This news release contains "forward-looking information and

statements" within the meaning of applicable securities laws. For a

full disclosure of the forward-looking information and statements

and the risks to which they are subject, see the "Cautionary

Statement Regarding Forward-Looking Information and Statements"

later in this news release.

Precision Drilling Corporation (Precision or

the Company) announced today that the Toronto

Stock Exchange (the TSX) has approved its

intention to implement a normal course issuer bid

(NCIB) for a portion of its common shares

(Common Shares). Precision believes the NCIB

continues to represent another tool for the Company to enhance the

value of its underlying shares.

Pursuant to the renewed NCIB, the Company has

been authorized by the TSX to acquire up to a maximum of 1,359,108

Common Shares, or approximately 10% of the public float as of

September 5, 2024, for cancellation. As of September 5, 2024,

Precision had 14,107,373 Common Shares issued and outstanding and a

public float of 13,591,089 Common Shares. Purchases under the NCIB

may commence on September 19, 2024 and will terminate no later than

September 18, 2025, or such earlier time as the Company completes

its purchases pursuant to the NCIB or provides notice of

termination.

Purchases under the NCIB will be made in

accordance with applicable regulatory requirements through the

facilities of the TSX, the New York Stock Exchange (the

NYSE), other designated exchanges and/or

alternative trading systems in Canada or the United States or by

such other means as may be permitted by the applicable securities

regulator at a price per Common Share representative of the market

price at the time of acquisition. The number of Common Shares that

can be purchased pursuant to the NCIB is subject to a current daily

maximum of 19,307 Common Shares (which is equal to 25% of the

average daily trading volume of 77,231 Common Shares on the TSX for

the six full calendar months ending August 31, 2024), subject to

the Company’s ability to make one block purchase of Common Shares

per calendar week that exceeds such limits. All Common Shares

purchased under the NCIB will be cancelled after their purchase.

The Company intends to fund the purchases out of its available

resources.

Pursuant to its prior NCIB, under which the

Company had approval from the TSX to purchase up to 1,326,321

Common Shares for the period of September 19, 2023 to September 18,

2024, through September 5, 2024 the Company has purchased 735,322

Common Shares on the TSX, NYSE and alternative trading systems at a

weighted average purchase price of CAD$88.48 per Common Share.

The Company intends to enter into an automatic

securities purchase plan effective September 19, 2024 under which

its broker may purchase Common Shares in connection with the NCIB.

The plan will contain a prearranged set of criteria in accordance

with which its broker may make Common Share purchases. These strict

parameters enable the purchase of Common Shares during times when

it would ordinarily not be permitted due to self-imposed blackout

periods, insider trading rules or otherwise. Such plan is adopted

in accordance with applicable Canadian securities laws and the

requirements of Rule 10b5-1 under the U.S. Securities Exchange Act

of 1934, as amended.

About Precision

Precision is a leading provider of safe and

environmentally responsible High Performance, High Value services

to the energy industry, offering customers access to an extensive

fleet of Super Series drilling rigs. Precision has commercialized

an industry-leading digital technology portfolio known as

Alpha™ that utilizes advanced automation software and

analytics to generate efficient, predictable, and repeatable

results for energy customers. Our drilling services are enhanced by

our EverGreen™ suite of environmental solutions, which

bolsters our commitment to reducing the environmental impact of our

operations. Additionally, Precision offers well service rigs, camps

and rental equipment all backed by a comprehensive mix of technical

support services and skilled, experienced personnel.

Precision is headquartered in Calgary, Alberta,

Canada and is listed on the Toronto Stock Exchange under the

trading symbol “PD” and on the New York Stock Exchange under the

trading symbol “PDS”.

Cautionary Statement Regarding

Forward-Looking Information and Statements

Certain statements contained in this release,

including statements that contain words such as “could”, “should”,

“can”, “anticipate”, “estimate”, “intend”, “plan”, “expect”,

“believe”, “will”, “may”, “continue”, “project”, “potential” and

similar expressions and statements relating to matters that are not

historical facts constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 (collectively, “forward-looking

information and statements”).

