company’s Board of Directors on August 9, 2023.

The information included in the Consolidated Condensed

Interim Financial Statements is recorded in US dollars, which is the Company’s functional currency and, in accordance with CNV requirements,

is presented in pesos, the legal currency in Argentina.

This consolidated condensed interim financial information

had been prepared under the historical cost convention, modified by the measurement of financial assets at fair value through profit or

loss and they should be read together with the Consolidated Financial Statements as of December 31, 2022, which have been prepared under

IFRS.

These Consolidated Condensed Interim Financial Statements

for the six-month period ended June 30, 2023 have not been audited. The Company’s management estimates they include all the necessary

adjustments to state fairly the results of operations for the period. The results for the six-month period ended June 30, 2023, does not

necessarily reflect in proportion the Company’s results for the complete year.

The accounting policies have been consistently applied

to all entities within the Group.

Comparative information

The information as of December 31, 2022, and for the

six and three-month periods ended June 30, 2022, disclosed for comparative purposes, arises from the Consolidated Financial Statements

as of those dates.

Additionally, certain non-significant reclassifications

have been made to those Consolidated Financial Statements´ figures to keep the consistency in the presentation with the figures

of the current period.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 4: ACCOUNTING POLICIES

The accounting policies applied in these Consolidated

Condensed Interim Financial Statements are consistent with those used in the Consolidated Financial Statements for the last fiscal year,

which ended on December 31, 2022.

New accounting standards, amendments and interpretations

issued by the IASB effective as of December 31, 2023 and adopted by the Company

The Company has applied the following standards and

/ or amendments for the first time as of January 1, 2023:

| - | IFRS 17 - “Insurance Contracts” (issued in May 2017 and modified in June 2020 and December

2021). |

| - | IAS 1 - “Presentation of financial statements” (amended in February 2021). |

| - | IAS 8 - “Accounting Policies” (amended in February 2021). |

| - | IAS 12 - “Income Tax” (amended in May 2021). |

The application of the detailed standards and amendments

did not have any impact on the results of the operations or the financial position of the Company.

NOTE 5: GROUP STRUCTURE

| 5.1 | Interest in subsidiaries, associates and joint ventures |

| 5.1.1 | Assets and liabilities available for sale – Agreement for the acquisition of an additional interest

in Rincón de Aranda and divestment of stake in Greenwind |

On June 23, 2023, the Company executed an agreement

with Total Austral S.A. (Argentine branch) to acquire the additional 45% interest in the Rincón de Aranda area, reaching a 100%

interest in the block. As part of the agreement, Pampa will assign 100% of its equity stake in Greenwind, which only asset is the Mario

Cebreiro Wind Farm.

Rincón de Aranda is a 240 km2 exploration block

located in the oil window of the Vaca Muerta formation, in the Province of Neuquén. It currently has a shut-in production well

and an uncompleted well, both drilled in 2019; although the block is not currently in production, its proximity to important productive

blocks in the Vaca Muerta formation makes it highly promising from a technical standpoint.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5: (Continuation)

The closing of the transaction is subject to the fulfillment

of certain conditions precedent, including, but not limited to, the assignment's approval and the granting of an Unconventional Hydrocarbons

Exploitation Concession ("CENCH") over the block in favor of the Company.

On July 26, 2023, the Company entered into a Memorandum

of Understanding with the Province of Neuquén agreeing on the CENCH's granting terms. Pursuant to Executive Order No. 1,435/23

dated July 31, 2023, the Province of Neuquén approved the above-mentioned Memorandum of Understanding, the assignment of Total

Austral S.A. (Argentine branch)'s interest to the Company and granted the CENCH to the Company. The assignment of rights over the area

and the CENCH will become effective at transaction closing.

On the other side, Mario Cebreiro Wind Farm, inaugurated

in 2018 with a 100 MW capacity and located in Bahía Blanca, Province of Buenos Aires, was the Company's first wind power project,

which was awarded under the Renovar 1 program. It is worth highlighting that, despite the wind farm's assignment, the Company remains

committed to renewable energy, which is essential to keep its position as a leading provider of efficient energy and has started the construction

of PEPE VI (see Note 18).

