UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. 1 )*

Quotient Technology Inc.

(Name of Issuer)

Common Stock Class A, par value $.00001

(Title of Class of Securities)

749119103

(CUSIP Number of Class of Securities)

David J. Snyderman

Magnetar Capital LLC

1603 Orrington Ave.

Evanston, Illinois 60201

(847) 905-4400

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

September 5,

2023

(Date of Event which Requires Filing of this Statement)

If

the filing person has previously filed a Statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D

and is filing this Schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7(b) for other parties to whom copies

are to be sent.

*The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| CUSIP No. 749119103 |

SCHEDULE 13D |

Page 2 of 8 |

| 1. |

NAME OF REPORTING PERSON: |

| |

Magnetar Financial LLC |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

(a) ¨ |

| |

(b) x |

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS |

| |

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER |

| |

0 |

| 8. |

SHARED VOTING POWER |

| |

0 |

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| 10. |

SHARED DISPOSITIVE POWER |

| |

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

0 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| |

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

0% |

| 14. |

TYPE OF REPORTING PERSON |

| |

IA; OO |

| CUSIP No. 749119103 |

SCHEDULE 13D |

Page 3 of 8 |

| 1. |

NAME OF REPORTING PERSON: |

| |

Magnetar Capital Partners LP |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

(a) ¨ |

| |

(b) x |

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS |

| |

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER |

| |

0 |

| 8. |

SHARED VOTING POWER |

| |

0 |

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| 10. |

SHARED DISPOSITIVE POWER |

| |

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

0 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| |

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

0% |

| 14. |

TYPE OF REPORTING PERSON |

| |

HC; OO |

| CUSIP No. 749119103 |

SCHEDULE 13D |

Page 4 of 8 |

| 1. |

NAME OF REPORTING PERSON: |

| |

Supernova

Management LLC |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

(a) ¨ |

| |

(b) x |

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS |

| |

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER |

| |

0 |

| 8. |

SHARED VOTING POWER |

| |

0 |

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| 10. |

SHARED DISPOSITIVE POWER |

| |

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

0 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| |

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

0% |

| 14. |

TYPE OF REPORTING PERSON |

| |

HC; OO |

| CUSIP No. 749119103 |

SCHEDULE 13D |

Page 5 of 8 |

| 1. |

NAME OF REPORTING PERSON: |

| |

David

J. Snyderman |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

(a) ¨ |

| |

(b) x |

| 3. |

SEC USE ONLY |

| |

|

| 4. |

SOURCE OF FUNDS |

| |

OO |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

| |

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| |

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH |

7. |

SOLE VOTING POWER |

| |

0 |

| 8. |

SHARED VOTING POWER |

| |

0 |

| 9. |

SOLE DISPOSITIVE POWER |

| |

0 |

| 10. |

SHARED DISPOSITIVE POWER |

| |

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

0 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

| |

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

0% |

| 14. |

TYPE OF REPORTING PERSON |

| |

HC; IN |

SCHEDULE

13D

This

Amendment No. 1 (“Amendment No. 1”) relates to the Statement of Beneficial Ownership on Schedule 13D filed

jointly by Magnetar Financial LLC, a Delaware limited liability company (“Magnetar Financial”), Magnetar Capital Partners

LP, a Delaware limited partnership (“Magnetar Capital Partners”), Supernova Management LLC, a Delaware limited liability

company (“Supernova Management”), and David J. Snyderman (“Mr. Snyderman”) with the SEC on

July 18, 2023, (as amended by this Amendment No. 1, the “Schedule 13D”).

This Amendment No. 1 is being filed to report that the Reporting Persons are no longer beneficial owners of more than 5% of the Shares.

The filing of this Amendment No. 1 represents the final amendment to this Schedule 13D and constitutes an exit filing for the Reporting

Persons.

Except as set forth below,

all Items of the Schedule 13D remain unchanged. All capitalized terms not otherwise defined herein shall have the meanings ascribed to

such terms in the Schedule 13D.

| ITEM 4. | PURPOSE OF TRANSACTION |

Item 4 of the Schedule 13D is hereby amended

to add the following information for updating:

The Reporting Persons acquired

the Shares reported herein on behalf of the Funds after the public announcement of the Merger Agreement (as defined below) for purposes

of receiving the merger consideration described below upon consummation of the Merger (as described below).

Finally, on September 5,

2023, the Issuer consummated a merger (the “Merger”) pursuant to which each issued and outstanding Shares were submitted for

the cash offering and the shares of Quotient Technology, Inc. were delisted.

| ITEM 5. | INTEREST IN SECURITIES OF THE ISSUER |

Item 5(a)-(c) and

(e) of the Schedule 13D is hereby amended to add the following information for updating:

(a) As

of the closing of the Merger on September 5, 2023, each of the Reporting Persons may have been deemed to have beneficial ownership

of 0 Shares.

(b) As

of the closing of the Merger on September 5, 2023, each of the Reporting Persons may have been deemed to share the power to vote

and direct the disposition of 0 Shares, which represented beneficial ownership of 0% of the Shares.

(c) The

response to Item 4 of this Amendment No. 1 is incorporated herein by reference. The Funds had no transactions in the Shares since

the filing of the Schedule D on July 18, 2023.