In particular, forward-looking information and

statements include, but are not limited to the funding of purchases

under the NCIB and the entering in to of an automatic securities

purchase plan and advantages of the NCIB.

These forward-looking information and statements

are based on certain assumptions and analysis made by Precision in

light of our experience and our perception of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate under the circumstances. These include,

among other things:

- the fluctuation in

oil prices may pressure customers into reducing or limiting their

drilling budgets;

- the status of current negotiations

with our customers and vendors;

- customer focus on safety

performance;

- existing term contracts are neither

renewed nor terminated prematurely;

- continued market demand for Super

Spec rigs;

- our ability to deliver rigs to

customers on a timely basis;

- the general stability of the

economic and political environments in the jurisdictions where we

operate; and

- the impact of an increase/decrease

in capital spending.

Undue reliance should not be placed on

forward-looking information and statements. Whether actual results,

performance or achievements will conform to our expectations and

predictions is subject to a number of known and unknown risks and

uncertainties which could cause actual results to differ materially

from our expectations. Such risks and uncertainties include, but

are not limited to:

- volatility in the

price and demand for oil and natural gas;

- fluctuations in the level of oil

and natural gas exploration and development activities;

- fluctuations in the demand for

contract drilling, well servicing and ancillary oilfield

services;

- our customers’ inability to obtain

adequate credit or financing to support their drilling and

production activity;

- changes in drilling and well

servicing technology, which could reduce demand for certain rigs or

put us at a competitive advantage;

- shortages, delays and interruptions

in the delivery of equipment supplies and other key inputs;

- liquidity of the capital markets to

fund customer drilling programs;

- availability of cash flow, debt and

equity sources to fund our capital and operating requirements, as

needed;

- the impact of weather and seasonal

conditions on operations and facilities;

- competitive operating risks

inherent in contract drilling, well servicing and ancillary

oilfield services;

- ability to improve our rig

technology to improve drilling efficiency;

- general economic, market or

business conditions;

- the availability of qualified

personnel and management;

- a decline in our safety performance

which could result in lower demand for our services;

- changes in laws or regulations,

including changes in environmental laws and regulations such as

increased regulation of hydraulic fracturing or restrictions on the

burning of fossil fuels and greenhouse gas emissions, which could

have an adverse impact on the demand for oil and natural gas;

- terrorism, social, civil and

political unrest in the foreign jurisdictions where we

operate;

- fluctuations in foreign exchange,

interest rates and tax rates; and

- other unforeseen conditions which

could impact the use of services supplied by Precision and

Precision’s ability to respond to such conditions.

Readers are cautioned that the foregoing list of

risk factors is not exhaustive. Additional information on these and

other factors that could affect our business, operations or

financial results are included in reports on file with applicable

securities regulatory authorities, including but not limited to

Precision’s Annual Information Form for the year ended December 31,

2023, which may be accessed on Precision’s SEDAR+ profile at

www.sedarplus.ca or under Precision’s EDGAR profile at www.sec.gov.

The forward-looking information and statements contained in this

news release are made as of the date hereof and Precision

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, except as required by

law.

Additional Information

For further information about Precision, please

visit our website at www.precisiondrilling.com or contact:

Lavonne Zdunich, CPA, CAVice President, Investor

Relations403.716.4500

800, 525 - 8th Avenue S.W. Calgary, Alberta,

Canada T2P 1G1Website: www.precisiondrilling.com

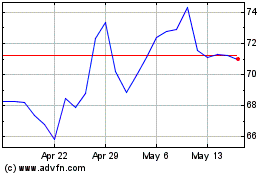

Precision Drilling (NYSE:PDS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Precision Drilling (NYSE:PDS)

Historical Stock Chart

From Nov 2023 to Nov 2024