Form 424B3 - Prospectus [Rule 424(b)(3)]

August 20 2024 - 4:15PM

Edgar (US Regulatory)

PIMCO CORPORATE & INCOME OPPORTUNITY FUND

(the “Fund”)

Supplement dated August 20, 2024 to the

Fund’s Prospectus Supplement, Prospectus and

Statement of Additional Information, each dated September 28, 2023,

as supplemented from time to time

(respectively, the “Prospectus Supplement”, the “Prospectus” and the “SAI”)

On August 15, 2024, the Fund’s Board of Trustees (the “Board”) (i) approved the removal of the

Fund’s non-fundamental investment guideline for the Fund to invest at least 25% of the Fund’s total assets in corporate debt obligations and other corporate income-producing securities and

(ii) approved the addition of a non-fundamental investment guideline for the Fund to invest at least 50% of the Fund’s total assets in corporate securities. Accordingly, effective September 20,

2024:

1. In the “Portfolio Contents” section on the cover pages of the Prospectus, the third sentence of

the first paragraph is replaced with the following:

The Fund normally invests at least 50% of its total assets in corporate debt

obligations and other corporate securities, including fixed-, variable- and floating-rate bonds, debentures, notes and other similar types of corporate debt instruments, such as preferred shares, convertible securities, bank loans and loan

participations and assignments, payment-in-kind securities, step-ups, zero-coupon bonds,

bank capital securities, bank certificates of deposit, fixed time deposits and bankers’ acceptances, stressed debt securities, structured notes and other hybrid instruments, common stocks and other equity securities.

2. In the “Prospectus Summary—Portfolio Contents” section of the Prospectus and the “Portfolio

Contents” section of the Prospectus, (i) the third sentence is deleted and (ii) the following language is added as the new fifth sentence:

The Fund normally invests at least 50% of its total assets in corporate debt obligations and other corporate securities, including fixed-,

variable- and floating-rate bonds, debentures, notes and other similar types of corporate debt instruments, such as preferred shares, convertible securities, bank loans and loan participations and assignments, payment-in-kind securities, step-ups, zero-coupon bonds, bank capital securities, bank certificates of deposit, fixed time

deposits and bankers’ acceptances, stressed debt securities, structured notes and other hybrid instruments, common stocks and other equity securities.

3. In the SAI, the first sentence of the first paragraph of the “Investment Objective and Policies—Corporate Debt

Securities” is deleted and replaced with the following:

The Fund normally invests at least 50% of its total assets in corporate

debt obligations and other corporate securities.

Investors Should Retain This Supplement for Future Reference

PTY_SUPP1_082024

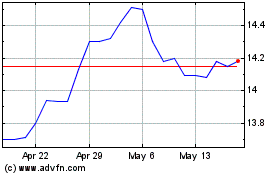

PIMCO Corporate and Inco... (NYSE:PTY)

Historical Stock Chart

From Oct 2024 to Nov 2024

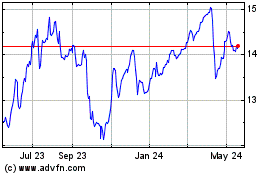

PIMCO Corporate and Inco... (NYSE:PTY)

Historical Stock Chart

From Nov 2023 to Nov 2024