(d) As

of September 5, 2023, the Reporting Persons ceased

to be beneficial owners of more than five percent of the Shares.

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date September 7, 2023

| |

magnetar financial llc |

| |

|

| |

By: Magnetar Capital Partners LP, its Sole Member |

| |

By: Supernova Management LLC, its General Partner |

| |

|

| |

By: |

/s/ Hayley Stein |

| |

Name: |

Hayley Stein |

| |

Title: Attorney-in-fact for David J. Snyderman, Manager of Supernova Management LLC |

| |

|

| |

magnetar capital partners LP |

| |

|

| |

By: Supernova Management LLC, its General Partner |

| |

|

| |

By: |

/s/ Hayley Stein |

| |

Name: |

Hayley Stein |

| |

Title: Attorney-in-fact for David J. Snyderman, Manager of Supernova Management LLC |

| |

|

| |

supernova management llc |

| |

|

| |

By: |

/s/ Hayley Stein |

| |

Name: |

Hayley Stein |

| |

Title:

Attorney-in-fact for David J. Snyderman, Manager |

| |

|

| |

DAVID J. SNYDERMAN |

| |

|

| |

By: |

/s/ Hayley Stein |

| |

Name: |

Hayley Stein |

| |

Title: Attorney-in-fact for David J. Snyderman |

EXHIBIT INDEX

EXHIBIT 99.1

JOINT FILING AGREEMENT

The undersigned hereby agree that the statement

on Schedule 13D with respect to the Shares of Quotient Technology Inc. dated as of September 7, 2023 is, and any amendments thereto

(including amendments on Schedule 13D) signed by each of the undersigned shall be, filed on behalf of each of us pursuant to and in accordance

with the previsions of Rule13d-1(k) under the Securities Exchange Act of 1934, as amended.

| Date: September 7, 2023 |

magnetar financial llc |

| |

|

| |

|

By: Magnetar Capital Partners LP, its Sole Member |

| |

|

| |

|

By: |

/s/ Hayley Stein |

| |

|

Name: |

Hayley Stein |

| |

|

Title: Attorney-in-fact

for David J. Snyderman, Manager of Supernova Management LLC |

| |

|

| Date: September 7, 2023 |

magnetar capital partners LP |

| |

|

| |

|

By: Supernova Management LLC, its General Partner |

| |

|

| |

|

By: |

/s/ Hayley Stein |

| |

|

Name: |

Hayley Stein |

| |

|

Title: Attorney-in-fact

for David J. Snyderman, Manager of Supernova Management LLC |

| |

|

| Date: September 7, 2023 |

supernova management llc |

| |

|

| |

|

By: |

/s/ Hayley Stein |

| |

|

Name: |

Hayley Stein |

| |

|

Title: Attorney-in-fact

for David J. Snyderman, Manager |

| |

|

| Date: September 7, 2023 |

DAVID J. SNYDERMAN |

| |

|

| |

|

By: |

/s/ Hayley Stein |

| |

|

Name: |

Hayley Stein |

| |

|

Title: Attorney-in-fact

for David J. Snyderman |

EXHIBIT 99.2

LIMITED POWER OF ATTORNEY

Know all by these present,

that I, David J. Snyderman, hereby make, constitute and appoint each of _Michael Turro_, Karl Wachter_ and Hayley

Stein_, or any of them acting individually, and with full power of substitution, as my true and lawful attorney-in-fact for the purpose

of executing in my name, (a) in my personal capacity or (b) in my capacity as Manager or in other capacities of Supernova

Management LLC, a Delaware limited liability company, and each of its affiliates or entities advised or controlled by me or

Supernova Management LLC, all documents, certificates, instruments, statements, filings and agreements (“documents”)

to be filed with or delivered to the United States Securities and Exchange Commission (the “SEC”) pursuant to the Securities

and Exchange Act of 1934, as amended (the “Act”), and the rules and regulations promulgated thereunder, including, without

limitation, all documents relating to the beneficial ownership of securities required to be filed with the SEC pursuant to Section 13(d) or

Section 16(a) of the Act, including, without limitation: (a) any acquisition statements on Schedule 13D or Schedule 13G

and any amendments thereto, (b) any joint filing agreements pursuant to Rule 13d-1(k) under the Act, and (c) any initial

statements of, or statements of changes in, beneficial ownership of securities on Form 3, Form 4 or Form 5.

All past acts of the attorney-in-fact

in furtherance of the foregoing are hereby ratified and confirmed.

This

Power of Attorney shall remain in full force and effect until the earlier of it being (a) revoked by the undersigned in a signed

writing delivered to the foregoing attorney-in-fact or (b) superseded by a new power of attorney regarding the purposes outlined

herein as of a later date.

IN

WITNESS WHEREOF, the undersigned has caused this Power of Attorney to be executed as of this __22__

day of December, 2022.

| |

/s/ David J. Snyderman |

| |

David J. Snyderman |

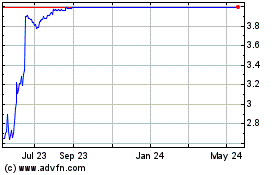

Quotient Technology (NYSE:QUOT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Quotient Technology (NYSE:QUOT)

Historical Stock Chart

From Jan 2024 to Jan 2025