Lastly, with the acquisition of the additional interest

in Rincón de Aranda, the Company diversifies its presence in the energy sector with a shale oil block having great production potential

and reinforces its commitment to the development of unconventional reserves in Vaca Muerta.

Within the described framework and in accordance with

IFRS 5, Greenwind's assets and liabilities have been classified as held for sale as of June 30, 2023.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5: (Continuation)

As of June 30, 2023, held for sale assets and liabilities

are as follows:

| ACTIVO |

|

| ACTIVO

NO CORRIENTE |

|

| Property, plant and

equipment |

31,083 |

| Intangible assets |

7,582 |

| Other receivables |

4 |

| Total non-current assets |

38,669 |

| |

|

| CURRENT

ASSETS |

|

| Financial assets at fair value through profit and loss |

1,668 |

| Trade and other receivables |

1,386 |

| Cash and cash equivalents |

4,908 |

| Total

current assets |

7,962 |

| Held

for sale assets |

46,631 |

| |

|

| LIABILITIES |

|

| NON-CURRENT

LIABILITIES |

|

| Provisions |

241 |

| Income tax provision |

1,473 |

| Deferred tax liability |

12,234 |

| Borrowings |

16,004 |

| Total

non-current liabilities |

29,952 |

| |

|

| CURRENT

LIABILITIES |

|

| Income tax provision |

554 |

| Borrowings |

4,276 |

| Trade payables |

155 |

| Total current

liabilities |

4,985 |

| Liabilities

associated to held for sale assets |

34,937 |

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5:

(Continuation)

| 5.1.2 | Subsidiaries information |

| |

|

|

|

|

|

30.06.2023 |

|

31.12.2022 |

| Sociedad |

|

País

de domicilio |

|

Actividad

principal |

|

%

de participación directo e indirecto |

|

%

de participación directo e indirecto |

| Autotrol Renovable S.A. |

|

Argentina |

|

Generadora |

|

100.00% |

|

100.00% |

| GASA |

|

Argentina |

|

Generadora |

|

100.00% |

|

100.00% |

| Enecor S.A. |

|

Argentina |

|

Transporte

de electricidad |

|

70.00% |

|

70.00% |

| Fideicomiso CIESA |

|

Argentina |

|

Inversora |

|

100.00% |

|

100.00% |

| Greenwind (1) |

|

Argentina |

|

Generadora |

|

100.00% |

|

100.00% |

| HIDISA |

|

Argentina |

|

Generadora |

|

61.00% |

|

61.00% |

| HINISA |

|

Argentina |

|

Generadora |

|

52.04% |

|

52.04% |

| CISA |

|

Argentina |

|

Comercializadora e inversora |

|

100.00% |

|

100.00% |

| PEB |

|

Bolivia |

|

Inversora |

|

100.00% |

|

100.00% |

| PB18 |

|

Ecuador |

|

Petrolera |

|

100.00% |

|

100.00% |

| Energía Operaciones

ENOPSA S.A. |

|

Ecuador |

|

Petrolera |

|

100.00% |

|

100.00% |

| Pampa Ecuador Inc |

|

Nevis |

|

Inversora |

|

100.00% |

|

100.00% |

| PE Energía Ecuador

LTD |

|

Gran

Cayman |

|

Inversora |

|

100.00% |

|

100.00% |

| EISA |

|

Uruguay |

|

Inversora |

|

100.00% |

|

100.00% |

| PISA |

|

Uruguay |

|

Inversora |

|

100.00% |

|

100.00% |

| TGU |

|

Uruguay |

|

Transporte

de gas |

|

51.00% |

|

51.00% |

| Petrolera San Carlos

S.A. |

|

Venezuela |

|

Petrolera |

|

100.00% |

|

100.00% |

| VAR |

|

Argentina |

|

Generadora |

|

100.00% |

|

100.00% |

| Vientos Solutions Argentina S.A.U. |

|

Argentina |

|

Servicios de asesoramiento |

|

100.00% |

|

100.00% |

| Vientos Solutions S.L.U. |

|

España |

|

Inversora |

|

100.00% |

|

100.00% |

(1) See Note 5.1.1.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5: (Continuation)

| 5.1.3 | Associates and joint ventures information |

The following table presents the main activity and

the financial information used for valuation and percentages of participation in associates and joint ventures:

