‘Baby steps’ toward retirement: Prudential gives Generation Beta a savings kick start and launches first-of-kind study

January 01 2025 - 10:00AM

Business Wire

First-of-its-kind report reveals what the future may hold for

Generation Beta, and the “Beta Baby Bonus” offered today inspires

early financial action

Today Prudential Financial, Inc. (NYSE: PRU) joins the world in

welcoming Generation Beta (people born Jan. 1, 2025, to Dec. 31,

2039) by commissioning a first-of-its-kind report, Generation

Beta: Redefining Life, Longevity, and Retirement, that reveals

how Americans envision the future, and how technological, social

and economic shifts will impact their financial security.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241217226022/en/

To celebrate this new generation and encourage a head start on

living a better life, longer, Prudential is kick-starting their

retirement savings by offering the Beta Baby Bonus.

Beginning today, parents or guardians of a “Beta baby” born in the

United States on Jan. 1, 2025, can apply to receive $150 to put

toward saving for their future. This amount, which also

commemorates the company’s 150th anniversary in 2025, has the

potential to grow to approximately $100,000 by age 70 if invested

toward retirement savings.1

New research commissioned in tandem with the Beta Baby Bonus

shows that Americans are already worrying about this new

generation’s financial journey, in addition to their own retirement

security. Eighty percent of prospective Generation Beta parents

agree that, in an ideal world, parents would start saving for their

child’s retirement from birth. In fact, the No. 1 regret among

current and prospective parents is that they “didn’t save more for

retirement.”

“As a first-time parent, I understand how daunting financial

planning can be for a family,” said Brandon Goldstein, ChFC®,

financial planner with Prudential Financial. “While you can’t

predict the future, you can plan for it from day one. My son’s

future starts with me and how we plan for it as a family. Most new

parents think about updating their healthcare plans or insurance

policies, but that’s only the beginning. Reassessing your budget to

ensure you’re accounting for long-term savings goals and factoring

in expected rising costs for the entire family is a critical

step.”

With a generation that may not retire until the 2100s, what

might Generation Beta’s world look like? Prudential’s new report,

Generation Beta: Redefining Life, Longevity, and Retirement,

explores that and its impact on their financial future. Key

findings include:

LIFE: How

Generation Beta will work and live will look vastly different, with

86% believing Generation Beta will have jobs that haven’t been

invented yet and 68% believing that Generation Beta will have more

pets than children, shifting the dynamics of retirement,

financial solutions and generational caregiving.

LONGEVITY: Generation Beta is predicted to

live longer than those before them, and the study reveals optimism

about a healthcare revolution that will transform their lives —

with half of adults believing that cancer will be cured by

Generation Beta. This advancement will lead to extended life

spans that will require increased financial preparation and evolved

retirement models.

RETIREMENT: Today’s retirement norm may become

a relic of the past, with more than half (58%) of parents and

prospective parents thinking their children will never retire.

The survey participants estimate that Generation Beta will need

approximately $1.88 million to sustain retirement.

For nearly 150 years, Prudential has grown to become a rock

millions have relied on by expanding access to investing, insurance

and retirement security. Prudential offers a range of ever-evolving

retirement strategies that can help build and protect your life’s

work, no matter what the future brings. The Generation Beta:

Redefining Life, Longevity, and Retirement report and the Beta Baby

Bonus underscore Prudential’s commitment to encouraging every

generation to take action in securing their financial future.

Visit the Prudential Newsroom to learn more, or find a local

financial professional here. To apply for the Beta Baby Bonus,

please visit www.betababybonus.com.

1 These amounts do not reflect actual investments and are

provided for illustrative purposes only. They are not intended as

investment advice or an investment recommendation. Estimated

amounts were calculated using a standard annual compounding

interest rate equation of 9.75% annually. Actual results may vary.

You should carefully consider a variety of options when determining

how much money you will need to save for your retirement. If you

need investment advice, please consult with a qualified

professional. It is possible to lose money when investing.

Generation Beta: A Prudential Study was conducted by

McCann Worldgroup Truth Central on behalf of Prudential. This

large-scale quantitative study surveyed 2,008 Americans aged 18+

between Nov. 1 and 7, 2024. For more information about McCann

Worldgroup Truth Central click here.

About Prudential

Prudential Financial, Inc. (NYSE: PRU), a global financial

services leader and premier active global investment manager with

approximately $1.6 trillion in assets under management as of Sept.

30, 2024, has operations in the United States, Asia, Europe, and

Latin America. Prudential’s diverse and talented employees help

make lives better and create financial opportunity for more people

by expanding access to investing, insurance, and retirement

security. Prudential’s iconic Rock symbol has stood for strength,

stability, expertise, and innovation for nearly 150 years. For more

information, please visit news.prudential.com.

1084271-00001-00

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217226022/en/

MEDIA CONTACTS Laura Coletti Prudential

Financial Laura.coletti@prudential.com Sherman

Fabes Weber Shandwick

sfabes@webershandwick.com

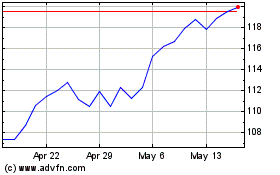

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

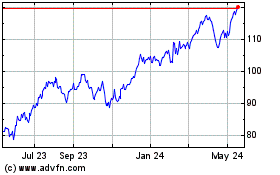

Prudential Financial (NYSE:PRU)

Historical Stock Chart

From Jan 2024 to Jan 2025