| |

|

|

|

Información

sobre el emisor |

|

|

| |

|

Actividad

principal |

|

Fecha |

|

Capital

social |

|

Resultado

del período |

|

Patrimonio |

|

%

de participación directo e indirecto |

| Asociadas |

|

|

|

|

|

|

|

|

|

|

|

|

| OCP Ltd |

|

Inversora |

|

06.30.2023 |

|

25,786 |

|

364 |

|

25,163 |

|

30.06% |

| TGS (1) |

|

Trasporte de gas |

|

06.30.2023 |

|

753 |

|

19,252 |

|

421,909 |

|

2.612% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Negocios

conjuntos |

|

|

|

|

|

|

|

|

|

|

| CIESA (1) |

|

Inversora |

|

06.30.2023 |

|

639 |

|

9,794 |

|

215,281 |

|

50.00% |

| Citelec (2) |

|

Inversora |

|

06.30.2023 |

|

556 |

|

4,171 |

|

66,857 |

|

50.00% |

| CTB |

|

Generadora |

|

06.30.2023 |

|

8,558 |

|

2,313 |

|

140,199 |

|

50.00% |

| (1) |

The Company holds a direct and indirect interest of 2.612% in TGS and 50% in CIESA, a company that holds a 51% interest in the share

capital of TGS. Therefore, additionally the Company has an indirect participation of 25.50% in TGS. |

|

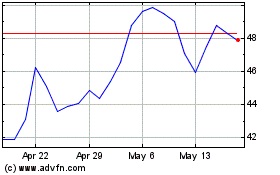

As of June 30, 2023, the quotation of TGS's ordinary shares and ADR published on the Buenos Aires Stock Exchange and the NYSE was $ 1,414.60

and US$ 13.78, respectively, granting to Pampa (direct and indirect) ownership an approximate stake market value of $ 315,943 million. |

| (2) |

The Company holds a 50% interest in Citelec, a company that holds a 52.65% interest in Transener’s capital stock; therefore, the

Company has a 26.33% indirect interest in Transener. As of June 30, 2023, Transener’s common share price listed at the Buenos Aires

Stock Exchange was $ 346 conferring Pampa’s indirect interest an approximate $ 40,4503 million market value. |

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5: (Continuation)

The detail of the balances

of investments in associates and joint ventures is as follows:

| |

|

06.30.2023 |

|

12.31.2022 |

| Disclosed

in non-current assets |

|

|

|

|

| Associates |

|

|

|

|

| OCP |

|

4,010 |

|

2,679 |

| TGS |

|

11,746 |

|

11,805 |

| Other |

|

6 |

|

3 |

| Total

associates |

|

15,762 |

|

14,487 |

| Joint

ventures |

|

|

|

|

| CIESA |

|

120,714 |

|

77,043 |

| Citelec |

|

33,428 |

|

20,801 |

| CTB |

|

70,100 |

|

47,502 |

| Total

joint ventures |

|

224,242 |

|

145,346 |

| Total

associates and joint ventures |

|

240,004 |

|

159,833 |

The following table shows the breakdown of the result from investments in associates

and joint ventures:

| |

|

06.30.2023 |

|

06.30.2022 |

| Associates |

|

|

|

|

| Refinor |

|

- |

|

(1,328) |

| OCP |

|

109 |

|

(157) |

| TGS |

|

594 |

|

561 |

| Total associates |

|

703 |

|

(924) |

| |

|

|

|

|

| Joint

ventures |

|

|

|

|

| CIESA |

|

4,625 |

|

3,672 |

| Citelec |

|

2,086 |

|

419 |

| CTB |

|

1,156 |

|

3,657 |

| Greenwind |

|

- |

|

37 |

| Total joint ventures |

|

7,867 |

|

7,785 |

| Total associates and joint

ventures |

|

8,570 |

|

6,861 |

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5: (Continuation)

The evolution of investments in associates and joint ventures is as follows:

| |

|

06.30.2023 |

|

06.30.2022 |

| At the beginning of

the year |

|

159,833 |

|

79,114 |

| Dividends |

|

- |

|

(854) |

| Acquisition of equity

interests |

|

- |

|

62 |

| Sale of equity interests |

|

(5,875) |

|

- |

| Held

for sale assets |

|

- |

|

(1,544) |

| Share of profit |

|

8,570 |

|

8,103 |

| Impairment |

|

- |

|

(1,242) |

| Exchange differences on translation |

|

77,476 |

|

25,528 |

| At

the end of the period |

|

240,004 |

|

109,167 |

On May 4, 2023, the Company, through its subsidiary

PEB, entered into a purchase agreement with Repsol OCP de Ecuador S.A. to acquire 2,979,606,613 additional shares, representing 29.66%

of the share capital, of OCP Ltd, which in turn holds the whole share capital and voting rights of OCP SA, for a price of US$ 15 million,

adjusted by subtracting the dividends collected by Repsol OCP de Ecuador S.A. between January 1, 2023 and the transaction closing date.

The completion of the transaction is subject to the customary precedent conditions, including the applicable governmental approvals.

Closing to combined cycle project

On February 22, 2023, CTB stared operations under the

supply agreement with CAMMESA. On April 26, 2023, CTB was commissioned to operate with gas oil.

Issuance of CB

The resolutive condition of the guarantees granted

by CTB’s co-controlling shareholders (Pampa Energía S.A. and YPF S.A.) in favor of holders of outstanding Classes 1, 2, 4,

6, 7 and 8 CB issued by CTB to secure the timely and proper payment of any owed amount, including principal and interest services, was

fulfilled with the combined cycle’s commissioning on February 22, 2023. Consequently, these guarantees are terminated, ineffective

and unenforceable.

On April 3, 2023, CTB issued Class 9 CB for a total

amount of US$ 50 million at an annual fixed interest rate of 0% and maturing on April 3, 2026. Class 9 CB were subscribed and paid in

cash and in-kind through the delivery of Class 1 CB, consequently, Class 1 CB with a face value of US$ 2.2 million were partially canceled.

The remaining outstanding face value of Class 1 CB, amounting to US$ 30 million, was redeemed in full in May 2023.

Free translation from the original prepared in Spanish for publication in Argentina |

|

NOTES TO THE UNAUDITED CONSOLIDATED CONDENSED INTERIM

FINANCIAL STATEMENTS (Continuation) For the six-month period ended June 30, 2023, presented in comparative format. (In millions of Argentine Pesos (“$”)) |

| |

NOTE 5: (Continuation)

As of the date of issuance of these Consolidated Condensed

Interim Financial Statements, CTB is in compliance with all the covenants under its debt agreements.

| 5.2 | Oil and gas participations |

Continuity plan in the Parva Negra Este block

On December 14, 2022, the Company, ExxonMobil Exploration

Argentina S.R.L. and GyP submitted to the Provincial Enforcement Authority a proposal for a contractual continuity plan which included:

(i) the granting of a Lot under Evaluation for the April-2022 through April-2025 period, (ii) a 50% reduction of the block’s surface,

to a total surface of 143 km2, (iii) the assignment of ExxonMobil Exploration Argentina S.R.L.’s 42.50% interest to the Company,

and (iv) the commitment to drill and complete 1 horizontal well targeting Vaca Muerta before September 2024.

As of the issuance of these Consolidated Condensed

Interim Financial Statements, the parties have executed an addendum to the Joint Venture agreement under the stated terms, and the Provincial

Executive Order approving it is pending issuance.

Anticlinal Campamento termination agreement

On January 19, 2023, the Company accepted Oilstone

Energía S.A.’s offer to terminate its rights and obligations under the investment agreement, the Joint Venture and the operating

agreement of the block, effective from January 1, 2023.

Estación Fernández Oro termination

agreement

On March 14, 2023, the Company accepted YPF S.A.’s

proposal to terminate, effective as from January 1, 2023, all the Company’s rights and obligations in the investment agreement,

the Joint Venture and the operating agreement for the Estación Fernández Oro block’s exploitation concession.

Las Tacanas Norte Exploration Permit Termination

On January 4, 2023, the Las Tacanas Norte block exploration

period terminated, and the Company’s rights and obligations over the area expired.

Aguaragüe Concession Extension

On February 3, 2023, an agreement for a 10-year extension